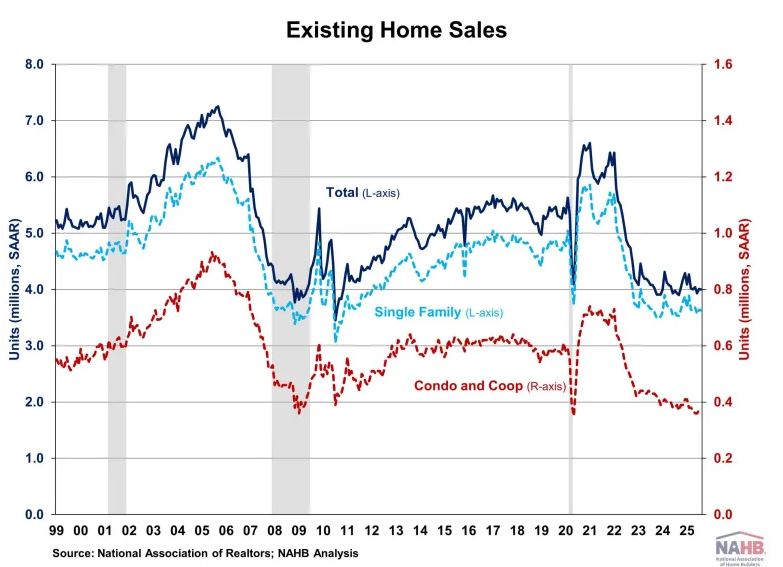

Total existing home sales, including single-family homes,

townhomes, condominiums, and co-ops, fell 0.2% to a seasonally

adjusted annual rate of 4.00 million in August. However, on a

year-over-year basis, sales were 1.8% higher than a year ago.

Other economic indicators including a rising stock market and

rising home values also are contributing to a sense of increased

wealth among homeowners, which could lead to lead to strong

furniture sales.

According to the National Association of Realtors, existing

home sales totaled 4 million, up 1.8% from August 2024 and down

just 0.2% from July. Year-over-year, sales rose in the Midwest

and South, and fell in the Northeast and West, while monthly

sales rose in the Midwest and West, and fell in the Northeast

and South, the NAR said.

Of the total sold, 3.63 million, or 90.8% were single-family

homes, up 2.5% from August 2024, with the balance being

condominiums or co-ops, down 5.1% from August 2024.

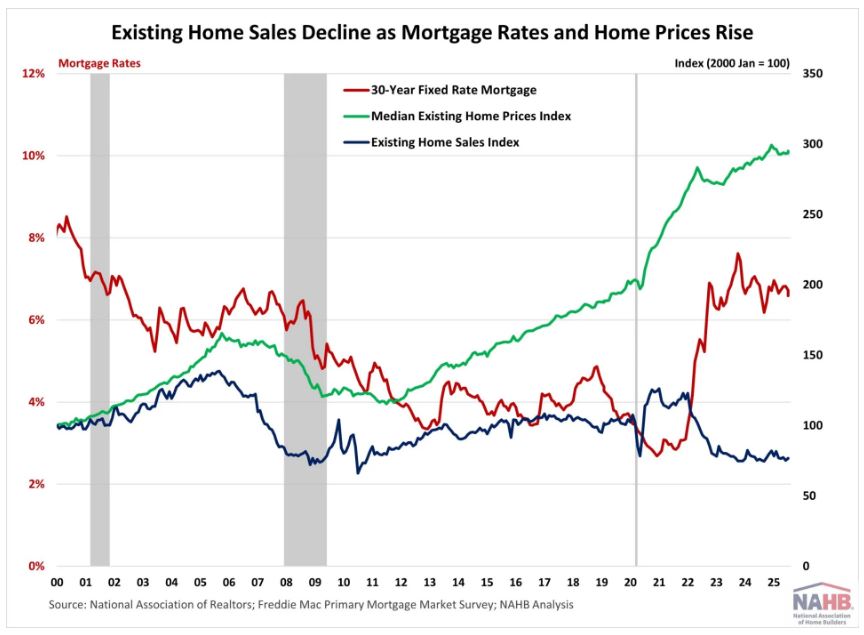

“Home sales have been sluggish over the past few years due to

elevated mortgage rates and limited inventory,” said NAR Chief

Economist Lawrence Yun. “However, mortgage rates are declining

and more inventory is coming to the market, which should boost

sales in the coming months.”

To Yun’s point, there were 1.53 million existing homes for sale

in August, up 11.7% from 1.37 million in August 2024 but down

1.3% from July. The total represents a 4.6-month supply of

unsold inventory, up from 4.2 months in August 2024 and

unchanged from July.

While inventory levels remain high, so do prices, which

continues to pose challenges for many buyers, including

first-time buyers. For example, the median home price was

$422,600 for all housing types, which was up 2% from $414,200 in

August 2024 and the 26th consecutive month of year-over-year

increases, the NAR said.

The median single-family home price in August was $427,800, up

1.9% from last year. This compares with $366,800 for

condominiums and co-ops, up .6% from August 2024.

By region, the activity was as follows:

In the Northeast, existing home sales totaled 480,000, down 2%

from August 2024 and down 4% from July. The median sale price in

the region was $534,200, a 6.2% increase from August 2024.

In the Midwest sales totaled 960,000, up 3.2% from August 2024

and up 2.1% from July. The median sale price was $330,500, up

4.5% from August 2024.

In the South, sales totaled 1.83 million, up 3.4% from August

2024 and down 1.1% from July. The median sale price was

$364,100, up .4% from August 2024.

In the West, sales totaled 730,000, down 1.4% from August 2024

and up 1.4% from July. The median sale price was $624,300, up

0.6% from August 2024.

“Record-high housing wealth and a record-high stock market will

help current homeowners trade up and benefit the upper end of

the market,” Yun said. “However, sales of affordable homes are

constrained by the lack of inventory. The Midwest was the

best-performing region last month, primarily due to relatively

affordable market conditions. The median home price in the

Midwest is 22 percent below the national median price.”

Other highlights of the report are as follows:

+ Homes were on the market for a median of 31 days in August, up

from 26 days in August 2024 and up from 28 days in July.

+ First-time homebuyers accounted for 28% of sales, up from 26%

in August 2024 and unchanged from July.

+ Cash sales accounted for 28% of transactions, up from 26% in

August 2024 and down from 31% in July. Individual investors or

second home buyers that make up many cash sales accounted for

21% of transactions, compared with 19% in August 2024 and 20% in

July.

+ About 2% of sales were distressed sales, including

foreclosures and short sales, up from 1% in august 2024 and

unchanged from July.

+ The average 30-year fixed-rate mortgage was 6.59% in August,

compared with 6.50% a year earlier and down from 6.72% in July

according to Freddie Mac.

As small as the increases might be, the good news for the

industry is that home sales continue to rise, which of course

almost always leads to some type of furniture sales.

Also of note is the increase in the number of first-time

homebuyers, another area of sales growth opportunity for the

industry. We believe that despite some challenges — including

higher finished product costs resulting from tariffs — existing

home sales and new home construction will continue amid an

environment of lower interest rates and rising consumer

confidence. While there are no guarantees in such volatile

times, the industry may have better times ahead thanks to a

confluence of factors that contributes to a strong housing

market that provides plenty of options for buyers and sellers

alike.

Source:

homenewsnow.com