According to the NAHB, spiraling costs, high interest rates and

economic uncertainty continue to act as headwinds on the housing

sector. As a result, many potential buyers are opting to not

pull the trigger.

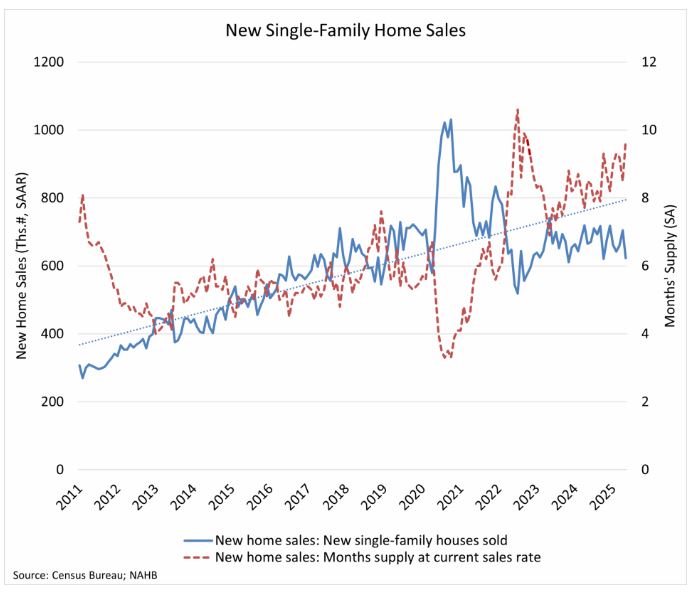

Sales of newly built single-family homes did rise 0.6% in June,

to a seasonally adjusted annual rate of 627,000, according to

newly released data from the U.S. Department of Housing and

Urban Development and the U.S. Census Bureau. However, the past

two months have been the slowest sales pace since October 2024,

as mortgage rates averaged above 6.8% in June.

“New home sales remained flat last month, highlighting

persistent weakness in the housing market despite seasonal

expectations for growth,” said Buddy Hughes, chairman of the

NAHB. “Elevated mortgage rates and sustained price levels

continue to limit purchasing power, particularly among

first-time and middle-income buyers.”

A new home sale occurs when a sales contract is signed or a

deposit is accepted. The home can be in any stage of

construction: not yet started, under construction or completed.

In addition to adjusting for seasonal effects, the June reading

of 627,000 units is the number of homes that would sell if this

pace continued for the next 12 months.

New single-family home inventory continued to rise with 511,000

residences marketed for sale as of June. This is 1.2% higher

than the previous month and 8.5% higher than a year ago. At the

current sales pace, the months’ supply for new homes remained

elevated at 9.8 compared to 8.4 a year ago. Completed,

ready-to-occupy inventory stood at 114,000 homes in June, up

21.3% from a year ago.

Regionally, on a year-to-date basis, new home sales are down in

all four regions, falling 25.6% in the Northeast, 8.5% in the

Midwest, 1.6% in the South and 4% in the West.

Source: NAHB