By The Third Week Of November Most Thoughts Were On Thanksgiving Turkey And

The Oncoming Holiday Season.

Demand for lumber slowed down as is normal for the time of year, and prices

softened a bit more as a result. More announcements of sawmill curtailments

did nothing to improve sentiment.

Without the regular data releases, specifically for the US housing market,

the lumber manufacturing industry could not know the state of housing starts

since August. This makes planning for the upcoming spring home building

season very difficult.

Most forestry operators took a “wait-and-see” approach; generally preferring

to err on the side of caution rather

than take a plunge only to have yet another unpleasant surprise come up. As

such, the by-now long term habit of just-in-time buying and not stocking

lumber inventory continued.

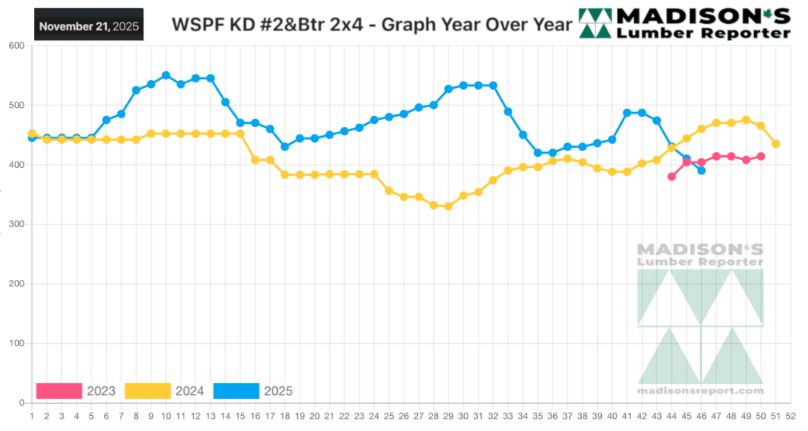

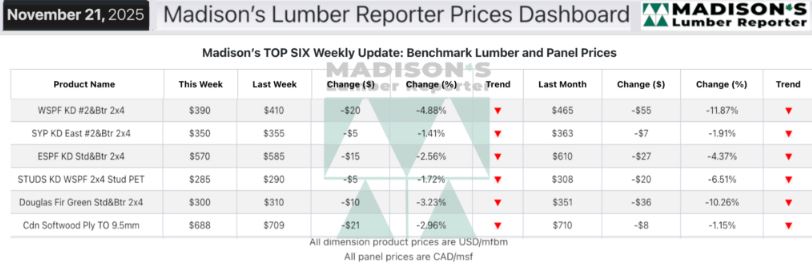

In the week ending November 21, 2025 the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$390 mfbm, which was down -$20, or -5%, from the

previous week when it was $410, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$20, or -16%, from one month ago when it was

$465.

Compared To The Same Week Last Year, When It Was Us$460 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending November 21,

2025 Was Down -$70, Or -15%.

Compared To Two Years Ago When It Was $404, That Week’S Price Was Down -$14,

Or -3%. ....

KEY TAKE-AWAYS:

Western-SPF buyers in the us had no trouble stocking up

immediate needs in a timely manner.

Buyers were leery of committing to anything before getting through the

holidays.

Customers of Western-SPF in Canada felt zero pressure to cover their needs

beyond the immediate.

There was plenty of price, mix, and shipment options to choose from between

primary and secondary suppliers.

In Eastern-SPF, buyers who were active had a leg up in price negotiations.

Purchasers of Southern Yellow Pine lacked urgency as they could get whatever

they needed within a quick timeframe.

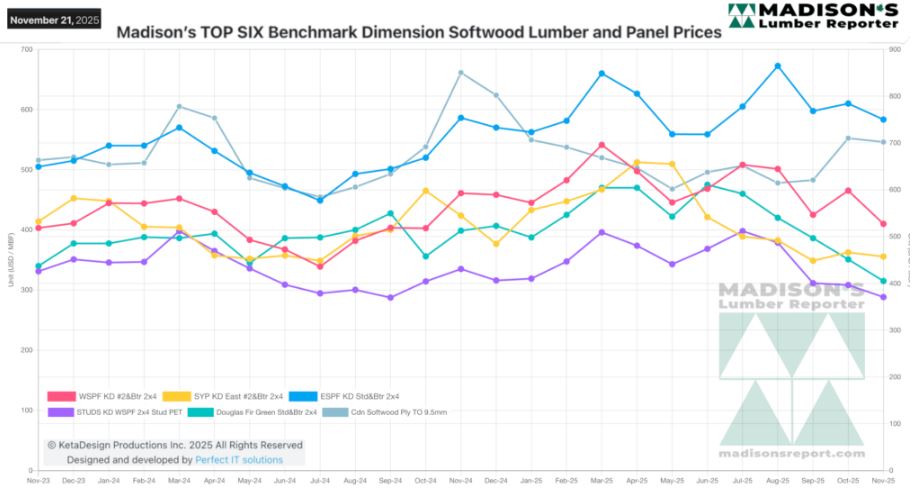

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source: madisonsreport.com

More Reports:

|

-

U.S. & Canada softwood and panel markets - week

45, 2025 (Nov 26,

2025)

-

U.S. & Canada softwood and panel markets - week

44, 2025 (Nov 19,

2025)

-

U.S. & Canada softwood and panel markets - week

43, 2025 (Nov 12,

2025)

-

U.S. & Canada softwood and panel markets - week

42, 2025 (Nov 5,

2025)

-

U.S. & Canada softwood and panel markets - week

41, 2025 (Oct 29,

2025)

-

U.S. & Canada softwood and panel markets - week

40, 2025 (Oct 22,

2025)

-

U.S. & Canada softwood and panel markets - week

39, 2025 (Oct 15,

2025)

-

U.S. & Canada softwood and panel markets - week

38, 2025 (Oct 8,

2025)

-

U.S. & Canada softwood and panel markets - week

37, 2025 (Oct 1,

2025)

-

U.S. & Canada softwood and panel markets - week

36, 2025 (Sep 25,

2025)

-

U.S. & Canada softwood and panel markets - week

35, 2025 (Sep 17,

2025)

-

U.S. & Canada softwood and panel markets - week

34, 2025 (Sep 10,

2025)

-

U.S. & Canada softwood and panel markets - week

33, 2025 (Sep 3,

2025)

-

U.S. & Canada softwood and panel markets - week

32, 2025 (Aug 27,

2025)

-

U.S. & Canada softwood and panel markets - week

31, 2025 (Aug 20,

2025)

-

U.S. & Canada softwood and panel markets - week

30, 2025 (Aug 13,

2025)

-

U.S. & Canada softwood and panel markets - week

29, 2025 (Aug 6,

2025)

-

U.S. & Canada softwood and panel markets - week

28, 2025

(Jul 30,

2025)

-

U.S. & Canada softwood and panel markets - week

27, 2025

(Jul 23,

2025)

-

U.S. & Canada softwood and panel markets - week

26, 2025

(Jul 16,

2025)

-

U.S. & Canada softwood and panel markets - week

25, 2025

(Jul 9,

2025)

-

U.S. & Canada softwood and panel markets - week

24, 2025

(Jul 2,

2025)

-

U.S. & Canada softwood and panel markets - week

23, 2025

(Jun 25,

2025)

-

U.S. & Canada softwood and panel markets - week

22, 2025

(Jun 18,

2025)

-

U.S. & Canada softwood and panel markets - week

21, 2025

(Jun 11,

2025)

-

U.S. & Canada softwood and panel markets - week

20, 2025

(Jun 4,

2025)

-

U.S. & Canada softwood and panel markets - week 19, 2025

(May 28

2025)

-

U.S. & Canada softwood and panel markets - week 18, 2025

(May 21

2025)

-

U.S. & Canada softwood and panel markets - week 17, 2025

(May 14

2025)

-

U.S. & Canada softwood and panel markets - week 16, 2025

(May 7

2025)

-

U.S. & Canada softwood and panel markets - week 15, 2025

(Apr 30

2025)

-

U.S. & Canada softwood and panel markets - week 14, 2025

(Apr 23,

2025)

-

U.S. & Canada softwood and panel markets - week 13, 2025

(Apr 16,

2025)

-

U.S. & Canada softwood and panel markets - week 12, 2025

(Apr 9,

2025)

-

U.S. & Canada softwood and panel markets - week 11 2025

(Apr 2,

2025)

-

U.S. & Canada softwood and panel markets - week 10 2025 (Mar 26,

2025)

-

U.S. & Canada softwood and panel markets - week 9 2025 (Mar 19,

2025)

-

U.S. & Canada softwood and panel markets - week 8 2025 (Mar 12,

2025)

-

U.S. & Canada softwood and panel markets - week

7 2025 (Mar 05,

2025)

-

U.S. & Canada softwood and panel markets - week

6 2025 (Feb 26,

2025)

-

U.S. & Canada softwood and panel markets - week

5 2025 (Feb 19,

2025)

-

U.S. & Canada softwood and panel markets - week

4 2025 (Feb 12,

2025)

-

U.S. & Canada softwood and panel markets - week

3 2025 (Feb 5,

2025)

-

U.S. & Canada softwood and panel markets - week

2 2025 (Jan 29,

2025)

-

U.S. & Canada softwood and panel markets - week

1 2025 (Jan 22,

2025)

-

U.S. & Canada softwood and panel markets - week

50 2024 (Dec 23,

2024)

-

U.S. & Canada softwood and panel markets - week

49 2024 (Dec 18,

2024)

-

U.S. & Canada softwood and panel markets - week

48 2024 (Dec 11,

2024)

-

U.S. & Canada softwood and panel markets - week

47 2024 (Dec 4,

2024)

-

U.S. & Canada softwood and panel markets - week

46 2024 (Nov 27,

2024)

-

U.S. & Canada softwood and panel markets - week

45 2024 (Nov 20,

2024)

-

U.S. & Canada softwood and panel markets - week

44 2024 (Nov 13,

2024)

-

U.S. & Canada softwood and panel markets - week

43 2024 (Nov 6,

2024)

-

U.S. & Canada softwood and panel markets - week

42 2024 (Oct

31,

2024)

-

U.S. & Canada softwood and panel markets - week

41 2024 (Oct

24,

2024)

-

U.S. & Canada softwood and panel markets - week

40 2024 (Oct

17,

2024)

-

U.S. & Canada softwood and panel markets - week 39 2024 (Oct

10,

2024)

-

U.S. & Canada softwood and panel markets - week 38 2024 (Oct

03,

2024)

-

U.S. & Canada softwood and panel markets - week 37 2024 (Sep 25,

2024)

-

U.S. & Canada softwood and panel markets - week 36 2024 (Sep 18,

2024)

-

U.S. & Canada softwood and panel markets - week 35 2024 (Sep 11,

2024)

-

U.S. & Canada softwood and panel markets - week 34 2024 (Sep 04,

2024)

-

U.S. & Canada softwood and panel markets - week 33 2024 ( Aug

28, 2024)

-

U.S. & Canada softwood and panel markets - week 32 2024 ( Aug

21, 2024)

-

U.S. & Canada softwood and panel markets - week 31 2024 ( Aug

14, 2024)

-

U.S. & Canada softwood and panel markets - week 30 2024 ( Aug 7,

2024)

-

U.S. & Canada softwood and panel markets - week 29 2024 ( Jul

31, 2024)

-

U.S. & Canada softwood and panel markets - week 28 2024 ( Jul

24, 2024)

-

U.S. & Canada softwood and panel markets - week 27 2024 ( Jul

17, 2024)

-

U.S. & Canada softwood and panel markets - week 26 2024 ( Jul

10, 2024)

-

U.S. & Canada softwood and panel markets - week 25 2024 ( Jul 3,

2024)

-

U.S. & Canada softwood and panel markets - week 24 2024 ( Jun

26, 2024)

-

U.S. & Canada softwood and panel markets - week 23 2024 ( Jun

19, 2024)

-

U.S. & Canada softwood and panel markets - week 22 2024 ( Jun

12, 2024)

-

U.S. & Canada softwood and panel markets - week 21 2024 ( Jun 5,

2024)

-

U.S. & Canada softwood and panel markets - week 20 2024 ( May

29, 2024)

-

U.S. & Canada softwood and panel markets - week 19 2024 ( May

22, 2024)

-

U.S. & Canada softwood and panel markets - week 18 2024 ( May

15, 2024)

-

U.S. & Canada softwood and panel markets - week 17 2024 ( May 8,

2024)

-

U.S. & Canada softwood and panel markets - week 16 2024 ( May 1,

2024)

-

U.S. & Canada softwood and panel markets - week 15 2024 ( Apr

24, 2024)

-

U.S. & Canada softwood and panel markets - week 14 2024 ( Apr

17, 2024)

-

U.S. & Canada softwood and panel markets - week 13 2024 ( Apr

10, 2024)

-

U.S. & Canada softwood and panel markets - week 12 2024 ( Apr 3,

2024)

-

U.S. & Canada softwood and panel markets - week 11 2024 ( Mar

27, 2024)

-

U.S. & Canada softwood and panel markets - week 10 2024 ( Mar

20, 2024)

-

U.S. & Canada softwood and panel markets - week 9 2024 ( Mar 13,

2024)

-

U.S. & Canada softwood and panel markets - week 8 2024 ( Mar 06,

2024)

-

U.S. & Canada softwood and panel markets - week 7 2024 ( Feb 28,

2024)

-

U.S. & Canada softwood and panel markets - week 6 2024 ( Feb 21,

2024)

-

U.S. & Canada softwood and panel markets - week 5 2024 ( Feb 14,

2024)

-

U.S. & Canada softwood and panel markets - week 4 2024 ( Feb 7,

2024)

-

U.S. & Canada softwood and panel markets - week 3 2024 ( Feb 01,

2024)

-

U.S. & Canada softwood and panel markets - week 2 2024 ( Jan 23,

2024)

-

U.S. & Canada softwood and panel markets - week 1 2024 ( Jan 17,

2024)

-

U.S. & Canada softwood and panel markets - week 48 2023 (Dec 20

2023)

-

U.S. & Canada softwood and panel markets - week 47 2023 (Dec 13

2023)

-

U.S. & Canada softwood and panel markets - week 46 2023 (Dec 7

2023)

-

U.S. & Canada softwood and panel markets - week 45 2023 (Nov 30

2023)

-

U.S. & Canada softwood and panel markets - week 44 2023 (Nov 23

2023)

-

U.S. & Canada softwood and panel markets - week 43 2023 (Nov 16

2023)

-

U.S. & Canada softwood and panel markets - week 42 2023 (Nov 09

2023)

-

U.S. & Canada softwood and panel markets - week 41 2023 (Nov 02

2023)

-

U.S. & Canada softwood and panel markets - week 40 2023 (Oct 23

2023)

-

U.S. & Canada softwood and panel markets - week 37 2023 (Oct 03

2023)

-

U.S. & Canada softwood and panel markets - week 36 2023 (Sep 27

2023)

-

U.S. & Canada softwood and panel markets - week 35 2023 (Sep 20

2023)

-

U.S. & Canada softwood and panel markets - week 34 2023 (Sep 13

2023)

-

U.S. & Canada softwood and panel markets - week 33 2023 (Sep 06

2023)

-

U.S. & Canada softwood and panel markets - week 32 2023 (Aug 29

2023)

-

U.S. & Canada softwood and panel markets - week 31 2023 (Aug 22

2023)

-

U.S. & Canada softwood and panel markets - week 30 2023 (Aug 15

2023)

-

U.S. & Canada softwood and panel markets - week 29 2023 (Aug 08

2023)

-

U.S. & Canada softwood and panel markets - week 28 2023 (Aug 01

2023)

-

U.S. & Canada softwood and panel markets - week 27 2023 (Jul 26

2023)

-

U.S. & Canada softwood and panel markets - week 26 2023 (Jul 19

2023)

-

U.S. & Canada softwood and panel markets - week 25 2023 (Jul 12

2023)

-

U.S. & Canada softwood and panel markets - week 24 2023 (Jul 05

2023)

-

U.S. & Canada softwood and panel markets - week 23 2023 (Jun 28

2023)

-

U.S. & Canada softwood and panel markets - week 22 2023 (Jun 21

2023)

-

U.S. & Canada softwood and panel markets - week 21 2023 (Jun 14

2023)

-

U.S. & Canada softwood and panel markets - week 20 2023 (Jun 07

2023)

-

U.S. & Canada softwood and panel markets - week 19 2023 (May 31

2023)

-

U.S. & Canada softwood and panel markets - week 18 2023 (May 24

2023)

-

U.S. & Canada softwood and panel markets - week 17 2023 (May 17

2023)

-

U.S. & Canada softwood and panel markets - week 16 2023 (May 10

2023)

-

U.S. & Canada softwood and panel markets - week 15 2023 (May 03

2023)

-

U.S. & Canada softwood and panel markets - week 14 2023 (Apr 26

2023)

-

U.S. & Canada softwood and panel markets - week 13 2023 (Apr 19

2023)

-

U.S. & Canada softwood and panel markets - week 12 2023 (Apr 12

2023)

-

U.S. & Canada softwood and panel markets - week 11 2023 (Apr 05

2023)

-

U.S. & Canada softwood and panel markets - week 10 2023 (Mar

29

2023)

-

U.S. & Canada softwood and panel markets - week 9 2023 (Mar

22

2023)

-

U.S. & Canada softwood and panel markets - week 8 2023 (Mar15

2023)

-

U.S. & Canada softwood and panel markets - week 07 2023 (Mar

08

2023)

-

U.S. & Canada softwood and panel markets - week 06 2023 (Mar

01

2023)

-

U.S. & Canada softwood and panel markets - week 05 2023 (Feb

22

2023)

-

U.S. & Canada softwood and panel markets - week 04 2023 (Feb

15

2023)

-

U.S. & Canada softwood and panel markets - week 03 2023 (Feb

08

2023)

-

U.S. & Canada softwood and panel markets - week 02 2023 (Feb

01

2023)

-

U.S. & Canada softwood and panel markets - week 01 2023 (Jan

18

2023)

-

U.S. & Canada softwood and panel markets - week 48 2022 (Dec

27

2022)

-

U.S. & Canada softwood and panel markets - week 47 2022 (Dec

20

2022)

-

U.S. & Canada softwood and panel markets - week 46 2022 (Dec

13

2022)

-

U.S. & Canada softwood and panel markets - week 45 2022 (Dec

06

2022)

-

U.S. & Canada softwood and panel markets - week 44 2022 (Nov

29

2022)

-

U.S. & Canada softwood and panel markets - week 43 2022 (Nov

22

2022)

-

U.S. & Canada softwood and panel markets - week 42 2022 (Nov

15

2022)

-

U.S. & Canada softwood and panel markets - week 41 2022 (Nov

08,

2022)

-

U.S. & Canada softwood and panel markets - week 40 2022 (Nov

02,

2022)

-

U.S. & Canada softwood and panel markets - week 39 2022 (Oct

11,

2022)

-

U.S. & Canada softwood and panel markets - week 38 2022 (Oct

04,

2022)

-

U.S. & Canada softwood and panel markets - week 37 2022 (Sep

28,

2022)

-

U.S. & Canada softwood and panel markets - week 36 2022 (Sep

20,

2022)

-

U.S. & Canada softwood and panel markets - week 35 2022 (Sep

13,

2022)

-

U.S. & Canada softwood and panel markets - week 34 2022 (Sep

06,

2022)

-

U.S. & Canada softwood and panel markets - week 33 2022 (Aug

30,

2022)

-

U.S. & Canada softwood and panel markets - week 32 2022 (Aug

23,

2022)

-

U.S. & Canada softwood and panel markets - week 31 2022 (Aug

16,

2022)

-

U.S. & Canada softwood and panel markets - week 30 2022 (Aug

09,

2022)

-

U.S. & Canada softwood and panel markets - week 29 2022 (Aug

02,

2022)

-

U.S. & Canada softwood and panel markets - week 28 2022 (Jul

26,

2022)

-

U.S. & Canada softwood and panel markets - week 27 2022 (Jul

19,

2022)

-

U.S. & Canada softwood and panel markets - week 26 2022 (Jul

12,

2022)

-

U.S. & Canada softwood and panel markets - week 25 2022 (Jul

05,

2022)

-

U.S. & Canada softwood and panel markets - week 24 2022 (Jun

29,

2022)

-

U.S. & Canada softwood and panel markets - week 23 2022 (Jun

22,

2022)

-

U.S. & Canada softwood and panel markets - week 22 2022 (Jun

15,

2022)

-

U.S. & Canada softwood and panel markets - week 21 2022 (Jun

08,

2022)

-

U.S. & Canada softwood and panel markets - week 20 2022 (Jun

01,

2022)

-

U.S. & Canada softwood and panel markets - week 19 2022 (May

25,

2022)

-

U.S. & Canada softwood and panel markets - week 18 2022 (May

18,

2022)

-

U.S. & Canada softwood and panel markets - week 17 2022 (May

11,

2022)

-

U.S. & Canada softwood and panel markets - week 16 2022 (May

04,

2022)

-

U.S. & Canada softwood and panel markets - week 15 2022 (Apr

26,

2022)

-

U.S. & Canada softwood and panel markets - week 14 2022 (Apr

19,

2022)

-

U.S. & Canada softwood and panel markets - week 13 2022 (Apr

12,

2022)

-

U.S. & Canada softwood and panel markets - week 12 2022 (Apr

05,

2022)

-

U.S. & Canada softwood and panel markets - week 11 2022 (Mar

29,

2022)

-

U.S. & Canada softwood and panel markets - week 10 2022 (Mar

22,

2022)

-

U.S. & Canada softwood and panel markets - week 9 2022 (Mar

15,

2022)

-

U.S. & Canada softwood and panel markets - week 8 2022 (Mar

08,

2022)

-

U.S. & Canada softwood and panel markets - week 7 2022 (Mar

01,

2022)

-

U.S. & Canada softwood and panel markets - week 6 2022 (Feb

22,

2022)

-

U.S. & Canada softwood and panel markets - week 5 2022 (Feb

15,

2022)

-

U.S. & Canada softwood and panel markets - week 4 2022 (Feb

08,

2022)

-

U.S. & Canada softwood and panel markets - week 3 2022 (Feb

01,

2022)

-

U.S. & Canada softwood and panel markets - week 2 2022 (Jan

25,

2022)

-

U.S. & Canada softwood and panel markets - week 1 2022 (Jan

18,

2022)

-

U.S. & Canada softwood and panel markets - week 47 2021 (Dec

22,

2021)

-

U.S. & Canada softwood and panel markets - week 46 2021 (Dec

15,

2021)

-

U.S. & Canada softwood and panel markets - week 45 2021 (Dec

08,

2021)

-

U.S. & Canada softwood and panel markets - week 44 2021 (Dec

01,

2021)

-

U.S. & Canada softwood and panel markets - week 43 2021 (Nov24,

2021)

-

U.S. & Canada softwood and panel markets - week 42 2021 (Nov17,

2021)

-

U.S. & Canada softwood and panel markets - week 41 2021 (Nov10,

2021)

-

U.S. & Canada softwood and panel markets - week 40 2021 (Nov

03,

2021)

-

U.S. & Canada softwood and panel markets - week 39 2021 (Oct

27,

2021)

-

U.S. & Canada softwood and panel markets - week 38 2021 (Oct

20,

2021)

-

U.S. & Canada softwood and panel markets - week 37 2021 (Oct

13,

2021)

-

U.S. & Canada softwood and panel markets - week 36 2021 (Oct

06,

2021)

-

U.S. & Canada softwood and panel markets - week 35 2021 (Sep

29,

2021)

-

U.S. & Canada softwood and panel markets - week 34 2021 (Sep

22,

2021)

-

U.S. & Canada softwood and panel markets - week 33 2021 (Sep

8,

2021)

-

U.S. & Canada softwood and panel markets - week 32 2021 (Sep

1,

2021)

-

U.S. & Canada softwood and panel markets - week 31 2021 (Aug

25,

2021)

-

U.S. & Canada softwood and panel markets - week 30 2021 (Aug

18,

2021)

-

U.S. & Canada softwood and panel markets - week 29 2021 (Aug

11,

2021)

-

U.S. & Canada softwood and panel markets - week 28 2021 (Aug

04,

2021)

-

U.S. & Canada softwood and panel markets - week 27 2021 (Jul

28,

2021)

-

U.S. & Canada softwood and panel markets - week 26 2021 (Jul

21,

2021)

-

U.S. & Canada softwood and panel markets - week 25 2021 (Jul

14,

2021)

-

U.S. & Canada softwood and panel markets - week 24 2021 (Jul

07,

2021)

-

U.S. & Canada softwood and panel markets - week 23 2021 (Jun

30,

2021)

-

U.S. & Canada softwood and panel markets - week 22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week 21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week 20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week 19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week 18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week 17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week 16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week 15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week 14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week 13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week 12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week 11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week 10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week 09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week 08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week 07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week 06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week 05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week 04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week 03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week 02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week 01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week 49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week 48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week 47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week 46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week 45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week 44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week 43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week 42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week 41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week 40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week 39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week 38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week 37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week 36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week 35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week 34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week 33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week 32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week 31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week 30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. & Canada softwood and panel markets - week 22, 2020 (Jun

10, 2020)

-

U.S. & Canada softwood and panel markets - week 21, 2020 (Jun

3, 2020)

-

U.S. & Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. & Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. & Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. & Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. & Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. & Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. & Canada softwood and panel markets - week 14, 2020 (Apr

17, 2020)

-

U.S. & Canada softwood and panel markets - week 13, 2020 (Apr

08, 2020)

-

U.S. & Canada softwood and panel markets - week 12, 2020 (Mar

31, 2020)

-

U.S. & Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. & Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. & Canada softwood and panel markets - week 4, 2020 (Feb

4, 2020)

-

U.S. & Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. & Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. & Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. & Canada softwood and panel markets - week 50, 2019 (December

17, 2019

|