The Combination Of Remembrance Day In Canada And Two Big Lumber Industry

Association Annual Meetings Took A Lot Of Folks Away From Their Desks.

The combination of Remembrance Day in Canada and two big lumber industry

association annual meetings took a lot of folks away from their desks. As

such, lumber sales in mid-November were soft. Naturally, prices continued to

drop a bit as the usual seasonal slow-down truly took effect.

The lack of data releases for US housing starts was troubling, as this

information is necessary for operators to make plans for production activity

to come the following year. Winter is the time that sawmills across North

America invest in timber harvest, to get the log supply they will need for

lumber demand in advance of the next construction season. This is a

months-long effort.

So solid wood manufacturers must know where the housing market stands at

this time of year to estimate the requirements for loading up on feedstock

for the next building cycle.

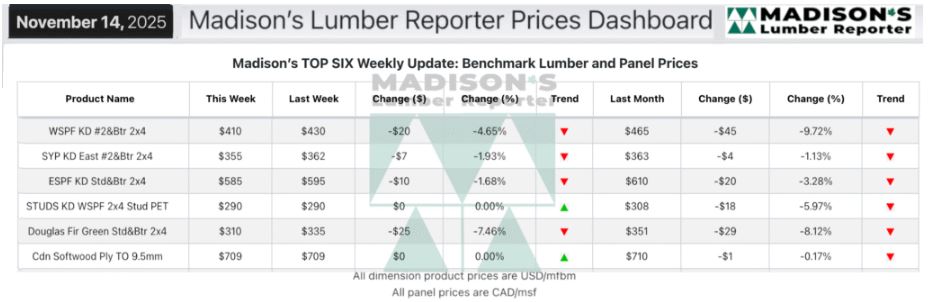

In the week ending November 14, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$410 mfbm. This was

down -$20, or -5%, from the previous week when it was $430, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$55, or -12%, from one month ago when it was

$465.

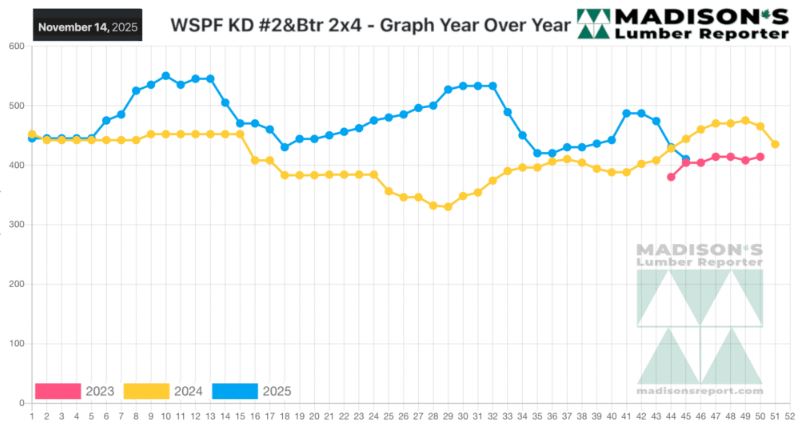

Compared To The Same Week Last Year, When It Was Us$444 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending November 14,

2025 Was Down -$34, Or -8%.

Compared To Two Years Ago When It Was $404, That Week’S Price Was Up +$6, Or

+1%....

KEY TAKE-AWAYS:

Several Western-SPF producers in the US indicated their openness to

counter-offers.

Canadian Western-SPF suppliers reported zero urgency and subpar demand from

downstream buyers.

Primary and secondary suppliers worked to move inventory and solidify

sawmill order files through December.

Decreasing Eastern-SPF prices cajoled many buyers into covering at least

some of their more pressing needs.

Price spreads were evident in Southern Yellow Pine with differing numbers

across mills, the distribution network, and geographical zones.

Eastern stocking wholesalers mostly had their yard stock and incoming

shipments to the ports at New Jersey covered for the balance of this year.

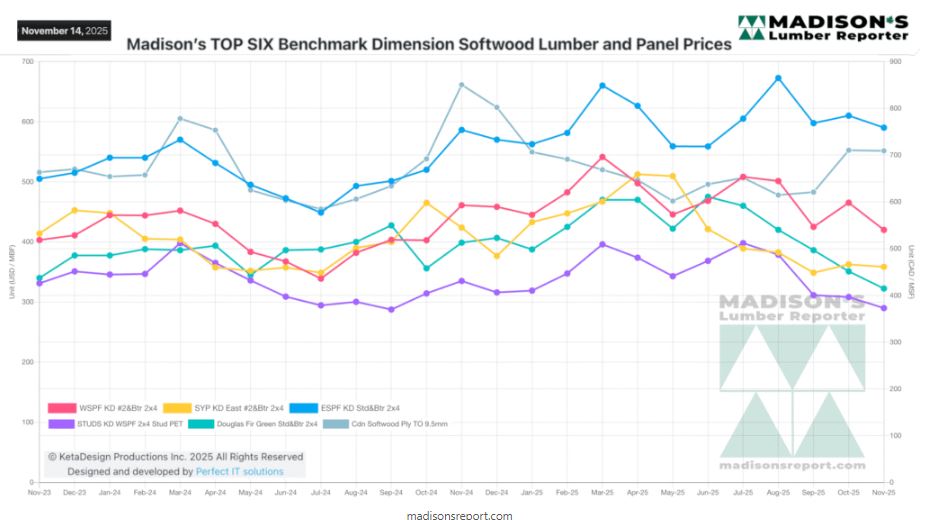

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: