A decidedly underwhelming 2025 spring building season slid into the usual

summer slow-down for the North American lumber industry.

Only the continued sawmill curtailments helped keep most prices generally

flat, as demand remained uninspired at best. Customers made the rounds

between producers and secondary suppliers in search of the best deals they

could find. The sawmills, having kept manufacturing volumes reduced, were

able to build out their order files past the two-week mark.

As such, they were not much inclined to hear counter-offers, keeping their

prices generally firm. Resellers were more amenable to negotiating,

if only to move wood out of their storage yards. For their part, purchasers

continued their now long-time habit of not stocking inventory and of

just-in-time buying.

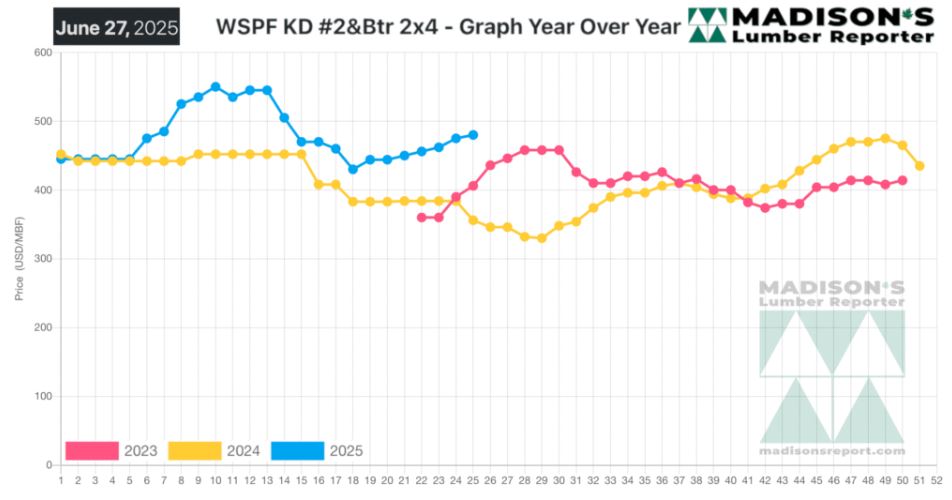

In the week ending June 27, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$480 mfbm, which is up +$5, or +1%, from the previous

week when it was $475, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter.

That week’s price was up +$34, or +8%, from one month ago when it was $446.

Compared to the same week last year, when it was US$356 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending June 27, 2025

was up +$124, or +35%.

Compared to two years ago when it was $406, that week’s price was up +$74,

or +18%.

.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

As June waned, lukewarm demand followed an underwhelming spring building

season.

Persistently cautious Western S-P-F buying was balanced by middling supply

in both Canada and the US.

While demand for Eastern S-P-F remained below seasonal standards, firming

prices and limited supply prompted increased sales.

Order files at Eastern sawmills extended through the two-week summer

shutdowns planned for late July.

Extreme heat in the US Southeast affected building activity, while

thunderstorms in the Southwest disrupted forestry operations for Southern

Yellow Pine operators.

Eastern stocking wholesalers noted that Douglas fir mills kept their prices

firm, were not receptive to major counter offers.

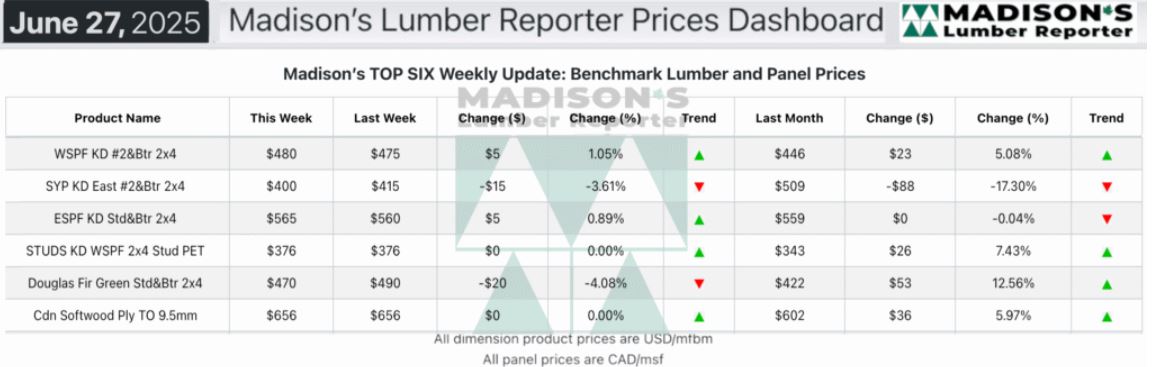

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: