Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Apr

2023

Japan Yen 132.40

Reports From Japan

Bank of Japan to review ultra-low

interest rate policy

The decision by the Bank of Japan (BoJ) to maintain ultra-low

interest rates under its new Governor Kazuo Ueda was widely expected,

however, it was the statement from the BoJ that core consumer prices are

likely to rise further that had an immediate impact on the exchange rate

with the yen dropping to a seven-week low against the US dollar at the end

of April.

The statement from the BoJ said it will spend about 12 to 18 months to

review its monetary policy.

See:

https://mainichi.jp/english/articles/20230428/p2g/00m/0bu/040000c

Covid downgraded

All COVID-19 border control measures will be removed on 8 May and

the legal classification of the coronavirus will be downgraded to become the

same as seasonal flu. Incoming travelers will no longer be required to show

proof that they have been vaccinated.

This will encourage a resumption of business travel and should boost inbound

tourism which is an important element in Japan's economy.

However, warnings have been given that there is a risk that a "ninth wave"

of infections is possible because of a recent rise in cases of a new,

contagious, sub-variant of the virus.

See:

https://english.kyodonews.net/news/2023/04/99539cd54a0f-japan-eyes-shift-to-quality-experiences-as-inbound-tourism-recovers.html

Fast up-tick of consumer price index

Consumer prices in fiscal 2022 rose 3% from the previous year, the

fastest gain in 41 years and the consumer price index, which excludes fresh

food prices, stood at 103 in fiscal 2022 (2020+100). The pace of increase

was the fastest since 1981.

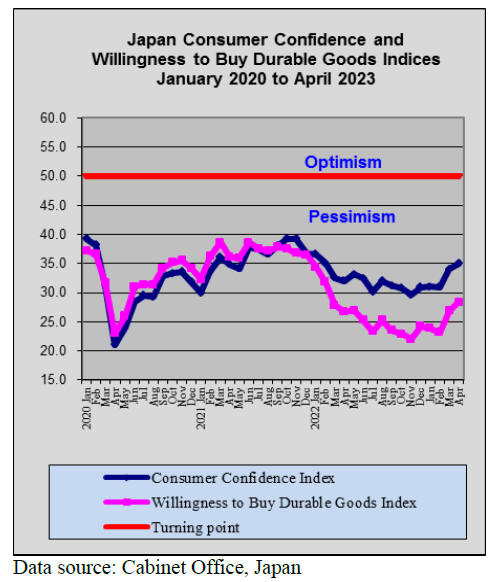

Private consumption improving but spending on durable goods weak

The April economic report from the Cabinet Office says “the economy

is picking up moderately, although some weaknesses are seen.” The report

said private consumption is improving but spending on durable goods remains

weak. Most of the rise in spending in April was on services. As a result of

the recent increases in wages and the lifting of covid rules social and

economic activities have picked up.

The April report revised up the assessment on imports for the first time

since July 2022, saying the sector is basically flat. The March report said

imports were “in a weak tone”.

Once again the report referred to slowing foreign economies because of

rising interest rates and financial market fluctuations as risks for the

Japanese economy.

See:

https://japannews.yomiuri.co.jp/business/economy/20230426-105752/

Prices continued to increase in the first quarter of

2023, however, the government programme to support electricity and gas

prices helped slow the rise in the price index. The new Bank of Japan (BoJ)

Governor, Kazuo Ueda, said Japan's consumer inflation is likely nearing its

peak and any further rise will be small.

See:

https://japannews.yomiuri.co.jp/business/economy/20230421-104970/

Long-term employment of foreign workers

It has been reported that the government plans to expand number of

sectors in its programme that allows foreign workers with specific skills to

live in the country long term. The change will mean that the accommodation,

agriculture and food service industries will be included. The plan is aimed

at promoting long-term employment of foreign workers to help resolve worker

shortages.

See:https://www.japantimes.co.jp/news/2023/04/24/national/foreign-workers-program-planned-expansion

Yen weakens

Over the past weeks the yen/dollar exchange rate remained rather

stable as inflation data was at forecast levels however, the suggestion from

the BoJ that inflation will continue to rise for some time drove down the

yen .

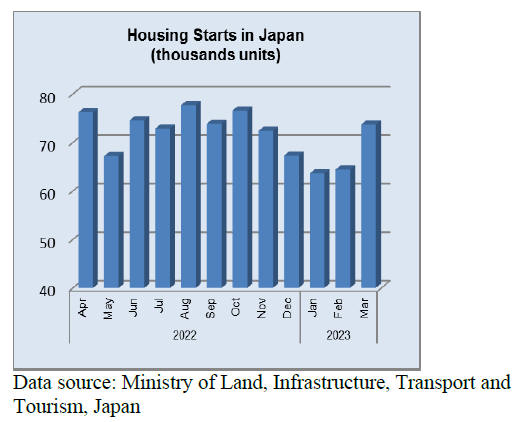

Investment in real estate slows

Over the past 12 months the inflow of money from international

investors helped drive up Japanese property values. This has helped drive up

land prices which, according to the Ministry of Land, Infrastructure and

Transport, have risen at the fastest rate in 15 years with the main cities

seeing most of the gains. However, recently the inflow of off shore funds

has slowed.

See:

https://asia.nikkei.com/Business/Markets/Property/Japan-real-estate-sees-signs-of-global-investors-shying-away

Import update

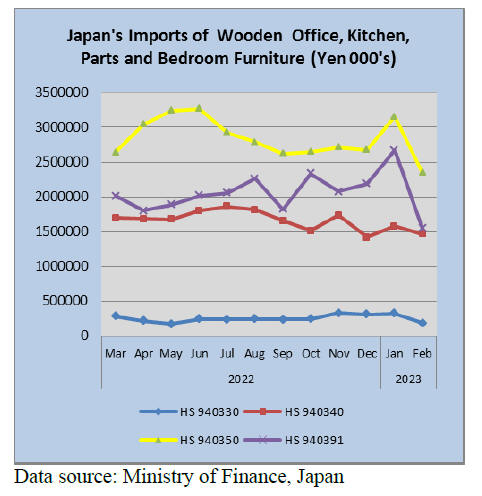

Massive correction in value of wooden bedroom furniture and wooden

furniture parts imports.

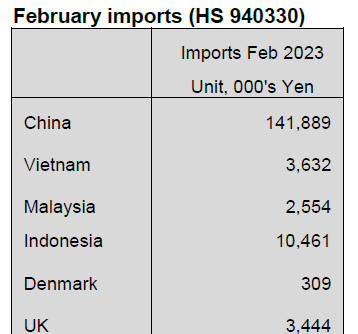

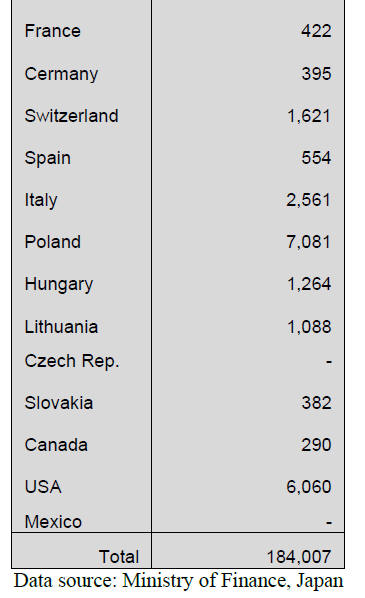

February 2023 wooden office furniture

imports (HS 940330)

The value of Japan’s wooden office furniture (HS940330) imports in

February was down 11% year on year and by 43% compared to Janauary this

year. The biggest losers were shippers in China who saw their share of

imports of HS 940330 drop from the over 90% in Janauary to 77% in February.

In February the other major suppliers were Indonesia and Poland.

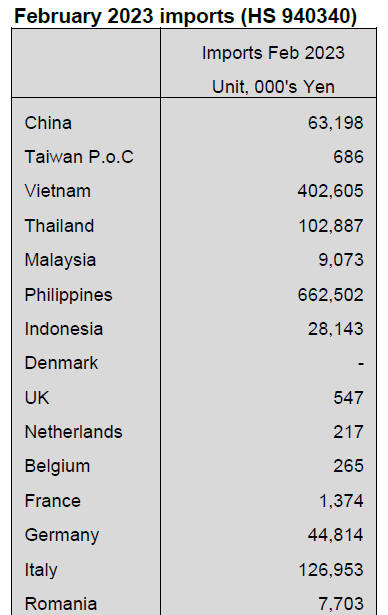

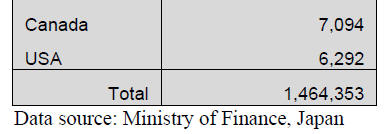

February 2023 kitchen furniture imports (HS

940340)

As was the case in January, over 70% of the total value of wooden

kitchen furniture (HS940340) imported by Japan in February this year was

from just two sources, the Philippines (43%) and Vietnam (23%).

Shipments of HS940340 from Vietnam in February were over 20% below that in

January. On the other hand there was an increase in the value of shipments

from Italy, Thailand and Germany.

Year on year Japan’s the value of imports of wooden kitchen furniture was

down 6% while compared oe January there was a 7% decline.

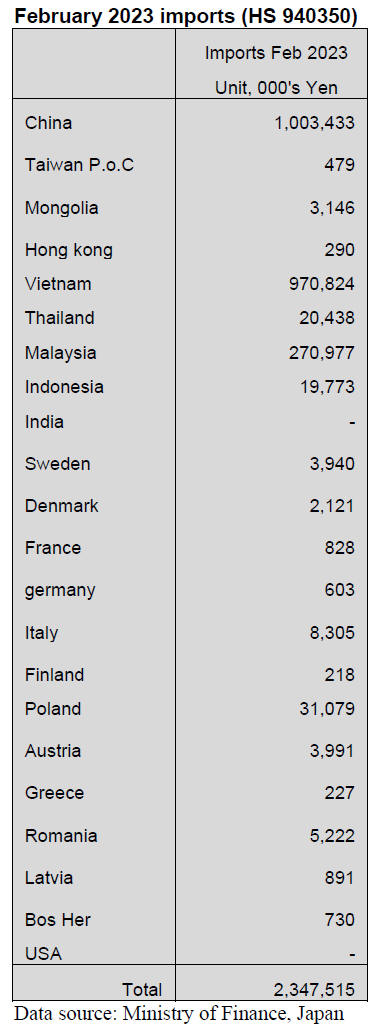

February 2023 wooden bedroom furniture

imports (HS 940350)

After the surge in the value of January imports of wooden bedroom

furniture there was a massive downward correction in February. It is likely

that this decline was due to the impact on trade of the New Year

celebrations in both China and Vietnam.

The value of arrivals of HS940350 from China in February was down 11% while

compared to Janaury there was a 25% decline. Shipments from China were down

40% in February while shipments from Vietnam dropped 15% in February.

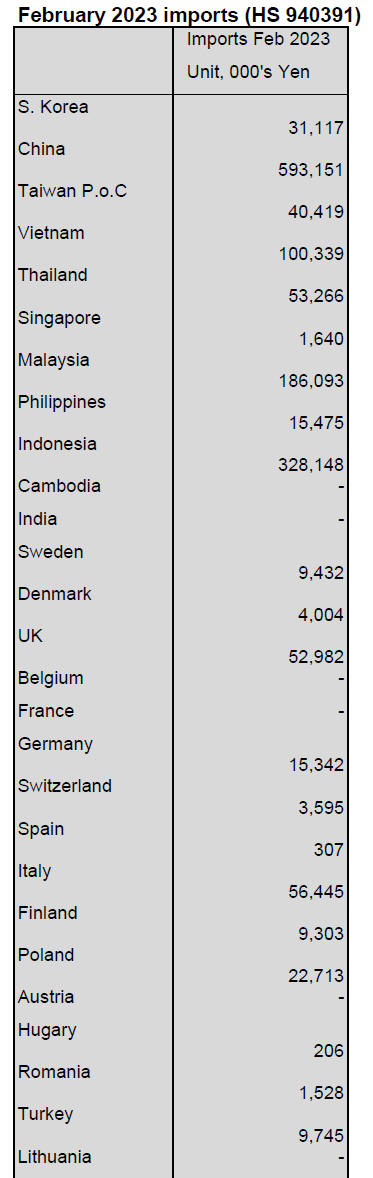

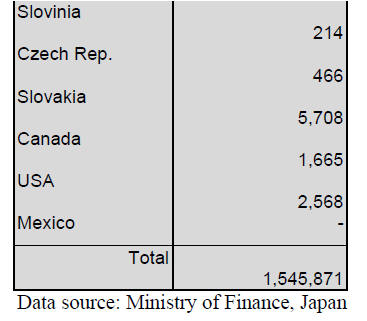

February 2023 wooden furniture parts imports

(HS 940391)

The impact of factory closures in China and Vietnam around the time

of the New Year is evident in the steep decline in the value of wooden

furniture parts (HS940391). Shipments from China and Vietnam were down by

half in February compared to a month earlier.

The top suppliers in February were China, Indonesia, Malaysia and Vietnam

and the value of shipments from each was down from a month earlier except

Indonsia for which the value of imports was little changed from Janauary.

Year on year the value of Japan’s imports of wooden furniture parts dropped

12% while month on month there was an over 40% decline.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market precisely as it appears in

the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

JAS certification on fixture materials of LVL

Woodsland Joint Stock Company in Hanoi, Vietnam got the

certification of JAS (Japanese Agricultural Standards) on LVL fixture

materials on 28th, February in this year. Styrax and acacia are used to

produce LVL and production is 2,000 – 3,000 cbms in a month. Sojitz Building

Materials Corporation will be in charge of finding a market for studs for

apartment buildings, cradling, core materials for fittings and materials for

prefabricated houses. About 2,000 – 2,500 cbms will be supplied in a month.

The company got the JAS certification for its first plant. The first plant

has the ability of producing over 2.7 meters of LVL for 2,000 cbms and under

2.7 meters of LVL for 3,000 cbms. The company used to produce acacia

building materials to Australia but the company started to look for a new

market due to intensification of competition in Australia. There are about

30,000 hectares of an afforestation area owned by the company.

About 6,000 hectares of the afforestation area has the FM (Forest

Management) of FSC (Forest Stewardship Council) for acacia. This

certificated acacia will be supplied to Japan. However, it would take time

to expand the use of acacia in Japan because many Japanese prefer white

colored LVL without burls such as styrax. Therefore, the company will expand

styrax LVL in Japan at first, then the company will see how the styrax LVL

move in Japan and propose acacia LVL.

Use more domestic lumber for 2 x 4 construction

Daito Trust Construction Co., Ltd. in Tokyo Prefecture finished

testing the strength of domestic red pine lumber for 2 x 4 construction and

confirmed that the strength is enough to use.

The company had been working with Forest Research and Management

Organisation and several other cooperative business associations to build

100% domestic lumber structures by 2 x 4 construction since 2022.

Japanese red pine from Iwate prefecture was used for testing the bending

strength and tensions. Results of tests and analyses, Japanese red pine

lumber is strong enough to use as floor joists and taruki of 2 x 4

construction. The company also designed a structure by using Japanese red

pine lumber as testing. For example, domestic cedar lumber for floor joists

on the 1st floor and Japanese red pine lumber for floor joists or taruki on

the 2nd floor. Moreover, domestic cedar lumber and Japanese red pine lumber

are for ceiling joists.

Purposes of the company are to curb climate change, to make forestry and

wood industry more active in Japan, to supply domestic lumber stably and to

promote using more domestic lumber. The company has been working on using

domestic lumber since 2009. Now, the company procures cedar mainly from

Kumamoto Prefecture, Iwate Prefecture and Kagoshima Prefecture.

UPM withdrew from Russia

UPM sold all its operations in Russia, including Chudovo plywood

mill, to Gungnir Wood Products Trading and completed withdrawal of its

business from Russia. Details of transaction are not open to the public.

South Sea logs and lumber

South Sea logs have been exported from Sabah, Malaysia to Japan for

the first time in five years. Actually, a banned export of logs was lifted a

year ago and logs had been exported to China until this year. Demand in

Japan remains strong at shipbuilding companies and steelmakers and there are

a lot of inquiries from South Sea lumber companies in Western Japan. Demand

seems good so far but it depends on the economy because prices are up in the

world.

The price movement of South Sea lumber and Chinese lumber in overseas and

Japan are having a temporary lull. Shippers in Indonesia would not lower the

prices because they were fasting for Ramadan at the end of March and they

had an Islamic New Year’s holiday at the end of April so the product will be

reduced.

A new platform for the J-credit Scheme

Sumitomo Forestry Co., Ltd. and NTT Communications Corporation work

together for creating a new platform for the J-credit scheme and start the

new platform in April. The J-credit Scheme is designed to certify the amount

of greenhouse gas emission reduced and removed by sinks within Japan. Under

the J-Credit Scheme, the government certifies the amount of greenhouse gas

emissions, such as CO2, reduced or removed by sinks through efforts to

introduce energy-saving devices and manage forests, as ‘credit’.

Credits created under the scheme can be used for

various purposes, such as achieving the targets of Japan Federation of

Economic Organizations to a Low Carbon Society, and carbon offset.

Those two companies start with PoC (Proof of Concept) for credit suppliers

and credit users. The new cloud service platform provides information about

forest resources or location of forest to the credit suppliers such as

owners of forest or examining authorities and the credit users by using GIS

(Geographic Information System). The services are:

Managing information of forest business, afforesting, or reforestation

with maps or pictures.

To support forest owners or forestry organizations to create the credit.

To support creating documents for applying certifications of the credit.

To provide any information about the credit for the credit suppliers and

the credit users for their transparency business.

Able to search good credit suppliers.

|