Hajiji also reported that over 100,000 hectares of degraded

forests have been identified for restoration in Sabah and

the State government has budgeted RM26.6 million in the

12th Malaysia Plan for forest rehabilitation and

management.

4.

INDONESIA

Double-digit growth in timber

exports

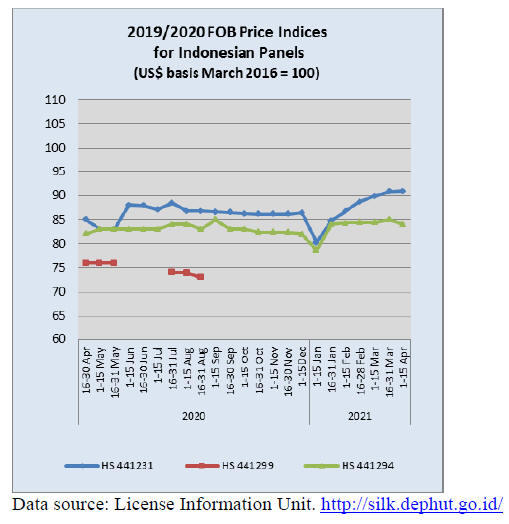

Indonesia notched up the remarkable feat of achieving

double-digit growth from its forestry exports in the first

quarter of this year despite the disruption of international

demand. Indonesian wood product manufacturers achieved

14% growth in exports in the first quarter of 2021. Siti

Nurbaya, the Minister of Environment and Forestry

applauded this as an outstanding performance.

The Minister commented that the upstream and

downstream forestry sector have benefitted from the

easing of tax and non-tax policies and have adapted well

to the new trading environment. She explained that

Indonesia's forestry exports to the US and China in the

first quarter of this year jumped over 30%.

See:

https://foresthints.news/indonesia-hits-double-digit-growthin-forestry-exports-during-first-quarter

Encouraging timber exports - First ‘Export Chats’

webinar

The Ministry of Trade through the Directorate General of

National Export Development conducted the first of a

series of export chat web seminars on ‘Processed Timber

Export Procedures’.

The Director General of National Export Development,

Kasan, said that this programme is part of the

government's response to global economic challenges and

aims to motivate businesses to increase exports of added

value wood products. The first ‘web-chat’ focused on

procedures, regulations and markets for small and medium

enterprises. Kasan said the government has simplified

export procedures and accelerated processing of business

licenses.

See:

https://www.kemendag.go.id/id/newsroom/tradenews/dorong-ekspor-kayu-olahan-kemendag-gelar-webinarperdana-ngobrol-ekspor-1

Chinese furniture association plans visit

Indonesia’s Ambassador to China, Djauhari Oratmangun,

has been involved in arranging a visit to Indonesia by a

furniture association from China. The Ambassador

commented that there is the potential for investment in an

industrial park for furniture and other manufacturing

companies.

See:

https://www.tribunnews.com/bisnis/2021/04/07/april-2021-asosiasi-furniture-china-akan-kunjungi-indonesia-untukinvestasi?page=2

In related news, according to the Indonesian Minister of

Trade, Indonesia and China are looking to triple bilateral

trade over the next three years.

To achieve this the two countries plan to review the

Bilateral Economic and Trade Cooperation (BETC)

agreement of 2011 and restructure it as a Trade and

Investment Framework Agreement (TIFA).

Recovery of SMEs a priority

Micro, small and medium-scale enterprises (MSME)

contribute over 60% to national economic growth and

absorbed a massive workforce of over 116 million

according to Coordinating Economic Affairs Minister,

Airlangga Hartarto. Recocognising this government, said

Hartarto, has focused on recovery of MSMEs and has

allocated a budget of Rp699.43 trillion for the national

economic recovery programme with around 25% to be

channeled for MSMEs.

See:

https://en.vietnamplus.vn/indonesian-govt-accords-priorityto-msme-recovery-for-bolstering-economic-growth/199549.vnp

New Ikea store to have section for local products

IKEA has opened a new store in Kota Baru Parahyangan

on the outskirts of Bandung. Patrik Lindvall, the CEO of

PT Rumah Mebel Nusantara which operates IKEA in

Indonesia said the planning of the new store was done in

cooperation with the West Java Governor and has a

dedicated area for quality domestically made products.

5.

MYANMAR

It has not been possible to

obtain news of the timber

industry.

Urgent action needed to stop violence

The UN Country Team in Myanmar reiterated its call for

an end to violence against civilians. “[We are] following

events in Bago with reports of heavy artillery being used

against civilians and medical treatment being denied to

those injured”, the Country Team (UNCT) said in

a Twitter posting. “The violence must cease immediately”,

it stressed.

See:

https://news.un.org/en/story/2021/04/1089492

Myanmar's military has rejected a request by U.N. special

envoy, Christine Schraner Burgener, to visit the country.

"I regret that Tatmadaw answered me yesterday that they

are not ready to receive me," she says on Twitter, referring

to the Myanmar military.

"I am ready for dialogue. Violence never leads to peaceful

sustainable solutions."

See:

https://asia.nikkei.com/Spotlight/Myanmar-Coup/Myanmarcoup-latest-UN-envoy-remains-ready-to-meet-junta-despiterefusal

Economic collapse

The Myanmar economy averaged 6% growth over the past

10 years but is now projected by the World Bank to shrink

10% in 2021.

Aaditya Mattoo, the World Bank’s chief economist for

Asia has been reported as saying “A 10% contraction in

growth for a poor country seems to me disaster enough

already.” Analysts at Fitch Solutions have projected a

“conservative” 20% contraction for the 2020-21 fiscal

year.

See:

https://www.businessstandard.com/article/international/myanmar-economy-likely-tocontract-up-to-20-as-crisis-looms-analysts-121041300053_1.html

6. INDIA

Strong housing

market in Q1

Compared to the final quarter of 2020 housing sales

increased 12% in the first quarter of 2021 according to a

report by PropTiger.com who noted that measures taken

by the Central and State governments to boost buyer

confidence have been effective.

The report ‘Real Insight - Q1CY21’ says 66,176 homes

were sold in the first quarter of 2021. However, compared

to the first quarter of 2020, home sales in the first quarter

2021 were down 5%.

The Group CEO of PropTiger.com, Dhruv Agarwala,

pointed out that real estate companies have more

confidence as liquidity support is available and buyer

sentiment is recovering.

The Inspector General of Registration in Maharashtrahas

reported a three-fold rise in property registrations in

March. The reduction in stamp duty rates has lifted

sentiment and spurred home buying.

See:

https://www.financialexpress.com/money/home-sales-rise-12-in-jan-march-quarter-amid-stamp-duty-home-loan-rate-cutsreport/2229249/

Good growth prospects – IMF

The IMF has projected a 12.5% growth rate for India in

2021, the only major economy to have a positive growth

rate last year. The annual World Economic Outlook,

prepared for the spring meeting with the World Bank, says

the Indian economy is expected to grow by 6.9% in 2022.

In 2020, India’s economy contracted by 8% according to

the IMF.

India’s exports and imports surged more than 50% from a

year earlier in March but this was from a very low base.

Data from the Ministry of Commerce shows that exports

grew 58% to a record US$34 billion and imports rose 53%

to US$48 billion in a month when global trade was

disrupted by the week long closure of the Suez Canal.

See:

https://indianexpress.com/article/business/economy/imfprojects-indias-growth-rate-to-jump-to-impressive-12-5-per-centin-2021/

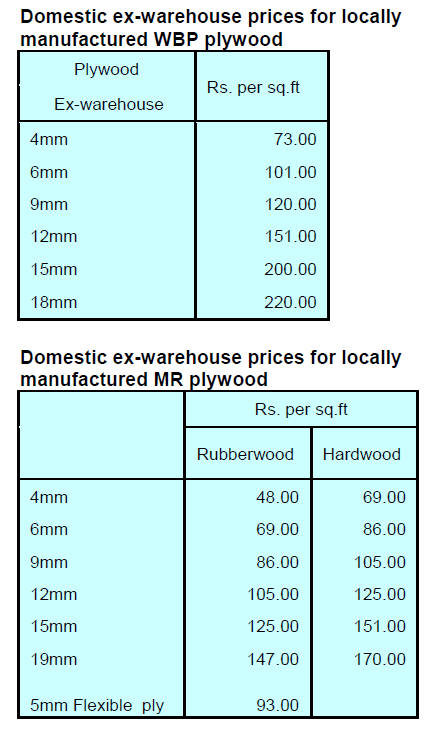

New investments in particleboard production

The growing demand for particleboard, driven partly by

increased purchases of ready to assemble furniture, is

attracting investment in production by major companies.

Currently, particleboard production is dominated by small

sized producers but now some of the laminate

manufacturers see an opportunity in panel production.

The Times of India has reported that the Gujarat

Government has approved a proposal from Merino

Laminates to establish a particleboard plant at Halol in

Panchmahal district. Plyreporter has indicated that other

high pressure decorative laminate producers are also

considering moving to downstream panel production.

See:https://timesofindia.indiatimes.com/city/ahmedabad/gujaratgovt-clears-rs-6k-cr-investments/articleshow/81160296.cms

and

http://emagazine.plyreporter.com/ply-reporter-march-2021/

Red sanders seized

Recently two tonnes of red sanders worth Rs.17 crores

(around US$2 million) was siezed just as the timber was

about to depart for Hong Kong via Dubai. Red sanders is

in demand especially in China and Japan but it is available

only in Seshachalam forests of Andhra Pradesh and is an

endangered species.

Plywood demand set to expand

According to a report ‘Indian Plywood Market: Industry

Trends, Share, Size, Growth, Opportunity and Forecast

2021-2026‘ from the IMARC Group a market research

company, the Indian plywood market was worth Rs222.5

Billion in 2020 and could expand over 4% annually up to

2026. The Indian plywood market is primarily driven by

construction activity and the home furnishing sector.

Growth in consumer disposable income levels along with

the rising expenditure on home décor will support demand

for wood based panels.

See:

https://www.imarcgroup.com/indian-plywoodmarket/requestsample

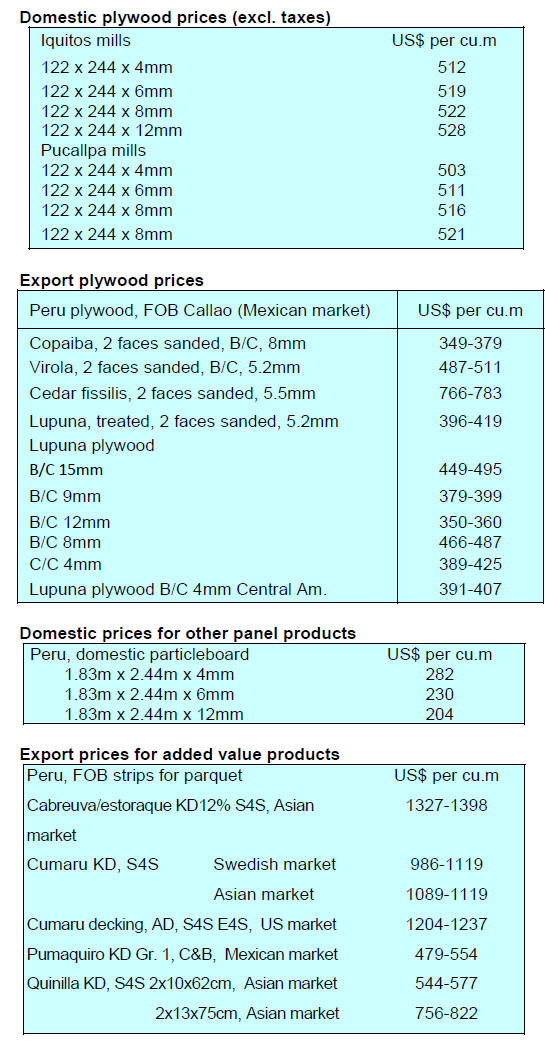

Plywood prices

The recently raised prices for plywood have been accepted

by the market and now, after a long wait, manufacturers

can beathe a sigh of relief. The improved prices, while not

raising margins, do help compensate for the higher

production costs due to rising raw material and labour

costs.

7.

VIETNAM

Phenominal export growth in first

quarter

Wood, forest and wood product export earnings in the first

quarter of 2021 reached US$3.944 billion, an increase of

41% over the same period in 2020 according to the

Vietnam Administration of Forestry.

Of the total, the export revenue from wood and wood

products stood at US$3.699 billion, up 41% while the

export revenue of other forestry products reached US$243

million, up 38% over the same period last year.

High export growth in the first quarter of this year was

achieved in Vietnam’s main export markets such as the

US, Japan, China, the Republic of Korea and the EU

which account for 90% of Vietnam’s forestry export value.

Meanwhile, imports of wood and wood products in the

first three months of this year was estimated at US$696

million, up 31% over the same period last year. The rise

in the value of imports was due mainly to increased prices

for raw materials.

The Ministry of Agriculture and Rural Development

has

asked the forestry sector to implement the “dual goals” of

preventing the COVID-19 pandemic and promoting the

export of products to achieve total export revenue of over

US$14.5 billion for the entirety of 2021.

See:

https://en.nhandan.org.vn/business/item/9754202-exportrevenue-of-forestry-products-soars-41-in-first-quarter.html

China the top investor in Vietnam’s timber industry

According to VNFOREST, over the first 3 months of

2021, there were 10 new wood product plants opened by

foreign investors from 6 countries with a total invested

capital of US$112.51 million. China continued topping

number of new FDI projects in the wood industry sector of

Vietnam.

Out of the 10 new projects, 8 projects were for production

of beds, cupboards and seats.

Investors from China accounted for half of the new

projects at US$13.86 million followed by Hong Kong (1

project for pallet production) Singapore (1 project for

wood/plastic flooring production), Belize (1 project on

indoor/outdoor furniture), South Korea (1 project on

plantation establishment) and the British Virgin Islands (1

project on production of dining tables, seats, beds and

cupboards).

In addition, in the first 3 months of 2021, there were 2

foreign investors which increased invested capital. One

was Chinese which expanded composite flooring

production capacity, the other was from Hong Kong which

upscaled its kitchen and vanity production factory.

See: 3 tháng đầu năm 2021: Trung Quốc vẫn dẫn đầu về số dự án đầu tư vào

Việt Nam trong ngành Gỗ (goviet.org.vn)

Container charges a burden

As of March 2021 the cost container rental for export has

more than doubled creating huge challenge for Vietnam’s

wood industry. Nguyen Liem, CEO of Lam Viet Company

(Binh Duong Province) which is exporting wooden

furniture to EU and US, claims that in the past the

container charge varied between US$2,800– 3,000 but

now it is between US$11,000-13,000.

In 2021, with forecast exports worth around US$14

billion, Vietnam will need 800,000 containers. Many say

part of the reason for this container crisis is the herding of

containers at Chinese ports (up to 50% of global

containers).

See:

https://goviet.org.vn/bai-viet/xuat-nhap-khau-nganh-go-vanoan-vai-vi-cuoc-van-tai-bien-tang-cao-9266

Vietnam’s Forestry development Strategy

On 4 April 2021 the Prime Minister approved the Vietnam

Forestry Development Strategy for the period 2021-2030

with a vision to 2050. The strategy targets that by 2050 the

forestry sector will have become a modern, effective and

highly competitive sector bringing into full play the

potentials and advantages of tropical forest resources with

modern and environmentally friendly technology.

The sector will have created a diversified product range

with high added value and will be a partner in global value

supply chains.

In terms of the contribution to society the forestry sector

will make an important contribution to building a safe and

prosperous country; a green economy will be associated

with forest resources, the traditional cultural identities and

living space of ethnic minorities will be preserved and the

sector will contribute to national defence and security.

On the environment, attention will be paid to sustainable

forest management and long-term conservation of natural

resources and biodiversity; ensuring environmental

security, water source security, minimising land

degradation and negative impacts of natural disasters,

proactively responding to climate change and providing

forest environment services; and participating in an active

and responsible manner and fully implementing the signed

international commitments.

See: Vietnam aims to become world leading forest producttrading centre -

Nhan Dan Online

E-commerce platform to boost trade with EU

The recent launch of a Vietnam/EU e-commerce

platform (VEFTA) is expected to boost Vietnam’s exports

to the EU market. Nguyen Kim Hung, Head of the

Vietnam Institute of Business Administration and Digital

Economy, said the platform will serve as a B2B

marketplace helping connect Vietnamese firms

and international trade partners, especially those from

Europe.

Once completed, it will be directly linked with the existing

e-commerce platforms of cities, provinces and sectors, he

said, noting that the platform will also provide necessary

information about trade agreements and policies regarding

international trade.

See:

https://en.vietnamplus.vn/ecommerce-platform-a-boost-forvietnams-exports-to-eu/199753.vnp

8. BRAZIL

Corona surge to impact economy

A second wave of the corona pandemic is sweeping Brazil

and is likely to impact economic activity in March, April

and even into May says the Central Bank president,

Roberto Campos Neto.

Brazilian Economy Minister, Paulo Guedes, said he

expects the economy will be back on track in two to three

months as the nationwide vaccination programme allows

people back to get back to work.

Forestry sector job creation

According to the Brazilian Agriculture and Livestock

Confederation (CNA) the agricultural sector created

32,986 new jobs in January this year, double the number

created in January 2020.

Among the agricultural activities that contributed

to the

job creation the forest sector created 1,022 new jobs. This

data is in line with private sector analysis which shows

that, although the forest sector was hit by an

unprecedented global crisis in 2020, it remained resilient.

Amazon task force

The ‘Task Force in Defense of the Amazon’ in the

Attorney General's Office will operate for one more year

according to the Brazilian Official Gazette after efforts by

the Brazilian Institute for the Environment and Natural

Resources and the Chico Mendes Institute for Biodiversity

Conservation (ICMBio). The Legal Amazon task force

was established in September 2019 to act on demands for

the defense of public environmental policies.

To date, the task force has collected R$3.11 billion from

environmental violators to guarantee the recovery of

151,700 hectares in the states of Amazonas, Rondônia,

Mato Grosso, Pará, Maranhão and Roraima in the Legal

Amazon. Most of the cases involve logging companies

and people who illegally transported, stored and traded

timber without an environmental license.

Furniture exports grow in February

Brazilian furniture exports continued to rise in February

according to data released by the Brazilian Furniture

Industry Association (ABIMÓVEL) in partnership with

the Brazilian Trade and Investment Promotion Agency.

2021 started well and international sales by the sector in

February 2021 were 27% higher year on year.

Specifically, exports of wooden furniture grew 29% in

February with the United States, the main destination

where demand expanded over 40%. The United States

continues as the main export market for Brazilian

furniture.

Furniture exports to Chile are also growing at a faster

pace, more than doubling compared to February 2020. As

a result Chile was the second placed destinations for

Brazilian furniture exports.

Successful marketing in the Chilean market demonstrates

that new opportunities for the national furniture sector can

be created. Proximity and bilateral agreements between

Brazil and Chile favour business development especially

in light of the disruption to global trade and exchange rate

issues for the Brazilian currency.

Reducing bureaucracy to support entrepreneurs

Provisional Measure (MP) N° 1.040 of March 29, 2021

published by the Federal government seeks to facilitate

foreign trade operations in Brazil.

This complements the Economic Freedom Act (Lei da

Liberdade Econômica) a set of measures to reduce

bureaucracy and make life easier for entrepreneurs which

came into force in September 2019. Flexibility in licensing

processes should facilitate the entry of imported goods

into Brazil.

The objective of the MP is to reduce the cases in which a

license is required. The regulation prohibits Federal

agencies from setting limits on the values of goods or

services traded. The exceptions are the regulations and

procedures for tax or customs under the jurisdiction of the

Special Federal Revenue Secretariat of Brazil and the

Ministry of Economy.

The government also ended the Integrated System of

Foreign Trade Services (Siscoserv). Previously companies

needed to use this system to inform the government of

their operations abroad. Now, the information on such

operations will be passed directly by the Central Bank and

then on to the Ministry of Economy eliminating

duplication.

It has been estimated the latest MP will help the private

sector to save R$3.5 billion per year by reducing

bureaucracy and eliminating barriers to imports.

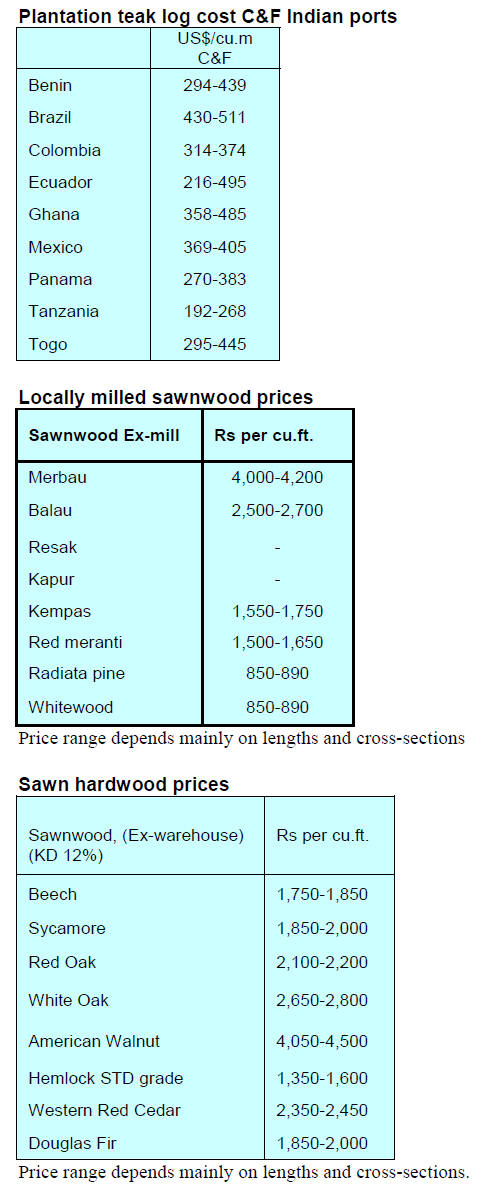

9. PERU

Adex: sustainable forest management

would help

reduce poverty

The president of the Exporters Association (Adex), Erik

Fischer, has said one way to end social exclusion and fight

extreme poverty is to value the Amazonian forests through

sustainable forest management, so that jobs can be

generated. He added that supervised forest concessions are

a tool that can improve productivity and at the same time

allow conservation of resources and generate

economically profitable and environmentally sustainable

jobs”.

He reiterated that most deforestation is a consequence of

the burning of forests for subsistence agriculture and that

after two years the areas are abandoned and new more

fertile areas cleared. He added that there are more than 13

million hectares of communal lands but this resource has

not become a source of development and well-being for

these communities.

A report from the CIEN-Adex Global Business and

Economy Research Center indicated that in 2020 the stock

of direct and indirect jobs generated by the wood product

export sector was 21,959, down 23% from 2019.

January export earnings

In January 2021 timber exports were valued at

US$7,227,000, a decline of 21% compared to the same

month last year. The top five destinations in January were

China (US2.31 million), France (US$1.127 million)

Mexico, the United States and Vietnam.

Businessmen - prioritise sustainable development in

the Amazon

The president of a leading wood product manufacturing

company has pointed out that, in recent years,

deforestation has topped 200,000 hectares per year.

This, he said, brought no benefits and there has been no

reforestation and claimed it was because there is no

coordinated work between regional governments, the

central government, entrepreneurs and international

organisations. To change this he urges the government to

establish priority actions in the Amazon for its sustainable

development promoting three economic sectors: forestry,

aquaculture and ecotourism.

A trans-Amazon train and infrastructure development that

integrates Peru, Brazil and the Pacific would boost

investments in reforestation, forest concessions,

aquaculture, ecotourism, agribusiness and responsible

exploitation of natural resources.

Currently the competitiveness of forestry businesses is

undermined as freight costs to transport wood to the coast

are between US$60 and US$250 per cubic metre. A trans-

Amazon rail line would cut transport costs.

First plantation harvest in 2023

With almost 25,000 hectares of forest plantations in

Ucayali Bosques Amazónicos (BAM) is preparing to serve

the domestic market taking advantage of the Federico

Basadre highway. The company will begin the first harvest

in 2023.

With an estimated investment of US$2 million between

2021 and 2022, the BAM nursery will have a capacity to

produce 1.5 million seedlings per year to supply its

operations in the Ucayali and Madre de Dios regions,

selling the excess to third parties. The main species

planted are Marupa, Capirona, Shihuahuaco and teak.

See:

https://gestion.pe/economia/empresas/moodys-bosquescalificacion-primera-cosecha-de-bosques-amazonicos-sera-en-el-2023-noticia/