|

Report from

North America

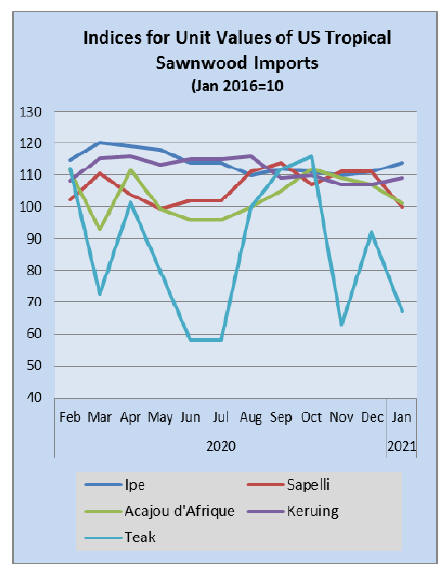

Sawn tropical hardwood imports fell in January but

new commodity codes make it uncertain by how much

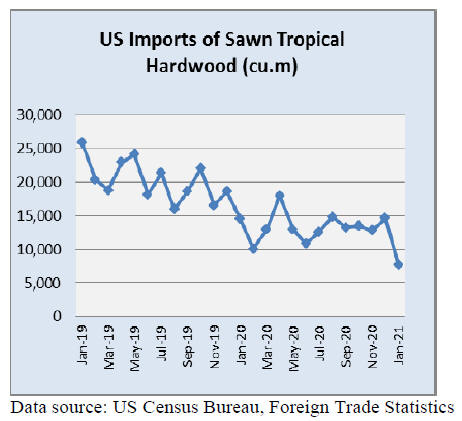

The volume of sawn tropical hardwood imported by the

US fell by in January but changes in how the US

government calculates the imports throw some doubt into

the actual amount of the decline.

Beginning with the release of January 2021 monthly trade

data, the US Department of Agriculture adopted the World

Trade Organization¡¯s internationally recognised definition

of ¡°Agricultural Products¡± as its standard definition for

reporting agricultural trade.

New commodity codes for ipe and jatoba imports were

created and appear to be indistinguishable from the former

codes. However, it appears the data for the new codes

have not been included in the January sawn tropical

hardwood imports. As such, the official total reported by

USDA for tropical hardwood imports was 7,662 cubic

metres in January which is a 48% decline from

December¡¯s volume. However, if January¡¯s ipe and jatoba

imports are added that total comes to 13,064 cubic metres,

a drop of only 11%.

Imports of balsa and virola more than doubled in January,

with Balsa imports showing the strongest volume in more

than a year. Imports of keruing fell 60% in January to

their lowest volume since 2012.

Canada¡¯s imports of sawn tropical hardwood stayed fairly

level in January, falling just over 1%.

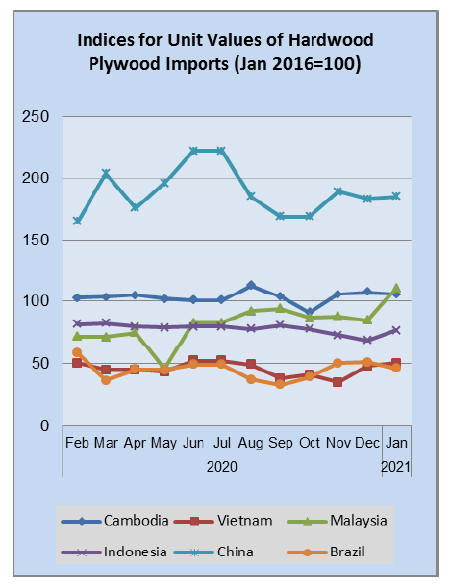

Hardwood plywood and veneer imports fell in January

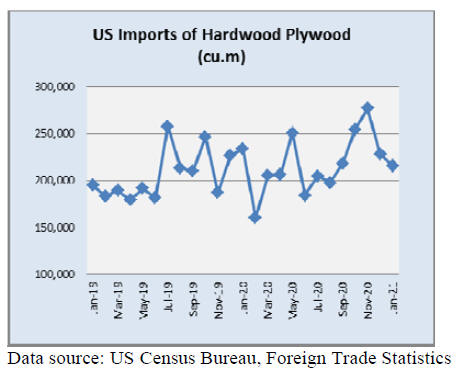

US imports of hardwood plywood fell by 5% in January

from December¡¯s volume to a level 8% less than that of

January 2020. January Imports were down sharply from

Malaysia and China with volume dropping 60% from

Malaysia and 57% from China.

Imports from both countries were more than 60% less than

that of the previous January. Imports from Indonesia and

Ecuador were down 14% and 10%, respectively, while

imports from Russia were up 15%.

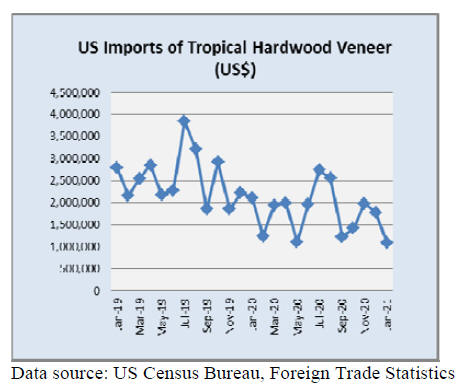

US imports of tropical hardwood veneer fell for the third

straight month in January, declining 39% to the lowest

level in more than five years. January imports were down

48% from January 2020.

The decline was due to there being noveneer imports from

Italy, the top supplier to the US. This also occurred in

September 2020. Meanwhile, imports from both India and

China were up sharply, but still did not reach the levels of

the previous January.

Strong start to year for hardwood flooring

US imports of hardwood flooring got off to a strong start

in 2021 as imports rose 25% in January. Imports for the

month from China more than doubled and imports also

rose sharply from Indonesia (32%).

Imports from Brazil were up 47% in January and were

also 47% better than the previous January. Total January

imports were 23% higher than January 2020.

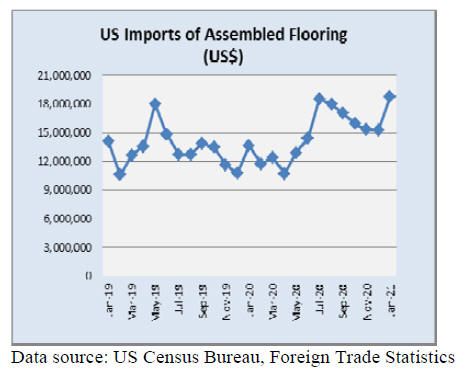

US imports of assembled flooring panels showed similar

strength, gaining 23% in January over December 2020.

Imports from Thailand more than doubled in January and

were 40% ahead of the previous January. Imports from

China, Canada, and Vietnam also surged in January and

significantly outdid totals for the previous January.

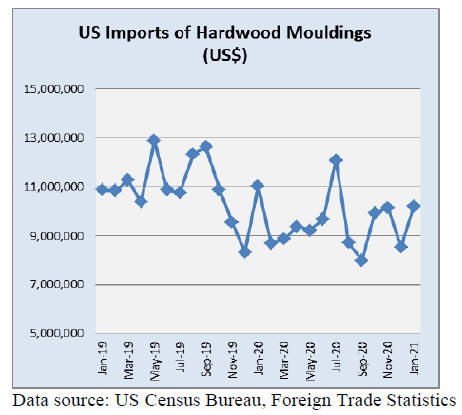

Moulding imports bounce back

US imports of hardwood mouldings rose 20% in January

to a level not seen since July 2020 but were still 8% less

the imports from the previous January.

Imports from China doubled in January while imports

from Brazil were down by 34%, both were down more

than 40% from last January. Imports from Canada grew

9% in January and were 10% higher than in January 2020.

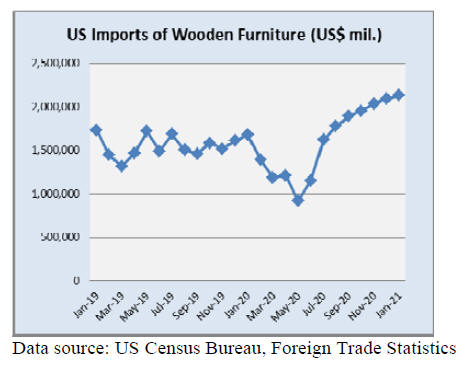

Growth in wooden furniture imports continues

US imports of wooden furniture continued a growth

streak, rising for the eighth straight month, up 2% in

January. Imports rose above US$2.1 billion for the month

as imports from most countries showed steady growth.

Imports from Vietnam and Canada both rose 6% while

imports from Indonesia rose 5%. Due to the steady

growth, imports from Vietnam were 45% higher than

January 2020. Total imports of wooden furniture were up

27% in January over the previous year.

The overall residential furniture market continues to grow

but has slowed somewhat according to the Smith Leonard

Furniture Insights report. Furniture orders slowed from

increases of more than 40% to a 17% increase in the

November 2019 to November 2020 comparison while

December 2020 orders were up 27% over December 2019.

Some 84% of survey participants reported increased orders

for the month. The increase in December brought total

orders for the year to 15% over those of 2019.

Shipments in December were only up 5% over December

2019. The increase in December resulted in a decrease in

shipments for the year of 6%. Approximately 78% of the

participants reported declines in shipments for the year.

See:

https://www.smith-leonard.com/2021/01/28/january-2021-furniture-insights/

Despite dip, cabinet makers report solid sales

Cabinet manufacturers reported an increase in overall

cabinet sales of 10.4% for January 2021 compared to the

same month in 2020 according to the Kitchen Cabinet

Manufacturers Association¡¯s (KCMA) monthly Trend of

Business Survey. Among survey participants, custom sales

are up 7.8%, semi-custom increased 17.7%, and stock

sales increased 6.1%.

When looking at the month-to-month comparison, cabinet

sales dipped. Overall sales were down 2.9% in January

2021 compared to December 2020. Custom sales

decreased 7.1%, but semi-custom sales rebounded to up

5.0%, while stock sales decreased 7.3%.

See:

https://www.kcma.org/news/pressreleases/january_2021_trend_of_busines_press_release

Circumvention finding on radiata/agathis pine plywood

overturned

In February this year the US Court of International Trade

overruled the finding by the US Department of Commerce

that imports of plywood with face and back veneers of

radiata and/or agathis pine from China are circumventing

the antidumping and countervailing duty order on

hardwood plywood.

As a result of the ruling the Department of Commerce has

until April to file a new determination finding, though it

could seek an extension of this deadline.

See:

https://www.cit.uscourts.gov/sites/cit/files/21-19.pdf

In January 2021, the commodity codes for ipe and jatoba were

redefined in the Harmonized Tariff System and adopted by the

US. Periodically, commodity codes are replaced, redefined or

recategorized.

These codes become obsolete and are replaced by

new codes.

|