2.

GHANA

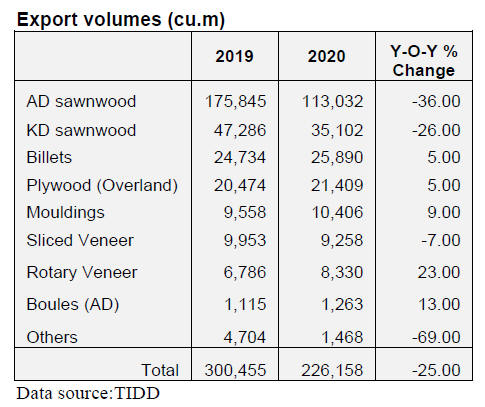

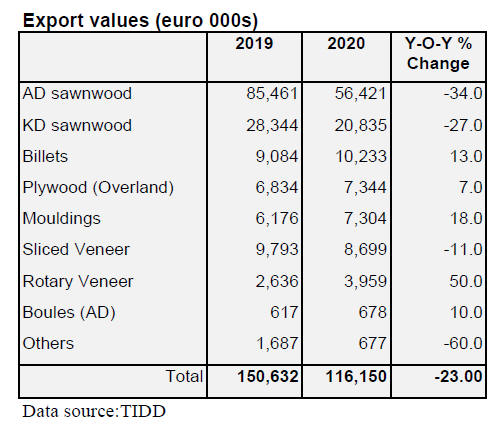

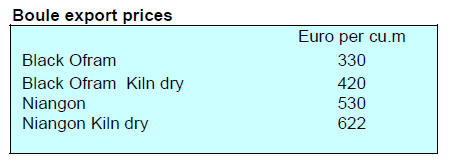

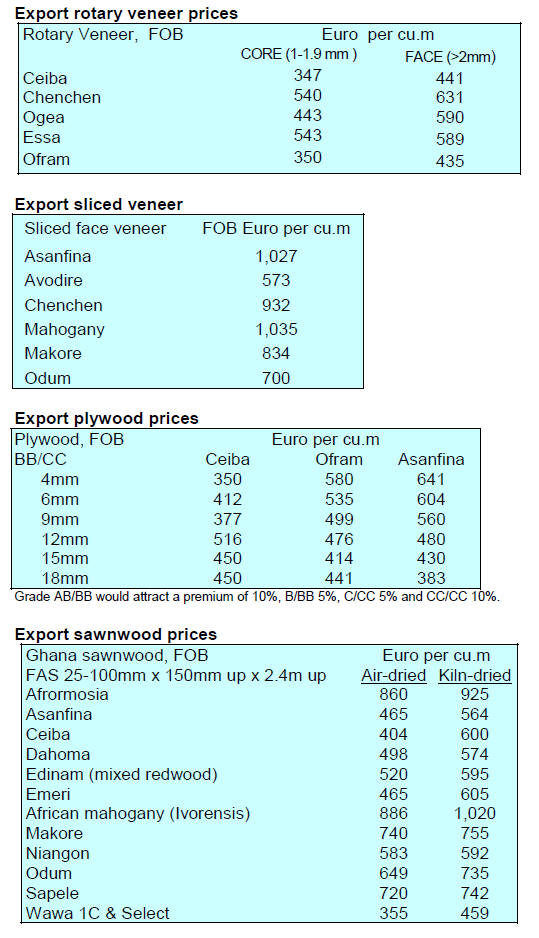

2020 exports declined in volume and value

Ghana’s exports of wood products in 2020 dropped to

226,158 cu.m representing a 25% year on year decline

compared with 2019. The export earnings for the year

were down 23% to Eur116.15 million in 2020 from

Eur300.455 million in 2019.

Air and kiln-dried sawnwood accounted for 66% of total

export volumes in 2020 but air dry sawnwood exports

were down 36% and kiln dry sawnwood exports fell 26%.

However, an increase in export in volumes was recorded

for rotary veneer (up 23%), air-dried boules (up 13%) and

mouldings (up 9%).

Overal,l export revenues plummeted but there were some

gains recorded for rotary veneer, mouldings, billets, airdried

boules and plywood for regional markets but

combined these products accounted for only 25% of total

2020 exports.

Direction of trade

Ghana’s wood product trade was largely with Asian

markets which accounted for over 60% of total exports in

2020. However, this was about 7% below levels seen in

2019.

The key markets were India, Vietnam, China and United

Arab Emirates. The major products were billets (plantation

logs) and sawnwood.

Wood product exports to Europe accounted for almost

19% of 2020 exports compared to 16% in 2019 and

included sawnwood, veneers, moulding, boules, plywood,

kindling and briquettes. The key markets were Germany,

Belgium and United Kingdom.

Neighbouring country wood products imports from Ghana

increased from 11% of all exports in 2019 to13% in 2020.

The ECOWAS market (mainly Senegal, Nigeria, Niger,

Gambia, Mali, Benin, Burkina Faso and Togo) accounted

for 83% of the volume of exports. Plywood and rotary

veneer dominated exports to ECOWAS member countries.

Ghana to benefit from EU funded mangrove project

Ghana is to benefit from an EU funded four-year project

on the management of mangrove forest that seeks to

protect mangroves in selected African countries from

Senegal to Benin.

The project aim is to strengthen the management of

protected and unprotected mangrove sites in these

countries.

National forest and land use map

The Ghana Forestry Commission has launched a National

Map of Forests and Land Use the culmination of a threeyear

project supported by Forests 2020, managed

by Ecometrica and supported by the UK Space Agency’s

International Partnership Programme.

See:

https://www.geospatialworld.net/news/national-map-offorests-and-land-use-by-ghana-forestry-commission/

Ghana recipient of COVAX vaccine

In a press release the UNICEF Representative in Ghana,

Anne-Claire Dufay and WHO Representative to Ghana,

Dr. Francis Kasolo announced the arrival of the first

COVID-19 vaccines in Ghana.

The shipment, consisting of 600,000 doses of

the AstraZeneca vaccines, arrived at Kotoka International

Airport in Accra. The Minister for Health-designate,

Kwaku Agyeman-Manu, led a government delegation to

receive the consignment.

3. MALAYSIA

Vaccine

roll-out scheduled

The pandemic is still disrupting life and businesses in

Malaysia but the government expects to complete its

vaccination programme by February next year covering

80% of its population of about 32 million people.

The first phase of the vaccine rollout is from February and

will involve 500,000 frontline workers followed by 9

million high-risk individuals who will be vaccinated

between April and August. A third and final phase will

involve more than 16 million adults aged 18 and older.

The country has seen a sharp spike in corona infections in

recent weeks after having largely reigned in the epidemic

for most of last year. The surge in cases has pushed the

cumulative total above 220,000.

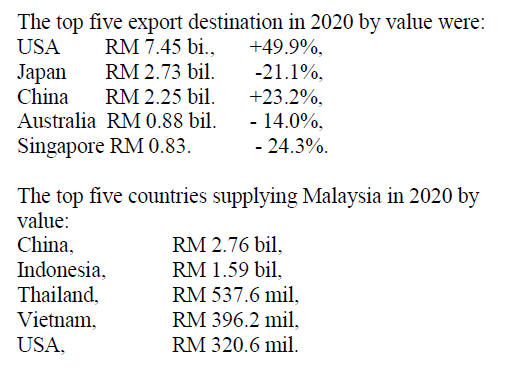

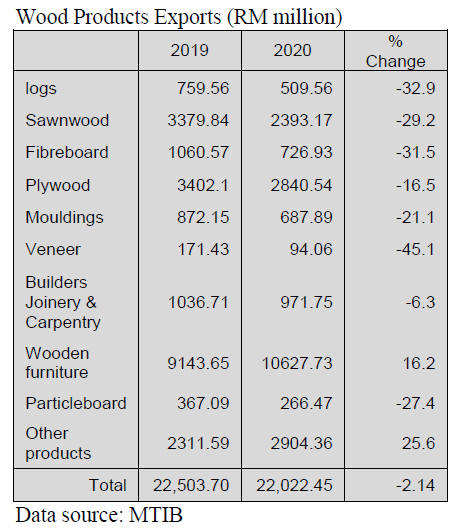

2020 timber industry performance

The Malaysian Timber Industry Board (MTIB) has

reported last year’s performance of the timber sector.

Exports were RM 22.02 bil (RM 22.50 bil in 2019) while

total imports were RM 6.81 bil (RM 5.95 bil in 2019).

Timber exports contributed 2.2% of the country’s overall

exports of RM 980.99 bil. The workforce in the forestry

sector was estimated at 140,000 of which 55% are

estimated to be foreign and 45% local. Annual investment

data are available only for 2019 showing domestic

investments were RM 479.88 mil and foreign investments

RM 851.42 mil.

Exports in the first quarter 2020 were badly impacted by

measures to address the Covid-19 pandemic though timber

companies were later allowed to operate with a 50%

reduction in manpower. The industry faces a shortage of

raw materials both domestic and imported. Moreover,

from July ocean freight rates for containers increased

sharply and the situation was made worse by disruption in

container availability.

The industry suffered from a shortage of and sustainable

supply of raw materials. Marketing was made more

challenging with the US Lacey Act, Australia’s Illegal

Logging Prohibition Act, the EUTR and the California

Anti Deforestation Act. Also, there was stiff competition

in pricing and quality from neighbouring Indonesia and

Vietnam.

E-commerce became more common during the Covid 19

pandemic and this was a challenge as not all products can

be sold in e-markets. The heavy reliance on foreign labour

is of concern though there seems to be no clear path to

address this.

There is a severe lack of skilled workers as can be seen by

the low productivity. The timber sector worker

productivity is about RM 47,000/worker/year while the

national average is RM 77,000/worker/year. Overall there

seems to be a lack of innovation in wood products and

original designs.

Shipping a major headache

The timber industry is experiencing a disruption of

container flows. Some shippers are keeping their

containers longer than usual and an imbalance between

exports and imports in some major trading countries has

caused surpluses in some ports and shortages in others.

Westports Holdings managing director, Ruben Emir

Gnanalingam, pointed out that, due to slow retail sales

because of the lockdowns, many companies have stored

packed containers and only when sales pick up can the

containers be unstuffed and put back into circulation. He

said under normal circumstances the container shipping

cycle averages about five to six shipments globally per

annum. However, container shipments take much longer

now and the cycle has dropped to between four and five

because of the pandemic.

See:

https://www.nst.com.my/business/2021/02/667840/containershortage-due-shippers-keeping-longer-expected

Attracting engineers and technologist to the timber

industries

A press release from the Malaysian Timber Council

(MTC) introduces its first ‘Engineer Placement and

Internship in the Timber Industry Programme’, a move to

attract engineers to the timber sector.

The programme will begin in March and is aimed at

engineers, wood technology graduates as well as

undergraduates who will be invited to join timber

companies for an internship that may lead to them building

successful careers in the industry.

The MTC internship programme will be a collaboration

between the Council, companies, higher learning

institutions and timber associations. MTC CEO, Muhtar

Suhaili, says the need for engineers is becoming more

crucial as timber-based manufacturers remodel their

operations towards digitalisation and smart manufacturing

He added that this programme is part of the MTC’s Five-

Year plan which focuses on building the knowledge talent

in the industry.

See:

http://www.mtc.com.my/media-PressRelease.php

4.

INDONESIA

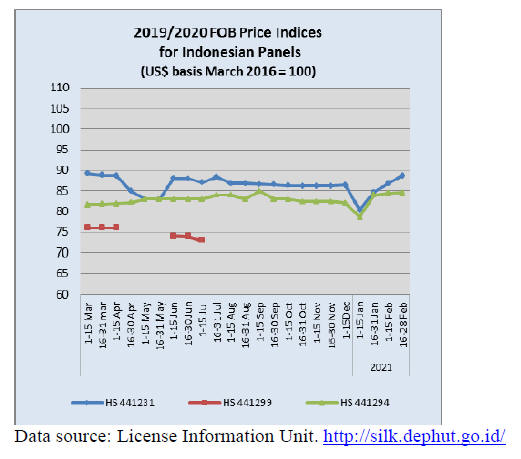

Indonesia’s exports of wood products

better than

expected in 2020

Indonesia’s exports of forest and wood products to all

destinations held up better than expected in 2020.

According to a statement in January 2021 by Bambang

Hendroyono, the Secretary General in the Indonesian

Ministry of Environment and Forestry, Indonesia’s 2020

export target for forest and wood products was projected

to be exceeded despite the impact of the corona pandemic

on production and trade.

Early in 2020 the export target was lowered from US$10

billion to US$7 billion to take account of the anticipated

disruption of business. However, export earnings in 2020

are expected to exceed US$11 billion, even more than the

original target and only 5% below that of 2019. The

Secretary General emphasised that Indonesian

Government incentives and relaxation of regulations

helped achieve this success.

Indonesian forest products export data can be found at:

https://www.flegtimm.eu/index.php?view=article&id=275:indonesia-sexports-of-forest-and-wood-products-better-than-expected-in-2020&catid=21:market-news

With growth in January 2021 of 6.3% compared to

January 2020 prospects for the year look positive. The

strongest growth in terms of export value was by the

furniture sector. Reacting to the positive growth level

attained by forestry exports in January the Association of

Indonesian Forest Entrepreneurs (APHI) Chairman,

Indroyono Soesilo, said he anticipates 2021 export

earnings by the forestry sector will be US$2 billion.

See:

https://foresthints.news/indonesias-forestry-exports-moveback-to-positive-growth/

Finland an appreciative market for teak products

According to a press release from the Indonesian Embassy

in Helsinki, Ambassador Ratu Silvy Gayatri has seen that

teak furniture made in Solo and Yogyakarta has found a

market in Finland.

A furniture store operator in Finland said "Indonesian

furniture is known for using high quality wood and unique

designs, which the Finnish people appreciate."

The Ambassador has been promoting furniture products

made by Indonesian micro, small and medium enterprises

to support improve the export performance.

See:

https://sinarjateng.pikiran-rakyat.com/internasional/pr-1001474366/dinilai-unik-furnitur-indonesia-punya-banyakpeminat-di-finlandia

President urges early preparation for forest fire season

The Indonesian President has urged local authorities to be

prepared to tackle forest fires later this year highlighting

growing risks in Sumatra, Kalimantan and Sulawesi. The

high risk period begins in May and peaks in August to

September. The President said fires cause considerable

financial losses and serious damage to the ecosystem.

As most fires are caused by human activity the President

stressed that the law should be applied without

compromise and anyone who sets fire to forests will face

the full weight of the law.

5.

MYANMAR

Civil Disobedience

Movement – businesses closed

After the military-led State Administration Council took

control of government on 1 February 2021 employees

from the private sector, along with government employees,

have joined the Civil Disobedience Movement in protest.

This resulted in almost all business ceasing operations and

exports. Only those containers stuffed before 1 February

have been shipped. The Myanma Timber Enterprise

suspended the monthly tender sale.

Priority for Economic Recovery

The new Minister of Investment and Foreign Economic

Relations of the State Administration Council outlined

plans for economic recovery in the aftermath of COVID-

19.

See:

https://www.mmtimes.com/news/myanmar-prioritiseeconomic-recovery-says-minister.html

Threat of sanctions a risk for businesses

Many firms, especially foreign-owned businesses in

Myanmar have reacted with shock to the declaration of a

yearlong state of emergency.Dr. Maung Maung Lay, vice

chair of the Union of Myanmar Federation of Chambers of

Commerce and Industry (UMFCCI), told The Irrawaddy

newspaper many investors are in shock over the military

takeover adding that businesses are waiting to see how the

situation unfolds.

Economist Dr. Aung Ko Ko said the military takeover

would impact small and medium-sized enterprises in the

country and jeopardise the economic reforms implemented

by the civilian government.

See:

https://www.irrawaddy.com/news/burma/sanctions-threatalready-chilling-effect-business-activity-myanmar.html

Running short of cash

A growing number of businesses reported that they are

running short of cash with banks closed. Most banks in the

country have been unable to open for business as

employees failed to report for work in order to participate

in the nationwide protest. Almost all 27 national banks

have been closed for the past two weeks.

See:https://www.mmtimes.com/news/myanmar-businesses-callstability-banking-sector.html

World Bank - Myanmar’s development prospects

threatened

In a statement on its website the World Bank says the coup

threatens Myanmar’s development prospects. The

statement dated 19 February reads:

“The World Bank Group is gravely concerned about the

ongoing situation in Myanmar following the events of

February 1, which constitute a major setback to the

country’s transition and its development prospects.

Effective February 1, we have temporarily put a hold on

disbursements on our operations in Myanmar, as we

closely monitor and assess the situation. The World Bank

Group’s internal policies and procedures lay out processes

in these situations which we are following carefully.

We are putting in place enhanced monitoring of projects

that are already underway, to ensure compliance with

World Bank Group policies.

For the last decade, the World Bank Group has been a

committed partner in supporting Myanmar’s transition to

democracy, and its efforts to achieve broad-based

sustainable growth and increased social inclusion. We

remain firmly committed to these goals and to the

development aspirations of the people of Myanmar.”

See:

https://www.worldbank.org/en/news/statement/2021/02/01/developments-in-myanmar

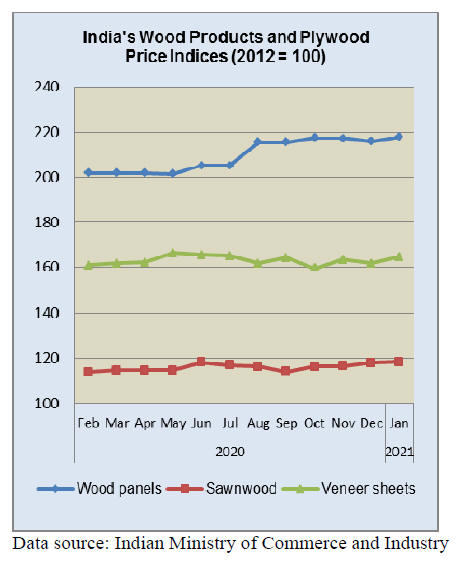

6. INDIA

Wood product price

indices rise

The Ministry of Commerce and Industry has reported the

official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for January 2021 increased to 124.0

in January from 123.0 in December 2020.

The index for manufactured products increased in January

2021. 18 groups saw increased prices including furniture,

paper and paper products, wood and of products of wood

and cork compared to December, 2020. The rate of

inflation based on monthly WPI stood at 2.03% in January

2021 compared to 3.52% in January 2020.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Encouraging export growth

India recorded a 6% surge in exports in January, the

second monthly improvement since the beginning of the

pandemic. Imports also grew for the second successive

month in January, rising 2% according to the Indian

Ministry of Industry and Commerce.

Supreme Court – foregone benefits from tree clearing

to be included in development project costs

Chief Justice SA Bobde of India’s Supreme Court's Green

Bench has declined to approve tree felling in the Taj

Trapezium Zone, an area of 10,400 sq. km around the Taj

Mahal. The court ruling says felling of mature, beneficial

trees for development work, including laying roads and

setting up industries is banned. The court further ordered

the inclusion of the value of trees, such as its oxygen

production, to be included in the project cost.

See:

https://www.hindustantimes.com/india-news/sc-puts-onhold-felling-of-trees-for-road-projects/story-NijChv0l4f9qgvj9N18A6N.html

(On April 16,1996, a division bench of the Supreme Court (SC)

comprising Justices Kuldip Singh and S Saghir Ahmed directed

the chief justice of the Calcutta High Court to constitute a

special division bench to hear environment-related petitions -

and the nation's first green bench was born. The SC has directed

this bench to meet once a week.)

Teak planted on over 1,000 hectares in Tiruchi and

Thanjavur

The Forest Department has planted teak seedlings along

the canal bunds of Cauvery river and on Padugai lands in

Tiruchi and Thanjavur circles.

About 30,000 saplings were planted at Samayapuram

Upparu, Natham and along Nattuvaikkal at Melur

covering a total area of 150 hectares. This is the fifth year

of implementation of the scheme that has been put in place

with the multiple objectives that includes meeting the

timber requirements and enhancing green cover. The teak

plantations would be harvested after 30 years and would

be sold through public auction by the Department.

Prices differential between Eucalyptus and poplar

narrowing

Plyreporter, in its January 2021 Indian panel journal, said

timber raw material costs appear to be heading higher this

year as firm demand, along with limited supply, fuels price

increases. Poplar and eucalyptus are used for core veneer

and composite panel production but poplar logs are

becoming more difficult to secure resulting in a switch to

eucalyptus as an alternative.

At the beginning of this year poplar log prices rose by 10

to 15%. An analyst suggests it will not be until 2022 that

the new harvest of poplar will come on stream and that

prices for large girth freshly harvested poplar will rise.

The rising demands for particleboard and MDF is adding

to the supply constraint and thus driving prices higher.

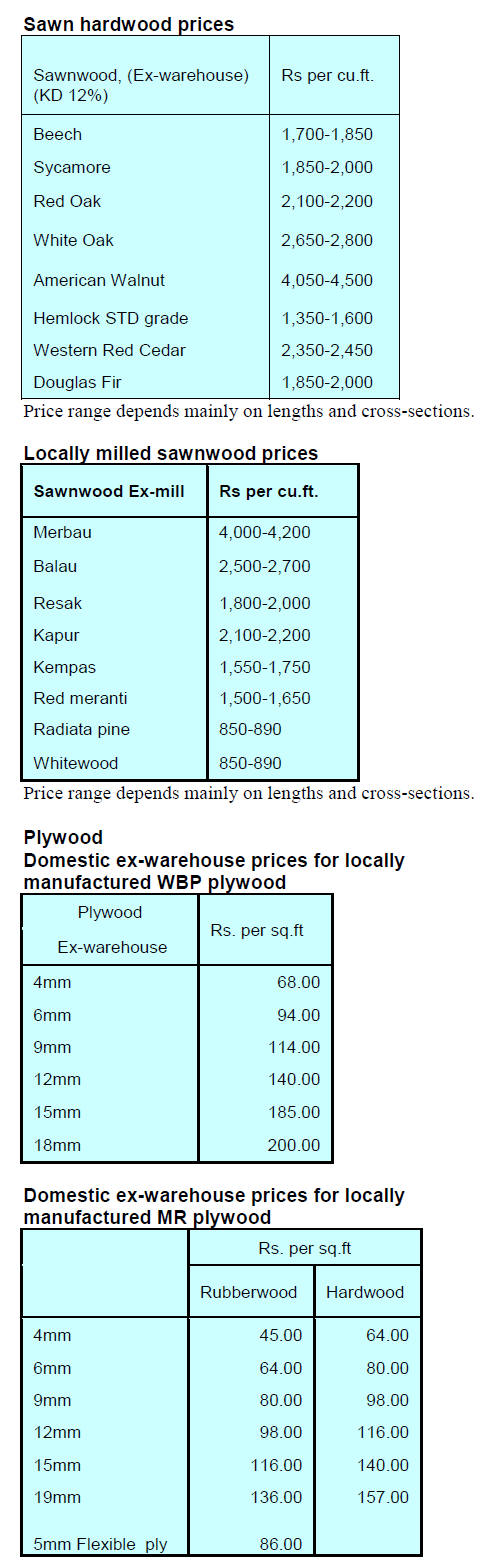

Sawn hardwood prices

Some of the main traders have accepted increased

container cost so as to move their timber. For a short

while, as the corona cases flattened, there was an

improvement in demand but now the virus has begun

spreading more rapidly and the market has become slow.

Merchants are anticipating that the government will

reintroduce lockdowns in badly affected areas.

7.

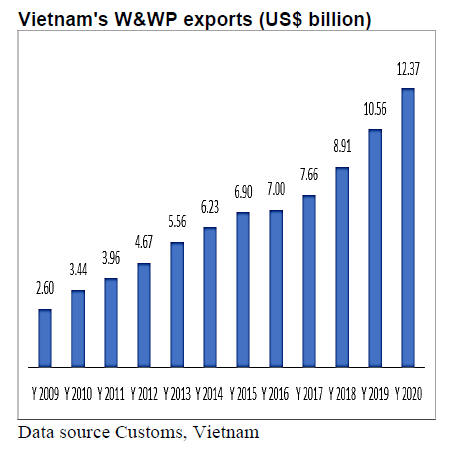

VIETNAM

Wood and wood product exports 2020

In 2020, in spite of the pandemic, exports of wood and

wood products (W&WP) amounted to US$12.371 billion,

a year-on-year growth of 16%. Of this, WP export were

valued at US$9.535 billion, 22.5% up compared to 2019

and accounted for 77% of total W&WP exports. With this

growth rate W&WP steadily remain amongst top 6 export

commodity groups in Vietnam.

The US continued as the top destination for of Vietnam’s

W&WP exports. In 2020, W&WP export to the US

reached US$7.166 billion, 34% higher than in 2019 and

accounted for 58% of the total W&WP exports.

With the current momentum, in 2021 W&WP export

growth is forecast to expand 15% generating US$14.0

billion provided no major export market uncertainties

occur.

W&WP export by foreign enterprises

In 2020, exports of W&WP by foreign enterprises were

valued at US$6.15 billion, 30% higher than in 2019 and

accounted for around half of all W&WP exports by the

entire industry (in 2019, this indicator was 42%). Exports

by foreign companies of WP reached US$5.661 billion,

318% up compared to 2019 and accounted for 93% of the

total value of W&WP exported by foreign enterprises.

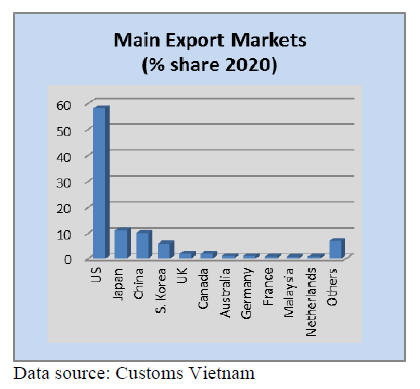

Export markets

The US continued as the top market, followed by Japan

consuming 11% of total W&WP exports. W&WP exports

to Canada and Australia also experience high growth rate

with the year-on-year growth of 14% each compared to

2019.

China and South Korea remain important buyers of

Vietnam’s W&WP but growth of exports was not

significant. In contrast, exports to the UK and France

declined by 27% and 19% respectively.

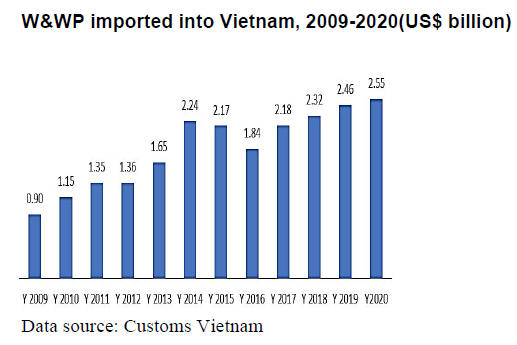

Imports

In 2020, W&WPs imported into Vietnam were valued at

US$2.558 billion showing a minor year-on-year growth of

0.6%.

W&WP imports by foreign enterprises

In 2020 the value of W&WP imported by foreign

enterprises reached US$1.045 billion, 35% up compared to

2019 and accounted for 41% of the total W&WP imports.

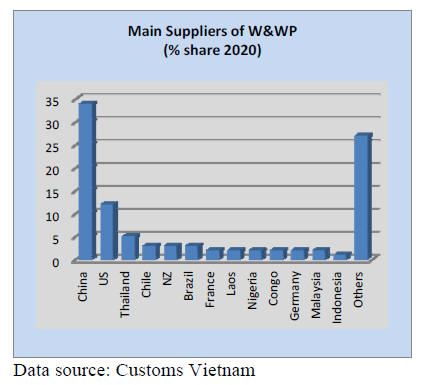

Main suppliers

In 2020, China continued as the largest W&WP supplier

for Vietnam accounting for US$862 million and a share of

34% of total imports.

Imports of W&WP from Thailand and Russia increased by

15% and 88% respectively compared to 2019. Conversely,

imports of W&WP from the US, Chile, Brazil, and France

declined compared to 2019.

W&WP exports by key products, 2020

The top W&WP exported in 2020 included wood chips,

wood-based panels, wood pellets, chairs and wooden

furniture. Of these, peeled veneer grew at the highest rate,

increasing by 94% in volume and 51% in value, followed

by chairs with a growth of 32% in export value and

wooden furniture of 22% compared to 2019.

Wood pellet: Export volume 3.2 million tons,

valued at: US$352.03 million, 15% up in quantity

and 13% up in value against 2019.

Fibreboard: Export volume 111,200 cu.m, value

US$45.78 million, 28% down in volume and 1 %

in value against 2019

Peeled veneer: Export volume 694,230 cu.m,

value US$81.69 million, 94% up in volume and

51% up in value against 2019

Particleboard: Export volume 39,700 tons, value

US$9.5 million, 16% down against 2019

Plywood: Export volume 2.09 million cu.m,

value US$719.41 million, 0.2% down against

2019

Woodchips: Export volume 11.6 million tons,

value US$1.48 billion, 3% down in volume and

12% down in value against 2019

Chairs: Export value US$2.67 billion, 32% up

against 2019

Wooden furniture: Export value US$5.87 billion,

22% up against 2019

W&WP importss by key products, 2020

Key imported W&WP included logs, sawnwood,

fibreboard, and plywood. In 2020 imports of logs and

sawnwood declined while the imports of wood-based

panels increased.

Logs: Import volume 2.02 million cu.m, value

US$563 million

Fibreboard: Import volume 744,670 cu.m, 8% up

in volume and 2 % up in value against 2019

Sawnwood: Import volume 2.54 million cu.m,

value US$ 42.06 million, 9% down in volume

and 1% down in value against 2019

Particleboard: Import volume 434,720 cu.m,

value US$84.69 million, 16% up in volume and

7% up in value against 2019

Plywood: Imports 604,280 cu.m, 16% up in

volume and 6% up in value against 2019

Veneer: Imports 275,980 cu.m, value US$208.13

million, 27% up in volume and 9% up in value

against 2019

Chairs: Import value (HS 9401) US$ 163 million,

28% up against 2019

Wooden furniture: Import value (HS 9403) US$

187.95 million, 51% up against 2019

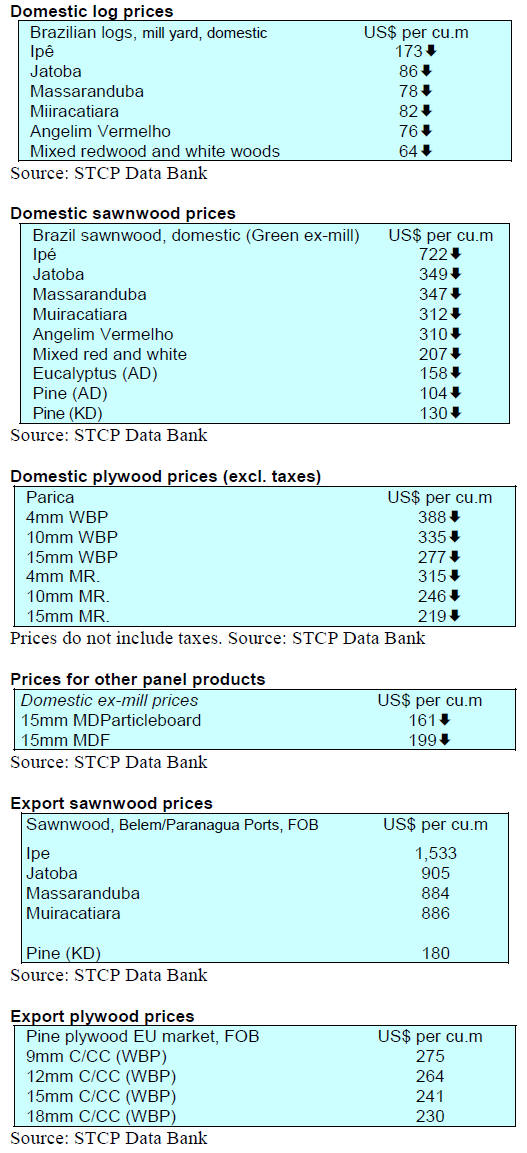

8. BRAZIL

Record low interest rate maintained

Inflation, as measured by the Broad National Consumer

Price Index (IPCA), was 0.25% in January 2021, 1.1%

down from December. Over the last 12 months inflation

came in at 4.56%. In January 2021 the Central Bank

decided to leave the basic interest rate (Selic) unchanged

at a record low of 2.00%.

Advances in development of technical standards

The process of development and updating technical

standards in Brazil involves discussion between

representatives of the production sector, regulatory

agencies, government and consumers.

One of the sectors that works intensively in this area is the

timber industry because products must be manufactured to

established standards which guarantee performance and

quality requirements for the consumer. The Brazilian

Association for Mechanically Processed Timber

(ABIMCI) has worked to advance updating and

development of new technical standards for wood

products.

In 2020, two parts of the standard (ABNT NBR 16864) for

sawnwood were published and now a standard for civil

construction, packaging and general timber use is under

discussion. Additionally, other standards such as “wood

preservatives” (ABNT NBR 16143) is being reviewed and

a text for a wood pellets standard is under preparation. The

most recently created Study Committee was charged with

developing a standard for film faced plywood.

Another standard under consideration in the wood and

civil construction sectors is for “light-frame wood

construction” (ABNT NBR 16936) a draft has been

submitted for national consultation.

ABIMCI expects that once the standard is agreed there

will be many business opportunities for wood products

manufacturers in this new construction system for housing

with the possibility of an increase in domestic

consumption.

Another standard directly linked to civil construction,

specifically related to wooden doors (ABNT NBR 15930 -

Part 3), has been drafted. The new standard includes

additional performance requirements such as wooden

soundproof doors, radiation protection doors and

emergency exits doors.

Amazon deforestation dropped in January

Deforestation alerts in the Legal Amazon in January 2021

were the lowest in the past four years, dropping of 70%

compared to January 2020. This information was released

by the Ministry of Defense and was based on data from the

National Institute for Space Research (INPE).

Between August 2020 and January 2021 there was a 988

sq. km reduction in deforestation alerts according to INPE.

The Ministry of Defense said that the data show the

success of work coordinated by the National Council of

the Legal Amazon in the region, mainly through the

Operation “Verde Brasil 2” (Green Brazil 2) to combat

environmental crimes in the Legal Amazon.

The Ministry of Defense explained that the Integrated

Group for the Protection of the Amazon (GIPAM) verifies

information available in the databases of environmental

protection and law enforcement agencies and produces

reports that detail where illegal deforestation has occurred.

Based on these reports, the operation “Verde Brazil” and

environmental agencies plan the action of the Armed

Forces and inspection teams.

Export update

In January 2021 Brazilian exports of wood-based products

(except pulp and paper) increased 22.8% in value

compared to January 2020, from US$206.6 million to

US$253.6 million.

Pine sawnwood exports dropped 6% in value between

January 2020 (US$37.5 million) and January 2021

(US$35.2 million). In volume, exports fell 8% over the

same period, from 207,700 cu.m to 191,000 cu.m.

Tropical sawnwood exports increased 7.2% in volume,

from 29,000 cu.m in January 2020 to 31,100 cu.m in

January 2021. In terms of value, exports grew almost 1%

from US$12.7 million to US$12.8 million, over the same

period.

Pine plywood exports saw a surge of 91% in value in

January 2021 in comparison with January 2020, from

US$26.4 million to US$50.3 million. In volume terms

exports increased 41% over the same period, from 121,000

cu.m to 170,400 cu.m.

As for tropical plywood, exports declined in volume (-

28.3%) but the value remained stable. Export earnings

US$1.8 million in January 2020 and US$ 1.8 million in

January 2021.

An encouraging increase in wooden furniture exports was

recorded in January with the value increased from

US$30.0 million in January 2020 to US$41.1 million in

January this year, a boost of 37% jump.

2020 export performance

In early February 2021, the Brazilian Association for

Mechanically Processed Timber (ABIMCI) published the

2020 export performance for wood products. With regard

to tropical plywood the volume shipped reached 101,720

cu.m., representing a 14% increase in relation to the

volume shipped in the previous year.

Tropical veneer exports in 2020 were 83,625 cu.m, an

increase over the previous year with Asia being the main

destination.

In 2020 exports of tropical sawnwood were 450,217 cu.m,

a 15% year on year decline. Vietnam was the main

destination for tropical sawnwood in 2020.

Tropical mouldings (profiled timber) followed the same

trend with a 7% decrease in the volume shipped compared

to 2019. Engineered wood flooring exports were

4,028,076 kg. down 29% over the previous year with the

United States being the main destination for the product.

For solid wood flooring the volume shipped reached

69,866,937 kg. an increase of approximately 27%

compared to the volume exported in the previous year.

The United States was the main market for this product.

As for the exports of wooden doors, the total exported in

2020 was 169,125,340 kg. representing a 30% growth in

relation to the amount shipped in the previous year. The

main exported type is solid wooden doors.

An overview of furniture exports

ABIMÓVEL, the Brazilian Association of Furniture

Industries, recently presented an overview of 2020

furniture exports by state. The states in the Southern

Region are the largest furniture exporters in Brazil.

Together, the states of Santa Catarina (41.3%), Rio Grande

do Sul (27.6%) and Paraná (14.9%) accounted for almost

85% of Brazilian furniture exports in 2020.

Despite the quite impressive performance exports from

Santa Catarina and Rio Grande do Sul declined compared

to 2019. In Santa Catarina there was a drop of US$5.9

million and in Rio Grande do Sul there was a drop of

US$16.2 million in exports. Paraná State, on the other

hand, experienced a growth in furniture exports of US$2.3

million.

In 2020 the states of Pará and Rio de Janeiro managed to

expand their share of exports but from a very low base.

2020 exports from Pará expanded 121% year on year

while the furniture industry in the state of Rio de Janeiro

exported 93% more in 2020 compared to a year earlier.

The export of furniture is an important employment sector

and provides significant opportunities regardless of the

size of the company and the segment in which it operates.

ABIMÓVEL is helping companies seize opportunities in

e-commerce and new logistical modalities. It supports

export promotion along with Apex-Brazil (Brazilian Trade

and Investment Promotion Agency).

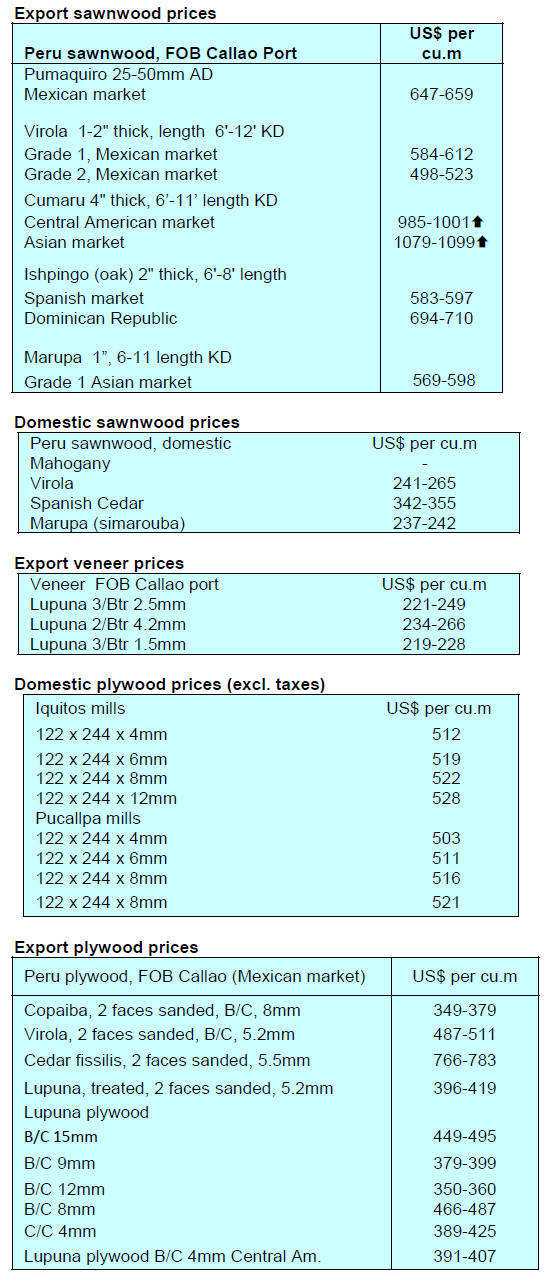

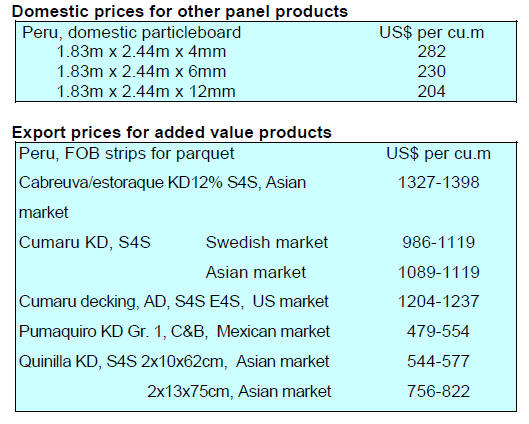

9. PERU

Exports declined in 2020

The FOB value of semi-manufactured wood product

exports in 2020 totalled US$55.4 million representing a

year on year decline of 31%.

The main market for wood products in 2020 was China

which took just over half of all wood products but in 2020

there was a 36% decline in exports to China. The second

most important market for the semi-manufactured

products in 2020 was France with a 15% share of exports

but, as with China, exports to France fell year on year in

2020 dropping by a third.

Denmark was the third placed market in terms of export

value with an almost 9% share of exports and there was a

rise of around 7% in the value of 2020 exports compared

to a year earlier.

Exports of wooden furniture defy the trend

Exports of furniture and furniture parts in 2020 were worth

US$3.8 million FOB, just 3% below that in 2019. The

main markets were the US which accounted for around

75% of exports followed by Italy with a 9% share. The

value of exports of furniture and parts to these two

markets increased slightly in 2020.

Furniture manufacturers in Peru had to contend with many

disruptions throughout the year and most were operating

well below capacity.

Peruvian chipboard imports set a new record

In 2020, despite a sharp fall in the first half of the year

imports, Peru’s imports of composite panels were a record

US$108.9 million, up on 2019 by about 8%.

With an increase in shipments of 1.6% ( US$44.9 million,

2020, US$4.2 million2019) Ecuador was once again the

main shipper followed by Chile (US$23.7 million). Spain,

was the third placed shipper (US$21.9 million) up 27%

year on year. Producers in Brazil supplied composite

panels valued at US$15.1 million.

8 million hectares identified for restoration

The Ministry of Agrarian Development and Irrigation

(MIDAGRI) has been advised by the National Forest and

Wildlife Service (Serfor) that 8.2 million hectares of

degraded forest have been identified for restoration. Of

this, 2.2 million are in the Andean zone, 519,000 hectares

in the Amazon and 149,000 hectares along the coast.

The main issues identified with degraded forests is the loss

of natural vegetation cover, loss of biodiversity and

reduced of ecosystem services for water regulation.

There are also cases of grazing, pasture burning and forest

fires, land use change, inadequate water management and

deforestation.

The departments with the largest areas with a very high

priority for restoration are Ayacucho with 2.1 million

hectares, followed by Áncash with 1.9 million, Huánuco

with 1.7 million, Piura with 1.7 million and Cusco with

1.6 million hectares.