Japan

Wood Products Prices

Dollar Exchange Rates of 25th

January

2021

Japan Yen 103.77

Reports From Japan

Consumer

demand takes a hit

The Japanese economy is increasingly facing challenges

following the declaration of a second state of emergency

that will be in place until 7 February. Consumer demand

has taken a hit and there are indications that prices are

falling.

The risk is that this could mark the return of deflation, a

nightmare for the government and the Bank of Japan after

years of efforts to reflate the economy.

The annual wage negotiations between management and

unions will soon begin and the early news, unsurprisingly,

is that companies are reluctant to raise pay after a difficult

2020. Without a boost to household income the prospects

for boosting consumption would weaken.

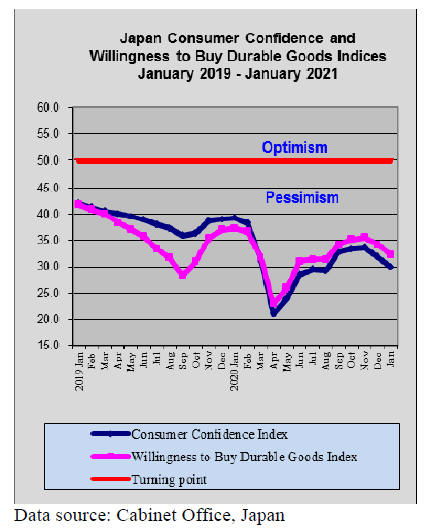

Further dip in consumer confidence

After a brief recover retail sales have declined again

driven down as the third wave of infections which resulted

in the government declaring a state of emergency in the

worst affected prefectures. The state of emergency calls

for everyone to avoid non-essential travel and gathering,

this kept shoppers home and darken the recovery outlook.

The downward trend in the January consumer confidence

index provides an indication of renewed weakness in

consumer spending, a key driver of the earlier rebound.

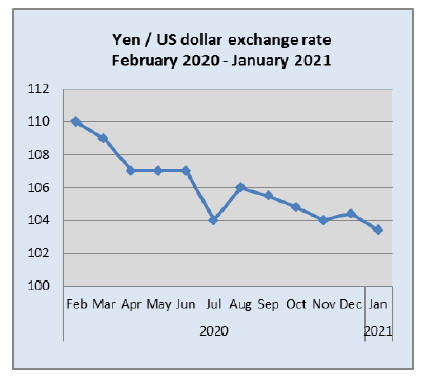

Yen edges firmer

The yen/dollar exchange rate continues to edge towards a

rate which will alarm the Bank of Japan (BoJ) as it tries to

steer the economy through a further tough patch brought

on by another stste of emergency due to a serious third

wave of corona infections especially impacting the main

urban areas.

At 103 plus to the US dollar the BoJ is not likely to

respond but, if as some analysts forecast, the yen

strengthens further the BoJ whas indicated it will respond.

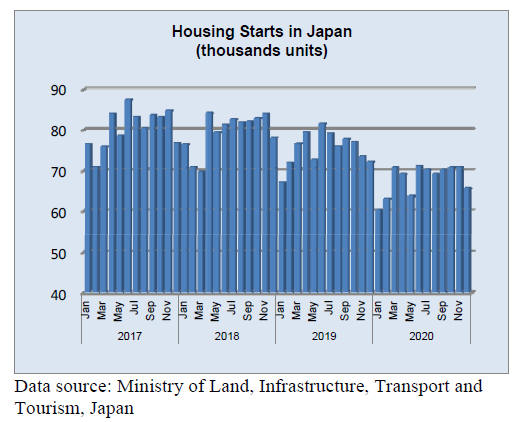

2020 not a good year for house builders

Housing starts tumbled in December 2020 falling 9% year

on year and dropping 7% compared to the previous month.

The table below shows housing starts. 2019 was not a

good year as starts were down 5% on 2018 and the

downtrend continued in 2020 with starts dropping a

further 10%.

The impact of corona virus control measures is partly to

blame for the decline but the core of the problem for

Japanese construction companies is the aging population

and the declining birth rate.

It has been reported that 2020 was the first time since 2012

that more people have left Tokyo than flowed in. The rare

situation is said to have arisen due to the novel

coronavirus pandemic. Tokyo¡¯s population was down by

nearly 37,000 by December 2020 compared to July

marking the fifth monthly decline.

The ¡®work from home¡¯ style is eliminating the need to live

close to the workplace and people can take advantage of

lower rents in the suburbs. This has helped works adjust as

the average wage increases have satlled and

accommodation is expensive in the cities.

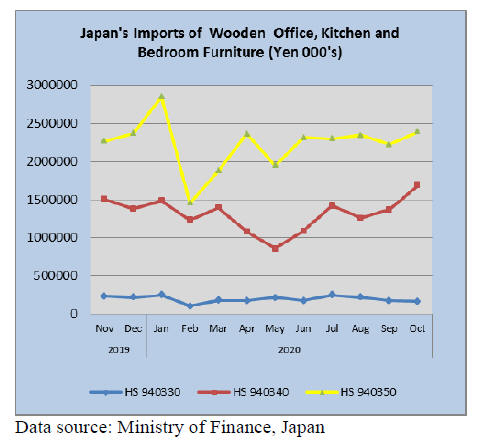

Furniture imports

The rising imports of wooden furniture, especially of

bedroom furniture, in the scond and third quarters of 2020

was surprising given the downward trend in consumer

confidence and especially in consumer willingness to buy

durable goods. (see consumet confidence graphic above).

While consumer confidence regained ground in the second

half of 2020 this was only a ¡®catch-up¡¯ on an earlier

decline. Clearly Japanese importers were confident of

sustained and expanding demand despite the weak

consumer confidence readings so steadily expanded

wooden furniture imports.

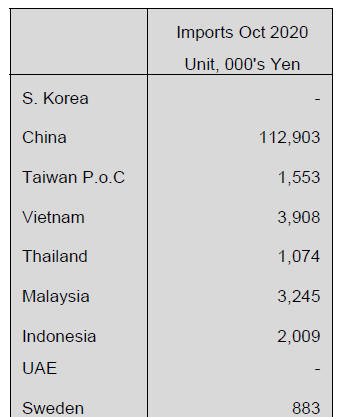

October office furniture imports (HS 940330)

Japan¡¯s imports of wooden office furniture have been

declining since July. Year on year there was a 12% decline

in the value of imports and month on month the decline

was around 4%.

October imports from China which accounted foralmost

70% of October arrivals were up slightly (around 4%)

compared to September but imports from the other main

suppliers dipped with shippers in Portugal seeing a7%

decline. Shipments from Poland were down 5% in October

but shipments from Italy remained at the same level as in

September.

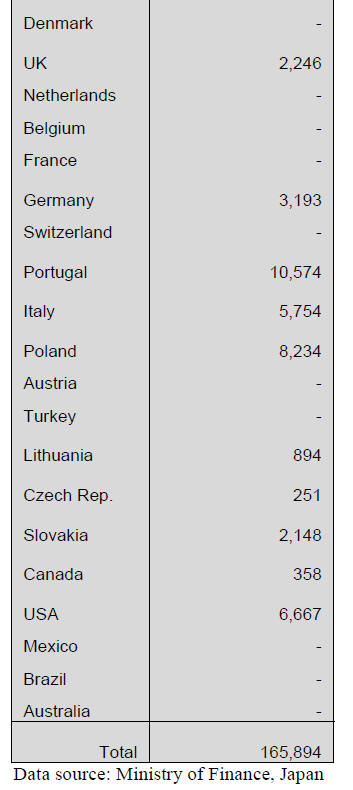

October kitchen furniture imports (HS

940340)

Beginning in May there has been a steady rise in the value

of kitchen furniture imports and in October this trend

continued with an 11% rise year on year and a 23% month

on month increase.

Housing starts (see above) have been flat since mid year

suggesting the rise in kitchen furniture imports could be

driven by increased kitchen renovation as home owners

send more time at home and because of limits on outdoors

activities are focused on home improvement.

In October, shippers in the Philippines which accounted

for around half of all kitchen furniture imports into Japan

in October did well, seeing an over 30% rise in shipments.

The other top shippers in October were Vietnam which

saw an 18% rise in shipments in October and accounted

(around 40% of Japan¡¯s HS940340 imports) and China but

here the level of shipments was much the same as in

September.

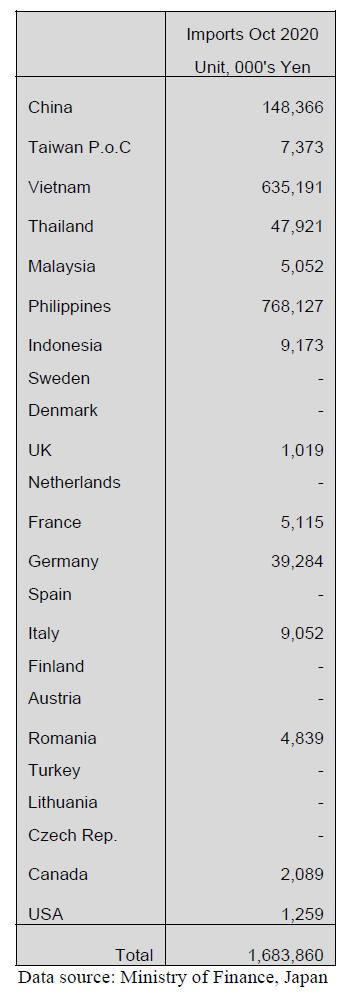

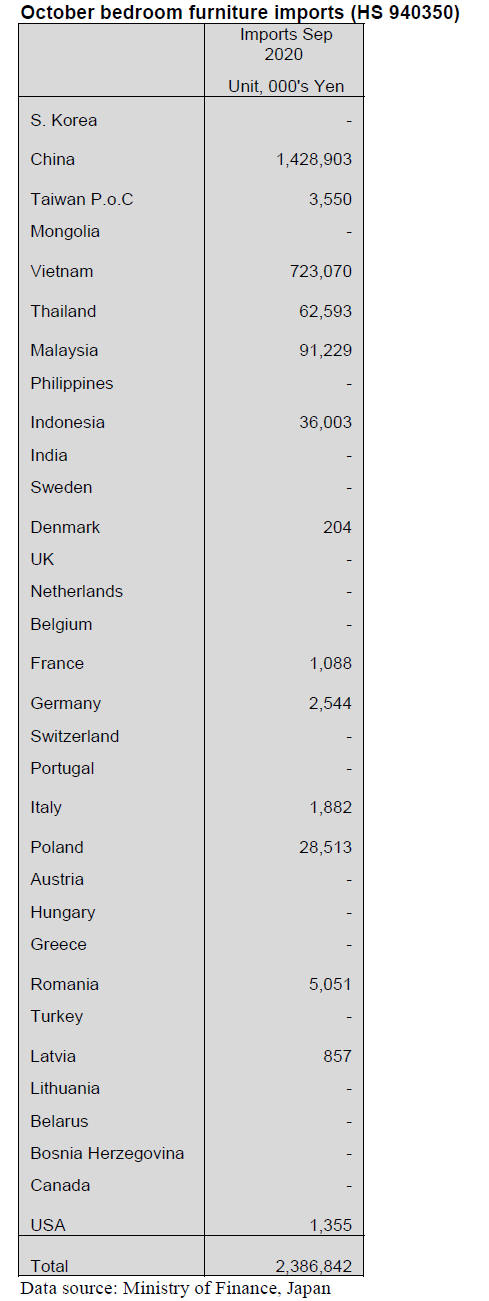

October bedroom furniture imports (HS

940350)

In contrast to the upward trend in kitchen furniture imports

japan¡¯s imports of wooden bedroom furniture have been in

a narrow range since mid 2020. However, the value of

October imports was up over 30% year on year but the

month on month rise was a modest 8%.

Shippers in China accounted for around 60% of Japan¡¯s

imports of wooden bedroom furniture in October and saw

a 7% month on month increase. Vietnam is the scond

ranked shipper accounting for around 30% of October

imports (up 6% month on month). Exporters in Malaysia

and Thailand together accosted for almost 8% of October

arrivals of wooden bedroom furniture.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Plywood

Demand continues active on domestic softwood plywood

in January. Normally January is quiet month but this year

is different. Delayed deliveries continue in Western Japan

and the longest is one month waiting. There are large

orders placed to the manufacturers in Eastern Japan but the

manufacturers carry excessive orders so they have no extra

volume.

Production increase is difficult due to abnormal heavy

snow fall in Northern Japan, which caused confusion of

transportation and log supply shortage. Therefore, supply

tightness would continue through end of February. The

manufacturers have been pushing the prices. The target

prices are 930 yen per sheet on 12 mm 3x6. The prices

have been inching up and there is no more 900 yen or

lower prices.

Malaysian and Indonesian plywood export prices are firm.

The largest supplier in Malaysia, Shing Yang increased the

export prices twice, one in December and another in

January.

There was expectation that the volume of imported

plywood would increase in January but the manufacturing

mills suffer log shortage and container shortage so the

supply has not increased.

The importers are not able to place large orders with high

prices when the demand in Japan stagnates so port

inventories seem to stay on tight through the first quarter.

South Sea (tropical) logs

Log production in PNG is slow but there is no reaction

since the demand is slow too. In PNG, demand by China

receded so log producers lost interest of log harvest. In

Japan, the largest tropical hardwood log plywood

manufacturer will close down in March and other mills

switched to use veneer instead of logs so there is very little

concern to log producing situation.

For more information see:

https://www.dailyadvent.com/news/c24cb997c67b1fd2254f5fde866f576e-Japan-tapers-imports-of-logs-from-tropical-trees-tonear-zero

Domestic logs and lumber

Supply of domestic logs and lumber has been tight since

last month. Demand is not large but the supply is much

tighter. Log prices have started climbing since last fall so

the production started increasing but heavy snow in

January hampers the production again.

After lumber prices rapidly started climbing in December,

sawmills are becoming bullish but foul weather reduces

production like frozen logs. Sawmills have acquired ample

logs by December so log prices are simmering down. 3

meter post cutting cedar log prices moved up to 14,000-

15,000 yen but in January, they are leveling off at 12,000-

13,000 yen. 4 meter sill cutting cypress log prices are

staying at 19,000-20,000 yen.

Lumber prices have kept going up. National average

prices

of 3 meter KD cedar post are 52,000-53,000 yen and 4

meter KD cypress sill are 62,000-64,000 yen. They are

firming. There are uneasy feelings that actual demand is

not so large but meantime there are rising demand to use

domestic wood to replace tight supplied North American

Douglas fir lumber so domestic share should increase.

|