4.

INDONESIA

Challenges for small-scale furniture

makers

Furniture and wood carvings produced in Jepara and its

surrounding area on the north coast of Java Island are

widely known for there unique designs and quality.

While over 90% of the carving producers are SMEs the

sector makes a big contribution to the economy. The

Jepara wood-processing sector generated exports worth

US$187 million in 2019. However, the rising demand for

wood raw material is having an impact on availability and

harvesting.

To ensure wood raw materials are sourced legally

Indonesia’s has its domestic Timber Legality Assurance

System (SVLK) and SMEs which comply have found this

boosts export opportunities. However, while the timber

sourcing may be legal many SMEs struggle to meet

government regulations on matters such as businesses

licencing.

Muhammad Suryadi from the Jepara Wood Artisans

Association (APKJ Asosiasi Pengrajin Kayu Jepara) has

urged the authorities to assist SMEs when they apply for

licence and tax registration and for such things as worker

insurance. With this completed the SMEs can secure

SVLK certification opening the chance for exporting and

creating opportunities to secure credit.

The results of an unpublished FAO/APKJ-CIFOR 2020

report of a study in Jepara and Pasuruan Regencies found

that many furniture SMEs were not SVLK certified. The

survey showed that only 9% of respondents in Jepara and

1.6% of respondents in Pasuruan were certified.

See:

https://forestsnews.cifor.org/70602/going-global-woodproduct-certification-requires-broad-legal-arena?fnl=en

A shift from contract to community group workers in

forestry

The National Economic Recovery programme is ongoing

and one aspect in the forestry and timber sectors is labour

intensive production through a community empowerment

strategy. The story of this effort has been captured in a

book "Pioneers at sites: Pioneers of National Economic

Recovery, Environment and Forestry."

This summarises the efforts of pioneers in peat and

mangrove conservation, forest food production,

community business and industry, traditional tourism.

The book highlights a new approach in managing forests

and forest areas in which there is a shift from contract

workers to community group workers.

In the book Dr. Siti Nurbaya, Minister of Environment and

Forestry forest is quoted as saying “communities have

strong anthropological, historical, religious and economic

relations with nature. Decisions on forests and forest areas

have strong impacts on these communities, both in terms

of benefits and disadvantages. Local wisdom will become

the basis of thinking and action for forest and forest area

management”.

See:

https://www.menlhk.go.id/site/single_post/3532/the-story-of-thepioneers-the-spearhead-of-pen-lhk-at-the-site-level

5.

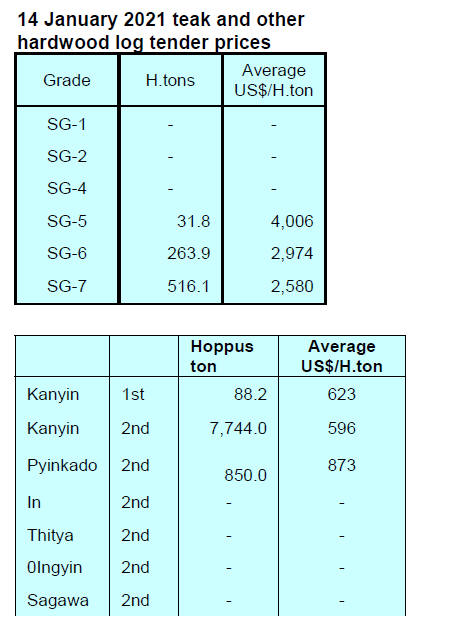

MYANMAR

Myanmar, one step

closer to verifying the legality of its

timber

According to a press release from the Myanmar Forest

certification Committee (MFCC) an agreement has been

signed for a project “Strengthening SFM Standards and

Timber Legality Framework in Myanmar”. This two year

project funded by the Forestry Agency of Japan through

the International Tropical Timber Organization (ITTO) is

scheduled to commence 1 February this year.

The project will strengthen sustainable forest management

standards, the national forest management certification

system and the chain of custody for wood products in

Myanmar.

The project is designed to make the Myanmar Timber

Legality Assurance System (MTLAS) certificate more

functional and to expand its wider acceptance in

international markets. Another important element of the

project is to support the DTTS (Digitalized Timber

Tracking System) which will ensure traceability.

The Myanma Timber Enterprise (MTE) is already

implementing a QR code system. The project will support

the QR code system so that the current level of ‘Access to

Information’ will be promoted to the level of ensuring a

robust chain of custody along the supply chain.

MFCC is currently undertaking the necessary steps to get

the domestic national certification system (MFCS)

endorsed by PEFC. In addition, MFCC and PEFC are

discussing a synergy platform to meet the project outcome.

See:

https://myanmarforestcertification.org/itto-awards-a-projectto-mfcc/

and

https://www.itto.int/project/id/PP-A_56-342A

Myanmar says Dawei SEZ contract breached

The Dawei Special Economic Zone (SEZ) Management

Committee says it lost confidence in the consortium led by

a Thai construction company due to breaches of contract at

the mega project in southern Myanmar’s Tanintharyi

Region. The Italian-Thai Development Public Co. Ltd.

(ITD) announced that it received a notification of

termination of its concession agreement to develop “the

initial phase” of the SEZ from the management committee.

The long-delayed SEZ on the Andaman Sea aims to cross

the isthmus by road into Thailand via the Gulf of Thailand,

connecting the Indian and Pacific oceans. The SEZ lies on

the Japanese-led Mekong Southern Economic Corridor

which aims to connect central Vietnam, Cambodia and

Thailand to Dawei.

See:

https://www.irrawaddy.com/news/burma/myanmar-saysthai-firm-dawei-sez-breached-contract.html

Singapore tops FDI list in Myanmar in Q1

Singapore was the top source of foreign direct investment

into Myanmar in the first quarter of the current financial

year 2020-2021, according to the data released by the

Directorate of Investment and Company Administration

(DICA).Singapore companies mainly put investments into

urban development, real estate, power and manufacturing

sectors.

China was the second largest investor in the current

financial year at US$133.53 million from eight enterprises,

followed by companies in Thailand investing US$24

million in Myanmar. Additionally, Singapore emerged as

the second-largest foreign investor in the Thilawa Special

Economic Zone, after Japan.

See:

https://www.gnlm.com.mm/singapore-tops-fdi-list-inmyanmar-in-q1/

Second IMF emergency loan

The International Monetary Fund (IMF) has approved a

second emergency loan for Myanmar, worth around

US$350 million as Myanmar continues to suffer the

impact of the pandemic.

Last month, Myanmar’s government negotiated with

international development organizations, including the

IMF to secure more than US$950 million in order to

purchase vaccines.

Myanmar expects that 40% of its 54 million inhabitants

will be vaccinated by the end of 2021. The remaining 60%

are expected to be vaccinated during the 2022-23 financial

year.

Investors expect growth to accelerate in Myanmar

Investors expect business to return to normal in Myanmar

by the third quarter of this year with the technology, media

and telecoms sectors leading the way.

According to U Thaung Tun, Union Minister for

Investment and Foreign Economic Relations, the

Myanmar economy is expected to recover and reach

growth levels of as much as 7% this year.

He emphasised that the recovery will be supported by the

government’s Myanmar Economic Recovery and Reform

Plan (MERP) which will prioritise manufacturing and

services. He said civil service reforms and digital

transformation will also be implemented.

Reduced trade for first quarter of fiscal 2020-21

Myanmar recorded US$8.9 billion in trade in the first

quarter of fiscal 2020-21, US$2.5 billion less than the

same period of the previous financial year. The fall was

attributed to lower exports of natural gas, gems, garments,

fishery and other animal products. Imports also declined

with the country buying less raw materials for local

processing.

See:(https://www.mmtimes.com/news/myanmar-sees-reducedtrade-first-quarter-2020-21.html)

6. INDIA

Further signs of

economic recovery

In its January Bulletin the Reserve Bank of India (RBI)

said that the Indian economy is getting stronger and that

the worst may be over provided there is not another wave

of infections. The Bank has said high-frequency indicators

such as government spending, a rise in merchandise trade,

growing credit and high manufacturing activity in

December 2020 were signs of economic recovery.

The RBI slashed interest rates early last year to support the

Indian economy and has left rates unchanged in recent

months to avoid pushing up inflation. The rate of inflation

stood at 1.22% for December 2020.

See:

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/EBUL21012021_F5770050C073B4C99AD00DD0B520ABAAC.PDF

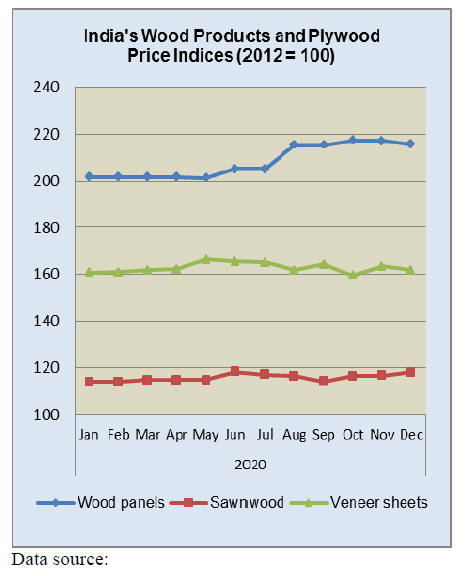

December dip in wood product price index

The Ministry of Commerce and Industry has reported that

the official Wholesale Price Index for the group ‘All

Commodities’ (Base: 2011-12=100) for December

increased by (1.40%) to 123.0 in December, 2020 from

121.3 for November, 2020.

In December of the manufactured products included in the

survey (16, including furniture) saw an increase in prices

whereas 6 in the group saw declines in prices. Among

those seeing declines was the category Wood and

Products of Wood and Cork.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Imports up for first time since February but

exports fall

A further sign of improving economic activity was the

December rise in the value of imports which rose for the

first time since February 2020. On the other hand, exports

were slightly lower than in November due mainly to

reduced shipments to the UAE and parts of Europe.

Exporters have said, while the domestic economy is

showing sure signs of recovery, the same cannot be said

for the global economy and that tough times lay ahead.

Pandemic created disruptive trends across all sectors

The need for home offices, home study and a need for

individual space has impacted peoples preferences and

driven demand for a multi-functional and convenient

furniture. This, coupled with the slowing international

trade and the ‘Make in India’ campaign as well as a rise in

e-commerce, has boosted the Indian furniture

manufacturing sector.

It has been estimated that the Indian domestic furniture

market could grow over 10% annually over the next 4

years and this will be driven by some key trends:

Changing consumer preferences: comfort and

functionality have become significant

Policy support for manufacturing: there has been

a major policy push by the government

Initiatives like ‘Make In India’ and ‘Vocal for

Local’ gave a boost to the furniture

manufacturing sector

Rise in e-retail for furniture

Rise in the rental furniture sector

Rise in manufacturing productivity from robust

logistics and supply chain infrastructure

See:

https://www.zeebiz.com/market-news/news-top-5-keytrends-manufacturing-and-retail-trends-that-will-drive-growthof-the-indian-furniture-sector-in-2021-146501

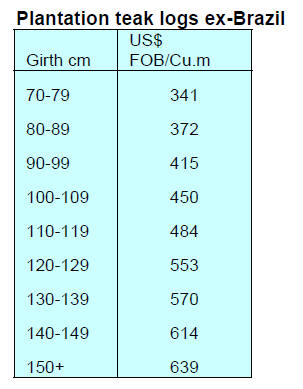

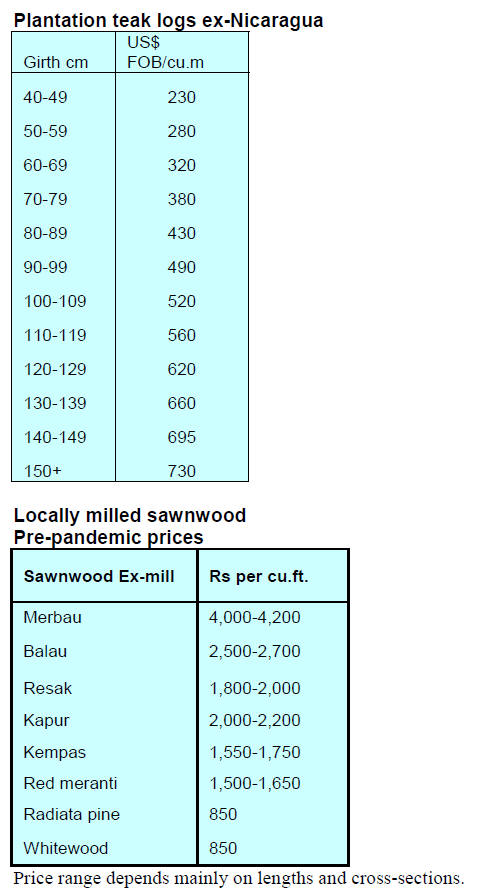

Plantation teak

The freight cost war continues with teak log exporters

anxious to get shipments away but importers reluctant to

commit to shipping due to freight rate volatility. The only

reliable guage of prices FOB prices which remain

unchanged.

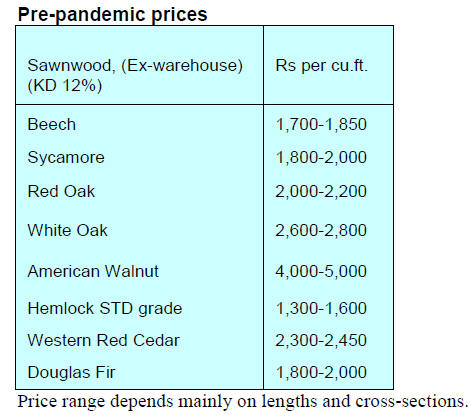

Sawn hardwood prices

Traders report improved sales in the main provincial

markets where spread of the Covid virus has been less

severe in contrast to demand in the urban areas. Some

wholesalers are adding a freight top-up to their listed exwharehouse prices.

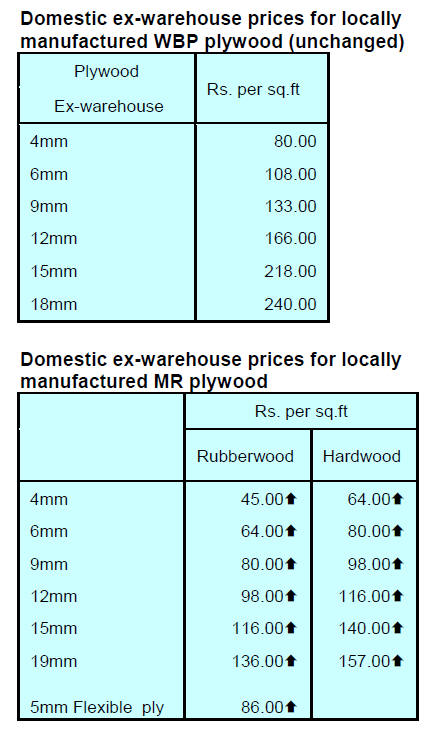

Plywood

The problem of finding an adequate numbers of workers to

maintain full production continues to be an issue

especially in mills in Kerala, Maharashtra and Orissa.

Wages are rising as are veneer prices and these are

undermining profitability. Plywood mills have raised

prices for locally manufactured MR plywood.

7.

VIETNAM

US$14 billion export target for 2021

At a recent press conference the Head of the Vietnam

Administration of Forestry, Nguyen Quoc Tri , said wood

and wood products exports topped US$13.22 billion last

year the highest in the history of the timber sector.

For 2021 the forestry sector export target is US$14 billion

and revenue from forest environmental services is

estimated at VND2.8 trillion. In 2021 there are plans, said

Nguyen Quoc Tri, to plant 230,000 hectares of forests,

comprising protection, special-use, and production forests.

See:

https://sggpnews.org.vn/business/forest-wooden-productspost-recordhigh-trade-surplus-90452.html

In related news, the Deputy Minister of Agriculture and

Rural Development, Ha Cong Tuan, has said over the next

five years wood and wood product exports should reach

US$20 billion.

In that five year period, he said, the sector will work to

sustain the forest cover at 42%, expand and diversify

markets, develop long-term trade partnerships and

promptly address international trade issues.

Vietnam now ranks fifth globally, second in Asia and first

in Southeast Asia in terms of wood and wood product

exports shipping to over 120 countries and territories

worldwide. Vietnam has more than 5,500 companies

operating in timber processing.

Decsion on Vietnam’s currency valuation practices

The US Trade Representative has issued findings in the

Section 301 investigation of Vietnam’s acts, policies, and

practices related to currency valuation, concluding that

Vietnam’s acts, policies, and practices including excessive

foreign exchange market interventions and other related

actions, taken in their totality, are unreasonable and

burden or restrict US commerce.

In making these findings, USTR has consulted with the

Department of the Treasury as to matters of currency

valuation and Vietnam’s exchange rate policy.

The findings in this investigation are supported by a

comprehensive report, which is on the USTR’s website.

The USTR is not taking any specific actions in connection

with the findings at this time but will continue to evaluate

all available options.

See: USTR Releases Findings in Section 301 Investigation of

Vietnam’s Acts, Policies, and Practices Related to Currency

Valuation | United States Trade Representative

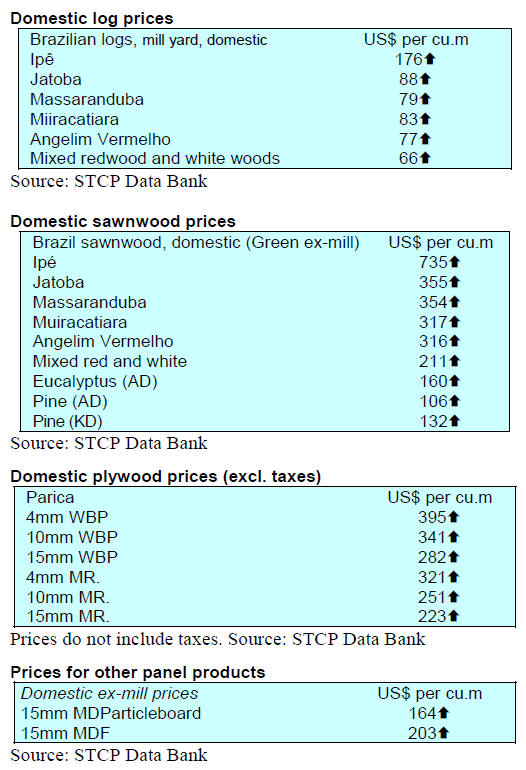

8. BRAZIL

Well-directed support means a

recovery can take hold

quickly

Brazil has been one of the countries worst affected by

coronavirus and the pandemic continues to take a heavy

toll. Between January and November central government

spending rose around 40%. According to the Institute of

International Finance most of the money went on a flatrate

payment as temporary income for nearly a third of the

population.

This has put a heavy burden on public debt which now

stands at over 90% of GDP but analysts say Brazil can still

fund itself and that well-directed support to the economy

now will mean a recovery can take hold quickly when the

vaccine roll-out is completed.

Environmental services policy approved

After nine years of discussion in the National Congress

Federal Law No. 14.119/21 was finally approved on 13

January 2021 establishing the National Policy for Payment

for Environmental Services (PNPSA - Política Nacional de

Pagamento por Serviços Ambientais).

According to the law, Payment for Environmental

Services (PES) is a voluntary transaction between users

and suppliers whereby a payer transfers remuneration to a

supplier that performs activities that favor maintenance,

recovery or improving ecosystem services.

Contrary to most environmental standards, the PES is an

economic instrument for achieving environmental goals

and policies, encouraging desired behaviors and is thus

different from the usual command and control

mechanisms.

The full text in English can be found at:

https://www.cbd.int/financial/pes/brazil-pescases.pdf

Sindmóveis foresees growth for the Bento Gonçalves

furniture cluster

In a press release the Furniture Industry Association of

Bento Gonçalves (Sindmóveis) has said the furniture

sector anticipates positive prospects for 2021 and an

expansion of revenue of 4%.

In 2020 the pandemic disrupted the supply and production

chain in the state of Rio Grande do Sul and that demand

recovered faster than production resulting in low stocks

and higher prices for inputs.

The press releasealso says between January to September,

compared to the same period in 2019, exports grew by

8.9%, from US$26 to US$28 million. Colombia and the

United States were the highlights being among the top five

destinations for Bento Gonçalves furniture, in addition to

Saudi Arabia, Chile and Uruguay. There were significant

increases in shipments in the period to India, Ecuador,

Puerto Rico and South Africa. On the other hand demand

in traditional markets such as Argentina and Paraguay has

been falling throughout the year.

See press release:

http://www.sindmoveis.com.br/portal/en/imprensa/noticias/crescimento-nas-exportacoes-do-polo-moveleiro-de-bento-goncalves

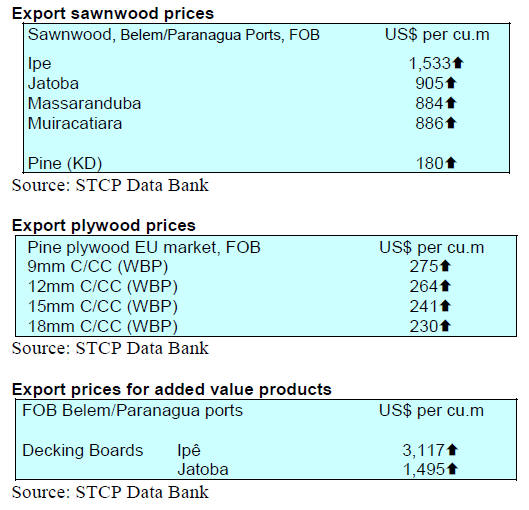

November 2020 export update

In November 2020 Brazilian exports of wood-based

products (except pulp and paper) increased 22% in value

compared to November 2019, from US$245.1 million to

US$299.3 million.

November pine sawnwood exports increased 21% year on

year from US$39 million in 2019 to US$ 47.2 million in

November 2020. In volume terms exports increased

almost 30% from 206,200 cu.m to 267,600 cu.m.

Tropical sawnwood exports in November fell 7.3% in

volume, from 41,300 cu.m in November 2019 to 38,300

cu.m in November 2020. The value of exports also fell

dropping 19% from US$19.2 million in November 2019 to

US$15.6 million.

In contrast pine plywood exports saw a 78% jump in value

in November 2020 in comparison with November 2019,

from US$36.0 million to US$64.1 million.

In volume terms, exports increased 41% over the same

period, from 160,700 cu.m to 226,400 cu.m.

Tropical plywood exports declined in volume (-11%) and

but maintained the same value year on year from 8,400

cu.m (US$3.2 million) in November 2019 to 7,500 cu.m

(US$3.2 million) in November 2020.

Encouragingly, wooden furniture exports increased from

US$47.5 million in November 2019 to US$57.7 million in

November 2020.

December 2020 export update

In December 2020 Brazilian exports of wood-based

products (except pulp and paper) increased 47% in value

compared to December 2019, from US$222.3 million to

US$327.4 million.

Pine sawnwood exports increased 53% in value, rising

from US$ 34.8 million in December 2019 to US$ 53.2

million in December 2020. In volume terms exports

increased 371% from 213,500 cu.m to 292,800 cu.m.

In a reversal of data for November tropical sawnwood

exports in December increased 37% from 33,300 cu.m in

December 2019 to 45,700 cu.m in December 2020.

Exports earnings grew just over 8% from US$15.4 million

to US$16.7 million.

In December 2020 pine plywood exports continued the

upward trend rising year on year 83% from US$35.9

million to US$65.7 million. In volume, exports increased

39% from 168,200 (Dec. 2019) cu.m to 233,900 cu.m

(Dec. 2020).

Tropical plywood exports continued down dropping 13%

in volume from 7,600 cu.m (US$2.7 million) in December

2019 to 6,600 cu.m (US$2.7 million) in December 2020.

Wooden furniture exports rose once again in December

2020 from US$43.9 million in December 2019 to US$59.8

million in December 2020.

Furniture exports dropped but by much less than

expected

Given the decline in international demand the 2020

performance of Brazil’s furniture industry can be

considered positive as the cumulative decline in the value

of exports was just under 3%.

The year ended with export sales of US$691.3 million

(US$710.9 million in 2019). Out of the four largest

exporting states which account for 95% of total furniture

exports two reported growth (São Paulo 0.6% and Paraná

3.4%) while Santa Catarina (-1.5%) and Rio Grande do

Sul (-8.9%) did less well.

By market region, Latin American demand was a surprise

as it accounted for 31% of the total value of exports

despite dropping 9% compared to 2019.

North America was the top market taking 42% of the total

(up 8% year on year) followed by Europe with 16% share

but with a decline of 16%.

Wood-based panel exports to China increased in 2020

Fibreboard and particleboard exports showed some growth

in 2020, increasing 1.5% compared to 2019. However, for

the two largest consumers among the 155 countries that

purchased wood-based panels from Brazil, the United

States and China, there was an increase in exports. Exports

to China increased 51%, while sales to the United States

increased 24%.

Among the five largest importer countrie, accounting for

60% plus of total exports, only the US and China

registered an increase. The greatest fall was in Mexico, -

35%, according to the Foreign Trade Statistics

(ComexStat) from the Ministry of the Economy.

9. PERU

Optimism that vaccinations will

allow economy to

recover quickly

Peru has reported more than one million cases of

coronavirus since the pandemic struck in March. Cases

have crept up recently following the end-of-year holidays

creating a shortage of beds in critical care wards in Lima

and across the country. The President announced that his

administration had negotiated vaccine supply deals with

Sinopharm Group and AstraZeneca.

See:

https://andina.pe/ingles/noticia-perus-fin-min-economy-togrow-115-in-2021-828209.aspx

The Minister of Economy and Finance has said that

despite measures taken to reduce the surge of COVID-19

cases during the second wave of the pandemic which

began after the Christmas and New Year holidays, Peru's

GDP will recover this year after a downturn in February.

ADEX sees UAE as Middle East export gateway

Erik Fischer, ADEX Chairman and the Director of

the Association of Peruvian Exporters' Global Business

and Economy Research Center (Cien-Adex) recently held

discussions with the UAE Ambassador to Peru in order to

open the way for strengthening ties through investments

and bilateral trade.

The UAE, said Fisher, serves as a gateway to markets in

the Middle East and hopes progress will be made on a free

trade agreement.

See:

https://andina.pe/ingles/noticia-peru-exporters-interested-intrade-agreement-with-united-arab-emirates-831678.aspx

SERFOR launches satellite monitoring platform

The National Forest and Wildlife Service (SERFOR) has

introduced a real time system using satellite imagery to

monitor deforestation, logging activities and forest fires.

The new system monitors forests at the national level and

provides accurate and timely information through the

"Satellite Monitoring of Impacts to Forest Heritage",

managed within the National Forest and Wildlife

Information System (SNIFFS).

With timely and accurate information State institutions in

coordination with SERFOR can take immediate actions to

prevent, minimize and halt damage to the forest heritage.

As of the end of January the system has identified more

than 500 instances where follow-up investigation was

necessary.

Data delivered by the new system allows for the

estimation of potential monetary losses from deforestation

through economic valuation generated by the SERFOR

Inventory and Valuation Department.

Madre de Dios advances in its forest zoning process

The Department of Madre de Dios has expanded its forest

zoning process incorporating 24 fragile ecosystems over

an area of 205,028.10 hectares identified by (SERFOR).

This process was carried out in coordination with the

Regional Government of Madre de Dios, as well as local

governments, native communities and holders of

conservation concessions and ecotourism concessions.

With this inclusion established through Executive

Directorate Resolution No. D000106-2020-MINAGRISERFOR-

DE, Madre de Dios takes an important step in its

Forest Zoning effort.

Participation of women in the Peruvian forestry sector

In order to value the participation of women in the forestry

sector the Ministry of Agriculture through (SERFOR)

undertook a study “Challenges of female employment in

the forestry sector: a first approximation”. This was

supported by the German Development Cooperation.

Based on testimony from women the report describes the

situation of women who work in the forestry sector and

their difficulties in participating fully. The report

concludes with policy proposals for improving working

conditions and efforts to alert institutions in Peru aware of

problems women face.