4.

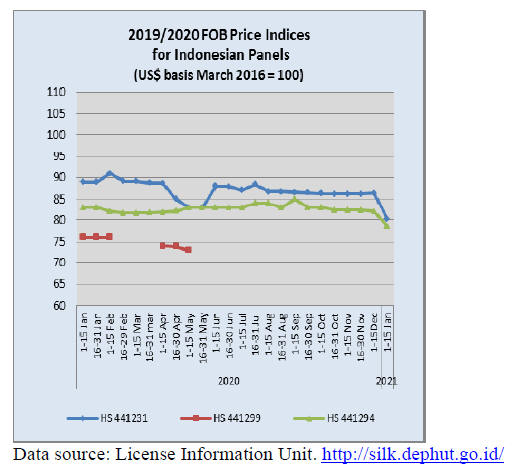

INDONESIA

Forestry exports exceed 2020 target

The 2020 export target for forest and wood products has

been exceeded despite the impact of the corona pandemic

on production and trade. Early in 2020 the export target

was lowered from US$10 billion to US$7 billion to take

account of the anticipated disruption of businesses

however, export earnings in 2020 topped US$11 billion

even exceeding the original target.

Bambang Hendroyono, the Secretary General in the

Ministry of Environment and Forestry, said the ministry is

very proud of the performance of Indonesian forestry

sector adding that 2020 forestry export earnings were only

5% below that of 2019. He added that government

incentives and relaxation of regulations helped achieve

this success.

See:

https://foresthints.news/despite-global-pandemicindonesias-forestry-exports-far-exceed-target/

Raw material prices undermining competitiveness

According to the Executive Board of the Indonesian

Furniture and Craft Industry Association (DPP HIMKI)

despite the country having vast forest resources the wood

processing sector struggles to make a real contribution to

national economic growth because the high price of raw

materials undermines competitiveness in the domestic

market and international markets.

During a recent online meeting it was concluded that

downstream SMEs cannot afford to purchase top quality

raw materials so must process low quality wood raw

materials which reduces productivity. The problem of raw

material supply has been raised by Purwadi Soeprihanto,

Executive Director of the Association of Indonesian Forest

Concession Holders (APHI), who said the growth in wood

product processing was hampered by raw matetila supply

and that is why Indonesia has fallen behind Vietnam in

terms of competiveness.

Purwadi said one way to raise the competitiveness of

Indonesian furniture products is to accelerate the

development of plantation forests.

See:

https://www.fordaq.com/news/Indonesia_Raw_material_prices_undermining_70929.html

Over 4 million hectares of forest land reallocated

The Minister of Environment and Forestry (MOEF), Siti

Nurbaya, said her ministry will support the efforts to

restore the national economy in 2021. She said Indonesia’s

forests can support nature tourism and environmental

services. Also, she indicated by changing the allotment

of forest such as land for the object of agrarian reform

productivity for the land can be increased. As of

December the forest land reallocation effort has provided

around 4.4 million hectares to about 882,072 farmers.

See:

https://nasional.kontan.co.id/news/realisasi-perhutanansosial-capai-44-juta-hektare-hingga-awal-desember

Strategy to encourage the furniture and craft

industries

The Indonesian Furniture and Craft Industry Association

(HIMKI) prepared several strategies to encourage the

national furniture and craft industry in 2020. Abdul Sobur,

HIMKI chairman, said the first issue to be addressed

should be a sustainable supply of wood and rattan raw

materials. This, he said, could be achieved with the

formation of a state run ‘Rattan Logistics Agency’.

Another priority area is the elimination of wood and rattan

smuggling.

HIMKI has continued its call for the elimination of the

mandatory SVLK for downstream industries saying this

holds back the competiveness of the sector and urges the

government to support promotion and marketing of wood

and rattan products.

Additional suggestions from the HIMKI include the call

for efforts to raise the quality of rattan furniture and craft

products which should include training and support for

design and advanced technologies.

Finally, Sobur encouraged the government to attract

investment in production in areas with adequate raw

materials.

See:

http://www.jurnas.com/artikel/84663/Strategi-HIMKIDorong-Industri-Mebel-dan-Kerajinan-Nasional/

Indonesia's 2020 forestry success stories

Amid the ongoing global COVID-19 pandemic Indonesian

Environment and Forestry Minister, Siti Nurbaya, has in

an interview with Foresthints.News, highlighted the major

successes achieved in 2020, a year marked by great

difficulties.

The full text can be found at

https://foresthints.news/ministerdont-lose-sight-of-indonesia-2020-forestry-success-stories/

5.

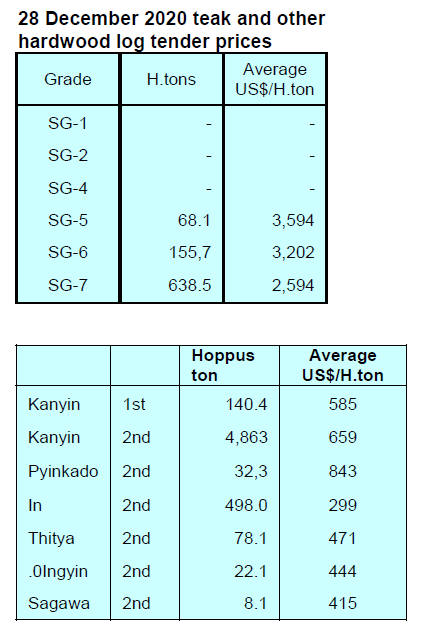

MYANMAR

First ever financial

release from MTE

The Myanma Timber Enterprise (MTE) recently

announced consolidated income statements for the three

fiscal years from 2016-17 detailing sales, operational cost,

taxes, contributions to the state and net profit. This is the

first such disclosure in the history of MTE and is a

significant initiative from MTE to ensure transparency.

Full details can be found at:

(http://www.mte.com.mm/index.php/en/activities/1386-myanmatimber-enterprise-activities)

From 1st April 2014 to 30th November 2020 MTE sold

1,864,921 tons of teak logs, other hardwood logs and

sawnwood earning US$531 million for 414,173 tons of

teak logs. In addition, MTE sold 925,074 tons of logs and

sawnwood in local currency earning around US$349

million (approximately equivalent).

Myanmar exports plunge

In the last two months of 2020 export earnings plummeted

to US$2.647 billion. In the corresponding period in the

previous financial year exports stood at US$3.847 billion

according to the Ministry of Commerce.

Both sea and border trade dropped as neighbouring

countries tightened border security and limited trading to

contain the spread of the virus. While agricultural exports

increased those of livestock, forest products, minerals,

fishery products and finished industrial goods declined. To

make matters worse the severe container shortage has

become the biggest headache for shippers in Myanmar.

In related news, Myanmar’s trade deficit is rising.

Between 1 October and 18 December in the current FY,

Myanmar’s external trade drastically plunged to US$6.14

billion from US$8.206 billion recorded in the same period

a year ago.

The government is trying to reduce the trade deficit by

eliminating imports of non-essentials. Myanmar mainly

imports essential goods such as construction materials,

capital goods, hygiene items and inputs for export

manufacturing.

Over 9,000 jobs created

According to the Directorate of Investment and Company

Administration (DICA) domestic and foreign enterprises

and other regional and state investment bodies created

9,031 jobs in the first two months (October and

November) of the current financial year 2020-2021 but for

October and November the rate was lower than in

September .

(Note: The Ministry of Planning and Finance announced in 2019

a change to the financial year which now ends 30 September

each year)

According to the DICA domestic and foreign projects

created over 96,000 jobs in the FY2016-2017, 110,000

jobs in the FY2017-2018, over 53,000 jobs in the 2018

mini-budget period, over 180,000 jobs in the FY2018-

2019 and 210,000 jobs in the FY2019-2020.

Health Insurance required for travel

Thailand has imposed tougher measures for foreign

travelers entering the country including a requirement for

a US$100,000 health insurance plan with at least six

months validity.

The Myanmar government plans to resume flights to

Southeast Asian neighbours and the MTE has launched a

Travel and Health Insurance (Thailand) service to

facilitate visa applications for those travelling to Thailand.

6. INDIA

Infections contained

in a few States

The New Year has brought further relief from the

coronavirus pandemic in India. Daily new cases are now

averaging around 19,000 per week, the lowest in six

months. The worst of the pandemic now seems

concentrated in Kerala and Maharashtra States. The

country has strated the world’s largest vaccination drive.

A Hindustan Times editorial says even when the pandemic

is under control action will be needed to help people

suffering from pandemic induced stress, anxiety,

depression and insomnia.

Strong GDP growth in 2021 forecast

The National Statistical Office (NSO), on Thursday,

announced its projections for India's GDP in 2020-21,

pegging the Indian economy to contract by 7.7%,

compared to a growth rate of 4.2% in 2019-20.

In its latest review the Reserve Bank of India (RBI) has

projected an economic contraction of 7.5%, an

improvement on its earlier forecast of a 9% plus decline

for fiscal 2020.

However, two successive phases of economic contraction

in the year drove the economy into and times continue to

be tough even though the Purchasing Managers' Index for

manufacturing is continuing to claw into positive territory.

The services and agricultural sectors have been supporting

recovery and this, along with a proposed increase in

government expenditure targeting agriculture as a vehicle

of growth, could lift growth prospects higher.

Analysts suggest the future of the Indian economy will

also hinge on expanded private investment. Of greatest

concern is the financial state of the millions of SMEs in

the country as the temporary relief from the government is

set to end in the months ahead.

Panel makers happy to see resin plant back in

operation

To the delight of plywood and panel makers the Haryana

State Government has approved resumption of

formaldehyde product manufacturing in the factories in the

State subject to clearance by the Environment Department.

Within days of the announcement resin products for the

wood panel industry dropped sharply.

Plyreporter has reported that the Haryana Plywood

Manufacturers’ Association Vice President, Satish Chopal

thanked the State Government for this decision.

See:

https://www.plyreporter.com/article/71922/big-relief-toindustry-by-re-opening-of-formaldehyde-units-in-haryana

Home buyers looking for bigger homes

In pre-pandemic days the real estate sector in India had

been adjusting to demand for moderately priced and

smaller homes but this has changed. Now buyers are

looking for and can afford due to low interest rate bigger

floor space.

The Economic Times reports that Himanshu Parekh a

property adviser in Mumbai as saying people are looking

to upgrade to bigger homes due to work from home and

for online education and that they can now afford the

bigger space housing loan rates are lower now and home

prices have eased. Late in 2020 the preferred size for a

one bedroom unit was 500 sq.ft. up from round 400 sq. ft.

in March 2019.

See:

https://economictimes.indiatimes.com/topic/Home-buyers

New furniture park planned

The Yamuna Expressway Industrial Development

Authority (YEIDA) intends to construct a furniture park

and some 15 firms have expressed an interest in opening

facilities in the Park.

Rakesh Kumar, Executive Director in the Export

Promotion Council, said a furniture park near Jewar

airport would help boost exports and encourage furniture

and handicraft manufacturers.

See:

https://timesofindia.indiatimes.com/topic/furniture-park

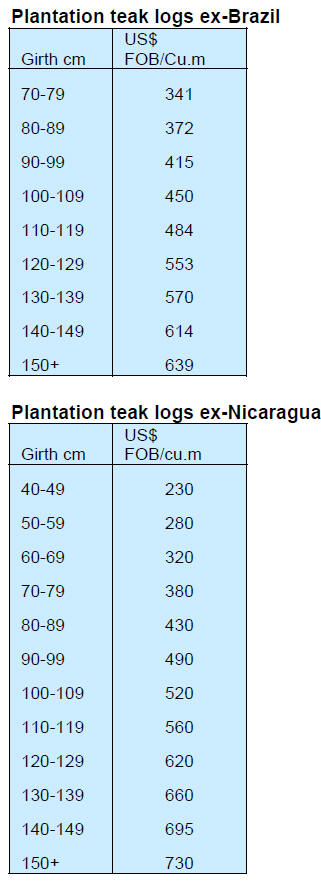

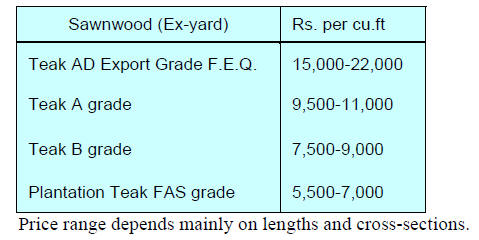

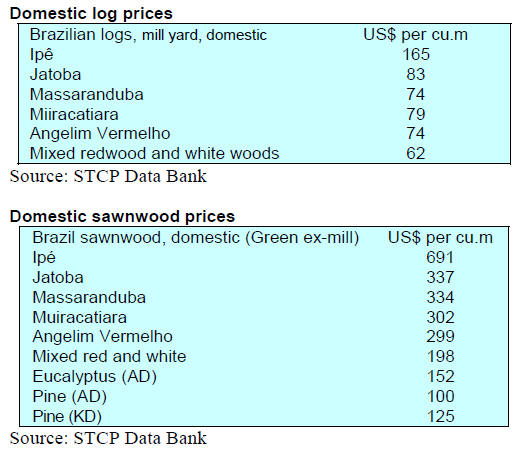

Plantation teak

Ship owners are not in a mood to reduce freight rates and

plantation teak shippers are anxious to maintain export

volumes putting Indian importers in a tough spot as they

want to see freight rates come down before committing to

purchases. Indicative FOB prices as of December 2020 are

shown below. It is not possible to provide C&F prices

given the volatile freight rates.

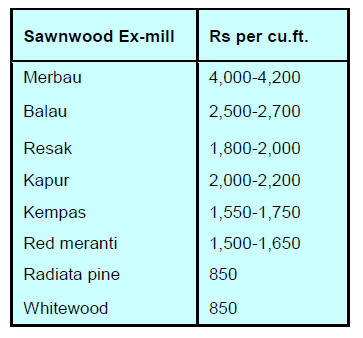

Locally milled sawnwood

Early January 2021 prices for locally milled hardwoods

are shown below. Because of the increased freight costs

exmill prices tend to be at the higher rates.

Millers face the problem of trying to pass on the higher

transport charges but that is difficult even though the

housing market is active.

Myanmar teak

There were no teak deliveries from Myanmar in December

2020 and as of mid January no shipments have arrived in

India. In the domestic market prices can be considered at

the top end of the range shown below.

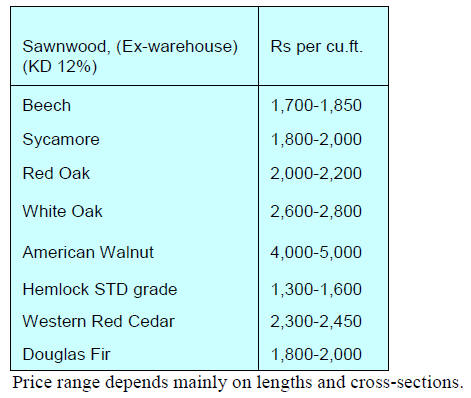

Sawn hardwood prices

Demand for imported hardwoods is reported as firm which

will eventually give traders the opportunity to lift prices to

take account of the increased freight charges.

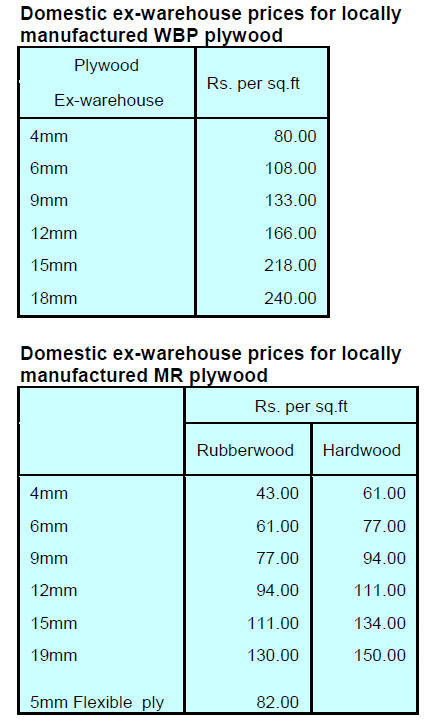

Plywood

Plywood mills in the north of the country have resumed

opeartions as most workers are back on the job. This is in

contrast to the situation in mills in the south of the country

and in the Mumbai/Puna area which still face worker

problems along with rising log costs.

It is reported that mills in the Kerala area are taking to

opportunity to retool their presses and boilers in order to

raise productivity.

The short fall in domestic plywood production has given

exporters an opportunity and recently Russian plywood

has been entering the Indian market.

7.

VIETNAM

W&WP export/impor int first 11 months

of 2020

Exports

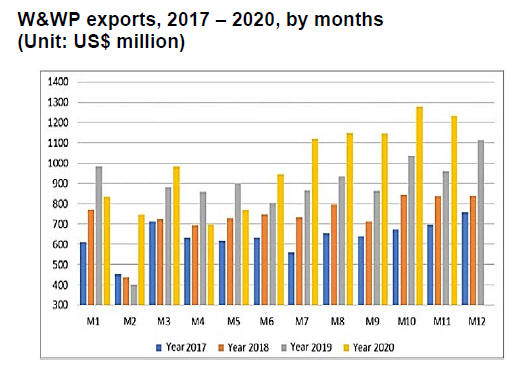

In November 2020, Vietnam’s wood and wood product

(W&WP) exports were valued at US$1,236 billion, 3.5%

less than that of October, but 20% higher compared to the

same month of 2019.

Of this, WP export accounted for US$1,005 billion, 4.8%

lower compared to the previous month, but 33% up as

compared to the same month of 2019.

In 11 months of 2020 W&WP exports amounted to

US$11,023 billion a 15.6% year on year growth.

In the first 15 days of December W&WP exports were

US$618 million, 20% higher compared to the first 15 days

of November.

All data that follows was provided by the General

Department of Customs, Vietnam and analyzed by GoViet.

During November 2020 W&WP exports by FDI

enterprises were worth US$696 million, up almost 9%

over October and 60% up year on year. In 11 months of

2020 W&WP exports by FDI enterprises amounted to

US$5,395 billion, 28% year on year higher and a 49%

share of total W&WP exports from Vietnam.

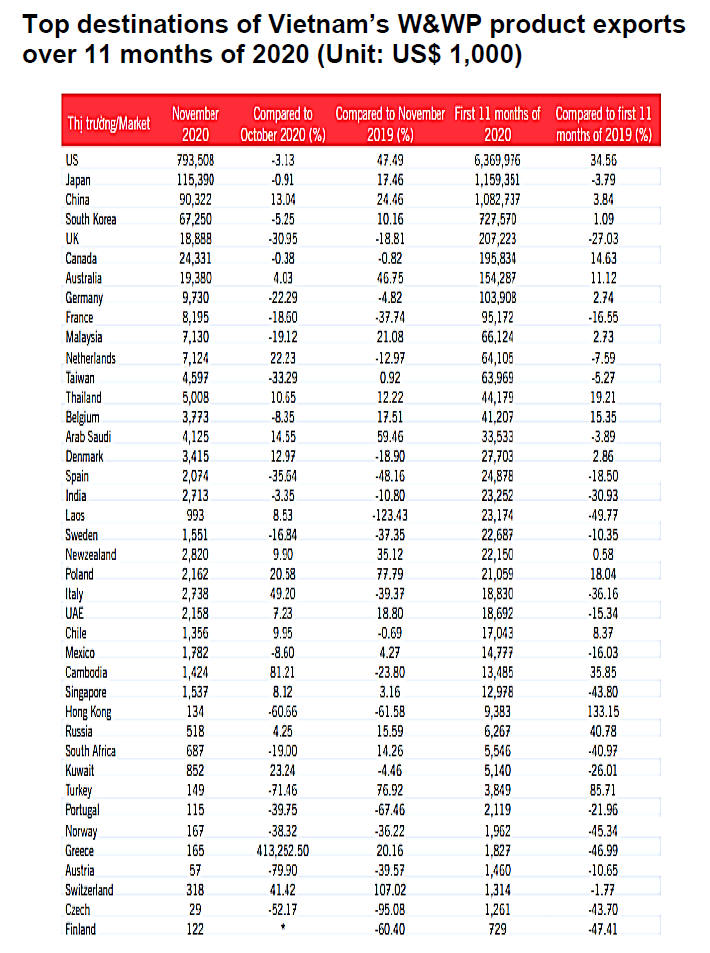

Export destinations

Compared to October, W&WP shipped to top destinations

declined. Exports to the US declined by 3%, Japan, 1%,

and South Korea, 5%.

With European markets such as the UK, Germany,

France

and the Netherlands the decline was even greater. In

contrast exports to China continued to grow, rising to

US$90 million, 13% up as compared with the previous

month.

The US topped the list Vietnam’s W&WP export markets

with a share of almost 60%. Over 11 months of 2020 the

US market consumed US$6.369 billion, a year on year

growth of 35%. Following the US, the 3 big consumers of

Vietnam’s W&WP included Japan, China and South

Korea.

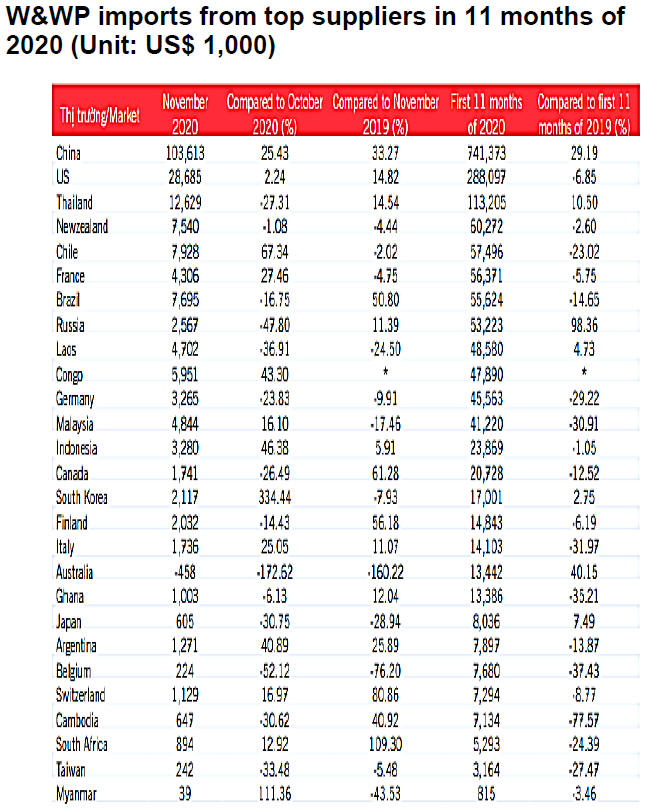

Imports

Following a significant increase in October, November

2020 imports of W&WP into Vietnam were valued at

US$252 million, just 1.5% over the previous month, but

15% higher than in the same month of 2019.

In 11 months of 2020 imports of W&WP into Vietnam

totalled at US$2,266 billion, down 1.6% year on year.

During the first 15 days of December, 2020 W&WP

imports amounted to US$156 million.

In November 2020 FDI enterprises imported US$118

million of W&WP, 20% higher than the previous month

and 60% higher than in November 2019. During 11

months of 2020 W&WPs imported by FDI enterprises

amounted to US$921 million, 32% up year on year and

contributed 41% of the total value of W&WP imported

into Vietnam.

In November, 2020, W&WP imports from China, Chile

and Congo increased by 25%, 67% and 43% respectively

as compared to the previous month. Conversely,

November imports from Thailand, Brazil and Laos

dropped sharply compared to October 2020.

Imports from Russia experienced a year on year expansion

of almost 100%. In contrast imports from the US, Brazil,

Germany and Malaysia declined compared to the same

period in 2019.

Vietnam’s forest certification scheme endorsed by

PEFC

In late October 2020, Vietnam’s Forest Certificate Scheme

submitted by Vietnam PEFC Council Member was

endorsed by the PEFC Council General Assembly.

Sustainable Forest management has been implemented in

Vietnam since the 1990s. In 2017, the Ministry of

Agriculture and Rural Development (MARD) assigned the

Vietnam Administration of Forestry (VNFOREST) and

the Vietnamese Academy of Forest Science (VAFS) to

develop Sustainable Forest Management (FM) and Chain

of Custody standards for Vietnam Forest Certification

Scheme (VFCS).

In 2018, the Prime Minister of Vietnam approved the

‘Project on Sustainable Forest Management and Forest

Certification’ through Decision No. 1288/QD-TTg, in

which the Vietnam Forest Certification Scheme (VFCS)

was established and operated under Vietnam

Administration of Forestry, Ministry of Agriculture and

Rural Development.

On 11 January 2019 the Minister of Agriculture and Rural

Development issued a Decision to establish the Vietnam

Forest Certification Office (VFCO). VFCO is responsible

for all activities in terms of sustainable forest management

and forest certification and issues national standards and

guidelines of the VFCS.

The benefits of Vietnam being part of the PEFC alliance

lie in the following:

To manage and use sustainable forest resources,

biodiversity conservation; to protect ecological

environment and values of forest environmental

services; and to promote forest certification in

Vietnam to meet the requirements of domestic

and international markets.

To create a legal source of plantation timber in

forest areas implemented by sustainable forest

management.

To improve the value of plantation timber and

contribute to poverty reduction for people who

depend on forestry for their livelihoods, as well

as increase the export values of timbers and forest

products for the forestry sector.

See:

https://pefc.org/discover-pefc/our-pefc-members/nationalmembers/viet-nam-forest-certification-scheme-vfcs

and

https://laodong.vn/kinh-te/he-thong-chung-chi-rung-quoc-giacua-viet-nam-da-duoc-pefc-cong-nhan-863742.ldo

8. BRAZIL

Action by Amazon Protection Task

Force

The Amazon Protection Task Force was created by the

Brazilian government in 2019 and since it became

operational has filed 114 public civil actions and collected

more than R$2.6 billion in fines from environmental

offenders. Lawsuits were filed against 230 people charged

with illegal deforestation of 135,000 hectares of the Legal

Amazon in the states of Mato Grosso, Pará, Amazonas,

Roraima, Rondônia, Maranhão and Acre.

The task force has also blocked assets worth around

R$169.7 million for three defendants accused of

deforesting 8,400 hectares of the Amazon Forest in the

municipality of Novo Aripuanã, Amazonas State.

In another lawsuit the task force secured the blocking of

R$130.7 million of assets for four environmental offenders

in the municipality of Gaúcha do Norte, in Mato Grosso

due to deforestation of more than 9,000 hectares in the

Amazon.

Support for small businesses

The federal government has approved the third phase of

the ‘National Program to Support Micro and Small

Businesses’ (PRONAMPE) releasing an additional R$10

billion from the Operations Guarantee Fund (FGO to be

used as guarantees for loans made through the programme.

From May to December 2020 more than 440,000

entrepreneurs received support from PRONAMPE. During

this period loans were granted in the total amount of R$33

billion. This programme was created by the federal

government to secure resources for small businesses so

that they could maintain jobs and business operations

during the pandemic.

The recipient companies have to commit to keep

employees and use the resources to finance business

activities such as investments and working capital.

The other programme, SEBRAE (Brazilian Service of

Support for Micro and Small Enterprises) has reported

that, while almost companies are operating, the level of

their revenue is still below that recorded before the

beginning of the pandemic (on average -39%) so

continued access to the fund is vital.

The Ministry of Economy has indicated this is the largest

programme of credit support for micro and small

businesses in the country's history.

US ends anti-dumping investigation of Brazilian

moulding exports

The Brazilian government has welcomed the decision of

US authorities to end anti-dumping investigations of wood

moulding exports from Brazil.

In a joint statement released 31 December 2020 the

Ministry of Economy and the Ministry of Foreign Affairs

reported that they have closely followed the US actions

and provided support to Brazilian exporters. Brazil

maintains that exporters do not practice dumping as

products are sold at fair market prices.

In 2020 Brazil exported approximately US$377 million in

wood mouldings to the US which is around 70% of all

Brazil’s moulding exports.

Tighter control of timber exports

Since the beginning of 2020 the Brazilian Institute of

Environment and Renewable Natural Resources (IBAMA)

has strengthened its oversight of Brazilian timber exports.

Around 35,000 forest products made from timber coming

from natural forests are exported annually with 90% being

shipped through four main ports in the states of Pará,

Paraná, Santa Catarina and Amazonas.

In addition to the monitoring and on-site inspection work

carried out IBAMA has required mandatory inclusion of

the Document of Forest Origin (DOF) registration number

in the Single Export Declaration (Documento Único de

Exportação - DUE).

The DOF is required for transportation, processing, trade,

consumption and storage of forest products and byproducts

coming from native forests.

Details are now loaded directly into the Integrated Foreign

Trade System (Portal Único de Comércio Exterior do

Sistema Integrado de Comércio Exterior) SISCOMEX.

The requirement for a DOF registration number for wood

products export has brought an improvement in inspection

procedures and a significant reduction in the possibility for

corruption.

9. PERU

Wood exports unlikely to take off in

2021

The negative consequences of the pandemic affected the

economic growth of all countries and has impacted

Peruvian exports of traditional and non-traditional

products.

Enrique Toledo, Vice President of the Committee of Wood

and Wood Industries of the Association of Exporters

(ADEX), has reiterated that the Peruvian forestry sector

represents a great opportunity for economic growth, job

creation and social inclusion but the government seems

not to recognize this.

Toledo speculated that timber production and trade will

continue to be impacted by the effects of the pandemic in

2021 and export shipments are unlikely to be more than in

2020.

To address this he suggested the implementation of

measures to support private investment such as the

granting of new forest concessions, the development of

forest plantations and the creation of financial mechanisms

that promote production in the Peruvian Amazon.

Training/technical assistance for companies in Loreto

and Ucayali

The CITEforestal Maynas Institute in coordination with

the ProBosques Project has undertaken activities in

various regions of the Amazon providing technical

assistance and training for forest companies in the region.

In Loreto training on sharpening of stellite tipped saw

blades was conducted late last year.

This training was aimed at raising the technical and

operational skills in sawmilling with the aim of promoting

efficiency in sawmilling and competitiveness in

companies.

Technical assistance was also started for downstream

processors and included guidance on semi-serial

production systems for wood products. Simultaneously, in

Ucayali, work was carried out on the production of doors

to international standard.

In related news the Regional Government of Ucayali

requested technical support for local companies that aimed

to contribute items for the government’s wooden school

furniture purchases saying this will involve 350 Ucayali

SMEs and will generate around 1,500 jobs in the region.

Work continues with micro, small and medium-sized

enterprises in Ucayali on the transition to a semi-serial

production system for doors manufacturing using six

commercially promising local species which are abundant

and have the required technological properties.