|

Report from

North America

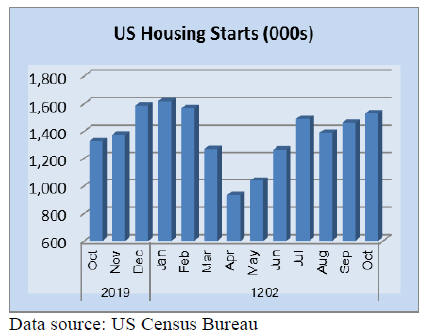

Home construction continues to show strength

U.S. homebuilding increased more than expected in

October as the housing market continues to be driven by

record low mortgage rates, but momentum could slow

amid a resurgence in new COVID-19 infections that is

putting strain on the economic recovery.

Housing starts rose 4.9% to a seasonally adjusted annual

rate of 1.530 million units last month. That lifted

homebuilding closer to its pre-COVID-19 pace of 1.567

million units in February. Economists polled by Reuters

had forecast starts would rise to a rate of 1.460 million

units in October. Homebuilding has surged 14.2% on a

year-on-year basis.

Permits for future homebuilding were unchanged at a rate

of 1.545 million units in October, the highest since March

2007.

Housing starts in the densely populated South region rose

by 12.9% as the region accounted for 56.1% of

homebuilding last month. Groundbreaking activity also

rose in the West and Midwest but tumbled in the

Northeast.

Single-family homebuilding, the largest share of the

housing market, raced 6.4% to a seasonally adjusted

annual rate of 1.179 million units last month, the highest

level since April 2007. Single-family starts have increased

for six straight months.

Existing home sales continue to soar

Sales of existing homes in October soared well past

expectations, rising 4.3% compared with September and

up 26.6% annually to a seasonally adjusted annualized rate

of 6.85 million units, according to the National

Association of Realtors.

The NAR¡¯s chief economist, Lawrence Yun, called the

annual increase a spectacular gain. ¡°The surge in sales in

recent months has now offset the spring market losses,¡±

Yun said.

The annualized sales rate is the highest since February

2006. The highest pace ever was in 2005 at 7.1 million

units. Sales could likely have been stronger if there was

simply more inventory available for sale. There were 1.42

million existing homes on the market at the end of

October, a 19.8% drop compared with October 2019. At

the current sales pace, that represents a 2.5-month supply,

the lowest on record.

The extreme shortage of homes for sale is adding more

fuel to the fire under home prices. The median price of an

existing home sold in October was US$313,000, up 15.5%

annually. That is the highest median price on record and

reflects the far stronger sales on the higher end of the

market.Regionally, month-to-month sales in the Northeast

rose 4.7%. In the Midwest they increased 8.6%. In the

South they were up 3.2%. In the West, they rose 1.4%.

See:

https://www.nar.realtor/newsroom/existing-home-salesjump-4-3-to-6-85-million-in-october

Builder confidence reaches a 35-year high

The National Association of Home Builders and Wells

Fargo Housing Market Index, a measure of builder

confidence, rose five points to 90 in November ¨C the

highest score the series has ever recorded since its

inception 35 years ago and the third month in its history

the score broke 80.

Based on a scale from zero to 100, the index gauges

builder perceptions of current single-family home sales

and sales expectations for the coming six months.

In November, all indices, including current sales

conditions, sales expectations, and traffic of prospective

buyers, posted their highest readings ever. In fact, current

sales conditions jumped all the way to 96 ¨C a nearly

perfect score.

Regionally, the West showed the greatest promise, with

builder confidence in the three-month moving averages

jumping up four points to 96. The South also climbed four

points to 86, while the Northeast gained two points to 83.

The Midwest increased six points to 75.

According to National Association of Realtors Chief

Economist Lawrence Yun, median home prices are rising

¡°much too fast.¡± Yun suggests transforming raw land into

developable lots to boost supply is clearly needed to help

tame the home price growth.

But it is not just availability of land that¡¯s causing all of

the upward pressure. An October report from the National

Association of Home Builders (NAHB) revealed that

lumber prices have soared 120% since mid-April, but are

down 20% since mid-September. The U.S. Bureau of

Labor Statistics estimates roughly $16,000 has been added

to the price of a typical new single-family home because

of the lumber price increase.

On Oct. 20, the NAHB, along with 100 members of

Congress, sent a letter to President Donald Trump that

asked the administration ¡°to bring all stakeholders to the

table and work to find a solution to address lumber

scarcity and subsequent price spikes that ensures

everyone¡¯s needs are met.¡±

See:

http://eyeonhousing.org/2020/10/builder-confidencecontinues-record-climb/

Unemployment drops on back of job growth

Employment growth in the U.S. was better than expected

in October and the unemployment rate fell sharply even as

the U.S. faces the challenge of surging coronavirus cases

and the impact they could have on the nascent economic

recovery. Total nonfarm payroll employment rose by

638,000 in October, and the unemployment rate declined

to 6.9%, the U.S. Department of Labor reported.

While the biggest job gains came in the recovering leisure

and hospitality sectors, construction posted a healthy gain,

up 84,000, while transportation and warehousing increased

by 63,000 and manufacturing was up by 83,000, even

though the sector remains well below its pre-pandemic

level.

However, there are signs of concern as the U.S. has since

surpassed 250,000 dead from coronavirus and new cases

have surged past the 100,000-a-day barrier in recent

weeks. A retightening of restrictions to public activities

has begun in many areas across the U.S.

COVID-19 worries may have led to an uptick in

unemployment so far in November. The Labor

Department listed 742,000 new unemployment claims for

the week ending Nov. 14, an increase of 31,000 from the

previous week.

The Department said there are almost 6.4 million

continuing claims, which lag initial claims by a week.

Consumer confidence surveys suggests Americans

are worried about their future

Consumer sentiment fell in early November as U.S.

consumers judged future economic prospects less

favorably, while their assessments of current economic

conditions remained largely unchanged, according to the

University of Michigan¡¯s consumer sentiment index.

The outcome of the presidential election as well as the

resurgence in COVID-19 infections and deaths were

responsible for the early November decline. Interviews

conducted following the election recorded a substantial

negative shift in the Expectations Index among

Republicans but recorded no gain among Democrats.

It is likely that Democrats' fears about the COVID-19

resurgence offset gains in economic expectations.

Manufacturers report growth in October

Economic activity in the U.S. manufacturing sector grew

in October, with the overall economy notching a sixth

consecutive month of growth, say the nation¡¯s supply

executives in the latest Manufacturing ISM¡¯ Report On

Business¡¯.

Survey Committee members reported that their companies

and suppliers continue to operate in reconfigured factories;

with every month, they are becoming more proficient at

expanding output. Panel sentiment was optimistic (two

positive comments for every cautious comment), a slight

decrease compared to September.

Demand expanded, with the (1) New Orders Index

growing at strong levels, supported by the New Export

Orders Index expanding moderately, and (2) Customers¡¯

Inventories Index at its lowest figure since June 2010.

Of the 18 manufacturing industries, 15 reported growth in

October. After leading in growth over each of the past four

months, the Wood Products and Furniture & Related

Products industries were among the middle of the pack

among the growing industries for the month.

Likely that US-China trade rivalry will continue under

Biden

President Donald Trump spent much of his term setting up

Beijing as Washington's greatest political and economic

adversary. Do not expect drastic changes when Joe Biden

takes the helm, even if he eschews the bluster and

unpredictability of his predecessor.

Economists and trade experts believe that the United

States and China will move further apart on trade and

technology as Washington continues to scrutinize virtually

every aspect of its relationship with the world's secondlargest

economy.

Washington has become increasingly wary of Chinesemade

technology and whether it could be used to spy on

Americans. That fear has caused lawmakers ¡ª

Republican and Democrat ¡ª to view China as a major

threat to U.S. national security.

"Biden has been pretty clear about how he wants to

proceed, and there has been bipartisan support for a tough

line," said William Reinsch, a trade expert at the Center

for Strategic and International Studies who served for 15

years as president of the National Foreign Trade Council.

He added that the president-elect "will be under constant

critical pressure from Republican China hawks in the

Congress to be more aggressive."

Foreign policy and trade experts do say that Biden will

bring a softer, more diplomatic tone, and will be more

likely to follow long-established procedures before

pursuing any new tariffs or sanctions.

There is also agreement the two countries will both

continue the trend of disentangling their economies,

particularly in the technology sector.

|