4.

INDONESIA

Indonesia looks to sign regional

trade deal in

November

Indonesia expects to sign the Regional Comprehensive

Economic Partnership (RCEP) in November According to

government officials quoted in the Jakarta Post, ASEAN

member countries, with Australia, China, Japan, New

Zealand and the Republic of Korea as participating

countries, had finished negotiating the technical aspects of

the deal and had carried out the legal “scrubbing” of the

text.

The participating countries, which collectively account for

nearly one-third of the global economy, are expected to

sign the RCEP in November, about eight years after

negotiations began. Around US$95 billion (61.6%) of

Indonesia’s total exports were channelled to RCEP

countries in 2019.

Anda Nugroho, a researcher at the Fiscal Policy Agency,

estimated that the trade deal would raise Indonesia’s gross

domestic product by 0.05 percent in 2032. The country’s

timber, paper and electronics industries were projected to

benefit, said Mr Nugroho.

The agreement will not come into force until at least six

ASEAN countries and three partners have ratified it, a

process that could take up to two years.

See:

https://www.thejakartapost.com/news/2020/10/27/indonesiaexpects-to-sign-rcep-in-mid-november.html

Ministry of Foreign Affairs supports furniture

entrepreneurs to explore new markets

Exports of Indonesian furniture and handicrafts to Latin

America and the Caribbean amounted to only US$38.4

million in 2019, which was 0.39% of the region’s total

imports (valued at US$9.73 billion). The Ministry of

Foreign Affairs will hold an online seminar on 9–11

November 2020 aimed at supporting furniture and

handicraft manufacturers and exporters to tap into this

largely unexploited market.

The participation of Indonesian entrepreneurs in the

event is expected to increase Indonesia’s exports in the

furniture and handicraft sector, as well as exports of

Indonesian products in general, to the 33 countries in

the Latin American and Caribbean region.

See:

https://www.radarbangsa.com/ekobis/27767/kemlu-dukungpengusaha-mebel-tembus-pasar-amerika-latin-dan-karibia

Furniture industry sees increasing demand trend

Export demand for Indonesian furniture and handicraft

products is increasing in the last quarter of 2020,

according to industry sources, largely because of the

ongoing trade dispute between China and the United

States.

Deputy Chairman of the Association of Indonesian

Furniture and Handicraft Industries Abdul Sobur said there

had been an increase in orders since September 2020,

especially from the United States.

He said it was now more difficult for Chinese products to

enter United States markets, opening up space for others.

“It is a good opportunity because US demand is increasing

more compared to other countries,” said Mr Sobur.

See:

https://ekonomi.bisnis.com/read/20201014/257/1305103/industri-mebel-klaim-tren-permintaan-meningkat

Plantation forests the future of Indonesia’s biomass

energy

Indroyono Soesilo, Chair of the Association of Indonesian

Forest Concessionaires (APHI), said that at least 34 APHI

member companies are interested in investing in biomass

energy through the Energy Plantation Forest Program to

increase the country’s use of biomass energy in the form

of wood pellets, woodchips and sawdust.

According to Mr Soesilo, energy plantation forests

constitute the future of Indonesia’s biomass energy,

offering a sustainable source of biomass energy raw

material for local power plants as well as for export.

See:

https://ekonomi.bisnis.com/read/20201023/99/1309008/hutantanaman-energi-masa-depan-energi-biomassa-indonesia

5.

MYANMAR

MONREC issues order

on teak tree ownership

Myanmar’s Ministry of Natural Resources and

Environmental Conservation (MONREC) recently issued

an order clarifying the ownership of teak trees. According

to the order signed by Minister Ohn Win, teak trees in

private plantations belong to those people and entities who

have invested in them.

Under the Forest Law of 1992, teak trees planted and

grown anywhere in the country are owned by the state, but

this has been a point of contention for private plantation

investment and community forestry.

The new Forest Law, enacted in 2018, enables the

ownership of teak trees by individuals and organizations

under certain conditions. If registered with the Forest

Department, teak trees in community forests and the

household compounds of individual citizens, and on any

other private and public lands, will now belong to those

relevant people or groups, according to the order. The

change may pave the way for the use of teak trees as

collateral for bank loans.

MONREC clarifies documents demonstrating legality

In another development, MONREC has issued a statement

clarifying which documents will be available to

demonstrate the legality of export consignments under

Myanmar’s rules and regulations. According to Myanmar

exporters, some competent authorities in the EU require all

the documents listed in the chain-of-custody (CoC) dossier

developed by MONREC in 2018.

According to the recently issued statement, the CoC

dossier was published for the purpose of assisting

international timber traders to legally complete the timber

extraction, milling and marketing process in Myanmar, but

it did not necessarily mean that all documents in the CoC

dossier would be provided with export shipments.

According to the statement, timber from Myanmar is legal

when accompanied by 14 documents in accordance with

existing rules and regulations. The 14 documents comprise

four from the Forest Department, eight from the Myanma

Timber Enterprise, one from the Trade Department and

one from Customs. The statement urged EU operators to

buy and import only timbers from Myanmar that meet the

requirements of the European Union Timber Regulation.

The statement referred interested parties and operators to

the Joint Focal Group (JFG) for further information. The

email address of JFG is:

jfgtimbertrademm@gmail.com

See:

http://www.monrec.gov.mm/news/1230

European Chamber of Commerce signs investment

MOU

Myanmar’s investment agency, the Directorate of

Investment and Company Administration, has signed a

memorandum of understanding with the European

Chamber of Commerce with the aim of attracting more

investment from the EU.

The signing comes as Myanmar drafts an economic reform

and recovery plan to address the impacts of COVID-19.

The EU’s total investment in Myanmar reached nearly

US$7 billion (MMK 9 trillion) in 2019, accounting for

8.6% of all foreign direct investment (FDI) in the country.

The European Commission said trade between the EU and

Myanmar reached €3.4 billion (MMK 5.2 trillion) in 2019.

The EU accounted for 11 percent of Myanmar’s trade.

Foreign investment target achieved despite COVID-19

According to the Myanmar Investment Commission, the

country secured US$5.7 billion (MMK 7.3 trillion) in FDI

in the 2019–20 fiscal year (which ended on 30

September), up by US$1 billion (MMK 1.3 trillion)

compared with the previous financial year.

Under the Myanmar Investment Promotion Plan, the

government set a target to attract US$5.8 billion (MMK

7.46 trillion) in the 2019–20 fiscal year and fell short by

US$110 million.

See:

https://www.irrawaddy.com/news/burma/myanmar-signseus-eurocham-investment.html

6. INDIA

Government to

“disengage” from forestry and

environment institutions

The government is considering a proposal to disengage

from five institutions currently under the Ministry of

Environment and Forests after a review of 16 autonomous

bodies under the ministry.

The Department of Expenditure, which conducted the

review, recommended that the government phase out its

budget support by 25% per year for the Wildlife Institute

of India, the Indian Institute of Forest Management, the

Indian Plywood Industries Research and Training Institute,

the CPR Environment Education Centre and the Centre for

Environment Education.

The proposal involves converting the institutes to

autonomous institutions or deemed universities; under the

plan, the Indian Plywood Industries Research and Training

Institute would ultimately be largely funded by the

plywood and panels industry.

See:

http://timesofindia.indiatimes.com/articleshow/78724775.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Real estate market goes upbeat

Sentiment in India’s real estate industry is turning

optimistic, according to an index tracked by Knight Frank.

The Real Estate Sentiment Index Q3 2020 Survey of

developers, banks, financial institutions and private equity

players operating in the sector notched a score of 40 points

in July–September, up from a record low of 22 in the

previous quarter but still in the “pessimistic” zone (a score

above 50 indicates optimism).

Fifty-seven percent of survey respondents thought that the

economy would grow in the next six months, thereby

improving conditions in the sector. Knight Frank

attributed the upbeat outlook to the “remarkable upturn

seen in the real estate business, especially in the residential

segment, in the third quarter of 2020 as a result of the

unlocking process”.

See:

https://www.financialexpress.com/industry/sentiment-inreal-estate-remains-pessimistic-in-jul-sep-outlook-turns-positivesurvey/2111540/

Economy picks up

India’s economy gathered pace in September, with five of

eight indicators (including exports – see below) tracked by

Bloomberg News improving and the other three remaining

steady. Economists at the Reserve Bank of India attributed

the recovery to the release of pent-up demand after the

lockdown imposed in March to contain COVID-19.

Nevertheless, the improvement may be insufficient to

prevent the economy from contracting overall in the

financial year to March 2021.

See:

http://timesofindia.indiatimes.com/articleshow/78907398.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Exports grow in September

India’s exports of goods rose in September for the first

time in six months, registering almost 6% growth, yearon-

year and hitting US$27.6 billion. Exports have

recovered much faster than imports, indicating operational

resilience in a very tough year.

According to the United Nations Conference on Trade and

Development (UNCTAD), global trade fell by 5% in the

third quarter of 2020 compared with the same period last

year, which nevertheless was an improvement on the 19%

year-on-year plunge in the second quarter of 2020.

UNCTAD expects the frail recovery to continue in the

fourth quarter.

See:

https://swarajyamag.com/economy/exports-have-bouncedback-sharply-after-the-covid-19-lockdown-india-needs-themomentum-to-continue

and

https://www.thehindu.com/business/india-recorded-exportgrowth-of-4-in-september-unctad/article32914365.ece

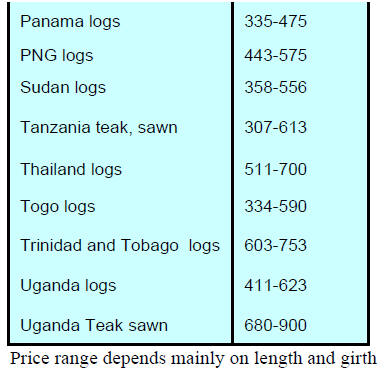

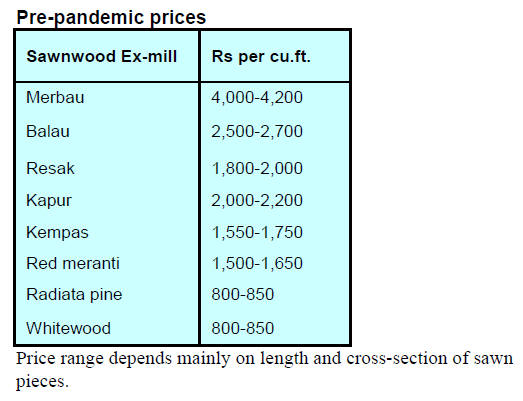

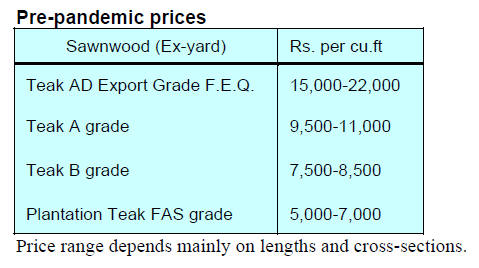

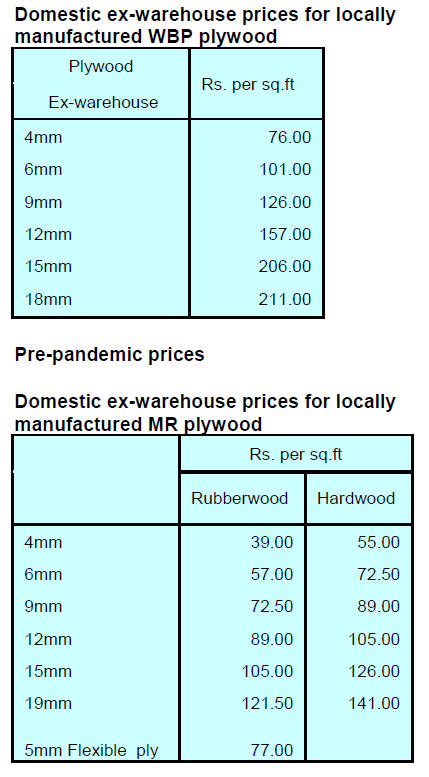

Pre-pandemic prices

Plantation teak C&F prices (as of end February 2020)

In light of the pandemic, there is a lack of information on

import prices for plantation teak logs at Indian ports.

Locally milled sawnwood

Prices for imported hardwood sawlogs have become

volatile and there is a shortage of containers as well. The

prices shown here are as given previously, due to a lack of

new information.

Myanmar teak

There is a lack of timber supply from Myanmar. The rates

shown here are as given previously, due to a lack of new

information. The effects of price rises in Myanmar will be

known when conditions normalize.

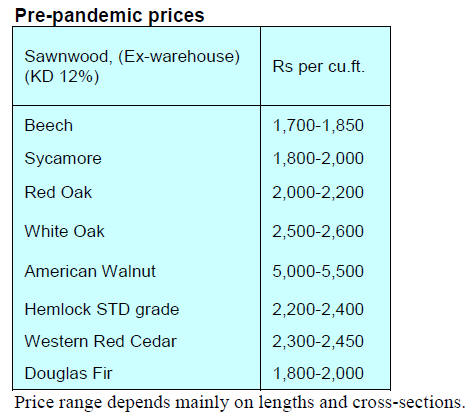

Sawn hardwood prices

The market is showing signs of revival and demand will

rise when business conditions normalise. The prices

shown here are as given previously due to a lack of new

information.

Plywood market

Plywood production and sales are improving but plywood

imports have not increased. Workers have been returning

to their jobs and full operations are expected by year end.

Current prices are as given below.

Pre-pandemic prices

7.

VIETNAM

Viet Nam looks to

tighten legality control on imported

timber

The Vietnam Timber and Forest Product Association

(Viforest) convened a seminar on 16 October on the

identification and control of risks associated with

exporting and importing Vietnamese wood products.

Participants heard that the development and activation of

geographic origin and timber species risk categories will

be important for ensuring the legality of imported timber.

To fulfil commitments under the Voluntary Partnership

Agreement on Forest Law Enforcement, Governance and

Trade (VPA/FLEGT), Prime Minister Nguyen Xuan Phuc

issued Decree 102/2020/ND-CP on 1 September 2020

stipulating regulations for importing and exporting timber

following a risk-based approach.

Under the decree, the management of imported timber will

be based on the application of risk management measures

to prevent, detect and promptly handle violations, ensuring

that timber is imported legally and creating conditions that

enable organizations and individuals to comply with the

law.

Imported timber will be subject to criteria for categorising

countries into positive or non-positive geographic regions

and for identifying the types of timber considered risky to

import into Viet Nam.

At the seminar, Viforest chair Do Xuan Lap said building

and activating a list of geographic region and species risk

categories was necessary for maintaining and developing

the industry and fulfilling the government’s commitments

to the international community. In addition to timber from

domestically planted forests, Viet Nam still imports raw

materials, including from tropical countries in Africa as

well as Cambodia, Lao PDR and Papua New Guinea.

See:

https://www.phnompenhpost.com/business/vn-lookstighten-legality-control-imported-timber

Vietnamese acacia farmers suffer sharp drop in

woodchip price

Wood and wood products exported from Viet Nam

comprise wooden furniture, woodchips, wood-based

panels and wood pellets. In recent years, Viet Nam has

emerged as one of the world’s top woodchip exporters. In

2019, it exported 13 million bone dry tonnes (BDT) of

woodchips, mostly to China and Japan, earning US$1.67

billion (18% of the total wood and wood product export

revenue).

According to VNFOREST, Viet Nam had 192 woodchip

companies in 2019 with a production capacity of 14.9

million BDT. Due to the impact of COVID-19 and the

consequent decline of paper demand, the price of

woodchips exported from Viet Nam declined by US$15–

18 per BDT in the first eight months of 2020.

The raw material for woodchip production in Viet Nam

derives from about 1 million farmer households, who

collectively maintain around 3 million ha of commercial

acacia plantations. These farmers, who stand at the

beginning of the acacia wood value chain, are bearing the

losses caused by the sharp decline in woodchip price.

Consequently, many Vietnamese woodchip producers

have decided to shift to plywood and laminated wood

production. These further-value-added products are also

expected to incentivize famers to extend rotations and

produce larger logs for high-end woodworking.

See:

https://goviet.org.vn/bai-viet/doanh-nghiep-dam-go-doimat-nguy-co-pha-san-9166

Exports grow in 2020

Export revenue in the Vietnamese wood and wood

products sector was US$7.3 billion in the first eight

months of 2020, up by 9%, year-on-year. Of this, wood

product exports were valued at US$5.5 billion, up by 14%

and accounting for 75% of the total (up from 71% in the

same period in 2019).

The United States was the top destination for Viet Nam’s

wood and wood product exports in the first eight months

of 2020, at US$3 billion (up by 27%, year-on-year), which

was 55% of total exports.

Exports grew by nearly 11% to both China and Canada in

the same period. In contrast, exports to the UK and France

declined by 35% and 15%, respectively.

Viforest pointed out that there has been a drop in office

and bedroom furniture exports this year compared with the

same period last year, but exports of kitchen and bathroom

furniture have been on the rise.

Viforest Chairman Do Xuan Lap said that items with

strong export growth are benefiting from the US

antidumping and antisubsidy duties on similar Chinese

products, which have encouraged US firms to switch to

Viet Nam to partly make up for supply shortages.

Nguyen Liem, Chairman of the Lam Viet JSC’s Board of

Directors, said COVID-19 has also given a boost to the

wood industry, especially kitchen cupboard and bathroom

cabinet sales, because people are spending more time at

home during the pandemic and thus have more demand for

house repairs and furniture.

See:

https://en.vietnamplus.vn/wood-product-makers-told-totake-actions-to-optimise-us-market/188571.vnp

Imports decrease, improving the trade balance

Viet Nam’s imports of wood and wood products in

January–August 2020 were valued at US$1.5 billion,

down by 8%, year-on-year. At the end of August 2020, the

country’s surplus of wood and wood product exports over

imports was about US$5.8 billion.

FDI enterprises spent US$467 million importing wood and

wood products into Viet Nam in the period January–

August 2020 (down by 5%, year-on-year).

Thus, net exports by FDI enterprises amounted to US$2.5

billion over the period.

See:

https://goviet.org.vn/bai-viet/doanh-nghiep-dam-go-doimat-nguy-co-pha-san-9166

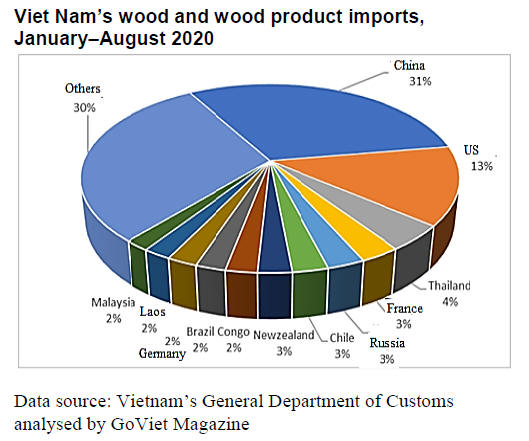

Viet Nam imports more from China

China continues to be the top supplier of wood and wood

products to Viet Nam, at US$475 million in the first eight

months of 2020. This amounts to an increase of 30%,

year-on-year, and accounts for 31% of Viet Nam’s total

wood and wood product imports, by value. In contrast,

Viet Nam’s wood and wood product imports dropped by

11% from the United States, by nearly 6% from Thailand

and by just over 7% from France.

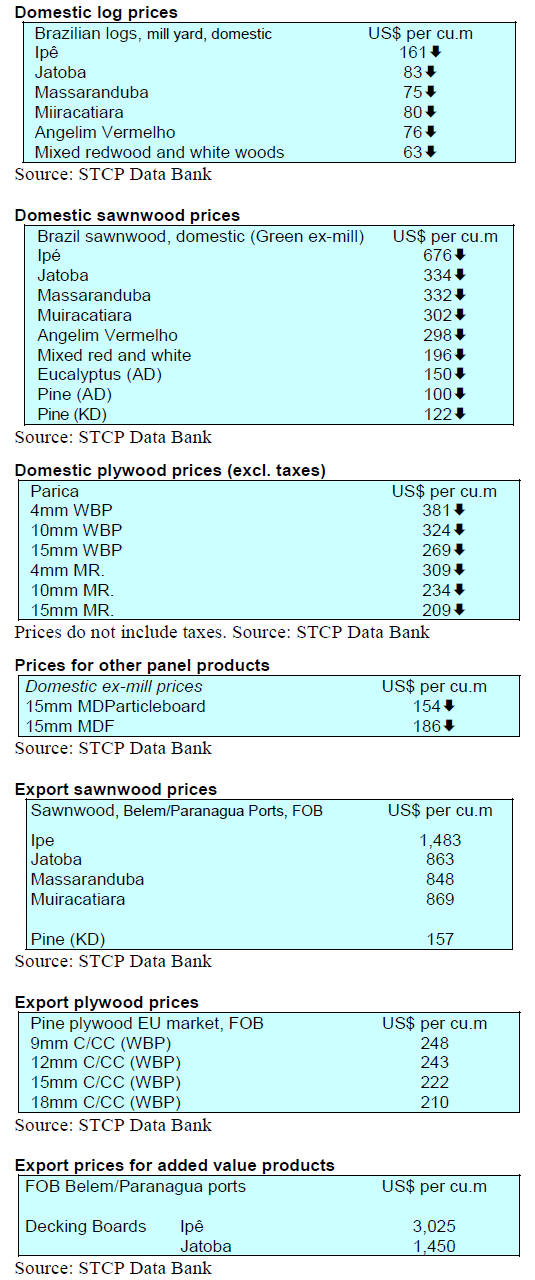

8. BRAZIL

Investments in forest sector will

reach BRL 35.5 billion

in 2023

The Brazilian Tree Industry (Ibß), which brings together

forest-based companies producing bio-products and

biomaterials for national and international markets, is

predicting that investments in the forest sector will grow to

about BRL 35.5 billion in 2023, directed towards the

expansion of forest plantations, processing facilities,

technology and science.

This investment amount would be almost double that in

the four years from 2016 and 2019 (BRL 18.0 billion).

According to Ibß, the high level of planned investment

shows the confidence of the sector in the growth of the

green economy and consumer preferences for traceable

products that have originated in renewable sources and

that absorb and store carbon dioxide.

In 2019, for the first time, the forest plantation sector

achieved a total gross revenue of BRL 100 billion. The

contribution to the trade balance was US$10.3 billion, the

second-best result in the last decade.

This industrial value chain represents 1.2% of national

gross domestic product and generates 1.3 million jobs

across the country. The coming investments for expansion

could create a further 36,000 jobs.

Furniture cluster continues recovery after historic

losses

An analysis of revenue for September 2020 by the

Furniture Industry Association of Bento Gonšalves

(Sindmˇveis) has confirmed a continuing recovery in the

furniture industry there. Bento Gonšalves is the country’s

main furniture cluster, with more than 300 companies. The

cluster generated revenue of BRL1.31 billion between

January and August 2020, which was a nominal growth

rate of 2.6% compared with the same period in 2019.

Revenue in the furniture sector reached BRL4.67 billion in

the state of Rio Grande do Sul as a whole, a nominal

decline of 2.7%, year-on-year.

The Bento Gonšalves furniture cluster added 92 net jobs

from January to August, an increase of 1.6%. The

furniture industry in the state of Rio Grande do Sul still

had a negative balance of 262 jobs, however, down by

0.8% since January.

March and April were the worst months in history for the

Bento Gonšalves furniture cluster, but a gradual recovery

began in May and is continuing, notwithstanding the many

economic uncertainties ahead.

Despite the incipient recovery in revenue, exports from the

Bento Gonšalves furniture cluster fell by 7.3% in January–

September 2020 compared with the same period in 2019,

to US$31.5 million. In the state as a whole, the drop was

19% in the same period, year-on-year, to US$116.5

million. Nationwide, furniture exports were down by 10%,

year-on-year, at US$456 million.

In the Sindmˇveis analysis, the better performance of the

Bento Gonšalves furniture cluster compared with the state

overall and nationally was due mainly to exports to the

United States, Peru and the United Kingdom. Despite the

negative overall export figures, foreign markets have

mitigated the effects of the pandemic on the revenue and

industrial performance of many furniture-exporting

companies.

In addition to the difficulties caused by trade uncertainties

and a decrease in purchases, Brazilian furniture

manufacturers are suffering from delays in the delivery of

raw materials and their rising cost.

Big boost in Brazilian wood exports

Brazilian exports of wood-based products (except pulp and

paper) amounted to US$286 million in September 2020,

an increase of 20.8% compared with September 2019

(when the value was US$236.6 million).

Pine sawnwood exports increased in value by 35.6%, from

US$38.2 million in September 2019 to US$51.8 million in

September 2020. The export volume increased by 52.9%

over the same period, from 192,400 to 294,100 cubic

metres.

Year-on-year, tropical sawnwood exports rose by 1.8% in

volume in September 2020, to 39,900 cubic metres, and by

7.7% in value (to US$15.4 million). Pine plywood exports

leapt in value by 88% in September 2020 compared with

September 2019 (from US$36.1 million to US$67.9

million).

In volume terms, pine plywood exports increased by

nearly 50% over the same period, from 159,900 to

239,500 cubic metres.

Tropical plywood exports increased in volume by 1.7% in

September, year-on-year (from 6,000 cubic metres to

6,100 cubic metres) but decreased in value by 11.5%, from

US$2.6 million to US$2.3 million.

Wooden furniture exports increased from US$49.3 million

in September 2019 to US$51.9 million in September 2020,

an increase of 5.3% over the period.

Tax incentive for Brazilian exports during the

pandemic

The Brazilian government approved Law No. 14.060 on

24 September 2020, which (according to the Ministry of

Economy) allows an exceptional extension, for one year,

of deadlines for complying with suspension and exemption

drawback regimes.

These regimes make Brazilian exporters more competitive,

relieving taxes on imports and local purchases of inputs

used in the production of goods destined for international

markets. The forest sector is one of the beneficiaries of

this law, given the large volume of exports by various

segments.

The new legislation originated in Provisional Measure No.

960 issued on 4 May 2020 on the actions taken by the

federal government to reduce the impacts of the COVID-

19 pandemic on the Brazilian economy. According to the

Secretariat of Foreign Trade of the Ministry of Economy,

325 concessionary drawback exemption acts expire this

year, and the Secretariat authorized input replacement of

inputs in the order of US$942.3 million.

Of this authorized amount, US$424.9 million (about 45%

of the total) refers to operations that, under the new law,

may be carried out in 2021. In 2019, US$49.1 billion was

exported with the use of the drawback mechanism, which

was 21% of Brazil’s total foreign sales in the period.

The tax exemption includes the Import Tax, the Tax on

Industrialized Products, the Contribution to PIS/Pasep and

the Contribution for Social Security Financing.

Specifically, in the suspension regime, the exporter does

not need to pay the Additional Freight for the Renewing of

the Merchant Marine (AFRMM) and the Tax on

Operations Related to the Circulation of Goods and on the

Provision of Interstate, Intermunicipal and

Communication Services imposed on external purchases.

9. PERU

SERFOR launches app to facilitate

access to forest

regulations

The National Forest and Wildlife Service (SERFOR) has

launched a mobile-phone and web app to provide forestsector

actors with greater access to forestry and wildlife

regulations.

SERFOR’s executive director said that the app would be

especially important given the current situation created by

the pandemic, which limits face-to-face meetings between

government, the private sector and other actors.

The app was developed in cooperation with the Forest

Resources and Wildlife Supervision Agency (OSINFOR),

the regional governments of Loreto and Ucayali, the

USAID Forest Program and the US Forest Service.

Exports of veneer, plywood and furniture decrease

According to Peru’s Association of Exporters (ADEX),

the country exported veneer and plywood worth US$1.4

million FOB between January and July, a drop of 9.1%

compared with the same period last year. The exported

products went mainly to Mexico (94%, with an overall

reduction in value of 2.5%, year-on-year) and El Salvador

(4.4%).

Peru exported furniture worth US$1.7 million in the first

seven months of the year, a drop of 18% compared with

the same period last year. Exports to the United States

were down by about 8%, year-on-year, but still accounted

for three-quarters of the total.

Exports to Italy, the second-largest destination for

Peruvian furniture, plummeted by 40% in the first seven

months of the year.

More than 100 specialists trained in forest fire

management

SERFOR provided virtual training for more than 100

specialists from 20 regions across the country in late

August on the prevention and control of forest fire, with an

emphasis on financing and methodologies for the training

of native communities.

The international forum, “Forest fire risk management

against climate change”, was also held as part of the

training, in which experiences from neighbouring

countries in the monitoring centres of Argentina and

Brazil were shared.

Further training aimed at strengthening forest fire risk

management is planned for coming months.