|

Report from

North America

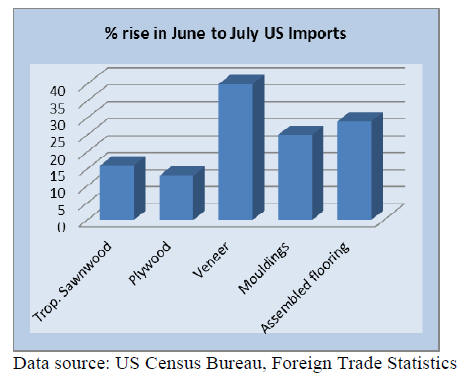

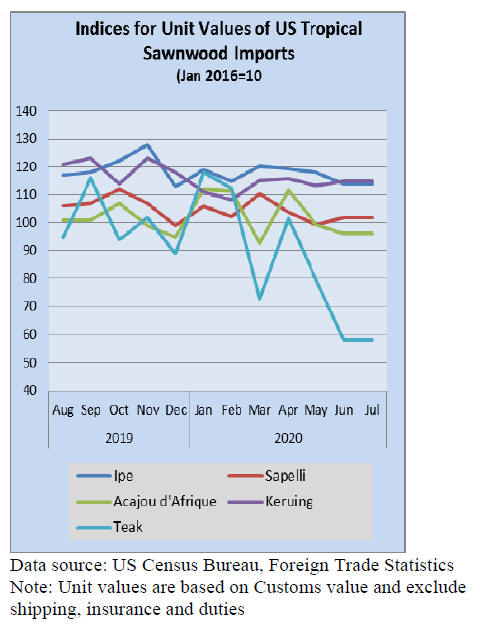

Tropical hardwood imports rose in July

July imports of sawn tropical hardwood rose 16% month

on month but at 12,596 cubic metres, the volume of

tropical hardwood imports was down more than 40% from

July 2019. Year-to-date imports remained down 39% up to

July.

Imports from Ecuador fell by 28% in July and are down

72% year-to-date. Imports from Brazil rose 21% in July

but only to a level about 15% less than that of the previous

July, with year-to-date imports up to July being down by

22%.

Similarly, imports from Malaysia rose sharply from weak

June numbers but remain down 40% year-to-date. On a

positive note, imports from Indonesia more than doubled

in July over June and are now ahead of last year by 8% for

the year.

Imports of jatoba rose 20% in July and imports of keruing,

virola and meranti all increased sharply in the month yet

all still lag 2019 totals year-to-date.

Imports of balsa, sapelli and acajou d¡¯afrique all fell by

more than 10% in July and are down sharply for 2020.

Canadian imports of tropical hardwood held fairly steady

in July, rising by 2% over the previous month. Imports for

the year so far are down by 9%.

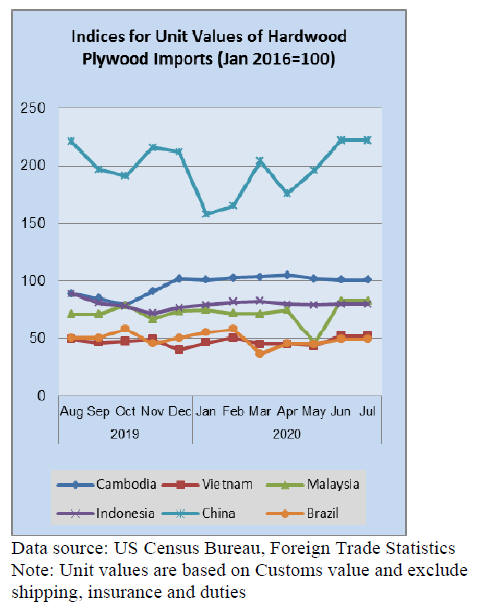

Hardwood plywood imports rose in July

US imports of hardwood plywood recovered somewhat in

July, rising by 13% for the month and bringing 2020 totals

even with 2019. Imports from China fell 3% in July,

ending a four-month streak of improvement after a sharp

decline at the beginning of the COVID-19 pandemic.

Imports from China are down 57% for the year. Imports

from other key trade partners: Russia, Indonesia,

Malaysia, Cambodia, and Vietnam all rose more than 10%

in July.

Veneer imports continue to catch up

Imports of tropical hardwood veneer continued to rally,

rising by 40% in July after improving 76% in June. Yet,

there is still much more ground to make up after imports

cratered in May.

Despite the gains, July imports were still down about 50%

from the previous July¡¯s figures, while year-to-date

imports are down by 30%.

Import volume was particularly volatile in July with

imports from Ghana and Cameroon nearly disappearing

while imports from Italy almost doubled and imports from

China grew by more than 850%.

Year-to-date imports from Cameroon are double what they

were last year, while imports from most other nations are

down by more than one-third.

Imports of assembled flooring spike to record level

The value of US imports of assembled flooring panels

jumped 29% in July to the highest level in more than 10

years at US$18.6 million. While increases in building

supply prices may have contributed to import value rises

in recent months, it was a more than 30% rise in the

import volume of panels that drove the jump in July.

The value of imports from Vietnam was up 68%, while the

value of imports from China and Canada rose 35% and

15%, respectively. Despite the record month, the value of

imports of assembled flooring panels is down 2% for

2020.

Imports of hardwood flooring also rose (12%) in July but

are still at a monthly level only about two-thirds of where

they were last July. Imports from China saw their

strongest month since February while imports from

Malaysia rose by 35%. Imports from Brazil were down

1% and are behind last year by 30% for the year. Overall

imports are down 33% year-to-date.

Moulding imports continue recovery, Malaysian scores

Imports of hardwood mouldings rose by 25% in July,

outpacing July 2019 imports by more than 10%. Imports

from Malaysia rebounded after two dismal months, rising

by just under 400%.

Due to the slump, imports from Malaysia are down 34%

for 2020. Imports from Brazil are even weaker, down

62% for 2020 after falling by 38% in July. Overall

imports are down 11% for the year.

Furniture orders soared in June

New US residential furniture orders continued to bounce

back, with a 73% increase in June following up an even

larger percentage gain in May. According to the latest

Smith Leonard survey of manufacturers and distributors,

new orders in June were 30% ahead of June 2019.

New orders were up for 73% of the participants. In May,

new orders were down 8% from May 2019. ¡°We had

heard from many that June orders had really started to

come in better than expected but the increase over June

last year was more than we would have thought,¡± the

survey report said.

For the first half of 2020 new orders were down 16% from

the same period last year after an 18% decline reported

last month. Some 81% of the participants reported a

decline in orders year-to-date.

Shipments in June were down 7% from June 2019 which

was pretty much in line with the decline in orders reported

in May. The results were split, with roughly one-half of

the participants reporting increases and the other one-half

reporting a decline.

See:

https://www.smith-leonard.com/2020/08/31/august-2020-furniture-insights/

Cabinet sales fell in July

US. cabinet manufacturers reported that cabinet sales were

down 5.8% in July 2020 compared to June, according to a

press release from the Kitchen Cabinet Manufacturers

Association (KCMA) on their monthly Trend of Business

Survey. Custom sales decreased 5.4%; semi-custom sales

increased 2.6%; and stock sales were down 10.8%

compared to the previous month.

US. cabinet manufacturers reported an increase in overall

cabinet sales of 3% for July 2020 compared to the same

month in 2019, Custom sales are up 0.9%, semi-custom

increased 3.6%, and stock sales increased 3%.

Overall year-to-date cabinet sales are down 2.9%. Custom

sales decreased 4%, semi-custom sales decreased 8.1%,

and stock sales are up slightly at 1% year to date.

See:

https://www.kcma.org/news/press-releases/july-2020-trendof-business

Contract furniture, retailers expand home office

partnerships

The trend in ¡®work from home¡¯ has been experienced for a

number of years but the pandemic has resulted in an

escalation of this in the US. Today, workers stuck at home

are buying a lot of desks, chairs, and shelves to furnish and

expand home offices.

Some of the major contract manufacturers offer their

products through online stores but the choices are very

limited. Industry experts interviewed by the Woodworking

Network found that companies are increasing their

offerings and expanding their marketing through a number

of outlets.

It has been estimated that about 50% of US office workers

are working from home or elsewhere rather than their

company¡¯s offices. Many workers will return to the office

when the pandemic ends but it is likely that many will

continue to work at home, at least part of the time.

|