|

Report from

Europe

Downturn in EU27 tropical imports may be less severe

than forecast

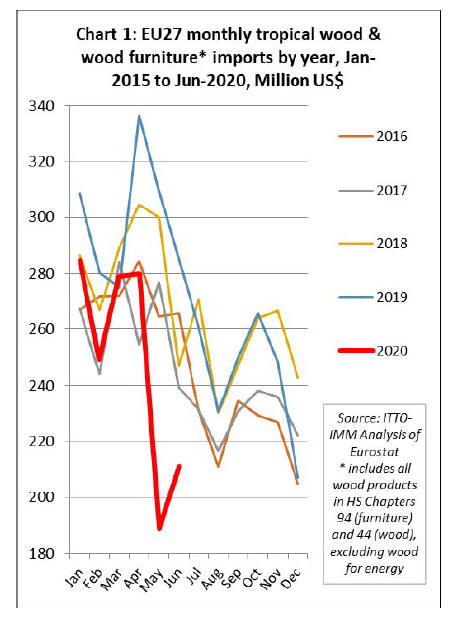

The downturn in EU imports of wood and wood furniture

products during the initial period of the COVID-19

pandemic may be less severe than first forecast. As

expected, EU27 (i.e. excluding the UK) tropical wood and

wood furniture product imports fell sharply in May in

response to supply side problems and the lockdown

measures in most of the main EU markets, losing around

one third of value against the five-year average for the

month.

However, imports were already recovering in June, a

month which in a more typical year is when imports tend

to slow before the summer holiday period (Chart 1).

Imports during June were only around 20% below the 5-

year average for that month. In total, EU27 imports of all

tropical wood and wood furniture products in the first half

of 2020 were US$1.49 billion, 17% less than the same

period in 2019.

There is a reasonable chance that, if the recovery

continues over the summer months, overall imports of

tropical wood and wood furniture in 2020 will not be too

far below 2019 or the five-year average.

This does assume, however, that there is no significant

uptick in COVID-19 cases in the EU with the onset of

winter leading to widespread resumption of lockdown

measures. As things stand, there is a still concern in the

EU about the possibility of a second wave.

More positively, anecdotal reports suggest that the DIY

sector in the EU remained quite buoyant in some countries

throughout the lockdown months with many people taking

the opportunity to carry out home improvement work. In

those EU countries with less stringent lockdowns, such as

the Netherlands and Sweden, commercial construction and

some manufacturing activity also continued, at a slower

pace but without interruption.

Another reason for optimism is the agreement reached

between the leaders of the 27 EU Member States at a

summit on 21st July 2020 on a comprehensive fiscal

stimulus package worth €1.85 trillion over the next seven

years.

The package consists of a €1.1 trillion budget, 30% of

which will be spent on tackling climate change, and a

further €750 billion in grants and loans, all of which must

be tied to meeting the bloc¡¯s carbon emission-cutting

targets. This has potential to create new market

opportunities for timber products in the EU.

EU27 tropical wood furniture imports down in the first

half of 2020

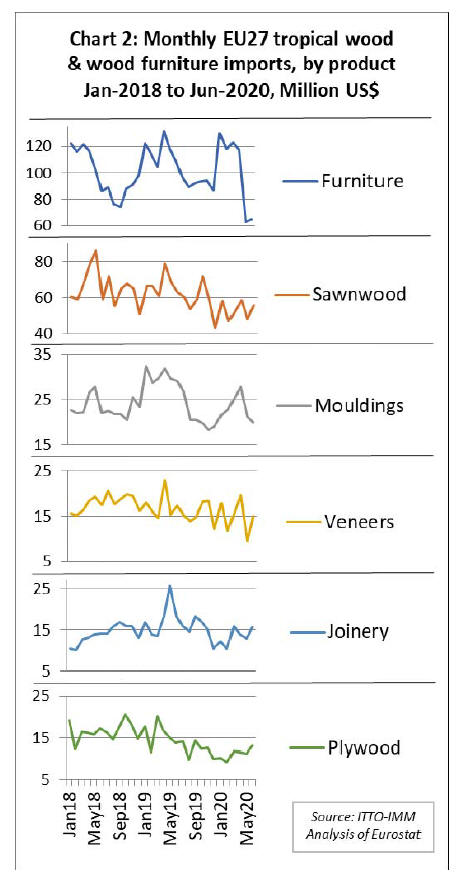

The path of decline and recovery in EU27 tropical wood

and wood furniture imports varied widely between product

groups (Chart 2). EU27 imports of tropical wood furniture

started the year strongly but fell sharply in April and May

with only a slight recovery in June. Total EU27 wood

furniture imports from the tropics in the second quarter of

2020 were 19% less than the average for the same period

in the previous 5 years.

At US$616 million, EU27 imports of tropical wood

furniture in the first six months of 2020 were 12% less

than the same period last year.

EU27 imports of tropical sawnwood were already weak in

the first quarter of 2020 and remained at a historically low

level in the second quarter. Total EU27 sawnwood

imports from the tropics in the second quarter of 2020

were 21% less than the average for the same period in the

previous 5 years.

At US$320 million, EU27 imports of tropical sawnwood

in the first six months of 2020 were also 21% down on the

same period last year. In quantity terms, the EU27

imported 382,000 m3 of tropical sawnwood in the first six

months of 2020, 21% less than the same period last year.

EU27 imports of tropical hardwood decking/mouldings

started the year particularly slowly and were just building

momentum when the lockdown measures were first

implemented in March. This led to imports falling sharply

in May and June. EU27 imports of decking/mouldings

during the second quarter of 2020 were 8% below the

average for the same period in the previous 5 years.

At US$139 million, EU27 imports of tropical hardwood

decking/mouldings in the first half of 2020 were 23% less

than the same period last year. In quantity terms, the EU27

imported 88,500 tonnes of tropical decking/mouldings in

the first six months of 2020, 17% less than the same

period last year.

EU27 imports of hardwood veneer from the tropics fell

very sharply in May, to only around 50% of the long-term

average for that month but recovered ground quickly in

June. Overall EU27 imports of tropical hardwood veneer

in the second quarter of 2020 were 21% below the average

for the same period in the previous 5 years.

EU27 imports of tropical hardwood veneers were US$89

million in the first half of 2020, 14% less than the same

period last year. In quantity terms, the EU27 imported

140,000 m3 of tropical veneer in the first six months of

2020, 10% less than the same period last year.

EU27 imports of joinery products from the tropics (much

of which comprises laminated window frames and kitchen

tops, together with finished doors) held up well during the

COVID lockdown period, with no significant decline in

May and June.

Overall EU27 imports of tropical joinery products in the

second quarter of 2020 were only 6% below the average

for the same period in the previous 5 years. The EU27

imported tropical joinery products with a total value of

US$81.2 million in the first six months of 2020, 24% less

than the same period last year.

EU27 imports of tropical plywood, already declining

before the lockdown period, fell sharply in the second

quarter of 2020, 22% below the average for the same

period in the previous 5 years. EU27 imports of tropical

plywood were US$67.4 million in the first half of 2020,

29% less than the same period in 2019. In quantity terms,

imports of tropical plywood were 112,000 m3 in the first

six months of 2020, 28% less than the same period last

year.

EU27 imports from Indonesia better than expected in

May and June

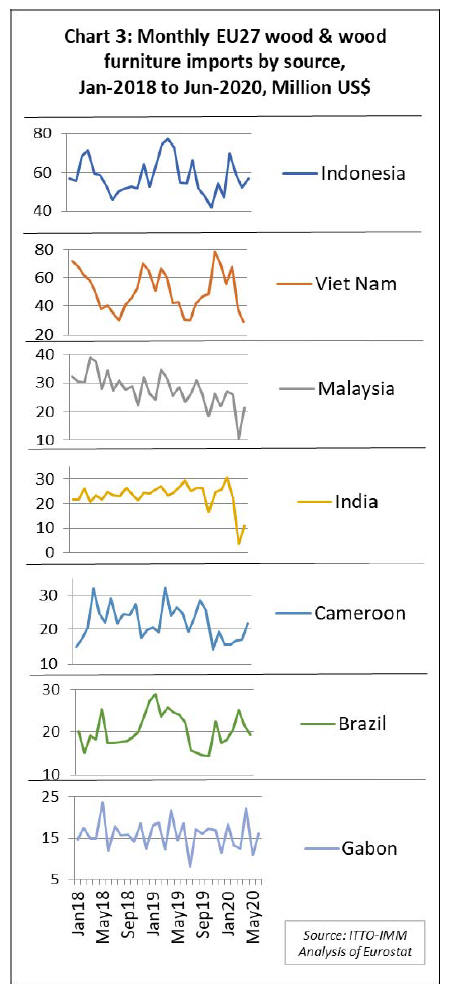

The fortunes of individual tropical supply countries also

varied widely in the EU27 market during the lockdown

period (Chart 3).

EU27 imports of wood and wood furniture from

Indonesia, which are dominated by garden furniture,

decking and plywood, tend to be strongest in the spring

season.

The sharp decline in imports from Indonesia in April this

year, at a time when trade is usually rising, did not bode

well.

However, trade held up better than expected in May and

June, perhaps bolstered by the continuing strength of

demand for exterior furniture products and decking.

Overall, EU27 imports of wood and wood furniture from

Indonesia in the second quarter of 2020 were 12% below

the average for the same period in the previous 5 years.

EU27 imports of these products from Indonesia were

US$340 million in the first half of 2020, 16% less than the

same period in 2019.

In contrast to Indonesia, EU27 imports from Vietnam are

dominated by interior furniture and tend to be strongest at

the turn of the year, in time for the January sales, and to be

very slow during the summer and early autumn. While

EU27 imports from Vietnam did fall very sharply in May

and June, the decline was not significantly out of

alignment with the seasonal fall that usually happens at

this time of year.

Overall EU27 imports of wood and wood furniture from

Vietnam in the second quarter of 2020 were only 8%

down on the average for the same period in the previous 5

years. EU27 imports of these products from Vietnam were

US$337 million in the first half of 2020, 5% less than the

same period in 2019.

The full effects of COVID-19 on EU imports from

Vietnam will only become truly apparent later this year

when furniture products for next season begin (or fail) to

arrive.

EU27 imports of wood and wood furniture products from

Malaysia, which were sliding before onset of the

pandemic, suffered a very sharp decline in May, but then

rebounded quite strongly in June. Overall, EU27 imports

from Malaysia were down 40% in the second quarter of

this year compared to the average for the same period in

the previous 5 years.

EU27 imports of wood and wood furniture from Malaysia

were US$133 million in the first half of 2020, 24% less

than the same period in 2019. The decline was apparent in

all four of the main product groups supplied by Malaysia

into the EU; interior furniture, sawnwood,

mouldings/decking, and joinery.

EU27 imports from India suffer severe decline this year

EU27 imports of Indian wood and wood furniture

products, dominated by interior furniture, suffered a very

severe decline in May, falling to negligible levels during

the month and rebounded only quite weakly in June.

Overall, EU27 imports from India were down 38% in the

second quarter of this year compared to the average for the

same period in the previous 5 years. EU27 imports of

wood and wood furniture from India were US$118 million

in the first half of 2020, 21% less than the same period in

2019. This was the first reversal for several years of a

long-term rising trend in imports from India.

EU27 imports from Cameroon are dominated by

sawnwood and tend to be volatile even in a ¡°normal¡± year.

This year the trade trend has been even more unusual and

less predictable. EU27 imports from Cameroon were very

low at the end of 2019 and the opening weeks of this year

and even picked up slightly during the COVID lockdown

period.

EU27 imports from Cameroon in the second quarter of

2020 were down 25% against the average for the same

period in the previous 5 years. However, they were 10%

more than the extremely weak level of trade in the first

quarter of this year. Overall, EU27 imports of wood and

wood furniture from Cameroon were US$105 million in

the first half of 2020, 26% less than the same period in

2019.

EU27 imports of tropical hardwoods from Brazil, mainly

sawnwood and decking, held up quite well during the

lockdown period. Imports from Brazil were higher in the

second quarter this year compared to the average for the

same period in the previous five years.

However, this follows a period of continuous growth

between 2015 and 2019 and imports from Brazil during

the second quarter of this year were 21% less than the

same period in 2019. Overall, EU27 imports of wood and

wood furniture from Brazil were US$122 million in the

first half of 2020, 21% less than the same period in 2019.

For the first time for many years, if sawnwood and

decking/mouldings are considered together, Brazil this

year has emerged as the largest tropical supplier of this

product group to the EU, overtaking both Cameroon and

Malaysia which formerly dominated this trade.

The lockdown appears to have had very little impact on

EU27 imports from Gabon. Overall EU27 imports of

wood and wood furniture from the country, which consist

mainly of sawnwood and veneer, in the second quarter of

2020 were down only 5% against the average for the same

period in the previous 5 years.

Although imports of sawnwood from Gabon weakened

slightly in the second quarter this year, this was offset by a

rise in veneer imports. Overall, Overall, EU27 imports of

wood products from Gabon were US$93 million in the

first half of 2020, 10% less than the same period in 2019.

EU27 imports from most other tropical wood and wood

furniture supplying countries also fell sharply in the first

half of 2020 including Congo (-23% to US$35 million),

Cote d¡¯Ivoire (-29% to US$24 million), Ghana (-19% to

US$13 million), Peru (-29% to US$10 million), DRC (-

54% to US$4.7 million) and Bolivia (-36% to US$5.9

million). Indirect EU27 imports of tropical hardwood

products (mainly plywood) also fell from China (-24% to

US$15 million) and the UK (-28% to US$8.8 million).

However, one tropical country increased trade with the

EU27 during the first half of the year: imports from

Ecuador increased 28% to US$32 million, presumably

benefitting from expansion of the renewable energy sector

(balsa wood is widely used for wind turbines).

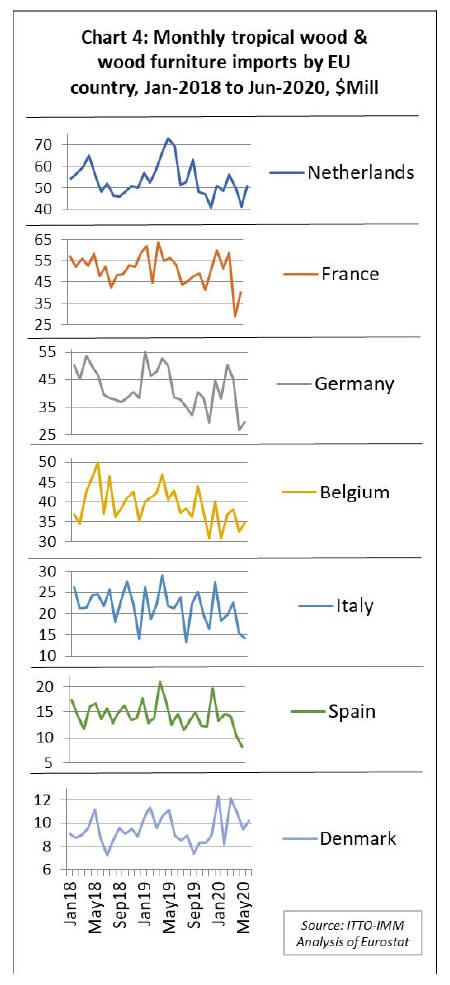

Impact of COVID-19 varies across member states

Chart 4 highlights that the impact of COVID-19 on

imports of tropical wood and wood furniture on individual

EU27 countries has varied widely, dependent on

underlying economic and trade trends before the onset of

the pandemic, the differing level of each country¡¯s

exposure to the pandemic, and variation in the timing and

scope of the policy response.

Due to the integrated nature of the EU market, for those

countries like Belgium and the Netherlands which

distribute a significant proportion of products to other EU

countries, the trends are not necessarily driven by the

domestic market situation.

The Netherlands is currently the largest destination for

tropical wood and wood furniture imports. Imports into the

country were less affected than most other major

destinations during the lockdown period.

The Dutch government won plaudits earlier in the

pandemic for a so-called ¡°intelligent lockdown¡± strategy

that relied on people abiding by social-distancing

measures while keeping large parts of the economy open.

Netherlands imports of tropical wood and wood furniture

were down 11% in the second quarter of this year

compared to the average for the same period in the

previous 5 years. In total, Netherlands imports of tropical

wood and wood furniture were US$299 million in the first

half of 2020, 21% less than the same period in 2019.

This is a large decline, but it follows a particularly buoyant

year for tropical wood imports in the Netherlands in 2019.

Particularly sharp fall in French imports in May

France imports of tropical wood and wood furniture

started the year quite strongly before falling very sharply

in May. In June there were signs of a robust rebound.

France's lockdown was imposed on 17 March, but

restrictions began to ease from 11 May.

Overall, France imports of tropical wood and wood

furniture were down 19% in the second quarter of this year

compared to the average for the same period in the

previous 5 years. In total, France imports of tropical wood

and wood furniture were US$290 million in the first half

of 2020, 15% less than the same period in 2019.

Signs of weakness in the German economy contributed to

slowing German imports of tropical wood and wood

furniture in 2019. A partial recovery in trade in the

opening weeks of 2020 was halted with the onset of the

pandemic.

German imports of tropical wood and wood furniture fell

very sharply in May and were yet to show any real

recovery in June. In total, German imports of these

products were down 27% in the second quarter of this year

compared to the average for the same period in the

previous 5 years.

For the first half of 2020, German imports of tropical

wood and wood furniture were US$234 million, 20% less

than the same period in 2019.

This is despite Germany managing to keep the number of

corona cases relatively low compared to many European

neighbours and the easing of lockdown measures since

April.

Belgium was hit particularly hard early in the pandemic,

encouraging the government to introduce tougher

restrictions than many of its neighbours. Nevertheless,

trade has continued to flow and, in terms of tropical wood

and wood furniture imports, Belgium has seen less of a

downturn than most of its neighbours.

Belgium imports of tropical wood and wood furniture

products were down 18% in the second quarter of this year

compared to the average for the same period in the

previous 5 years. In total, Belgium imports of tropical

wood and wood furniture were US$213 million in the first

half of 2020, 16% less than the same period in 2019.

Like Belgium, Italy was hit early and hard by the

pandemic leading to imposition of a tough national

lockdown starting on 7 March. The three-month lockdown

took a heavy toll on the economy. The Italian government

forecasts that GDP will contract 8% in 2020, while

analysts see a 10% decline. Italy¡¯s imports of tropical

wood and wood furniture fell sharply in May and

continued to slide in June.

Imports were down 27% in the second quarter of this year

compared to the average for the same period in the

previous 5 years. In total, Italy¡¯s imports of tropical wood

and wood furniture were US$117 million in the first half

of 2020, 16% less than the same period in 2019.

Spain is another European country hit particularly hard by

the pandemic. Spain started easing the lockdown, one of

the strictest in Europe, in phases from 4 May. Spain¡¯s

imports of tropical wood and wood furniture fell steeply in

May and this trend continued in June.

Overall, Spain¡¯s imports of tropical wood and wood

furniture were down 30% in the second quarter of this year

compared to the average for the same period in the

previous 5 years. In total, Spain¡¯s imports of tropical wood

and wood furniture were US$80 million in the first half of

2020, 16% less than the same period in 2019.

Denmark is unusual for experiencing a rise in tropical

wood and wood furniture imports this year, despite the

pandemic. In total, Denmark¡¯s imports of tropical wood

and wood furniture were US$63 million in the first half of

2020, 2% more than the same period in 2019.

Imports remained strong even as much of the rest of

Europe went into lockdown. Danish imports of tropical

wood and wood furniture products were up 12% in the

second quarter of this year compared to the average for the

same period in the previous 5 years.

Denmark¡¯s imports from Vietnam, the largest supplier,

increased 10% in the first 6 months of this year, while

imports from Ecuador were up 50%. Ecuador overtook

Brazil and Indonesia to become Denmark¡¯s second largest

tropical wood supplier in the first half of 2020. Denmark is

a primary location for manufacture of wind turbines in the

EU creating demand for Ecuadorian balsa wood.

Denmark was one of the first countries in Europe to

emerge from lockdown. According to a recent

international survey by the Pew research Centre, 95% of

people in Denmark believe their government did a good

job in handling the crisis. That is the highest rating for any

country in the analysis, which encompassed 14 advanced

economies.

|