Japan

Wood Products Prices

Dollar Exchange Rates of 10th

August

2020

Japan Yen 106.49

Reports From Japan

¡®Pandemic fatigue¡¯ setting in

A second wave of corona virus cases in Japan¡¯s major

cities is a threat to the initial signs of economic recovery

but the government is hesitating to request businesses to

again suspend operations hoping the regular news on

infections would encourage residents to continue with

their efforts to reign in the spread.

The problem is that now there is a growing ¡®pandemic

fatigue¡¯ setting in especially among the younger

generation who make up most of the new cases of

infections.

The Ministry of Finance has painted an optimistic picture

for all regions in the country saying consumer spending

and production appears to be bottoming-out. The ministry

also revised its overall assessment of the Japanese

economy saying that there are signs of recovery in some

areas.

See:

https://www.nippon.com/en/news/yjj2020080400539/japanmof-revises-up-economic-views-for-all-regions.html

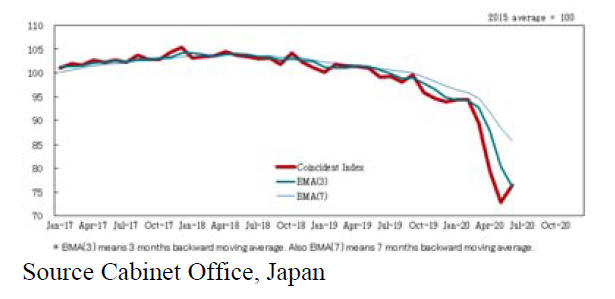

Lending support to the suggestion that the economic

downturn is bottoming-out an index reflecting the current

state of the Japanese economy improved in June for the

first time in five months. The Cabinet Office preliminary

data for business conditions in June showed an uptick.

But, the Cabinet Office maintained its assessment that the

Japanese economy is "worsening," using the most

pessimistic expression for the 11th straight month.

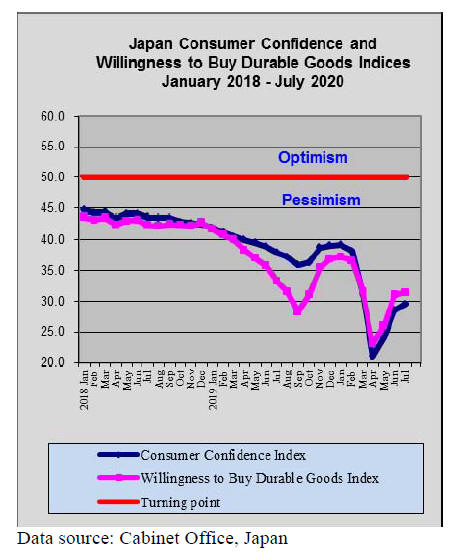

Pace of decline in spending slows

Data from the Ministry of Internal Affairs is suggesting

that June household spending, while still dipping down,

fell at a much slower pace than in May when spending

dropped over 16%.

The 1% decline in June marks the ninth consecutive

decline. The Ministry data shows spending on tours and

theater admissions were down more than 90%. In contrast,

purchases of household furniture and electrical goods

almost doubled compared to May. A ministry

spokesperson said the government's yen 100,000 payout to

all residents helped slow the decline in spending.

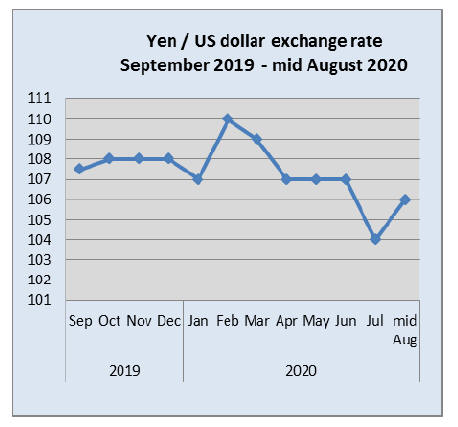

Yen/dollar exchange rate change losses steam

The Japanese yen gained against the US dollar towards the

end of July but by mid-August had weakened again to

around the 106/7 yen to the dollar. A weaker yen is good

news for exporters but it appears the yen is set to

strengthen given the increased uncertainty on many

economic fronts.

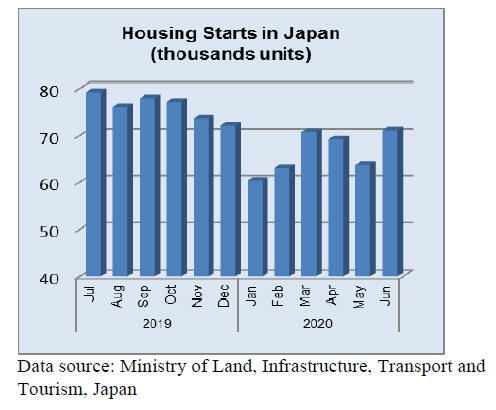

Uptick in orders for new homes

The Japan Lumber Reports has assessed demand for

housing and reports major builders have seen a slight

recovery. Sales by major builders in June were higher than

May.

Japan/UK trade deal close

Japan and the UK have been discussing a free trade

agreement to come into effect when the UK leaves the EU.

The Japanese media has reported that agreement has been

reached on tariffs covering almost all industrial products

and on digital, data and financial services that go beyond

the EU-Japan arrangement. Japanese government has said

the remaining issues are limited to some agricultural

products.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20200808_05/

Import update

Furniture imports

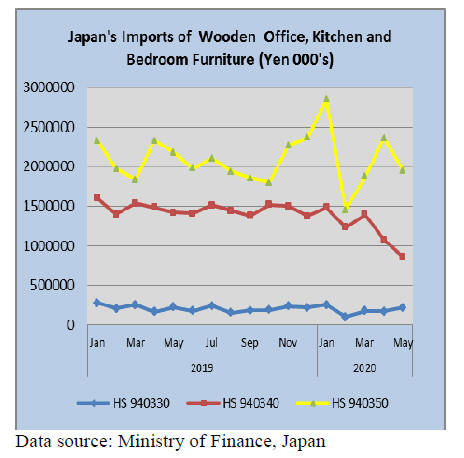

There has been a noticeable downward trend in imports of

wooden kitchen furniture (HS940340) that appears to have

started in October last year. In the seven months to May

2020 in only two months have there been month on month

increases in the value of imports.

Office furniture imports (HS 940330)

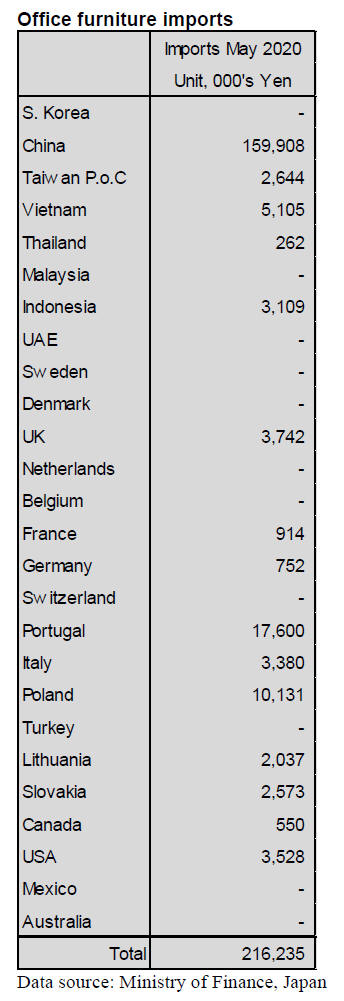

The value of May imports of wooden office furniture

(HS940330) was down around 3% year on year but

compared to April the value of imports rose 24%.

Most wooden office furniture imports originate in China

(74% of the May total) and in May the other main shippers

were Portugal and Poland. Shippers in China saw May

exports to Japan rise 15% and shippers in Portugal and

Poland also saw a sharp increase in office furniture exports

to Japan.

Kitchen furniture imports (HS 940340)

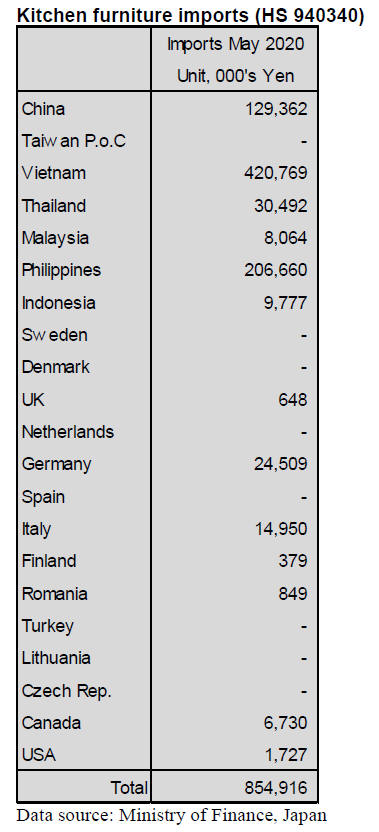

Year on year Japan¡¯s imports of wooden kitchen furniture

have fallen around 40% and the value of May imports

were some 20% below that in April.

Each of the three main shippers saw declining exports of

wooden kitchen furniture in May. Exports in May from

Vietnam, now the main supplier, were down by almost

half compared to April and Japan¡¯s imports of wooden

kitchen furniture from China dropped 15% in May.

Bedroom furniture imports (HS 940350)

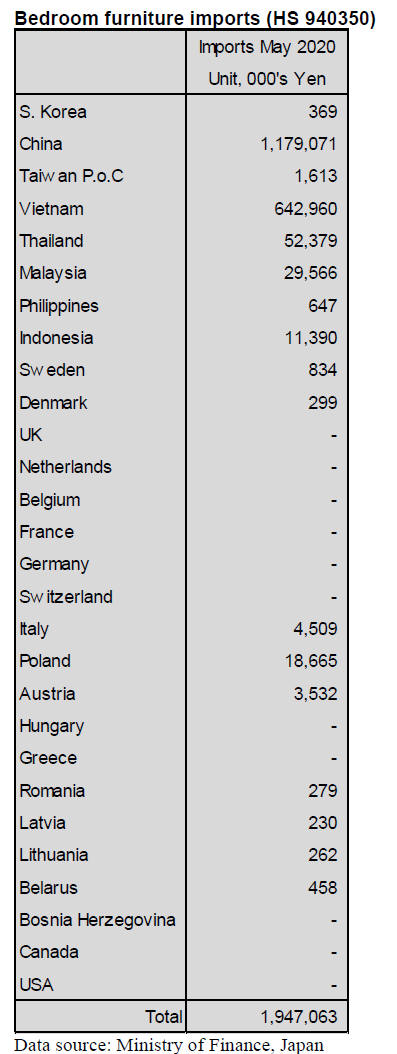

After the steep decline in the value of wooden bedroom

furniture in February there has been two consecutive

months of increases bring the average value for a three

month period back to usual levels.

However, May imports of wooden bedroom furniture

slipped into negative territory once again dropping 17%

month on month. Year on year, imports of HS(940350)

were down 10% in May this year.

Shippers in China and Vietnam dominate Japan¡¯s imports

of wooden bedroom furniture with China accounting for

around 60% of all wooden bedroom furniture imports with

another 30% plus coming from Vietnam. Exporters in

Thailand (the 3rd largest shipper in May) accounted for

just 3% of all wooden bedroom furniture imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Wood demand projection meeting

The Forestry Agency held wood demand projection

meeting on June 29 for the second half of 2020. In wood

demand in 2020, domestic logs would decrease by 11.9%

from 2019. Imported logs would drop by 15.3%. Imported

lumber would decline by 12.3%.

Forecast for new housing starts in 2020 by private think

tanks would drop much more than the forecast made in

last March.

In total of 12 think tanks, only two predicted less than

800,000 units in last March forecast then this time, five

out of ten forecast drop of less than 800,000 units.

Average starts would be 788,000 units from 847,000 units

in March.

In previous forecast, the reason of decline was

consumption tax hike then coronavirus outbreak is added

another declining factor. Actually two think tanks forecast

starts of less than 750,000.

For domestic logs in 2020, logs for lumber would decrease

by 14.4% and for plywood would drop by 5.0%.

Paper and pulp manufacturing plants restrict purchased of

logs by rapid decline of use of paper for office use and

others like flyers. Log export business for China and other

countries is hard to forecast, particularly for China because

of trade conflict with the U.S.A. despite of the fact that

lumber production in China is rapidly recovering.

In imported lumber, North American lumber would

decrease by 17.8% not by supply side problem but by

dropping domestic demand. European lumber supply

deceased by supply side problem in the first half of 2020

then the demand would decrease in the second half of the

year. Forecast of demand in 2020 would be down by 8.3%.

Radiata pine lumber supply from New Zealand and Chile

in the second quarter this year is 55.6% less than the same

period of last year. The supply seems to increase in the

second half to the same as last year.

Russian lumber inventory in Japan increased during the

second quarter by active supply in the first quarter. The

supply would decrease in the second half of the year but

the demand is also dropping so heavy inventory seems to

continue through the year.

Import of legally certified wood products

The Japan Lumber Importers Association held general

meeting on June 19. It reports that total import of logs and

lumber in 2019 was 8,840,000 cbms, 5.7% less than 2018.

This is three consecutive years¡¯ decline and wood demand

is related to new housing starts, which have been

declining.

It forecasts that the demand would continue decreasing

particularly by coronavirus outbreak in 2020. However, it

continues to advise importing of legally certified wood

products.

Import of legally certified wood products in 2019 by 60

members of the Association was 73.5%, 0.6 points less

than 2018.Percentage of sales with the certificate were

33.7%, 4.4 points less, which is 24.7% in total imported

volume. This is 3.5 points less than 2018 and trend seems

to keep declining.

The Association reports that it is not because of negligence

of the members but because of the fact that about one

fourth of products is unable to obtain legality certificate so

the Association reports that any more increase of the

percentage seems impossible.

Also the Association reports that the share of imported

wood by the members is 53% in total imported volume.

South Sea (tropical) logs and lumber

Supply and demand of South Sea hardwood logs are

balanced and users carry about two to three months

inventory as the consumption is dropping by slower

demand by corona virus incident.

The largest log consuming plywood mill in Japan will be

out of business in March 2012 so it may need another log

ship before closing but log demand will keep dropping.

Inventory of free board of Chinese red pine and

Indonesian mercusii pine is adequate. The demand in

Japan is dropping so the orders from Japan are decreasing.

Recovering housing orders

Orders for house builders, which specialize in order-made

houses were recovering in June.

Order values for eight major builders in June was 15% less

than June last year. It was about 35% less for April and

May so house buyers who stayed at home during March

and May started going out in June.

Number of visitors to house exhibition sites by large house

builders has not recovered enough yet. Meantime, low cost

house builders and builders for units built for sale attract

more buyers since negotiations are shorter.

Sales value by eight major builders (Sekisui House, Daiwa

House, Sekisui Chemical house, Panasonic Homes,

Misawa Homes, Sumitomo Forestry, Asahi Kasei Homes,

Mitsui Home ) in June is higher than May.

They report that reaction of buyers is getting better week

after week but fear of second wave of corona virus is

concern and large sales promotional events are not

allowed yet so there is no blind optimism.

Major builders are also concerned to competition with low

cost builders despite different class of buying people. Low

cost builders had more orders during March and May

when major¡¯s activities were almost dead.

Weakening softwood plywood market

In Tokyo market, softwood plywood (12 mm/3x6) prices

are down to 900 yen per sheet delivered, lowest in about

four years. The prices have been softening since last May

and wholesalers comment that price skidding in last one

month is much faster than the Lehman shock days.

In weak demand, June was quarter end book closing

month and sales competition got fierce and price war

started.

Looking at rapid price decline in June, dealers saw bearish

future and reduces the purchase and precutting plants¡¯

consumption is also decreasing.

Plywood manufacturers plan to reduce the production in

August by 30% to stop rapid skidding of the prices. With

such strong attitude of the manufacturers, the market

finally settled down now temporarily.

Imported plywood market

In South Sea hardwood plywood, market prices of 12mm

coated concrete forming panel are down by 20-30 yen per

sheet down from June. Due to uncertain future market,

dealers are trying to dispose of the inventory as fast as

possible and offered low prices.

There is warning of supply shortage after July but there is

opposite opinion so the prices are highly fluid.

Prices of 12 mm panels turned soft after the State of

Emergency was lifted in May. The prices were rather firm

before that as fear of supply from Malaysia by corona

virus epidemic so dealers tries to sell the inventory

cautiously but with uncertainty of future demand, they are

trying to move the inventory to get cash so the market

prices turned weak.

The importers did not place any future orders since last

April so the arrivals continue low.

Warehouse management in Tokyo Bay reports that the

arrivals have started declining sharply since June. The

importers should place large orders now but supplying

mills have been curtailing the production so the mills need

to start buying logs to deal with larger orders and the

proposed export prices should be higher.

There are two opposite forecasts. One is supply shortage

in coming months and another is no shortage because of

stagnant demand. It is like groping in the dark by hands.

Thus, sales attitude differs. Some keep selling as fast as

possible while the others are cautiously selling so the

market prices are hard to pin point.

Present market prices of JAS 3x6 concrete forming panel

for coating are 1,290 yen per sheet delivered, 20 yen down

from June. Prices of JAS green concrete forming panel are

about 1,220 yen and of 3x6 structural panel are about

1,230 yen. Both are 20 yen down from June.

Trend of imported logs for manufacturing plywood in

Japan

Declining trend of imported logs for manufacturing

plywood continues. There are various reasons by

supplying countries. Log export ban by state of Sabah,

Malaysia, increase of log export duty by PNG, increase of

log export duty in Russia and harvest disruption by B.C.,

Canada¡¯s major log supplier but there is very little impact

to plywood manufacturing industry in Japan, which has

been shifting to use domestic logs and by current

production curtailment for shrinking demand by corona

virus epidemic.

In North America, Mosaic Forest Management, the largest

log export log supplier in B.C. Canada, stopped log

harvest since last November so log import form Canada

drastically dropped by 76.6% during January and May.

Supply of Russian Far East larch log has been decreasing

after increase of log export duty started last year. For the

first five month, total supply was only 14,611 cbms,

51.9% less than the same period of last year.

Export prices are US$190 per cbm C&F, which are higher

than Canadian Douglas fir logs. There should be more

demand when the North American Douglas fir log supply

decreases but the inquiries are declining by weak demand

of plywood in Japan.

The reason is plywood manufacturers¡¯ production

curtailment. They have been reducing the production since

last February by 20-30% so log demand drops that much.

Demand for domestic logs is the same. In other words,

domestic log supply is ample to supplement shortage of

imported logs.

South Sea log import for the first five months is 44,836

cbms, 24.9% less than the same period of last year.

South Sea log supply situation has deteriorated rapidly in

last two years. Supply of South Sea hardwood logs has

been decreasing and the volume in 2017 was less than

150,000 cbms. In these days, 48.5% was Sabah logs.

After Sabah, Malaysia banned log export in May 2018, the

demand shifted to PNG, which increased log export duty

since last February. Sabah supply was almost 50% for

Japan market and after Sabah, stopped log export, hope of

stable supply of South Sea hardwood logs was gone.

PNG log supply in 2017 was only 19.7% in 2017 then

fortunately main PNG log buyer of China retreated

because of trade war with the U.S.A. so that Japan could

get in and replace Sabah supply so in 2019, PNG logs took

76.1% share of total import of South Sea logs. Then in

February 2020, PNG government raised log export duty

then the government commented to reduce log export

volume by half by 2025 and total ban in 2030.

Under this situation of supplying countries, the largest

plywood manufacturer of South Sea hardwood logs,

Daishin Plywood in Niigata announced to withdraw from

the business in March 2021. It consumes about 80,000

cbms a year, about 60% of total imported volume of South

Sea logs.

The reason is obvious that future supply of South Sea

hardwood logs is ambiguous. PNG replaced Sabah but

there is no other supply source to replace PNG.

Canadian Douglas fir log prices soared to US$150 per cbm

FAS from US$110 when North American lumber market

in 2017 and 2018.

Imported cost was about 24,000 yen per cbm FOB truck

port yard then FAS prices dropped down to US$135 in

2019 but the cost remained over 20,000 yen. It is not

competitive with domestic larch logs, which is about

17,000 yen.

Demand for Douglas fir logs was strong because 12 meter

length and high strength but now the cost of domestic logs

is lower than Douglas fir logs even with premium for long

length cutting in Japan.

The Russian government has been promoting wood

processing in the Russian Far East region and log export

duty has been raised step by step, which reduced supply of

larch logs for plywood manufacturing in Japan. The duty

was 25% until 2018 then increased to 40% in 2019 and

60% in 2020.

The import of Russian larch logs in 2018 was about

102,000 cbms, in 2019 was about 77,000 cbms, 25.2% less

than 2018. First five months import in 2020 is about

14,600 cbms, 52% less. High export duty is prohibitively

high so that many larch log exporters quit in 2019. Export

prices of Russian larch are about US$190 per cbm C&F,

which costs over 20,000 yen per cbm so again like

Canadian Douglas fir logs, the prices are not competitive

with domestic larch logs.

Larch veneer is another major export item from coastal

Russia. The supply needs to be adjusted to reduced

production of Japanese plywood mills but larch veneer

helps simplify plywood processing at the mills and it can

be used for face and back to guarantee enough strength so

it is valuable material for plywood mills.

According to the wood statistics, logs supplied for

plywood manufacturing are 5,448,000 cbms in which

share of imported logs is 12.9%. In 2015, the volume was

4,218,000 cbms in which share of imported logs was

20.5% so in four years, share of imported logs decreased.

Reasons that domestic plywood manufacturers look for

domestic logs for plywood manufacturing are long term

supply stability and no risk of exchange rate, which

changes cost of logs from time to time. Domestic larch and

cypress are higher in cost compared to cedar but lower

than imported species.

Long plywood used to need imported long length logs but

now log harvesters in Japan have started supplying long

length logs as the demand by plywood mills increases so

now long plywood with 100% domestic species are being

supplied. When plywood mills curtail the production, the

mills are aware that supply of domestic logs is necessary

in long term so that they reduce inventory of imported logs

and give domestic logs priority.

Demand of imported logs for plywood seems to keep

decreasing by reasons of supplying countries and

availability of domestic logs in Japan.

|