Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2020

Japan Yen 107.72

Reports From Japan

Businesses consider four day week, a radical

experiment for Japan

The Japanese government has now lifted the state of

emergency in Hokkaido and the Tokyo metropolitan area

where it had been maintained even after it was lifted over

the rest of the country.

Industry groups have announced wide ranging corona

virus safety prevention measures that their members are

expected to implement before reopening. Fundamental in

the guidelines is implementation of stricter hygiene

standards, improved ventilation in work areas and more

stringent social distancing measures.

In an effort to reduce congestion, especially during the

morning and evening rush hours, continuation of ¡®work

from home¡¯ is encouraged and the country¡¯s main business

lobby group has asked member companies to consider

introducing three-day weekends, a radical experiment for

Japan.

For more see:

https://www.japantimes.co.jp/news/2020/05/15/business/japanindustry-guidance-covid-19/#.Xsx4CtUzbIU

Technical recession but worst to come

Japan's Cabinet Office has reported that the economy

contracted in the first quarter of 2020 at an annualised rate

3.4%, piling pressure on policy makers as the economy

was in a technical recession even before the state of

emergency was declared over the coronavirus outbreak.

In the October-December 2019 quarter GDP dipped a

massive annualised 7.4% driven down by a collapse of

private consumption, the result of the increase in

consumption tax and the impact of natural disasters in

October.

While the first quarter 2020 contraction was anticipated it

came as a timely reminder of the need for action to prevent

the pandemic from ruining the economy. All segments of

the private sector experienced declines, from private

consumption and housing to business investment,

inventories and trade. According to a survey of economists

by the Japan Center for Economic Research the worst is

still to come. Japan's economy is expected to decline 5.8%

in the April-June quarter, equivalent to a 21% annualised

decline.

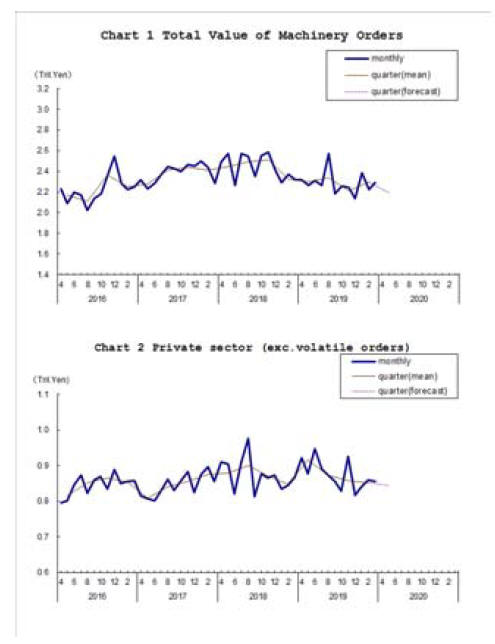

Machinery orders better than expected in Q1 2020

In the first quarter of 2020 January-March private-sector

machinery orders, excluding those from ship builders and

power companies, rose by 3.9% compared with the

previous quarter. However, there was a sharp drop in

March orders and a further decline of around 5% is

forecast by the Cabinet Office for the second quarter.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2020/2003juchue.html

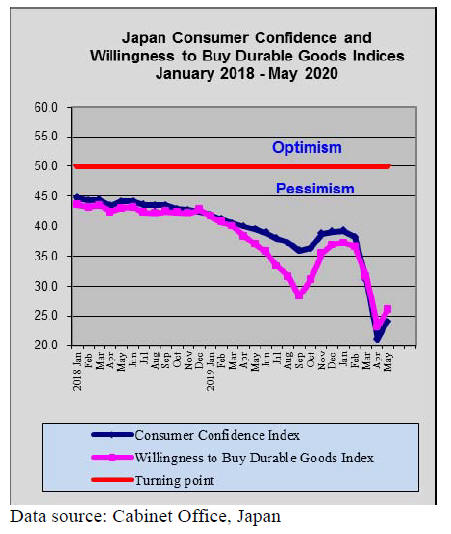

Uptick in consumer confidence as pandemic

restrictions eased

Japan¡¯s Consumer Confidence index published by the

Cabinet Office rose in May, the first upward movement in

five months. Analysts put the rise down to the lifting of

the national state of emergency.

The overall sentiment index for households of two or more

people stood at 24, up from the all-time low of 21.6 set in

April. However, the May figure is the second-lowest since

April 2004 and even lower than at the start of the 2008/9

financial crisis.

The index is intended to provide an indication of

consumers¡¯ expectations for the coming six months. A

reading below 50 indicates that pessimists outnumber

optimists. The index for willingness to purchase durable

goods (such as household furniture) trended higher but is

still deeply in negative territory.

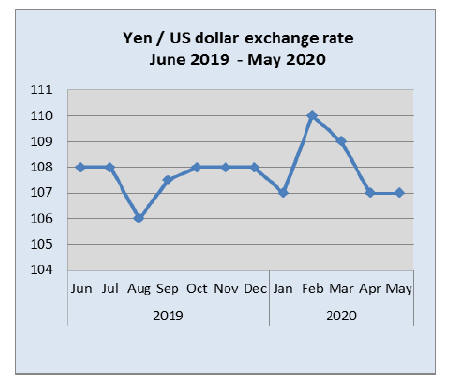

Yen/dollar exchange rate steady while other

major

currencies fall

While many emerging market currencies have depreciated

sharply the major currencies, despite the pummeling of

their economies by the pandemic, have continued to trade

in a narrow band unlike the volatility during the 2008

financial crisis. Nowhere is the stability of a major

currency more apparent than with the yen/dollar exchange

rate.

After Lehman¡¯s collapse the yen swung to 89 to the dollar

from around yen 110, an appreciation of 24%. But during

the first quarter of the current pandemic the yen/dollar

exchange rate has remained remarkably stable in a range

from yen 106 to yen 109 to the dollar. In contrast, the

euro, sterling, and Australian dollar exchange rates have

all declined steeply.

The strength of the yen has happened despite the overall

weakness of the Japanese economy, a weakness that was

apparent even before the coronavirus pandemic.

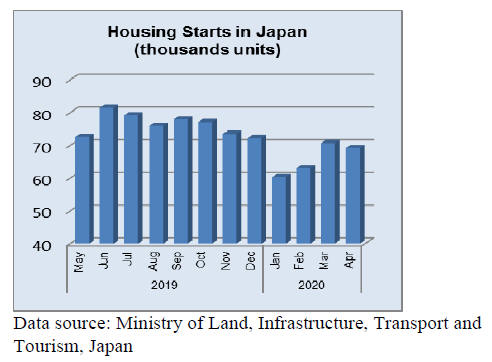

Housing starts beat expectations

Housing starts across Japan fell almost 10% year on year

in April, the ninth consecutive decline but this was much

less of a fall than had been expected. Compared to the

76,600 units completed in March there were only 69,200

completions in April.

Import update

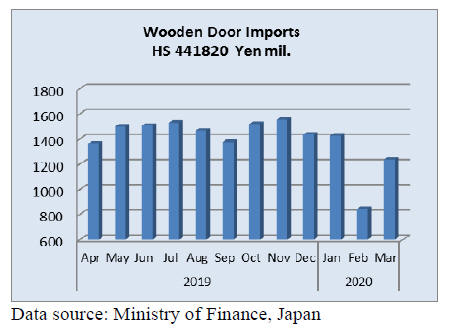

Wooden door imports

While the sharp drop in imports of wooden door

(HS441820) in February the rebound in the value in March

was more of a surprise. Year on year, the value of wooden

door imports in March dropped a further 18% adding to

the year on year decline seen in February. For the first

quarter 2020 there was a 22% decline in the value of

wooden door imports.

As in previous months shippers in China and the

Philippines dominated Japan¡¯s March 2020 imports of

wooden doors (HS441820). The main shipper, China,

accounted for 47% of all door imports. Shippers in the

Philippines saw a decline in market share in March,

slipping to 24% from the 35% in February. The other

major shipper was Indonesia which accounted for 7.5% of

the value of imports in March.

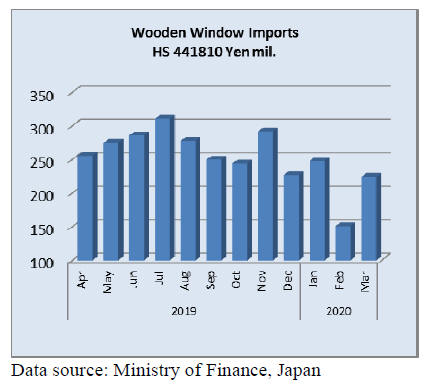

Wooden window imports

As was the case with door imports, the value of wooden

window imports (HS441810) in March 2020 was

significantly up on February rising almost 5% month on

month. However, year on year March wooden window

import values were down 12% and for the first quarter

Japan¡¯s wooden window imports were down 21%

compared to the first quarter 2019.

As in previous months the main suppliers of wooden

windows in March 2020 were China (39% of imports), the

US (32%) and the Philippines (18%). Month on month

March 2020 import values surged almost 50%.

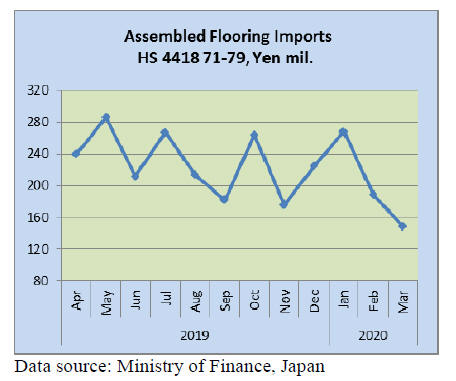

Assembled wooden flooring imports

Japan¡¯s imports of assembled flooring (HS441871-79) in

February followed the regular peak and dip scenario and

did not showing any signs of decline which was something

of a surprise. Although orders delivered in February would

have been placed before the pandemic there could have

been some disruptions due to shipping delays but this

appears not to have been the case.

However, the impact of shipping and production delays in

China feed through into the March import data where,

instead of maintaining the peaks and dips observed over

the years, there was a double dip in February and March.

Month on month March import values dropped 21% but

year on year there was little change. Remarkably, there

was a slight rise in the value of first quarter flooring

imports compared to the first quarter 2019.

Of the four categories of flooring tracked, HS441875

made up almost 80% of all wood flooring imports and of

the China shipped 57% with another 21% arriving from

Malaysia.

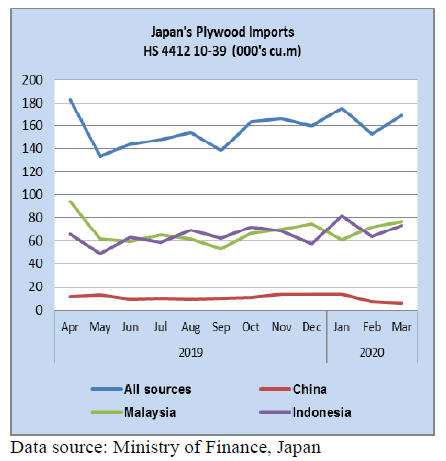

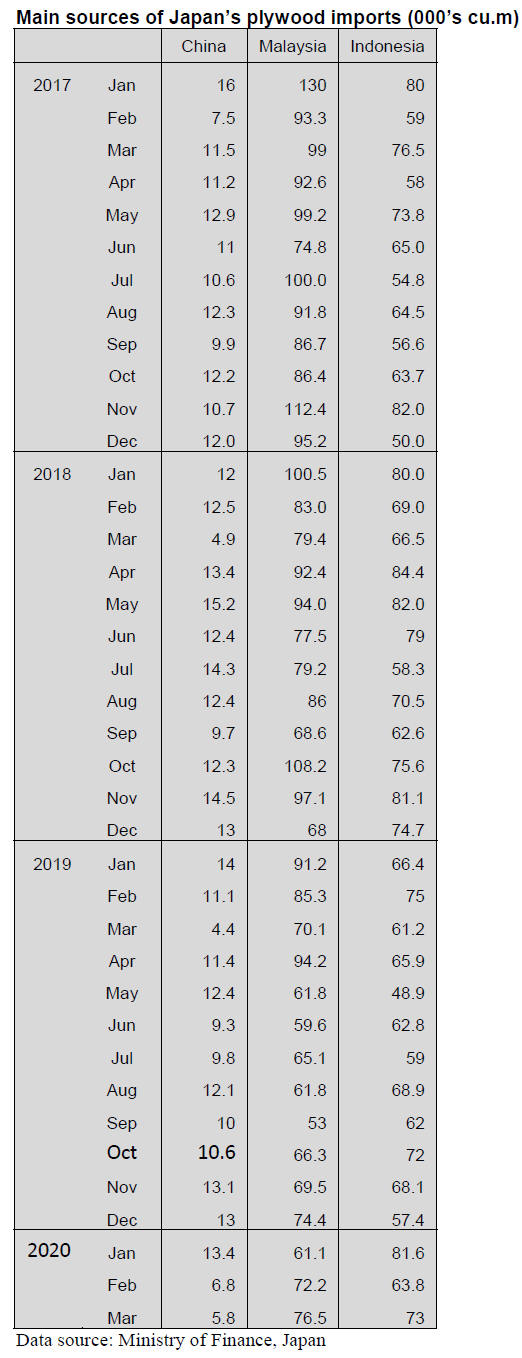

Plywood imports

Year on year the volume of Japan¡¯s March 2020 imports

of plywood (HS441210-39) rose 21% and there was a 10%

month on month increase in import volumes.

Of the various categories of plywood being tracked

HS441231 accounted for over 90% of March imports.

Year on year, shipments from the main suppliers

Malaysia, Indonesia, China and Vietnam increased but the

month on month change was more variable. Month on

month shipments from China dropped while for all of the

other main suppliers there was an increase.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Increasing bankruptcies due to corona virus pandemic

Tokyo Research, credit standing investigating company,

disclosed on May 1 about bankruptcies related to corona

virus pandemic. It reports that total bankruptcies are 114.

By business categories, hotels and restaurants are the

hardest hit by dropped cash revenue as people stay at

home and many shops closed voluntarily. There are three

bankruptcies in wood related industry.

Number of bankruptcies was two in February, 23 in March

and soared to 84 in April so total exceeded 100 in 2020.

By the regions, Tokyo is the most with 26 then 11 in

Hokkaido. Hotels are 26, restaurants are 16 and apparel

related business is 10 by sudden stop of visitors from

overseas. These are all with liabilities of over 10 million

yen and there are many bankruptcies of privately owned

small business with smaller liabilities and the number will

increase month after month.

In wood business, one in Hokkaido is Kususe lumber,

whose liabilities are 140 million yen. In Tokyo, Pan

Living, disaster prevention plywood processor went

bankruptcy with total liabilities of 820 million yen.

In early May, there was a series of holidays, which is the

most busy season for hotels, restaurants and tourist visiting

places but this year, there was strong request by the

authorities to stay home to prevent infections of corona

virus and crowd decreased by 70-80% in the most bustling

part of town in the first week of May. Many shops and

stores immediately face shortage of cash flow without any

sales.

In wood related industry, sales of building materials would

drop for sure as many housing and building construction

works stopped so sharp drop of sales cause difficulty of

financing and there will be more bankruptcies in coming

months.

Japan¡¯s log export to China

In China, operational rate of sawmills were down to 20%

in late February because of corona virus pandemic but in

April it recovered to 70-80% while radiate pine log export

stopped by corona virus infections in New Zealand so

China looks for logs elsewhere and showed more interest

to Japanese cedar logs and April export log prices were

about 7,500 yen per cbm or US$118-120 C&F and there

are contracts through June.

However, future is uncertain since New Zealand restarts

log export after lockdown is partially cancelled and

economic activities are getting active.

Domestic demand has priority for log supply in New

Zealand so active log export to China may not start so

soon yet but China prefers radiate pine logs to Japanese

cedar so Japanese log export depends on New Zealand log

supply.

Also if Chinese export business dwindles, demand for

export crating lumber and pallet would decrease then

demand for Japanese cedar logs would decline.

Problem of overseas market is not all for future cedar log

supply. In Japan, low grade log demand for export

recovered but demand for higher grade A and B class logs

for lumber and plywood manufacturing continues slow. In

total harvest, A and B class logs take about over 50% so if

higher grade log prices drop, total harvest would decrease

as log suppliers lose money then low grade logs supply

decrease. In short, there are many uncertain factors in this

business.

Plywood

Movement of plywood is stagnating because of uncertain

future of the market after corona virus outbreak. Users are

limiting purchase volume at minimum.

In April, orders from precutting plants were normal so the

movement was rather firm but after the state of emergency

declaration on April 6, housing companies¡¯ activities

slowed down and orders for precutting are declining.

Plywood manufacturers have been curtailing the

production since last March to stop skidding of market

prices and hoped to increase the prices. Declining trend

stopped but price increase was impossible.

Softwood plywood inventory increased to nearly 30,000

cbms in February but it dropped down to 17,300 cbms so

the manufacturers feel confident of production curtailment

and they will maintain the same program or increase

degree of production cutback after June.

Demand for imported plywood is hard to read as large

construction companies stopped construction works in

early May temporarily but after the works restarted

schedule is difficult to judge. Management of workers is

difficult due to corona virus infections among workers.

Port inventories continue decreasing and it is time new

orders should be placed but with uncertain market future,

it is risky to commit high priced hardwood plywood.

Maruwa Forest exports logs to Vietnam

Maruwa Forest Group (Kochi prefecture) shipped out first

export of logs to Vietnam on April 29. This is sample

shipment with two 40¡¯containers. The ship will arrive at

Haiphong, Vietnam on May 23. Logs are 28 cbms of

cypress of 2 and 3 meters with top diameter of 28 cm or

larger and cedar of 4 meter with 40 cm or larger with 27

cbms.

Cypress is preferred species but cedar is sample

shipment.

Consignee is Vinafor, former government owned company

and manages 43,400 hectares of forestland with more than

10,000 employees. Maruwa will accept two Vietnamese

workers in fall this year to cover labor shortage.

2019 wood panel and plywood review

Total supply of wooden board including plywood in 2019

was 8,842, 226 cbms, 3.3% less than 2018. This is first

decline of less than nine million cbms after three years. In

this, domestic panel was 5,171,539 cbms, 2.1% more and

imported panel was 3,670,687 cbms,10% less so share of

domestic and imports was 58.5 vs 41.5%.

The largest reason of decline of imported panel is

decreases supply of South Sea hardwood plywood, which

was 13.3% or 383,000 cbms less than 2018. The demand

in Japan stagnated while plywood producers in South East

Asian countries suffered high cost of logs and

manufacturing cost so that the orders decreased. Log

supply has been dropping by environmental restrictions so

the supply is unlikely to increase.

The producers are trying to use planted species like

eucalyptus and falcate to cover shortage of hardwood logs.

Supply of imported wooden board in 2019 was almost flat

with 2018.

Particleboard increased by 8.0% but OSB decreased by

16.0% due to supply drop from Canada. Canadian volume

was 167,462 cbms, 20.3% less while German¡¯ supply was

up by 51.1% with 38,523 cbms.

MDF supply was almost flat. In imported MDF, New

Zealand was 305,508 cbms, 10.5% less while Malaysia

was 185,947 cbms, 5.6% more. Indonesia was 64,966

cbms, 72.7% more. Demand for thin MDF is active as

domestic floor manufacturers have been replacing

imported hardwood thin plywood as floor base to

combination of MDF and domestic plywood floor base.

Meantime, domestic plywood supply increased by 3.3%,

four straight years¡¯ increase. Share of domestic plywood is

over 55% now.

Two new plywood mills started in 2020 and log supply

was steady. The shipment of plywood was also firm and

the supply and demand were well balanced so that mills¡¯

inventories had kept tight. Actually since 2016, the

inventories had been less than 0.5 month every month so

the market prices stayed firm.

Domestic wooden board supply was almost flat with only

1.8% less. There were some fluctuations of demand and

supply but the market was steady.

|