Japan

Wood Products Prices

Dollar Exchange Rates of 10th

April

2020

Japan Yen 107.76

Reports From Japan

State of Emergency in Japan - government

announces

massive economic support

The state of emergency announced by the Japanese

government was widely welcomed by the private sector.

Hiroaki Nakanishi, chairman of the Japan Business

Federation, said this may avoid the collapse of the medical

system which had been likely if no measures to slow the

spread of the virus were introduced.

Nakanishi called on the government to ensure essential

services and important infrastructure continues to function.

The chairman of the Japan Association of Corporate

Executives also expressed support for the declaration of a

state of emergency saying that the country is "in a critical

situation where many lives could be at risk." Various

associations and business groups have urged the

government to provide financial support to citizens and

businesses.

On 7 April the government adopted its biggest-ever

emergency economic package worth 108 trillion yen

(US$990 billion), equivalent to about 20% of GDP. The

package includes cash handouts to businesses that have

been hit hard by the coronavirus pandemic.

The government has planned a two-phase economic

package to help workers and businesses survive the impact

of the corona virus in Japan. The first phase aims to

eliminate job losses and bankruptcies, the second phase of

the support package will try to drive a ¡°V-shaped¡±

recovery and include measures to stimulate consumer

spending and tourism as well as financial support for

regional economies.

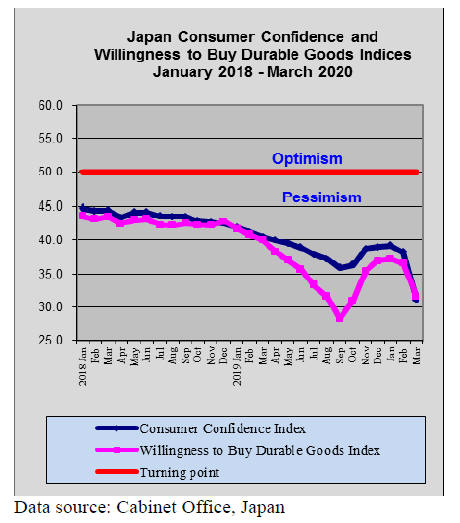

Consumer confidence at 11 year low

The March consumer confidence indices plunged to the

lowest level in 11 years as the reality of the spread of the

corona across Japan dawned on the public. Sentiment

among households dropped to the lowest since March

2009 when the Japanese economy and global economies

were battered by the global financial crisis. A reading

below 50 suggests pessimists outnumber optimists.

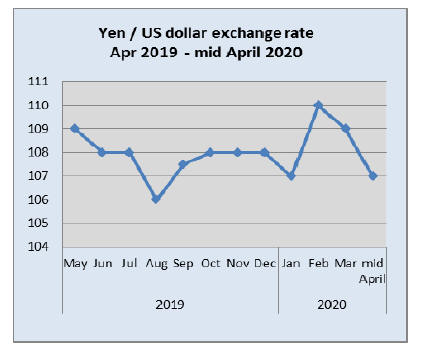

Yen volatility fades

The short term outlook for the US Dollar/Yen exchange

rate has become a little more predictable now that the

volatility over the past months has settle down. The recent

yen weakness against the dollar has been welcomed in

Japan where growth depends very much on exports.

From around yen 103 to the dollar at its strongest the yen

is now at around 107 to the US dollar, a level that was

seen pre-pandemic. Not surprisingly business sentiment

among large Japanese manufacturers turned sharply

negative in March, the first time in seven years, driven

down as they witness weak export demand.

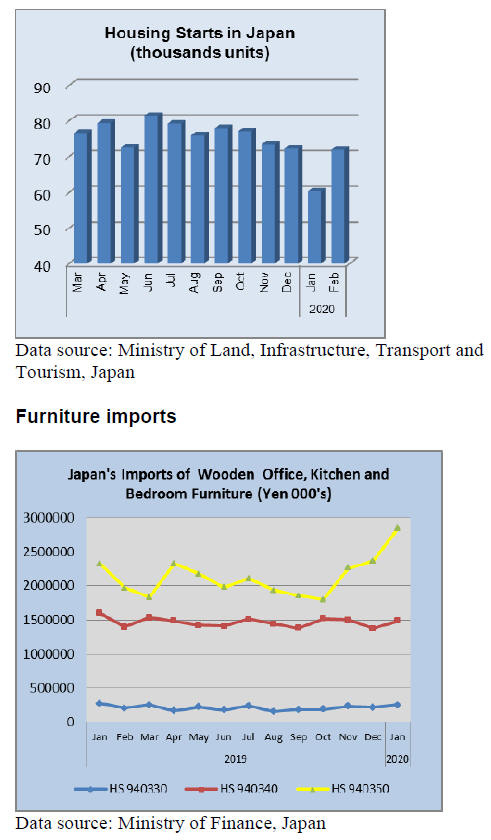

Construction activity slowed dramatically

On 8 April Japan began a month-long state of emergency

with strict measures proposed for Tokyo, as well as nearby

Kanagawa, Saitama and Chiba prefectures and Osaka,

Hyogo and Fukuoka, the worst hit prefectures.

The government has provided details of how the hardest

hit prefectures, should respond to slow the spread of the

virus. As of 14 April several other prefectures had gone

ahead and announced their own State of Emergency.

As a result of the measures introduced construction

activity in Japan has slowed dramatically.

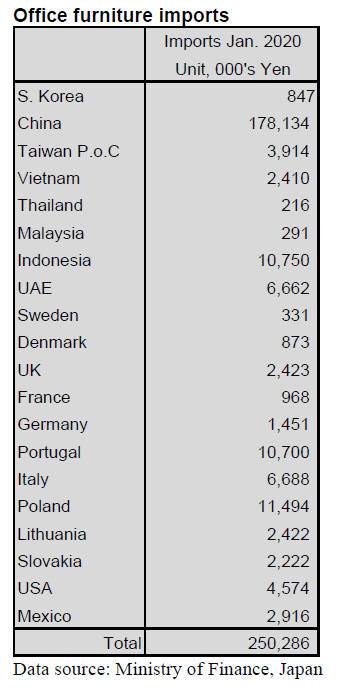

Office furniture imports (HS 940330)

Exporters in China, Poland and Portugal continue to

dominate Japan¡¯s imported wooden office furniture

(HS940330) sector. In January 2020 these three shippers

accounted for over 80% of the value of wooden office

furniture imports however, in January shippers in

Indonesia doubled their market share of imports to climb

to around the same value as imports from both Portugal

and Poland.

Year on year Japan¡¯s January 2020 imports of wooden

office furniture declined by 8% but there was a 15% rise in

January imports compared to the previous months.

Already in January some companies had been asking staff

to work from home as a result of the corona virus risk.

Office furniture retailers had already started to see a rise in

demand for home work stations and by the end of April

there was a strong demand even for second hand office

furniture especially from individuals rather than

enterprises.

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s January 2020 wooden kitchen

furniture imports, while being down 7% year on year, was

up around 8% from December.

Japanese house builders were affected by a slow-down of

exports of kitchen supplies from Chinese suppliers and

some builders faced delays in completing the interior

house fittings.

The Philippines and Vietnam accounted for over 70% of

Japan¡¯s imports of wooden kitchen furniture (HS940340)

in January with a further 14% of the value of imports

being shipped from China leaving little market share for

other shippers.

January 2020 shipments from Vietnam, the biggest

supplier in January were up 19% but the Philippines saw a

10% decline in shipments. Surprisingly there was a 36%

surge in shipments from China in January, most likely due

to fears that the corona virus could spread and disrupt

production and shipments.

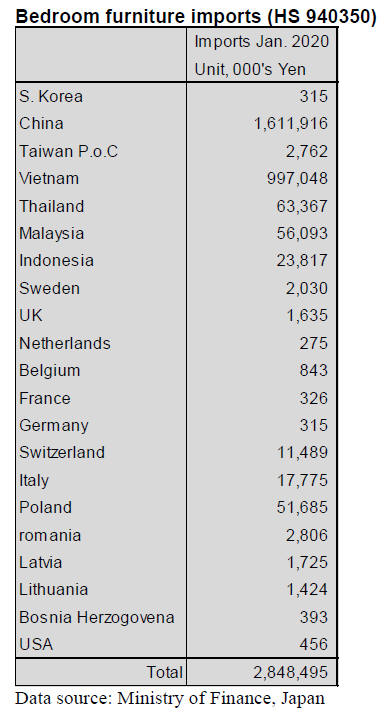

Bedroom furniture imports (HS 940350)

As was the case with kitchen furniture, Japan¡¯s imports of

wooden bedroom furniture in January 2020 from China

surged over 30% compared to the value of imports in

December 2019.

Shipments from China made up around 55% of the value

of Japan¡¯s January 2020 imports. The second largest

shipper was Vietnam (35%) with much of the balance

being supplied by manufacturers in SE Asia.

Year on year, the value of January 2020 imports of

wooden bedroom furniture were up 22% and month on

month there was a 20% increase.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Plywood mills¡¯ production curtailment

starting

Hayashi Plywood Industrial Co., Ltd. (Osaka)

manufactures softwood plywood at Maizuru and Nanao

plant. To deal with dropping sales, it has started reducing

the production by 10% since last month and March

production is down by 15%. With dropping orders from

precutting plants and large house builders, it plans to

curtail the production by 20% since April.

Demand for softwood plywood had been active until last

January then since February, the orders sharply declined.

At the same time, wide spread of corona virus infections

caused delay of delivery of new houses by shortage of

necessary appliances like toilet, wash basin and interior

finishing materials, which resulted in slowdown of

plywood orders.

The market prices of softwood structural panel in Osaka

market dropped down to 990-1,010 yen per sheet delivered

and lower offers like 970 yen are being made by dealers,

which need more sales before book closing in March.

Ishinomaki Plywood Co., Ltd. (Miyagi prefecture)

announced that it will reduce the production for March and

April by 15% after having experience of slowing orders

since late February by direct users of precutting plants

then corona virus epidemics makes future market foggy so

it decided to curtail the production sooner. The first

quarter is demand slow season so it is normal that the

market weakens but mills have kept running full to prepare

busy spring demand but this year is different.

South Sea (tropical) logs and lumber

Supply and demand of South Sea logs are well balanced in

Japan now but in PNG entry and exit of foreign visitors

are banned between middle of March and middle of April

although there is no corona virus infection in the country

so log inspection by foreign visitors is not possible now.

In Sarawak, Malaysia, stay-at-home order is issued

between March 18 and March 31(now extended) so the

operations stop.

Administration offices to issue harvest permit are also

closed. Weather is improving after rainy season is over but

local plywood mills have very little orders and activities

are limited by corona virus outbreak.

In China, corona virus disease seems to have peaked out

and red pine free board and LVL manufacturing plants in

Dalien have already restarted operation but some plants

have not enough workers back yet and transportation is

still stagnating so the supply has not fully recovered yet.

In Japan, the yen¡¯s exchange rate shot up to 102 yen per

dollar in early March and there are large orders at that time

but the volume is necessary for works after April and it

was not large speculative purchase.

Production curtailment by Meiken Lamwood

Meiken Lamwood Corporation (Okayama prefecture),

laminated lumber manufacturer, has started reducing the

production by 30%. Reasons are slowing demand of

laminated lumber and the largest reason is possible delay

of lamina supply.

It is not supply side reason but shipping reason. Loaded

containers come through hub ports like Hong Kong and

Shanghai for transshipment but functions of such hub

ports are largely reduced by wide spread of corona virus

infections in China and empty containers are short by port

congestion in these ports so European suppliers are not

able to load lamina into containers.

It is hard to predict how soon port congestion would be

over so Meiken is trying to economize use of lamina.

Meiken produces about 11,000 cbms of laminated post and

20,000 cbms of redwood laminated beam a month at peak

time but now production of post is about 8,000 cbms and

of beam is about 13,000 cbms.

It will continue curtailed program until lamina supply is

fully secured. Meiken says the orders are dropping since

last January so reduced production is enough to satisfy the

orders.

Disrupted supply from China resuming

Since outbreak of corona virus infections in China, various

supplies of house appliances stopped since February and

house builders in Japan are unable to complete and deliver

newly built houses.

Mainly shortage is house appliances like toilet dishwasher

and kitchen parts. These are furnished after 80% of house

construction completed. There are mounting order balance

and it is said that normal condition will not be until June.

Order balance of toilet is said to be much more than

10,000 pieces. When people get panicky, there is always

speculative orders and some dealers carry seven times

more orders than normal time. Chinese manufacturing

plants are getting back to the operation gradually.

Import of European softwood lumber in 2019

Total import of European softwood lumber import in 2019

was 2,563,961 cbms, 0.1% less than 2018. The volume

was less than 2,600,000 cbms for two straight years.

The prices of KD stud, lamina and genban were weak. In

particular, KD stud prices dropped much after the

inventories swelled up in Japan since middle of the year.

Lamina prices were affected by weak Euro prices of

finished products of post and beam with cautious purchase

by the users in Japan. The volume of planed products like

KD stud was 972,067 cbms, 13.2% more than 2018 but

others like lamina and genban were 1,591,429 cbms, 6.7%

less.

Export prices of whitewood KD stud maintained history

high level of about Euro 360 per cbm C&F by busy orders,

which stimulated supply for Japan but the market in Japan

started stagnating, resulted in heavy inventory.

The supply side started reducing the supply since middle

of the year and major supplier skipped September

shipment to restore the market but it was not uniform

move by the suppliers so that the monthly supply exceeded

monthly supply of the same month of 2018 for the first

three quarters and the supply finally started dropping in

the fourth quarter but it was not dramatic supply

curtailment.

Export prices of lamina and genban stayed low despite

rising log cost in supply regions because lamina and

genban users in Japan held the purchase by minimum as

the future market is hard to forecast in depressed market.

The export prices of whitewood and redwood lamina were

Euro 230-240 per cbm C&F and of genban were about

Euro 260. Supply side struggled to secure the profit with

these prices.

Bearish mood stopped after lamina prices are up for the

first quarter 2020 as orders are getting active after lamina

inventories by laminated lumber manufacturers are down.

Japan¡¯ log and lumber export in 2019

Total value of exported logs in 2019 was 34.614 billion

yen, 1.3% less than 2018. This is the first decline in seven

years since 2012.

Log volume increased to China, the main market but

lumber volume stayed flat. China took 947 M cbms of

logs, 2.2% more than 2018 and 64 M cbms of lumber,

0.1% more. Japan relies on China as to log export market

since China¡¯s share of log export is 83.6%. Volume for

other markets like Taiwan, Philippines and Korea all

declined although total increased slightly.

Total log volume exported was 1,133,259 cbms, 0.3% less

than 2018 and lumber was 147,153 cbms, 0.8% more.

By species, for China, 87.9% is cedar and 10.1% is

cypress. The value for China was flat for total year of

2019 but in the second half, monthly amount declined as

China bought sizable volume of beetle damaged logs from

Europe. China market in 2020 is suffering impact of

corona virus epidemic and total economy will definitely

stagnate so log export volume from Japan would be down

considerably.

For Korea, the value dropped by 9.8% but lumber export

value increased by 17.6% with the volume of 10,590

cbms, 26.5% more so trend is shifting from logs to lumber.

For Taiwan P.o.C. total export value dropped by 7.1%.

Log volume was down but lumber increased with value of

409 million yen, 13.0% more so same as Korea.

Lumber export for the U.S. market rapidly grew during

2016 to 2018 but the pace is slowing now. The volume

2019 was 24,332 cbms, 7.2% more than 2018. Majority is

cedar lumber for exterior use like decking and fencing.

The volume is expected to keep increasing.

North American log import in 2019

Total imported volume of North American logs in 2019

was 2,431,433 cbms, 4.8% less than 2018. This is three

straight years¡¯ decline. Toa, the second largest Douglas fir

lumber manufacturing mill, which consumed about

400,000 cbms of logs a year, withdrew from the business

in late 2018 so total decrease was expected from the

beginning but other mills tried to cover up short fall of

Toa¡¯s supply so total decrease of logs was only about

120,000 cbms. Busy production of plywood mills

contributed more consumption of North American logs.

By source, supply from the U.S.A. was 1,537,006 cbms,

6.5% less and from Canada was 894,427 cbms, 1.6% less.

Total Douglas fir was 2,202854 cbms, 6.5% less. Douglas

fir lumber is facing severe competition with European

laminated beam lumber so the suppliers agreed to reduce

log.

Hemlock log supply was 132,051 cbms, 7.0% less. Other

species like spruce, yellow cedar and red cedar all

increased but absolute volume is small.

For 2020, Canadian supply would decrease because

Mosaic Forest, the largest log supplier, stopped log harvest

since last November.

|