2.

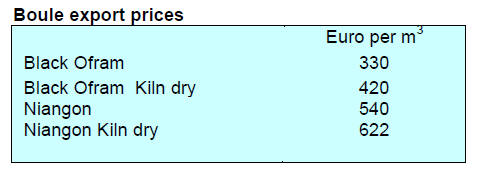

GHANA

Government urged to implement policies to support domestic

manufacturers

The Association of Ghana Industries (AGI) has called on government to adopt

policies more favourable to the manufacturing sector so the sector can

contribute more to the ‘Ghana Beyond Aid’ agenda.

This was disclosed by the President of the AGI, Dr. Yaw Adu Gyamfi, at a

conference on the theme ‘Attaining Ghana Beyond Aid: Prospects and

Challenges’.

Contributing to the discussions on the transformation of the manufacturing

sector, Dr. Adu Gyamfi urged government to revisit and review some of the

policies in the 2011 Ghana Industrial Policy to promote industrial

transformation.

He noted that the ‘Ghana Beyond Aid’ agenda can be achieved if the

government’s One-District-One-Factory (1D1F) flagship programme engages and

focuses more on the promotion of the local manufacturing sector rather than

the current focus on attracting foreign companies.

See:

https://agighana.org/news_details.php?nw=172

Communication tool to promote wood products

Timber enterprises have designed a new communication/promotional tool

“Message House” aimed at increasing the awareness of buyers, especially

those in the EU, of Ghana’s capacity to deliver a range of wood products.

This initiative comes at a time when Ghana is at the final stages of

satisfying all conditions of the Voluntary Partnership Agreement (VPA) with

the EU. The ‘Message House’ initiative will build on Ghana’s commitment to

export verified legal and FLEGT certified wood products.

The Kumasi Wood Cluster (KWC) and the Ghana Timber Millers Organization

(GTMO), with the support of the FAO-EU FLEGT Programme, have begun a project

‘Development of private sector-focused messages for Ghana’s FLEGT license

communication strategy’.

See:

https://www.gbafrica.net/the-timber-sector-in-ghana-discovers-communication-strategies-to-seize-eu-opportunities/

World Bank financial agreement includes forestry sector

Ghana has recently signed four agreements with the World Bank worth over

US$500 million to be used to help transform Ghana’s economy. Included in the

planned investments is an element to reduce forest losses and degradation.

At the agreement signing ceremony Pierre Laporte, the World Bank’s Ghana

Director, commended Ghana for its longstanding and strong partnership with

World Bank. In responding, Finance Minister Ofori-Atta, emphasised the

government’s focus on reforms would reposition the private sector as engines

of growth.

See:

https://www.mofep.gov.gh/news-and-events/2020-01-21/government-and-world-bank-group-sign-financial-agreement-for-four-projects

3.

MALAYSIA

Mood of pessimism among the timber

exporters

The talk in the timber industry, indeed in most of the industrial sector is

on the coronavirus and how it will affect business.

Trade analysts in Malaysia report a mood of pessimism among the timber

exporters with some anticipating “very bad business” as the disruptions from

the latest coronavirus outbreak are weakening an already disrupted global

market.

Prior to the coronavirus outbreak becoming an epidemic, the Federation of

Malaysian Manufacturers (FMM) urged the government to bring forward its

planned stimulus packages to address the risks Malaysia faces from the

US-China trade dispute.

The measures proposed to diversify Malaysian exports include intensifying

the buy ‘Made-in-Malaysia’ campaign, concluding the Regional Comprehensive

Partnership Agreement (RCEP) and implementation of free trade agreements

such as the Comprehensive and Progressive Agreement for Trans Pacific

Partnership (CPTPP). The FMM called for a further range of measures to

protect Malaysian exporters and manufacturers.

China has been Malaysia’s largest trading partner for a decade and trade

reached over RM300 bil. last year. This trade is now at risk according to

the president of FMM as China’s imports are set to be considerably lower

especially in the first half of this year.

Read more at

https://www.theedgemarkets.com/article/fmm-calls-expeditious-antivirus-shot-putrajaya

Legal status of forest community established

At the Sabah State Assembly sitting in November last year, the Assembly

passed amendments to the Forest Law (Constitution of Forest Reserves and

Amendments 1984) which came into force in December 2019.

The amendment in 2019 was to de-gazette 1,637 ha. of forest reserves and

gazette 2,154 ha. as new permanent forest reserves.

The state government wanted to de-gazette the 1,637 ha. of forests reserve

because of long-established human settlements there. The area classification

has changed from the ‘forest reserves category’ and will be re-gazetted

under the Land Ordinance for the purpose of kampung (or village) reserves.

These areas involve at least 90 settlements with about 3,800 houses and

20,000 residents.

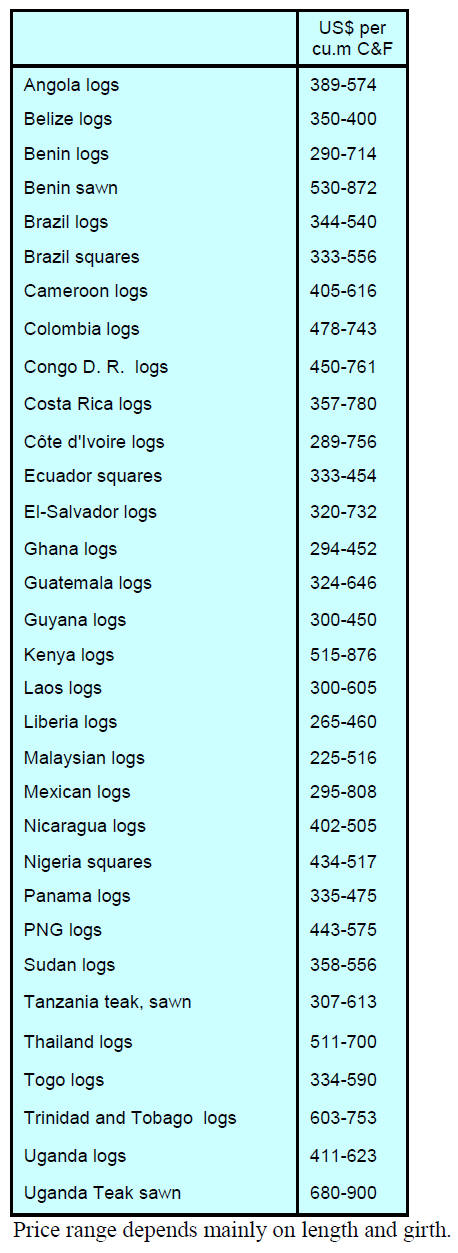

Sarawak 2019 log exports

The latest data shows that the volume of logs exported in 2019 was 1,290,133

cu.m, worth RM722,216,788. The species which contributed the most value was

meranti at RM299,751,936 (402,971 cu.m). By comparison, the total volume of

logs exported in 2018 was 1,418, 742 cu.m, worth RM 773,448,482.

In 2019 the second most valuable timber was acacia mangium at RM123,709,614

(558,504 cu.m) and the third was kapur at RM83,906,280 (79,129 cu.m). Other

export species were selangan batu RM83,598,818 (56,740 cu.m), MLH (Mixed

Light Hardwoods) RM51,993,533 (96,140 cu.m) followed by keruing RM40,858,543

(47,592 cu.m).

MIFF 2020 to be held as planned

The organiser of the Malaysian International Furniture Fair has issued a

statement saying MIFF 2020 will be held as scheduled from March 6 to 9,

2020.

The organiser, Informa Markets, will implement precautionary hygiene

measures at the two show venues, the Malaysia International Trade and

Exhibition Centre (MITEC) and Putra World Trade Centre (PWTC) and will work

to support the nation-wide preventive action taken by the Malaysian

Government.

Medical personnel will be on standby at the two venues throughout the show

for health screening.

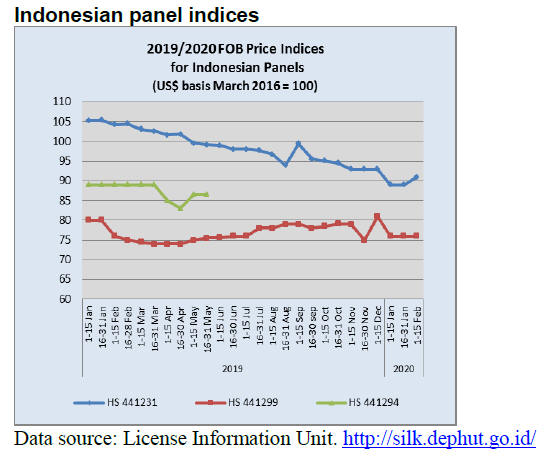

4.

INDONESIA

Overburdening regulations blamed for

fall in investment

The Indonesian Furniture and Crafts Industry Association (HIMKI) Secretary

General has said the decline in foreign investment in the wood processing

sector last year was largely because of the complexity of government

regulations.

The Association considers that the Omnibus Law can help increase investment

absorptions. The Indonesian Investment Coordinating Board reported that in

2019 domestic investment in the timber sector increased slightly but that

foreign investment dropped over 65% from US$276 million in 2018 to US$95

million in 2019.

HIMKI Secretary General, Abdul Sobur, said under the present conditions

Indonesia cannot compete with Vietnam in attracting foreign investment.

Sobur pointed out that the so-called Omnibus Law which has been drafted is a

step in the right direction in efforts to attract investors.

See:

https://ekonomi.bisnis.com/read/20200130/257/1195527/regulasi-rumit-sebabkan-investasi-mebel-turun

Indonesian returns to Internationale Möbelmesse

Indonesian furniture products returned to the European international

exhibition, Internationale Möbelmesse (IMM) 2020, one of the largest

exhibitions for furniture makers and designers.

Eight Indonesian furniture companies joined the Indonesian Pavilion and

achieved positive reviews and attracted significant orders. Indonesia missed

the previous IMM and Risnawaty, the Head of the Indonesian Trade Promotion

Center in Hamburg said the participation in this exhibition introduced the

uniqueness of Indonesian handicraft and furniture products.

The Director of National Export Development, Dody Edward, commented that,

while visitors to IMM come from around the world, Europe is still the main

market for Indonesian furniture.

Indonesia needs permanent solution to forest fires

In 2019 Indonesia lost almost 2 million hectares of its forests and peat

land to fires at a cost of over US$5 billion according to the World Bank.

Because most fires are the result of human activity the Indonesian President

has demanded a permanent solution be found to prevent these devastating

annual forest fires. It has been reported that more frequent patrols by

security personnel will be undertaken as well as expanded outreach

activities with communities.

Indonesian growth slipped in 2019

The Indonesian economy grew more slowly than expected last year and warnings

have been issued to expect a further slow-down because the tourism sector,

which attracts Chinese tourists, will be affected by the coronavirus

outbreak.

Indonesia’s economy grew just over 5% in 2019, down from the previous year

mainly because of a decline in exports and lower manufacturing output.

5.

Myanmar

Myanmar authorities ready to cooperate

with investigation in Holland

Police in the Netherlands have seized a shipment of what is said to be

Myanmar teak that was being transported from the Czech Republic. The police

followed up with raids of several locations in Holland.

When asked for comment, Barber Cho, Secretary of Myanmar Forest

Certification Committee ( MFCC) said that he was particularly upset about

the way this has been reported with headlines such as “Dutch police seize

allegedly illegal Myanmar teak”.

He said that readers will not pay due attention to “Allegedly” but will

focus the phrase “Illegal Myanmar Teak”.

Cho further said he welcomes a full investigation of this case and is

willing to offer assistance to the authorities in Holland, adding the

documents, which are provided for consignments leaving Yangon Port in

Myanmar can readily be traced to determine who and how this consignment was

shipped.

He pointed out that problems, such as the current one, could happen with any

consignment as the system in Myanmar for verification of legality is not

acceptable to EU authorities.

Under the EU Timber Regulation (EUTR) importing wood without acceptable

supporting documents showing a clear chain of custody, including the origin

of the timber are required this has been a persistent issue in the Myanmar

teak trade with the EU.

Cho reiterated that the documents with shipments provide information on the

shipper, the quantity in exact number of pieces and the cubic ton (CBT).

Myanmar applies only volumetric weight ton - known as Cubic Ton which is

equivalent to 50- Cubic Foot.). Shipping documents can readily be checked

against relevant documents issued by Forest Department.

Cho pointed out that, provided importers in EU keep track of the documents

and carefully record any transfer of goods, the EU authorities can check

whether the products are exported in accordance with the existing

regulations in Myanmar.

But, even if inspection takes place at the first ‘Point of Entry’ in EU the

documents provided by Myanmar exporters and the relevant Myanmar authorities

still do not overcome the issue of Myanmar’s legality verification system

being unacceptable to the EU. Under these circumstances any shipment can be

controversial.

Cho further explained that MFCC website has information on legality

certificates issued by the independent Certification Body and any EU

Competent Authority and anyone can communicate with the Certification Body

in Myanmar or the MFCC.

Details of legality certificates issued to-date can be viewed at:

www.mfcc.org.mm. However, at this initial stage of introducing the

certification system not many certificates have been issued and therefore

consignments are shipped with all supporting documents.

The MFCC is to review and revise the current MTLAS aiming to close the gaps

which are already identified and to further strengthen MTLAS to comply with

the EUTR. MTLAS and the independent certification bodies in Myanmar were

established specifically to meet the requirements of the EU and would

welcome further cooperation with the EU in order to satisfy the EUTR

requirements.

For the moment, MTLAS Certificate is voluntary and it is up to the exporters

to apply MTLAS certificates.

Cho has said he looks forward to seeing a detailed investigation of the

current case in the Netherlands and hopes the results will be widely

publicised so the lessons can be learned.

Legality – as seen from Europe

The issue of verifying the legality of timber exports from Myanmar from an

EU perspective is discussed on page 20 .

Here the correspondent reports, “At their December meeting, the EU Expert

Group on EUTR and FLEGT, comprising representatives of the EC and government

authorities from across the EU, reiterated their view that it is not

possible to demonstrate a negligible risk that any timber from Myanmar is

legally harvested in line with EUTR definitions”. According to the Expert

Group this is due to a “lack of sufficient access to the applicable

legislation and documentation from governmental sources”.

6. INDIA

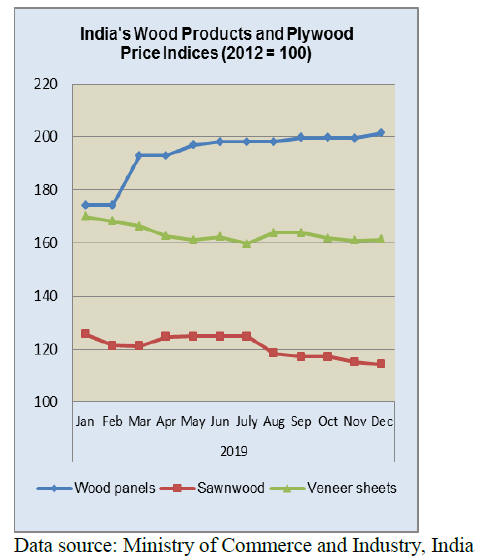

Lower prices for sawnwood and veneer

push down price indices

The official Wholesale Price Index for ‘All Commodities’ (Base: 2011-12=100)

for December 2019 rose slightly to 122.8 from 122.3 from the previous month.

The index for the group 'Manufactures of Wood and of Products of Wood and

Cork' declined further to 133.1 from 133.3 for the previous month mainly

due, once again, to lower prices for sawnwood.

The annual rate of inflation based on monthly WPI in December 2019 stood at

2.59% compared to 3.46% in December 2018.

The press release from the Ministry of Commerce and Industry can be found

at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Bihar government to expand raw material

sources for timber industries

The Bihar Government has instructed officials to prepare plans to expand the

forest cover so as to promote expansion of the local veneer and plywood

processing sector. This plan, it is understood, will include suggestions to

strengthen the investment promotion policy developed in 2016.

The Bihar Industries Association president, Sanjay Goenka, was asked to seek

suggestions from the wood processing sector on how to attract investment.

Goenka suggested the creation of large scale plantations of poplar and semal

(Ceiba) which are suited for small scale wood lots that can generate income

for farmers and can be the raw material for industries.

Association members called on the local government to use locally

manufactured wood products for government construction projects.

Furniture sector to be protected by import duties

The Indian Finance Ministry is considering raising the import duty on

furniture to shield domestic companies from the fierce competition from

imports.

Finance Minister, Nirmala Sitaraman, has called for protection to be offered

to furniture SMEs as they are labour intensive and competition from imports

could impact employment security in the sector.

She said cheap and low quality imports will slow development of the domestic

furniture sector. The plywood and wood panel industry has welcomed the

Minister‘s comments.

Furniture imports have increased since India signed various Free Trade

Agreements but these agreements are undermining the local industries, said

the Minister.

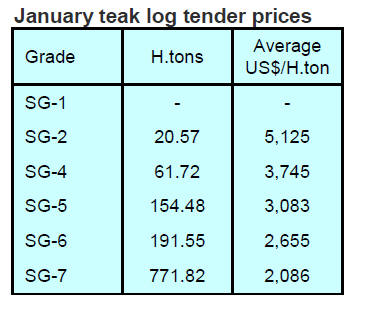

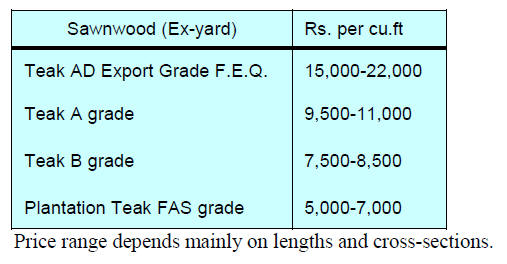

Plantation teak prices

Prices for plantation teak remain steady and the recent budget that is

focused on lifting consumption could benefit teak importers.

However, the possible impact of the current coronavirus outbreak has

everyone on edge even though it is difficult to foresee how this will impact

either supply or demand. It may well be that increased uncertainty alone is

enough to impact demand.

Since the beginning of February the rupee has weakened slightly and is

trading between Rs.71 and Rs.72 to the US dollar.

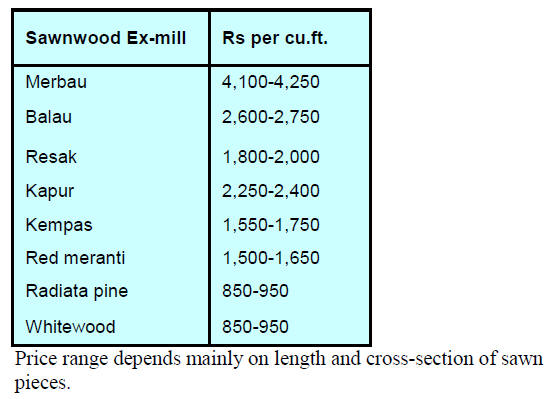

Locally sawn hardwood prices

Prices remain as reported at the end of January.

Myanmar teak prices

The Central Government has released the 2020 budget and this has elements

that support the housing sector. There are also specific advantages for low

and middle income home buyers who have not yet been attracted to purchase

the affordable homes that are available.

Myanmar teak is primarily used in top end housing developments and as such

consumption is little affected by either exchange rates or interest rates.

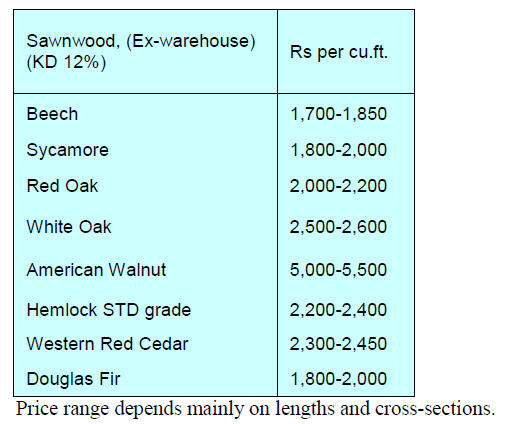

Sawn hardwood prices

Analysts report that there appears to be a strengthening of demand for

imported US timbers but that this has not filtered down to impact prices. US

hardwood exporters are keen to develop the Indian market to diversify away

from dependence on the Chinese market.

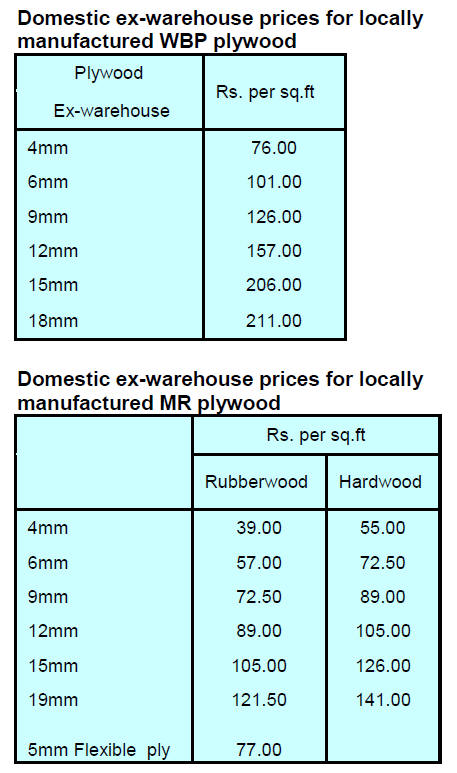

Plywood

Plywood prices remain as reported at the end of January. Analysts report

that manufacturers have benefitted from competition between veneer shippers

so profit levels have stabilised.

7.

VIETNAM

Exports set to plunge

Nguyen Bich Lam, Director General of the Statistics Office has estimated

that Vietnam’s first quarter 2020 exports could be down around 20% from the

same period last year as trade will be disrupted by the coronavirus

epidemic.

The decline in exports is expected to affect a range of exports including

agricultural and forestry products, aquatic products, textiles and garment,

footwear and electronics. Exports to China are likely to be severely

affected he said. In January foreign trade was down almost 13% and exports

dropped almost 16% year on year.

In response measures to support exports as a result of the suspension of

cross-border trade with China are being considered. The Director General of

the Foreign Trade Agency in the Ministry of Industry said Vietnam could see

a loss of around US$200-300 million in export revenue from declines in

agricultural, forestry and fisheries exports.

This could rise to US$600-800 million if the outbreak lasts half a year.

See:

https://en.vietnamplus.vn/vietnams-exports-forecast-to-plunge-in-q1/168202.vnp

According to VIFORES, there are currently 867 foreign enterprises in the

wood processing sector in Vietnam of which 161 are Chinese companies

processing and exporting wood products from Vietnam.

Around 20% of these companies are in the services and distribution isectors.

Due to current coronavirus outbreak Chinese businessmen and workers are not

permitted to enter Vietnam and this is seriously affecting business

operations of the Chinese enterprises as well as domestic companies

providing services.

Because of the coronavirus many timber sector events such as VIFA Expo, VIFA

GU and the Hanoi Wood 2020 scheduled for the first half of 2020 have to be

postponed.

Local authorities urged to plant

At the end of 2019 the total forest area with national sustainable forest

management certificates reached 269,163 ha. across 24 provinces according to

the Director general of the Forestry Department.

He added that over the past year around 240,000 ha. of new plantations were

established. To achieve the goal of 220,000 hectares of planted forests in

2020 the forestry sector has instructed local authorities to promote

planting to increase the availability of raw material for the production of

added value wood products for domestic consumption and export.

See:

https://en.nhandan.org.vn/business/item/8388302-measures-to-promote-sustainable-forest-development.html

Better business environment to raise competitiveness

The Government has issued a new Resolution (No. 02/NQ-CP2020) which seeks to

improve the business environment so as to raise national competitiveness so

that Vietnam’s businesses can compete more effectively in international

markets.

This Resolution requires ministries and agencies to publish the revised and

simplified administrative procedures related to the issuance of business

certificates.

The Resolution also assigns Chairpersons of provincial People's Committees

to oversee implementation of the regulations and strictly regulate officials

and civil servants.

See:

https://en.nhandan.org.vn/business/item/8392002-new-measure-for-business-environment.html

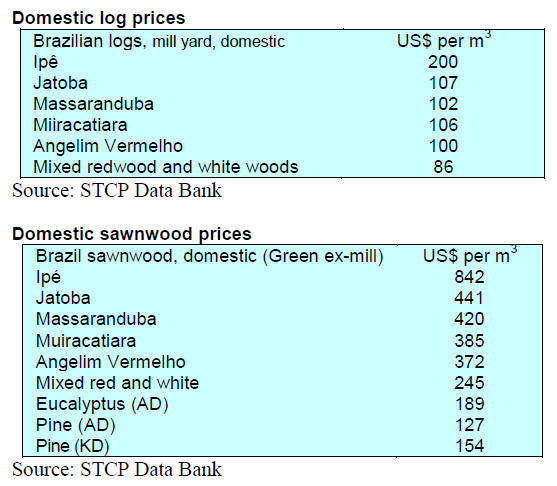

8. BRAZIL

ABIMCI Sectoral Study-2019

2019 was a good year for the Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI). The Association started a dialogue with the new

Federal government and also launched its new Sectoral Study presenting the

current situation in the timber sector and business opportunities in the

domestic market.

The study shows that, although the sector faced subdued domestic demand, the

sector has made some advances as the government has worked to improve the

business climate through measures that encourage economic growth and

consumption.

These measures include reducing bureaucracy; revision of NRs (Regulatory

Standards for Safety and Health at Work); simplification of “e-Social”

(Digital Bookkeeping System for Tax, Social Security and Labor Obligations)

and simplification of “Block K” (Digital Tax Bookkeeping of ICMS and IPI).

These measures, along with the increase in entrepreneurs and consumers’

confidence, pave the way for a more prosperous year ahead with greater

business opportunities for the entire timber sector. For 2020, expectations

are promising. The Association has pledged to continue to assess the needs

of member companies and defend the interests of the timber sector in Brazil.

Use of drones for mapping and scaling

The use of drones in forestry is a trend in the sector's automation process

and this strengthens forest planning as access to remote areas has been made

possible according to Embrapa (Brazilian Agricultural Research Corporation).

For example, mapping forests manually is time-consuming and costly but

aerial images taken by drones saves time and money. Tests have been

conducted on using drones to assess volumes of stacked wood according to

Embrapa.

According to a study, in order to measure piled wood in the forest, a drone

flies over the stacked wood and captures images that make it possible to

obtain volume estimates. This methodology was tested on a 1,000 cu.m of

roundwood in Rio Branco municipality in Acre State.

The tests carried out in the National Forest of Jamari (RO), in partnership

with the Brazilian Forest Service (SFB), proved the efficiency of the drone

methodology using drone in log scaling.

See:

https://blogs.canalrural.com.br/florestasa/2020/01/28/uso-de-drones-otimiza-atividades-florestais/

Growth in domestic furniture demand

The November/December 2019 report ‘International Trade of the Furniture

Sector in Brazil’, published by IEMI (Market Intelligence Institute), shows

that furniture production in Rio Grande do Sul State grew 1.7% compared with

the same period of the previous year.

This growth was at a faster rate than registered in the national furniture

industry.

The report also shows exports declined in December by 18% to US$ 15.6

million. The three Southern States of Santa Catarina, Rio Grande do Sul and

Paraná accounted for 85% of the total value of furniture exported in the

period. A further 11% was shipped from Săo Paulo State.

The top furniture markets for exporters in Rio Grande do Sul state were

Uruguay (17.5%), the United States (16%) and the United Kingdom (14%). A

sharp increase in exports to Mexico was recorded.

Brexit and EU wood product quotas

This year ABIMCI started a dialogue with the Brazilian Ministry of Foreign

Affairs (MRE) to define the positioning of the sector due to changes in the

quota system for timber products exported by Brazil to the European Union

and the United Kingdom.

Because of Brexit the volumes and percentages in the existing quotas will be

reassessed and may undergo changes in each timber product segment.

The MRE requested ABIMCI’s participation in the quota negotiations as the

Association’s input will be useful for the Brazilian government to explain

the country's position. The Association considers it important to

participate in this process so that any changes that may be made for each

product are as close as possible to the trade practices relating to pricing

and legal concerns.

The expectation is that the changes will not happen in 2020. ABIMCI

anticipates that one of the Brazilian wood products that may have its quota

rearranged is pine plywood as the UK is one of the main markets for this

product.

9. PERU

8 million hectares of forest to be

allocated for investors

It has been reported that this year the Government plans to award around 8

million hectares of forests to private investors. The allocations will be

for logging concessions, ecotourism, conservation and for commercialising

ecosystem services.

This proposal was submitted by the National Forest and Wildlife Service (Serfor)

as a means to reduce persistent deforestation and combat illegal logging. It

is planned that allocations of logging concessions will begin in April and

will be based on the technical and financial capacity of the applicants

among other requirements.

In related news, to curb migratory agriculture which, it is said, is the

cause of most of the deforestation in Peru, and is practiced by some 125,000

families occupying over 1.3 million hectares Serfor needs government

approval for an investment programme with the German bank KfW, a German

state owned development bank based in Frankfurt.

"The German resources will allow the implementation of a range of projects

for communities creating conditions to attract private investment in for

example, the development of forest plantations according to Serfor.

San Martín the first in achieving forest zoning

The San Martín Region was the first to conclude the forest zoning exercise.

In San Martín it has been determined that 85% of the region’s territory has

the potential for development according to Serfor.

The authorities in San Martín region have delimited areas to be allocated

for the various functions such as conservation concessions, ecotourism,

exploitation of timber and non-timber products, wildlife, plantations as

well as agro-forestry and silvo-pastoral.

The forest zoning process has the financial support of the Norwegian

government in the framework of the Joint Declaration of Intent, a

results-based payment agreement signed by Peru, Norway and Germany.

For more see:

http://www.bosques.gob.pe/archivo/23-apoyo-dci-wwf-pncb-norad.pdf