Japan

Wood Products Prices

Dollar Exchange Rates of 10th

December

2019

Japan Yen 109.34

Reports From Japan

Dip in machinery orders signals economic

slowdown

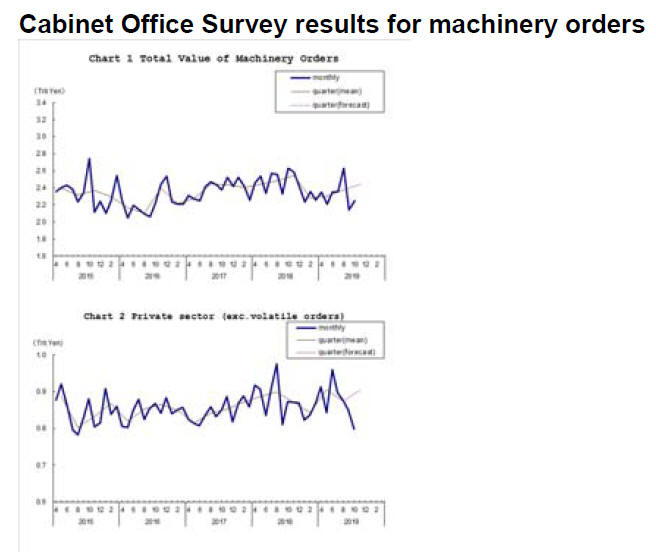

Signalling a likely slowdown in growth, orders for

machinery placed with Japanese companies fell in the final

quarter of the year according to Cabinet Office data.

Capital expenditure driven by orders for machinery has

been resilient until recently as companies at home and

abroad invested in new equipment and in automation by

Japanese companies because of the tightening labour

market, the result of a shrinking and rapidly aging

population.

Policymakers had been hoping business investment would

remain robust to off-set the dip in consumer spending as a

result of the sales tax hike in October. Private-sector

machinery orders, excluding those for ships and electric

power companies, declined by 6.0% in October.

See:

https://www.esri.cao.go.jp/en/stat/juchu/1910juchu-e.html

Massive economic stimulus package to support

growth

Japan¡¯s economy is highly sensitive to exports so the

US/China dispute and now the Japan/Korea trade dispute

are undermining export growth. To counter slowing

growth the government has put together a massive

stimulus package worth over yen 25 trillion yen (around

US$ 230 billion).

This is the first stimulus package in three years and is

focused on lifting consumer spending by promoting

"cashless sales". Public infrastructure will also be targeted.

Source:

https://www.esri.cao.go.jp/en/stat/di/di-e.html

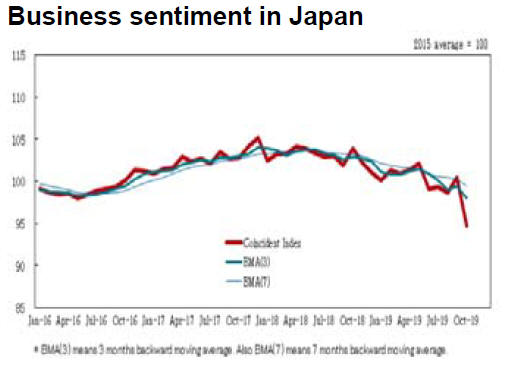

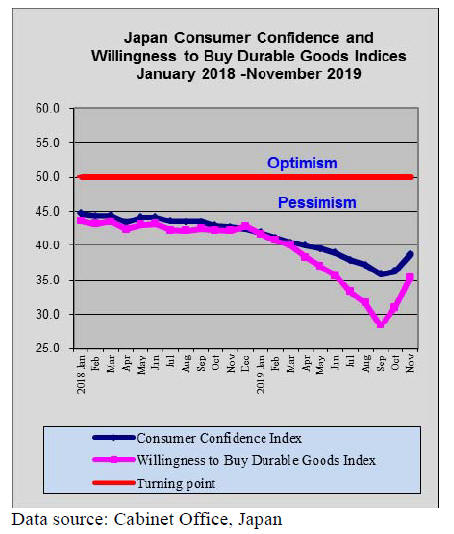

Consumer confidence continues upward momentum

November consumer confidence data from the Cabinet

Office showed a remarkable reversal, climbing to a five

month high.

The overall consumer confidence index rose and the index

reflecting household¡¯s inclination to buy durable consumer

goods also rose in November. In contrast the Tankan

survey conducted by the Bank of Japan showed Japanese

manufacturers had again turned pessimistic about business

prospects. Analysts put this down to the continuing

US/China trade dispute and weakening global demand.

Long period of yen stability could about to

be rocked

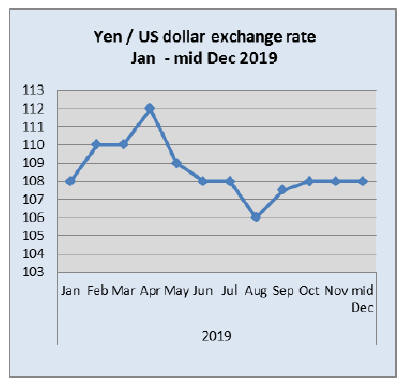

The US Federal Reserve has announced it is maintaining

its current monetary policy and this allowed the US

dollar/yen exchange rate to maintain the approximate US

dollar to 108 yen that has been in place for several weeks.

The yen is the third most commonly used currency in the

world, behind the US dollar and euro. While the Chinese

RMB is growing in importance its managed status and

lack of flexibility means the yen is still the preferable

Asian reserve currency.

Popularity of wooden housing drops

Interest in wooden housing among Japanese has been

steadily declining since 1989 according to a Cabinet

Office survey. The reasons cited by respondents to the

survey include high maintenance costs and vulnerability to

fire.

The share of respondents preferring to build or buy

wooden homes dropped to just over 73%, down from the

over 80% polled 30 years earlier. Homes made of

reinforced concrete and steel frames the main alternative

mentioned. The Japanese Forestry Agency has said ¡°We

need to promote the positive (environmental) aspects and

the safety of wooden housing,¡±

Apartment prices in Tokyo up 4.5%

The average price of existing condominiums in Tokyo

rose by 4.46% during the first three quarters of 2019 and

the average price of new apartments in Tokyo surged

almost 14% in the same period in contrast to the decline of

over 6% a year earlier.

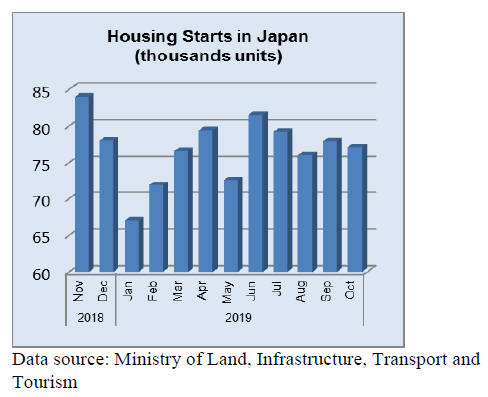

Import update

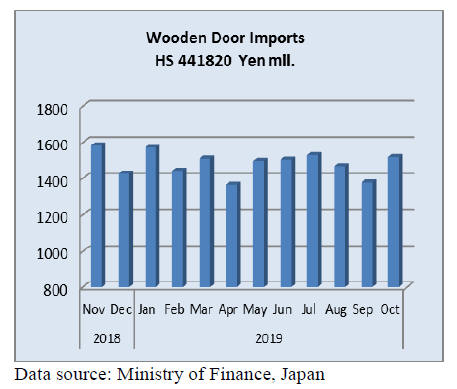

Wooden door imports

As has been the pattern in previous months, two shippers,

China and the Philippines, accounted for over 80% of

October imports of wooden doors (HS 441820). The other

significant shippers in October were Indonesia and

Malayasia. Of the non-Asian suppliers the US topped the

ranking.

The value of Japan¡¯s imports of wooden doors in October

was almost the same as in October a year earlier but there

was a 10% month on month increase in imports.

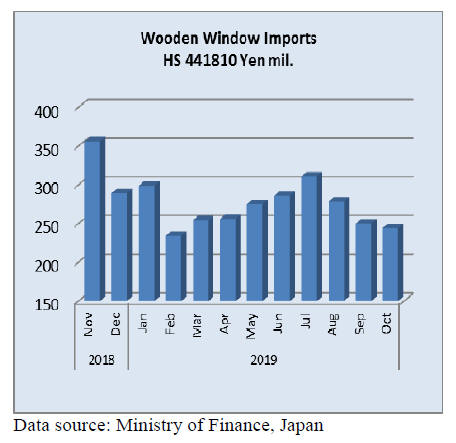

Wooden window imports

October marked the third consecutive decline in the value

of japan¡¯s wooden window (HS 441810) imports.

Year on year the value of wooden window imports was

unchanged but there was a 2% month on month decline.

The value of Japan¡¯s wooden window imports peaked in

July but from there steadily declined. There was a 22%

drop in the value of wooden window imports between July

and October.

Three suppliers accounted for over 90% of October

wooden window deliveries, China (53%) the Philippines

(20%) and the US (18%).

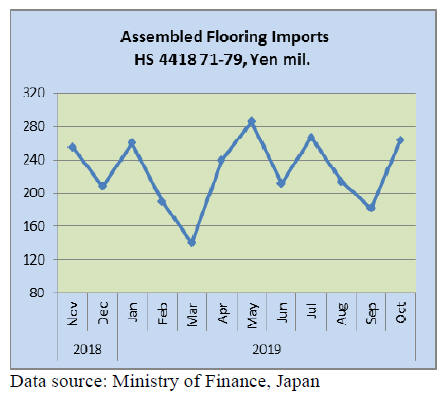

Assembled wooden flooring imports

The value of Japan¡¯s assembled wooden flooring imports

continued its ¡®see-sawing¡¯ between peaks and dips and the

sharp increase in October import values off-set the double

dip seen in August and September.

Year on year wooden flooring imports (HS441871-79) in

October rose 13% and month on month there was a 45%

increase in the value of imports.

As in previous months most of the October assembled

wooden flooring imports were of HS441875 and China

and the US were the main shippers followed by Malaysia

and Indonesia.

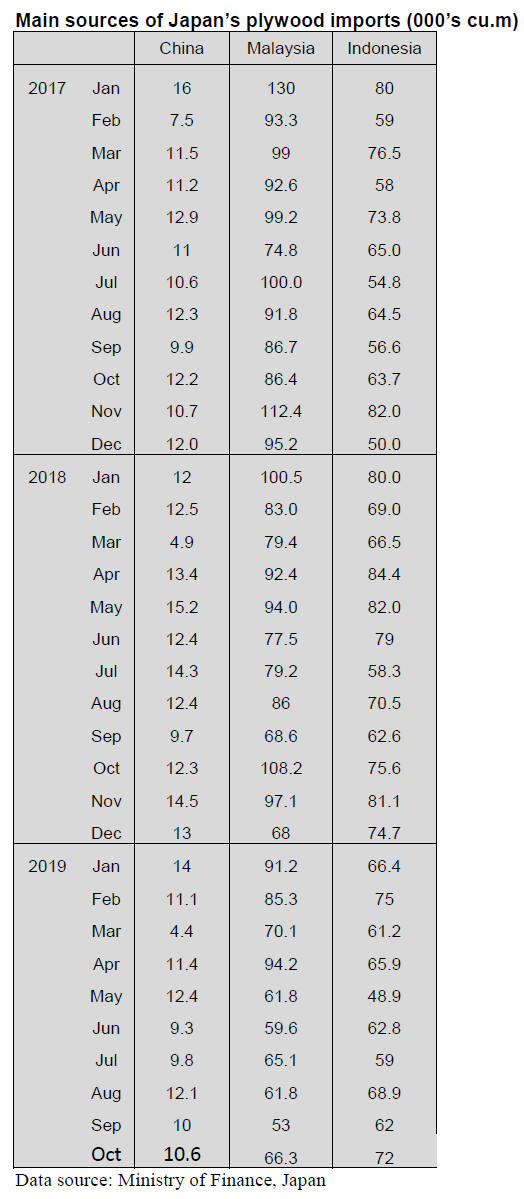

Plywood imports

Imports reported as HS 441231 dominated Japan¡¯s

October plywood imports accounting for almost half of all

import categories. Malaysia and Indonesia continue to be

the main suppliers accounting for around 80% of all

plywood imports by volume. The other significant supplier

is China.

Year on year, Japan¡¯s October 2019 plywood imports

dropped 25% but there was a rise (25%) in the volume of

imports in October 2019 compared to September levels.

October shipments from Malaysia dropped 39% year on

year in October and there was a year on year decline of

17% in the volume of imports from China.

Indonesia¡¯s October 2019 shipments were around the same

as in October 2018. Despite the sharp decline in imports

from a year earlier both Malaysia and Indonesia saw

plywood shipments rise in October.

National Conference to Advance the Use of

Wood

The Japan Lumber Journal has reported on the inaugural

meeting of National Conference to Advance the Use of

Wood held in early November. The aim of the group is to

revitalise rural areas through encouraging greater domestic

wood use which will stimulate harvesting and replanting.

Through seminars and information and activities

highlighting the environment benefits it is hoped that

greater use will be made of domestic resources. The gropu

also aims to promote the values of wood use for the

environment and society and promote productivity

improvement and spread of new technologies in the

forestry sector.

See:

https://jlj-news-english.jimdofree.com/

|