Japan

Wood Products Prices

Dollar Exchange Rates of 25th

November

2019

Japan Yen 107.87

Reports From Japan

Falling exports of concern ¨C government

economic

stimulus pack on its way

Ministry of Finance data shows Japan's October exports

fell almost 10% year on year. This follows the 7% drop in

September. The decline in exports to China and the US

was the main reason for the fall but all markets have been

showing weakness. To ward off the negative impact on the

economy the government plans to compile a stimulus

package.

Exports to China dropped 10% year on year in October,

down for the eighth consecutive month. Exports to Asia,

which account for more than half of Japan's exports, fell

11%, down for the 12th month and Japan's exports to the

US also dropped 11%.

The decline in exports and weak domestic demand has

driven down manufacturing activity for the seventh

consecutive and this has spurred the government to prop

up the economy which is growing at its slowest pace in

twelve months.

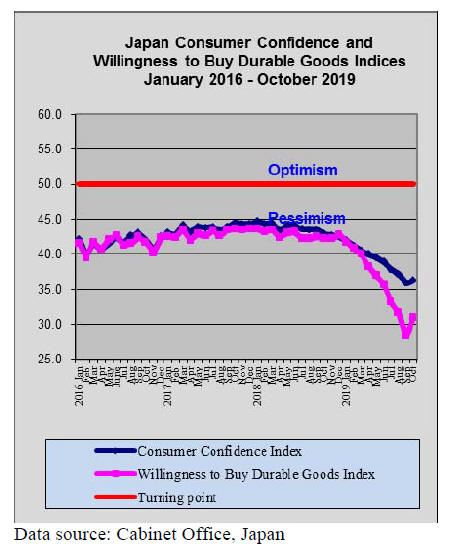

Domestic consumption is vital for economic growth but in

the long term Japan faces a big problem as low birthrates,

coupled with rising longevity, is creating what has been

termed a ¡°crumbling¡± population pyramid which will

shrink the labour force and lower consumption.

Analysts also point to the problem of the ¡°dependency

ratio¡± as there are around 68 dependents (people less

than15 or older than 64) for every 100 people of working

age (15-64) and this is getting progressively worse and

will undermine Japan¡¯s economic potential.

Parliament approves US trade deal

On 19 November the Japanese parliament approved the

trade deal negotiated with the US that will lower import

tariffs and set new quotas for US farm goods. Both sides

are hopeful of quick ratification so the deal can be

implemented.

Under the deal over 80% of the approximately US$15

billion worth of US exports to Japan will be tariff-free or

attract preferential treatment. The new deal is scheduled

for implementation in January 2020. This trade deal helps

restore market access for US exporters to levels they

would have enjoyed if the US joined the Trans-Pacific

Partnership.

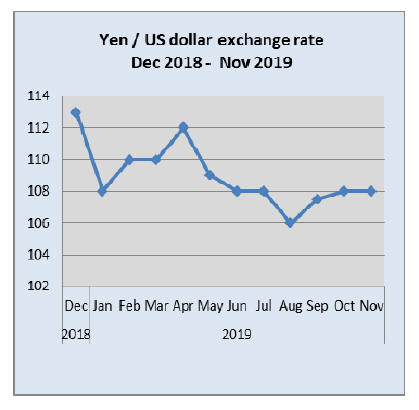

Yen exchange rate within narrow band all

year

One of the surprises this year has been very modest

strengthening of the yen in response to the US/China tariff

war and weak global trade. Usually in times such as now

the yen strengthens significantly as a safe haven currency.

This year the yen has traded against the dollar in a very

narrow range and has held at around 108 to the dollar for

months. Analysts put this down to the changing

composition in Japan¡¯s external assets.

See:

https://www.bloomberg.com/news/articles/2019-10-31/one-clueto-why-yen-bulls-are-struggling-lies-in-japan-m-a-boom

Over the past month there was growing optimism that a

deal between China and the US was close but it soon

became apparent that there is a long way to go. Until a

trade deal is struck the yen/dollar exchange rate will

respond because of the ¡®safe haven¡¯ mentality but other

factors are now in play which could minimise the

exchange rate volatility.

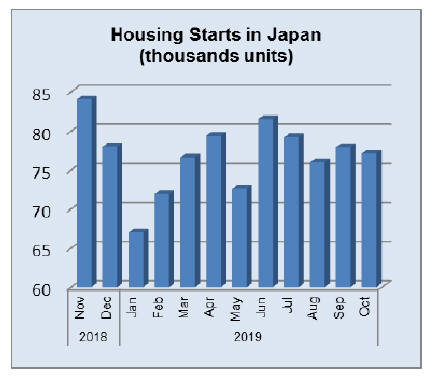

Housing starts flat in October

Ministry of Land, Infrastructure, Transport and Tourism

data showed that housing starts dropped 7% year-on-year

in October. This follows the almost 5% decline in

September. On an annualized basis, housing starts fell to

879,000 in October from 897,000 in September.

Import update

Furniture imports

In 2019 there were 94 trade shows in Japan, many of

which focused on furniture and household items.

Details of upcoming fairs can be found at:

https://www.tradefairdates.com/Furniture-Trade-Shows-Japan-FSL246-L112-S1.html

The most recent fair IFFT/Interior Lifestyle Living was

held in Tokyo in late November. This show welcomed

over 400 exhibitors with variety of products related to the

entire living space from furniture to tableware. The show

attracted a wide range of visitors including retailers,

hotels, restaurants, architectural designers and office

designers.

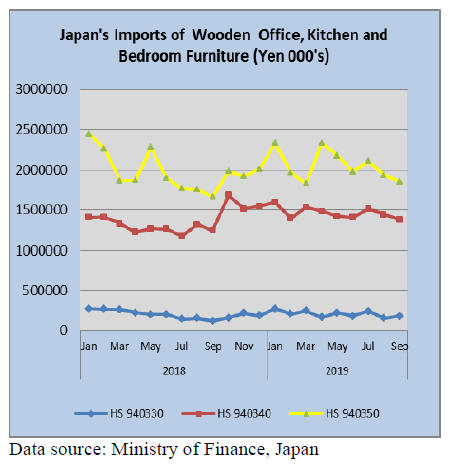

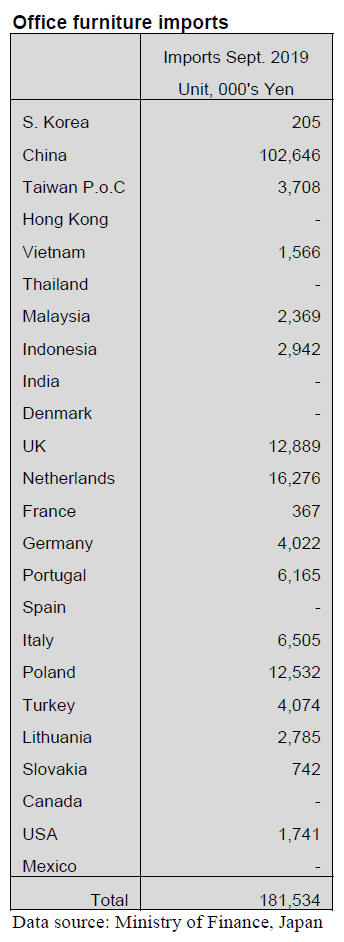

Office furniture imports (HS 940330)

Japan¡¯s September imports of wooden office furniture (HS

940330) reversed course once again rising 50% year on

year and by 16% month on month.

Shipments from China, while still accounting for the

highest level of imports of wooden office furniture,

dropped sharply in September but still accounted for

almost 60% of all HS 940330 imports.

The Netherlands emerged as the second largest shipper in

September capturing a 9% market share in Japan. Two

other shippers, the UK and Poland were in the top rank of

suppliers in terms of value.

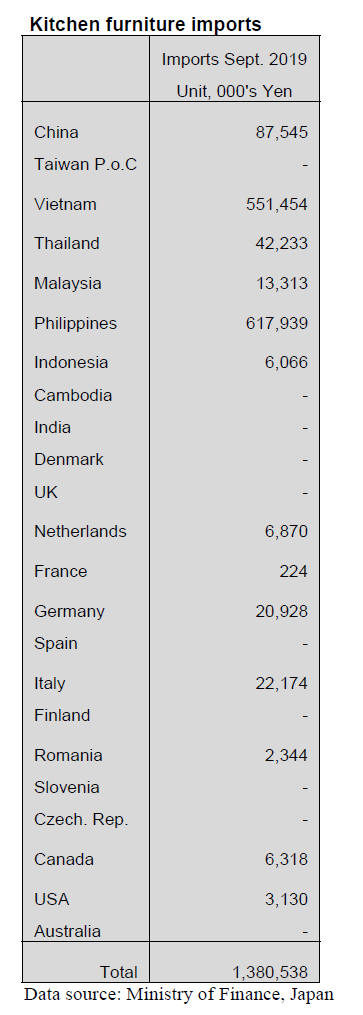

Kitchen furniture imports (HS 940340)

September marked the second monthly decline in the

value of imports of wooden kitchen furniture (HS940340).

Imports from China almost halved in September but the

value of imports from the other two main suppliers, the

Philippines and Vietnam held up well. The Philippines and

Vietnam accounted for around 85% of Japan¡¯s imports of

wooden kitchen furniture in September.

Year on year the value of imports of HS 940340 in

September was up 11% but there was a 4% decline from

levels in August this year.

Germany and Italy feature in the top 20 suppliers of

wooden kitchen furniture but between them have only

around 2% of total September shipments into Japan.

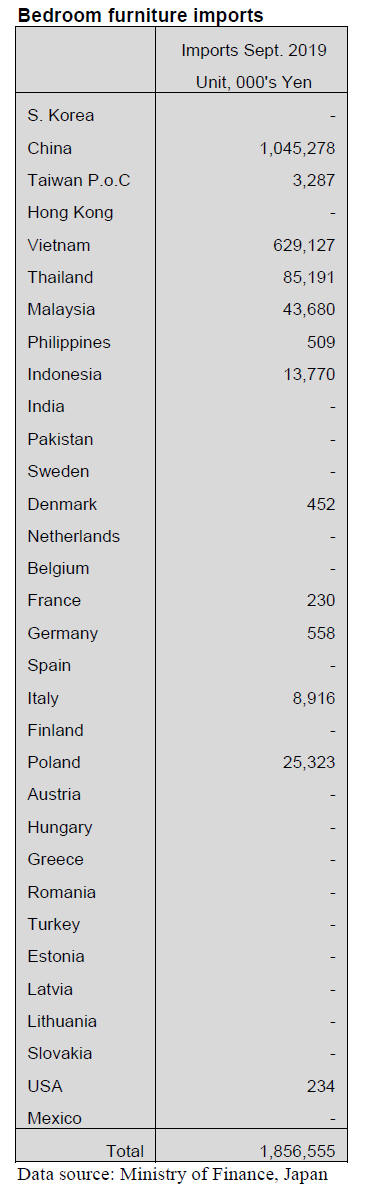

Bedroom furniture imports (HS 940350)

Once again, China¡¯s dominace of Japan¡¯s imports of

wooden bedroom furniture (HS 940350) was apparent in

September when imports from China accounted for around

60% of all wooden bedroom furniture imports. The second

largest supplier in terms of import value was Vietnam with

a 34% share of September imports.

Other shippers such as Thailand and Malaysia have a

small share of Japanese imports but have not managed to

increase their share of wooden bedroom furniture imports.

Year on year, the value of Japan¡¯s September imports of

wooden bedroom furniture rose 11% but there was a 4%

month on month decline in the value of imports.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

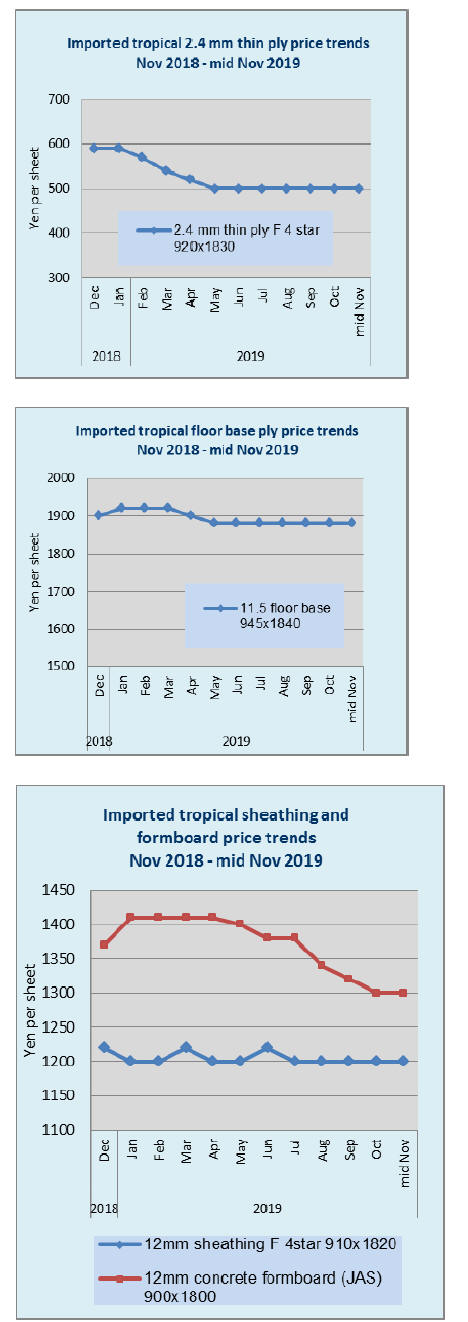

Structural change of plywood import business

Performance of building materials trading firms for the

last term is disclosed and imported plywood business is

major key factor but gap between suppliers¡¯ export prices

and the market prices in Japan is getting wider particularly

since 2017 so the importers suffer negative business for

almost a year.

In the first half of 2018, the market prices rose together

with suppliers¡¯ prices so imported plywood was major

factor of profit for some companies. Then in late 2017, the

suppliers¡¯ prices dropped and the market prices in Japan

decreased much more than suppliers¡¯ price drop so many

importers suffered loss.

In producing regions in Malaysia and Indonesia,

production and shipment plan collapsed by log supply

shortage and resultant higher log prices. In Japan,

warehouses near ports are plugged with imported plywood

and many ports restricted accepting plywood cargo ships.

Smooth import procedures were disrupted. While

confusion lasted in ports, the market skidded and high cost

inventories had to be disposed at lower prices, which

resulted in huge loss for the importers. Initially price skid

was supposed to stop around June but bleak market

continues during summer months. This is nothing unusual

and it happened cyclically before.

The most noticeable change is that imported plywood is no

longer influential to the plywood market. Imported South

Sea hardwood plywood used to dominate the market but

now even when monthly import volume is less than

200,000 cbms, there is no panic at all. Market share of

domestic softwood plywood and imported plywood

reversed and domestic share is getting larger while supply

of South Sea hardwood plywood became unstable by log

shortage. Plywood users rely more on stable supply of

domestic plywood.

This means structural change of plywood market from

imports to domestic. It is obvious that domestic plywood

is leading the market. By environmental restriction and

declining of forest resources, there is no chance that

supply of hardwood plywood from Malaysia and

Indonesia would become competitive in price and quality

like before.

South Sea hardwood plywood has been the most important

material as composite floor base but after by insufficient

supply and high prices, Japanese floor manufacturers have

been shifting to use domestic softwood plywood without

choice.

Supplying mills in these countries have been struggling

with tight log supply and low orders from Japan and only

thing they can do now is to curtail the production. One

solution is to use planted species to manufacture plywood

if the prices are competitive with Japanese cedar.

Diversification of floor base materials

Base materials of composite floor have been diversified.

According to statistic made by the Japan Laminated Wood

Flooring Manufacturing Association (JLWFMA),

percentage of domestic wood used for floor base in

September is 36%, 10 points more than September last

year.

Reason of shifting is price increase of South Sea hardwood

plywood and decline of the supply. This has been used as

floor base for many years in Japan with dimensional

stability. To replace natural hardwood, plywood of planted

species of falcate and eucalyptus increased for some time

but after the demand increased, the prices soared so use of

domestic softwood plywood rapidly increase due to price

stability since 2014. Planted species grow faster but it

lacks strength and surface is soft to have scratches easily.

Up until 2000, South Sea hardwood plywood was the main

material for floor base then the prices started climbing

since 2006 and they shot up to US$700 per cbm C&F at

one time, which triggered diversification of floor base

materials.

In 2007, Panasonic developed 100% particle floor base for

the first time in Japan then in 2009, Daiken started

marketing composite floor ¡®Forest Hard¡¯, which is the first

domestic softwood plywood floor with MDF.

In 2010, the JLWFMA declared to pursue using domestic

softwood plywood for floor base.

Prices of South Sea hardwood plywood climbed again

since late 2017 so the composite floor manufacturers all

increased the sales prices then major house builders

changed the specifications to use domestic softwood

plywood as floor base. This speeded up use of softwood

plywood.

Right now, the main floor base is domestic softwood

plywood with MDF but there are variety of other materials

such as hardboard with softwood plywood or planted

wood plywood and hardboard so diversification is

progressing to avoid risk of high cost and supply stability.

Looking at development of new floor base by individual

companies, everyone is now trying to increase use of

domestic materials to avoid risk of exchange rate of

imported materials and unstable supply.

South Sea (tropical) logs and lumber

Supply and demand of South Sea logs are balanced. There

was no arrival in September both from Malaysia and PNG

but plywood manufacturers carry about two to three

months inventories. Malaysia is in rainy season so the log

supply is dropping largely.

After log prices dropped in last summer, log suppliers

have begun reducing harvest since last August so the

supply decreased much faster than normal year. Log

inventories of local plywood mills are decreasing rapidly

so local log prices are also climbing.

Export log prices for China stagnate

Export prices of cedar logs for China from Kyushu ports

had been about 9,500 yen per cbm FOB port until last May

then the prices have started dropping and now 8,000 yen

or lower for last six months.

Radiata pine log prices from New Zealand to China have

been gradually climbing and ocean freight is also

increasing but Chinese buyers demand 12,000 yen per cbm

C&F Shanghai for Kyushu cedar logs.

Chinese log market bottomed in September and is

improving and the buyers plan to build up the inventories

for next year¡¯s New Year in February. They will keep

buying if present price level continues.

In 2018, total logs exported from Kyushu ports are about

950,000 cbms, 25% more than 2017, out of which logs for

China were about 800,000 cbms.

For the Japanese log exporters, concern is log purchase

competition with biomass power generation plants. If the

export log prices drop too much, logs would go to biomass

business. Present prices for biomass are holding at 7,000

yen per cbm FOB chip plant. In short, minimum export

log prices are 7,500 yen per cbm FOB port and if they are

lower than this, logs would go to biomass plants.

|