3.

MALAYSIA

MTCC sets new goals

The Malaysian Timber Certification Council (MTCC)

recently celebrated its 20th anniversary. Since the

establishment of MTCC in October 1998, much has been

done to implement the Malaysian Timber Certification

Scheme (MTCS) with priorities given to planning,

creating awareness, building trust and confidence among

the various stakeholders as well as gaining international

recognition for the scheme.

As of March 2019 a total of 22 forest management units

(FMUs) have been certified under the MTCS. Of these, 15

FMUs are for natural forests covering around 4.5 million

ha. the remaining seven FMUs are forest plantations

extending over almost 121,000 ha. Additionally, a total of

364 timber companies have been certified under the

MTCC’s chain of custody scheme.

With its successes to date the MTCC has reviewed the

progress and set a path up to 2025 with seven major goals

outlined in a publication /MTCC Strategy 2020-2025:

See:

http://mtcc.com.my/mtcc-20th-anniversary-conference/

Trade conflict to expand immediate

opportunities and

create long lasting market ties

Former Malaysian Furniture Council President, Chua

Chun Chai, is optimistic that Malaysian furniture exports

to the US could grow substantially over the next few years

having got a boost from the high tariffs on Chinese exports

and through expanded business ties with US importers.

Chua has said Malaysian manufacturers need to recognise

that the furniture supply chain, once dominated by China,

is evolving with Vietnam, Indonesia and Malaysia vying

for a greater share of international demand.

In the first five months of 2019, Malaysian furniture

exports to the US grew year on year by almost 21% to

RM1.55 billion.

Between January and May 2019 Malaysia’s share of

the

markets was 38% in the US, around 8% in Japan and

Singapore and almost 6% in both Australia and the UK.

See: https://www.thesundaily.my/business/us-china-trade-waraugurs-

well-for-furniture-exporters-MA1121482

Sabah log ban an boon for furniture makers

Malaysia Furniture Council Vice Chairman Cha Hoo Peng

has said the log export ban in Sabah is benefitting the

downstream industry in the State, particularly the furniture

sector which has seen sales increase.

The issue now, said Cha, is that while raw materials are

adequate there is an acute shortage of skilled workers for

the furniture sector.

One country, three forest policies

Malaysia has three different forestry policies and sets of

laws one for each of Peninsular Malaysia, Sarawak and

Sabah and recently Dr. Xavier Jayakumar, the Federal

Ministry of Water, Land and Natural Resources, has

suggested there would be advantages in bringing all three

forest policies into a common Malaysian Forestry Policy.

Dr. Xavier stressed that the suggestion did not mean that

the ministry was considering amendments to any of the

current policies as he knows forest policy is a matter for

each State and the Federal government does not have any

right to demand changes. The Minister invited all

concerned parties to consider this so it can be discussed at

a later date.

Malaysian exhibitors did well at Shanghai Fair

In a press release the Secretary-General of the Ministry of

Primary Industries Dato’ Dr. Tan Yew Chong,

congratulated the Malaysian Timber Council (MTC) for its

successful Malaysia Pavilion at the 25th China

International Furniture Expo. In 2018 Malaysian furniture

manufacturers exhibiting at MTC’s pavilion recorded sales

of RM10.92 million but this year’s sales are expected to be

around RM28 million.

The MTC has been supporting participation in this fair for

the past five years and this year19 Malaysian furniture

companies exhibited and promoted sales.

The MTC has said this fair is a useful venue to boost

business as it not only attracts buyers from within China

but also other international buyers from countries such as

the United States, Canada, United Kingdom, South Africa,

Spain, Japan, France, India and Italy.

See:http://www.mtc.com.my/images/media/691/Furniture_China_Press_Release_2019_-Bernama-.pdf

4.

INDONESIA

Major effort to capture market share in the

US

The Indonesian President recently met with timber

industry representatives to discuss how to take advantage

of the US/China trade friction specifically on how to push

Indonesian furniture exports to the US.

The government has introduced incentives such as the

value-added tax exemption for logs and a partial relaxation

of the timber legality assurance system (SVLK) for

exports to countries where SVLK certification is not

mandatory.

Indonesia’s exports of wood products were worth US$2.2

billion in the first seven months of this year down around

14% year on year. On the other hand furniture exports rose

9.4% year-on-year to US$1.12 billion in the first seven

months of this year.

The Chairman of the Association of Indonesian Forest

Concessionaires (APHI) Indroyono Soesilo, said value

added tax exemption for log (currently at 10%) is good

news for the domestic downstream wood industry.

But serious hurdles are yet to be overcome one of which is

the high cost transportation and logistics according to the

Director General of Small, Medium and Miscellaneous

Industries of the Ministry of Industry, Gati

Wibawaningsih. She pointed out that compared to China

and Vietnam. Indonesian exporters face very high logistic

costs which undermines competitiveness.

Proposed simplification of the mandatory SVLK

Companies are eager to hear how the SVLK has been

simplified. Gunawan Salim, International Relations and

Marketing Manager of Indonesian Wood Panel

Association (Apkindo), said a simplification would help

small companies become more competitive in markets

where SVLK is not mandatory.

See:

https://ekonomi.bisnis.com/read/20190912/99/1147485/pebisniskayu-nantikan-penyederhanaan-mandatori-svlk#

Not everyone is keen on a simplification of the

SVLK

however’ Asmindo (Indonesian Furniture and Handicraft

Industry Association) Executive Director, Indrawan, said

that there must be consistency in implementing the SVLK

to ensure good forest governance.

According to Indrawan, every business in the timber sector

should have a business license and a business permit as

required by the SVLK. However, he did point out that for

small and medium businesses need help in meeting the

requirements of the SVLK.

Also adding a word of caution, Dwi Sudharto, Head of the

Center for Research and Development of Forest Products

at the Ministry of Environment and Forestry (KLHK), said

the SVLK has eliminated the negative image of Indonesia

timber sector and that lowering the SVLK standard is

being promoted by businesses that do not want to follow

the regulations.

See:

https://news.trubus.id/baca/31778/jpik-nilai-revisi-svlkhancurkan-reformasi-tata-niaga-kayu

SMEs targeted for assistance on SVLK

The Ministry of Environment and Forestry (KLHK) is

targeting 400 groups of micro, small and medium

enterprise groups for assistance in satisfying the national

Timber Legality Verification System (SVLK).

The Director of Processing and Marketing of Forest

Products in the KLHK more SMEs will be assisted this

year. In 2018, 152 groups of SMEs comprising 3,172

industrial SMEs and 247 private forest owners. This year

the KLHK will spend Rp20 billion from the state budget

for this exercise.

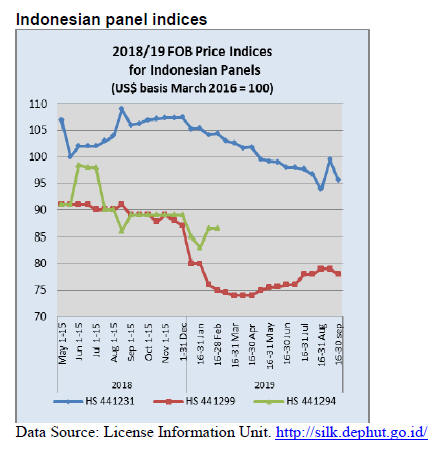

Prices for domestic logs being undermined by weak

international demand

Weakening international demand for processed wood

products is beginning to impact the domestic market for

logs. Purwadi Soeprihanto, Executive Director of the

Asssociation of Indonesian Forest Concessionaires,

(APHI) has reported that in the first seven months of 2019

log sales were 25.2 million cubic metres compared to the

26.1 million cubic metres in the same period 2018.

The decline is the result of sluggish international demand

largely the result of the escalation of the trade

frictionbetween the United States and China. The

immediate impact of softening demand has been a fall in

plywood prices which feeds back into the prices offered

for domestic logs.

Purwadi indicated there are about 14 million cubic metres

of raw material available but if prices fall owners will

reduce harvests.

See:

https://ekonomi.bisnis.com/read/20190919/99/1150184/produksikayu-bulat-tergerus-lemahnya-permintaan

5.

MYANMAR

First timber legality certificate issued

The Myanmar Forest Certification Committee (MFCC)

has announced that the first MTLAS Legality Certificate

has been issued providing details on the shipper, the type

of products and species among other details.

See:

http://www.myanmarforestcertification.org/certificates/

Barber Cho, Secretary of MFCC, said getting to this

point

was the result of two-years of hardwork. Cho continued

saying that the MFCC has built a reliable MTLAS with

limited resources.

Over the past two years the Certification Committee and

supporters compiled the certification standard and

provided auditors training for certification bodies.

Currently the MFCC recognises three certification bodies

and will soon announce approval of others.

The major challenge going forward is accreditation in

Myanmar. The Department of Research and Innovation

(DRI) under Ministry of Education is currently the official

Accreditation Body but the DRI is not yet a member of the

International Accreditation Forum (IAF).

The IAF is the world association of Conformity

Assessment Accreditation Bodies and other bodies

interested in conformity assessment in the fields of

management systems, products, services, personnel and

other similar programmes of conformity assessment.

Because the DRI is not accredited to IAF it has little

international standing in the accreditation of Myanmar’s

certification bodies. As an interim measure, MFCC has

assumed the role of accreditation body but it is the priority

of the MFCC to solve this accreditation issue as soon as

possible.

With the issuance of the first MTLAS legality

certificate,

Cho, on behalf of the MFCC, put on record the gratitude to

PEFC which provided assistance in the development of the

legality certification process in Myanmar. The MTLAS

process began in 2009 and the PEFC began to provide

assistance in 2017/18 for which everyone in Myanmar is

grateful.

The MTLAS is a uniquely Myanmar effort but has built

upon the experiences of other countries and the PEFC

expertise in building capacity in the MFCC, training

auditors and introducing the PEFC chain of custody

system. The MFCC looks forward to further cooperation

with the PEFC to strengthen and promote Myanmar’s

forestry and wood products sectors.

The MFCC anticipates that as soon as the accreditation

issue is resolved the MTLAS certificates will benefit

importers in the EU in meeting the due diligence

requirements of the EUTR. Cho said he is well aware that

there is much to do to overcome the concerns on

allegations of corruption in Myanmar, on improving

transparency and a host of other domestic issues of

concern to the international community.

Memorandum of understanding with RECOFTC

Myanmar's Forestry Department signed a memorandum of

understanding with RECOFTC (The Center for People and

Forests) an international not-for-profit organisation that

focuses on capacity building for community forestry in the

Asia Pacific region.

The agreement is the second between the Forestry

Department and RECOFTC. The organisations signed the

first agreement in 2013. Since the beginning of the

partnership, Myanmar has achieved important milestones

in forestry. The most notable being the formation of a

Community Forest National Working Group (CFNWG) in

2014 and the establishment of a community forest

database.

Maung Maung Than, Director of RECOFTC Myanmar,

said this agreement is an important milestone in the

history of community forest development in Myanmar as

it will continue to address challenges that face the

country’s forests and the communities that depend on

forests.

Work under the new agreement will focus on the

development a plan for Myanmar’s Community Forest

National Working Group. The working group aims to

establish 14,000 hectares of community forest a year. The

working group will also strengthen community forest

enterprises.

Belt and Road plan being discussed

The governments of China and Myanmar are negotiating a

five-year plan on economic and trade cooperation under

the Belt and Road Initiative.

Investment in infrastructure in Myanmar is expected to

increase over the next 18 months as a result of projects

including those under the China-Myanmar Economic

Corridor (CMEC) such as the New Yangon City,

Kyaukphyu Deep Sea Port and the Kyaukphyu-Kunming

Railway projects.

Foreign investment flows improving

Myanmar’s economy is forecast to expand 6.4% in the

current fiscal year and to 6.8% in the next according to the

Institute of Chartered Accountants in England and Wales

(ICAEW). The report said that the forecast for Myanmar’s

economy is positive as the country opens to foreign

investment. The ICAEW report mentioned that the

infrastructure, manufacturing and wholesale and retail

services sectors are expected to be the greatest

beneficiaries.

According to the Myanmar Investment Commission after a

14% decline in foreign investment to US$5.7 billion in

2018 foreign investment inflows are now rising

improving.

6. INDIA

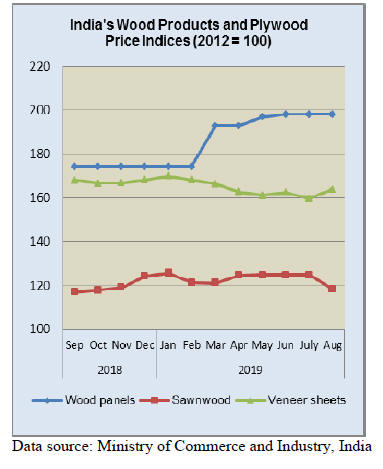

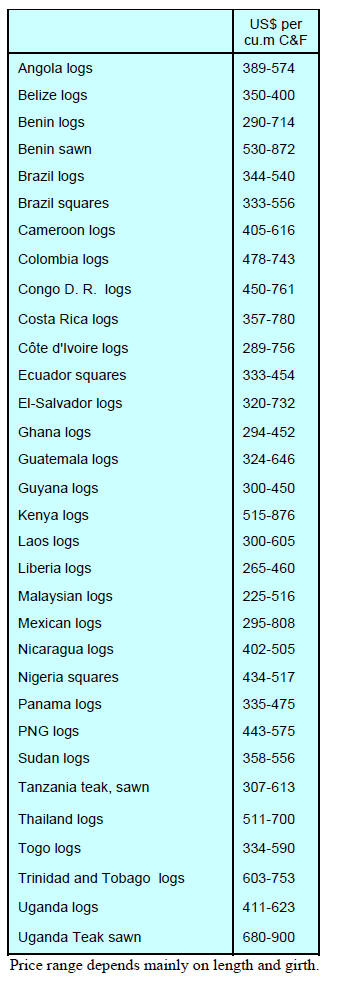

Modest rise in wood product price indices

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for August 2019 rose to 121.4 from

121.2 for the previous month. The index for the group

'Manufactures of Wood and of Products of Wood and

Cork ' declined to 134.1 from 134.2 for the previous

month due to lower price of wooden splints, sawnwood

and wooden boxes/crates. However, the price of veneer

sheets and wooden blocks moved higher.

The annual rate of inflation based on monthly WPI in

August 2019 stood at 1.08% compared to 3.27% in August

in the previous year.

The press release from the Ministry of Commerce and Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Tax cuts and boost to housing

The Indian government has reduced taxes for

manufacturers in an effort to revive the economy. It has

been reported that the Finance Minister, Nirmala

Sitharaman, announced a reduction in the country’s

corporate tax rate from around 35% to 25%. For

companies that do not benefit from any other incentive the

effective tax rate would be just 22%.

In addition she revealed that firms incorporated after

October this year will be taxed at 15% instead of 25%.

These decisions resulted in a slight strengthening of the

rupee against the US dollar. However, some analysts have

raised concern on the impact of these cuts on government

finances.

The current economic slow-down is mainly due to weak

consumer demand so analysts say there is little reason for

companies to invest even if their tax falls. Indian

consumers are not spending because of unemployment

risks and falling wages. Under these conditions expanding

investment in housing projects or manufacturing is risky.

To further boost growth prospects action is being

discussed to kick-start completion of stalled housing

projects through easier borrowing terms for affordable

home buyers.

See:

https://housing.com/news/rbi-monetary-policy-interestrates/?utm_source=internal&utm_medium=email&utm_campaign=subscribersDigest

Plantation teak imports

At the most recent meeting of the Goods and Services Tax

Committee over 100 cases were considered and most

provided with relief but the GST on wood products has not

been reduced.

The rupee rose in late September after forex trading

sentiment was boosted by the government decision to

lower corporate taxes. C&F prices for imported plantation

teak products remain unchanged from two weeks earlier.

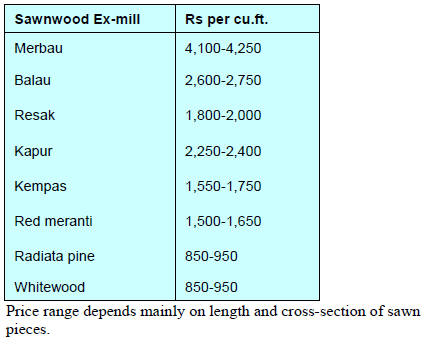

Locally sawn hardwood prices

Ex-mill prices have been maintained despite demand being

flat.

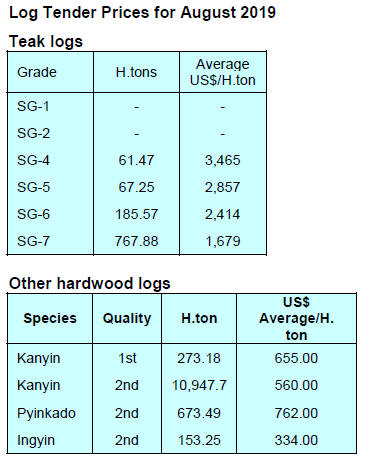

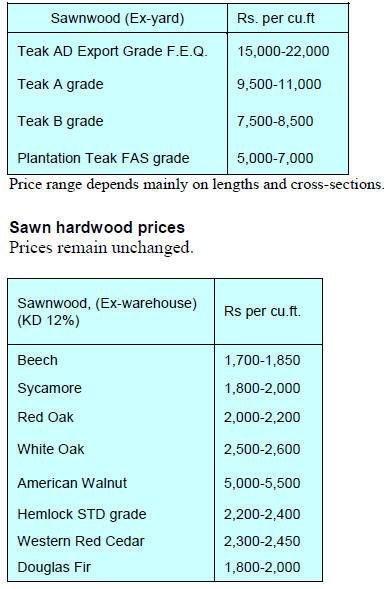

Myanmar teak prices

The timber sector has accepted that for the medium term

the GST Committee is unlikely to recommend reduced

GST for wood products. The economic stimulus from the

government may boost demand but it is not only demand

that is an issue the other concern of manufacturers is the

difficulty in securing credit.

Traders are reporting that there are signs that demand for

Myanmar teak may be firming but this has not yet

translated into an opportunity to raise prices.

Price range depends mainly on lengths and

cross-sections.

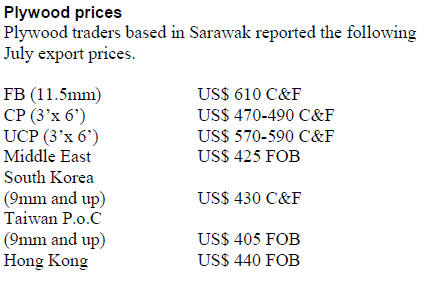

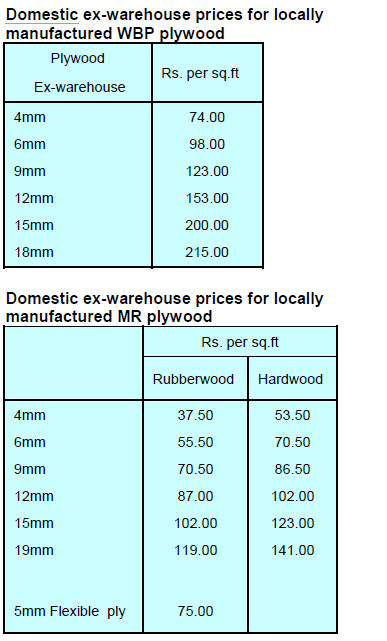

Plywood

Plywood manufacturers continue to face problems related

to the rising cost of log raw materials and other inputs. It

has been learnt that the main plywood associations have

been discussing when the next round of prices increases

should be introduced.

7.

VIETNAM

Vietnam’s wood products trade

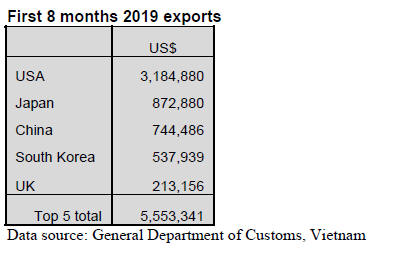

According to the General Department of Customs,

Vietnam’s exports of wood (especially chips) and wood

products in August 2019 continued to rise reaching

US$935 million, up 8.2% compared to July 2019.

Exports of manufactured wood products totalled US$671

million in August an almost 6% increase from July.

Cumulative export earnings for the first 8 months of 2019

totalled around US$6,613 billion, a 17% rise year on year.

The major export markets were the USA, Japan, China,

South Korea and UK. The top 5 markets accounted for

around 85% of total exports.

Turning to wood and wood product imports,

the General

Department of Customs reports that imports in August

2019 dropped for the second consecutive month to

US$219 million, an almost 2% fall compared to July 2019.

However, in the first 8 months of 2019 imports totalled

US$1.675 billion, up 14.4% over the same period in 2018.

The main suppliers in order of rank were China, USA,

Thailand, Chile and Brazil.

See:

http://goviet.org.vn/bai-viet/muc-tieu-xuat-khau-go-11-tiusd-nam-2019-tren-duong-ve-dich-9033

Industrial expansion driving up labour costs

Vietnam’s Foreign Investment Agency has reported that

total foreign investment has increased sharply this year

with about 60% of this investment going into the wood

processing sector.

The surge in investment has put pressure on labour supply

and Nguyen Quoc Khanh, Chairman of Ho Chi Minh City

Handicraft and Wood Processing Association (HAWA)

said the number of new factories processing wood has led

to labour shortage and is driving up labour costs. He

reported that labour costs in the industrial zones have risen

by 10-20% but enterprises are still finding it difficult to

recruit people.

Productivity in timber sector below ASEAN levels

According to the Vietnam National Economics University,

labour productivity in Vietnam’s wood processing

industry is significantly lower than in most other ASEAN

countries.

The university report says Vietnam’s labor productivity is

just 7% of that in Singapore; 18% of that in Malaysia and

55% of that in the Philippines. The report cites industrial

structure and organisational management as substantial

contributing factors.

The study identified the main problems as poor time

management, low entrepreneurship and weak corporate

management. Only through raising labour productivity

will Vietnam’s timber processors be able to maintain

competitiveness said Nguyen Ton Quyen, Secretary

General of Viforest (Vietnam Timber and Forest Product

Association).

An MOU has been agreed between three parties; the

Handicraft and Wood Industry Association of Ho Chi

Minh City (HAWA), the Taiwan (P.o.C) wood processing

Association and Ho Chi Minh Technical Education

University aimed at lifting the productivity of labour in the

wood processing sector.

All industries in Vietnam are facing fiercer competition at

home and in international markets and much of this stems

from the inflow of advanced processing and skilled

management in foreign companies that have set up

operations in Vietnam.

See:

https://baodautu.vn/hop-tac-3-ben-nang-cao-nang-suat-laodong-nganh-go-d107519.html

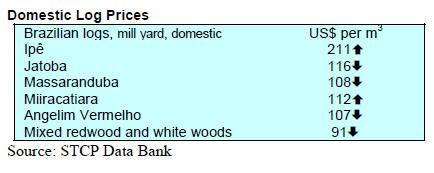

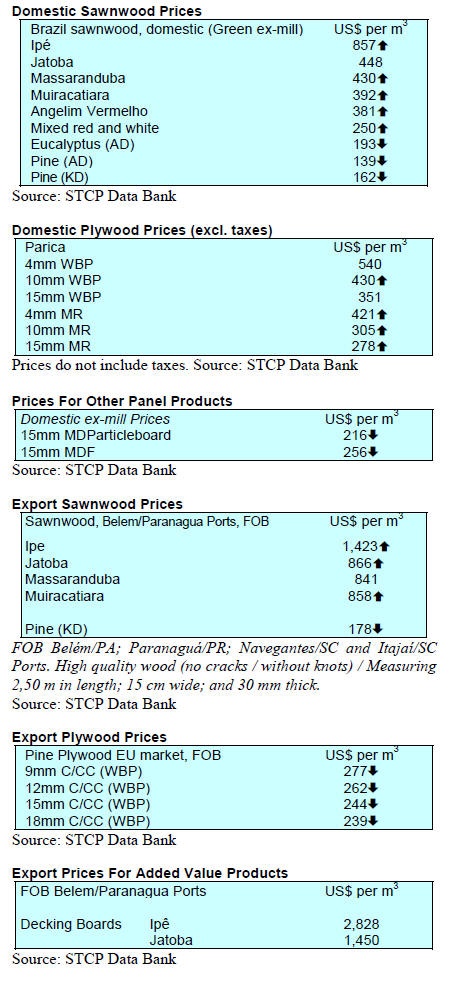

8. BRAZIL

Furniture production back into positive

territory

In July 2019, furniture production picked up in the two

main producing states, Rio Grande do Sul and Paraná

marking the first rise in production for the past six months.

In Rio Grande do Sul there was an almost 34% rise in

production compared to a month earlier while in Paraná

there was a 15% increase. In June this year production in

Rio Grande do Sul dropped 13% month on month and in

Paraná there was an 8% decline.

Although the July production figures in Paraná were good

they were not enough to compensate for the downturn in

the first seven months of 2019. The annualised rate of

Paraná´s furniture production remained at -4.5%.

Cumulative furniture production in Rio Grande do Sul in

the first seven months of this year rose by almost 5%

compared to a year earlier.

Brazilian Forest Service prepares for COFO

The Brazilian Forest Service (SFB) participated in the 31st

FAO Latin America and the Caribbean Forestry

Commission (LACFC) meeting held in the first week of

September, in Montevideo, Uruguay. SFB participated in

the panel discussions on Restoration of forests and

landscapes; Forest Protection: Integrated fire management,

Forest health and invasive species, Preventive approach to

illegal logging and Forests and Bio-economics.

LACFC was established in 1948 and aims to provide a

technical and political forum for member countries of

Latin America and the Caribbean to discuss forest-related

issues and their contribution to food security.This event

discussed the forest agenda of the countries of the region

and was a preparatory meeting for the FAO World

Forestry Committee (COFO) meeting to be held in Rome

in 2020.

At the meeting, the SFB Director detailed the activities of

the Brazilian Forest Service especially the Environmental

Rural Registry (CAR), forest concession control and the

work developed by the National Forest Inventory.

The Director also highlighted the importance of these

projects for the establishment of the Brazilian Forest Code,

for the promotion of sustainable use of Brazilian forests

and for planning of government policies related to the

country's forest management.

Export update

In August 2019, Brazilian exports of wood-based products

(except pulp and paper) fell 22% in value compared to

August 2018, from US$282.4 million to US$219.7

million.

The value of pine sawnwood exports declined 30%

between August 2018 (US$47.1 million) and August 2019

(US$32.8 million). In volume terms exports dropped

around 20% over the same period, from 204,800 cu.m to

164,200 cu.m.

Tropical sawnwood exports also dropped (-16%) in

volume, from 45,800 cu.m in August 2018 to 38,500 cu.m

in August 2019. The value of exports also dropped (-29%)

from US$20.2 million to US$14.4 million over the same

period.

The value of pine plywood exports fell 41% in August

2019 in comparison with August 2018, from US$64.2

million to US$37.6 million. In volume terms pine plywood

exports dropped just 9% over the same period, from

182,800 cu.m to 166,000 cu.m.

Following the same trend export volumes of tropical

plywood fell (-57%) and in value (-59%), from 12,900

cu.m (US$ 6.1 million) in August 2018 to 5,600 cu.m

(US$ 2.5 million) in August 2019.

To complete the depressing picture, wooden furniture

exports declined from US$51 million in August 2018 to

around US$45 million in August 2019, a 12.4% decline

year on year.

First half 2019 plantation sector performance

The IBÁ Bulletin from the Brazilian Tree Industry reports

a 2.9% first half 2019 increase in the value of sector

exports in comparison with the first half of 2018. In the

first six months of the year overseas trade topped US$5.6

billion. Pulp exports increased 1% in the period, while

paper exports increased by 4.1%.The trade balance for the

sector reached US$5.1 billion, a 3.3% year on year

increase.

In the first half 2019 China was the main market for

Brazilian pulp accounting for US$1.9 billion of all pulp

exports. Latin American countries were the main market

wood panels (US$ 89 million) and paper (US$ 592

million).

9. PERU

Budget increase for forestry authorities

Regional forestry authorities have two ways to generate

the income necessary to finance their operations: the first

is allocations from the Ministry of Economy and Finance

(MEF) and the second is through directly collected fees

and charges levied on companies.

For many years regional forestry authorities have been

pointing out that their operational budgets were

insufficient to properly supervise forest management. To

address this the regional governments of Loreto, Ucayali

and Madre de Dios determined that they should make an

effort to increase allocations from the central government.

These efforts have paid off as recently the MEF approved

the transfer of additional resources to the three regional

forestry authorities in the amount of around US$2.5

million.

This effort was possible because the regional authorities

could articulate their needs. To achieve this they had the

technical support of the USAID Forest Program and the

United States Forest Service (USFS).

Analysts write that this is the first time that a forestry

authority has requested and received an additional budget

from the Ministry of Economy and Finance.

Capacity building for forestry sector transparency

As transparency is a fundamental of governance a process

of capacity building in transparency and access to public

information in the forestry sector is being promoted.

The first step has been a workshop in Lima attended by the

National Forest and Wildlife Service (SERFOR), the

Agency for Supervision of Forest Resources and Wildlife

(OSINFOR) and the Regional Governments of Loreto and

Ucayali. Members of the Ombudsman's Office and the

Digital Government Secretariat also participated.

According to Eduardo Luna, Director General of

Transparency, Access to Public Information and

Protection of Personal Data in the Ministry of Justice, this

process which has just started could result in improved

directives, guidelines and a policy on transparency for the

forestry sector initially and then other sectors.

Trends and solutions in plantation establishment and

management

Because of the increase in forest plantations, especially in

the Amazon, the “First Peruvian Meeting of Forest

Plantations” was recently organised by the Research and

Conservation Circle in the Forestry Area - CICAF, in

coordination with the Faculty of Forest Engineering of the

National Agrarian University - La Molina.

The event brought together stakeholders from the Peruvian

forestry sector to discuss trends and solutions in plantation

establishment and management through exchange between

professionals, companies and institutions in the forestry

sector. In the presentations the emphasis was on

management of nurseries, forestry, biomass, harvest, forest

transport and technologies supporting forest production.

Advances of Amazon forest zoning

With technical assistance of the National Forest and

Wildlife Service (SERFOR), the Ministry of Agriculture

and Irrigation, the Amazonian Regional Governments of

San Martín, Ucayali, Loreto, Amazonas, Junín, Madre de

Dios and Huánuco are successfully advancing forest

zoning.

This was reported by the Executive Director of SERFOR,

Alberto Gonzales-Zúńiga Guzmán, who explained that the

first region that would have ready the forest zoning of its

entire territory would be San Martín.

Ucayali, with some 3 million hectares of forest has

advanced its forest zoning in support of ecological

protection and conservation; reserves for indigenous

peoples and has prioritised ecosystems for conservation.

Work will shortly begin in Loreto.

Plan for national bamboo development

At the first International Bamboo Congress held in the city

of La Merced a national plan for bamboo was proposed in

order to enhance the development of the cultivation of this

non-timber resource that has enormous economic

potential.

Stakeholders in the bamboo sector from all 18 regions in

the country actively participated in this event and shared

experiences on bamboo plantation management, handicraft

development, food production, architecture and

sustainable construction with bamboo.

Experts from Mexico, Colombia, Ecuador, Brazil,

Argentina, Uruguay and France exchanged experiences

with their Peruvian counterparts.

The Congress heard that in the mixed forests of the

departments of Ucayali, Madre de Dios and Cusco there

are almost eight million hectares of native bamboo forests,

commonly called “paca” and northeastern Peru has more

than 3,000 hectares of bamboo plantations distributed in

the regions of Cajamarca, Piura, Amazonas and San

Martín.