3.

MALAYSIA

Optimism high that 2019 wood product

exports will be

a record

The government has reported that wood product exports

for the first 5 months of this year were up just over 2%

year on year. Based on this performance it is anticipated

that exports for the full year could exceed the RM22.3

billion recorded last year. Last year the wood products

sector contributed 1.6% to national GDP.

Forestry laws under review

Tengku Zulpuri Shah Raja Puji, Malaysia's Deputy

Minister of Water, Land and Natural Resources said that

the government is reviewing the current forestry laws and

will consider suggestions on amendments that would

strengthen forest protection.

In August environmental activists lobbied demanding

changes to the current decades old laws in order to

strengthen forest protection and to increase punishments

for forest-clearing, corruption and pollution.

One option being considered is closer coordination

between the central government and state administrations.

Under Malaysia's constitution, forest management falls

mainly under State not Federal control. Many complain

that this has led to greater focus on economic interests

compared to the environment or indigenous people’s right.

Forest fires in Sarawak

The current dry spell has resulted in several forest fires in

Sarawak, especially in the northern Miri area. In early

August forest and peat fires were out of control in Kuala

Baram and had extended over 600 hectares. Unseasonably

strong winds and dry weather contributed to the rapid

spread of the fires.

Malaysia will establish a National Action Plan for Open

Burning and refine the existing National Haze Action

Plan. In early August much of Malaysia was affected by

smoke as forest fires continued to rage in Sumatra and

Kalimantan.

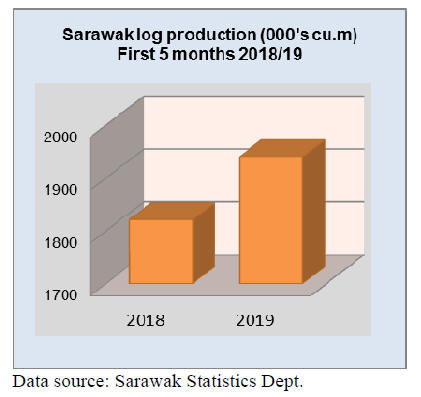

Sarawak log Production

The Sarawak Statistics Department has released log

production data for the first five months of this year

showing an almost 7% rise compared to 2018. This data

has been met with scepticism in trade circles.

New head for MTC in Europe

In a press release the Malaysian Timber Council (MTC)

has announced it has moved its operations to Rotterdam

and appointed Agnes Seah as the new Regional Head of

MTC Europe.

As Regional Head of MTC Europe, Seah will oversee all

operations that represent MTC’s interest in the region.

MTC moved its operation from London to Rotterdam in

April to better facilitate trade-related matters in Europe.

See:

http://www.mtc.com.my/images/media/685/Press_Release_on_A

gnes.pdf

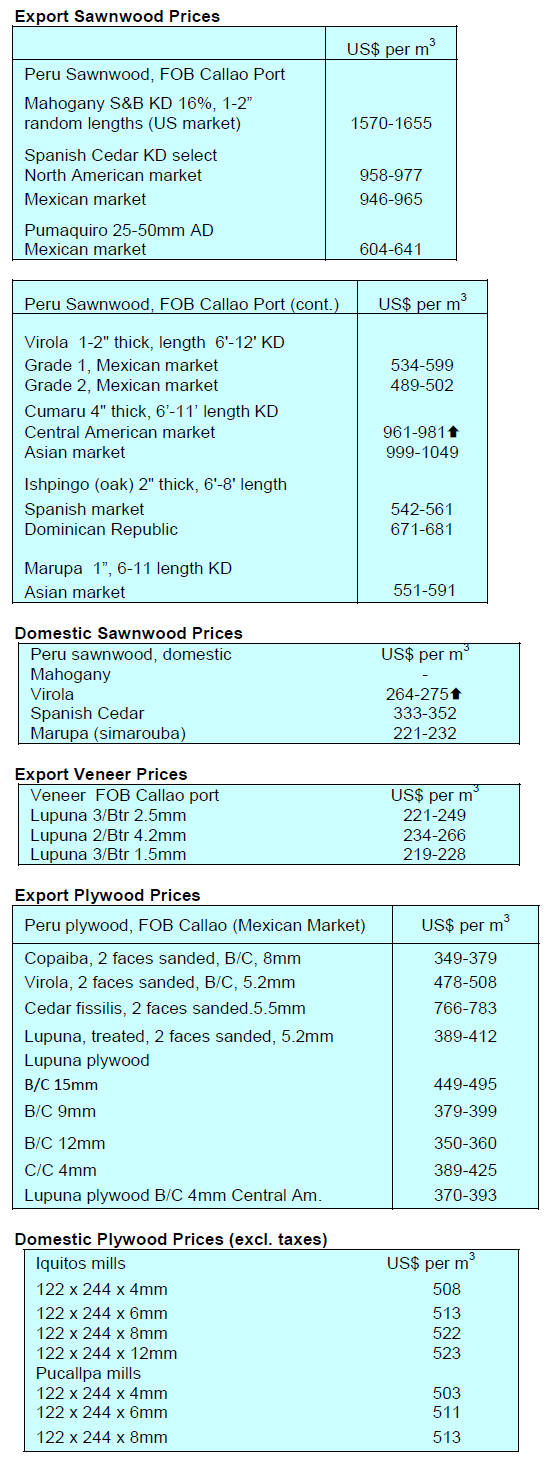

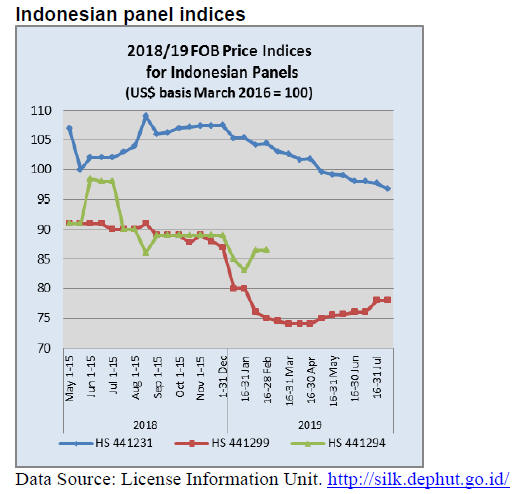

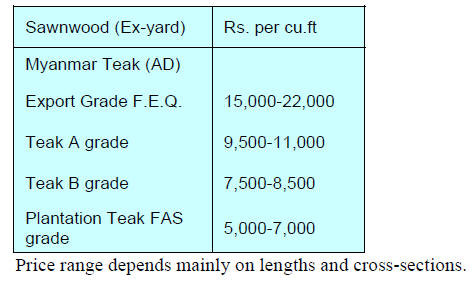

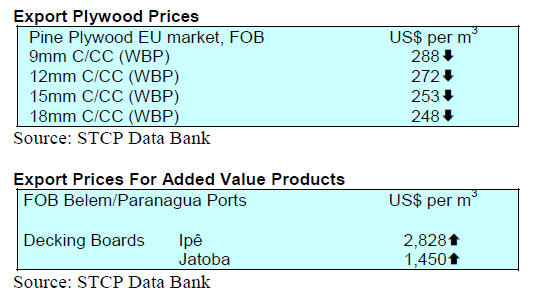

Plywood prices

Plywood traders based in Sarawak reported the following

June export prices.

4.

INDONESIA

Vietnam a major competitor in

US furniture market

Indonesian furniture producers are unable to expand

market share in the US despite the tariffs on Chinese

products.

Based on data from the Indonesian Center for Reform of

Economics (CORE) in April 2018, when the US

Government began imposing tariffs on Chinese products,

the furniture market share of China in the US was 48%,

while Vietnam’s was 7.4% and Indonesia’s 1.63%. A year

later China's market share fell to 46%, while Vietnam’s

rose to 10.5% but Indonesia’s share did not change much,

rising to only 1.65%.

Mohammad Faisal, Executive Director of CORE

Indonesia said that Indonesia has adequate raw materials

so it should have taken advantage of the market

opportunity in the US. However, as he pointed out, there

are several reasons why domestic furniture products failed

to capture more of the market from China, one of which

that Indonesian exporters lack ability to identify market

preferences and lack skills to innovate.

See:

https://ekonomi.bisnis.com/read/20190801/257/1131279/furnitur

-vietnam-jadi-pesaing-berat-produk-indonesia

Attracting overseas furniture firms to Indonesia

The government has seen an opportunity in the trade

conflict between the US and China and is working to

attract Chinese furniture manufacturing companies to

move operations to Indonesia. The Head of the Investment

Coordinating Board (BKPM), Thomas Lembong, said

Chinese companies in Dongguan have been approached.

In addition to Chinese enterprises, efforts have been made

to attract companies in Taiwan P.o.C.

Community forests to be redefined to boost log

availability

The Ministry of Environment and Forestry (KLHK) plans

to redefine community plantation forests (HTR) as smallscale

industrial forest plantations forest (HTI).

To effect the change the Minister directed the Director

General of Social Forestry and Environmental Partnership

(PSKL), Bambang Supriyanto and Acting Director

General of Sustainable Production Forest Management

(PHPL), Bambang Hendroyono, to review regulations.

This change was decided upon as the HTRs have not

delivered the economic benefits expected and have not

been registered in the Forest Product Administration

Information System (SIPUHH) of the Directorate General

of PHPL making it difficult for owners to find buyers for

their logs. The Minister hopes that with the new

regulation, HTR will have the same business function as

HTI without a reduction in the social benefits.

The Association of Indonesian Forest Concessionaires

(APHI) added its support to the planned change which will

encourage community forest plantations to be managed as

small-scale industrial plantations. APHI Executive

Director, Purwadi Soeprihanto, said this change would

benefit plantation owners and has the potential to deliver

more raw materials for manufactures.

See:

https://ekonomi.bisnis.com/read/20190730/99/1130357/tingkatka

n-produktivitas-skema-bisnis-hutan-tanaman-rakyat-bakalberubah

and

https://ekonomi.bisnis.com/read/20190730/99/1130386/aphidukung-

rencana-pemerintah-ubah-skema-bisnis-hutan-tanamanrakyat

Permanent moratorium on forest permits

The Indonesian President has signed a Presidential

Instruction regarding the moratorium on forest area

permits. The Minister of Environment and Forestry, Siti

Nurbaya, said the moratorium is now permanent for

primary and peat forests. Previously the moratorium was

renewed every two years.

See:

https://nasional.kontan.co.id/news/presiden-jokowi-tandatanganiinpres-

moratorium-izin-hutan

https://republika.co.id/berita/pvw6rc383/pemerintah-hentikanpemberian-

izin-kelola-baru-hutan-primer

5.

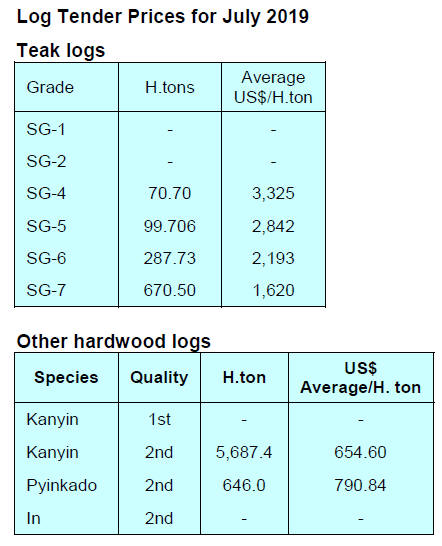

MYANMAR

MTE facing slow sales of

hardwood logs

The Myanma Timber Enterprise (MTE) has said it is

holding as much as 40,000 tons of unsold inn-kanyin logs

from last years’ harvest. Inn-kanyin logs from Myanmar

are commonly used for plywood face veneer. The price of

first quality of inn-kanyin logs is between US$700-800 exsite

but at this price plywood manufacturers complain it

pushes production costs too high. Prices for teak and other

hardwood logs have been rising since a decision was made

to lower the annual allowable cut.

U Ohn Win, Minister of Natural Resources and

Environmental Conservation, has called on MTE to further

reduce in harvest levels in 2019/20 saying the harvest

should be just sufficient to cover the costs of logging.

The Minister also mentioned an age limit for teak harvests

and urged the planting of three seedlings for every tree

felled in Mandalay and Sagaing. The Ministry is also

planning support for the mahouts and working elephants

affected by the reduction in logging.

Myanmar Arbitration Center opened

For the first time a Myanmar Arbitration Center has been

opened at the headquarters of the Union of Myanmar

Federation of Chambers of Commerce and Industry

(UMFCCI). In the past the UMFCCI formed the mediation

committees to deal with commercial disputes between

business persons and merchants. Myanmar passed an

Arbitration Law in 2016 in order to solve commercial

disputes.

At the Arbitration Center opening ceremony, U Zaw Min

Win, President of UMFCCI, reminded Arbitrators not to

be biased as action will be taken against biased and

dishonest members. With the creation of the Arbitration

Center dispute resolution will become more transparent.

Union taxation law

The Parliament recently passed the Union Taxation Law

which set a tax of 10% on logs and sawnwood for export

and 5% for import ( export of logs from the natural forest

is banned). Manufacturers have urged the government to

reduce the tax on imports.

While it is understood the Ministry of Natural Resources

and Environmental Conservation is in favor of reducing

tariffs on the importing wood as manufacturers have a

hard time competing with products from neighboring

countries.

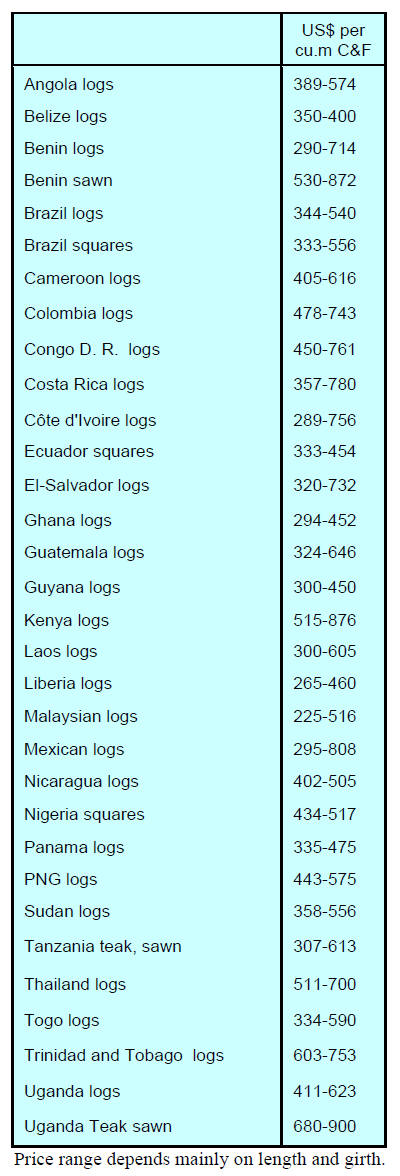

6. INDIA

Home buyers find some relief in

interest rate cut

India’s economy grew at its slowest pace in more than

four years in the January-March period, falling behind

China’s pace for the first time in nearly two years.

On the housing front, home sales in India’s main property

markets declined by 11% year-on-year in the first quarter

(April June) of the current financial year. During the same

period housing starts dropped almost 50%.

Home buyers will welcome the cut in interest rates by

India’s largest lender State Bank of India (SBI) and other

lenders following the decision of the Reserve Bank of

India to lower interest rates.

In related news, the government is planning construction

of 18 million new homes with electrictity supplies and

fittings for cooking gas to fulfill an election promise to

rural voters.

Plantation teak imports

Optimism amongst teak importers was dented recently as

the rupee slipped by around 4% against the dollar driving

up import costs. Against this background, and with no

decision on easing the advance payment conditions under

the Goods and Services tax rules, C&F prices are stuck at

the same level as a month ago.

Locally sawn hardwood prices

While demand and import levels are balanced traders

report severe market competition such that prices, while

steady, are under pressure.

Myanmar teak prices

Analysts report that weakening demand levels reported

earlier continued into early August citing the sluggish

housing market and dampened consumer sentiment

because of political issues.

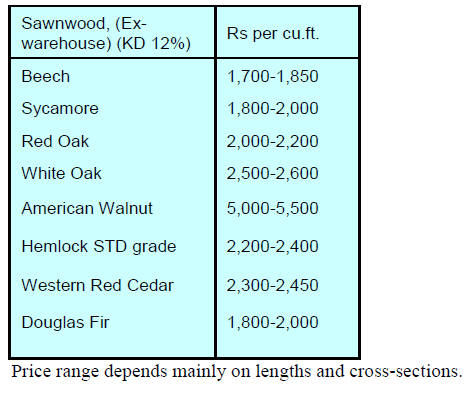

Sawn hardwood prices

No changes in demand or prices for imported European

and US hardwoods has been reported.

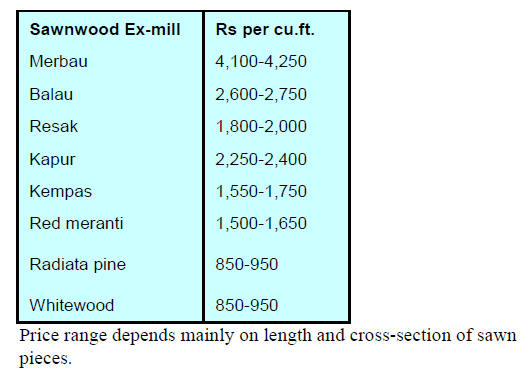

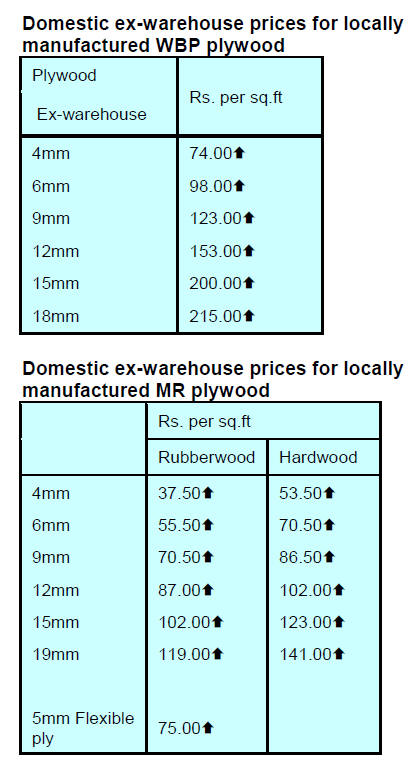

Plywood

Millers report continued increases in production costs

driven by rising log costs and wages. The increases have

now become so high that wholesale prices have been

increased.

The various plywood manufacturers associations

collectively decided to increase prices by around 7% as

shown on the right.

7.

VIETNAM

Rubberwood – a major raw

material in Vietnam

Rubberwood has become an important raw material for

Vietnamese wood product exporters. Over the past few

years clearing of rubberwood for replanting has yielded a

volume of between 4.5 and 5 million cu.m of roundwood

and some 70% of this is utilised by manufacturers.

In 2017, exports of rubberwood products were worth

around US$1.7 billion accounting for almost 25% of

Vietnam’s wood products exports.

In the future this source of raw material will have

sustainable forest management certificates and CoC

documents to satisfy demands for legality verification.

The greater use of rubberwood will sharply improve the

supply of raw material for Vietnamese manufacturers.

Piloting Vietnam’s Forest Certificate System

In order to certify 20,000 hectares of plantation forests in

accordance with the Vietnam Forest Certification System

(VFCS), the Vietnam Administration of Forest and

Vietnam Rubber Group (VRG) plans to coordinate with

sector stakeholders to ensure Vietnamese wood product

manufacturers meet the standards set in the VFSC for

sustainable management and for CoC.

The Vietnam Rubber Group has already signed an

agreement under which about 12.000 ha. of rubberwood

will be certified.

To build upon this effort the VRG and its members

organised training activities for stakeholders on (i)

building capacity to understand and implement CoC and

certify SFM (ii) Planning the roadmap to achieve CoC (iii)

summiting documents to verify SFM and CoC.

See: http://tapchicaosu.vn/tin-tuc/thoi-su-trong-nganh/tong-cuclam-

nghiep-se-ho-tro-vrg-cap-chung-chi-rung-cho-10-000-hacao-

su.html

Calls for long-term plantation plan

Forest plantations play a vital role in the national wood

processing industry and Nyssaceae (dogwood) is utilised

commercially. Due to intense pressure on manufacturers to

secure raw materials Nyssaceae trees are being harvested

after just 5-7 years and this has raised concerns as felling

at such an early stage diminishes the economic potential of

the plantations.

To address the issue of Nyssaceae harvesting, Ha Cong

Tuan, Deputy Minister in the Ministry of Agriculture and

Rural Dvelopment (MARD), signed a Decision (No. 2962)

providing regulations for Nyssaceae harvests.

The new regulations are seen as demonstrating the

determination of government to improve the current

obstacles in the national wood processing industry and to

promote sustainable harvesting and export of certified

wood products.

According to the Forestry Administration worth wood

product exports were almost US$7 billion in the first 6

months of 2019.

The General Statistics Office (GSO) has reported that in

the second quarter of 2019 the central plantation forest

area was estimated at 78,000 ha a decline of around 5%

compared to the same period of 2018. These plantations

produced around 7 million cu.m.

See: http://fpabinhdinh.com.vn/tinh-hinh-xuat-nhap-khau-go-vasan-

pham-tinh-den-trung-tuan-thang-7-2019/

8. BRAZIL

Furniture sector strategy to promote

export

There is a prominent furniture cluster in Bento Gonçalves

and the Bento Gonçalves Furniture Industry Union

(SINDMÓVEIS) has started to support training in export

marketing.

The first training course focused on export-related issues

such as risks and costs, production capacity, quality and

brand image as well as tax incentives for exporters. Other

topics include global market strategy and development,

international marketing plans and promotion of Brazilian

brands abroad.

In comments to the local media a spokesperson for

SINDMÓVEIS said the first export training programme

involves four seminars until year end.

Drop in June domestic furniture sales

After an almost 16% year on year increase in May 2019

domestic furniture sales fell in June, the first decline in the

second quarter. Up to May this year the accumulated sales

growth was around 8% and the annualised rate rose

slightly.

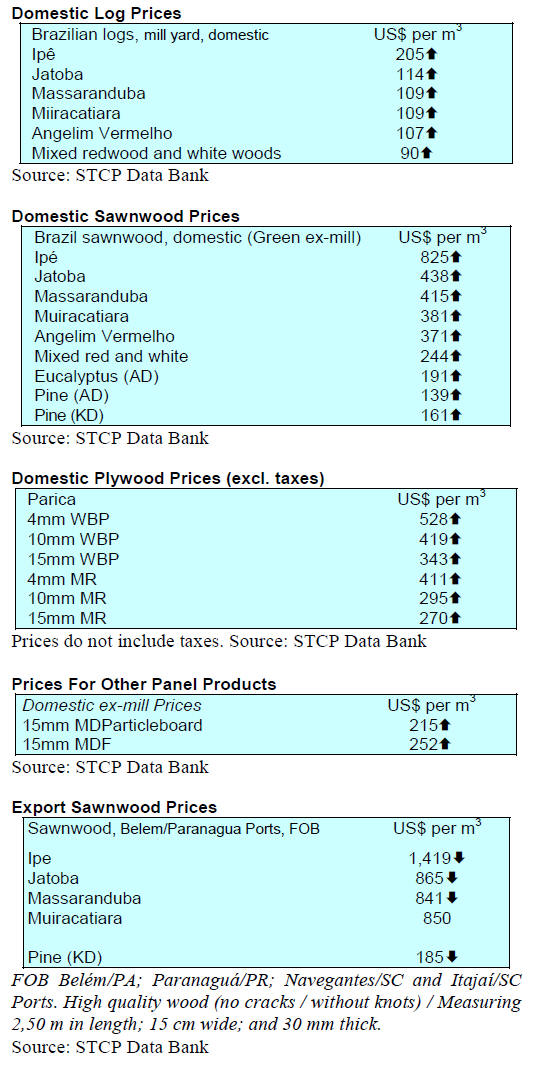

Export update

The value Brazilian exports of wood-based products in

June 2019 (excluding pulp and paper products) fell 12%

year on year from US$263.4 million to US$230.6 million.

The value of June 2019 pine sawnwood exports dropped

around 5% year on year (2018 June US$45.5 million and

2019 June US$43.4 million). In volume terms exports

increased 11% from the same period in 2018 from 214,200

cu.m to 237,700 cu.m.

Tropical sawnwood exports also fell in June dropping 14%

in volume, from 47,400 cu.m (June 2018) to 40,800 cu.m

in June 2019. But in terms of value exports dropped

almost 19% from US$19.1 million to US$ 15.5 million.

The downward trend in exports continued with pine

plywood which recorded a 36% fall in the value of exports

in June 2019 in comparison with June 2018, from US$60.8

million to US$38.7 million. Export volumes also fell but

by a lesser amount dropping 10% from 173,700 cu.m in

June 2018 to 155,700 cu.m this June.

The decline in exports was even more severe for tropical

plywood as export volumes fell 39% and export values

dropped a massive 46% from 11,600 cu.m (US$1.2

million) in June 2018 to 7,100 cu.m (US$ 2.8 million) in

June 2019.

Adding to the bad news, wooden furniture export earnings

fell from US$49.1 million in June 2018 to US$43.4

million in June 2019, an almost 12% decline.

Furniture production in Rio Grande do Sul higher than

national average

The July 2019 report on Brazil’s foreign trade in furniture

published by the Market Intelligence Institute (IEMI)

shows that between January and May, 2019 furniture

production in Rio Grande do Sul expanded around 8%,

higher than the national industry average.

According to the Brazilian Institute of Geography and

Statistics (IBGE), over the past 12 months furniture

production in Rio Grande do Sul expanded around 8%

while at the national level there was a decline. The three

southern states, Santa Catarina, Rio Grande do Sul and

Paraná are the top 3 in terms of furniture exports

accounting for 86% of the national total. A further 10% is

exported from São Paulo.

The main export markets in June were the US, with 18%

of exports, followed by the UK, 13%, and Uruguay, 13%.

In June there was a spike in exports to Bolivia.

Strong demand for pulp lifts Mato Grosso do Sul

exports

According to the Mato Grosso do Sul Federation of

Agriculture and Livestock (FAMASUL) during the first

six months of 2019 forest product exports from the state

increased by 12% over the same period of the previous

year.

According to FAMASUL this increase was due to the

increased international demand especially from China

which accounted for about 60% of all wood product

exports. There is a large area of eucalyptus plantations in

Mato Grosso do Sul extending over around 1 million

hectares and exports are mainly of wood pulp.

9. PERU

New President for exporters

association

The Association of Exporters (ADEX) has announced the

resignation of its president Alfonso Velásquez. In

accordance with the association’s constitution the first

Vice President, Erik Fischer, will assume the leadership of

the export union and will serve until 31 March 2021.

Fischer, according to ADEX, is a promoter of forest

governance in Peru and defender of the Forest

Development Executive Board agenda. This is the first

time that ADEX has a president specialising from the

forestry sector.

Promoting the use of legal wood products

Taking advantage of the 2019 Pan American and Para-Pan

American Games to be held in Lima the National Forest

and Wildlife Service (SERFOR) will mount a campaign

‘Casa Peru’ with the aim of promoting the use of legal

wood products. It is government policy to prioritise the

forestry sector because it has high economic potential.

The theme of ‘Casa Peru’ is to promote the domestic use

of legal wood in architectural projects and for wooden

items for the home. Samples have been manufactured from

wood from well managed forests and come with details of

traceability and are for display to the public.

The use of Amazonian species such as capirona, anacaspi,

shiahuahuaco, quinilla, yacushapana and others, which are

sustainably managed, will be exhibited.

Particleboard imports up 13%

Between January and May 2019 Peruvian imports of

composite panels were worth US$42.23 million, a 13%

year on year increase. Ecuador was the main supplier

followed by Chile and Spain. Recently producers in Brazil

have secured market share in Peru.

Forest fires a challenge for SERFOR

According to SERFOR more than 30 forest fires have been

reported over the past month. Fires have been reported in

the Departments of Amazonas, Cusco, Apurímac, Puno,

Ancash, Huancavelica, La Libertad and Ayacucho. Some

fires were burning in the altimontano mountain forest, an

ecosystem that is very vulnerable to fire, but these have

been controlled. Forest fires in the country are mostly

caused by farmers clearing the land.