Japan

Wood Products Prices

Dollar Exchange Rates of 10th

July

2019

Japan Yen 108.46

Reports From Japan

¡¡

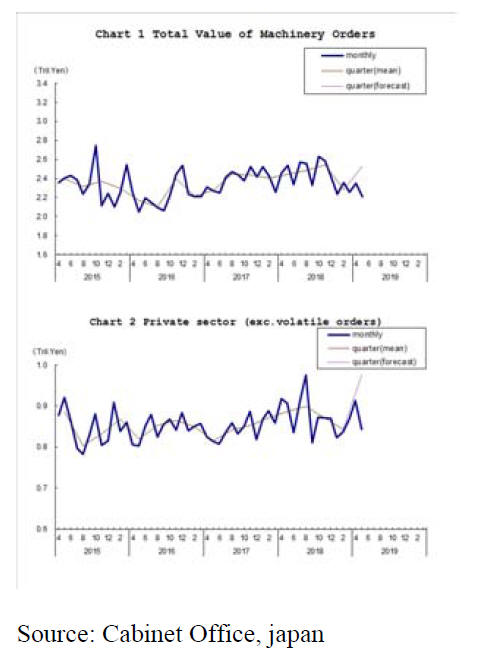

Companies ease-up on expansion

The May monthly survey of Japan¡¯s machinery orders, an

indirect measure of private sector confidence for mediumterm

economic expansion, dipped the sharpest for the past

eight months. Machinery orders, while admittedly a

volatile data series, fell by almost 8% in May from the

previous month.

Global trade tensions are causing Japanese companies to

scale back on investment and there is doubt that domestic

demand can fill the gap in weakening export earnings.

This downturn in private sector spending undermines

prospects for achieving 2% inflation, the Bank of Japan¡¯s

target.

See: https://www.esri.cao.go.jp/en/stat/juchu/1905juchu-e.html

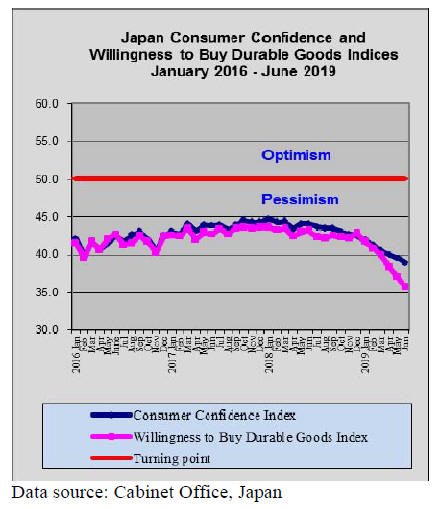

Election

The campaign for Japan's upper house election is

underway and voting will take place on 21 July.

Opposition parties, pointing to falling consumer

confidence, have strongly criticised the government after a

report from a government expert panel said the state

pension is insufficient and because of the government¡¯s

plan to raise the consumption tax this year.

This plan has raised alarm because previous tax hikes in

1997 and 2014 were followed by serious economic

downturns.

Long May holiday boosted spending

Household spending in Japan rose at the fastest pace in

four years in May. A recovery in private consumption is

seen as vital in Japan¡¯s fight against deflation. Household

spending grew 4% in May from a year earlier.

Behind the unexpected rise was the 10-day public holiday

in May. Data shows the growth in household spending was

driven mainly by accommodation bills, mobile phone

charges, transport costs and electricity charges.

Analysts point out that the risk is that consumer spending

will worsen as sentiment appears to be weakening because

wage growth has stalled and there is uncertainty over the

economic outlook. The planned consumption tax increase

set for October could drive up spending temporarily as

consumers try to beat the rise by buying early.

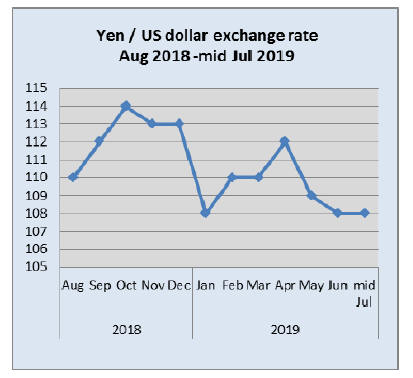

Yen still firm despite opening of US/China

trade talks

The Japanese Yen experienced an unusual level of

volatility in the first half of this year with a marked surge

in strength as the ¡®safe-haven¡¯ effect kicked in due to

rising risks in the global economy. However, by May the

risk notion had diminished and the yen/dollar exchange

rate steadied to move in a narrow range around 108 to the

dollar.

In June good data from the US lifted US stocks and the

likelihood of a cut in US interest rates further boosted US

stocks. Despite positive news on the US/China trade talks

the yen continues to be rather firm suggesting there is still

money seeking safety in the Japanese currency.

900 Japanese towns no longer viable by 2040

The data from the 2018 survey by the Japanese

government has shown that, excluding resident foreigners,

the population is now 124.8 million, the lowest since the

survey began in 1968.

With fewer than 1 million births in Japan for the third

straight year in 2018 the population dropped a record

433,239, the 10th straight year of decline.

The number of registered foreign residents, meanwhile,

increased to 2,667,199, up 169,543 from a year earlier,

with all 47 prefectures seeing a rise in the figure as

companies are turning to people from overseas to deal

with a severe labour shortage because of Japan's rapidly

aging population and declining birthrate.

People aged 65 or older accounted for 28% of the entire

population. The ratio of people aged between 15 and 64

who are regarded as working population was just over

50% and continues down.

The population decreased in 42 prefectures as the urban

drift accelerates with young people flocking to the big

cities. The most visible impact of the population decline is

in the countryside, with millions of empty homes and vast

areas of unworked farms. It has been estimated that at the

current rate of rural depopulation nearly 900 towns and

villages across Japan will no longer be viable by 2040.

Import update

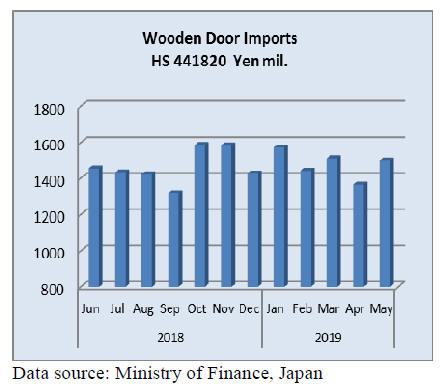

Wooden door imports

The value of Japan¡¯s May imports of wooden doors

(HS441820) was down 4% year on year but up 10% from

April. The top three shippers accounted for over 80% of

May imports with manufacturers in China accounting for

61% of May imports followed by the Philippines (18%)

and Malaysia (6%).

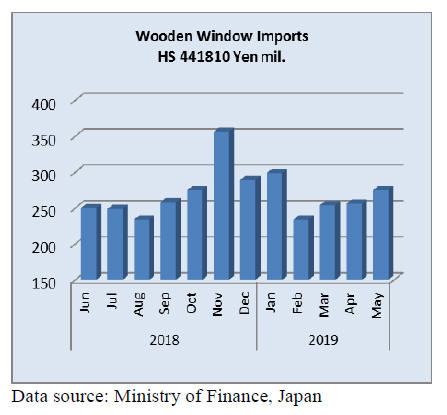

Wooden window imports

Japan¡¯s imports of wooden windows (HS441810) are not

very large but from the beginning of the year there has

been a steady rise in the value of imports. The value of

May imports were up 7% year on year and month on

month May imports rose by the same amount.

The three main shippers are China (39% of imports) the

US (27%) and the Philippines (20%). Sweden is a regular

supplier of windows to Japan and in May the value of

shipments added a further 8% to total imports.

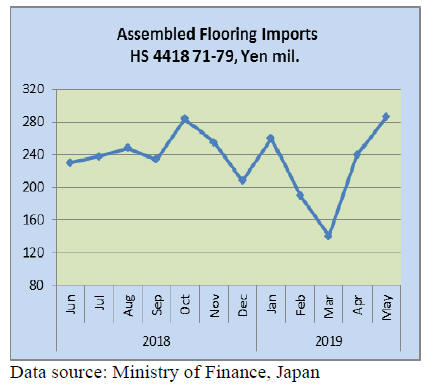

Assembled wooden flooring imports

A range of categories of assembled wooden flooring is

imported into Japan being in the range HS441871-79.

HS441875 accounted for 68% of May imports with China,

Indonesia, Thailand and Malaysia being the top shippers in

order of magnitude.

Imports of HS441879 accounted for a further 22% of May

import values with Indonesia, Germany and Thailand

being the top three shippers.

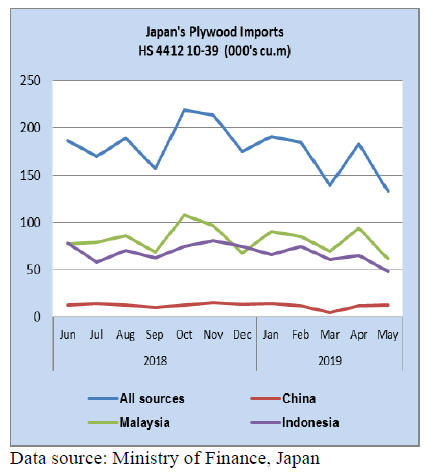

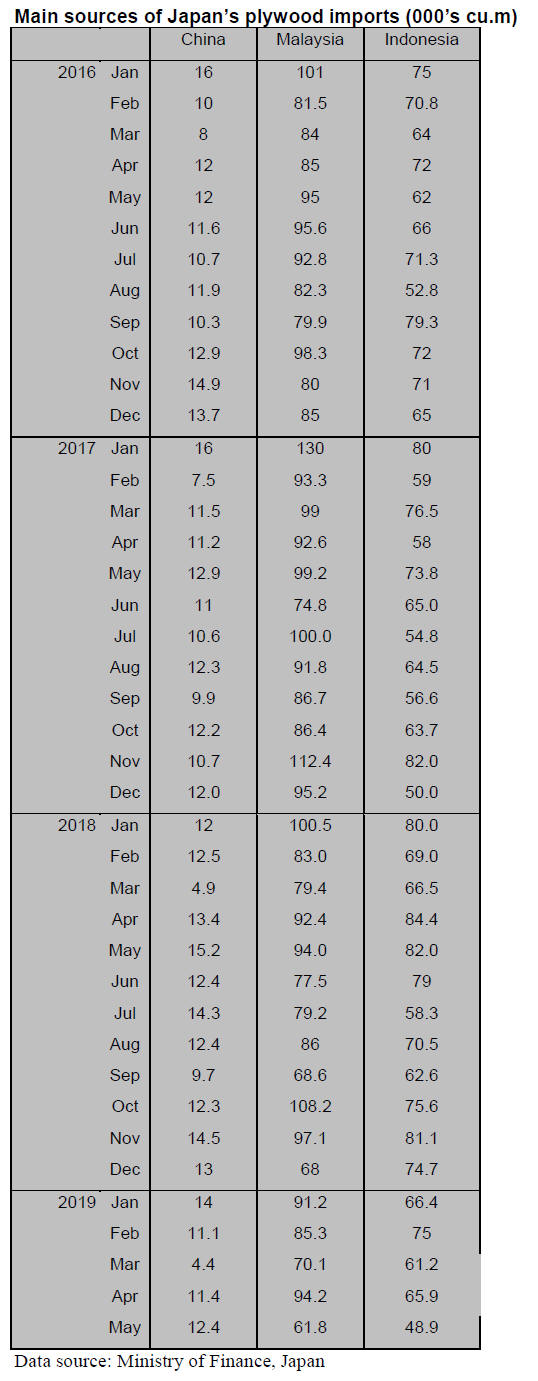

Plywood imports

There are major changes taking place in Japan¡¯s plywood

importing sector brought on by falling production in

Sarawak and to log supply issues in Indonesia.

The volume of May plywood imports dropped a massive

37% year on year, imports were also down 27% from

April. The Biggest losses were recorded in shipments

from Malaysia which were down 34% year on year and

also -34% month on month.

Shipments from Indonesia dropped 40% year on year in

May and were down 26% compared to the volume of

April imports. China ships some plywood to Japan but is

not a major supplier. The volume of May shipments from

China dropped 20% year on year but rose 10% month on

month.

As in previous months, imports were dominated by HS

441231 accounting for 88% of all May imports. HS441233

and 34 contributed 5% each with another 2% being

HS441239.

Tropical log imports forecast to drop

further in 2019

The Japan Lumber Journal (vol. 60 No. 13J) has reported

that, at its most recent meeting, the Japan Southsea

Lumber Conference discussed the issue of declining

supply of and weakening demand for tropical logs in

Japan.

The JLJ says Japan¡¯s imports of logs from PNG in the first

four months of 2019 increased mainly to substitute for

logs that were coming from Sabah before the introduction

of the log export ban.

The meeting heard that the current government in PNG

has a policy of encouraging domestic processing and that

this may affect future supplies of logs to Japan.

The meeting learned that some Japanese companies are

trying to expand veneer imports from Sabah while others

are testing imports of plantation timbers such as acacia and

falcata.

For 2019 the delegates forecast the supply of tropical

timber in 2019 at around 140,000 cubic metres, almost

10% less than in 2018.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

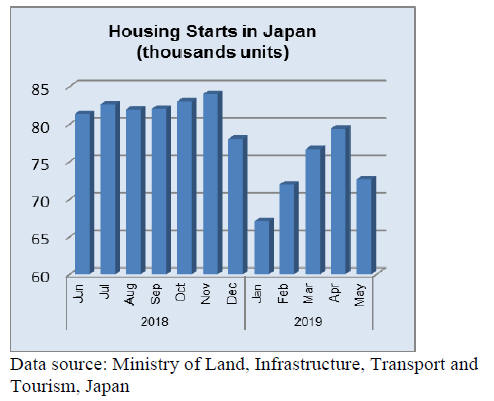

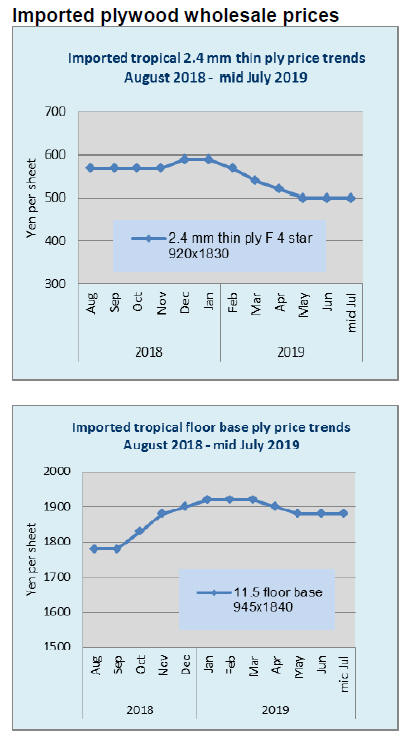

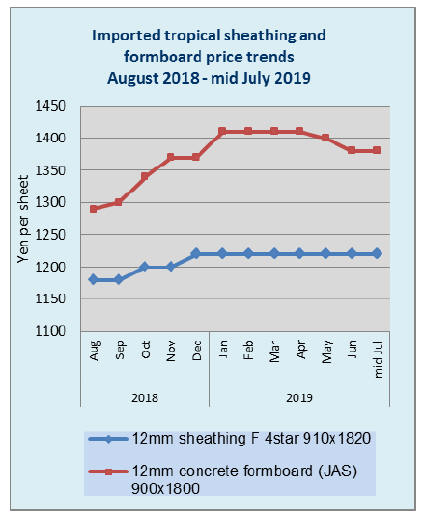

Performance of building material trading firms

Sales of four building materials trading firms, Itochu

Kenzai Corporation, SMB Kenzai Co., Ltd, Sojitz

Building materials Co., Ltd. and Tomen Materia

Corporation and Sumitomo Forestry for the term ended

March 2019 are almost unchanged from the last term but

the profit declined.

The largest reason is soaring cost of imported hardwood

plywood in the second half of the year and they failed to

pass higher cost onto sales prices by weak market. Also

new housing starts decreased by 2.3% so sales of building

materials were slow.

Total sales by five companies are 1,220.5 billion yen,

2.3% more than the last term. Ordinary profit increased by

three billion yen is by large increase of Sumitomo Forestry

and that of remaining four companies is 11.2% less than

last term.

Sales increased by 27.7 billion yen out of which plywood

business was 16.3 billion yen (2.4 billion yen of domestic

and 13.9 billion yen of imported plywood). Non-wood

materials were 9.9 billion yen. Construction and materials

were 3.2 billion yen. Wood products were 2.6 billion yen

and house appliances were 300 million yen.

Almost half of increased sales were imported plywood.

First half was booming then the cost of thin plywood and

floor base soared in the second half and they failed to pass

the high cost onto sales prices so they suffered large loss

to wipe out profit in the first half.

Construction and related materials were good.

Renovation

business did not grow. Home appliance business is flat.

In sales, Sumitomo Forestry is the top with 378 billion yen

and SMB Kenzai is the second with 338 billion yen.

Itochu Kenzai was the third with 308 billion yen.

Sumitomo Forestry shifted overseas manufacturing

business to the building materials division and New

Zealand manufacturing business transferred tree plantation

business to subsidiary company and 8.4 billion yen of

profit by transfer is listed as ordinary profit, which pushed

the profit up.

Itochu Kenzai made profit in all the business but plywood

so total profit decreased but three subsidiary companies

registered sales of 28.6 billion yen with ordinary profit of

one billion yen so consolidated sales are 330 billion yen

with current income of 2.9 billion yen, which are the

record high.

Marutama starts Hokkaido fir plywood

Marutama Plywood (Abashiri, Hokkaido) has finished test

manufacturing of local fir plywood (4 mm, 4x8) and will

take orders as soon as manufacturing line is maintained

properly hopefully sometime within this year. It also plans

to manufacture plywood with unused local hardwood logs

(4 mm, 3x6).

Japanese plywood manufacturers are developing nonstructural

plywood and this is the first case of medium

thick panel made by all local Hokkaido species.

The trial product is three plied fir plywood. This size of 4

mm 4x8 has been used as base of decorative plywood,

which is unique size of South Sea hardwood plywood. It is

used as interior finishing panel of 2x8 with sliced veneer

cover or printed surface. It will manufacture 4 mm 3x6

local white birch plywood.

Trial products are 100% birch three plied panel and face

and back with birch and larch core.

In Hokkaido, stock of hardwood is 385 million cbms but

only 576,000 cbms are harvested, which is 26% of total

domestic hardwood.

Actually Hokkaido hardwood is only used for high quality

products like furniture and sliced veneer so development

of unused hardwood is Hokkaido¡¯ challenge for many

years and now Marutama stepped up to try manufacturing

birch plywood.

Marutama has several log yards, where logs are sorted by

use like lumber, plywood and wood chip. Sorted logs are

sent to plywood mill. So far, logs are mainly larch and fir

but now unused hardwood species are gathered in log

yards.

The largest reason of developing unused specie is

declining trend of South Sea hardwood plywood supply

and demand of floor base and concrete forming panel

relied on South Sea hardwood plywood and now Japanese

mills need to find substituting source for these items.

Marutama has been manufacturing structural plywood

with local larch but it also has been manufacturing nonstructural

plywood for floor base, sheathing panel and

concrete forming at the second plant.

South Sea logs and lumber

South Sea log import for the first four months were 45,143

cbms, about 2.2 times more than the same period of last

year. Domestic plywood manufacturers are able to build

up two to three months log inventories.

Orders on laminated free board were active in April and

May due to dropping inventories while the supply is

recovering since late June. Indonesian suppliers are

anxious to export due to weak Indonesian currency.

|