3.

MALAYSIA

ASEAN determined to conclude

Regional

Comprehensive Economic Partnership

Leaders of the Association of Southeast Asian Nations

(ASEAN) are determined to conclude the Regional

Comprehensive Economic Partnership (RCEP) this year

according to the chair of the recently concluded 34th

ASEAN Summit held 23 June in Thailand.

“All member states agreed that the RCEP is important for

this region because of the uncertainty of the world

economy. The partnership will be an important strategy to

drive members’ GDP growth and attract investments to

ASEAN”, said Thai chairperson, Lt. Gen. Werachon.

The RCEP comprises all 10 ASEAN members plus China,

Japan, South Korea, India, Australia and New Zealand

which have a combined population of 3.56 billion, with

trade worth US$10.3 trillion or 29% of the world’s trade.

For more see

https://www.bangkokpost.com/business/1699944/aseanleaders-

back-thai-push-for-rcep-deal

Development of commodities sector the focus of

government

The Federal Government intends to focus on expanding

the commodities sector of the economy (including timber)

according to the Minister of Primary Industries. To

support this the ministry is seeking a bigger budget

allocation under the 12th Malaysia Plan (2021-2025).

Minister, Teresa Kok, called on players in the

commodities sector to come with proposals for increasing

output as this, in turn, will boost government revenues.

Sarawak to maintain forest cover

Sarawak Chief Minister, Abang Johari Tun Openg, said

the State government would continue to maintain the 63%

forest cover in the state because of the important role the

forestry sector has in the State.

He said the government has a very clear land use policy

under which six million hectares is permanent forest

reserves while another one million hectares is totally

protected areas.

He added that the State government would implement

policies to restore and regenerate degraded forests,

including swamp forest using indigenous tree species. He

also said the government would allocate funds for forestry

R&D and work with the private sector to further develop

Sarawak’s forestry resources in a sustainable manner.

In related news, the Sarawak Forest Department Director,

Hamden Mohammad, said his Department had planted an

area of 528,238 hectares covering hills, swamps and

coastal area forests in collaboration with various

stakeholders.

Seeking new markets and raw materials – MTC to open

new offices

Richard Yu, the Malaysian Timber Council (MTC) CEO

has stated that the MTC will open regional offices in

Houston and Rotterdam to promote Malaysian wood

products and to help Malaysian companies source raw

materials. The Rotterdam office is set to open in mid-year

while the Houston office could be operational in the

second half of the year.

Yu said the European office would cover the Middle East

and African countries adding that the function of the new

offices will be aligned to widen MTC’s access to niche

markets and new raw material sources.

In a related development Yu announced that the function

of the MTC office in Bengaluru, India will be expanded to

cover South Asia while the MTC office in China will now

cover East Asian countries such as South Korea, Taiwan

(P.o.C) and Japan.

Sabah working with NGOs to restore forests

The Sabah Chief Minister, Mohd. Shafie Apdal, said to

enable the sharing of expertise in planting local species,

the State, through the Sabah Foundation, would support

non-government organisations (NGOs) in carrying out

activities to conserve the forest areas in the State.

In November 2012, the Sabah State government and the

Tropical Rainforest Conservation and Research Centred

(TRCR) signed an agreement on cooperation towards the

sustainability of the forest in Sabah. TRCR is an NGO

which was entrusted to protect the Dipterocarp tree species

in Sabah through reintroducing it to its original habitat.

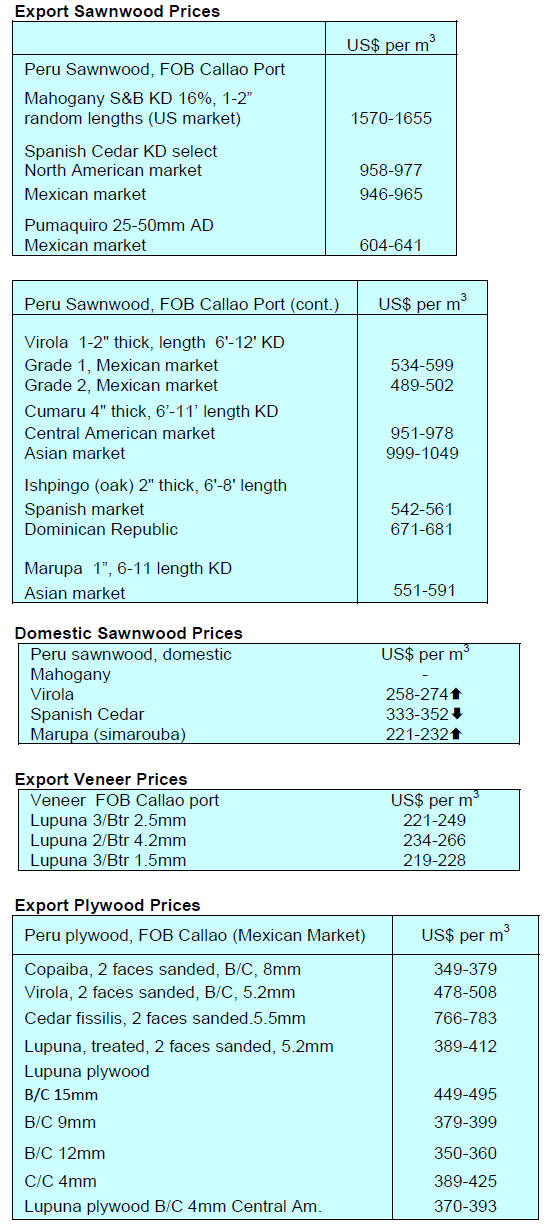

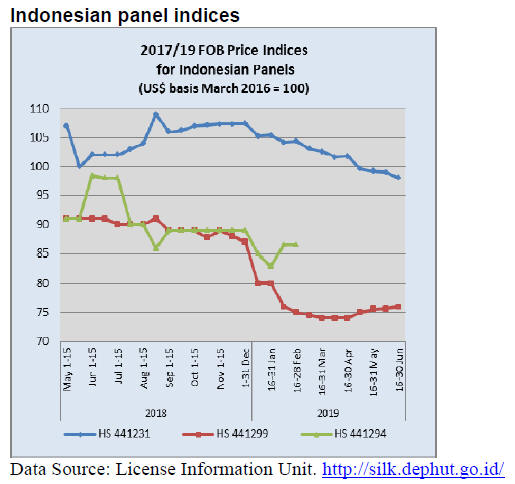

Plywood prices

Plywood traders based in Sarawak reported the following

June export prices.

4.

INDONESIA

Government sees opportunities

in trade conflict –

offers to help exporters

President Joko Widodo recently met with business leaders

to offer government assistance to local industries trying to

secure opportunities created by the ongoing trade conflict

between the US and China. He told members of the

Indonesian Chamber of Commerce and Industry (Kadin)

and the Indonesian Young Entrepreneurs Association

(Hipmi) that efforts must be focused on economic matters

now that the election is over.

He called on the business community to offer policy

suggestions which would help the country benefit most as

there are opportunities in the electronics, textile and

furniture markets in the US.

Permanent moratorium on forest clearing

Forestry and Environment Minister, Siti Nurbaya Bakar,

has indicated her preference to permanently maintain the

ban on forest clearing for oil palm plantations.

Since 2011, there has been a moratorium on clearing

covering more than 60 million hectares of primary forest

and peatland in an effort to reduce emissions from fires

caused by deforestation. Every year fires break out on

peatland forests drained for agriculture.

See: https://www.eco-business.com/news/indonesia-to-fixtemporary-

ban-on-new-forest-clearing-for-plantations-andlogging/

Responding to the comments by the Minister the

Association of Indonesian Forest Concessionaires (APHI)

agreed with suggestion of a permanent moratorium saying

the existing production forest area for timber production is

enough if it managed well. At the same time, once again,

APHI asked the government to allow the export of

planation logs and wood chips to help address the

country’s trade deficit.

Indroyono, speaking on behalf of APHI, said the shortterm

solution to Indonesia’s trade deficit is to optimise the

use of natural resources and encourage exports.

He pointed out that in meetings with South Korean

companies there was great interest shown in securing raw

material and chips from Indonesia as they do from

Vietnam.

Platinum Teak – 30cm in 5 years

‘Platinum’ teak, developed by the Indonesian Institute of

Sciences through tissue culture, can become the mainstay

of Indonesia’s furniture exporters because ‘platinum’ teak

is different from other teak say analysts. Platinum teak has

been found to grow to a diameter of 30 cm in just 5 years.

See:

https://economy.okezone.com/read/2019/06/23/320/2069822/kay

u-jati-platinum-andalan-baru-ekspor-furnitur-indonesia

Expansion of customary forests held back by land

rights issues

The Ministry of Environment and Forestry is targeting the

establishment of Customary Forests to provide income

sources and employment in rural areas. The Minister, Siti

Nurbaya Bakar, said the process of establishing such

forests will likely be lengthy as many stakeholders are

involved.

Siti said her Ministry took the initiative to determine the

area of customary land so that the establishment of

customary forest areas can be undertaken. The area

targeted consists of around 380,000 ha. of State Forest,

Other Use Areas covering 68,935 hectares and existing

Customary Forests of 1,950 hectares. Activities will be

undertaken initially in Sumatra, Java Bali Nusa Tenggara,

Kalimantan, Sulawesi, Maluku and Papua.

In related news, according to government officials efforts

to hand back control of customary forests to indigenous

people is being hampered by overlapping land claims for

mines, plantations, forests and public land.

The Indonesian President vowed to return 12.7 million ha.

of land to indigenous people following a historic 2013

court ruling lifting state control of customary forests but

land rights activists say the progress has been is slow

because of boundary issues.

Prabianto Mukti Wibowo, Assistant Deputy Minister for

Forest Governance in the Ministry, said there are too many

maps. Apparently there are 85 thematic maps for forestry,

mining, plantations and customary forests, many with

overlaps which need to be reconciled on the ground.

5.

MYANMAR

Myanmar, 51st PEFC member

The Myanmar Forest Certification Committee (MFCC)

and PEFC International have announced the conclusion of

PEFC membership for the MFCC. The MFCC is the

latest and 51st national member of the PEFC Alliance said

Ben Gunneberg, CEO of PEFC International.

Under a banner headline: “Myanmar’s forests gain

visibility through PEFC membership” the PEFC CEO said

“It is great to see that the collaboration with MFCC has

been successful and has already led to the acceptance of

Myanmar as a member. We are collaborating with MFCC

on a three-year project to support the country as it

transitions to the sustainable management of its forests.

The project is co-funded by the Prince Albert II of

Monaco Foundation.

See: https://www.pefc.org/news/myanmars-forests-gainvisibility-

through-pefc-membership

Commenting on this significant step, Barber Cho,

Secretary General of MFCC, said “Forest management is

not a matter of one country or one region anymore it is a

global issue”.

He continued “By becoming a PEFC member, we send a

message to the world and show our commitment to

sustainable forest management through an internationally

recognised system”.

However, this is just the beginning said Cho who reemphasised

MFCC’s aim of establishing a fully

operational national forest certification system in line with

PEFC standards within a few years.

Certification and sustainable forest management are of

special importance in Myanmar. In the last thirty years,

forest cover in Myanmar has fallen from 60% to 40%.

A sharp decline in forest cover was seen in the period

when forests in Myanmar were exploited for quick

economic returns rather than long-term sustainability,

explained Cho.

Cho stressed that forest resources are of enormous value

for the people of Myanmar as many in the country are

heavily dependent on forests for their basic needs. In

meeting these needs Cho stressed the participation of civil

society groups who can contribute to the development of

forest management systems.

To move forward with CSOs in the country there are

several challenges, one of which is the financial strength

of the MFCC.

At present no forest in Myanmar is certified to any

certification system and the forest are administered and

conserved by Forest Department through Work Plans.

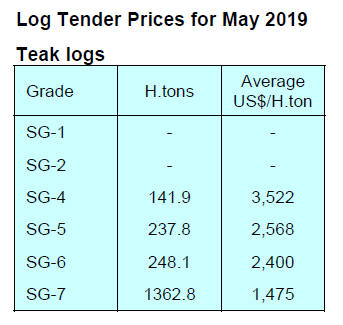

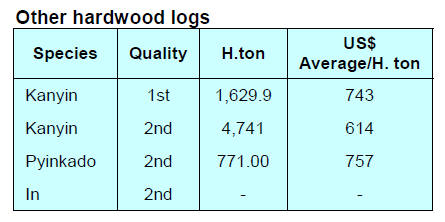

Log harvest target revisited

On 21 May 2019, the Permanent Secretary of Ministry of

Natural Resources and Environmental Conservation said

that log extraction will be reduced gradually. It was

proposed that teak log harvests will be 10,000 tons in

2019-20, 8,000 tons in 2020-21 and 6,000 in 2021-22. For

other hardwoods harvests will be 300,000 tons in 2019-20,

250,000 tons in 2020-21 and 220,000 tons in 2021-22.

Issue of ‘CoC Dossier’ unresolved – causing major

problems for exporters

During the past seven months of the current budget year

the export of forest products was valued at US$102

million. Myanmar exporters are facing tough times in the

international markets especially the EU where the EUTR

is impacting market access.

Exporters complained that EU buyers continue to refer to

the so-called ‘CoC Dossier’ and demand many documents

to verify the legality of shipments some of which are not

readily available as most of the documents are held by

district offices. This issue would be resolved when all

information related to each harvest was computerised, this

is currently being piloted.

Exporters are anxious that third party certification should

be in place as soon as possible so they can maintain

exports to international markets.

The ‘CoC Dossier’ was compiled at the beginning of this

year by Ministry of Natural Resources and Environmental

Conservation merely to demonstrate the multiple steps

along the supply chain from the pre-harvest planning to

the shipment. It was never intended that all documents

identified along the supply chain in the Dossier would be

provided to overseas importers.

Production costs set to rise as power charges raised

The government has announced a significant increase in

electricity prices from July but will retain some subsidies

in an effort to protect low-income households.

The increase announced in state media is the first price

hike since 2014 and will help to reduce electricity

subsidies that have ballooned to K630 billion in the 2018-

19 fiscal year and were expected to hit K1.5 trillion

annually if prices remained unchanged. Industry,

businesses, government offices, embassies and

international organisations will be charged substantially

more.

6. INDIA

A boost to the ‘Green Building

Movement’ in India

The Confederation of Real Estate Developers’

Associations of India (CREDAI) has signed a

memorandum of understanding (MOU) with the Indian

Green Building Council (IGBC) to accelerate the push

towards the Green Building Movement in the country.

The MOU will also see the two organisations come

together and construct green building projects in five

cities. By joining forces, CREDAI and the IGBC intend to

collaborate and share knowledge and extend industrial

support to reinstate the importance of constructing

environmentally friendly buildings for sustainable growth

of the Indian real estate sector.

See press release at :

https://credai.org/press-releases/credai-signs-mou-with-igbc-toaccelerate-

green-building-movement-in-india

Calls for re-think of Forestry Act 1927 amendments

Less than a month after the Bharatiya Janata Party (BJP)-

led National Democratic Alliance government was sworn

in for a second consecutive term parliamentarians are

calling for a rethink on the draft amendments to the Indian

Forest Act, 1927. Principal among the concerns is that the

National Forest Policy should be agreed before any

amendment to the Indian Forest Act of 1927.

The parliamentarians avoided commenting on the draft

amendment which is controversial because it would

classify commercial plantations as forests and because the

amendment would authorise state governments to relocate

people living in areas of forest where development or

conservation efforts would be directed.

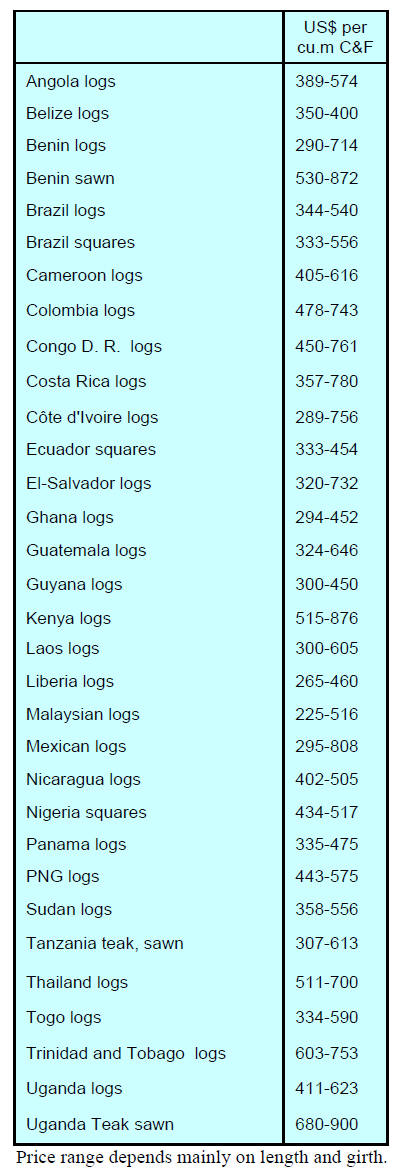

Plantation teak imports

Analysts report signs of change amongst teak importers. It

appears that many importers are gradually beginning to

see a business advantage in importing durable hardwood

alternatives to teak.

Behind this change is the continuing weak demand for

teak products and the financial burden of rising production

costs and the high tax rates. To help reduced transaction

costs concerted efforts are being made by importers’ to

ease the advance payment requirements demanded by

exporters.

While the rupee/US dollar exchange rate favours

importers, African and Central American shippers are

trying to attract buyers but market conditions are working

against any immediate increase in imports.

C&F prices teak at Indian ports from around the world are

shown below.

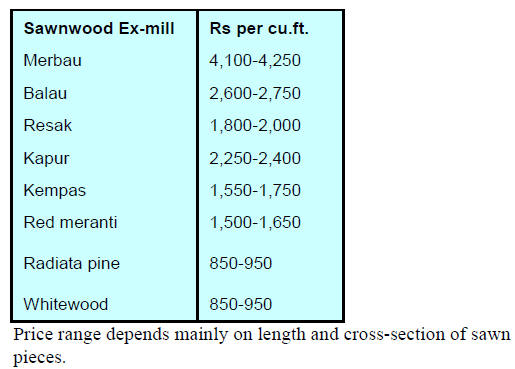

Locally sawn hardwood prices

Imports of tropical sawn hardwoods as well as softwood

are steadily rising as manufacturers find the quality, kiln

drying and ease of processing more profitable than from

using domestic sawnwood.

Malaysia continues to be major supplier of sawn tropical

hardwoods to India. Import prices have not changed for

the past few months being held down by weaker demand

in other markets affected by the US/China trade conflict.

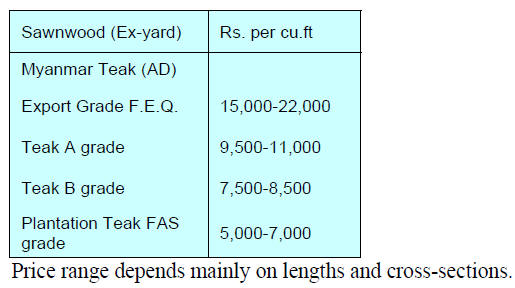

Myanmar teak prices

The steady demand for Myanmar teak has consolidated the

recent ex-yard price increases.

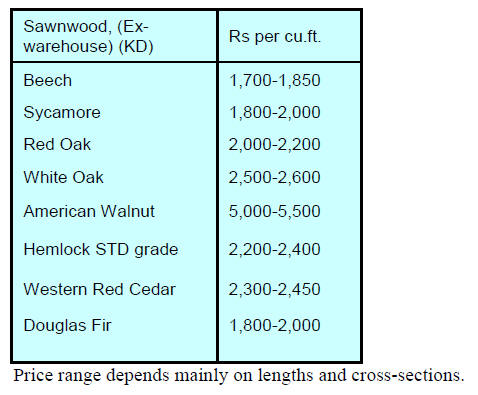

Sawn hardwood prices

The recent ex-warehouse price increases for European and

N. American temperate hardwoods and softwoods remain

unchanged.

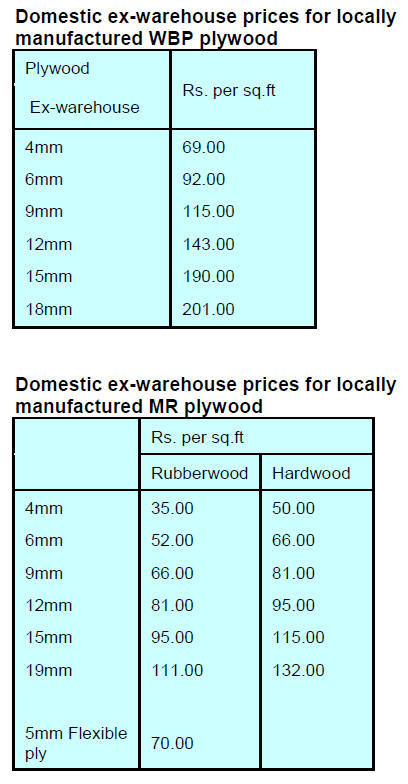

Plywood prices

Rising log and other raw material input costs ares causing

headaches for plywood manufacturers and is driving down

profit margins. Against the backdrop of dull market

conditions there are no opportunities to raise prices.

In recent months some millers have reported a shortage of

labor and this has resulted in cuts in production at some

mills.

Bamboo can substitute for wood in some

end-uses

At the recent World Bamboo Workshop 2019 the

Executive Director of World Bamboo Organization

(https://worldbamboo.net/) Susanne Lucas called for more

use of biodegradable products such as bamboo.

She also announced that WBO and government of

Manipur, through the Chief Minister will be signing the

Damyang Call Imphal Reiteration, ‘to recognize the

essential contribution of bamboo in the fight against

climate change, to free bamboo from the restrictions of

outdated national forestry codes to stimulate social and

economic developments and to support research, exchange

knowledge and improve communication on bamboo

development for the sake of all humanity’.

Analysts write “Bamboo harvests can substitute for wood

in some end-uses and the growing of bamboo on fallow

farm land can provide an income for farmers and the

processing and manufacture of bamboo products generates

employment.” The north eastern areas of India produce

large quantities of bamboo and is important in regional

economies.

See: https://worldbamboo.net/news-and-events/world-bambooworkshop/

significant-results-with-the-government-of-manipurwbw

7.

VIETNAM

2018 timber imports almost 10

million cubic metres

Vietnam is increasing its imports of primary wood

products, especially hardwoods, from over 100 countries

to meet the demands of the rapidly expanding processing

sector in the country.

In 2018, Vietnam’s wood processing industry imported the

roundwood equivalent nearly 10 million cu.m of timber

that provided around 25% of the total input required by the

domestic industries. The value of this wood raw material

was US$2.34 billion in 2018 up by 7% compared to 2017.

The EU-Vietnam VPA/FLEGT is to be implemented soon

according to analysts who say this is expected to generate

many export opportunities for domestic manufacturers.

However, implementation will challenge the sourcing of

wood raw materials as Vietnam still depends on imports

from so-called ‘high-risk’ countries in terms of

verification of legality.

Most of Vietnam-made finished wood products are

exported to developed markets such as the USA, EU,

Japan and South Korea so must meet the legal and

technical requirements in these countries. This can be

achieved by utilsing domestic planation material such as

acacia, eucalyptus and rubberwood and importing verified

legal timber raw materials.

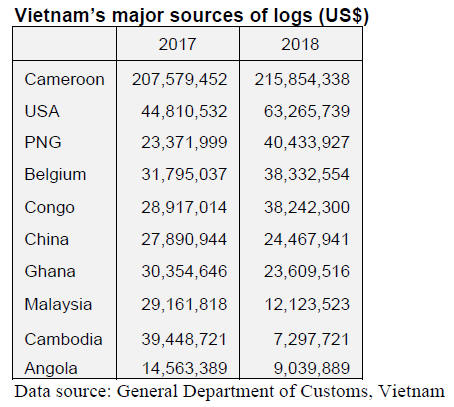

Among the top 15 raw wood supplying countries there

are

7 high risk sources in terms of legality and these currently

account for a high proportion of Vietnam’s timber imports.

The implementation of the VPA will also impact imports

of high value precious species used mainly for domestic

consumption and imported from countries with weak

forest management and law enforcement.

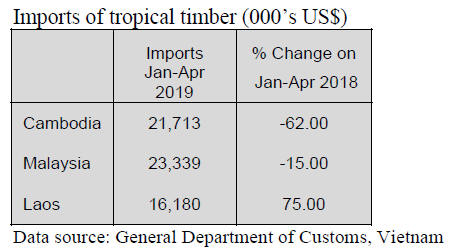

Sourcing high value species a challenge

The Vietnamese timber sector is facing to a serious

shortage of logs and sawnwood due first to the domestic

logging ban and secondly to the various restrictions and

regulations on raw material exports in many nearby Asian

supply countries such as Laos, Cambodia and Myanmar

which were once major suppliers of tropical timber for

Vietnam. The table below shows the change in import

values for three major suppliers to Vietnam.

High import prices threatens competitiveness

of

Vietnamese companies

Over the past few years there has been a rise in raw

material imports from the US, the EU and some African

countries but the Vietnamese industries complain the CIF

prices are very high and there are high logistics costs and

that this is threatening the competitiveness and

productivity of the Vietnamese companies in international

markets.

The industry is now relying more heavily on domestic

plantation resources for both exports and for domestic

sales.

8. BRAZIL

Sound environmental practices of the

forest sector in

the Amazon

With the aim of strengthening the credibility of the

Amazon timber trade Unifloresta, the Amazon Forest

Productive Chain Association, has created a system to

verify environmental practices.

Unifloresta was founded in 2009 by a group of

entrepreneurs with the objective of supporting the

economic development of the forest sector; representing

and protecting the rights and interests of its associates and

collaborators and unifying forest preservation and

environmental sustainability.

Unifloresta comprises a multidisciplinary team in

partnership with Uniconsult and the environmental law

firm Murilo Araujo. It comprises lawyers, foresters,

environmentalists, civil engineers, geologists, biologists

and lawyers who provide technical environmental services

and legal advice, contributing to a better performance of

the members.

See:

https://www.unifloresta.org.br/

The early experiences in implementing the system were

presented during the Innovative Ideas for the Wood

Construction Chain event promoted by Núcleo da

Madeira”, a non-profit initiative of representatives of

several sectors of the wood construction sector.

Through mobile tracking, data such as timber transport

documents, machinery inventory, driver and truck

identification documents, geographic coordinates,

transport routes and chain of custody are collected. The

first step in the process of supply chain management

includes document verification, the second step involves

traceability through QR Codes on logs.

In addition to traceability, the work carried out by the

Association goes further to preventive surveys in

sawmills, intelligence services, local due diligence, legal

verification program and community management. The

aim is to promote good management as this will create

greater value for producers.

National forest plantation plan adopted

The Brazilian Ministry of Agriculture, Livestock and Food

Supply (MAPA) has adopted a National Plan for the

Development of Forest Plantations (PNDF). The Plan aims

to expand forest production areas by two million hectares

by 2030, an increase of 20% over the current area.

The Regulation, Portaria No. 111, approving the PNDF

was signed by MAPA on June 5, 2019. With action plans

formulated for the next ten years, the PNDF seeks to

provide legal security for investors in the forestry sector,

recognising the economic, social and environmental

importance of the sector.

More than half of the planted forest will be internationally

certified according to the plan to address the issue of

sustainable management, natural resource preservation and

sound socio-environmental and labour practices. It is

noteworthy that around 90% of all industrial wood utilised

domestically comes from planted forests.

According to the Brazilian Institute of Geography and

Statistics (IBGE) 35% of the forest plantation areas in

Brazil are owned by pulp and paper industries; 13% by

steelworks/charcoal; 6% wood-based panels and laminate

flooring; 9% financial investors; 30% independent

producers; 4% solid wood products and 3% others.

The sector holds a stock of approximately 1.7 billion tons

of carbon dioxide equivalent according to IBGE.

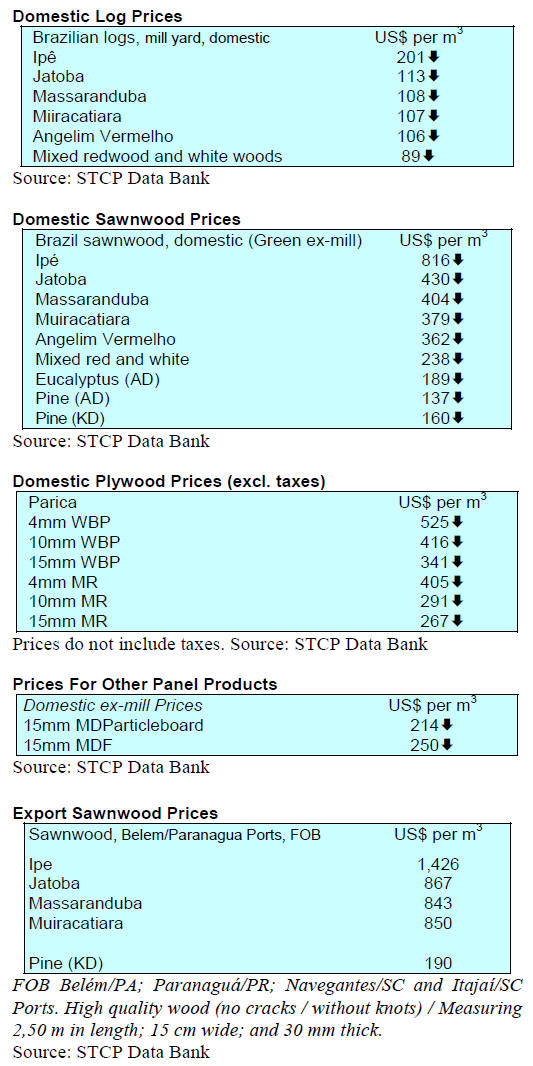

Export update

In May 2019, Brazilian exports of wood-based products

(except pulp and paper) increased 29% in value compared

to May 2018, from US$ 211.1 million to US$ 272.6

million.

The value of pine sawnwood exports increased 24%

between May 2018 (US$ 38.2 million) and May 2019

(US$ 47.4 million).

In volume terms exports increased 29% over the same

period, from 180,800 cu.m to 233,300 cu.m.

Tropical sawnwood exports increased 63.2% in volume,

from 31,800 cu.m in May 2018 to 51,900 cu.m in May

2019. In value, exports increased 49.3% from US$ 14.0

million to US$ 20.9 million, over the same period.

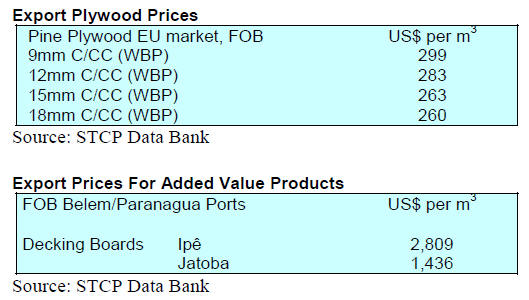

Pine plywood exports increased 4.7% in value in May

2019 in comparison with May 2018, from US$45.1

million to US$47.2 million. The volume of pine plywood

exports increased 37% over the same period, from 131,700

cu.m to 180,900 cu.m.

As for tropical plywood, exports declined in volume and

in value, from 9,600 cu.m (US$4.2 million) in May 2018

to 9,000 cu.m (US$3.5 million) in May 2019.

The performance of wooden furniture exporters was

encouraging as export values increased from US$34.2

million in May 2018 to US$47.8 million in May 2019, an

almost 40% rise.

Falling exports of wood-based panels

In the first quarter of 2019, exports of wood-based panels

fell by 4.5% compared to the same period in 2018

according to Brazilian Tree Industry (IBÁ).

The most significant drop was to markets in Asia and

Oceania. Sales to Europe, amounted to just US$1 million

compared to the US$2 million in the first quarter of 2018.

Exports to North America also fell dropping 23%.

Between January and March 2018 Brazil’s imports woodbased

panels was around US$17 million up from the

US$13 million in the first quarter 2018.In the Brazilian

domestic market sales rose just over 1%

‘Brazilian Furniture Project’ hosts importers

Since the beginning of this year the value of business

transactions by members of the ‘Brazilian Furniture

Project’, amounted to around US$30 million and there are

good prospects for the next 12 months as the ‘Buyer

Project’ (Projeto Comprador) export programme will work

closely with the Brazilian Furniture Industries Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (APEX-BRASIL).

The ‘Buyer Project’" fair held in mid-June in Rio Grande

do Sul, one of the main furniture exporting states in Brazil,

played host to 14 importers from 10 countries from Latin

America, North America and Europe.

The participating countries were France, Peru, Mexico,

Colombia, Paraguay, US, the UK, Italy, the Dominican

Republic and Uruguay.

ABIMÓVEL has reported that visiting importers held

discussions with 45 Brazilian furniture producers, all

members of the Brazilian Furniture Project.

ABIMOVEL has indicated it was pleased with this

important partnership for strengthening the Brazilian

furniture in the international markets as it has been

working in a structured and effective way both in

encouraging exports and improving the business

environment and in dialogue with the federal government.

So far in 2019 more than 1,500 ‘business rounds’ have

been held under the Brazilian Furniture Buyer Project.

9. PERU

Export of builders’ woodwork

The export of builders’ wood work in the first four months

of the year reached US$2.6 million, 10% more compared

to the same period in 2018 as 2017 according to the

Association of Exporters (ADEX).

The increased shipments mirror recent growth in the US

housing market. Shipments to the US between January and

April increased by almost 42% year on year.

Other significant markets were Bolivia (US$150,360,

down 34%), Mexico (US$85,500, down 28%) and Panama

(US$78,460). Builders’ woodwork was also shipped to

Belgium, Dominican Republic, French Polynesia and

Spain.

Wood for construction represents 6.5% of the total

shipments of wood products from Peru ranked third

behind semi-manufactured products and sawnwood

surpassing others such as veneers, plywood, furniture and

its parts.

Builders woodwork shipped from Peru includes doors and

frames, counter frames and thresholds; wooden posts and

beams; wooden frames for paintings, photographs, mirrors

or similar objects; windows, shutters and their frames.

Congress approves economic incentives for forest

plantations

The Parliament has approved a law to encourage forest

plantations, mainly in the Amazon region of the country,

through economic incentives.

This initiative is part of the package of bills in support of

the Agrarian Commission. The President pointed out that

the proposed incentives are for the production and

protection of the ecological system and will benefit rural

communities.

The National Forestry and Wildlife Service (SERFOR)

will publish the beneficiaries of incentives, the amounts

granted as well as the forest species, areas and the

payments received.

Information system to verify the legal origins of wood

in Loreto

To promote the governance and competitiveness of the

forestry sector SERFOR and the Regional Government of

Loreto, with the support of the USAID Pro-Forests

Project, will coordinate the implementation of National

System Control Module Applications of Forest and

Wildlife Information (MC-SNIFFS), a tool that will

provide for the traceability and verification of timber

legality. The Loreto regional authorities will coordinate

with SERFOR to establish a transparent and open

management instrument for the wood value chain.