3.

MALAYSIA

MTCC certification consultation

The Malaysian Timber Certification Council (MTCC) has

opened for public consultation their Draft Malaysian

Criteria and Indicators for Forest Management

Certification or MC&I Forest Management.

The Enquiry Draft, which is a revised and merged

standard that combines the requirements of both the

MC&I (Natural Forest) and MC&I (Forest Plantation.v2),

was finalised by the Standards Review Committee (SRC)

at its Fourth Meeting in February 2019.

The draft MC&I Forest Management Certification

maintains the similar format as the previous standards with

updated requirements through feedback received from the

first public consultation as well as the key requirements of

the ISO 17021-1 Conformity assessment – Requirements

for bodies providing audit and certification of management

systems – Part 1: Requirements, and the PEFC benchmark

standard on sustainable forest management. The major

changes to the revised MC&I Forest Management

Certification are summarised below:

Incorporation and streamlining of the

Incorporation and streamlining of the

requirements under Principle 10 of the MC&I

Forest Plantation.v2 into the corresponding

Principles 1-9 of the MC&I Forest Management

to reduce redundancy. All the requirements in the

standard apply to both natural forest and forest

plantation, with requirements that apply only to

natural forest or forest plantation clearly

specified.

Inclusion of requirement on conversion of

Inclusion of requirement on conversion of

degraded forest to forest plantation that is not

subject to the cut-off date of 31 December 2010

for conversion of natural forest to other land uses.

Stronger requirements on social aspects

through

Stronger requirements on social aspects

through

the incorporation of all core ILO Conventions

and the principle of gender equality.

Incorporation of requirements that provide

Incorporation of requirements that provide

guidance for internal audit and management

review and improvement.

Improved clarity on the requirements for

Improved clarity on the requirements for

communicating claims from certified areas.

Stakeholders are invited to submit comments

Stakeholders are invited to submit comments

and/or proposals for amendments to the Enquiry

Draft, providing justification for the proposals as

well as the suggested wordings for the proposed

changes.

The Enquiry Draft is available at: http://mtcc.com.my/wpcontent/

uploads/2019/05/LAMPIRAN-IB-Enquiry-Draft-MCIFMC.

docx

See: https://mtcc.com.my/public-consultation-on-malaysiancriteria-

and-indicators-for-forest-management-certificationenquiry-

draft/

MTCC suspends certification certificate for Kedah

A press release from the Malaysian Timber Certification

Council (MTCC) gives details of the suspension of forest

management certification for the Kedah State forest

management Unit (FMU).

An announcement on the MTCC website reads “ (The)

Certificate for Forest Management issued to the Kedah

State FMU (FMC 0003) against the requirements of

MC&I(Natural Forest) have been suspended with effect

from 8 May 2019 until further notice.

SIRIM QAS International Sdn. Bhd. made this decision

after the Kedah State FMU failed to close a major

Corrective Action Request (CAR) following the second

surveillance audit carried out by SIRIM QAS International

Sdn. Bhd. It is required that any major non-conformity

raised must be adequately addressed within the given time

for the FMU to maintain its certification.

In light of the above development, all logs sourced from

the Permanent Reserved Forests (PRFs) in the Kedah State

FMU beginning 8 May 2019 (i.e. all logs accompanied by

Removal Passes issued dated 8 May 2019 and onwards)

will not be recognised as PEFC certified material under

the Malaysian Timber Certification Scheme (MTCS).

Nevertheless, the logs originating from Kedah State FMU

can be accepted as PEFC Controlled Sources, provided

that a due diligence system has been implemented and

does not involve sourcing of logs from conversion areas.”

See: https://mtcc.com.my/suspension-of-forest-managementcertificate-

for-kedah-state-fmu/

High Conservation Value training for Sarawak

foresters

As Sarawak moves towards having all its Forest

Management Units (FMUs) certified by 2022, foresters

experienced in High Conservation Values (HCVs) Forests

identification, management and monitoring practices will

be in high demand.

The Sarawak Forest Department, the Sarawak Forestry

Corporation (SFC), the Sarawak Timber Association

(STA) and WWF-Malaysia have collaborated to produce a

set of HCV training modules to equip foresters to

contribute to the State objective.

A field testing workshop to obtain feedback on draft

modules took place at the Samling Central Base Camp and

Gerenai FMU in Upper Baram, Miri Division, in early

May. Participants gained valuable feedback from those

with knowledge or experience on HCV. The HCV

modules will undergo a stakeholder consultation in June.

Sabah export update

The latest statistics released by the Statistics Department

of Sabah show exports of major timber products for the

first three months of 2019 were worth RM265 million.

Of the total, RM59.4 million was from sawnwood exports,

(22.4% of total), RM188 million from plywood exports

(70.5% of the total) and almost RM18 million from

exports of veneer.

The volume of sawnwood exports in the first quarter was

28,409 cu m with China being the main buyer (10,200 cu

m) followed by Taiwan P.o.C (7,274 cu m) and Thailand

(1,856 cu m).

For plywood, the total volume exported was 86,667 cu m

with most being shipped to Japan (16,429 cu m) followed

by South Korea (14,591 cu m) and the USA (13,570 cu

m). For veneer, exports were 9,466 cu m and the main

buyers were South Korea (3,305 cu m), Japan (2,251 cu

m) and the Philippines (1,993 cu m).

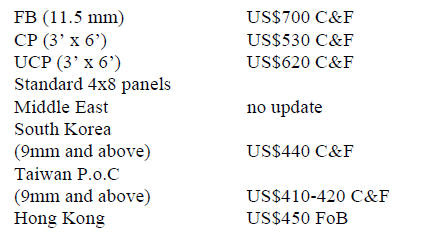

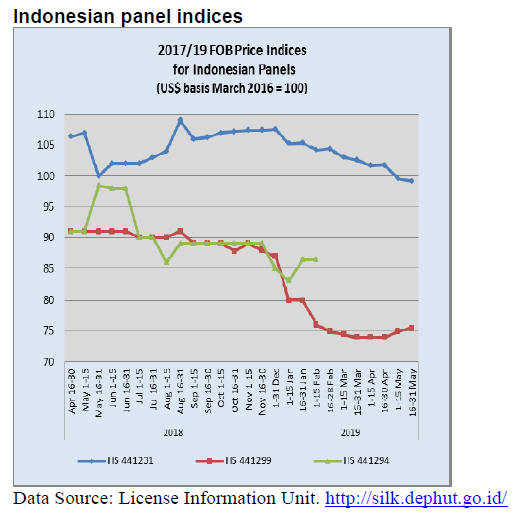

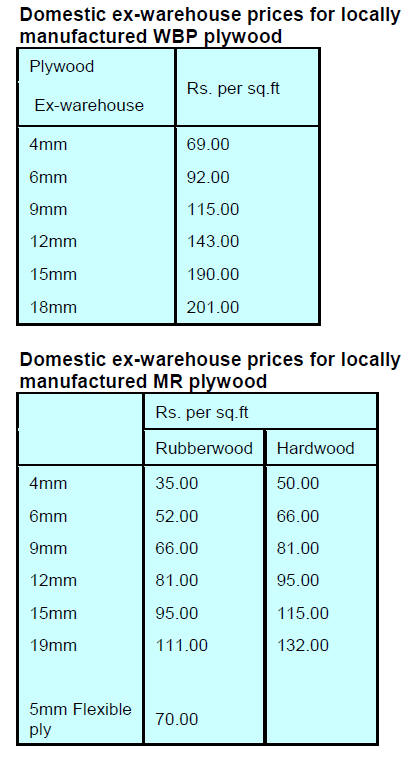

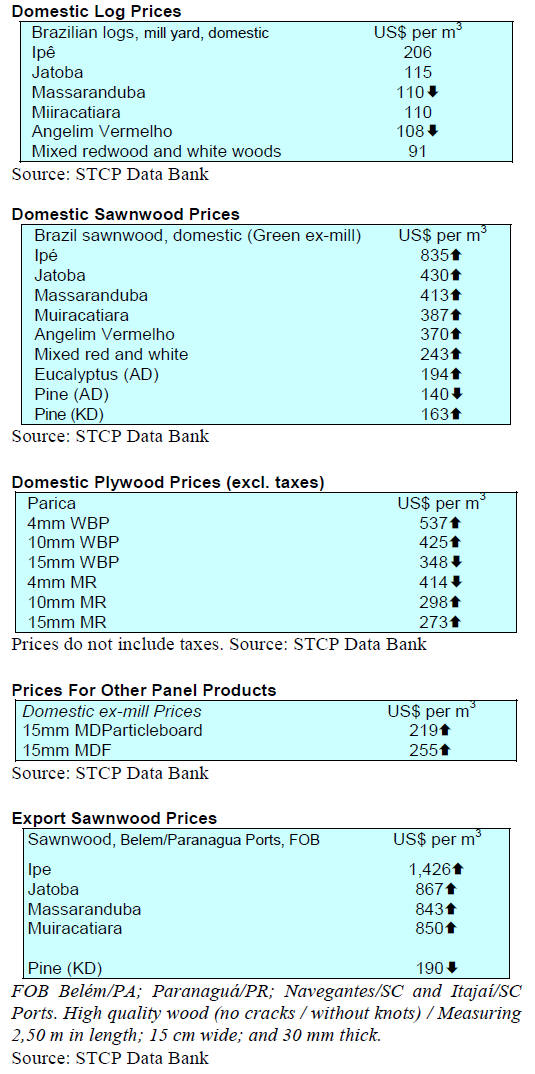

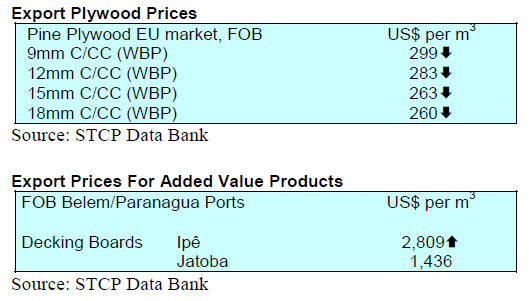

Plywood prices

Traders based in Sarawak reported the following export

prices in April:

4.

INDONESIA

Trade War could mean a flood

of exports to Indonesia

Sanny Iskandar, Deputy of Regional Economic

Development in the Indonesian Chamber of Commerce,

said the trade dispute between the United States

and China is expected to impact Indonesia’s export and

domestic trade. He said China may become more active in

promoting sales into Indonesia and it may also eat away at

market share held by Indonesia in overseas markets.

Sanny warned a surge in Chinese imports could disrupt

domestic sales as local industries are not prepared to face

the tough competition from Chinese imports, an issue of

relevance to domestic furniture makers.

Huge economic value in non-timber forest products

and environmental services

Minister of Environment and Forestry, Siti Nurbaya

Bakar, said that a recent study suggest most of the

economic value from forests is in non-timber forest

products and environmental services.

Because of this the ministry intends to encourage further

development non-timber forest products so forestry

becomes a multi-business sector integrating upstream to

downstream activities.

In related news, a local company, Shopee Indonesia, is

working with the to market non-timber forest products and

will also provide training to small, micro and medium

enterprises (MSMEs) commercialising non-timber forest

products.

The Executive Director of the Association of Indonesian

Forest Concessionaires (APHI), Purwadi Soeprihanto, said

the Association urges the government to review incentives

for entrepreneurs involved in the non-timber forest product

sector.

See: https://ekonomi.bisnis.com/read/20190510/99/921098/klhkdorong-

pengembangan-komoditas-hutan-nonkayu

and

https://ekonomi.bisnis.com/read/20190510/99/921067/klhkgandeng-

shopee-pasarkan-produk-hutan-nonkayu

Industry calls for review of regulations to stimulate

exports

With the Indonesian election concluded the private sector

is looking forward to more export friendly government

policies. The Executive Director of APHI, Purwadi

Soeprihanto, said the export value chain for forest

products needs to be optimalised.

This can be achieved, he said, if the new government can

overhaul the procedures for licensing of forestry

entrepreneurs by expanding the One Single Submission

(OSS) across the country. According to Purwadi, while the

One Single Submission works well in the capital, permit

applications in the regions still rely on the manual system.

In related news, Bambang Supijanto, Chairman of the

Indonesian Wood Panel Association, identified some

issues that he hopes the government can address to support

the Indonesian wood panel and veneer industry: first,

remove VAT on roundwood and secondly set the

reforestation funds payment in Rupiah not US dollars as at

present.

The other issues that should be addressed are facilitating

access to credit lines with commercial banks and

exemption of import duty on manufacturing machinery

important for industry restructuring.

https://ekonomi.bisnis.com/read/20190521/99/925460/pemerinta

han-baru-diharap-hapuskan-ppn-kayu-bulat

Plans to accelerate replanting in degraded forests

The Ministry of Environment and Forestry (KLHK), the

Association of Indonesian Forest Concessionaires (APHI)

and other stakeholders intend to develop plans to

accelerate the replanting in degraded forests.

APHI Chairman, Indroyono Soesilo, said that the use of

drones for seeding may be a viable option especially in

areas that are difficult to access. The ministry has targeted

planting 230,000 hectares this year.

5.

MYANMAR

Industries closer to forest create

employment for

communities

A member of parliament has proposed allowing wood

processing industries to be established close to production

forests to create employment opportunities for local

people. This will also help in raising the awareness of rural

communities in the development and protection of forest

resources.

Currently, the location of wood processing industries is

controlled as part of the government’s efforts to ensure

illegal timber does not enter the supply chain. Exportoriented

wood industries are mostly located in Yangon but

there are many small scale sawmills operating in rural

areas.

Myanmar Reforestation and Restoration programme

proposed

The Myanmar Timber Merchants Association was one of

the agencies visited by a World Bank delegation. The

delegation also met with government and other non-

Government organizations.

The forestry sector in Myanmar is an important economic

sector and historically timber exports consistently ranked

among the top-five exports. Today, despite reduced timber

harvest and lower revenue from forestry, the sector still

generates over 8% of government revenues and is a vital

supplier of non-market forest products such as fuelwood

and non-wood forest products.

There are plans for a 10-year Myanmar Reforestation and

Restoration Programme (MRPP) supported by the World

Bank and the Forest Department will be the implementing

agency.

This project has four components; community forestry and

community enterprises, strengthening of protected areas,

creating an enabling environment for the MRPP and

institutional investments in project management,

monitoring and evaluation.

US/Japan alliance could advance shared aims in

Myanmar

A recent report “Forging a Stronger Economic Alliance

between the United States and Japan” proposes strategies

the two countries can implement to improve their

economic partnership in third countries and advance

shared interests. Myanmar was a case-study.

The report says “By strengthening infrastructure, human

capacity and governance practices, Myanmar can become

a stronger, more democratic, more stable nation, better

able to negotiate relations with neighbouring countries on

its own terms.”

See: https://www.csis.org/analysis/article-ii-mandate-forgingstronger-

economic-alliance-between-united-states-and-japan

Third Myanmar-EU Economic Forum set for June

The European Chamber of Commerce in Myanmar will

host the Third Myanmar-EU Economic Forum in June.

Myanmar and European business communities will have

the opportunity to interact and more than 500 participants

are expected. This annual event provides an opportunity

for business people and high level government officials to

discuss developments in the business climate.

Foreign investments continue pour into Myanmar

According to the Myanmar Directorate of Investment and

Companies Administration (DICA) over US$2.5 billion in

foreign investments flowed to Myanmar up to May this

fiscal year. The transportation and communications sectors

topped the list of foreign investment.

In 2013, in cooperation with Japan International

Cooperation Agency (JICA), the Myanmar Investment

Commission developed its foreign investment policy and

this was implemented in 2014.

6. INDIA

Industrial output slips but GDP holds

up well

Data from the Indian Central Statistics Office is showing

that, month on month, the industrial output index fell

slightly in March, the first time in nearly two years. The

manufacturing sector accounts for over 75% of the

industrial production index and it was the decline in the

manufacturing sector that pulled down the index.

In other news, GDP growth is holding up well with the last

quarter 2018 data showing a 6.6%, expansion.

See: https://data.gov.in/catalog/all-india-index-industrialproduction-

base-2011-12100

GST adjusted to boost affordable homes sector

At its mid-March meeting the GST Council discussed the

implementation of recommendations for lower GST rates

of 1% in case for affordable houses and 5% on

construction of houses other than affordable house. The

GST Council formally reduced the GST rates for underconstruction

flats and affordable housing to 5% and 1%.

The Council also increased the so-called ‘carpet area’

defining affordable homes as up to 90 sq. m from 60 sq.

m. A move aimed at attracting more buyers. This changes

are aimed at giving a boost to the affordable homes sector

and are a welcome move which could lift wood product

consumption.

See:

http://gstcouncil.gov.in/sites/default/files/34th_GST_Council.pdf

Booming housing growth in Southern cities

The Vestian Quarterly Newsletter has reported that the

pace of new residential launches in the three southern

cities of Bengaluru, Hyderabad and Chennai in the first

quarter of this year were up around 17% on the last quarter

2018.

The authors of the article interpret this as signaling finally

that real estate companies have adjusted to the recent

regulatory changes and are increasingly active. The

Vestian newsletter notes recent launches were mainly in

the affordable and mid-price market segment.

See:

https://housing.com/news/tag/vestian-quarterly-newsletter/

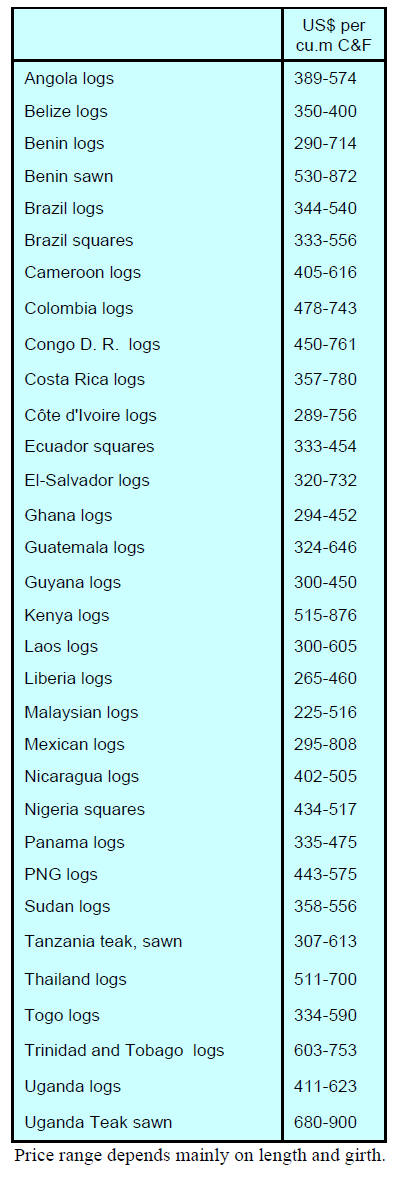

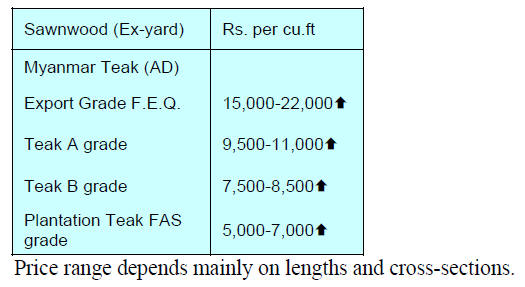

Plantation teak prices

Since the third quarter 2018 C&F prices for imported

plantation teak have not changed and this is largely

because the US dollar/rupee exchange rate has been stable.

Analysts write that the current rise in oil prices may feed

into higher freight costs which could result in a downward

pressure on prices in the face of the steady but flat demand

in India.

C&F rates for Indian ports are within the same range as

given earlier.

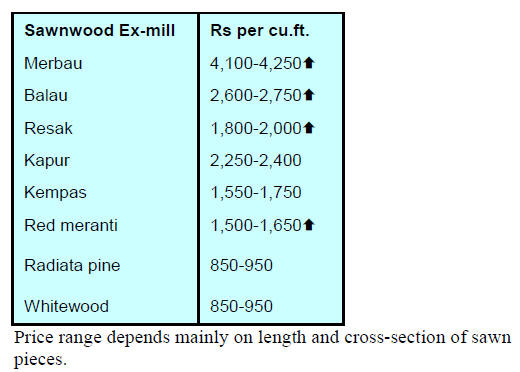

Locally sawn hardwood prices

Demand for imported hardwoods remains steady and in

recent weeks ex-mill prices for locally milled sawnwood

have risen slightly.

Myanmar teak prices

There has been a rise in demand for imported Myanmar

teak sawnwood and this has created an opportunity for

price increases.

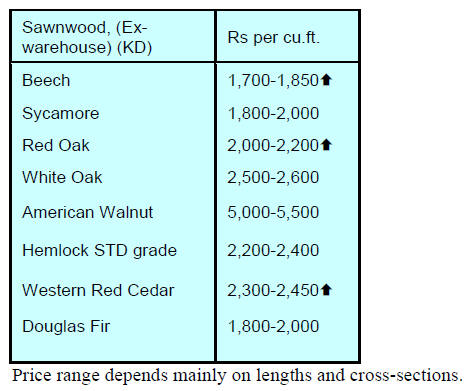

Sawn hardwood prices

The firming demand for sawnwood has lifted prices for

imported European and US sawn hardwoods.

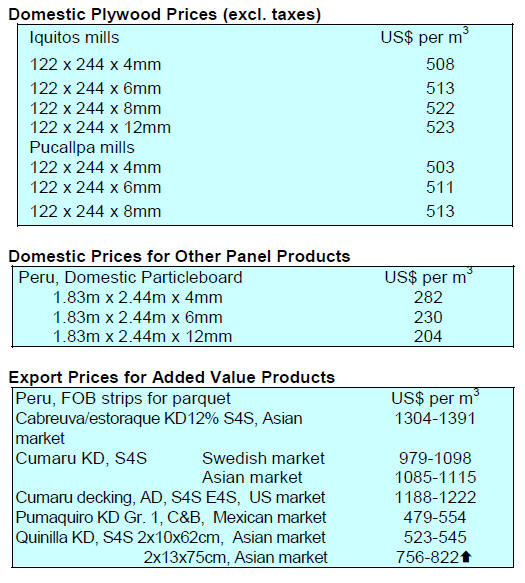

Plywood prices

Plywood prices are unchanged.

7. BRAZIL

Santa Catarina wood, pulp and

paper products rise

15%

Santa Catarina, in the southern region of Brazil, is known

for its vibrant timber sector. In 2018, the value of forestry

sector output in Brazil was just over R$14 billion of which

about 10% was from Santa Catarina.

According to the Santa Catarina Association of Forest

Companies (ACR) in 2018 forest plantations extended to

829,000 ha. of which 70% was pine, the balance

eucalyptus. At the beginning of this year there were almost

6,000 companies in the direct and indirect timber sector

and they provide thousands of direct jobs.

The State Department of Agriculture recognises the

forestry sector is a major exporter as in 2018 export

shipments of wood, pulp and paper products expanded

15% year on year contributing revenues of US$1.4 billion.

IBA – exports firm but domestic consumption weak

The IBÁ Bulletin reports a 2.3% increase in wood product

export values in the first quarter of 2019 compared to the

first quarter 2018. In the first three months of this year

business negotiations with importers were valued at

US$2.8 billion.

Among the various products, exports of pulp expanded

3.3%. The main market for pulp was China with a 39% of

exports (US$ 856 million). The wood-based panel export

market recorded growth of 13% with revenues at US$44

million compared to the same period of 2018. The main

destinations for its exports were Latin American countries.

In contrast, IBÁ says domestic consumption of woodbased

panels grew only 1.1% in the first quarter 2019

compared to the same period of 2018, a reflection of the

slow revival of the Brazilian economy. About 1.6 million

cubic metres were consumed, some 17,000 cubic metres

more than the first three months of 2018.

Export update

In April 2019, the Brazilian exports of wood-based

products (except pulp and paper) declined 19% in value

compared to April 2018, from US$286.6 million to

US$232.9 million.

The value of April 2019 pine sawnwood exports dropped

10.5% compared to April 2018, from US$48.8 million to

US$43.7 million. In terms of volume, exports fell 9% over

the same period.

Exports volumes of tropical sawnwood also fell (-8%) in

April from 46,200 cu.m in April 2018 to 42,500 cu.m in

April 2019. There was an even sharper decline in export

values which dropped 14% from US$20.2 million to

US$17.3 million in April this year.

The negative trend in exports continued with plywood.

Pine plywood exports fell 41% in value in April 2019 in

comparison with April 2018, from US$68.3 million to

US$40.0 million. However price for plywood held up

better as export earnings dropped only 27% over the same

period, from 198,500 cu.m to 145,000 cu.m.

Tropical plywood exports are now very small and in April

there was a drop in the value and volume of exports from

13,900 cu.m (US$6.1 million) in April 2018 to 7,500 cu.m

(US$ 2.8 million) in April 2019.

Wooden furniture exports also took a hit in April with

earnings falling from US$45.3 million in April 2018 to

US$42.8 million in April 2019.

Three southern states – 85% of exports

Furniture production in February 2019 was 34 million

pieces, down 4% compared to January of the same year.

Year-to-date, over the same period of the previous year,

volume production increased 1.2%.

According to the Brazilian Institute of Geography and

Statistics (IBGE) accumulated furniture production over

the past twelve months declined 1.5% compared to the

previous 12 month period. On the other hand, national

manufacturing output expanded.

Furniture exports totalled US$137 million in the first

quarter of 2019, up 1.6% compared to the same period in

2018. Of this total, exports of furniture to the United

States stood out with a 34% share. This was followed by

the United Kingdom, an 11% share and Uruguay with 8%

of total exports.

The three southern states are the largest furniture exporters

in Brazil. Altogether, Santa Catarina (41.3%), Rio Grande

do Sul (30.4%) and Paraná (13.9%) accounted for just

over 85% of all Brazilian furniture exports in the first

quarter of 2019.

For more see: http://www.brazilianfurniture.org.br/

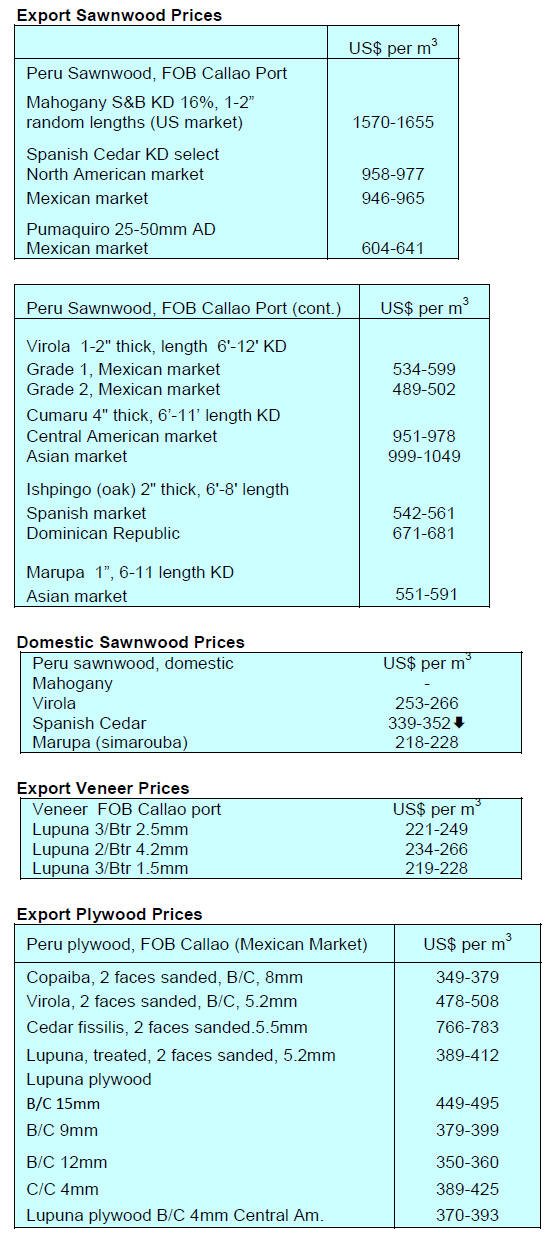

8. PERU

New operation guidelines for

industry

Through two new resolutions the Peruvian government

introduced measures to strengthen and promote the

forestry sector. One of the provisions approves the Official

List of Forest Species which includes 275 species. The

object of this resolution is to standardise timber names to

facilitate forest inventory and control measures along the

supply chain.

The second resolution provides updated formats for

qualification requirements for timber harvesting operations

as well as those for processing operations. The Forest

Service (SERFOR) will lead a training programme for

both guides and the overall aim is to improve its timber

traceability and guarantee the legal origin of wood

products.

Officials are trained on forest legislation and wildlife

Representatives of the Public Prosecutor's Office,

members of the National Police, the Superintendent of the

Tax Administration and other governmental officials

recently participated in a specialised course on the

Forestry and Wildlife Legislation. This activity was

organised by SERFOR with the support of the US Forest

service.

This course was part of the programme for continuous

capacity building and sought to provide specialised tools

to participants for the application of the Forestry and

Wildlife Law and regulations.

Loreto to offer forest concessions

As part of the programme of activities for Regional Forest

and Wildlife Development Management (GRDFFS) a

recent event focused on facilitating promotion, marketing

and strengthening of forestry sector businesses in the

Loreto region. The main themes were forest management,

conservation of natural resources, industry and

technology.

The Regional Governor of Loreto said that reactivating

forestry activity can improve the economy of the region

which has decline over the past five years. It was

announced that Loreto will allocate around one million

hectares of forest concessions for commercial exploitation.

The Governor called on communities and forest

entrepreneurs to work together to ensure sustainable use of

the natural resources.