|

Report from

Europe

German wood consumption rises rapidly, but tropical

timber rapidly loses share

Analysis of the timber market in Germany, which plays

central in the European wood products sector, highlights

the extent to which tropical wood is losing market share,

with important implications for the long-term future of

tropical wood demand in the broader European market.

Germany is Europe¡¯s largest economy with GDP likely to

have exceeded US$4 trillion for the first time in 2018

(according to IMF), over 40% more than the UK, Europe¡¯s

second largest economy.

Germany is Europe¡¯s largest producer of sawnwood and

wood-based panels, with output of 22 million m3 and 11

million m3 respectively in 2017 (according to FAO).

Germany is also Europe¡¯s largest consumer (annually €9.4

billion) and second largest producer (annually €7.3 billion)

of wood furniture. Germany¡¯s annual per capita

consumption of wood furniture is €118, second only to

Luxembourg amongst European countries.

Germany weathered the economic storms of the last

decade better than most other European economies.

Although GDP growth slowed in the second half of last

year as Germany¡¯s large export-oriented manufacturing

sector came under pressure from cooling demand in

overseas markets, domestic consumption in Germany has

been very resilient.

Germany¡¯s domestic market has benefited from strong

consumer confidence, which has remained much higher

than in other European countries in recent years, bolstered

by a low and declining unemployment rate (which fell to

only 3.1% in February 2019) and the expansionary policy

of the European Central Bank which has combined low

interest rates with quantitative easing.

In 2019, domestic consumption in Germany is expected to

remain high, particularly as the German government has

introduced further fiscally expansionary measures,

including a higher minimum wage to help offset an

anticipated slowdown in export demand for German

products. Economic indicators this year have revealed

further rises in consumer sentiment and the composite

Purchasing Managers Index showing better business

conditions.

Feedback from hardwood traders in Germany indicates

that there is good activity in the door and kitchen sectors.

Furthermore, German importers continue to sell significant

volumes of hardwood into the expanding furniture and

joinery manufacturing sectors in Eastern European

countries, notably Poland and Lithuania.

The successful 2019 edition of IMM-Cologne interior

design fair held in January confirmed that underlying

market sentiment in Germany is good and, with strong

growth in overseas visitors, highlighted once again that

Germany is viewed as a major global leader both in wood

product design and innovative processing.

A commentary on material preferences by the fair

organisers noted that ¡°wood is simply invincible¡± because

¡°it is not only sustainable, but also cosy, healthy and

versatile¡±.

The fair suggested a particularly strong preference for

natural wood to be used ¡°as raw as possible: not coarse,

but un-smooth" and that, while paler monotone colours are

still very fashionable, there is a growing trend for ¡°warm

colours tending to dark that harmonise with reddish

wood¡±.

On the surface, all this should imply good opportunities to

increase sales of tropical timber in Germany. However, in

practice, the market has been moving decisively against

tropical hardwood for some time. This is clear from data

presented by Rupert Oliver, Trade Analyst to the FLEGT

Independent Market Monitor (IMM) project (hosted by

ITTO), to the GD Holz ¡°Foreign Trade Day¡± on 4 April.

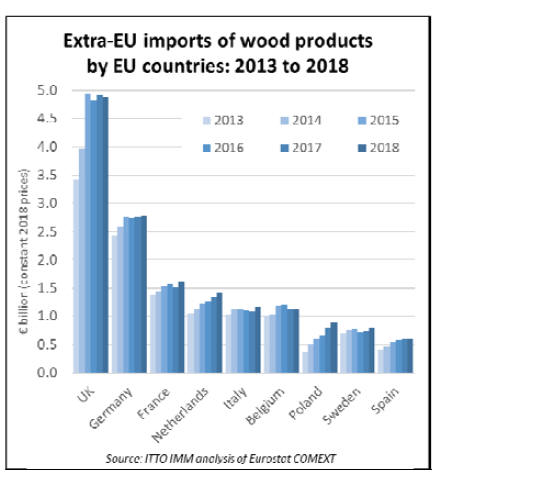

Overall the data shows that Germany is importing large

and growing quantities of timber products. Should the UK

leave the EU, an event now scheduled to happen by 31

October 2019, Germany will become by far the largest

single EU importer of wood products from outside the

bloc (Chart 1).

However, most of the gains in German imports are being

made in softwoods, particularly from Russia and other

European countries. Furthermore, where Germany is

importing tropical timbers, direct purchases from the

tropics are falling rapidly and more is being purchased

indirectly from importers elsewhere in the EU. This has

important implications for future development of policy

measures like FLEGT and EUTR.

Germany imports around 8 million m3 of logs every year,

but much is low grade, mainly softwood, material for

manufacture of panels and other industrial applications.

Around 90% of all Germany¡¯s log imports derive from

other EU countries.

In 2018, Germany imported only around 400,000 m3 of

hardwood logs, of which 330,000 m3 were from other EU

countries and 70,000 m3 from non-EU countries.

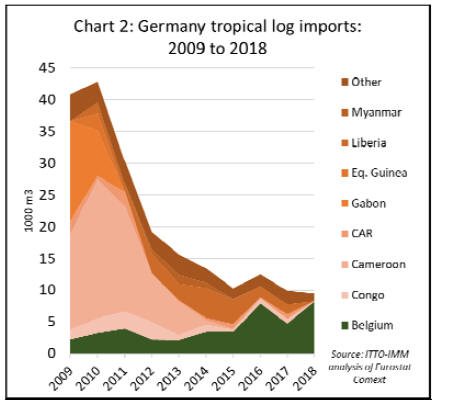

Germany¡¯s imports of tropical hardwood logs declined

sharply from 43,000 m3 in 2010 to only 9,000 m3 last

year, with nearly all volume now sourced through Belgium

(Chart 2).

Germany¡¯s total imports of sawnwood increased from 5.0

million m3 in 2017 to 5.4 million m3 last year. This builds

on a long-term upward trend which has seen Germany¡¯s

sawnwood imports increased by over 40% in the last

decade.

85% of these imports comprise softwoods, and 67% is

from other EU countries. Nearly all the sawnwood

imported into Germany from outside the EU is from just

three countries; Belarus, Russia and Ukraine.

The rise in Germany¡¯s timber imports in 2018 comes

despite domestic softwood sawnwood production hitting

an all-time high of around 23 million m3 last year. The

signs are that total demand for sawnwood in Germany is

¡°red hot¡± at present.

However, this is not at all reflected Germany¡¯s tropical

sawnwood imports which have been declining (Chart 3).

Germany¡¯s imports of tropical sawnwood were only

around 73,000 m3 in 2018, a slight improvement on the

67,000 m3 imported the previous year, but well down on

103,000 m3 imported in 2016 and around half the level

prevailing a decade ago.

As in the log trade, there was a significant rise in indirect

imports via Belgium between 2009 and 2016, at the

expense of both direct imports from tropical countries and

other indirect imports from the Netherlands. However, in

2017, there was also sharp reversal in Germany¡¯s imports

of tropical sawn timber via Belgium.

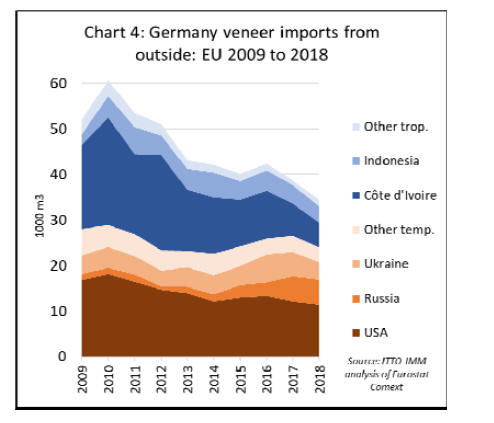

Germany imported 109,000 m3 of veneers in 2018, down

from 115,000 m3 the previous year. Around 70% came

from other EU countries and 34,000 m3 from outside the

EU. Imports from other EU countries have been rising in

recent years as a large part of Germany¡¯s domestic

production has been relocated to lower cost locations in

Eastern Europe.

Meanwhile Germany¡¯s veneer imports from outside the

EU have fallen sharply, mainly due to a decline in imports

from the United States and Ivory Coast. This decline has

been only partially offset by a rise in imports from Russia

and Ukraine (Chart 4).

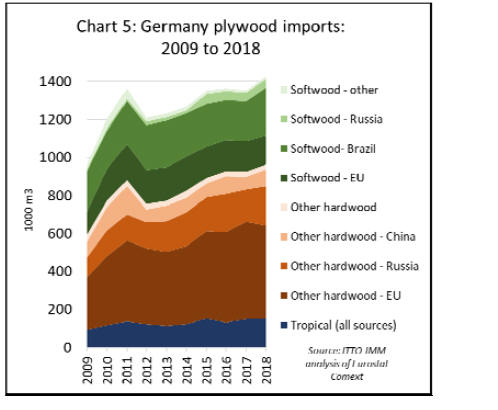

Germany¡¯s plywood imports have been rising in recent

years, peaking at 1.43 million m3 in 2018, of which

816,000 m3 was faced with hardwood and 615,000 m3

with softwood. Much of the recent growth in Germany¡¯s

plywood imports has comprised hardwood products

(mainly birch) from other EU countries and Russia (Chart

5).

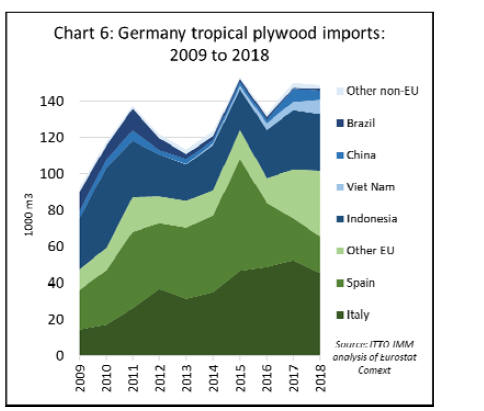

Despite stiff competition from birch plywood, tropical

hardwood plywood has made gains in Germany in recent

years, with total imports of tropical hardwood faced

plywood rising from less than 100,000 m3 a decade ago to

peak at 153,000 m3 in 2015. Imports fell back to 133,000

m3 in 2016 but rebounded to 150,000 m3 in 2017 and

remained at that level last year.

Much of the recent gain in Germany¡¯s tropical plywood

imports comprises products either manufactured using

tropical hardwoods in other EU countries, notably Italy

and Spain, or imported indirectly via these countries.

However, there has also been an increase in direct imports

of tropical hardwood plywood from Indonesia, from a low

of 20,000 m3 in 2013 to 31,000 m3 in 2018 (Chart 6).

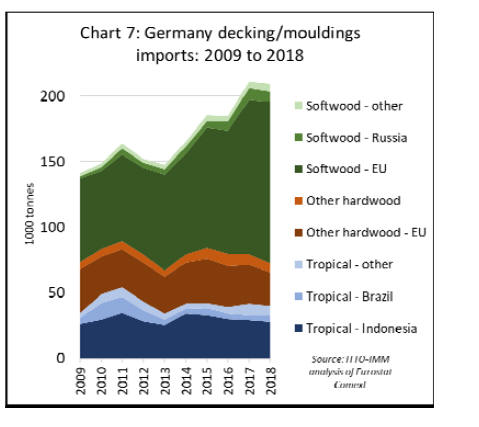

(classified under HS code 4409) increased sharply from

148,000 m3 in 2013 to 210,000 m3 last year. Nearly all

the gains were in softwood products from other EU

countries.

Germany¡¯s imports of these products from the tropics have

been edging downwards in recent years, from 42,000 m3

in 2015 to 40,000 m3 last year. Imports from Indonesia, by

far the largest tropical supplier to Germany, fell from

33,000 m3 to 28,000 m3 (Chart 7).

IMM Trade Consultation explores drivers of tropical

wood decline in Germany

Insights into the reasons for Germany¡¯s shift away imports

of tropical wood, particularly direct imports, were

provided by the IMM Trade Consultation held in Berlin at

the end of 2018.

This consultation forms part of wider series of

consultations being held during 2018 and 2019 in all the

main European markets for tropical wood products to

obtain feedback from the trade on the potential to develop

markets for FLEGT licensed timber in the EU.

During the Berlin consultation, to help place FLEGT

licensed timber in the correct market context, traders were

asked to identify and rank the key factors driving market

decline for tropical timber products in Germany in recent

years.

The main drivers identified, in declining order of

significance, were:

-

Substitution by temperate wood, composites and

other materials (16 votes);

-

Environmental prejudice and uncoordinated

marketing (9 votes);

-

Competition from China for material access and

in markets for finished goods (9 votes);

and

-

The

challenges of conformance to the EU Timber

Regulation (8 votes).

|

The first driver is indicated both by the trade flow

data,

which shows large increases in Germany¡¯s trade in wood

products other than tropical timber, and by other reports

from traders.

These reports highlight, for example, that all solid wood

products, but particularly tropical, are losing share to

wood plastic composites in the market for decking and

other exterior products.

This trend is so far-reaching in Germany that even

thermally and other treated temperate wood products,

which are making ground elsewhere in Europe, are losing

share in Germany.

Similarly, the market for real-wood flooring in Germany

has been struggling in recent times even as broader

domestic consumption trends have been on the rise, an

indication of the pressure being felt in this market from

alternatives such as laminated flooring and luxury vinyl

tiles.

The fourth driver of tropical wood¡¯s decline, relating to

EUTR, features more strongly in Germany than in other

EU countries. It is also reflected in the trade data which

shows the growing proportion of tropical wood imported

indirectly into Germany via other EU countries.

This tends to confirm reports that an increasing proportion

of tropical wood imports into the EU are now being

channelled via larger importing companies close to the

main European ports that are willing and able to devote

more time and resources for a wide range of specialist

services, including EUTR due diligence.

A feature of the Germany IMM trade consultation

(interestingly also repeated in a more recent Dutch/Belgian

IMM event held in Antwerp) is that while EUTR is

identified by the importing sector as a significant of driver

of decline in tropical wood trade, at the same time it is also

seen as a potentially important part of long-term strategy

to maintain and, potentially, rebuild market share.

Having rated drivers of market decline, German importers

at the consultation were then asked to rate the potential of

different market development strategies for tropical timber

in the EU. One strategy was rejected outright by all

participants; this proposed ¡°deregulation¡±, the total

abolition of requirements for EUTR and FLEGT licensing,

based on the assumption that tropical timber imports may

be boosted by reducing the regulatory burden.

Not only was the deregulatory approach rejected, but the

strategy receiving by far the most votes was the exact

opposite; ¡°a regulatory approach involving increased

supply of FLEGT-licensed tropical timber linked to

consistent and effective enforcement of EUTR to remove

illegal wood¡±.

Practically all participants in Berlin regarded the EUTR

combined with FLEGT licensing as the right approach to

improve credibility and reputation of the tropical timber

trade in the EU. The process of consolidation in the sector

and the concentration of import activities in the hands of a

smaller number of expert importers was also generally

seen as a positive development by participants.

The second most favoured strategy for rebuilding tropical

wood¡¯s market share in Germany was identified as

¡°highlighting/promoting the environmental benefits of

tropical timber and underpinning these scientifically

through life-cycle analysis (LCA)¡±.

Here, traders were also calling for increased regulatory

support through government procurement policies.

Participants at the trade consultation also called for

inclusion of FLEGT-licensed tropical timber in public

procurement policies as evidence of both legality and

sustainability.

While these strategies were seen as having potential to

improve market conditions for tropical wood in the

German market, trade consultation participants generally

expected stagnation of the German and wider EU tropical

timber market at the current low level, at least in the short

to medium term.

New resource on benefits of FLEGT-licensed products

Timber buyers can now visit a new webpage in English,

French, Italian or Spanish to learn about the business

benefits of trading in FLEGT-licensed timber and the

social, environmental and economic benefits that such

trade brings to producer countries.

The EU FLEGT Facility created the page ¡ª

www.timberbuyers.flegtlicence.org ¡ª to inform traders,

specifiers, architects and retailers, as well as sustainability

specialists and end consumers of timber products.

Combining text, pictures and an animated film, it

describes how the EU is working with tropical timberexporting

countries to stop illegal logging and promote

trade in legal timber products.

The new resource explains what FLEGT licenses are, how

they benefit timber buyers in the EU, and how the

advantages of FLEGT licensing extend far beyond legality

to encompass social, economic and environmental gains in

producer countries.

It includes links to multimedia stories that highlight the

benefits of FLEGT licensing, and to downloadable

resources that can help timber buyers to communicate

about FLEGT-licensed products with their customers.

The EFI FLEGT Facility, that developed the site, note that

¡°FLEGT-licensed timber products are best known for their

verified legality.

They automatically meet the requirements of the EU

Timber Regulation so, for operators in the EU, they

eliminate the risk of trading in illegal timber. Less wellknown

are the considerable social, economic and

environmental credentials of FLEGT-licensed products.

Yet the trade in these products, and the reforms and

improvements that stand behind the licenses, are helping

ensure that forests contribute to economic growth and

poverty reduction, while promoting responsible forest

management¡±.

The new webpage is part of the FLEGT license

information point, which the Facility set up in 2016 to

provide practical information about FLEGT licenses,

import procedures, trade scenarios and answers to

frequently asked questions.

European parquet flooring industry reports stable to

slightly positive trend

Compared to the same period last year, sales of wood

parquet flooring in the EU in the first quarter of 2019 were

stable or moderately increasing in all countries except

Belgium, the Netherlands, Switzerland and the UK which

reported limited declines.

The shortage of hardwood face material ¨C particularly oak

¨C which has been a significant problem in recent years,

seems to have eased so far in 2019. However, prices are

rising for panel products (HDF, plywood) used in the other

layers. These are the principal conclusion of the Board of

Directors of the European Federation of the Parquet

Industry (FEP) when they met on 4 April 2019 to discuss

the parquet market situation.

The FEP Board also provided the following insights into

current market conditions in each EU country in the first

quarter of 2019:

Austrian parquet sales were up 1% during the period:

European company looks to expand supply of

acetylated wood in Asia

Accsys Technologies PLC has announced that its

subsidiary, Tricoya Technologies Limited (¡°TTL¡±), has

now entered into an agreement with Petronas Chemicals

Group Berhad (¡°PCG¡±) to evaluate the feasibility of

jointly funding, designing, building and operating an

integrated acetic anhydride and Tricoya wood elements

production plant in Malaysia.

It is envisaged that Tricoya wood elements produced at the

plant would use acetic acid from PCG¡¯s existing joint

venture in Malaysia. The plant would then supply the

wood panel industry within South East Asia, under

licence, as the key raw material for the formation of

Tricoya panels for the use in the construction industry in

the region.

The Malaysia feasibility study forms part of a wider

strategy to develop markets for products manufactured

using Accsys technology. Accsys Technologies PLC has

recently made multi-million dollar investments in a

Tricoya plant for annual production of up to 30,000 tonnes

per year of acetylated wood chips in Hull, England, and to

increase capacity of its Accoya production plant in

Arnhem, Netherlands, by 50% to 60,000 cubic metres.

Abbreviations

|

LM Loyale Merchant, a grade of log parcel |

Cu.m

Cubic Metre |

|

QS

Qualite Superieure |

Koku

0.278 Cu.m or 120BF |

|

CI

Choix Industriel

|

FFR

French Franc |

| CE Choix

Economique

|

SQ

Sawmill Quality |

|

CS Choix Supplimentaire |

SSQ

Select Sawmill Quality |

| FOB

Free-on-Board |

FAS

Sawnwood Grade First and |

| KD

Kiln Dry

|

Second |

| AD

Air Dry

|

WBP

Water and Boil Proof |

| Boule

A Log Sawn Through and Through |

MR

Moisture Resistant |

| the

boards from one log are bundled |

pc

per piece |

|

together |

ea

each |

| BB/CC

Grade B faced and Grade C backed |

MBF

1000 Board Feet

|

|

Plywood |

MDF

Medium Density Fibreboard |

| BF

Board Foot |

F.CFA CFA Franc

|

|

Sq.Ft

Square Foot |

Price has moved up or down

Price has moved up or down |

|