3.

MALAYSIA

MTIB to assist private sector boost

exports

The Malaysian Timber Industry Board (MTIB) Deputy

Director-General, Norchahaya Hashim, has said MTIB

will offer assistance to exporters in diversifying markets

and, because of the strong demand in India, Malaysia’s

exports of wood products are expected to grow to RM23

billion in 2019 from RM22.30 billion in 2018. Currently

around 17% of wood product exports go to the US with

about the same destined for Japan.

Certified sawnwood accounted for half of all certified

timber exports

Malaysia has certified 4.38 million hectares of tropical

forests and certified sawnwood accounted for almost half

of all certified timber exports in 2017. Mouldings and

plywood manufactured from certified forest raw materials

accounted for a further 28% and 18% respectively. The

total volume of certified timber exported in 2017 was

237,981 cubic metres according to Malaysia’s statistics.

The Netherlands was the main importer of Malaysia’s

certified timber taking just over 86,000 cubic metres in

2017 followed by UK at 38,000 cubic metres and

Germany at 18,000 cubic metres.

Calls for Sabah to have its own Timber Council

Sabah Timber Industries Association (STIA), Kota

Kinabalu branch Chairman, Tan Peng Juan, said the State

Government should have its own marketing agency for

promoting timber products and certification similar to the

Malaysian Timber Council (MTC) in Peninsula Malaysia.

He also urged the State Government to offer solutions to

problems faced by the industry. He recommended:

creating viable policies for the sustainable supply of raw

material; ensuring priority is given to local mill operators

when harvesting licenses are allocated; setting up a log

auction platform to facilitate transparent sales; upgrading

port facilities; lowering electricity tariff to improve

competitiveness; investing in infrastructures and most

importantly, reducing the administrative burden and ‘red

tape’ to improve the business environment in Sabah.

Sarawak – production from natural forest drops

Sarawak recorded RM5.44 billion in wood product exports

last year, a decline of 11% year on year. In an annual

assessment the Sarawak Timber Industry Development

Corporation (STIDC) General Manager said over 90% of

exports comprised primary products such as logs (RM773

million), sawn timber (RM673 million), medium-density

fbireboard (RM332 million) and veneer (RM3.19 billion).

Sarawak’s export markets in 2018 were Japan (RM2.69

billion), India (RM545 million), South Korea (RM424

million), Middle East countries (RM385 million), Taiwan

P.o.C (RM358 million) and Asean countries (RM666

million).

Production from natural forests in Sarawak continues to

slow and is forecast to stablise at around 2 million by 2030

according to the STIDC. Against this backdrop plantation

developments would need to be stepped up so annual

harvests of four million cubic metres are feasible.

Sabah seeks investment in wood processing

The Malaysian Investment Development Authority

(MIDA) recently held a seminar in Kota Kinabalu on the

theme ‘New Era of Manufacturing for Furniture & Wood-

Based Industry’. This attracted attention from companies

operating in Peninsular Malaysia that would like to secure

timber raw materials in Sabah.

To follow up on interest in resources, MIDA arranged

discussions with Yayasan Sabah, POIC Lahad Datu and

Sabah Softwood Berhad (SSB) towards strategic

collaborations. MIDA’s Deputy Chief Executive Officer,

Datuk N Rajendran, said “With abundant natural

resources, Sabah is poised for more investments in the

wood-based industry.”

The Sabah State Government set up POIC Lahad Datu in 2005 to

spearhead the development of palm oil downstream processing to

add value to its 1.55 million hectares of oil palm plantations, to

create jobs and business opportunities.

SSB is 70% owned by Innoprise Corporation Sdn. Bhd., the

investment arm and holding company of Yayasan Sabah Group.

Its core business is in timber, oil palm, milling and woodchip

production.

See: http://www.mida.gov.my/home/announcement-mediarelease/

posts/

Record investment approvals in manufacturing sector

Malaysia attracted a total of RM139.3 billion investments

in the manufacturing, services and primary sectors for the

first nine months of 2018. This was an 18% increase from

the RM118.1 billion approved in the same period last year.

The investments were in some 3,240 projects and are

expected to generate over 90,000 job opportunities.

Approved foreign direct investments (FDI) increased by

10% to RM64.1 billion in the period January-September

2018 from RM30.5 billion in the same period in 2017

mainly driven by the manufacturing sector which recorded

a strong increase of almost 250%.

See: http://www.mida.gov.my/home/7743/news/malaysiarecords-

rm139.3-billion-of-approved-investments-for-januaryseptember-

2018/

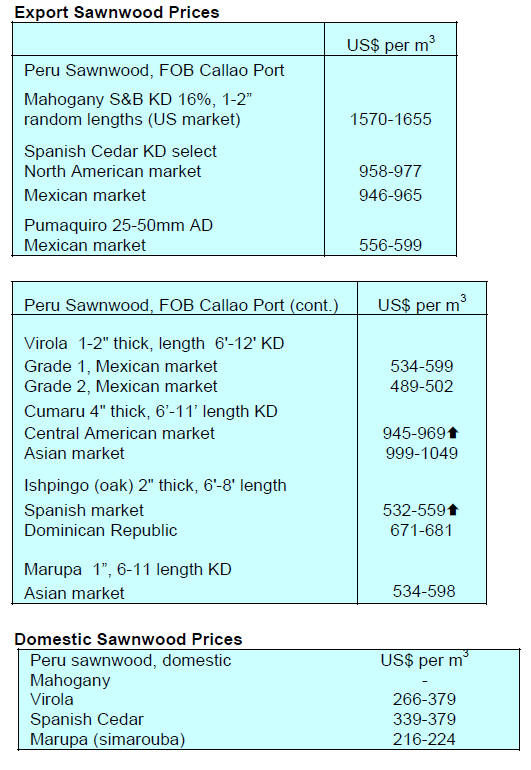

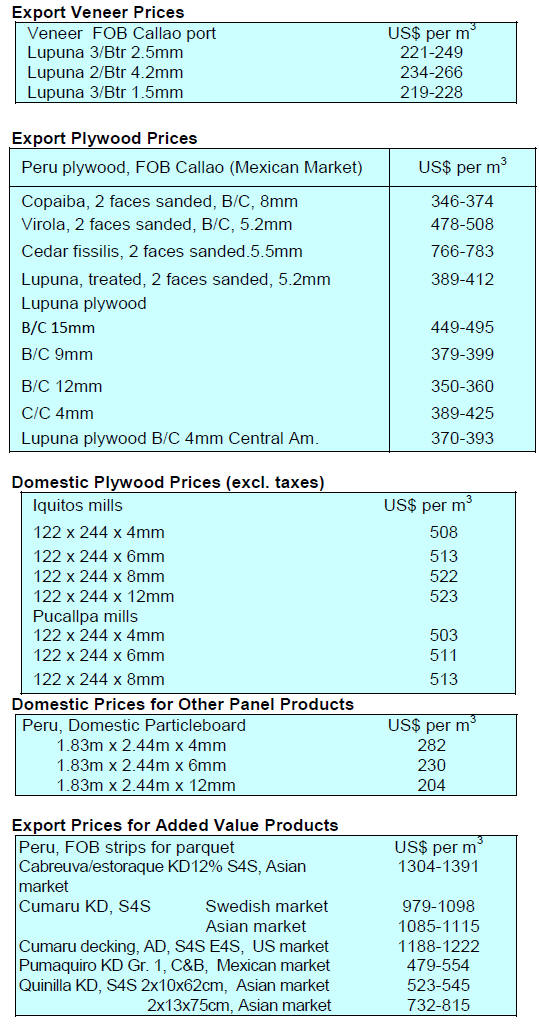

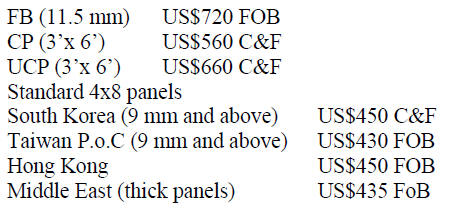

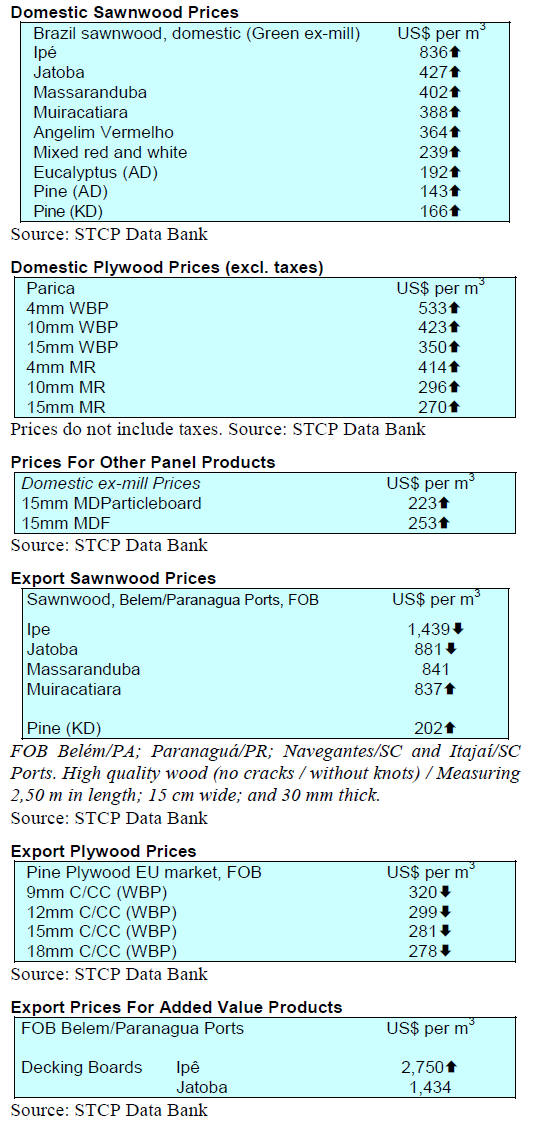

Plywood traders based in Sarawak reported the following

export prices for mid-January 2019:

4.

INDONESIA

Furniture makers urged to

target US market

Considering that Indonesia is one of the top 10 countries

in terms of forest area in the world, the output of the

furniture sector is way below its potential according to the

Minister of Industry, Airlangga Hartarto. This was the

theme of his address at the opening of the Polytechnic for

the Furniture and Wood Processing Industry in the Kendal

Industrial Area, Central Java.

The Minister continued saying Indonesia’s furniture

exports can grow and the government urges exportoriented

industries to pay more attention to the US market

so the national target for furniture exports of US$5 billion

in the next two years can be achieved.

Hartarto noted that between January and October 2018 the

national furniture trade balance was a surplus of US$99.1

million with exports totalling US$1.4 billion.

In related news the Secretary General of the Association of

Indonesian Furniture and Handicraft Industry (HIMKI)

Abdul Sobur, has said that the Indonesian domestic market

in 2019 could be worth as much as Rp15 trillion up around

10% from 2018 driven mainly by the buoyant housing and

office building markets.

However, Sobur pointed out that competition from imports

in the domestic market is severe and that imported

furniture has a major slice of the domestic market.

Exporters continue to enjoy GSP status in the US – for

now

Trade Minister, Enggartiasto Lukita recently met with US

Trade Representative Robert Lightizer to discuss the

importance to Indonesia and to US manufacturers of

maintaining the GSP status for Indonesian wood products

such as plywood which are raw material for many US

industries.

Enggartiasto told a media gathering that the meeting with

US officials was constructive and both sides understood

that the GSP for Indonesia actually benefits both countries

and they agreed to further discuss the GSP in order to

reach a positive and equally beneficial result and that until

a deal is reached Indonesian exporters can continue to

enjoy GSP status in the US.

See: https://www.thejakartapost.com/news/2019/01/18/tradeministry-

secures-us-gsp-for-now.html

Export boost to beat back trade deficit

According to Coordinating Minister for Economic Affairs,

Darmin Nasution, wood and horticultural products will be

a focus of exports so as to reduce the trade deficit that

Indonesia suffered over the past year. Indonesia posted

wider-than-expected trade deficit in December, bringing

the gap for 2018 to the largest ever.

The Central Bureau of Statistics has reported that

Indonesia posted a record trade deficit of almost US$$9

billion in 2018 in sharp contrast to the US$12 billion

surplus in 2017. Suhariyanto, the Bureau Head said data

shows that in 2018 exports slowed at a time when imports

surged due to a recovering domestic economy.

Businesses ready to support strengthening of SVLK

certification

In response to statements from the Ministry of

Environment and Forestry to the effect that there were

suspicions that the SVLK system was being circumvented

by some in the timber sector, the Chairperson of the

Indonesian Forest Entrepreneurs Association (APHI),

Indroyono Soesilo, affirmed that APHI members comply

with the SVLK regulations.

He confirmed the Association is ready to work with the

Ministry to strengthen the monitoring of SVLK

compliance.Indroyono further said that none of the

Association members had complained about the

administrative system for applying for SVLK certification.

Indonesia’s SVLK certification system serves to ensure

wood products and raw materials come from sources

whose origins and management fulfill the legal

requirements of the regulation.

See:

https://ekonomi.bisnis.com/read/20190120/99/880503/legalitaskayu-

pengusaha-siap-sumbang-masukan-penyempurnaan-svlk

5.

MYANMAR

2018-19 harvesting target

announced by MTE

The Myanma Timber Enterprise (MTE) has announced its

harvesting target for 2018-19. MTE plans to harvest 7,657

teak trees from the 19,210 trees defined in the Forest

Department’s Annual Allowable Cut (AAC). In addition,

173,529 non-teak hardwoods will be harvested from the

592,330 trees in the AAC.

This equates to approximately 10,400 H.tons of teak and

330,000 H.tons of non-teak hardwoods. This openness and

transparency by MTE has been warmly welcomed by its

critics.

When logging resumed after the nation-wide moratorium

in 2016-17 MTE suspended private sector logging

contracts. For 2018-19 harvesting will be undertaken by

MTE but, because of a lack of capacity, MTE has said it

may need to conclude contracts with the private sector for

the use of logging trucks.

The ‘home of teak’ Bago Mountain Range at risk from

illegal logging

Despite the efforts of the government and Forest

Department to protect forest resources and ensure

sustainable harvesting it has been reported that illegal

logging is still rampant in the country even in the Bago

Mountain Range.

In late January a member of parliament presented pictures

taken along the road used by illegal loggers in the Bago

Mountain Range and said these demonstrate weak law

enforcement and called for more effective measure to

combat illegal activities.

The Forest Department has admitted it does not have the

capacity to tackle the widespread illegal activities.

Commentators suggest that other law enforcement

agencies should be brought in to assist the Forest

Department.

This problem will not be easy to solve as local

communities are deeply involved in the illegal logging

network. To address this many are suggesting civil society

organisations operating in the area could play an active

role to persuade the local people not to become involved.

This is easier said than done when people in the areas

affected by illegal logging have few opportunities to earn

money.

Change to land law threatens to turn smallholder

farmers into trespassers

The needs of people to earn a living are also driving

conflict over land as well as deforestation. The Myanmar

media has reported that illegal immigrants from Yunnan

Province have cleared land in Myanmar to produce

bananas and water melons.

An investigation by a Kachin-based civil society

organisation has suggested the area of illegal farms is very

large. In support of this a coalition called the Land

Security and Environmental Conservation Group has

analysed satellite imagery and conducted field trips and is

preparing to present its findings in the hope that action

will be taken against illegal plantations.

Subsistence and smallholder farming is a very sensitive

issue in Myanmar. A recently amended law governing

vacant, fallow and virgin land has, say local observers,

threatened to turn millions of smallholder farmers into

criminal trespassers.

Government statistics show that over 80% of the land now

classified as vacant, virgin or fallow is in states populated

mainly by Myanmar’s ethnic communities. Much of this

land, that now falls under the revised law, is being used for

farms, gardens, orchards, productive forests and

communal village land – often in accordance with

customary law and practices.

An article in the magazine Frontier Myanmar says “Far

from being informal, ill-disciplined and inefficient, these

systems (of land-use) are often intricate, closely regulated

and uniquely well adapted to marginal, ecologically fragile

upland areas. The amended law, enacted on September 11,

requires all those occupying land classified as vacant,

fallow or virgin to apply for a land use permit from a

management committee made up of government

departments, or risk falling foul of a new trespassing

offense.”

See: https://frontiermyanmar.net/en/why-a-land-law-change-issparking-

fears-of-mass-evictions

Single window to lower investment transaction costs

Myanmar Investment Commission Chairman, U Thaung

Htun, has been quoted as saying that a single window

system will be applied for investment applications to

eliminate red tape. The World Banks’ Ease of Doing

Business Index for Myanmar is currently a low of 171 out

of all 190 countries.

Vice President, U Myin Swe, has been meeting with the

business sector every month under the auspice of the

Union of Myanmar Federation of Chambers of Commerce

and industry (UMFCCI). The Private Sector is understood

to have urged the Vice President to reduce private sector

transaction costs which are higher than other ASEAN

countries they say.

6. INDIA

Real estate sector outlines issues to

be addressed to

boost housing demand

At its second ‘New India Summit’ held in Mysore,

Karnataka, the real estate growth potential of Tier II, III

and IV cities was the focus of discussion. The Summit

resulted in three significant policy recommendations to

government aimed at sustaining growth and development

of the Indian real estate industry:

Review of GST

CREDAI;s view is that, because the real estate

sector is subject to both GST and stamp duties,

there is a case for the rate of GST on real estate

(currently 12%) to be reduced to 8% across all

segments and not just for houses of up to 60

square metres. The current land abatement charge

of 33% is also not appropriate in case of cities

where land costs make up to 70 % of the total

cost of the home.

Single window for clearance and approval

Without a Single Window for clearance there are

major delays in building projects which

ultimately adds to the cost of new homes.

CREADAI recognize there have been

improvements in tackling administrative

roadblocks the implementation of the Single

Window for clearance would be a step forward

for real estate sector.

Liquidity crisis

Demonetisation and GST administration places a

heavy burden on the sector because of the

multiple transitions in the real estate sector. The

current liquidity crunch in the Indian real estate

sector, even for loans that have been sanctioned,

is a problem. CREDAI recommended a one-time

restructuring of all real estate loans to enable the

sector to emerge successfully from the burden of

multiple transitions.

For more see:

https://credai.org/press-releases/credai-predicts-double-digitincrease-

in-gdp-contribution-by-emerging-cities-of-india

With the Rupee/US dollar exchange rate remaining

steady

at around Rs.71 importers are gaining more confidenec to

forward purchase, something they avoided during the time

the Rupee exchange rate was volatile.

The main issue in the sector at present is the sluggish

building and furniture markets as consumers try to

economise.

The cautious mood on the part of consumers is having a

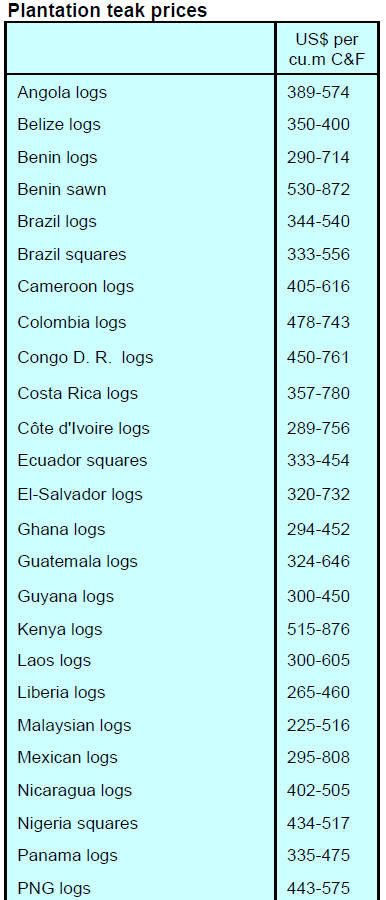

direct impact on demand for teak, even the lower priced

plantation teak, and analysts anticipate that this negaitive

market sentiment will eventually lead to lower prices in

order to spur demand.

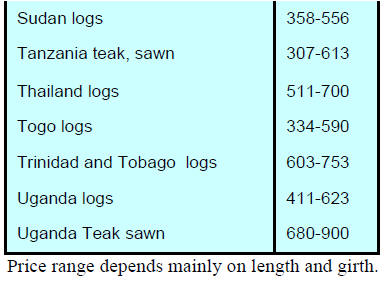

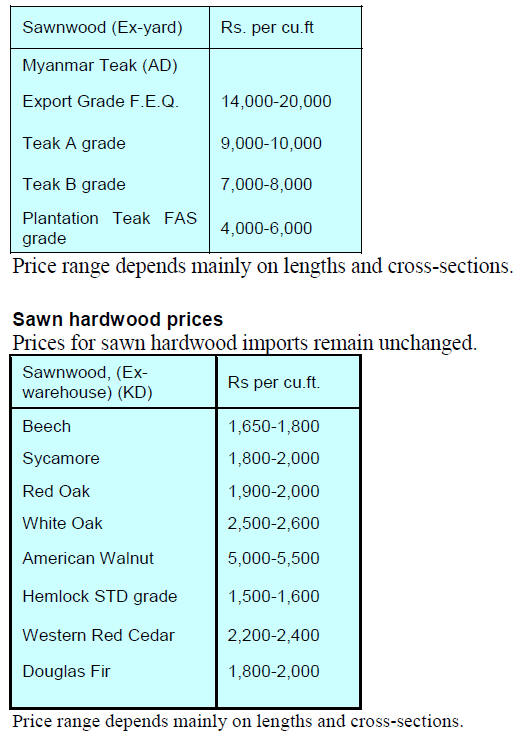

The C&F prices for imported teak shown above are within

the same range as previously reported.

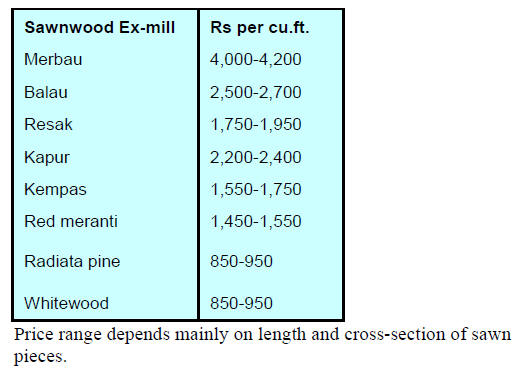

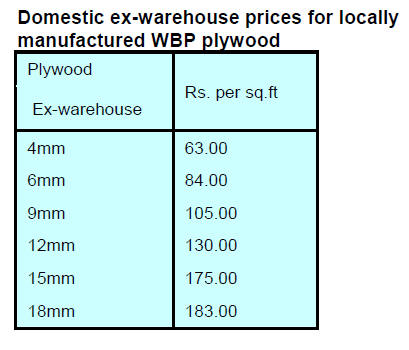

Locally sawn hardwood prices

Prices for imported hardwood sawnwood remain

unchanged from a month earlier but will eventually come

under the same downward pressure as anticipated in the

teak market.

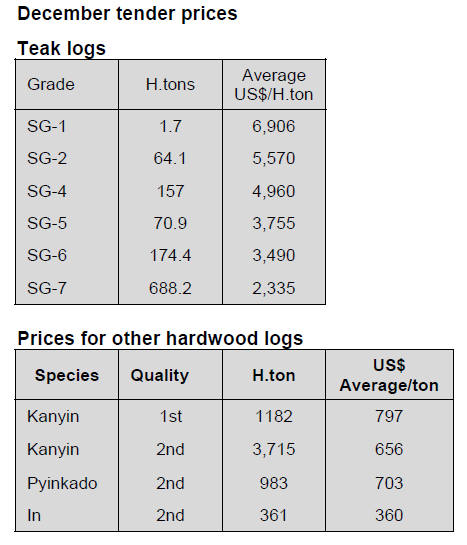

Myanmar teak prices

Traders report that demand for imported sawn teak from

Myanmar is flat. The weak housing market and the high

prices for imported Myanmar teak have combined to

weaken interest in top quality sawnwood.

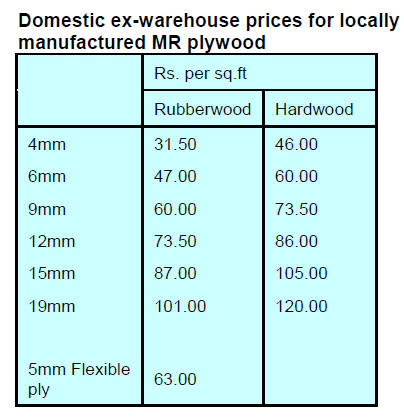

Plywood

Woodbased panel manufacturers, especially plywood and

MDF makers, are facing stiff competition from imported

panels and are considering asking the government to

investigate if some overseas suppliers are dumping panels

into the Indian market.

At the heart of the issue is that supplies are flowing faster

than the market uptake which is leading to pressure on

prices which, for domestic manufacturers who suffer

rising production costs, could be serious.

UN body says India overstates forest cover

The United Nations Framework Convention on Climate

Change (UNFCCC) has raised concerns about India’s

definition of forests, which they suspect exaggerates forest

cover and masks deforestation.

India’s definition of forests has been criticised in the past

on the grounds that it doesn’t provide an accurate picture

of the extent of biodiversity in rich natural forests.

The government considers an area of one hectare (ha) or

more with at least 10% canopy cover, irrespective of land

use and ownership, and as such includes tree crops, fruit

orchards, bamboo and agro-forestry areas as a forest.

For more see: https://www.hindustantimes.com/indianews/

recheck-forest-cover-data-un-body-tells-india-flagsconcern-

about-definition/storyqrB51xpKlnAuYTXzstBAFK.

html

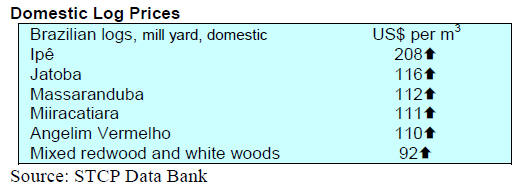

7. BRAZIL

Natural vegetation protection

successes

Statistics from the Brazilian Agricultural Research

Corporation (Embrapa Territorial) show that 66% of the

natural vegetation in Brazil is under

conservation/preservation management. This was backed

up by data from the MapBiomas database, a platform that

maps landuse in Brazil.

According to the United Nations Environment Programme

report “Protected Planet Report 2016”, Brazil is among the

top 10 countries with more than 2 million square

kilometres of protected territory.

New tool improves control of illegal deforestation

Yet another tool, “MapBiomas Alert”, has been introduced

to allow environmental agencies a more accurate view of

real time deforestation. The system, developed in a

partnership between Brazilian Institute for Environment

and Renewable Natural Resources (IBAMA) and

MapBiomas Network, integrates information from

different sources and produces high resolution images.

More than a dozen satellite deforestation warning systems

contribute to the system allowing for real-time

observations. IBAMA is already using remote surveillance

and the new system will strengthen efforts to respond

quickly to deforestation.

For more see:

http://www.ibama.gov.br/noticias/436-2018/1795-novaferramenta-

aprimora-controle-do-desmatamento-ilegal

Export round-up

In November 2018, Brazilian exports of wood-based

products (except pulp and paper) increased 24% in value

compared to November 2017, from US$243.2 million to

US$301.1 million. This performance extended into

December 2018 when exports of wood-based products

(except pulp and paper) increased 5.2% in value compared

to December 2017.

November pine sawnwood export values increased 28%

year on year and export volumes expanded almost 25%

over the same period, from 213,700 cu.m to 266,700 cu.m.

The growth in both export values and volumes extended

into December when export values increased 9% year on

year and export volumes grew almost 10% over the same

period from 201,000 cu.m to 220,600 cu.m.

The positive market developments continued with tropical

sawnwood exports the volumes of which increased 32% in

November 2018 while export values rose almost 20%

from US$19.2 million in November 2017 to US$ 23.0

million in 2018. In December there was an even sharper

growth in export volumes (+23%) from 42,700 cu.m in

December 2017 to 52,500 cu.m in December 2018 at the

same time export values in December also rose 8%.

November 2018 pine plywood exports increased around

8% in value year on year from US$ 55.0 million to

US$59.3 million but export volume growth was lower at

around 5% from 180,100 cu.m to 188,800 cu.m. There

was a further modest increase (1.5%) in pine plywood

export values in December and export volumes grew faster

at around 8% from 177,800 cu.m to 192,300 cu.m.

The positive developments in demand did not spill over to

tropical plywood where, in November, export volumes fell

26.0% year on year 15,400 cu.m in November 2017 to

11,400 cu.m in November 2018. The value of November

exports was also down around the same level (22%) from

US$6.2 million in November 2017 to US$4.8 million in

November 2018.

There were further declines in the value and volume of

tropical plywood export in December 2018 compared to a

year earlier.

Export values for wooden furniture rose from US$41.2

million in November 2017 to US$49.0 million in

November 2018 an almost 19% rise. This upward trend

continued into December 2018 where export values rose

from US$43.9 million in December 2017 to US$50.5

million in December 2018, a 15% rise.

Furniture sector growth

The Brazilian Furniture Industry Association

(ABIMOVEL) has reported that furniture production in

November was recorded at 42 million pieces, 5% higher

than in October. For the 11 months to November 2018

there was a modest rise in production.

Furniture exports in 2018 totalled US$716.5 million

according to ABIMOVEL representing an increase of 10%

compared to 2017. Of the total, the United States

accounted for 30% of export share, an increase of 26.3%

over last year, followed by the United Kingdom with 10%

and Argentina with 7.5%.

Plantation products dominate exports

Export data for wood products show that over the past five

years there has been a steady increase in export volumes

driven mainly by exports of processed pine plantation

timbers. Pine plywood exports were a record 2,272,067

cubic metres in 2018.

Exports of pine veneer rose to 165,582 cubic metres in

2018 from 103,013 cubic metres in 2017 and pine

sawnwood exports were 12% higher in 2018 compared to

a year earlier.

The plantation sector is optimistic about the resumption of

growth in the domestic and international markets but has

identified measures necessary to restore Brazilīs

competitiveness. These include: improving infrastructure

and logistics; improving legal security; adjusting

environmental licensing to best practices and reviewing of

the taxation system to ensure competitiveness.

Against the background of expanding markets for

plantation products exports of tropical wood products have

been steadily declining. Tropical plywood exports were

only 61,016 cubic metres in 2018, about the same as in the

previous year. Exports of tropical veneer in 2018

followed a similar trend with just 13,424 cubic metres

being exported, the same as in the previous year.

Tropical sawnwood exports increased slightly in 2018

rising to 556,441 cubic metres, an18% increase compared

to 2017.

8. PERU

ADEX releases export data for

first 11 months 2018

The Exporters Association (ADEX) has reported that up to

November 2018 exports of wood products were worth

US$112.6 million FOB, this compares to the US$110.7

million in the same period in 2017.

Of the US$112.6 million, exports to China were the largest

and accounted for a 42% share of total wood product

exports however this was down around 14% from 2017.

The United States was the second ranked market in terms

of export values accounting for 12%, a rise of 25% year on

year. However, exports to Mexico dropped 24% year on

year.

Exports of sawnwood between January-November 2018

were US$21.1 million FOB, a drop of 3% year on year.

The Dominican Republic was the main market with a 31%

share. The market in Mexico accounts for another 23% of

sawnwood exports followed by China at 22%.

Peru’s reconstituted panel imports surge

Between January to November 2018 Peruvian imports of

particleboard and MDF were valued at US$94.17 million,

an increase of 28% compared to the same period of 2017.

Of this, Ecuador was the main supplier followed by Chile.

Imports of particleboard and MDF from Spain increased

last year and up to November 2018 shipments from Spain

grew almost 40%.

Most rise in wooden furniture imports last year

ADEX also reports that in the first 11 months of 2018

Peruvian imports of wooden furniture reached US$55.28

million, an increase of 5.5% compared to the same period

in 2017. Brazil was by far the largest supplier of wooden

furniture to Peru shipping almost US$38 million or close

to 70% of all wooden furniture imports.

Imports from China totalled USS6 million with a further

US$2.5 coming from Malaysia. The consolidated imports

of Peru’s Sodimac, the home improvement chain and

Peruvian Homecenters (Promart) accounted for 51% of

total wooden furniture imports to Peru.