|

Report from

North America

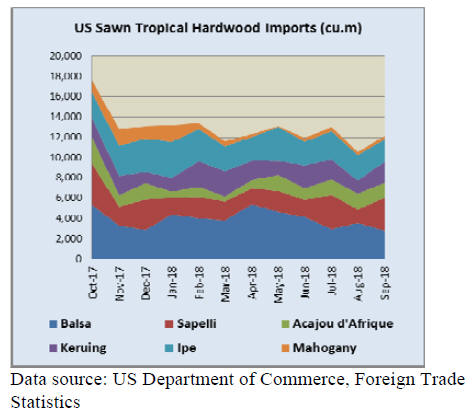

Tropical sawnwood imports hold steady in August

US imports of tropical sawn hardwood held steady in

September with imports up less than 1% from the previous

month at 16,611 cu.m.

However, because US imports historically drop by 5% to

20% from August to September, a flat month actually

improved the outlook for the year as September 2018

imports nearly matched the volume of September 2017.

Year-to-date, tropical hardwood imports are down 12%

compared with 2017. The overall decline in tropical

sawnwood year-to-date is mainly due to lower balsa,

sapelli and virola imports. Sapelli imports rebounded

strongly in September from a weak August but are still

21% down from 2017 year-to-date. Keruing imports grew

again in September and now surpass 2017 year-to-date

figures by nearly 50%.

Balsa imports declined by 22% in September and are

down nearly one-third versus 2017 year-to-date. Virola

and teak imports were down sharply in September and are

both falling further behind 2017 year-to-date figures.

Cedro, meranti and ip¨¦ imports all declined in September,

but remain ahead of their 2017 pace.

Unit values fell slightly for sapelli and acajou d¡¯Afrique

Ip¨¦ prices were up and teak continued its steady climb

back up, nearly returning to its level of one year ago after

a prolonged decline.

Canadian Sawnwood Imports Continue to Trail

Canadian imports of sawn tropical hardwood fell by nearly

a quarter in September as the Canadian market for tropical

imports continues to lag behind last year.

Total imports to Canada are down 18% year-to-date, with

sapelli, virola, ibuia and balsa all down by about one-third.

Imports of Mahogany rose sharply in September to move

ahead of last year-to-date by 7%. Imports of most other

tropical sawnwood fell sharply in September but are still

slightly ahead year-to-date from 2017.

Data source: Statistics Canada

US Consumer Confidence at 18-Year High

US consumer confidence rose in October to an 18-year

high amid optimism about jobs and the economy,

according to figures from the New York-based Conference

Board. The results, coming amid a rout in US stocks, bode

well for continued gains in consumer spending, which

accelerated in the third quarter to the best pace since 2014.

A solid job market is helping to support household

confidence as well as Americans¡¯ purchases, which

account for about 70 percent of the economy.

The consumer confidence index rose to 137.9 from 135.3

in September and the present conditions measure advanced

to 172.8 from 169.4, both seeing their highest levels since

2000. The index measures consumers¡¯ assessment of

current economic conditions and their outlook for the next

six months.

Lynn Franco, Director of Economic Indicators at the

Conference Board, said in a statement that ¡°consumers do

not foresee the economy losing steam anytime soon.

Rather, they expect the strong pace of growth to carry over

into early 2019.¡±

US GDP continued strong growth

The US economy grew at a faster-than-expected rate in the

third quarter as inflation was kept in check and consumer

spending surged, according to data released by the US

Commerce Department. Gross domestic product (GDP)

expanded by a 3.5% annual rate.

The department said the PCE price index, a key measure

of inflation, increased by 1.6% last quarter, much less than

the 2.2% increase expected by economists polled by

StreetAccount.

Consumer spending, which accounts for more than two

thirds of US economic activity, grew by 4% in the third

quarter, the strongest since the fourth quarter of 2014.

The strong rise in consumer spending helped offset a 7.9%

decline in business spending. That was the biggest

quarterly decline in business spending since the first

quarter of 2016.While stronger than expected, the overall

expansion was a slower pace of growth than in the

previous quarter.

Housing starts and home sales fall

Led by a drop in multifamily home building, total housing

starts fell 5.3% in September to a seasonally adjusted

annual rate of 1.2 million units, according to data from the

US Department of Housing and Urban Development and

the US Commerce Department.

According to the US Census Bureau and US Department

of Housing and Urban Development single-family starts

edged down 0.9% to 871,000 units. Meanwhile,

multifamily starts, which includes apartment buildings and

condos, fell 15.2% to 330,000. Regionally in September,

combined single-family and multifamily housing starts

rose 29% in the Northeast and 6.6% in the West. Starts fell

13.7% in the South and 14% in the Midwest.

Existing-home sales declined in September after a month

of stagnation in August, according to the National

Association of Realtors. All four major regions saw no

gain in sales activity in September.

Total existing-home sales fell 3.4% from August to a

seasonally adjusted rate of 5.15 million in September.

Sales are now down 4.1% from a year ago according to

data from the National Association of Realtors.

Sales of newly built, single-family homes fell to a

seasonally adjusted annual rate of 553,000 units after

downwardly revised August, July and June reports,

according to the US Department of Housing and Urban

Development and the US Census Bureau. This is the

lowest sales pace since December 2016. However, on a

year-to-date basis, sales are up 3.5 percent from this time

in 2017.

According to the Census Bureau¡¯s Housing Vacancy

Survey, homeownership rates among all age groups under

64 increased over the last year. Millennial households,

mostly first-time homebuyers, registered the largest gains

among all households, with owners under age 35 showing

a 1.2 percentage point increase from a year ago to 36.8%.

Millennials are gradually returning to the for-sale housing

market, where gains in home price are slowing down. The

homeownership rates of households ages 45-54 and 55-64

experienced a 0.8 percentage point increase. The US

homeownership rate was 64.4% in the third quarter of

2018, which is not statistically different from its last

quarter reading.

|