Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November

2018

Japan Yen 113.81

Reports From Japan

¡¡

Natural disasters disrupt

production and drive down

machinery sales

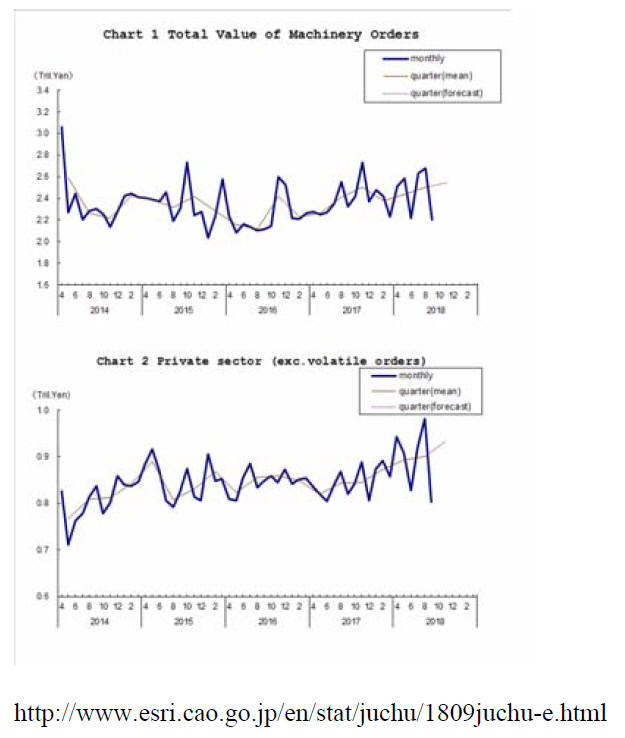

Data on machinery orders derived from a survey

conducted by the Cabinet Office in Japan show that in

September orders fell by the most ever recorded.

The cause of this has been put down to the series of

natural disasters. Western Japan experienced widespread

flooding in early September due to one of the most

powerful typhoons ever to pass over the country. The

international airport in Osaka was damaged and had to

close.

The typhoon was followed almost immediately by a

magnitude 7 earthquake in Hokkaido causing widespread

blackouts and then another typhoon hit western Japan at

the end of September.

These events disrupted business activity so it is not

surprising that there was an 18% dip in machinery orders.

Manufacturers surveyed by the government expect

machinery orders to come in higher in the last quarter of

this year but uncertainties on the direction of global trade

have analysts worried.

Japan's gross domestic product fell a seasonally adjusted

0.3% in the third quarter of 2018 in line with expectations

following the 0.7% gain in the previous three months. On

an annualised basis, GDP declined 1.2% year on year.

Infrastructure spending to be boosted to support

growth

The Japanese media over the past weeks has focused on a

growing concern among policymakers about the direction

of the economy which contracted in the third quarter. The

recent drop in machinery orders has also worried

policymakers.

In the face of these risks to growth the prime minister has

called for an increase in public works spending and some

other measures to support consumption.

Analysts anticipate an increase in infrastructure projects to

be announced in April next year. The Council on

Economic and Fiscal Policy (CEFP) sees the thrust of

spending being aimed at infrastructure related to

earthquake risks and damage control from flooding.

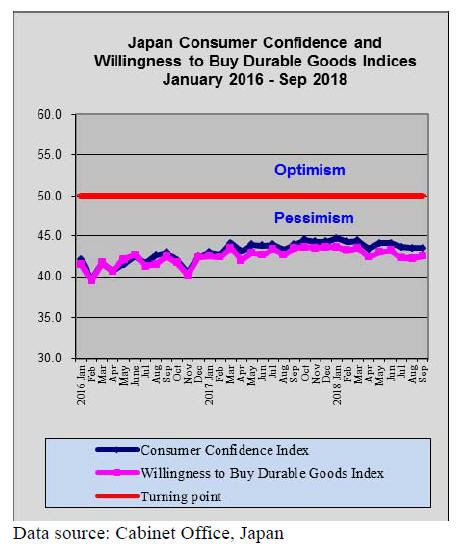

Weak wage growth undermines consumer spending

The September decline in Japanese workers¡¯ inflationadjusted

real wages was the second consecutive fall a

worrying sign that rising petrol prices and higher living

costs are depriving consumers of purchasing power.

September¡¯s 0.4% drop in real wages from a year earlier

followed a revised 0.7% decline in August.

Household spending is a cornerstone of the economy

so

any fall in consumption will be a problem for the Bank of

Japan which is aiming for 2% annual inflation. The

traditional summer bonuses lifted incomes in June but

since then real wages have been weakening.

See data at: https://www.mhlw.go.jp/english/database/dbl/

30/3009pe/3009pe.html

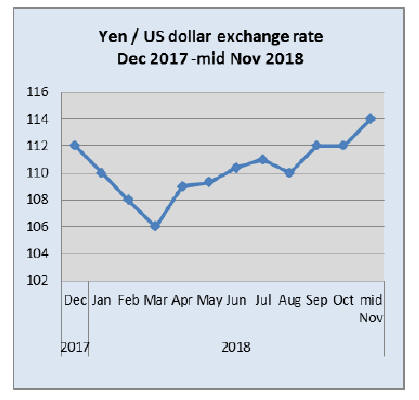

Yen tips to 114 to the dollar

As anticipated, the US Federal Reserve (Fed) left interest

rate unchanged at its November meeting, saying "risks to

the economic outlook appear roughly balanced." In a

statement, the Fed noted that inflation remained around

2% on the back of strong employment figures and

consumer spending. However the Fed did say US business

investment has cooled from its rapid pace earlier in the

year.

The yen weakened slightly against the dollar in early

November because its attraction as a safe haven

diminished. However, analysts say the diverging monetary

policies of the US Federal Reserve and the Bank of Japan

continues to dominate sentiment. The Fed remains on

course to raise interest rates in December and the Bank of

Japan is widely expected to continue its loose monetary

policy. The yen was traded at 113.85 to the US dollar on 9

November .

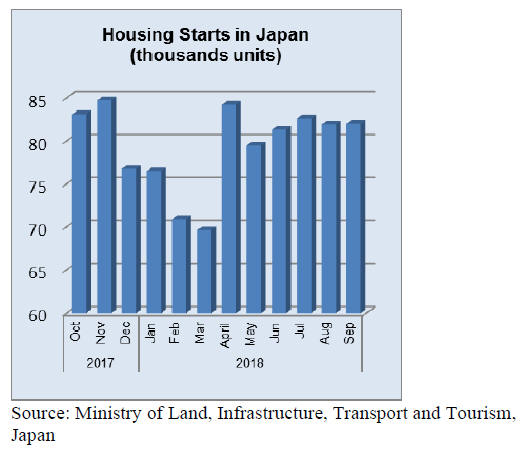

Revival of housing ¡®eco-points¡¯ ahead of

consumption

tax hike

The Ministry of Land, Infrastructure, Transport and

Tourism is thinking about re-introducing the ¡®eco-point¡¯

subsidy programme to promote building and renovation of

energy-efficient homes. Behind this revival is the aim to

help limit the likely decline in housing starts when the

consumption tax is raised from the current 8% to 10% in

October next year.

Under the programme home owners would receive ¡®ecopoints¡¯

when homes meet energy-saving standards through

improved insulation. The ¡®eco-points will be

exchangeable for environmentally friendly goods and gift

tickets. In 2015, when such a programme was introduced

¡®eco-points¡¯ worth yen300,000 for a new home and up to

yen 450,000 were offered for renovation work to improve

both heat insulation and earthquake resistance.

The government is also considering expanding the existing

tax relief for home loans and a cash handout for low and

middle-income home buyers.

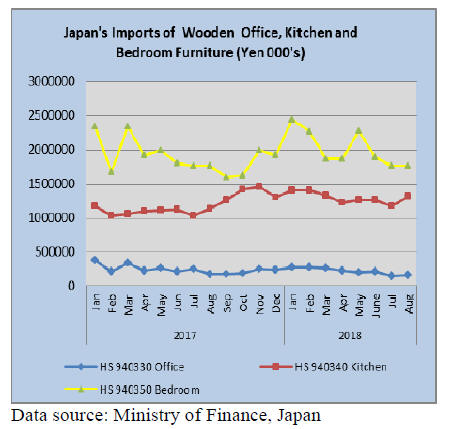

Furniture imports

In line with trends observed in previous years, the third

quarter of the year traditionally marks a turning point for

Japan¡¯s imports of wooden furniture.

In every year since data has been provided in this report

wooden furniture imports to Japan dip in the first two

quarters of the year and reverse direction in the middle of

the second quarter and an upward trend is generally

recorded into the final quarter of the year. However, while

this overall trend applies to wooden office and bedroom

furniture it is less pronounced with imports of wooden

kitchen furniture.

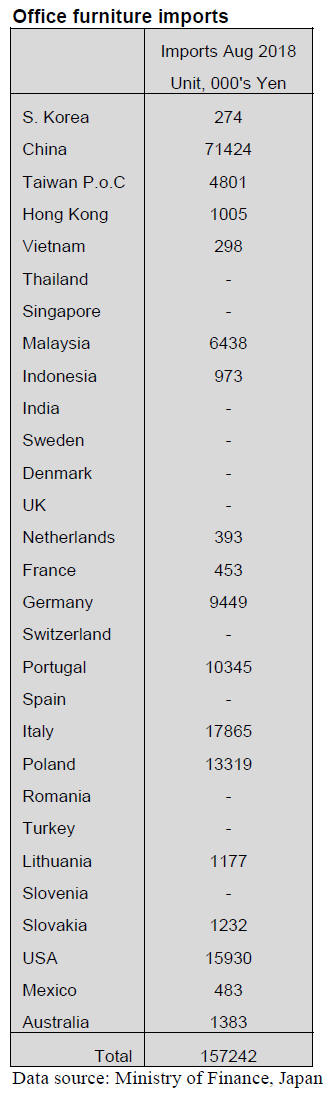

Office furniture imports (HS 940330)

The top three shippers of wooden office furniture

(HS940330) to Japan in August were China which

accounted for 45% of all wooden furniture imports

followed by Italy 11% and the US 10%. Other significant

suppliers of wooden office furniture in August were

Poland and Portugal.

August marked the first time manufacturers in the US had

shipped such a high value of wooden furniture to Japan.

August 2018 shipments from the US are at a record around

being some ten times the value shipped in July.

Year on year, Japan¡¯s wooden office furniture imports in

August were down 6% but in contrast month on month

imports were up around 7%. Compared to the value of

wooden office furniture imports in the first eight months

of last year 2018 imports over the same period were down

14%.

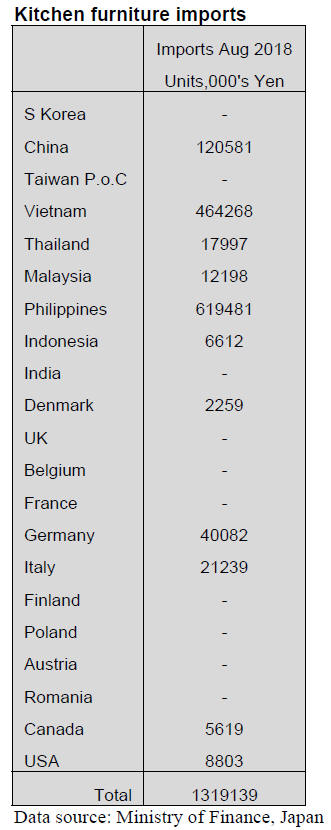

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s wooden kitchen furniture imports

(HS940340) continue to move in a very narrow range.

Tracking exports of this category of furniture over the past

4 years it has been observed that wooden kitchen furniture

imports do not follow the month by month trend observed

for both wooden office and bedroom furniture signaling

there are different demand drives in play for wooden

kitchen furniture.

Year on year, August imports of wooden kitchen furniture

were up 17% and month on month import values rose

12%. The top three shippers of wooden kitchen furniture

to Japan in August were the Philippines at 47% of all HS

940340 imports followed by Vietnam at 35% and China at

9%. In August shipments from Vietnam rose 11% month

on month and Chinese shippers secured a 50% rise in

month on month exports to Japan.

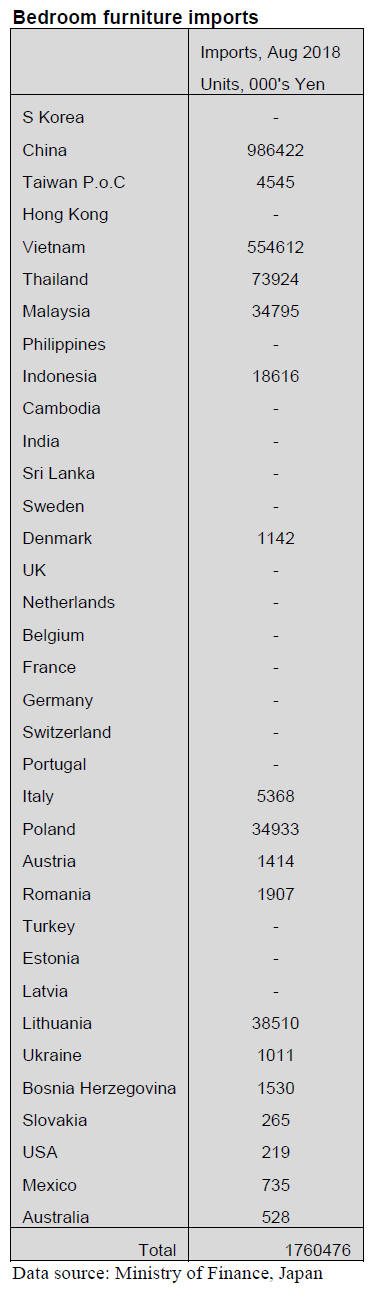

Bedroom furniture imports (HS 940350)

It appears that the value of Japan¡¯s imports of wooden

bedroom furniture (HS940350) bottomed out in July

which fits with the pattern of imports in previous years.

Both year on year and month on month there was virtually

no change in the value of bedroom furniture imports.

China and Vietnam dominate Japan¡¯s imports of HS

940350 with China accounting for 56% of August imports

and Vietnam a further 31%. However in August both the

top suppliers lost market share to other suppliers. Thailand

increased shipments in August and two new comers,

Lithuania and Poland, made it to the list of top 20 shippers

in August.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Promotion to hire foreign workers

The government has started to promote hiring foreign

workers as one of solutions to cover labor shortage by

depopulation of Japan and aging labor force. It will form a

new law for status of residence for foreigners.

Presently there is technical intern system to accept foreign

workers. This is to hire and train foreign workers for five

years and as of 2017, there are about 270,000 foreign

trainees working in Japan. However, there are three

categories for the qualification. System one allows one

year to stay. System two allows three years and system

three allows five years, depending on type of job.

System one is applied to any type of job and system two is

applied to 77 jobs, which does not include jobs like

lumber, plywood, laminated lumber and precutting so

trainees for these business are allowed only one year¡¯s

stay.

Now the National Federation of Log and Lumber Co-op

Association is trying to have system two for wood related

jobs so that workers can stay three years. Wood industry

needs imported workers and training period should be

longer than one year since they need to learn high skills.

System two requires official examination of technical

skills and the test is equivalent to basic degree of National

Trade Skill Test System .

System two does not include lumber manufacturing and

processing but includes manufacturing fixtures,

maintenance of machines, industrial packaging and

carpentry for construction and about 2,500 foreign

workers are engaged in these jobs now.

The government is aware of the needs so it will set new

staying qualification and establish entry and staying

administration bureau in 2019. New qualification for five

years stay requires certain ability to communicate in

Japanese language and completion of technical training.

Wood demand projection meeting

The Forestry Agency held the second demand projection

meeting recently. Projection for the fourth quarter this year

and the first quarter next year is increase of domestic

wood and decline of imports.

Time limit to withhold 8% consumption tax is contracts

made by April 1, 2019 even with delivery is after October

2019 when the tax rate is increased to 10% so rush-in

demand should arise during the first quarter next year but

negative factor is decline of both supply and demand as a

result of recent successive natural disasters such as

earthquakes, typhoons and unusual heavy rains.

Also trade friction between U.S.A and China, which may

result in decline of crating lumber demand.

Housing starts forecast for 2018 by 13 private think tanks

is 951,000 units. However, forecast by top managements is

down by 4,000 units from previous forecast with the

comment that there is no sign of demand pick-up before

the tax rate is increased.

Demand for domestic logs will increase for plywood with

start-up of new mills. Log demand for lumber for the

fourth quarter this year is down from the same quarter last

year because of successive natural disasters then there is

some expectation of demand pickup in the first quarter

next year.

North American log import for the second half of this year

would decrease compared to the first half while North

American lumber would increase in the second half.

Import of European lumber continues to increase after

October. Solid wood European lumber demand would

increase while lamina for beam manufacturing would

decrease. Total supply of structural laminated lumber

including laminated beam would increase with more

supply capacity in Europe.

Expectation for last minutes rush-in demand before tax

increase is strong. Domestic manufactured laminated

lumber supply would decrease in the first quarter next year

compared to the same quarter this year.

Supply of imported plywood from Malaysia and China

would decrease while Indonesia and Vietnam would

increase slightly.

Radiata pine demand continues shifting from New Zealand

logs to Chilean lumber. Russian supply of logs would

continue declining and shifting to lumber and veneer

would continue.

Change of wood based house members

By the survey made by the Japan Forest Products Journal

on ranking of wood based house builders, questionnaires

were sent out to 400 builders to find out what type of

materials they use as members of house building.

For post, 82.2% use laminated lumber, the highest since

the survey started in 1998. It was 60.8% in 1998. In this,

percentage of domestic laminated lumber was 23.6%.

25.0% of redwood, 2.5 points up from 2017 and 21.6% of

whitewood, 1.0 points up. Domestic cedar laminated post

was 17.3%,1.1 points less and cypress laminated lumber was 6.3%.

Solid wood post of cedar was 9.2%, 0.4 points less and

cypress was 6.2%, 10.4 points less.

For beam, 69.4% was structural laminated lumber, 3.4

points less. In this, redwood was 43.9%, 2.2 points up and

KD Douglas fir solid wood was 22.1%, 4.8 points less.

Cypress is the top for sill with 33.4%, 7.9 points less.

Laminated lumber for sill was 29.4%, 2.8 points less.

Others are hemlock, Douglas fir and yellow cedar.

South Sea (tropical) log market

After log export ban in Sabah, Malaysia, log supply for

Japan was expected to drop considerably but the importers

have developed sources in PNG and necessary volume is

secured and plywood mills keep running.

Species from PNG is mersawa, which prices are 20-30%

higher than meranti regular in Malaysia. This is tough deal

for plywood mills but no choice.

Supply of keruing and melapi logs for lumber

manufacturing is also exhausting and lumber supply is

also unstable.

Lumber demand has not recovered even in fall. Orders for

laminated free board for construction are not increasing so

distributors¡¯ inventories are not decreasing so they stopped

ordering to supply side.

Indonesian mercusii pine laminated free board prices are

getting weak.

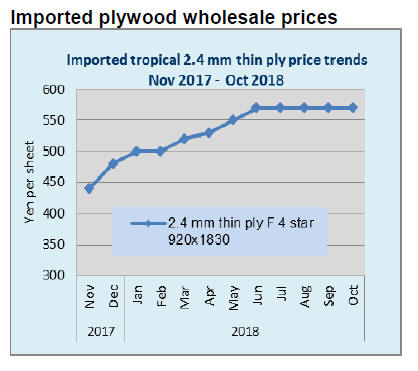

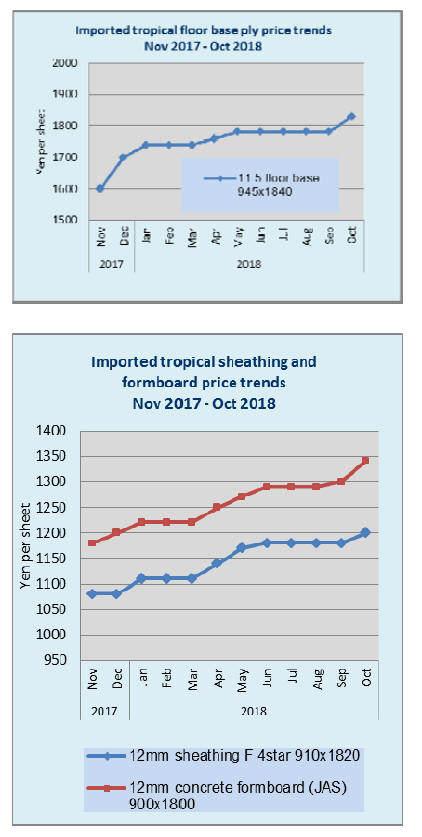

South Sea hardwood plywood

Facing approach of rainy season and declining log supply,

plywood mills in Malaysia and Indonesia are proposing

higher export prices with reduced volume. In the past,

plywood mills in producing regions build up log

inventories before arrival of rainy season but this year is

different.

With tight supply of logs even in summer months, mills

are not able to build up log inventories so now offer

volume is much less than normal volume. Also plywood

mills sell some portion of logs for export to generate profit

even when mills rely on log supply from its own

timberland. Also Sabah, Malaysia banned log export since

last May so ample log supply was expected for plywood

mills but in reality log harvest is stagnant by investigation

of the central government for illegal harvest so the

situation is the same as Sarawak.

Actually plywood mill in Sabah, Sinora Sdn Bhd stopped

plywood manufacturing because of log supply shortage.

Sinora has been supplying about 4,000 cbms of 12 mm

structural and concrete forming plywood a month for

Japan market. Also Korindo, Indonesian plywood mill

shut down some of plywood mills.

Korindo is the only manufacturer of coated concrete

forming panel for Japan and has been supplying about

7,000 cbms a month from two plants. It stopped the

operation of KAS plant so the supply volume will be down

by half. Korindo shut down in late last year and early this

year for about two months because of log shortage.

Log supply is one reason but Korindo accepted too much

orders before log prices soared so more they run, more

loss for the company. After all, weather factor and tighter

restriction of illegal harvest cause tight log supply so even

in dry season, log supply was not enough.

Proposed prices by Malaysian suppliers are about US$690

per cbm C&F on JAS 3x6 coated concrete forming panel

and about US$590 on JAS 3x6 uncoated concrete forming

panel.

Both are up by US$10 from September. Indonesian mills

are following Malaysian prices. The export prices are

expected to keep climbing during rainy season by drop of

log supply.

In Japan, the market for imported plywood continues dull

but as higher cost cargoes keep arriving, the importers are

proposing higher prices while low cost inventories have

been consumed. Market prices of JAS 3x6 coated concrete

forming panels are 1,480 yen per sheet delivered, 30 yen

higher than September but the importers asking prices are

over 1,500 yen.

Since September was the month of mid-term book closing,

there were some low priced offers to dispose of the

inventories so the prices varied much but October is

different. Prices of JAS 3x6 uncoated concrete forming

panesl are about 1,320 yen per sheet and of JAS 3x6

structural panel are 1,340 yen per sheet. Both are up by 20

yen from September. In any case, the market prices have

been edging up on all the items. Higher cost, further

increase is necessary.

The suppliers export prices are US$315-320 on thin board

per cbm C&F and $305-310 on square. Arauco plans to

increase the supply volume of both green and KD lumber

so number 8 ship¡¯ volume will be 20,000 cbms.

Demand by other market is changing. By trade war with

the U.S.A., KD lumber for furniture to China is declining

then crating lumber for Korea is also dropping because of

decreasing demand of export crating lumber for China.

Part of these will be coming to Japan. Demand of KD

lumber by North America and Central America is active

for interior laminated lumber and wood pallet but these do

not compete with demand for Japan.

|