|

Report from

Europe

Tropical sawnwood battles for share of buoyant

European market

Recent reports on European economic and construction

sector health and outlook make for almost exclusively

positive reading. After the EU economy enjoyed its

strongest growth in gross domestic product in a decade in

2017, the overviews and forecasts for the first part of 2018

state that not only has expansion continued to date, it is set

to persist through the rest of the year and into 2019.

In the Spring 2018 Forecast from the European

Commission Directorate General of Economics and

Financial Affairs (ECFIN), almost all the EU country

summaries are strongly upbeat. The one exception is the

UK, with its weaker outlook attributed to a large degree to

the political and economic uncertainties surrounding its

prospective departure from the EU.

Euroconstruct also stated at its conference in Helsinki in

June that European construction was set for continued

growth ¡®in the next few years¡¯.

¡°European construction is growing well on the back of low

interest rates, good economic growth and pent-up needs,¡±

the organisation stated. ¡°Economic growth is expected to

remain solid, unemployment will decrease, exports will

grow, interest rates will remain low and the confidence of

consumers and business and industry in the future is high.¡±

It added that increased tax revenues would drive public

building and infrastructure projects, and that immigration

and the ageing of the population would also likely boost

construction.

Against this backdrop, it might be assumed that the

tropical sawn hardwood sector would be among those

benefitting from higher sales. Certainly the rest of the EU

construction products industry is on a strongly upward

curve, even in the UK.

Like much of the rest of the sector in northern Europe,

businesses were was severely disrupted by poor weather in

the first three months of 2018, but the UK Construction

Products Association reports a strong quarter two upturn

in sales and rising confidence in the country¡¯s £56 billion

industry.

EU tropical import figures mixed

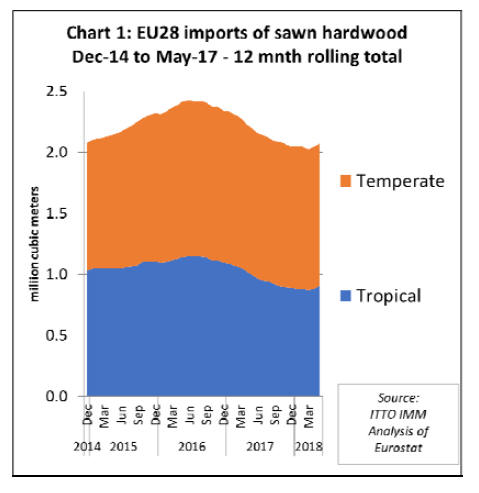

However, the latest figures for the tropical sawn hardwood

sector in Europe show a very mixed and fluid picture. In

the first quarter of 2018, European imports were down 6%

compared to the same period in 2017, continuing a long

term trend. However, overall business recovered slightly

over the next two months to leave the January to May

import figure up 4.4% (Chart 1).

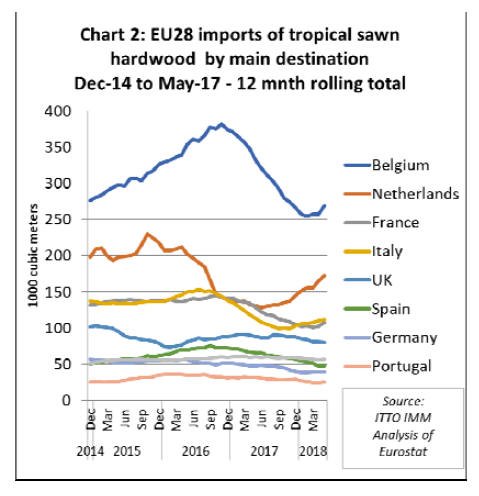

The improvement in EU tropical sawn hardwood imports

in the second quarter of 2018 was accounted for mainly by

rising trade in the Netherlands and Belgium. There was

also a slight uptick in imports by Italy and France. Imports

in the other leading tropical timber consuming EU

countries was either flat or declining (Chart 2).

Total EU imports of tropical sawn hardwood for January

to May 2018 were 405,597 cu.m, compared to 388,395

cu.m for the same period the year before. Belgium¡¯s

imports were up 2.1% at 119,354 cu.m, while the

Netherlands¡¯ jumped 45.7% to 88,692 cu.m. France and

Italy¡¯s imports were up respectively 5.5% and 19.7% at

49,517 cu.m and 48,019 cu.m, while Denmark¡¯s rose

23.9% to 8479 cu.m and Poland¡¯s 47.2% to 4,271 cu.m.

Of the larger importers, Spain saw the sharpest

contraction, down 31.8% to 18,129 cu.m, while the UK¡¯s

imports fell 20.1% to 29,903. Germany¡¯s tropical sawn

hardwood trade was down 3.4% to 18,397 cu.m,

Portugal¡¯s 30.3% at 9,623 cu.m, Ireland¡¯s 48.3% at 3,878

cu.m and Greece¡¯s 3.16% at 3,550 cu.m.

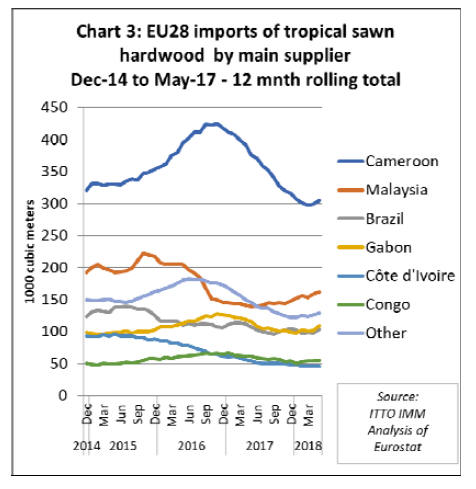

There was also divergence in the EU fortunes of various

tropical suppliers. EU imports of sawn hardwood from

Malaysia progressively increased in the first five months

of 2018.

Imports from Cameroon declined in the first three months

of 2018 before recovering a little ground in April and

May. Imports from Gabon, Brazil and Congo remained

static at a relatively low level in the first five months of

2018. Imports from Cote d¡¯Ivoire continued to slide

between January and May this year (Chart 3).

Comparing the January to May period in 2018 with the

same period in 2017, EU imports of sawn hardwood fell

from Cameroon by 8.3% to 124,853, from Brazil by 1.6%

to 48,939 cu.m, from Côte d¡¯Ivoire by 12.8% to 17,593

cu.m, from Suriname by 25.2% to 2,690cu.m and from

Madagascar by 20.6% to 2,915cu.m.

In contrast, in the first five months of 2018 EU sawn

hardwood imports increased from Malaysia by 21.4% to

78,305 cu.m, from Gabon by 23.2% to 53,167 cu.m, from

Congo by 6% to 22,973 cu.m and from Myanmar by

45.5% to 4,932 cu.m.

EU importers face rising competition for supplies

EU timber traders cited a number of factors shaping

tropical import trends. These included intensifying

competition for material from Chinese and other Asian

buyers, which was driving up prices for tropical and

temperate hardwood alike, as well as resulting in short

supply in some species.

But logistical problems, the ¡®deterrent effect¡¯ of the EUTR

in the tropical market on both suppliers and buyers, as one

importer described it, and ever intensifying competition

from rival products, including temperate hardwoods,

modified timber and wood composites, also had an

influence.

The restructuring of the African operations of the Frenchbased

Rougier Group, one of the EU¡¯s key tropical

producers and importers, was also felt to have impacted

the market. And some companies also believe there is an

underlying long term ¡®slow but discernible¡¯ decline in the

EU tropical trade, although this is not a view shared by

everyone.

Interestingly, however, the EU temperate sawn hardwood

market has also been experiencing its own challenges,

notably supply constraints, price inflation and most

recently allegations of illegality and breaches of the EUTR

in one of the best selling species, European oak.

Backlogs grow at Douala Port

One factor in the contraction in Cameroon¡¯s EU exports,

which started in 2016, cited by a number of EU importers,

was the continuing deterioration of operations at the port

of Douala, the key timber trade export hub for much of

Central and West Africa. The government has now

appointed a commission to investigate the ¡®failed

operations¡¯ at the facility. But importers don¡¯t expect rapid

improvement to the rate of throughput and reductions in

backlogs at the port any time soon.

¡°It¡¯s a combination of poor management, old and

unreliable equipment and silting up of access channels,

which means that larger, deep-draft vessels can¡¯t dock,¡±

said an continental EU importer. ¡°Some shippers are

exploring the possibility of using the new, Chinesefunded,

deep-water port at Kribi, but this still has teething

problems, and the only other real alternative is Pointe

Noire in the Republic of Congo.¡±

According to latest reports the backlog of timber for

shipment to China alone at Douala has now reached

60,000cu.m.

As mentioned, the disruption to supply from Rougier¡¯s

Cameroonian operations while the company has been

under protective receivership is also thought to have hit

the country¡¯s overall export figures.

Rougier has now finalised the sale of its businesses SFID,

Cambois and Sud Participation in Cameroon and RSM in

the Central African Republic to Cameroon-based

consortium Sodinaf.

The latter was chosen as the buyer, said Rougier in its July

19 statement, ¡°for the quality of its project, which will

help ensure the sustainability of the activities sold¡±.

At the same time the company said it intended to

¡°continue to be a major player within its industry¡± and

would focus on developing its other more ¡®geographically

aligned¡¯ African operations, notably in Gabon, ¡°in better

conditions¡±.

But, while the situation is now seemingly resolved, some

EU importers feel there may be continuing implications

for trade with the Cameroonian operations.

¡°With those ex-Rougier businesses now in Cameroonian

rather than French ownership, they may well take a

different market view and approach,¡± said an importer,

who also questioned whether the new owners would renew

the FSC-certification which Rougier let lapse under

receivership.

Concentration of EU African import trade

The combination of these factors, with intensifying

competition from Chinese buyers and the administrative

time and cost burden of EUTR compliance is reported by

companies in some EU countries to be leading to further

concentration of the African importing sector.

¡°We¡¯re seeing operators on the periphery of the trade,

previously importing smaller quantities now and again,

coming to us instead,¡± said an importer.

Supply issues are also applying further upward pressure on

African prices. One company said both sapele and

sipo/utile were being quoted €50 to €60 per cu.m more for

quarter one delivery 2019, an increase of around 10% on

current prices. And another importer forecast a further 5-

7% increase in sapele by the year-end.

Iroko and framire/idigbo prices were also reported to have

firmed, with supply of the former improving, but the latter

becoming increasingly difficult to source.

¡°Overall African supply is tight, and drying specialists in

the UK and the Netherlands in particular are finding it

difficult to get enough hardwood to put through their

kilns,¡± said an EU importer.

¡°It¡¯s very much a sellers¡¯ market. Our African suppliers

have full order books and are very bullish. They can pick

and choose their customers and often they¡¯re also

choosing Chinese buyers because they both pay a good

price and don¡¯t require the legality and sustainability

verification we do.¡±

Competitive Asian market

While both Indonesia and Malaysia increased their EU

exports of sawn hardwood in the first five months of 2018,

EU importers reported tight supply due to competition

from Asian buyers and continuing wet weather affecting

harvest and transit.

Lead times for Malaysian keruing and meranti were

extended and prices firming, with the strength of the

ringgit against the dollar said to be adding to price

pressure, while suspension of some suppliers¡¯ certificates

has affected PEFC-certified supply.

Indonesian bangkirai prices are also already up this year,

and importers say more increases are in the pipeline, with

quotes up 20-30% for end-of-year deliveries. One

company also said that the premium on FSC-certified

material over FLEGT-licensed had increased.

Whether FLEGT-licensing is assisting imports from

Indonesia is unclear. One importer said they were

highlighting it in their customer documentation, but others

were doubtful.

¡°It still needs more communication and education in the

market place,¡± said one company. ¡°It¡¯s not sufficiently

understood or valued by our customers, and awareness

decreases the further you go down the supply chain.

Brand recognition is nowhere near the levels for FSC or

PEFC.¡±

EU importers discouraged from importing Myanmar

teak

Given continuing controversy in the EU over whether

Myanmar teak can be traded in compliance with EUTR

requirements, importers questioned by ITTO¡¯s

correspondent were surprised by EU import statistics

showing a 46% increase in sawn hardwood trade with

Myanmar in the first five months of this year. The

statistics indicate that much of the rise in trade was

destined for Italy, Belgium, Germany, and the

Netherlands.

Some NGOs claim that it is not possible, under the

existing regulatory framework in Myanmar, for EU

importers to gather information sufficient to ensure a

negligible risk of teak being from an illegal source in line

with EUTR requirements.

As things stand, this position is effectively endorsed by the

Competent Authorities (CAs) responsible for enforcement

of EUTR at national level in the EU.

At their meeting in November 2017, the European

Commission¡¯s Expert Group on the EUTR and FLEGT

Regulation which provides a forum for member state CAs,

reviewed a statement issued by the Ministry of Natural

Resources and Environmental Conservation (MONREC)

in Myanmar regarding improvements in traceability and

transparency. The Expert Group agreed that this still falls

short of what is needed to demonstrate the origin of the

timber and so ensure full due diligence from an EU

perspective.

A Myanmar delegation recently met with EU officials,

trade bodies, NGOs and CAs, but the outcome was

reported to be ¡®status quo¡¯ with the CA¡¯s assessment of

risk on Myanmar imports unchanged.

Until the matter is resolved, several timber trade bodies,

including Le Commerce du Bois in France and the UK

TTF, are advising members not to import Myanmar teak.

Sharp fall in UK tropical timber imports

UK hardwood companies attributed the particularly sharp

fall in their imports of tropical sawn hardwood to a

number of factors. These included the situation in Douala

and disruption in supply from Rougier, a major supplier to

the country. They reported too that, after heavy buying in

2017, there was an excess of stock on the ground. General

economic uncertainty in the market was additionally

leading to customers buying just in time and little and

often.

Some importers thought too that sales of tropical

hardwood were in long term decline due to a combination

of aversion to perceived illegality risk and increased

consumer acceptance of other products. The UK is a

particularly strong market for modified timber, notably

Accoya, thermo-treated timber and wood composites,

which are reported to be increasing in choice and quality.

One importer recently told the UK¡¯s TTJ magazine that

they saw all these products as ¡°part of the armoury of a

modern timber products and service provider¡±.

Competition from temperate hardwoods was also cited as

a factor in tropical timber sales trends by EU importers,

although as highlighted above, this sector is not without its

own issues.

Prices across the range of temperate species are said to be

firm thanks to demand levels in the EU and competition

from Asian, again notably Chinese buyers, who have been

taking growing quantities of logs as well as sawn timber.

At the European Oak Conference in London in March, the

European Organisation of Sawmill Industries (EOS) stated

that in seven years Europe¡¯s oak lumber exports to China

are up 34%, while log exports have risen 244%. This had

led to demands in France in particular for some form of

controls on log exports.

The recent imposition of phytosanitary restrictions on US

hardwood logs by China was expected by some to

alleviate demand pressure in the market. However, one

importer thought that it might lead to Chinese buyers

sourcing more US hardwood lumber instead.

European oak export controls

Adding price inflationary and demand pressure in the

European oak market are export and transit controls on

oak logs and green lumber in Croatia, ostensibly to curb

the spread of oak lace beetle (Corythucha arcuata).

At the European Oak Conference a representative of the

Croatian Oak Cluster said the controls might be relaxed

this summer, but according to the EOS there is no news to

date.

The latest is that Croatian authorities have informed the

European Commission Standing Committee on Plant,

Animals, Food and Feed (PAFF) that their course of action

would be decided in July following consideration of a new

report into the effectiveness of measures to control spread

of the beetle.

The ten-year ban on unprocessed timber exports from

Ukraine has also impacted on EU oak processors and has

been challenged by the EU authorities.

Now, following an investigation by ENGO Earthsight,

there is also added concern that lumber from Ukrainian

mills entering EU supply chains may have derived from

illegally felled trees, including oak.

Earthsight alleges that Ukrainian rules allowing felling of

diseased trees have been illicitly used to harvest healthy

forest. The subsequent timber, some of it stamped FSCcertified,

was then finding its way, despite EUTR due

diligence, into neighbouring EU countries, notably Poland

and Romania. The NGO said corruption in Ukrainian

authorities was facilitating the trade.

On July 18 Ukrainian prime minister Volodymyr

Groysman, seemingly in response to the Earthsight

expos¨¦, said he was initiating a crackdown on illegal

timber and appealed to the EU to provide information on

imports of timber from his country. But in the meantime

an importer said his company was ¡°interrogating all

European oak imports much more closely¡±.

Turning back to tropical timber, the International Tropical

Timber Technical Association (ATIBT) says that its Fair

& Precious brand-based marketing initiative to promote

tropical timber internationally was continuing to roll out.

Speaking at the EU FLEGT Independent Market Monitor

Trade Consultation in Nantes in June, the organisation said

the Fair&Precious brand was open to companies across the

tropical timber supply chain which committed to source

material legally and sustainably, and to submit to third

party audit of their procurement practice.

ATIBT also said it would be considering where the

FLEGT VPA initiative and FLEGT licensed timber might

fit in the Fair&Precious sourcing criteria.

Meanwhile the 2018 conference of the Sustainable

Tropical Timber Coalition, the industry alliance dedicated

to increasing sustainably sourced tropical timber sales in

Europe, has the theme of using data and market

intelligence to drive market share. It takes place in Paris

on October 25 (www.europeansttc.com).

|