Japan

Wood Products Prices

Dollar Exchange Rates of 25th

July 2018

Japan Yen 110.97

Reports From Japan

¡¡

Japan/EU trade deal to

eliminate tariffs

Japan and the European Union have signed a significant

free trade deal that will lead to deep cuts or eliminate

tariffs on nearly all goods.

An on-line statement from the EU says ¡°The Economic

Partnership Agreement between the EU and Japan is the

biggest ever negotiated by the European Union. It creates

an open trade zone covering over 600 million people and

nearly a third of global GDP.

It will remove the vast majority of the €1 billion of duties

paid annually by EU companies exporting to Japan, and

has led to the removal of a number of long-standing

regulatory barriers, for example on cars.

It will also open up the Japanese market of 127 million

consumers to key EU agricultural exports and will

increase EU export opportunities in a range of sectors. The

Agreement follows the highest standards of labour,

environmental and consumer protection and has a

dedicated chapter on sustainable development. It is the

first trade agreement negotiated by the European Union to

include a specific commitment to the Paris climate

agreement.¡±

See:

https://ec.europa.eu/commission/news/president-juncker-25th-eujapan-

summit-2018-jul-17_en

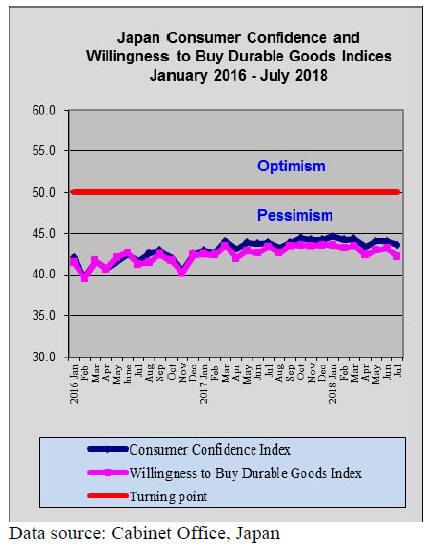

Consumers signal reluctance to buy durable goods

Japan's Cabinet Office has released details of its July

consumer confidence survey which pointed to an

unexpectedly decline in July. The overall livelihood index

fell as did other indices. Of concern to the timber sector

was the sharp drop in consumer willingness to buy durable

goods.

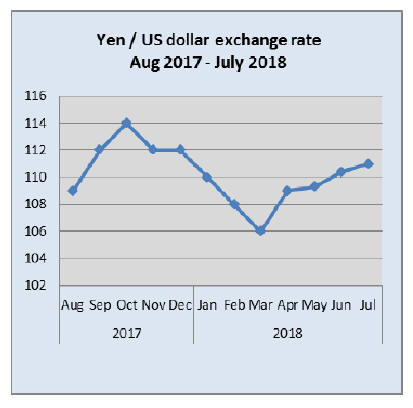

Hints of policy change at Bank of Japan

Towards the end of July the yen firmed against the dollar,

giving up some of the weakness following the US interest

rate increase but then fell back which analysts put down to

the traditional ¡®rush to yen¡¯ when a crisis looms, the latest

being the destabilised global economy.

Despite a flurry of negative economic indicators some

suspect the BoJ is considering policy changes to make its

currency management ¡®more sustainable¡¯ but the

interpretation of sustainable is open to question. In the

second half of July the yen moved to 112 to the dollar but

has firmed to 110-111 yen per dollar by month end.

Disaster relief hampered by scorching

temperatures

There are still almost 5,000 evacuees from the recent

floods and landslides staying in shelters. Recently the

Tokyo Metropolitan Government has said it offers free

housing for victims. The capital has available 200

residences in council housing areas. Relief and recovery

efforts in the disaster hot areas have been hampered by

extremely hot weather with day time temperatures rising

to over 35 degrees centigrade for almost two weeks.

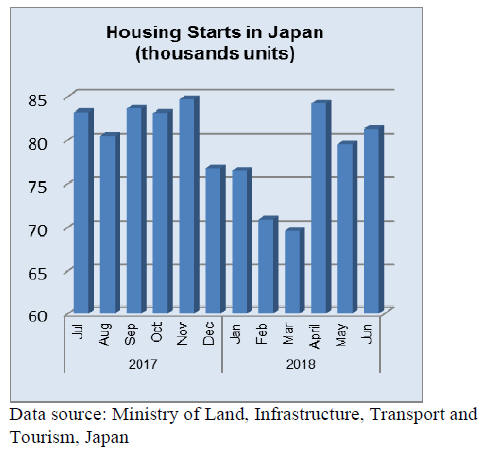

Housing starts dip year on year

Despite being up on levels in May, year on year Japan's

housing starts fell sharply in June according to statistics

from the Ministry of Land, Infrastructure, Transport and

Tourism. June 2018 starts were down over 7% reversing

the tear on year rise seen in May. Ministry data also

pointed to a decline in orders received by the major

construction companies.

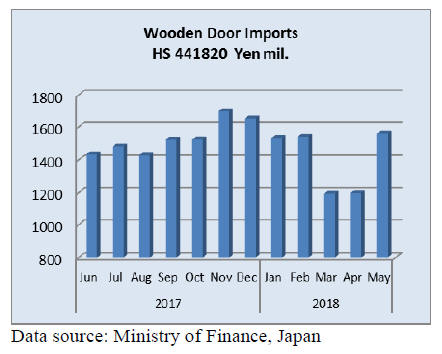

Import round up

Doors

May door imports

As if to compensate for the decline in door imports in

March and April, the value of May imports skyrocketed

30% month on month with the top three suppliers, China,

the Philippines and Indonesia all posting gains.

Shipments from China regularly account for around 60

%

of all imports and in May shippers in China saw a 30%

increase in delivers to Japan. The top three suppliers of

wooden doors to Japan accounted for over 90% of May

2018 imports.

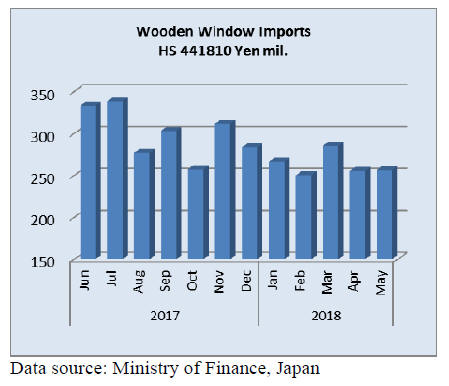

Window imports

May window imports

Year on year Japan¡¯s May imports of wooden windows

were down 20% and month on month they were little

changed from a month earlier.

The top three shippers, as was the case in April, were

China (43%), USA (26%) and the Philippines (24%). In

May, shippers in China saw a 20% increase in total

shipments and shippers in the Philippines posted a 5% rise

in the value of shipments.

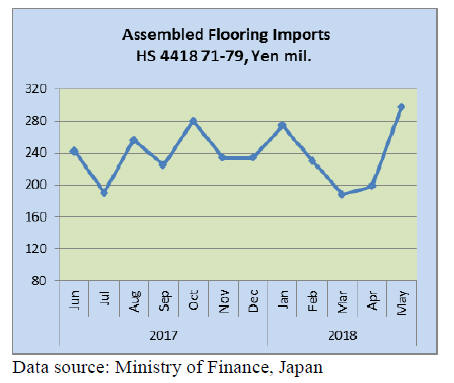

Assembled flooring

May imports

As in previous months wooden flooring imports were

dominated by HS 441875 followed by HS441879.

Together these two categories of assembled flooring

accounted for over 90% of the value of all assembled

wooden flooring imports in May.

In order of rank by value, China, Malaysia and Indonesia

were the main shippers of HS441875 in May while for

HS441879 the main shippers were Indonesia and

Thailand.

The value of May 2018 imports of wooden flooring was

the highest for the past 12 months and almost up to the

record level seen in January 2016. Year on year, May

2018 imports of wooden flooring were up 60% and there

was a 50% increase from levels in April.

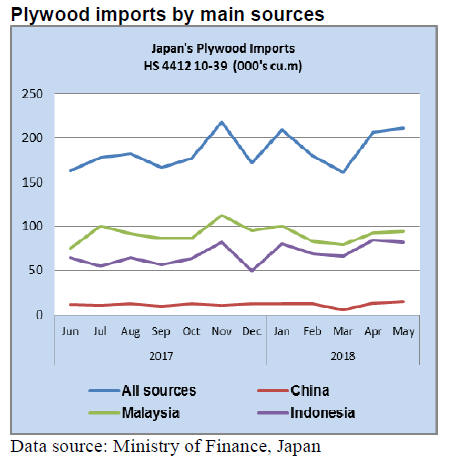

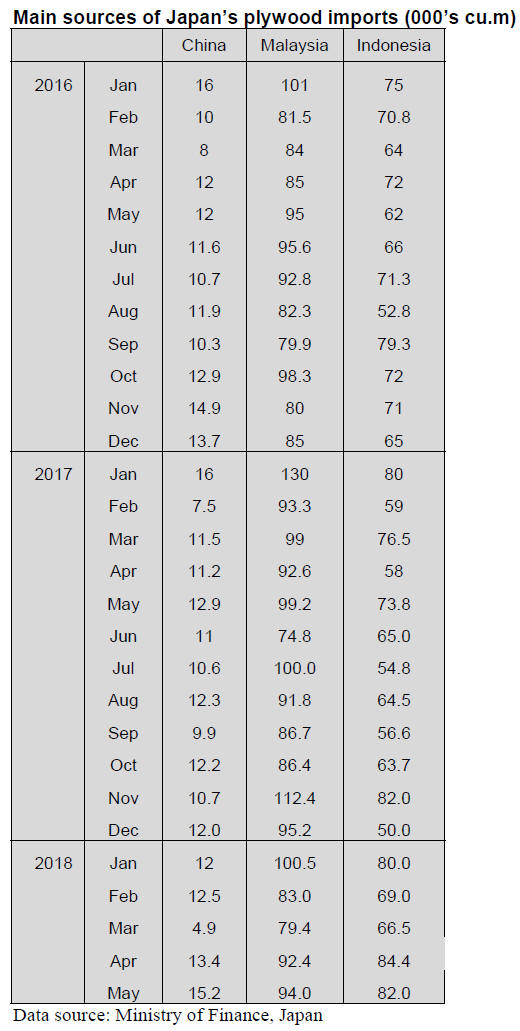

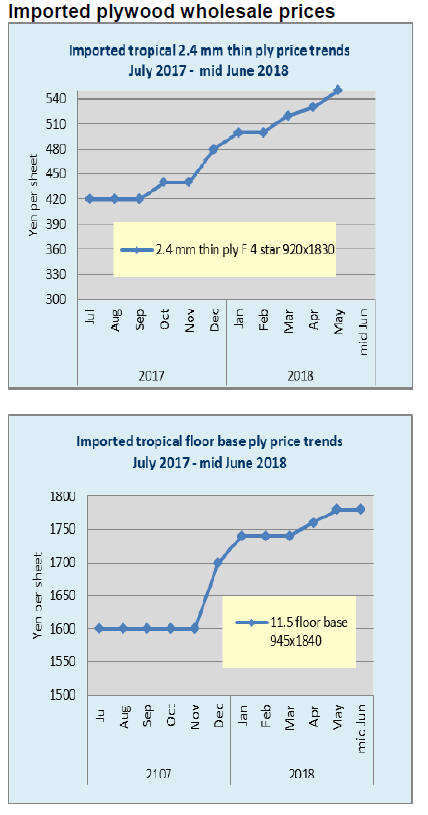

Plywood

May plywood imports

As in previuos months plywood in HS 441231 accounted

for most of Japan¡¯s imports of plywood. As in April, May

imports of HS441231 accounted for over 89% of all

plywood imports. HS441234 accounted for just 5% of

May plywood imports.

Year on year May plywood imports from all sources rose

5% with shipments being dominated by Malaysia and

Indonesia with smaller volumes from China and now,

Vietnam. May shipments from Malaysia and Indonesia

were up slightly (2% and 3% respectively) while

shipments from China jumped 14%.

Trade news from the Japan Lumber Reports (JLR).

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Indonesian floor base plywood supply

Delayed shipment and escalating prices of Indonesian

floor base plywood have continued for more than a year.

Reason is tight log supply. Even after rainy season was

over, log supply has not recovered and tight supply may

continue until arrival of next rainy season in both Malaysia

and Indonesia.

Log production in both countries plunged sharply by

heavier rain fall. This results in inflating log prices. Floor

base plywood prices finally exceeded $750 level and June

offer prices are $780 per cbm C&F for 11.5 mm thick

overlay better panel. Previous settled prices were $730-

740 so this is steep climb. Plywood suppliers in Indonesia

realize the prices are too high but they have to pass high

log cost onto export prices.

Meantime, Japanese floor manufacturers need to accept

higher prices to continue manufacturing floor products so

they purchased future supply in May and June. With

exchange rate of over 100 yen per dollar, $780 would cost

about 1,950 yen per sheet, the highest ever. Japanese floor

manufacturers carry some inventories and some orders

made about six months to a year ago have not arrived yet.

These are lower cost so the manufacturers can average

down the high cost of recent orders then they have been

using more domestic softwood and plantation wood like

falcate plywood, which are another items to average down

the cost.

In short, imported floor base plywood is no longer reliable

material for Japanese floor manufacturers with delayed

shipments and skyrocketing prices.

Plywood

Movement of both imported and domestic plywood is

getting slower. Domestic softwood plywood market is

weakening in wholesale channels. Slower demand by

precutting plants is getting active again.

Imported plywood market lost upward momentum. The

prices had been climbing as export prices have

kept soaring then in April, the movement started

stagnating so that the price escalation stopped.

May softwood plywood production was 251,700 cbms out

of which structural panel was 234,400 cbms, 0.8% less

than May last year and 2.0% less than April. With series of

holidays in early May, operating days are less than other

months but starts-up of new mill added some production

so total production did not drop much.

The manufacturers are determined to keep present sales

prices but actual market prices are bit confusing with some

low offers.

Market of imported plywood confused some after lower

cost inventories were in the market in June but the volume

is limited so that the market is tightening again in July.

New arrivals cost higher so sales price increase is

necessary by one notch.

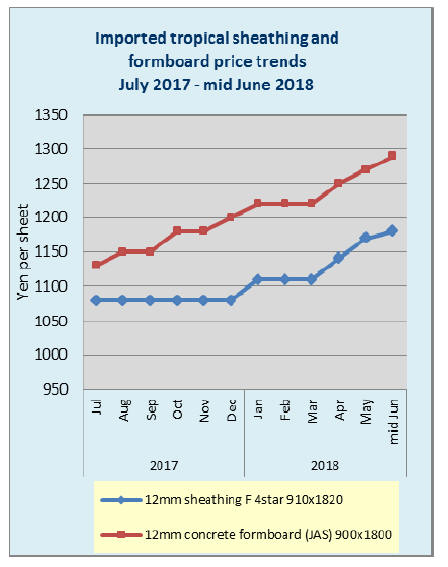

Imported South Sea (tropical) plywood market

Export prices by the suppliers continue climbing so future

prices will be firm and higher but the market in Jap an is

not able to follow escalating cost with weak demand.

Particularly concrete forming for coating panel market is

soft.

The demand skidded after early May. The prices had been

climbing since last year but the movement slowed after

May so price hike stopped.

Actually the prices are down in June when the importers

and wholesalers need to reduce the inventories before

closing the book. Cargoes arrived in April are lower in

cost compared to recent contracted cargoes so some low

offers are proposed. This pushes market prices downward

in general.

Supply side continue bullish with tight supply of logs so

export plywood prices seem to keep escalating so the

importers face rising future cost and weakening market

inJapan so they look for low cost items in Japan market to

average down the cost but with limited inventories, it is

hard to find such low priced panels.

After all, gap between high cost offered by supply side

and weakening market prices in Japan by lack of demand

is widening and it becomes much harder to commit future

cargoes.

Weakening domestic softwood plywood market

Domestic softwood plywood demand had been very active

in 2016 and 2017 by high housing starts so that the

shipment had been more than the production by the

manufacturers, which have been operating with maximum

capacity but such robust demand finally eased in early

2018.

Demand slowness during winter months is normal every

year and in last two years, the demand picked up in early

spring so that the manufacturers continued full production

even in winter months.

For the first time in three years, the demand and prices are

softening due to slowdown of orders from precutting

plants as start of rental units are declining.

Accumulated starts of wooden units for the first four

months are 3,156 units less than the same period of last

year. This may be the reason that orders from precutting

plants decrease. Since middle of March, the market prices

have started weakening and there were some spotty low

offers. Even after new fiscal year started in April, the

demand continues dormant.

Building materials trading firms have started selling

without any commission since they need to dispose of

certain amount of allocated volume by the manufacturers.

Start-up of new Miye softwood plywood plant by Nisshin

in April gives psychological impact to the market as an

additional supply source.

If this bearish mood is temporary or not depends on orders

by precutting plants. Large precutting plants are having

ample orders for the summer and the manufacturers have

such bullish view that the demand should recover shortly

so that they continue full production for coming fall

demand.

The manufacturers had to curtail the production by oversupply

in 2014 and 2015.

This is the first time that the prices softened in distributing

channels. Present prices of 12 mm 3x6 are 1,030-1,050

yen per sheet delivered, 10-20 yen lower than May. The

manufacturers think that this is temporary dip and the

demand should come back shortly.

High export log prices in Kyushu

In Kyushu, where is major supply region of export logs,

prices of export logs stay up high. Prices of 4 meter cedar

C grade logs are 8,500 yen per cbm delivered. Prices of

logs for lumber have been weak due to seasonal reason

and prices of logs for biomass power generation are lower

than export.

Kyushu is geographically close to Korea and China market

so prefecture of Kagoshima, Miyazaki and Kumamoto are

major log suppling regions.

In Southern Kyushu, cedar logs with top diameter of 50

cm and large cypress logs are practically all for export and

log exporters compete with each other to secure the

volume.

Weak yen is favorable factor for export so the momentum

of log export seems to continue for some time. Market of

competing logs for biomass power generation is weakly

holding at about 6,500-7,000 yen per ton delivered chip

plants because of over-supply and power plants are

reducing purchase of logs for wood chip.

Meantime, market of logs for lumber (A class logs) is also

weak because sawmills are reluctant to buy too much logs

in the rain season for fear of beetle damages.

In Southern Kyushu, price difference between A class logs

for sawmills and C clsss logs for export is narrowing to

2,000-2,500 yen per cbm since C class log prices hold up

and bottom is supporting upper class log prices.

However, demand for A class logs should recover toward

fall and substituting demand of domestic logs from high

priced import wood products should increase in the second

half of the year.

May softwood plywood production was 251,700 cbms out

of which structural panel was 234,400 cbms, 0.8% less

than May last year and 2.0% less than April. With series of

holidays in early May, operating days are less than other

months but starts-up of new mill added some production

so total production did not drop much.

The manufacturers are determined to keep present sales

prices but actual market prices are bit confusing with

some low offers.

Market of imported plywood confused some after lower

cost inventories were in the market in June but the volume

is limited so that the market is tightening again in July.

New arrivals cost higher so sales price increase is

necessary by one notch.

Weakening domestic softwood plywood market

Domestic softwood plywood demand had been very active

in 2016 and 2017 by high housing starts so that the

shipment had been more than the production by the

manufacturers, which have been operating with maximum

capacity but such robust demand finally eased in early

2018.

Demand slowness during winter months is normal every

year and in last two years, the demand picked up in early

spring so that the manufacturers continued full production

even in winter months.

For the first time in three years, the demand and prices are

softening due to slowdown of orders from precutting

plants as start of rental units are declining.

Accumulated starts of wooden units for the first four

months are 3,156 units less than the same period of last

year. This may be the reason that orders from precutting

plants decrease. Since middle of March, the market prices

have started weakening and there were some spotty low

offers. Even after new fiscal year started in April, the

demand continue dormant.

Building materials trading firms have started selling

without any commission since they need to dispose of

certain amount of allocated volume by the manufacturers.

Start-up of new Miye softwood plywood plant by Nisshin

in April gives psychological impact to the market as an

additional supply source.

If this bearish mood is temporary or not depends on orders

by precutting plants. Large precutting plants are having

ample orders for the summer and the manufacturers have

such bullish view that the demand should recover shortly

so that they continue full production for coming fall

demand.

The manufacturers had to curtail the production by oversupply

in 2014 and 2015. This is the first time that the

prices softened in distributing channels. Present prices of

12 mm 3x6 are 1,030-1,050 yen per sheet delivered, 10-20

yen lower than May.

The manufacturers think that this is temporary dip and the

demand should come back shortly.

High export log prices in Kyushu

In Kyushu, where is major supply region of export logs,

prices of export logs stay up high. Prices of 4 meter cedar

C grade logs are 8,500 yen per cbm delivered. Prices of

logs for lumber have been weak due to seasonal reason

and prices of logs for biomass power generation is lower

than export.

Kyushu is geographically close to Korea and China market

so prefecture of Kagoshima, Miyazaki and Kumamoto are

major log suppling regions.

In Southern Kyushu, cedar logs with top diameter of 50

cm and large cypress logs are practically all for export and

log exporters compete with each other to secure the

volume.

Weak yen is favorable factor for export so the momentum

of log export seems to continue for some time. Market of

competing logs for biomass power generation is weakly

holding at about 6,500-7,000 yen per ton delivered chip

plants because of over-supply and power plants are

reducing purchase of logs for wood chip.

Meantime, market of logs for lumber (A class logs) is also

weak because sawmills are reluctant to buy too much logs

inrainy season in fear of beetle damages.

In Southern Kyushu, price difference between A class logs

for sawmills and C clsss logs for export is narrowing to

2,000-2,500 yen per cbm since C class log prices hold up

and bottom is supporting upper class log prices.

However, demand for A class logs should recover toward

fall and substituting demand of domestic logs from high

priced import wood products should increase in the second

half of the year.

|