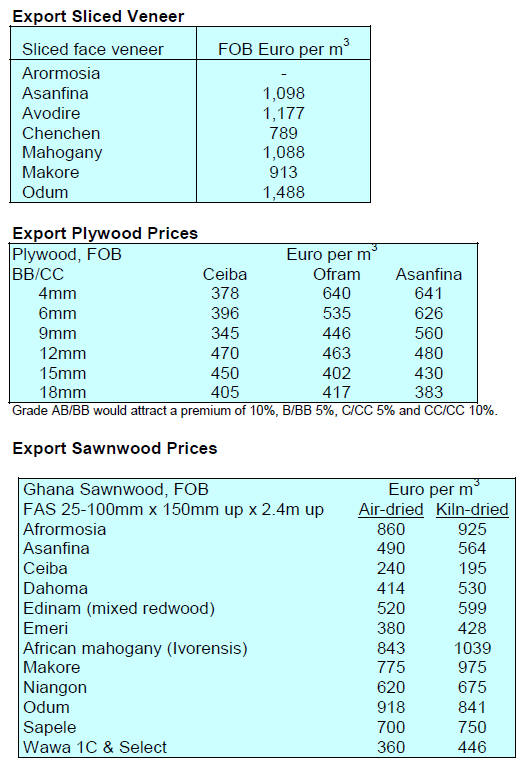

2. GHANA

Manufacturers told - Be more innovative

The Deputy Trade and Industry Minister, Robert Ahomka-

Lindsay, has reminded enterprises in the country that the

government aims to lift the level of industrialisation and

has called upon domestic companies to be more innovative

so they can raise competiveness in the domestic and

international markets.

Expansion of the manufacturing sector is at core of

government plans to drive the economy and wean it off

the dependence on aid. This is part of the Presidents dream

of a Ghana ‘Beyond Aid’.

For its part, the timber sector is forging ahead with efforts

to export a higher proportion of added value wood

products.

Port expansions welcomed

The Ghana Ports and Harbours Authority (GPHA) is

investing heavily in a programme to modernise the

country’s port facilities and operations as well as expand

port capacity.

In recent years, because of the strategic location and

business friendly environment, several shipping

companies and trading houses have opened offices in

Ghana from which they manage operations along the West

African coast. The GPHA has indicated that it aims to

triple annual port capacity by mid-2019.

Forestry sector needs stimulus to recover

Timber enterprises are growing increasingly concerned

about the declining availability of timber raw materials

and are calling on the government to expand efforts on

reforestation. The other major problem facing the timber

industry is the lack of skilled workers.

In a related development, participants at a global forestry

conference, have called on African governments to reverse

the declining trend of deforestation on the continent where

reports say between 2010 and 2015 Africa recorded the

highest net annual loss of forests which was attributed

mainly to subsistence farming.

3.

MALAYSIA

Sabah ban log exports

The export of logs from Sabah, a major timber producing

state, has been banned with immediate effect.

The recently elected Chief Minister, Mohd Shafie Apdal,

said the move was taken to ensure sufficient timber for

mills in the State and secure jobs. The steady decline in

availability of natural forest logs is behind this ban, say

analysts.

In recent years Sabah exported between 200,000 and

300,000 tonnes of logs to countries such as China, Japan,

Philippines and India.

James Hwong You Chuaang, President of Sabah Timber

Industries Association (STIA), welcomed the ban saying

this long awaited measure will help revive the timber

industry in the State where many mills have been forced

out of business because of a log shortage.

It is the uncertainty over log supply that has held back

investment in downstream manufacturing said Hwong.

The members of the STIA hope this ban will be the

beginning of a new era in the timber industry in Sabah.

Malaysian companies urged to use Rotterdam as hub

for European trade

The Malaysian Timber Council (MTC) in cooperation

with the Netherlands Foreign Investment Agency (NFIA)

recently held a seminar themed “The Netherlands: Your

Base for Malaysian Timber and Wood Products Exports to

Europe” .

The seminar brought together key speakers from

Malaysian industry and the Netherlands who spoke on

facilities and incentives provided to investors by the Dutch

government. At the seminar MTC Chairman, Datuk Gooi

Hoe Hin, touted Malaysia as a strategic partner with the

Netherlands in reaching the Netherlands target of securing

90% of certified tropical timber products by 2020.

Currently the Netherlands accounts for about 30% of

Malaysia’s exports of certified timber and timber products

worth around RM435 million last year. Representatives

from NFIA, the Holland International Distribution Council

(HIDC) and the International Port of Rotterdam promoted

the Netherlands as an ideal European trade hub.

No news yet of governments plans for forestry

Calm has returned to Malaysia after the recent general

election which saw the ruling party of over 60 years

replaced by an opposition coalition.

Malaysia is a federation of 13 states and three federal

territories and forestry is the responsibility of the states not

the federal government. Under the new political

administration three states are controlled by the (now)

opposition party, this includes Sarawak a major timber

producing state.

The Federal Cabinet is currently being formed and it is

still too early to know of any changes, if any, to the

direction on national forest policy or policies affecting the

timber industries.

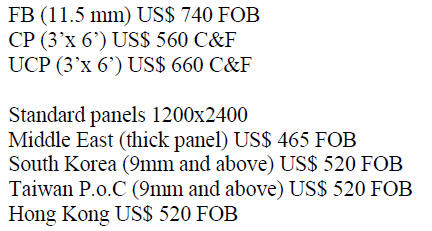

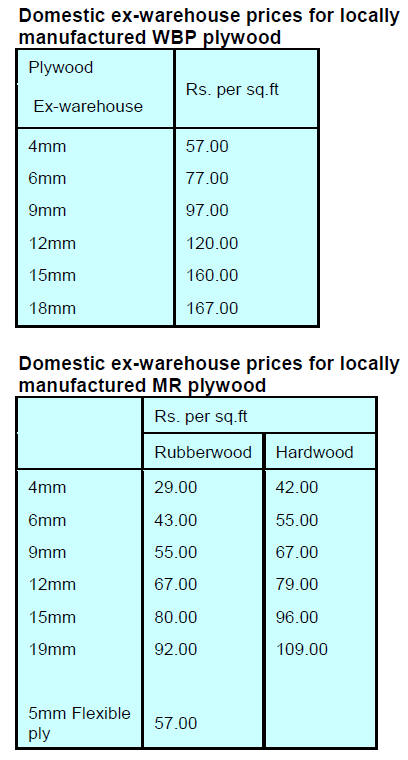

Sarawak Plywood prices.

Traders based in Sarawak reported the following export

prices of plywood:

4.

INDONESIA

Mills maintain output despite

recent dip in log

production

The Chairman of the Indonesia Sawmill and

Woodworking Association (ISWA) has said exports by

members of the Association in the first quarter of this year

were around the same as in the same period last year.

Data compiled by the Association show exports in the first

quarter of 2018 at approximately 1 million cubic metres

worth US$550.5 million. This was significant he said as

there was no major impact from the decline in natural

forest log production.

Last year exports of processed wood products amounted to

just over 4 million cubic metres worth US$2 billion

(FOB). Exports of BareCore contributed most in volume

to 2017 exports (1.9 mil. cu.m). BareCore is a panel

comprised of strips of solid wood glued together and

commonly utilises Albizia falcata.

However, in terms of value, moldings contributed the

most, US$727.5 million. China was the main market

importing some 2 million cu.m worth US$637 mil. in

2017.

Furniture companies still suffer domestic regulatory

hurdles

Indonesian furniture and handicraft manufacturers are

seeking assistance from the government to urge local

governments to implement government directives on

deregulation of production.

The Vice Chairman of Association of Indonesian

Furniture and Handicraft Industry (HIMKI), Wiradadi

Suprayogo, said that many members complain that

regulatory obstacles are still being encountered despite the

many changes that have been introduced aimed at easing

the burden on enterprises and these amount to non-tariff

barriers for the local industry.

In addition, the Association is questioning the logic of

imposing SVLK certification on enterprises which utilise

already SVLK certified raw materials.

State of Indonesia`s Forest – a new publication

launched

The Ministry of Environment and Forestry has announced

it will publish the first ‘State of Indonesia`s Forests’ in

collaboration with FAO.

The publication will highlight efforts by the government to

promote good governance and sustainable forest

management in Indonesia.

The Minister of Environment and Forestry, Siti Nurbaya,

who will be the editor of this publication, said this is a

huge step forward for Indonesian forestry.

See:http://indonews.id/artikel/13411/KLHK-dan-FAO-Susun-

Dokumen-Status-Hutan-Indonesia/

Speedy VAT refund would aid industry

Wood product exporters are calling on the government to

speed up the process of VAT refunds to boost the

competitiveness of the national plywood industry.

Gunawan Salim, of the Indonesian Wood Panel

Association (Apkindo) said the 10% VAT on roundwood

purchases is a burden for the plywood industry where log

costs can make up as much as 60% of production costs.

In Indonesia the VAT can be refunded when processed

products are exported but at present it taks the government

agency responsible around one and a half year to process

refunds. Apkindo has repeatedly submitted proposals to

accelerate refunds.

Ministry of Trade - No to log exports this year

The domestic press is reporting that, according to Tuti

Prahastuti, Director of Export of Agricultural and Forestry

Products, the Ministry of Trade has no plans to allow log

export this year despite the request from the Ministry of

Environment and Forestry.

A review will be conducted by the Coordinating Ministry

of Economic Affairs according to Tuti. The main concern

is that natural resources should be utilized for the

manufacture and export of downstream products.

Resistance to the log export proposal has come from

furniture and wood product manufacturers who fear a

decline in availability will lead to a surge in log costs as

export logs attract high prices.

Log production set to rise

The Executive Director of the Association of Indonesian

Forest Concessionaires (APHI), Purwadi Soeprihanto, has

reported that first quarter 2018 log production was 10.62

million cubic metres, only slightly down on the level in the

same period in 2017 (10.95 million cubic metres).

The dip in 2018 first quarter production was the result of

bad weather which hampered logging according to

Purwadi.

APHI is forecasting that roundwood production will

increase from April when the dry season sets in and

production will rise as log prices at present are good.

APHI has suggested that roundwood production this year

will be around 10% more than last year.

Export market data

In 2017 the value of exports to Asian and North American

markets accounted for over 80% of total exports.

5.

MYANMAR

Myanmar to adjust dates of

fiscal year

The Myanma Timber Enterprise (MTE) intends to sell

about 440 h.tons of teak logs and about 9,500 h.tons of

non-teak logs each month between April and September

this year.

Myanmar has revised the system for the beginning and end

of the fiscal year which currently runs 1 April to 31

March. In future the fiscal year will begin 1 October and

end 31 September. The announced sale of timber by MTE

(mentioned above) has been arranged to facilitate

transition to the new beginning and end of the fiscal year.

Plantation teak logs scheduled for sale in the next fiscal

year are between 35 and 100 year-old. The projected

annual allowable cut (AAC) is around 19,000 trees for

teak and 600,000 trees for non-teak hardwoods. The

targeted annual production is just about 7,500 teak trees

and 160,000 non-teak trees.

Rising non-teak hardwood prices

The price of fresh inn-kanyin ( gurjang/keriung) logs has

recently surged to over US$1,000/h.ton because of the

high demand from the plywood mills. For many years the

prices for these timbers was stable in the range from

US$600 to US$800/h.ton.

Export update

For fiscal 2017-18, which ended on 31 March 2018,

exports of forest products earned US$212 million, of

which some US$2.68 million was from the border trade

according to the Ministry of Commerce.

Working elephants earn their keep in tourism camps

As a result of the log export ban the elephants trained for

log harvesting have no work so the management of

MTE converted some elephant camps into elephant

conservation-based tourism camps in a bid to generate

revenue to support the elephants and their handlers

(mahouts).

The government-run Myanma Timber Enterprise earned

about Kyat430 million (approx US$325,500) since it

began operating conservation-based tourism camps around

the country two years ago.

MTE has 3,078 elephants of which 514 are under 4, 734

are between 4 and 18 and 1,597 are 18 to 55 years old, the

rest are retired elephants.

Plans to restructuring MTE with private sector

management

After the log export ban came into force in 2014

harvesting of both teak and non-teak has been drastically

reduced and reforestation and forest restoration

programmes have been implemented.

This development had a big impact on MTE and made the

management and government start to consider a new

business model.

But the legal ramifications of changing MTE are

complicated. Analysts write that it appears MTE will be

restructured as a corporation within government but with

private sector management.

However, these changes have to be made through a State

Corporatisation Law which is still under discussion and

may not be enacted by 2020 when the term of current

government ends.

Minimum wage hiked

The government has announced a new daily minimum

wage of K4,800 raising the minimum negotiated in 2015

which in itself was a landmark for labour market reform in

the country.

Although Myanmar has not ratified the International

Labour Organization’s Minimum Wage Convention 131,

the new minimum in Myanmar largely reflects the ILO

recommendations.

The latest adjustment was negotiated through an open and

transparent process of tripartite social dialogue between

the government, representative employers and workers’

organisations.

6. INDIA

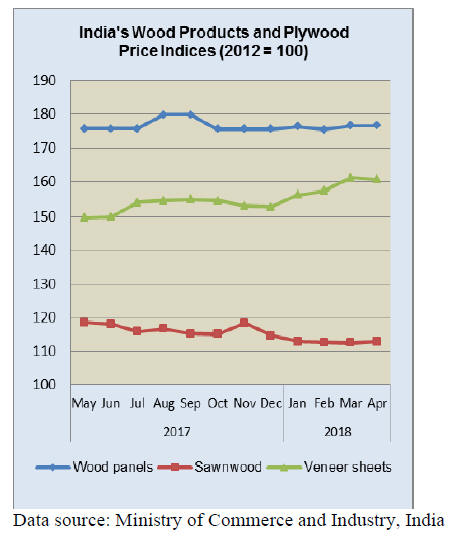

Plywood price index flat in April but

prices have now

risen

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for April 2018 released by the Office

of the Economic Adviser to the government rose to 116.8

from 116.0 for March.

The annual rate of inflation, based on monthly WPI in

April 2018 was 3.18% compared to 2.47% for the previous

month.

The index for Manufacture of Wood and of Products of

Wood and Cork group declined by 0.1 percent to 131.6

from 131.7 for the previous month due to lower price of

plywood, blockboard and wooden box/crate (1% each).

However, the price of particleboard moved up. In early

May domestic manufacturers lifted prices for plywood.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

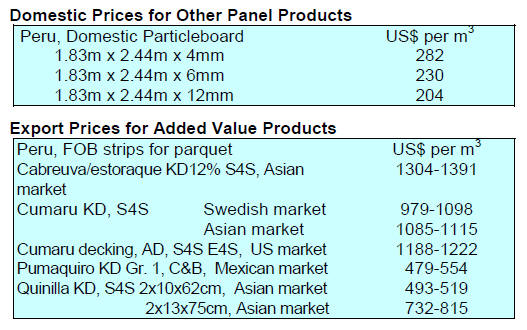

Rupee under pressure

The rupee/dollar exchange rate in mid-May was down to

almost its all-time low of 68.825 recorded in August 2013.

The rupee has fallen over 6% against the US dollar this

year making it the most vulnerable Asian currency.

Analyst fear that another increase in crude oil prices will

create added pressure on the rupee and may increase

inflationary pressures and lower the chances of an interest

rate cut by the Reserve Bank of India.

The Indian economy benefitted from the low oil prices in

the past 2-3 years but the advantages this brought are now

fading fast. From an average of around US$46/barrel in

2016 prices climbed to US$56/barrel in 2017 and averaged

over US$65/barrel in April this year and prices seem set to

rise further as especially if the US pulls out of the Iran

nuclear deal.

High oil prices will undo much of the gains in managing

the fiscal and current account deficits as this would impact

consumer sentiment, consumption and investments.

Sale of red sanders in Andhra Pradesh

The following quantities were sold on different days of the

Andhra Pradesh auction; 24 April, 94.21 tonnes of A

grade, 26 April 124.8 tonnes of A grade and on 3 May one

lot of 14.898 tonnes of A grade were sold.

While the prices for the most recent sale have not yet been

released, prices at an earlier sale were as follows:

A grade, Rs 1.95 crore per tonne, grade B prices ranged

from Rs155.35 lakh to Rs48.45 lakh per tonne while for

grade C prices ranged from Rs40.72 lakh and Rs15.15

lakh per tonne. (One Crore =10 million and 10 lakh =1

million)

Analysts point out that by managing the sale of this

valuable timber the government can undermine the black

market in red sanders and a sustainable trade can be

created. Prices at the recent sale reflect the rarity of this

timber but prices may fall when the Australian plantations

of red sanders come onto the market. Australia is said to

have around 7,000 hectares of red sanders.

Grading red sanders

The central government has developed guidelines for

grading of red sanders based on the experience gained

from sales in Andhra Pradesh.

Best quality

-Straight or nearly straight

-Minimum length of 75 cms

-Top end girth of 36 cms or above.

The logs are further graded into A, B, C or D (Non-Grade)

according to the following characteristics.

A-Grade (priced above Rs1 crore per tonne)

- Sound or nearly sound with few or no defects

-Surface gives a ripple reflection

B and C grades range between Rs.50 lakh and Rs 1 crore

per tonne

B Grade

-Semi-sound A grade logs but with more defects

-A grade logs with bends

-Logs with some defects

-Logs with medium long and medium deep wavy grain

clearly visible

C-Grade

-Long and shallow wavy grain or straight grain

-Logs sound or semi-sound with some or no defects

-Utilisable A-grade logs with many defects

-Utilisable B-grade logs with many defects

D Grade: Utilisable logs of all grades (depends on highest

price)

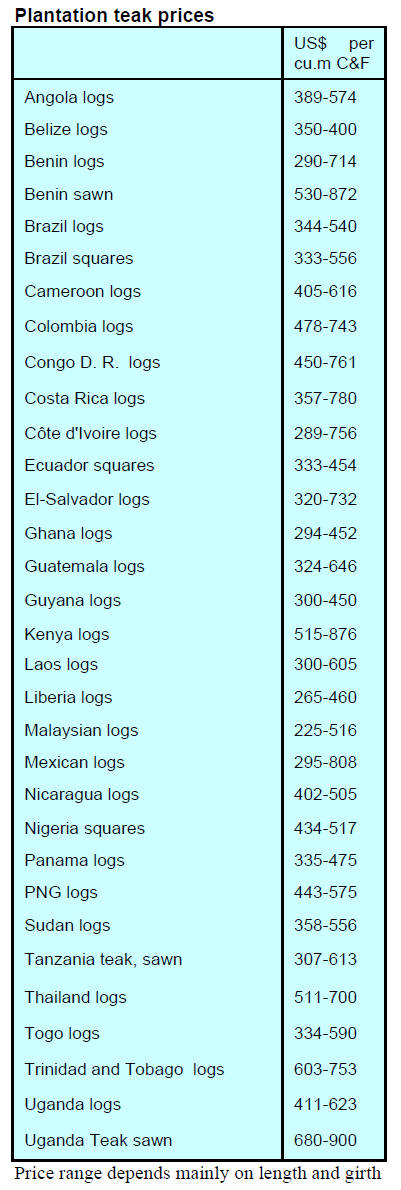

Plantation teak prices

Demand for imported logs remains steady but log arrivals

are still affected by the withdrawal of importers credit

facilities. In addition, the exchange rate for the Indian

rupee against the US dollar has been sliding.

Recently, the rupee slid around 5% against the US dollar

making imports more expensive. Analysts say the credit

crisis should be overcome the end of July. C&F prices

remain unchanged.

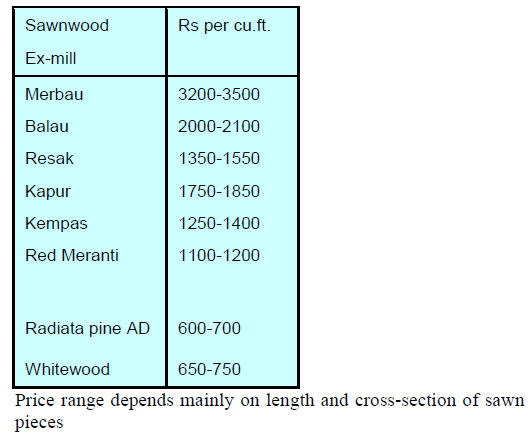

Locally sawn hardwood prices

Prices remain flat with importers saying competition is

stiff amongst traders as alternative and cheaper timbers are

on offer and are gaining market acceptance.

Imported sawn Myanmar teak

Trade circles report that more and more endusers are

moving away from Myanmar teak as cheaper alternatives

have been found to be good enough. The other issue is

supply. Indian traders say given the situation in Myanmar

it is unlikely that the volumes of both sawn teak and

veneers can be increased in the medium term.

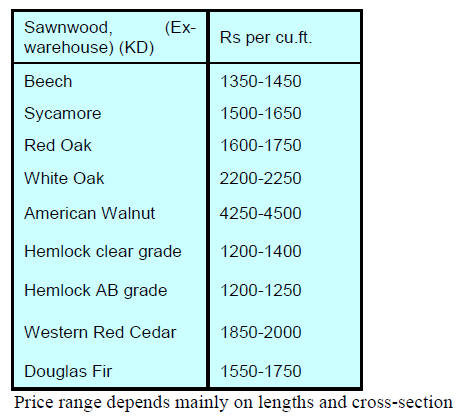

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) ex-warehouse

remain unchanged.

Domestic plywood update

Composite panels continue to eat into markets that

previously were dominated by plywood. Domestic

plywood manufacturers are facing the dual problems of

rising raw material costs especially for imported veneers

as well as a severe shortage of labour. Both are having a

major impact on production and profitability.

Domestic mills recently felt compelled to raise prices

despite the very negative response by the market.

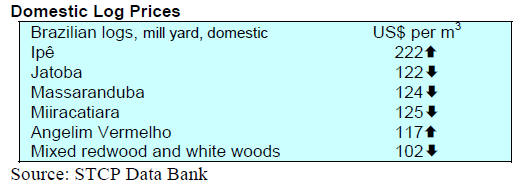

7. BRAZIL

Brazil as source of timber for

CLT production

The global market for cross-laminated timber (CLT) is

expected to be worth around US$2 billion by 2025

according to a new report published by Grand View

Research, Inc. One of the factors driving this will be an

increase in the building of wooden homes.

https://www.grandviewresearch.com/press-release/global-crosslaminated-

timber-market

The press release from the research company says rising

awareness about the environmental hazards caused by

the use of cement concrete in infrastructure construction

coupled with rising number of cross laminated timber

manufacturers and increasing demand for green homes

are factors propelling the market growth.

The shift from concrete-based construction to woodbased

construction around the world is positively

influencing the market. In addition, the cost

effectiveness of CLT and shorter construction time will

drive demand.

Europe was the first to investigate cross laminated

timber and research. The availability of timber from the

forests of central European countries and advanced

timber processing industries are the leading cause for

market growth in Europe. Countries like Canada, the

U.S., New Zealand, Japan and China are also rapidly

developing markets for cross laminated timber.

This development could benefit Brazil say analysts

because plantations in Brazil mature quickly and are a

good source of raw material for CLT production.

Resumption of investments in civil construction

The National Meeting of the Construction Industry (ENIC)

held in mid-May in Florianopolis, Santa Catarina,

discussed the importance to the economy of reviving the

civil construction sector.

Representative of the wooden door manufacturing sector

participated in the event since they were particularly

interested in the recovery of investment in civil

construction.

In a side event organized by the Quality Programme for

Wooden Doors for Buildings (PSQ-PME), entrepreneurs

and representatives of the Brazilian Association of the

Mechanically Processed Timber Industry (ABIMCI)

presented the work carried out under the programme for

the development of wooden door production supply chains

and brands that has led to product certification by the

Brazilian Association of Technical Standards.

The PSQ-PME works to promote the improvement of the

quality of wooden doors in Brazil through strengthening

the sector and raising competitiveness amongst

manufacturers as well as through improvements and

guarantees for consumers.

Export update

In April 2018, the value of Brazilian exports of woodbased

products (except pulp and paper) increased 30%

compared to April 2017, from US$221.0 million to

US$287.0 million.

Pine sawnwood export values rose 28.5% between April

2017 (US$38.3 million) and March 2018 (US$49.2

million). In terms of volume, exports increased 24% over

the same period, from 187,700 cu.m to 233,000 cu.m.

Tropical sawnwood exports increase 49% in volume, from

31,000 cu.m in April 2017 to 46,200 cu.m in April 2018.

The value of this trade increased 42% from US$14.2

million to US$20.2 million over the same period.

Pine plywood exports also increased, jumping 68% in

value in April 2018 in comparison to April 2017, from

US$40.6 million to US$68.3 million.

The volume of exports increased 35% over the same

period, from 146,800 cu.m to 198,500 cu.m.

As for tropical plywood, exports increased in value from

US$5.4 million in April 2017 to US$6.1 million in April

2018.

To cap off a good month, wooden furniture exports rose

from US$38.2 million in April 2017 to US$45.3 million in

March 2018 an almost 19% rise.

In the three main markets for Brazil’s furniture sales

improved in the first four months: the United States

(+20%), the UK (+10%) and Argentina (+9%). It is

encouraging that importers in Argentina have increased

purchases after three consecutive years of decline. The

three main markets represent 47% of the country's total

sales in the first four months of this year.

The States of Santa Catarina and Rio Grande do Sul

continue to provide the bulk of Brazilian furniture. The

value of year on year export sales by manufacturers in

Santa Catarina expanded 16% in the first four months of

this year. The comparable figure for manufacturers in Rio

Grande do Sul was +12%.

Brazil’s furniture imports expanded over 20% in the first

four months of this year compared to the same period in

2017 rising to US$193.4 million, of which 37% came from

China.

Search for new timber markets

In search of new markets and technologies a group of

entrepreneurs from Mato Grosso will visit Carrefour Du

Bois to be held in Nantes 30May to 1 June.

The Directors of Center for Wood Producing and

Exporting Industries of Mato Grosso (CIPEM) have said

they expect to establish business contacts for new markets

so as to increase exports from Mato Grosso state.

Analysts write “there is a great potential in external market

for the products produced in Mato Grosso as European

consumers appreciate timber from natural forests. With the

adoption in Brazil of chain of custody tracking the

credibility of the sector has becomes more transparent

opening up new market opportunities”.

The forestry sector represents the main economy of 44

municipalities in the state of Mato Grosso. In addition, the

sector ranks in the 4th in the state economy.

8. PERU

IKEA to expand into Peru

IKEA is ready to expand into South America with outlets

planned in three countries including Peru. To ensure the

success of this expansion Ikea will partner with the

Chilean retailer Falabella.

IKEA has announced it will open a regional warehouse in

Santiago in 2020 and expand into Lima and Bogotß.

In a press release, Torbj÷rn L÷÷f, CEO of the Inter IKEA

Group said “We are of course very excited to bring IKEA

to South America together with Falabella, who is a strong

local partner with a lot of experience in developing and

successfully operating retail businesses.

They also have a well-developed distribution network in

the region, which will give us the speed we need to be

more accessible to the many. Together we’ll work to make

IKEA a loved and meaningful brand for the people in

Chile, Colombia and Peru.”

IKEA has around 1.2 billion customers which the

company expects to increase to 3.2 million customers by

2025.

For more see:

https://newsroom.inter.ikea.com/News/ikea-meets-customers-ona-

new-continent/s/77174369-a796-441c-a4b6-2b5364460a80

Mission to IWF USA Fair 2018

In August the consulting company Tropical Forest will

organize a trade mission to the International Woodworking

Fair (IWF) 2018 fair to be held in Atlanta.

This fair is a major event for suppliers of technology,

equipment and accessories for the wood processing and

furniture manufacturing sectors.

Peru’s forestry sector attracting foreign investors

Drago Bozovich, CEO of Maderera Bozovich, has said he

was aware of increased acquisitions of domestic

enterprises by foreign investors who are attracted by

opportunities in the wood processing industries and by the

revamped legal framework that now supports the sector.

According to Bozovich, production in 2017 was badly

affected by abnormal weather conditions in the country

but that in early 2018 production levels had returned to

normal.

Carbon credits from conservation projects

The authorities in Peru have begun moves to designate

forestry conservation projects as contributors to meeting

international climate targets and have announced REDD+

carbon credits from two projects in Peru will be

acknowledged by the Ministry of Environment.

The Business Green website says carbon credits generated

by the Tambopata-Bahuaja Reserve and Cordillera Azul

National Park REDD+ conservation projects will be

integrated into its nationally determined contribution

(NDC) climate action plan under the Paris Agreement.

For the full story see:

https://www.businessgreen.com/bg/news/3032624/peru-movesto-

integrate-redd-forest-conservation-projects-into-paris-climateplan