|

Report from

Europe

Expanded sales of tropical wooden furniture but

market share drops

There was plenty of tropical wood furniture to be found at

the first two big European furniture exhibitions of 2018 每

the IMM interiors fair in Cologne, Germany (IMMCologne),

and the January Furniture Show at the NEC in

Birmingham, UK (JFS-Birmingham).

Judging by the stand listings, tropical timber products

were also set to have a strong presence at the biggest

international show of them all, the Milan Furniture Fair

from April 17-22.

Among the 2,000 exhibitors at the latter (including 650

from outside Italy), companies were listed from Brazil,

India, Indonesia, Vietnam and, leading the way with a

total of 12 stands, Thailand. In addition, said organising

federation Federlegno Arredo, judging by previous Milan

shows there were set to be more tropical products on

European importers*, distributors*, designers* and

manufacturers* stands.

At the German and UK shows, plantation teak and

mahogany furniture made a particularly strong showing,

while other prominent tropical species included acacia,

mango, munggur/suar (Albizia saman, also called Rain

Tree).

At both events, there seemed to be a fashion too for

recycled tropical timber products, with tables and storage

units made from a range of species recovered from old

doors, flooring, decking and even boats. Indian companies

seemed to be particularly favoured, with their style

currently in fashion, said exhibitors.

※Originally these recycled pieces looked recycled, with a

deliberately rustic finish,§ said one UK designer-importer.

※But now, manufacturers, under our guidance, are working

the wood more and going for more sophisticated, polished

styles.§

In fact, furniture from tropical countries has been

performing reasonably well in the European market for the

last four years.

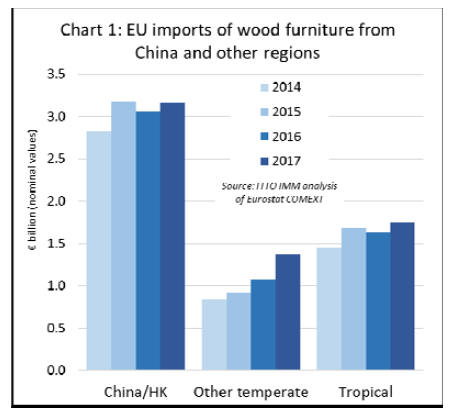

There was a slight dip in EU imports in 2016, which some

attributed to the impact on wider consumer confidence

caused by the UK*s vote to leave the EU, although others

said it was small enough (under 3%), to have been &normal

trade fluctuation*. But business picked up again last year

as EU imports rebounded 7% to euro1.75 billion. (Chart

1).

Increasing competition in furniture market

However, looking more closely at the figures and wider

sales trends, the news for tropical wood furniture in the

EU is not quite as good as it might at first seem. Given the

increasingly vigorous post-recession growth of the EU

furniture market, said exhibitors and trade association

representatives at the UK and German shows, you might

have expected tropical products to have done better and

have more of a profile at trade fairs.

The fact is 每 and the statistics support the anecdotal

feedback from the trade 每 tropical suppliers have not been

keeping pace with the competition in the EU, either from

other EU import sources, or more significantly the EU*s

own robust and dynamic furniture manufacturing base. So,

while they may have grown overall sales in recent years,

they have lost market share to rival producers.

According to latest figures, EU imports from temperate

timber furniture suppliers in the last four years rose 66%,

from euro 830 million in 2014 to euro 1.38 billion last

year.

Amongst the largest increases in wood furniture imports

from temperate countries last year came from the Ukraine,

up a further 67.7% to euro 133 million, Bosnia, up 14.9%

to euro 218 million, and Serbia, up 13.7% to euro 127

million.

A further major hike in 2016, from euro 62 million to euro

150 million, is also shown in EU imports from the US, all

destined for the UK.

However, this figure needs closer examination as it could

be the result of large distributors changing sourcing policy,

or a change in reporting of products against furniture

customs code.

Other big rises came from &other temperate* producers, up

35.5% last year, notably from Turkey and Switzerland.

EU domestic furniture sector recovery and growth

The biggest shift in the EU furniture sector in recent years

has come in the degree of market self-sufficiency, with

European manufacturers taking more of their domestic

national and intra-EU trade. Further underlining their

growth and increasing competitiveness, they are also

exporting more.

According to the European Furniture Industries

Confederation, the sector was hard hit in the international

downturn from 2007, seeing turnover fall from euro136

billion to euro90 billion and shedding 280,000 jobs. Since

then, however, it has seen sales recover to euro96 billion

and its workforce to rise to over 1 million again.

In 2010, EU furniture suppliers achieved intra-EU trade

turnover of euro 15.3 billion from, while exports were

valued at euro 6.4 billion and imports at euro 5.9 billion,

delivering a euro 500,0000 trade surplus. By the end of

2017 the intra-EU trade figure had jumped 26% to

euro19.2 billion, while exports hit euro 8.8 billion. With

total imports having grown only to euro 6.3 billion, this

pushed the trade surplus to euro 2.5 billion in 2017, five

times the level of 2010.

Several reasons are given for the success and development

of the EU furniture industry. One is the maturing of

investment from Western Europe into manufacturing in

former Soviet bloc Eastern European countries, led by big

brands such as IKEA. From being principally production

satellites for companies like the latter, the plants are

reported increasingly to have developed their own identity

and market momentum.

An illustration of this is the latest market development

project from the American Hardwood Export Council

(AHEC). As part of its strategy to grow European sales of

US red oak, it has linked with leading Polish furniture

designer Tomek Rygalik. He has worked with leading

international labels, including IKEA, and is now design

director for major Polish producers Paged and Comforty.

In the AHEC project, Tomek Rygalik is creating a US red

oak furniture collection, which the Americans hope will

not only sell well and help promote the species in Poland

itself, but also in the latter*s Western European furniture

export markets. The goal is also to fire the interest of

other Polish designers.

Embracing technological change boosts EU furniture

sector productivity

Increasingly advanced computer-controlled and automated

manufacturing has also benefited European producers,

boosting their productivity, cutting overheads and

reducing the relative labour cost advantages of

competitors, such as those in Asia.

※The increasing migration of European furniture sales

online additionally favours a local manufacturing base,§

said a German designer/producer. ※It is better placed to

meet the short lead times demanded by today*s EU

internet retailers and consumers.§

Whether it also benefits domestic EU producers that sell

in-fashion timber furniture species in the EU market such

as oak is more debatable. There*s no doubting oak*s

overwhelming dominance of the sector 每 in the latest

development underlining this, it is reported that one of the

Europe*s biggest retailer/producer brands is currently

looking to sign up a supplier of up to 140,000 cu.m this

year.

But while European manufacturers may be close to

sources of European oak supply, there are few limits

placed on oak log export outside the EU. This is despite

efforts by manufacturers in France, in particular, to lobby

their government to curb log exports, notably to China.

It*s also notable that EU furniture producers import large

quantities of US white oak and that Asian producers also

have ready access to this material. In fact, a number of

companies at the IMM-Cologne and JFS-Birmingham

exhibitions were showcasing EU-designed ranges

manufactured in US white oak by joint venture or

subcontractor partners in South East Asia, notably

Vietnam.

※Source locally§ a key theme of EU manufacturers

There seems to be a growing preference in the EU market

to &source local*, particularly in the design and specifier

sectors. This is mainly to support homegrown forest and

timber-using industries - although EU furniture

manufacturers and retailers like to take credit for the

reduced transport miles and carbon footprint implied. This

is despite several recent LCA studies of wood furniture

undertaken by AHEC showing that environmental impacts

incurred during the transport phase are significantly less

than those incurred during the processing and

manufacturing phases.

In practice the carbon footprint of wood furniture is often

more dependent on the quantity and mix of energy used to

convert and dry the wood, and the energy efficiency of the

manufacturing operation, than on shipping even when

materials need to be transported over large distances.

Nevertheless, the ※source local§ theme will feature at the

Carrefour International du Bois show scheduled for 30th

May to 1st June this year in Nantes, France.

The four-year-old &Le Bois Français* campaign will once

more have a prominent presence and there will be

significant regional French timber industry representation.

In the UK, the Grown in Britain initiative, which is

supported by such leading furniture retail brands as Heal*s

and Marks & Spencer, is now in its fifth year and said to

be still increasing its impetus.

Underlining just how competitive the EU furniture market

is, even China has recently struggled to increase sales. EU

imports of wood furniture from China rose 12% to

euro3.17 billion in 2015, but since then have plateaued

around that level.

Leading tropical suppliers of wooden furniture to the

EU

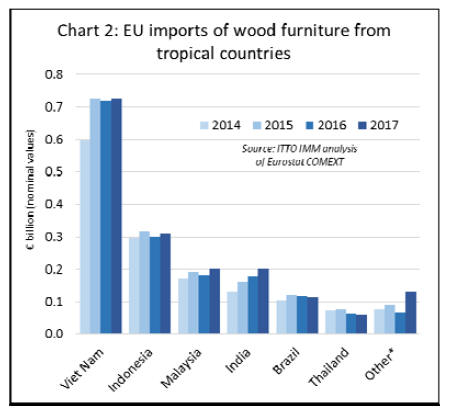

In terms of the leading tropical furniture suppliers to the

EU, imports from Vietnam and Indonesia have followed a

similar trend; rising relatively strongly in 2014 but

slowing since. EU imports from Vietnam increased just

1.3% to euro 730 million last year, while imports from

Indonesia increased 3.7% to euro 310 million. (Chart 2).

There was better news for Malaysia. After dipping 5% in

2016 to euro 184 million, EU imports from Malaysia

recovered 10.3% to reach euro 203 million last year. EU

imports from India have experienced more consistent year

on year growth since 2015, with trade rising an additional

12.3% to euro 202 million in 2017.

After relatively static performance for four years, EU

imports from Brazil and Thailand both saw decreases in

2017, down 5.3% and 3.4% to euro 112 million and euro

61 million respectively.

The biggest increase last year, albeit from a modest base

of euro 69 million, came in EU imports from &other

tropical countries*, up 87.8% to euro 130 million.

Contributions to this rise came from Singapore, which is

channelling furniture to the EU from elsewhere in South

East Asia, and from the UAE and Qatar.

EU imports of wood furniture from the two Middle

Eastern countries jumped from under euro 1 million in

2016 to a combined total of nearly euro 36 million last

year. This increase all went to the UK and is either an

error in the customs statistics or could indicate a switch in

sourcing by major retailers or distributors.

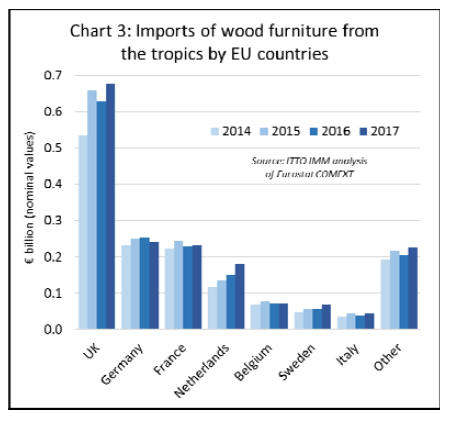

In terms of EU importers of furniture from tropical

countries, the leading buyers have stayed in the same order

by sales value since 2014.

The UK remains the largest buyer, with imports up 8% last

year at euro680 million, having dipped 4.5% in 2016.

Germany is in second place, despite a 4.2% downturn in

imports last year to euro 240 million. Next is France, with

imports up 2.4% at euro 230 million, the Netherlands, up

20.5% at euro 180 million (another anomalous requiring

further scrutiny), Belgium up 2.4% at euro 70 million,

Sweden up 23.7% at euro 70 million, and Italy, up 10.4%

at euro 40 million. Other EU importers increased their

combined total 9.1% to euro 230 million in 2017. (Chart

3).

Tropical timber market promotion in the EU

In the face of falling market share, proactive steps are

being taken to consolidate and grow tropical timber

product sales in the European market.

The European Sustainable Tropical Timber Coalition

(STTC), comprising timber importers, traders, end-users

and retailers, plus public and private sector specifiers and

procurement personnel, continues its market education and

promotion efforts.

A key aim is to ensure that sustainably sourced tropical

timber products receive due and fair consideration in

business and public sector procurement policy. The core

message is that ensuring a healthy, viable market for the

timber will drive the spread of sustainable forest

management in tropical countries.

The STTC has recently been reviewing its activities,

working with various partners in the industry. Aims

include becoming more effective and efficient in

delivering key market data and also focusing more on

monitoring trade flows of sustainably sourced tropical

timber into Europe.

ATIBT, the International Tropical Timber Technical

Association, also continues to roll out its Fair & Precious

marketing/branding initiative.

This too aims to educate the market on the wider social,

environmental and economic benefits of increasing

demand for sustainably sourced tropical timber and wood

products.

All businesses along the supply chain can use the Fair &

Precious brand on their products, provided they pledge to

source third party-accredited legal and sustainable goods

and material and &commit to respecting social,

environmental and economic concerns in their activities,

subject to audit by third-parties approved by the Fair &

Precious ethics committee*.

Whether the EU FLEGT VPA initiative and FLEGT

licensing has the potential to underpin the tropical timber

market is still a matter of debate.

Indonesia, the first country to issue FLEGT licences, did

see its timber furniture sales to the EU rise marginally last

year to euro310 million. However, they have been around

that figure for the last four years, so, say importers, offer

no real clue on the market impact or perceptions of

licensing.

A key conclusion of discussions at IMM-Cologne and

JFS-Birmingham, and of the EU FLEGT Independent

Market Monitor (IMM) trade consultation held in London

during March, is that there is still a need for more market

education and communication about the wider FLEGT

initiative.

Several exhibitors at the UK and German shows and

participants at the trade consultation acknowledged they

knew little about it. They seemed particularly surprised by

the scope of licensing systems and the extent of the forest

reforms implemented as part of the FLEGT process.

At the IMM London trade consultation, Kate Towler,

Assistant Manager Sustainability and Responsible

Sourcing at retail giant John Lewis, said that companies

like hers needed to know more &human stories* behind

FLEGT which they could relay to their personnel and

consumers.

But she did conclude that the consultation had provided

&knowledge of the further capabilities of the [EU FLEGT

VPA initiative and FLEGT licensing] beyond just legality

assurance*. ※This is something I will be looking into

further with the possibility of positioning FLEGT within

our internal timber sourcing policy,§ she said.

At the same IMM event Andy Duffin, Operations Director

of one of the UK*s leading timber importers and

distributors James Latham, cautioned that the emphasis in

promoting FLEGT should not be on selling a licensed

product, but on selling the product first and as licensed

second.

※I believe that the real issue behind tropical timber*s loss

of EU volume market share is lack of promotion of

products before schemes,§ he said. ※No one buys or sells

FLEGT. We need to sell balau products, for instance, that

are also FLEGT-licensed. Environmental issues are key,

but they are side-lined if no-one wants the product.§

|