Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March

2018

Japan Yen 106.41

Reports From Japan

CP-TTP heralds reduced import

tariffs

Japan is one of eleven countries to have signed the

Comprehensive and Progressive Agreement for Trans-

Pacific Partnership (CP-TPP) which was negotiated after

the US pulled out of the Trans-Pacific Partnership

negotiations when the new US administration came to

power.

The CP-TPP will reduce tariffs in participating countries

that together account for over 10% of the global economy

worth US$10 trillion. The CP-TTP eliminates some

requirements of the original TPP demanded by US

negotiators at the earlier TPP talks so efforts to bring the

US into the new agreement will be difficult.

It is difficult to anticipate how long it will be before the

new tariff structures impact consumers in Japan who are

still waiting for signs of improved incomes so continue to

hold onto savings rather than boosting the economy by

spending.

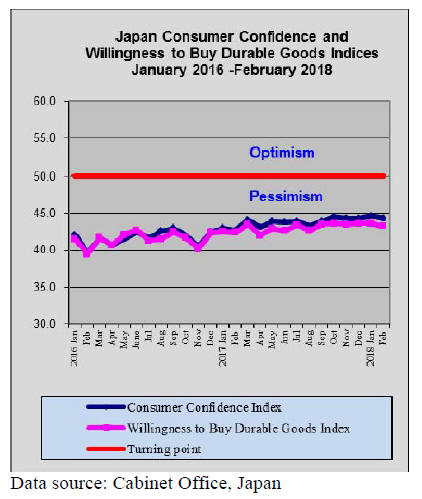

The latest consumer survey by the Cabinet Office in

Japan

shows that in February consumer confidence slipped

slightly. The overall index dropped to 44.3 from 44.7 in

January, analysts had anticipated a rise.

The index for livelihood expectations fell as did the

indices for employment and the willingness to buy durable

goods. The only positive news was that consumers are

anticipating some level of income growth.

Dollar repatriations drives up yen

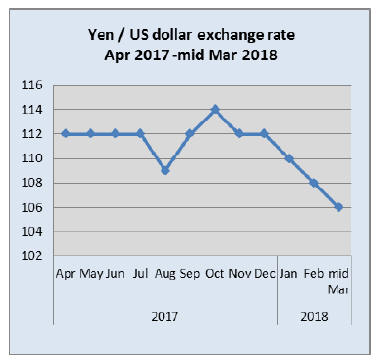

After hovering around yen 112 to the US dollar for months

the yen has suddenly strengthened and analysts say this is

likely to continue until the end of March as Japanese

companies with overseas operations repatriate foreign

funds before the end of the fiscal year.

This annual transfer is a feature of the yen dollar

exchange

rate and this year the conversion of foreign dollars to yen

should sustain the yen strength for some time.

However, at the current rate of yen 106 to the dollar seems

unusually weak given the wide divergence between the

policies of the US Federal Reserve which is set to raise

interest rates and the Bank of Japan which is committed to

ultra-loose monetary policy for the foreseeable future.

Seven years on from the 11 March earthquake

March 11 2018 marked seven years since a massive

earthquake in NE Japan caused a tsunami which claimed

thousands of lives and destroyed coastal towns and

villages. Ceremonies have been held to try and remind the

nation that there are valuable lessons to be learned from

this disaster and that everyone must be better prepared for

the next major quake.

In the worst affected areas rebuilding of infrastructure is

almost complete but there are still around 30,000 people

living in ¡®temporary¡¯ housing in the worst affected areas of

Iwate, Miyagi and Fukushima.

Relaxed regulations and aversion to second hand

homes raises concerns

According to Chie Nozawa, a science and engineering

professor at Toyo University in Japan, the country has too

many homes while still more continue to be built. Her

main contention is that the children of current home

owners will be stuck with the burden of worthless

inheritances. The issue is that homes in Japan are not built

to last, commonly being torn down and replaced after 30-

40 years.

In an informative interview she blames policies by local

governments saying local authorities are competing to

attract migrants and are easing regulations to make more

land for residential development available.

Another major cause, says professor Chie, is that the

business model of construction companies is built around

new home building and not renovation of existing

properties. This unfortunate cycle reflects desire of home

buyers to have a newly built home, Second hand homes in

Japan are considered second class.

For more see: http://the-japannews.

com/news/article/0004261801

Furniture imports

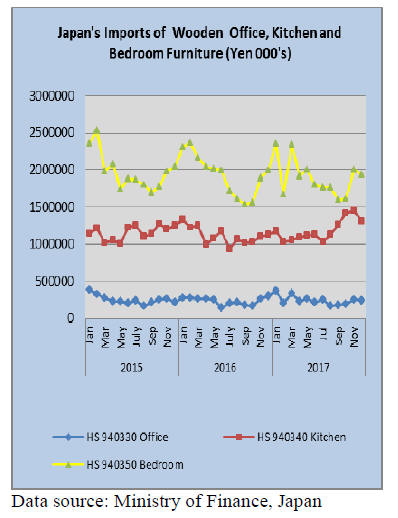

The graph below shows the trends in Japan¡¯s imports of

office, kitchen and bedroom furniture (HS 940330/40 and

50). For the three years illustrated in the graph a familiar

trend of end year highs and mid-year lows was observed

for wooden bedroom furniture.

Over the three years illustrated there was little movement

in wooden office and kitchen furniture imports. The 2017

rise in wooden kitchen furniture is thought to be mainly in

response to the surge in apartment renovations in the buyto-

let market in Japan.

The value of Japan¡¯s 2016 imports of wooden office,

kitchen and bedroom furniture were all below levels in

2015. Imports of wooden office furniture declined 6%,

imports of wooden kitchen furniture dropped 4% and

imports of wooden bedroom furniture dropped over 2%.

In contrast, 2017 wooden furniture imports expanded with

wooden office furniture imports growing 4%, wooden

kitchen furniture growing 6% with only imports of

wooden bedroom furniture falling (-2%).

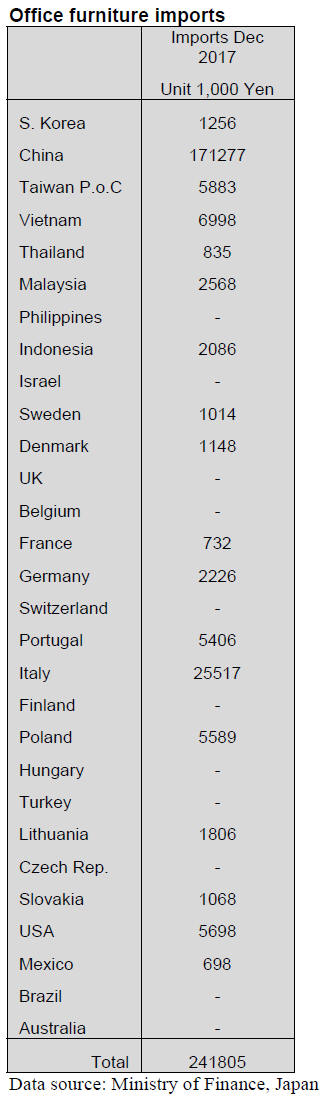

Office furniture imports (HS 940330)

The value of Japan¡¯s imports of wooden office furniture

continues to represent a declining proportion of the value

of wooden bedroom and kitchen furniture imports. Year

on year, the value of December imports of wooden office

furniture fell by 18% and month on month the value of

imports barely changed.

In December shipments from China accounted for around

71% of the value of Japan¡¯s wooden office furniture

imports down slightly from a month earlier. The other

main shippers in December were Italy (10%), Vietnam

(3%) and Taiwan P.o.C (2%).

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s imports of wooden kitchen furniture

grew in the third quarter of 2017 but then reversed

direction in the final months of the year. Year on year

Japan¡¯s imports of wooden kitchen furniture were up 16%

but month on month imports fell around 10%.

The combined shipments from the Philippines, Vietnam

and China once again account for over 90% of all

December shipments of wooden kitchen furniture. The

Philippines accounted for 46% of the value of Japan¡¯s

wooden kitchen furniture imports followed by Vietnam

(36%) and China (12%).

Bedroom furniture imports (HS 940350)

The surge in Japan¡¯s year-end imports of wooden bedroom

furniture came to an end in December. Year on year

December imports were down 3% and month on month

imports dropped around 4%. Looking at previous years the

2017 year end surge was well below expectations.

Shippers in China and Vietnam continue to dominate

Japan¡¯s imports of wooden bedroom furniture accounting

for 60% and 30% of the value of December imports.

Compared to a month earlier December imports from

China were up around 10% while imports from Vietnam

dropped 13%.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Import of wood products in 2017

The Japan Lumber Importers Association disclosed total

import of foreign wood products in 2017. Total of logs

and lumber was 9,740,000 cbms, first time to drop under

10,000,000 cbms after two years. Lumber import has been

almost flat but log import was 3,275,000 cbms, which was

less than 1958¡¯ 3,340,000 cbms.

According to the statistics since 1950, South Sea log

import is the second from the bottom. Russian log import

is the fourth from the bottom and North American log

import is the fourteenth from the bottom.

Log import dropped by 320,000 cbms out of which about

half is North American logs of about 180,000 cbms then

logs from New Zealand dropped by 67,000 cbms. Log

supply situation of South Sea countries and Russia

becomes inflexible with high prices so that log users in

Japan have lost interest.

On lumber import, the volume from Europe and Chile

exceeded previous year¡¯s volume, which covered drop of

import from other sources. In 2016, there was large price

gap between Japan market and European export on items

like stud so the importers suffered large loss.

1,940,000 cbms of North American lumber import was

Canadian products. Chilean radiate pine lumber volume of

288,000 cbms was the second highest next to 2008¡¯s

320,000 cbms. The demand of radiate pine lumber is

shifting from New Zealand to Chile after log purchase

from New Zealand is overpowered by China.

Import of plywood did not reach 3,000,000 cbms but

increased from 2016. Demand for MDF in Japan was very

active so orders for both softwood MDF and South Sea

hardwood MDF increased. Import of structural laminated

lumber was 867,000 cbms, 12.5% more than 2016, which

was the record high volume.

Soaring wood fuel import in 2017

According to the statistics the Ministry of Finance

publicizes, import of biomass fuel (wood pellet and PKS)

increased. Main demand is for newly built biomass power

generation plants by FIT system and combined use of

biomass fuel by coal burning power plants. There will be

more large FIT system power generation plants on the

coast so import of biomass fuel will keep increasing.

Wood pellet import in 2017 was about 510,000 ton, 46%

more than 2016 and PKS was about 1,140,000 ton, 49.4%

more. This is the first time that PKS import volume

surpassed one million ton.

Main sources of wood pellet are Canada with 360,000 ton,

38% more than 2016 and Vietnam with about 130,000 ton,

110 % more. These two takes 97% share of total volume.

Sources of PKS are Indonesia with about 790,000 ton,

99.1% more and Malaysia with about 340,000 ton, 5.1%

less because of active demand in the Peninsula Malaysia.

Newly built FIT power generation plants in 2017 are

Summit Handa Power (Aichi Prefecture) with output of

75,000 kw, Tsuruga Green Power (Fukui prefecture) with

output of 37,000 kw, SGET Sanjo Biomass (Niigata

prefecture) with output of 6,300 kw and Paltec Energy

(Hyogo prefecture) with 22,100 kw. Both Handa and

Tsuruga use imported wood chip with annual consumption

of 275,000 BD ton.

Total wood chip import in 2017 was about 14,354,000 BD

ton, which is mainly used for paper and pulp

manufacturing.

South Sea (tropical) lumber and logs

Both plywood mills and lumber mills struggle to secure

volume of South Sea hardwood logs. South East Asian

countries are in rainy season and heavy rain fall continues

so log production is sharply dropping.

Export prices in Sarawak and Sabah, Malaysia and PNG

and Solomon Islands are climbing. Meranti regular log

prices in Japan are 12,000 yen plus per koku CIF.

Logs like keruing for lumber are harder to get. Log

inventories by lumber manufacturers in Japan are in

critical level but as there is traditional ceiling prices for

solid wood hardwood lumber, sawmills are caught in

between high cost and limited sales prices.

Prices of laminated free board are unchanged on both

supply side and Japan market. Supply volume of

Chinese red pine lumber is decreasing due to active

demand in China. The prices are firming at 110,000 yen

per cbm FOB truck.

Prospects for material supply in 2018

Focus of materials¡¯ supply in 2018 is supply situation of

European and North American lumber, which are main

building materials.

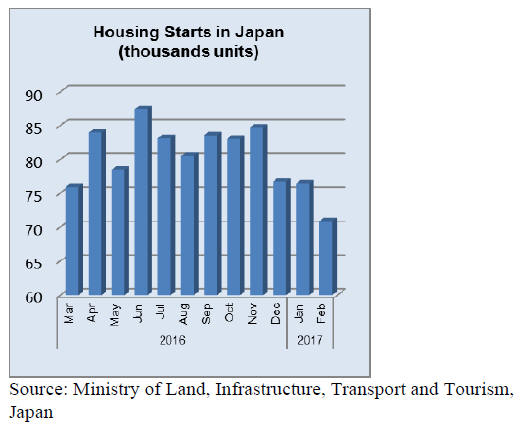

Housing starts in 2018 are forecasted about the same as

last year. If the supply would get tight from these sources

or the prices soar, it would become challenging year for

supply of substituting materials of domestic wood

products. The Forestry Agency has been promoting to

increase share of domestic wood by taking share from

importing materials.

North American logs and lumber prices for Japan have

been climbing as U.S. economy is booming and export to

other countries are also active so that the export prices

continue rising. Japanese sawmills manufacturing lumber

from imported North American logs have been increasing

sales prices but log cost climbs faster than lumber price

hike.

North American lumber export prices also go up in fast

pace. European lumber is the same. Redwood beam and

whitewood post export prices will be higher so unless

Japan follows higher export prices, the supply would

decline as the suppliers have options to go other markets.

Russian lumber, New Zealand radiate pine logs and South

Sea hardwood logs depends on China since China

becomes dominant buyer and price leader.

Demand for domestic wood has been expanding in various

fields of not only plywood and lumber but also for export

of logs and lumber for neighboring countries. North

America becomes a new market.

Domestic log supply and demand should stay firm through

the year with temporary softness during rainy season.

There will be new sawmills and plywood mills starting up

so despite demand situation, log demand should continue

to increase.

Small mills may face difficulty of getting enough logs by

start-up of new large mills. Log production has been

steady since beginning of the year so that the market eased

after sharp increase of log prices in last fall but cypress

should stay firm with positive demand for sill lumber.

Plywood mills may have difficulty of obtaining quality

logs for face and back particularly plywood mills are now

producing not only structural but floor base and concrete

forming panel, which are new additional market. Log and

lumber export of domestic wood will continue increasing

this year.

Log export was about one million cbms in 2017 and

lumber export was more than 100,000 cbms and they will

be much more this year, particularly lumber export. Cedar

lumber for exterior use in the U.S. market is new market

and this will also be climbing.

Focus on North American logs is fast rising Douglas fir

log prices for sawmills in Japan and how much surplus

logs B.C., Canada will put up for export. Log supply last

year was largely influenced by weather factor like heavy

snow and forest fires in summer then housing starts

increased in the U.S.A.

This year¡¯s housing starts in the U.S.A. are predicted more

than last year so the lumber market prices are likely tostay

firm. Lumber supply in the North America could not catch

up expanding demand last year, which pushed the lumber

market prices and the same would happen this year.

IS sort Douglas fir log FAS prices were $860 per M

Scribner in July last year then they have kept rising to

US$1,040 in January this year. Douglas fir cutting

sawmills in Japan increased the sale prices of lumber four

times last year but not enough to fast rising log cost so

mills need more price hike.

Same as logs, North American lumber export prices will

continue rising this year. Export prices of SPF, Douglas fir

and hemlock lumber for Japan market increased across the

board but not high enough to attract the suppliers so if

Japan is not able to follow higher prices, the supply

volume would decline after the second quarter.

There is no immediate substitution of SPF lumber so the

component companies have to follow higher export prices

but they will seek other sources like domestic cedar and

European dimension lumber.

European lumber has two different move. Redwood

lamina for laminated beam continue to be firm while

demand for whitewood lamina will decline for the first

half of the year because of sluggish demand for laminated

post in competition with domestic cedar laminated post.

For the European suppliers, there are other active markets

for whitewood products. Specifically China is expanding

purchase of European wood. The volume for China from

Finland and Sweden is more than Japan. Supply of

whitewood KD stud is reduced after hot North American

market buys more volume. After all, supply volume and

the prices for Japan depend on other markets.

Laminated lumber supply may not be the same as last

year. Redwood laminated beam should stay the same but

whitewood laminated post is likely to drop due to

stagnated market. Problem is climbing lamina cost.

Redwood lamina cost for the first quarter is 42,000 yen per

cbm FOB truck port yard, which is 7,000 yen higher than

the first quarter last year. Present redwood beam prices are

63,000 yen per cbm delivered but to cover higher lamina

cost, they have to go up to 66,000 yen. Imported redwood

beam prices are 63,000-66,000 yen per cbm FOB truck.

Competing Douglas fir KD solid wood beam prices are

58,000 yen per cbm delivered, only 4,000 yen higher than

the same quarter last year so difference between laminated

beam and solid wood beam is about 5,000 yen, which was

2,000 yen a year ago. Solid wood KD beam prices should

go higher as sawmills face climbing Douglas fir log prices.

Prices of hybrid laminated beam of cedar and Douglas fir

are 62,000-63,000 yen per cbm delivered. Lamina prices

for whitewood laminated post for the first quarter are

39,000 yen per cbm FOB truck, 4,000 yen higher than the

first quarter last year but prices of laminated post are 1,880

yen per piece delivered, only 20 yen higher so the

manufacturers are notable to pass high lamina cost.

Reasons are increasing volume of imported whitewood

laminated post and low priced domestic cedar laminated

post.

Domestic whitewood laminated post manufacturers need

to reduce the production to avoid loss. Supply of imported

post will continue at high level and prices of domestic

cedar laminated post do not seem to drop so price hike of

whitewood laminates post is remote.

|