Japan

Wood Products Prices

Dollar Exchange Rates of 25th

February

2018

Japan Yen 106.98

Reports From Japan

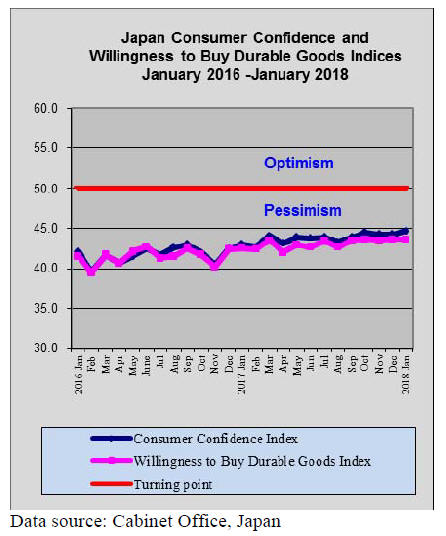

Growth hits a wall

Japan¡¯s economy has grown for eight consecutive

quarters, the best performance since a period between

1986 and 1989 during the ¡®bubble economy¡¯.

But now growth has hit a wall, the combination of much

slower growth in two years and the stronger yen in more

than twelve months is underlining how difficult it is to

revive inflation in Japan, even when other countries are

seeing improvements.

Despite this setback, a short term phenomena according to

the Bank of Japan, the government is maintaining the view

that steadily expanding industrial output and increased

capital expenditure will serve to correct any downturn.

The biggest problem is in the labour market where

shortages are emerging but not translating into higher

wages as yet. Only when this happens will a solid

foundation for inflation be established.

Exports support economy but growth at risk from

strengthening yen

The latest data on Japan¡¯s core machinery orders shows a

decline in December. Core machinery orders are regarded

as an indicator of capital investment and in a recent

government survey it was found that companies expect

orders to rise only marginally in the first quarter of this

year which risks undoing the recent improvements in

spending.

While the yen is competitive against other currencies it is

exports that are supporting economic expansion not

consumer spending.

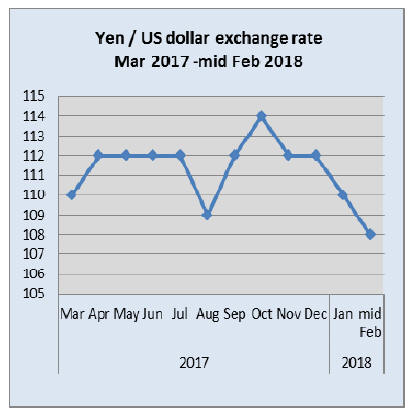

Yen volatility of growing concern

From ending 2017 at 112/US$ the yen had strengthened by

around 5% by the end of February to around 106/US$. The

abrupt volatility in the yen dollar exchange rate has been

put down to three main converging factors, expectations

that the Bank of Japan (BoJ) will begin to unwind its

monetary easing policy, pessimism on the US dollar and

demand driven by traders looking for a safe haven in the

yen.

The Japanese government does not want to see the yen

strengthen and this played a role in the decision to

reappoint the Governor of the BoJ and at the same time

introduced a new deputy who has a reputation for bolder

views on monetary easing.

A government spokesperson is quoted as saying ¡°We

(Japan) agreed at the Group of Seven and the Group of 20

that excessive foreign exchange moves are undesirable

because they can harm the economy. Foreign exchange

stability is extremely important.¡±

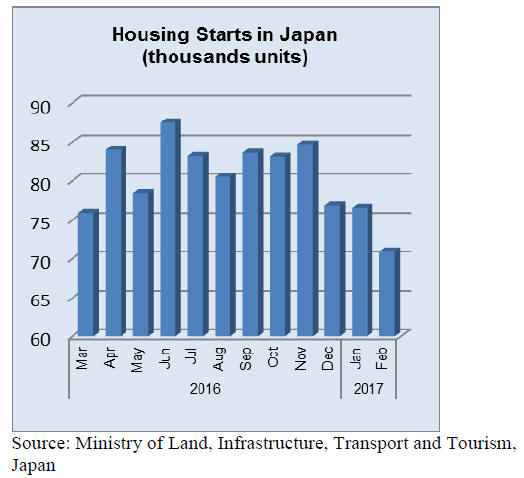

Bad winter weather and slower bank lending

eats into

housing starts

Housing starts have been falling since the end of 2016 and

while the bad winter weather has disrupted building

activity more than usual there does seem to be a correction

underway.

Data is showing that real estate financing rates have fallen

with 2017 seeing an over 5% decline. Analysts put this

down largely to the decision by banks in Japan to cut back

on easy term lending rates for apartment construction.

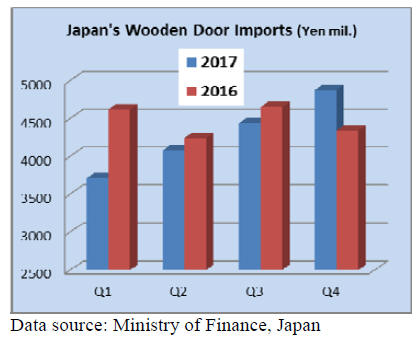

Import round up

Doors

The value of Japan¡¯s 2017 imports of wooden doors

dropped 4% compared to a year earlier. Imports in 2017

started from a low point in the first quarter but expanded

throughout the year in contrast to the rather stable value of

quarterly imports in 2016. It remains to be seen how the

cooling of the buy-to-rent market in Japan which created a

rise in renovation expenditure impacts door imports.

December door imports

December imports of wooden doors (HS441820) reflect a

correction from the high in November dropping around

3%. Year on year Japan¡¯s wooden door imports were up

17% driven largely by the expansion of home renovation

activity.

Shippers in China continue to dominate imports of

wooden doors and in December expanded market share to

around 60%. The other main suppliers in order of rank

were the Philippines (18%), Indonesia (8%) and Malaysia

(5%).

Window imports

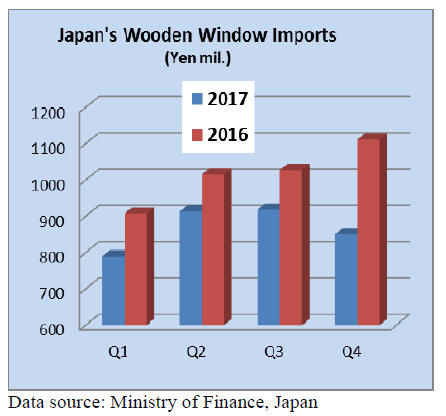

2017 saw a sharp drop in the value of Japan¡¯s wooden

window imports (-15%) compared to levels in 2016. The

decline in imports was in each quarter, the decline became

even more apparent in the final quarter of 2017.

December window imports

Month on month, the value of Japan¡¯s wooden window

imports were down around 3%.

The top supplier of wooden windows to Japan in

December was China which accounted for 40% of all

wooden window imports. Other suppliers were the US

(24%), the Philippines (20%) and Sweden (8%). Put

together, shippers in Europe accounted for just over 13%

of the value of Japan¡¯s wooden window imports.

Assembled flooring

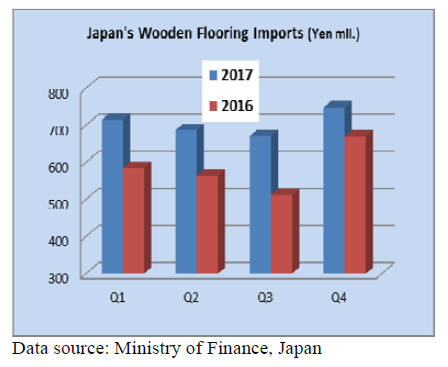

The value of Japan¡¯s 2017 wooden flooring (HS441871-

79) imports was up sharply from levels in 2016, rising

over 20%. For each quarter of 2017 imports topped those

in 2016 and import values in the final quarter of 2107 were

at a multi-year high.

December imports

As in previous months wooden flooring imports were

dominated by HS 441875 which accounted for 80% of all

wooden flooring imports. HS 441879 accounted for 16%

of imports followed by HS441874 at 3%.

Shippers in China, SE Asia accounted for most of the HS

441875 shipped to Japan while Indonesia and Thailand

joined China as the main suppliers of HS441879.

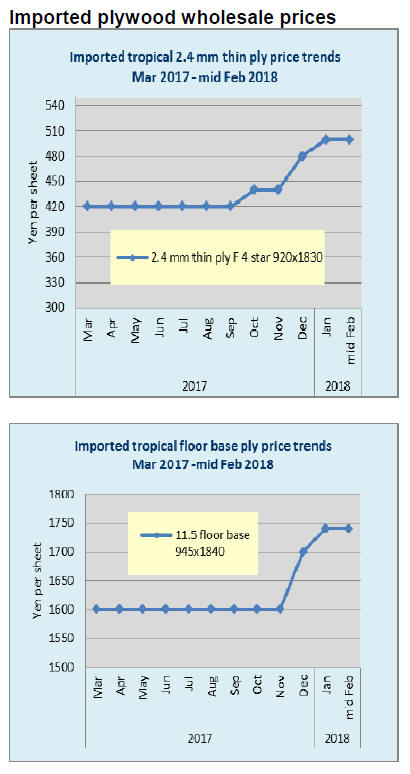

Plywood

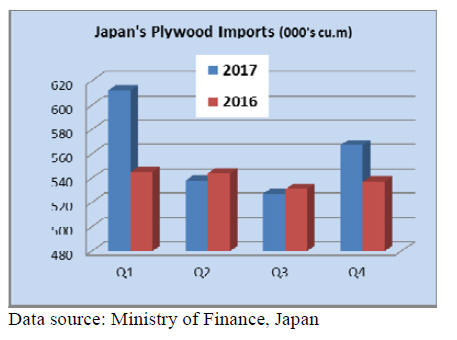

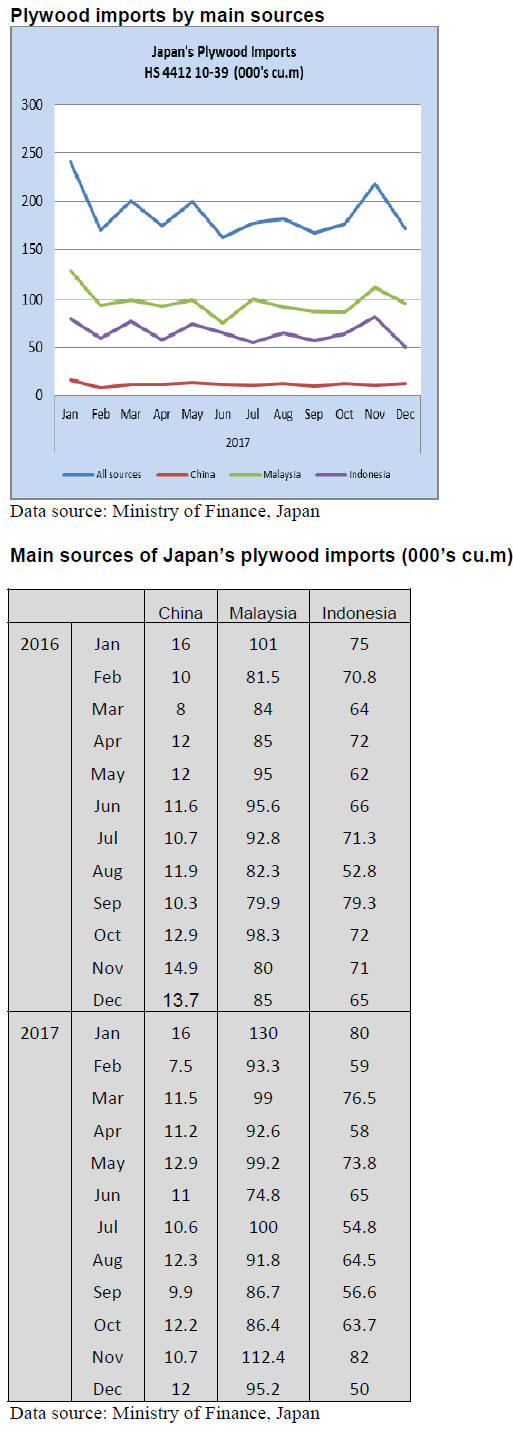

Japan¡¯s plywood imports in 2017 at almost 250,000 cu.m

were 4% higher than in 2016. Year on year shipments

from China were down 3%, Indonesian shipments were

down 5% which left Malayia accounting for the rise in

2017 imports. Shipments from Malaysia were up around

9.5% year on year.

The surge in first quarter 2017 imports was due to the high

volumes arriving in Japan from Malaysia and Indonesia

however the level of shipments slpiped in subsequent

quarters. Over 85% of 2017 plywood imports into Japan

comprised HS 441231 with a further 8% being HS

441234.

Dember plywood imports

Year on year, Japan¡¯s December 2017 plywood import

volumes were flat but month on month there was an over

20% decline in the vloume of imports with bot Malaysia

and Indonesai seeing shipments drop. This year end

decline in arrivals of plywood is usual as building activity

slows due to the winter weather which in 2017 was

particularly harsh.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Local cedar for eaves of the National Olympic Stadium

The Japan Sport Council announced that wood from

7refectures in Japan will be used for eaves of the New

National Stadium for the Olympic Games in 2020. As

prayer for the East Japan Earthquake and Kumamoto

earthquake, wood from damaged prefectures will be used

for entrance gate.

Concept of the new stadium is that it is pride to the world

with utilization of domestic wood. Material is forest

certified cedar from 47 prefectures. Cedar is cut into 105

mm by 30 mm with the quality of not clear but of small

knots.

The eaves surround the stadium with 360 degrees and

wood from each prefecture is placed in the direction of the

prefecture. For instance, wood from Hokkaido and the

North East will be placed on the North side of the stadium.

The volume of the wood is 143 cubic meters in total so

each prefecture puts up 1.5 ¨C 3.0 cubic meters.

Roof construction will start in February and be completed

in November of 2019. Plan is to use the wood from the

same prefecture in case of replacement or repair in future.

China approves use of Japanese species for housing

The China Wood Structural Design Standard will be

revised in August to allow use of Japanese species of

cedar, cypress and larch for post and beam construction in

China. Discussion has been held for more than seven years

between the Wood Export Promotion Association of Japan

(WEPA) and the Housing Construction department of

China for use of Japanese wood for Chinese wooden

housing.

WEPA stipulates cedar, cypress and larch lumber as

structural material so that they can be used to build

Japanese style post and beam construction in China. With

the revision, Japan now is able to export value added

precut lumber for China market.

WEPA has been eagerly promoting Japanese wood for

housing and built model house, held seminar and manual

of wooden house building in China. There is no accurate

statistics for housing starts in China but according to

WEPA¡¯s estimate, annual starts in urban area is Chinese

gives high evaluation to the Japanese style expose use of

wood but for actual construction, it is necessary to train

Chinese architects for design and carpenters for

construction. Canada¡¯s 2x4 housing was authorized back

in 1998.

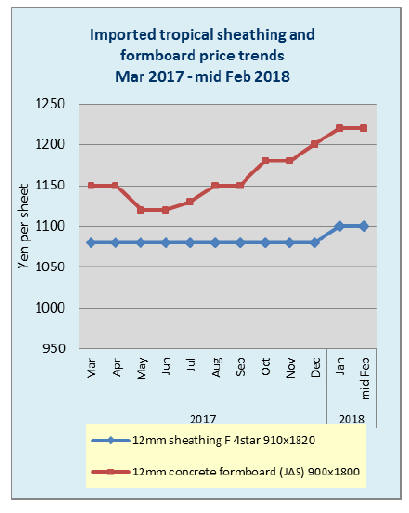

Plywood

Softwood plywood demand is easing but precutting plants

are asking delivery of delayed production. Normally the

movement slows down in the first quarter but because of

labour shortage, construction works are delayed so the

demand is being carried over. Domestic plywood

manufacturers are busy catching up delayed orders.

December production and shipment maintained high level

despite many holidays. December domestic plywood

production was 271,100 cbms, 4.8% more and 4.1% less.

Softwood production was 259,300 cbms, 8.6% more and

4.4% less. Softwood structural panel production was

244,800 cbms, 6.5% more and 5.0% less.

December imported plywood was 232,300 cbms, 0.5%

less than December last year and 16.7% less than

November. Malaysian supply was 97,200 cbms, 10.7%

more and 15.9% less. Indonesian supply was 56,900

cbms, 20.8% less and 37.6% less. Major plywood mills in

Indonesia stopped the operation because of log shortage so the arrivals

dropped

considerably.

The production in Malaysia and Indonesia should stay low

during rainy season so the arrivals do not seem to increase

until next spring. The inventories of imported plywood in

Japan keep declining by reduced arrivals.

|