Japan

Wood Products Prices

Dollar Exchange Rates of 25th

January

2018

Japan Yen 111.26

Reports From Japan

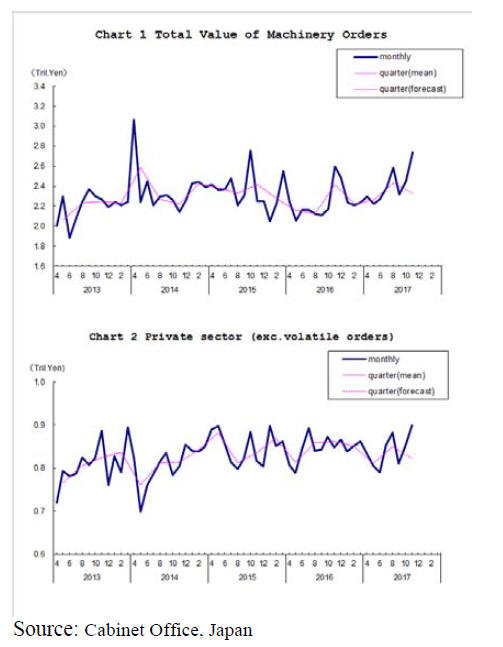

Boost in private sector

spending a surprise

Private-sector machinery orders rose in November, the

second monthly gain, driven mainly by orders from

service sector providers (see graphs right).

While this gain came as a surprise (analysts forecast a

decline) the positive numbers add to the sense that the

Japanese economy is really picking up. In view of the

positive news the Japanese Cabinet Office maintained its

forecast for private sector capital spending to continue to

increase. However, on a cautionary note, analysts point out

that machinery orders by manufacturers declined.

Japanese firms are slowly investing in equipment to boost

capacity and in automation to address a labour shortage

which is expected to become worse as the population of

working age people shrinks.

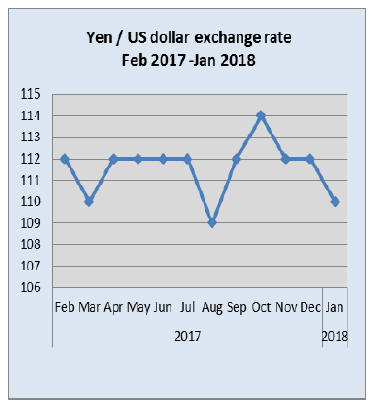

US shutdown drives dollar lower

Worries the US government shutdown weighed heavily on

the yen/dollar exchange rate. At one point late in the

month the US dollar was at a three-year low marking five

weeks of declines.

The stop-gap US legislation to fund essential US

government services until mid-February stemmed the

dollar fall.

On the 25 January the dollar was at a high of around yen

109 but since gave up some strength. However, analysts

are constantly watching for any change in the stance of the

Bank of Japan where there are suggestions that it could

begin to pull out from its aggressive monetary easing

policy, a move which would see the yen strengthen.

New report on Japan¡¯s housing demand

Satprnews, a company in the EU, has announced the

release of a report ¡®Single-Family Housing Construction in

Japan to 2020: Market Databook¡¯ this, says the Satprnews

website, contains detailed historic and forecast market

value data for the single-family housing construction

industry, including a breakdown of the data by

construction activity (new construction, repair and

maintenance, refurbishment and demolition).

Satprnews writes ¡±the report provides a top-level overview

and detailed insight into the operating environment of the

single-family housing construction industry in Japan. It is

an essential tool for companies active across the Japanese

construction value chain and for new players considering

to enter the market.¡±

See: http://www.satprnews.com/2018/01/16/single-familyhousing-

construction-in-japan-to-2020-market-databookconstruction-

manufacturing-and-construction-residentialconstruction-

industries/

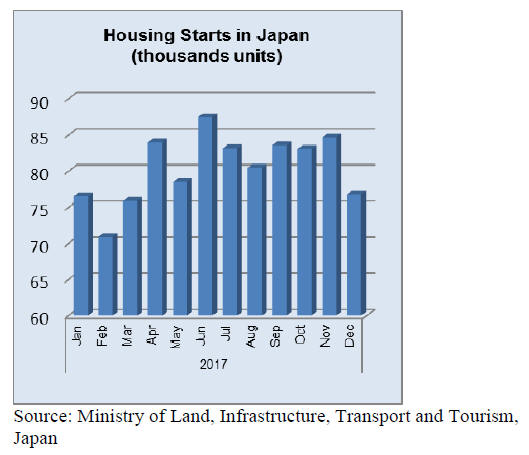

Housing data from Japan¡¯s Ministry of Land,

Infrastructure, Transport and Tourism show that December

2017 starts were down year on year, the sixth straight year

on year drop.

Annual housing starts for 2017 came in at almost the same

level as in 2016.

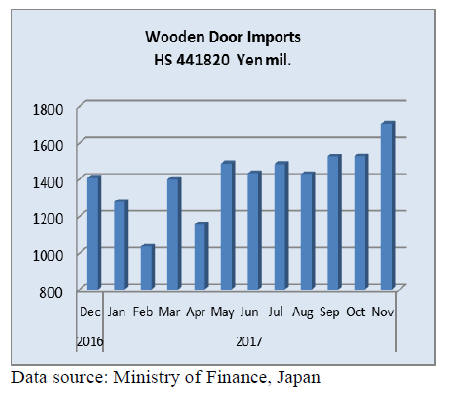

Import round up

Doors

Despite the surprise jump in November wood door imports

into Japan, total 2017 imports are set to be below those of

a year earlier.

November 2017 imports of wood doors (HS441820) were

up sharply year on year (+19%) and compered to levels in

October a 17% rise was observed.

Shippers in China continue to capture the lions share of

demand for imported wooden doors in Japan and in

November accounted for a little over 56% of all wooden

door imports. The Philippines was the second largest

supplier (18%) followed by Indonesia and Malaysia at

around 12% each.

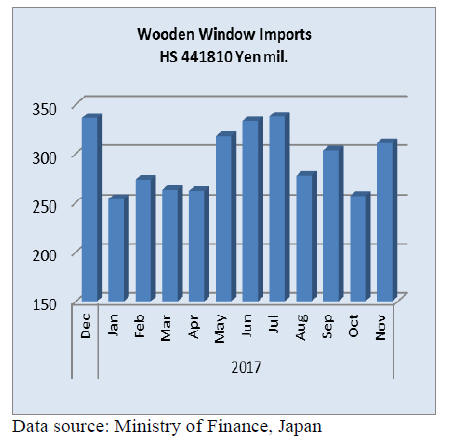

Windows

The value of wooden windows (HS441810) imports has

become more erratic over the past four months with

August 2017 imports dropping only to rise again in

September. However the expansion was not sustained

towards year end.

Infact, 2017 imports of wooden windows are likely to be

significantly below those of a year earlier based on data up

to November. Three shippers, China, US and the

Philippines each captures around a third of all Japan¡¯s

demand for imported wooden doors.

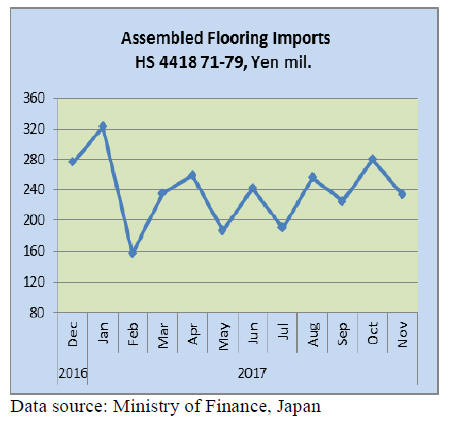

Assembled flooring

If Japan¡¯s imports of assembled wooden flooring

(HS441871-79) follow the usual pattern then there will be

a surge in December imports followed by a decline.

Year on year November assembled flooring imports were

up sharply (+17%) but compared to a month earlier import

values dropped.

Flooring falling within HS441875 accounted for the bulk

(70%) of November wooden flooring imports followed by

HS441879 at 25%. Imports of other categories of wooden

flooring are small. China was the only supplier of

HS441873, for HS441875 China was again the main

supplier (67%) followed by Indonesia (11%).

Shipments of HS441879 were fairly evenly distributed

between China, Thailand and Indonesia.

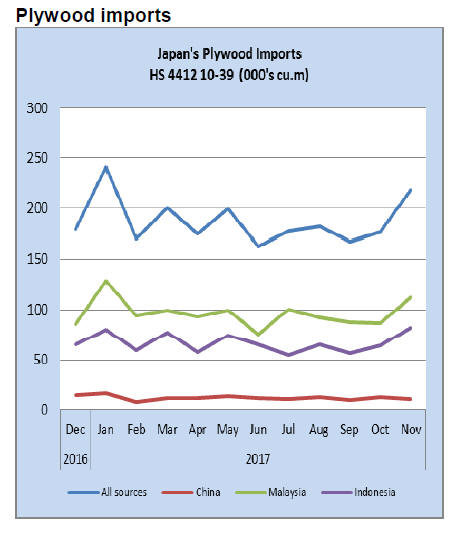

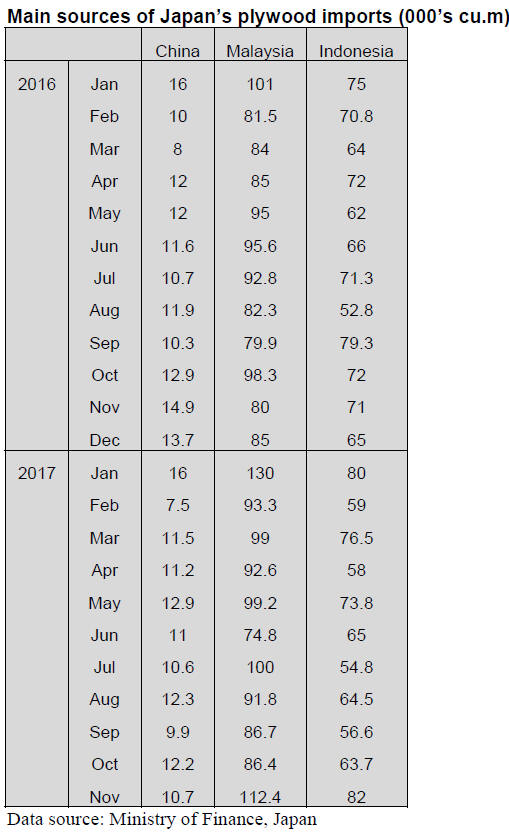

Plywood

Japan¡¯s November imports surged on the back of

increased shipments from Malaysia and Indonesia, both of

which were at monthly record highs.

Since June last year Japan¡¯s plywood imports have

remained at around 170,000 cubic metres per month but

October and November shipments have risen lifting the

average monthly volume of shipments .

November shipments from Malaysia were mainly of HS

441231 with smaller volumes of HS 4412 33 and 34.

November shipments from Indonesia followed a similar

pattern with most being HS 441231 but more HS 441234

is shipped from Indonesia than Malaysia.

In contrast plywood shipments from China are of more

varied specifications with HS 441231 accounting for most.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Japan¡¯s wood products exports climbing

There is increasing demand for Japanese wood products

from not only neighboring countries but far markets like

North America.

Logs and lumber have been exported to Korea, China and

Taiwan for last several years. The volume of lumber

export for the first ten months of 2017 was more than

107,000 cbms, more than 60% increase from 2016. About

60% is for China, 40% more than 2016. The volume for

the U.S.A. was more than 10,000 cbms, more than three

times of 2016. There was no export to the U.S.A. until

2013. Plywood export is also three times more than 2016.

Cedar lumber for the U.S. market is new demand after red

cedar supply gets short. It is mainly used for exterior like

fencing. Main size is 15 mm thick with length of 24 and

3.6 meters. There are increasing inquiries for this products.

Mukai Lumber in Ehime prefecture produces and ships

about 700-800 cbms of cedar lumber every month since

last summer. There are more sawmills handling this

product steadily now. Chugoku Lumber, the largest

Douglas fir lumber manufacturer, exported more than

10,000 cbms of cedar and cypress lumber for China, Korea

and Taiwan P.o.C in 2017, three times more than 2016 in

sales amount.

Presently monthly export volume is more than 10,000

cbms. Log export volume in 2017 did not quite reach one

million cbms but it is about 36% more than 2016.

Background of active export of Japanese wood is

worldwide climbing of wood prices and booming Chinese

economy. Log export prices from North America and New

Zealand are likely to go higher this year so there will be

more orders for Japanese cedar.

Wood products demand projection

The Forestry Agency held the meeting for wood products

demand projection for the first half of 2018. Imported

lumber from North America, Europe and structural

laminated lumber would decrease while logs from North

America for the second quarter and from New Zealand for

the first quarter would increase. Supply of domestic logs

for lumber would decrease some but logs for plywood

would increase by 8.5%.

Housing starts show sign of decline and average of 12

private think tanks forecast for 2017 is 960,000 units,

9,000 units less than previous forecast then forecast for

2018 is 961,000 units.

The Japan Federation of Housing Organization reported

that the survey made in last October through house

builders indicated that index of orders for the third quarter

2017 was minus 32 points and the amount was also minus

23 points. Orders were minus for six consecutive quarters.

North American lumber supply would continue in 2018

with climbing prices by active North American demand

while North American log demand remains firm and the

arrivals for the second quarter would be up by 7% but it

depends on winter weather on the Pacific coast.

European lumber, which supply increased in the fourth

quarter 2017, would decrease in the first quarter 2018 and

the purchase remains weak for the second quarter since the

market has no strength to pass on higher import cost.

Arrivals of structural laminated lumber for the first half of

2018 would decline by 11.5% while domestic production

of structural laminated lumber would remain the same as

2017.

Demand for domestic plywood would continue active for

the first half of 2018. The supply would increase as a new

plywood mill would start up in April 2018. This would

result in higher demand of domestic logs for plywood

manufacturing in 2018.

Meantime, there are different views on demand for

domestic lumber. Some forecast the same degree of

demand of the first half while the others comment slight

decline of demand.

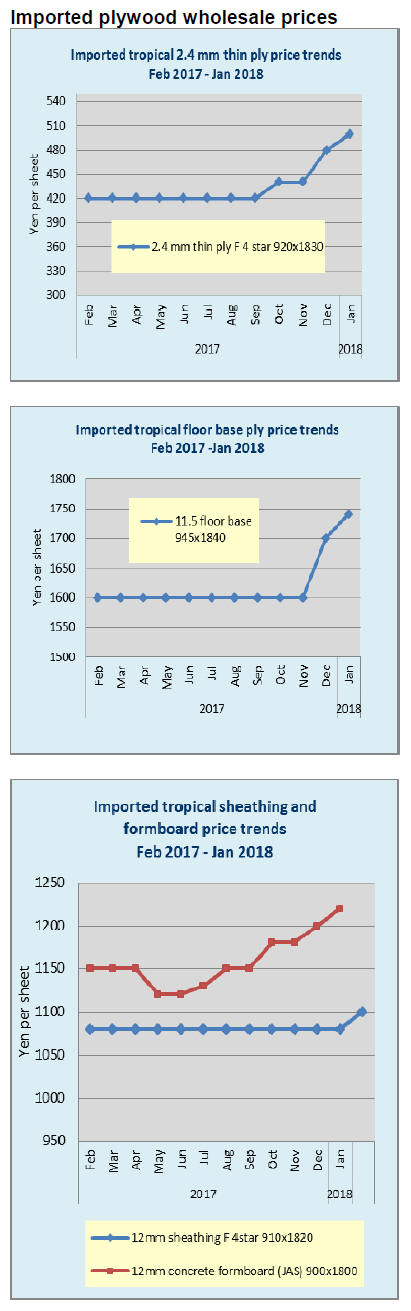

Plywood

Supply tightness continues on both domestic and imported

plywood. Active demand for domestic softwood plywood

continues after the New Year by precutting plants.

Inventories of imported thin panel, floor base and coated

2x6 concrete forming are down. This seems to continue

until March.

November plywood production in 2017 was 271,200

cbms, 8.1% more than November 2016 and 1.3% more

than October, which was the highest monthly production.

In this, softwood plywood was 257,600 cbms, 6.5% more

and 1.5% more.

The shipment of softwood plywood was 268,500 cbms,

6.5% more and 1.7% less. Since the production was more

than the shipment, the inventories were 102,900 cbms,

2,300 cbms increase.

Usually December is busy month for distribution so many

failed to deliver even with produced plywood due to

shortage of trucks. Many construction works are carried

over into January so busy demand would continue through

January.

Arrivals of imported plywood was 279,000 cbms, 20.3%

more and 20.5% more. Malaysian supply was 115,600

cbms, 39.0% more and 31.9% more.

Indonesian supply was 91,100 cbms, 15.1% more and

25.4% more. Chinese supply was 57,900 cbms, 6.8% more

and 5.8% more. Despite supply increase in November, the

supply from South East Asian countries would be down in

December because of arrival of rainy season.

The movement of imported plywood in Japan continues

inactive but the demand should pick up in 2018 for various

constructions related to the Tokyo Olympic Games in

2020 and start of urban redevelopment and if the supply

declines when the demand recovers, some fear delay of

construction activities.

South Sea (tropical) logs

South East Asian countries are in rainy season now so log

production is low.

Japanese plywood manufacturers have been struggling to

secure material logs since last fall and some bought

mersawa to supplement meranti. Present market prices of

Sarawak meranti regular are 12,000 yen plus per cbm CIF

and further increase is expected.

Domestic inventories of keruing and melapi for lumber

manufacturing are down. Lumber manufacturers

commented that they may need to consider using genban

instead of logs.

Movement of laminated free board from China and South

East Asia continues slow. The inventories are low but

demand and supply are balanced. Market prices of

Indonesian mercusii pine are high end of level of 110,000

yen per cbm FOB truck and Chinese red pine are middle

of 110,000 yen level.

Inventory of solid lumber of keruing and white serayah

used for truck body and ship building is very low.

Russia to increase log export duty

The Russian government announced a new ministerial

ordinance regarding log export from the Far East regions.

It states that if any company, which achieved a certain

amount of wood processing, wishes to export logs, 6.5%

export duty rate is applied then the duty will be increased

step by step and the rate will be 80% after 2021, which

practically prohibits log export.

The idea is to promote wood processing in the Far East

regions. The ordinance is effective since January 1, 2018.

While promoting processing wood, the government allows

export of logs unsuitable for processing and the annual

quota of log export is four million cubic meters.

Applicable species are whitewood and larch.

Any company, which has amount of share of 20% of all

export processed products, is allowed 6.5% export duty

then processed percentage is raised year after year like

25% in 2019 and 35% after 2021. Processed products

mean lumber, veneer, plywood and wood chip.

Log export duty rate is raised step by step. 25% in 2018,

40% in 2019, 60% in 2020 and 80% after 2021. China

buys sizable volume of Russian logs and if this is strictly

applied, China will need to look for log sources elsewhere

and the most likely sources would be North America and

New Zealand.

|