|

Report from

North America

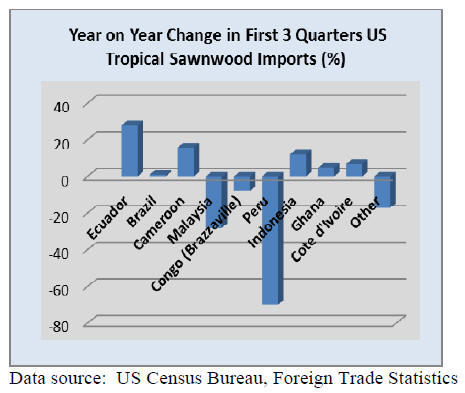

Brazil expands market share

US imports of temperate and tropical sawn hardwood

declined 13% in September from the previous month to

62,939 cu.m. Tropical sawnwood imports fell 22% to

16,755 cu.m., primarily due to a 40% drop in balsa

imports in September.

Imports of several other major tropical species were also

down in September, with the exception of ipe, virola and

mahogany. Ipe sawnwood imports increased 19% from the

previous month to 2,871 cu.m., while the value of

imported ipe grew at an even higher rate to US$6.5

million.

1,043 cu.m. of virola sawnwood were imported in

September, up 24% from August. The majority came from

Brazil, whose tropical shipments to the US reached 4,900

cu.m. in September due to the higher ipe and virola

imports.

Imports from Malaysia fell by more than half in

September. Keruing sawnwood imports were significantly

down from August. Imports of meranti, teak and jatoba

also declined from the previous month.

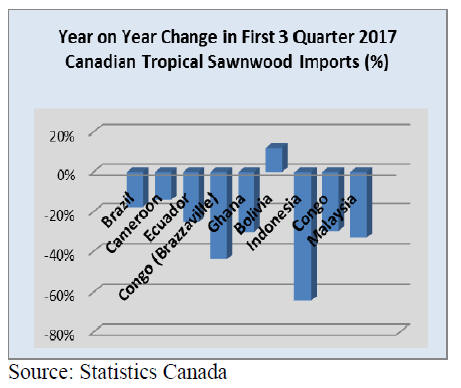

Canadian tropical imports up in September lead by

balsa

The value of Canadian imports of tropical sawnwood grew

by 11% in September to US$1.68 million (all values in US

dollars). Year-to-date imports were 4% lower than at the

same time last year.

Imports of virola, imbuia and balsa (combined) and

mahogany recovered from the drop in August. Unlike in

the US the growth was largely in balsa imports from

Ecuador, which more than tripled in September to

US$17,643.

At US$324,560 sapelli sawnwood imports were slightly

down in September, but year-to-date imports were

unchanged from the same time last year. Sapelli exports

from Cameroon grew to US$209,795 in September, while

Cameroon¡¯s shipments of ¡°other¡± tropical species to the

US reached US$237,457.

Note:

In addition to the sources mentioned above, Canadian

imports of tropical sawnwood from US sources in the first

9 months of this year more than tripled compared to 2016.

Imports from the US totalled more than 3 million cubic

metres accounting for around 25% of all tropical

sawnwood imports into Canada.

US architects and designers lack knowledge on

endangered species

Many US architects and designers have limited knowledge

of endangered and threatened wood species and often do

not know which alternative species or materials to use.

Even if they do know that a species is endangered, 40%

would still chose the wood if a client requested it.

These are the findings of a national survey of architects

and designers that was commissioned by laminate

manufacturer Wilsonart. The survey results were presented

at an event for architects in New York and reported by

Woodworking Network.

The survey also found that almost none of the survey

respondents could correctly identify most endangered

wood species from a list provided but 70% agreed that

using responsibly sourced wood is a priority.

Potential legal liabilities under Lacey Act are not well

understood by architects and designers.

Producers and suppliers of tropical wood products have a

significant opportunity and challenge to educate designers

in the US about tropical species, sustainable tropical forest

management and legal procurement.

A good starting point for understanding the educational

needs are the survey results and recommendations

provided on the Wilsonart website.

See:

https://www.wilsonart.com/understanding-wood

The survey respondents were designers, architects and

specifiers who work on a wide range of building projects,

including residential, office and hospitality.

Chemically modified pine for outdoor applications

The US internet portal Woodworking Network recently

featured the use of chemically modified radiata pine in a

landmark high-end apartment building near downtown

Washington DC. The pine product (Kebony) is used for

outdoor decking, benches and a pergola. The manufacturer

of Kebony compares its properties to ipe, teak and

thermally modified temperate species. While the product

falls short of ipe in hardness and dimensional stability, it

rates similarly to teak according to the Norwegian

manufacturer¡¯s data.

More US antidumping investigations

Enforcement of trade laws is a prime focus of the Trump

administration, according to the US Department of

Commerce.

Between January 20 and November 1 of this year the

department has initiated 77 antidumping and

countervailing duty investigations, which represents a 61%

increase from the same period in 2016.

The US Department of Commerce announced in early

November the final duties on sawn softwood products

from Canada. Five Canadian manufacturers were assessed

combined duties between 9.92% and 23.76%, while all

others will pay 20.83%.

US home builders and other users of Canadian softwood

criticized the decision since it will raise cost to US

consumers. Canadian manufacturers and their customers in

the US had hoped for a long-term settlement between the

two countries, similar to the previous softwood trade

agreements, but a negotiated agreement was not reached.

Commerce Department plywood investigation goes

against Chinese manufacturers

The US Secretary of Commerce has announced its final

determinations in the antidumping duty (AD) and

countervailing duty (CVD) investigations of imports of

hardwood plywood products from China.

The Commerce Department determined that exporters

from China sold hardwood plywood products in the

United States at 183.36 percent less than fair value.

Commerce also determined that China is providing unfair

subsidies to its producers of hardwood plywood products

at rates ranging from 22.98 to 194.9 percent.

As a result of these decisions the Commerce Department

will instruct US Customs to collect cash deposits from

importers of hardwood plywood products from China

based on the determined rates.

In 2016, imports of hardwood plywood products from

China were valued at an estimated USUS$1.12 billion.

The investigation was conducted after petitions were filed

on behalf of the Coalition for Fair Trade in Hardwood

Plywood and its individual members: Columbia Forest

Products (NC), Commonwealth Plywood Inc. (NY),

Murphy Plywood (OR), Roseburg Forest Products Co.

(OR), States Industries, Inc. (OR), and Timber Products

Company (OR).

For the press release see:

https://www.commerce.gov/news/pressreleases/

2017/11/us-department-commerce-findsdumping-

and-subsidization-imports-hardwood

and more at:

https://www.trade.gov/enforcement/factsheets/factsheetprc-

hardwood-plywood-products-ad-cvd-final-111317.pdf

|