2. GHANA

Industries to enjoy reduced power rates

Ghanaian industries, including timber manufacturing

companies, could benefit from reduced electricity tariffs if

the budget submission from Ken Ofori-Atta, the Minister

of Finance is accepted. The Vice President, Dr. Bawumia,

has hinted at a 25% reduction in power tariffs aimed at

accelerating industrialisation.

Dr. Bawumia recently told an international conference that

the government had shifted its focus from taxation to

production and is working to create an industrial

environment that focusses on technology as one tool for

growth.

At an Association of Ghana Industries (AGI) awards

event, Ghana’s President confirmed that efforts are

underway for a review of electricity tariffs. AGI President,

James Asare-Adjei, welcomed the move by the

government to address the power crisis in the country as it

will pave the way to restore economic stability and an

improvement in the business environment.

The AGI has been lobbying for a change in the high

electricity tariffs paid by local manufacturing companies.

The unreliable supply of electricity was the biggest

challenge faced by local manufacturers as it undermined

competiveness.

Strengthen financial sector for economic growth

Bank of Ghana Governor, Dr. Ernest Addison, has said the

Bank aims to create a stronger and more sophisticated

financial sector to meet the needs of the domestic private

sector and provide a boost to attracting investment from

overseas.

He said the Bank will build on policies to attain macroeconomic

stability which is critical if the country’s

economic growth is to be maintained.

3.

MALAYSIA

Exports on track for a record high

Malaysia’s Ministry of Plantation Industries and

Commodities says exports of wood products are forecast

to rise to RM23 billion this year, up from the RM21.86

billion last year.

Nasrun Datu Mansur, the Deputy Minister said the

government will do all it can to develop the talent of

Malayasian wooden furniture manufacturers as the sector

is of importance to the economy. In the first eight months

of this year wood product exports rose 7% year on year to

almost RM16 billion.

SMEs to be offered soft loans for automation

Malaysia’s 2018 budget will, for the first time, deliver

support through a loan facility for expanded automation in

small and medium-sized enterprises.

The President of the Malaysian Furniture Council, Chua

Chun Chai, welcomed this initiative saying one way

around the acute labour shortage in the furniture making

sector is automation. He said many furniture factories

were keen to automate production to minimise dependence

on foreign workers and improve productivity.

Chua said if the furniture industry can boost productivity

through greater levels of automation then Malaysian

exporters will be better equipped to meet the competition

from countries like China, Vietnam and Indonesia. The

president of the Johor Furniture Association, Koh Choon

Chai, said furniture manufacturers were struggling to meet

export orders on time because of a shortage of workers.

Third party verification of certification in Sarawak

The state government has indicated it will make it

mandatory for all timber concessions in Sarawak to obtain

forest management certification in order to enhance

sustainable forest management in the state.

Deputy Chief Minister, Awang Tengah Ali Hasan, said the

state government has strengthened the Sarawak Timber

Legality Verification System (STLVS) by providing a

formal standard to include independent third party

verification.

He also said his ministry aims to reduce reliance

on the

natural forests for raw materials through the establishment

of a viable and robust industrial forest estate in the state.

Off-site fabrication mandatory for government projects

The recent International Conference on Wood

Architecture, hosted by the Malaysian Timber Council

(MTC), delivered the message that a magnificent building

material like timber should not be reduced to secondary

functions and that Malaysian architects as well as

structural engineers need to relook the use of timber in

architecture.

In an opening address stakeholders in the construction

industry were urged to embrace the concept of

industrialised building systems whereby components, such

as timber frames, are fabricated off-site to improve

productivity and reduce onsite construction waste. For

government funded construction projects there is a

minimum level of mandatory off-site fabrication.

For more see:

http://www.mtc.com.my/images/media/555/20171109_WA2017

_Post_release-eng.pdf

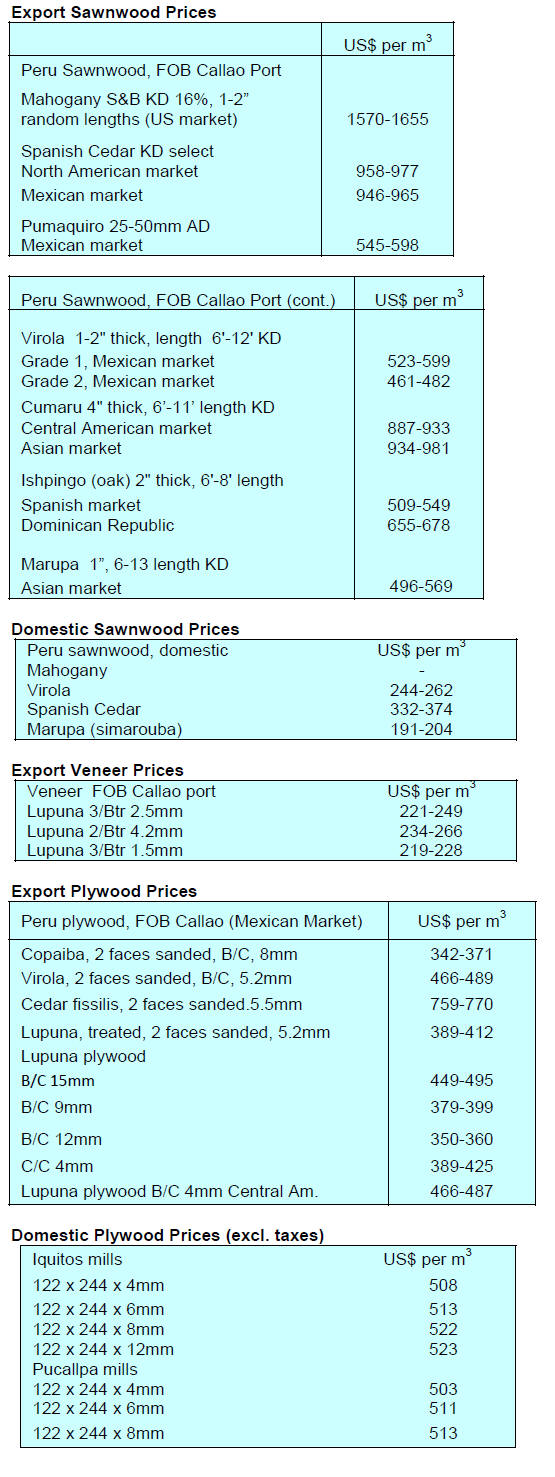

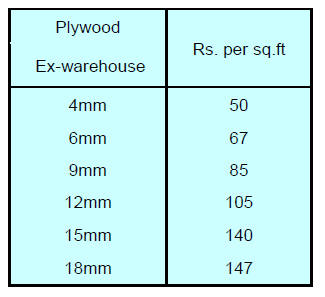

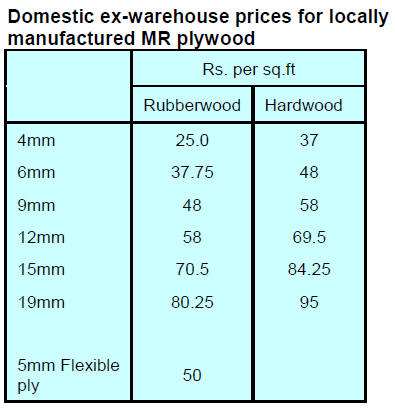

Plywood prices in October

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

Bright prospects in furniture

markets says Ministry

Panggah Susanto, Director General of Agro Industries

within the Ministry of Industry (Kemenperin), is on record

as saying within two years furniture exports could rise to

US$5 billion as demand in the United States, Japan, and

Western Europe picks up.

Currently the value of annual furniture exports is US$1.7

billion.

Much of the furniture exported from Indonesia is made

from rattan and Paggah said rattan furniture production

will be increased.

Kemenperin noted employment in the formal segment of

the domestic furniture industry in 2016 was around

101,000 but this could double in a few years.

To boost rattan furniture production the Ministry of

Industry is encouraging development of the furniture

industry as it is a labour intensive sector and has decided

to make Cirebon, a port city on the north coast of Java,

one of the main centres for rattan supply and rattan

furniture and handicraft production.

In contrast to the positive outlook from the Ministry of

Industry, the Chairman of Association of Indonesian

Furniture and Handicraft Industry (Asmindo) Mugiyanto

said furniture manufacturers are facing challenges in

international markets where sales of Indonesian furniture

face tough competition and suffer from a poor image due

to perceptions that illegal timber is being utilised.

Mugiyanto said to expand sales manufacturers need to be

deliver innovative product designs and to expand outreach

to address the negative perceptions of Indonesian wood

products in international markets.

In the current trading environment Asmindo has suggested

a focus on the domestic market as the building sector is

very active with huge investments in family homes,

apartments, hotels and office buildings where furniture

will be needed.

Policy for forest-based energy needed

Haruni Krisnawati, from the Forest Research and

Development Center, Ministry of Environment and

Forestry, said the utilisation of renewable energy based on

forest resources can support Indonesia’s efforts on to cut

greenhouse gas emissions.

However, little progress will be made until the government

has a defined policy to support this. What is needed, says

Haruni, is a policy on competitive tariffs for electricity

from renewable sources.

Ministry to expand community forests

management

The Ministry of Environment and Forestry has targeted the

allocation of 5 million hectares of social forestry from now

until 2019. Currently the area of allocated to social

forestry is only 1.07 million ha but this is expected to rise

when full 2017 data is available.

In related news, the Indonesian President granted

customary forest management rights to nine village forest

management units covering an area of 80,230 hectares and

promised technical help and financial support for the

recipient communities.

5.

MYANMAR

Myanmar millers lobby MTE to sell logs in

local

currency

In a letter to the Myanma Timber Enterprise (MTE)

national sawmillers are urging that bids in tender sales be

permitted in Myanmar kyats. This proposal was included

in a letter submitted by the Myanmar Forest Products

Merchants Federation (MFPMF) to the Vice President. In

the same letter the MFPMF also asked for separate tenders

only for Myanmar national manufactures.

The MTE accepts US dollars for some sales and kyats for

others which causes confusion. Domestic companies can

pay in kyats but when these millers tried to export

products from logs purchased in kyats they ran into trouble

as traceability was said to be weak which resulted in the

Forestry Department suspending export of wood products

milled from logs purchased with kyats.

Exports dip as confidence of international buyers has

been undermined

From 1 April to 3 November 2017 the value of timber

exports amounted to US$4.1 million down sharply on

recent years. Analysts say the recent action by authorities

in Denmark and Netherland has undermined the

confidence of importers and this is reflected in the level of

exports.

MTE clarifies export documentation

The MTE has issued a document “The Current Situation of

the MTE and the Future Plans and Documentation for

Myanmar Timber export.

See:

https://drive.google.com/file/d/0B7YRHkC0qQmak83X3ZJTENhcXM/

view)

This attempts to clarifying what documents will be

provided to importers and how they can be interpreted.

MTE is making this effort in order to satisfy the demands

of importers especially those in the EU who are required

to satisfy the EUTR.

Myanmar seeks PEFC membership

A delegation from the Myanmar Forest Certification

Committee (MFCC) attended the PEFC General Assembly

in Helsinki and formally declared their intention to be a

PEFC member within three years.

MFCC and PEFC are undertaking a three-year project

supported by the Prince Albert II of Monaco Fund to

strengthen MFCC as an institution and to strengthen the

Myanmar Forest Certification System (MFCS) as the

National Certification System.

This, say analysts, will contribute the mitigation of risk in

Myanmar’s forestry and timber industry sectors.

Aim to have forestry sector included in EITI

negotiations

Myanmar’s most recent economic policy identifies the role

that satisfying the requirements of the Extractive

Industries Transparency Initiative (EITI) can play in

assuring transparent natural resource governance.

The extractive sector in Myanmar makes a significant and

growing contribution to the country’s GDP and U Tin Tin,

leader of EITI working group in the Forestry Department,

told the local media that discussions are underway to have

the forest sector assessed independently in readiness for

further discussion with EITI.

It is anticipated that assessment of the forestry sector for

the EITI will demonstrate improvements in transparency

and the growing cooperation between the Forestry

Department, the private sector and civil society. The

ultimate aim is to strengthen the international image of the

Myanmar forestry sector.

For more see:eiti.org/myanmar

India and Myanmar promote bilateral relations

A recent workshop “India-Myanmar relations: “The Way

Forward" organised jointly by the Calcutta-based Institute

of Social and Cultural Studies (ISCS) and the Yangonbased

Myanmar Institute of Strategic & International

Studies (MISIS) highlighted trade between India and

Myanmar and reported that this had doubled to over US$2

billion over the past 10 years.

Participants called on both countries to work towards

removing obstacles to trade through

addressing connectivity, infrastructure, labour movement,

logistics and complementary financial services. This last

point is particularly relevant as at present most

international transactions between India and Myanmar are

through Singapore. The meeting called for the authorities

in Myanmar to modernise its banking sector.

The workshop also recommended the creation of Special

Economic and Industrial Zones along main road arteries

linking the two countries.

A 19 point action plan was adopted which can be found at:

http://www.mizzima.com/development-news/yangondeclaration-

india-myanmar-cooperation

Encourage investment in Myanmar’s inland waterways

Earlier this year the government announced plans to

develop six inland maritime port terminals – four on the

Ayeyarwaddy River and two on the Chindwin River.

The Ayeyarwaddy ports will be built at Mandalay,

Pakkoku, Sinkham and Magway, while the Chindwin ports

will be located at Kalewa and Monywa.

Myanmar’s Minister of Transport and Communications,

U

Thant Sin Maung, said that the government is encouraging

private investment in infrastructure is key to the National

Transport Master Plan.

In support of the Minister, U Phyo Min Thein, Chief

Minister of the Regional Government of Yangon, said it is

a priority to upgrade the infrastructure including the

development of inland waterways.

According to estimates from the Ministry of Transport and

Communications, the transport sector will require

investments of over US$50 billion over the next 20 years

and investments in inland port developments can deliver

attractive returns.

6. INDIA

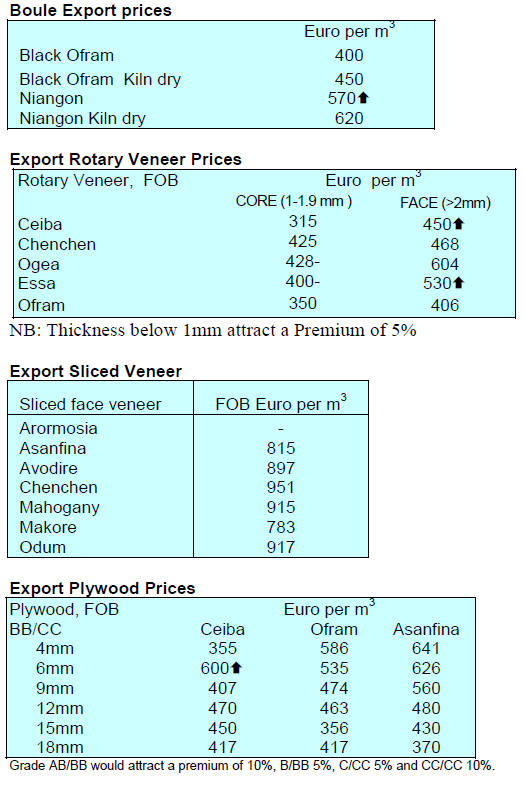

Gabon okoume veneers gain a foothold

in India

The Indian panel sector journal, Ply Reporter in its

October issue, says okoume face veneer shipped from

Gabon has gained a foothold in the Indian panel market

and is gradually gaining acceptance in the Indian market.

Ply Reporter predicts that the supply of okoume veneer

from Gabon is set to rise.

In the past plywood manufacturers in India could rely on

imported raw materials from forest rich countries such

Myanmar, Laos, Indonesia, Solomon Islands, Papua New

Guinea and West/Central African countries. But now

many of these countries have restricted log exports and

even veneers in some cases.

Given some regulatory changes in the forestry sector by

the Governments of Myanmar and Laos the supply of face

veneers to India is severely impacted so Indian plywood

manufacturers welcome the production and export of

veneers from Gabon.

Recently, one of India’s leading plywood manufacturers,

Greenply, began veneer production in Gabon alongside the

other Indian owned mills operating in the country’s

Special economic Zone.

For more see:

http://www.plyreporter.com/

Job opportunities in the real estate sector jobs set to

rise

A New report from CREDAI, the Confederation of Real

Estate Developers Associations of India, says real estate

sector employment is set to increase by 80% by 2025.

CREDAI commissioned the study “Assessing the

Economic Impact of India’s Real Estate” with CBRE

(consultants to the real estate sector) to assess the impact

of economic such as the new Goods and Services tax on

the real estate sector.

Potential employment opportunities in the sector are

expected to rise to 17.2 million jobs by 2025 up from 9.2

million in 2016. The economic contribution of the real

estate sector is projected to increase significantly during

the period from 6.3% in 2016 to almost 13% in 2025.

Increasing demand for new housing, especially in the socalled

tier II and tier III cities in the country, will be the

drivers of real estate growth says the report. However, the

increase in contribution to the economy is, says the report,

subject to an effective implementation of relevant policy

measures to resolve bottlenecks bothering the sector.

For more see:

https://credai.org/press-releases/credai-steps-in-to-resolvecomplaint-

of-ncr-home-buyers

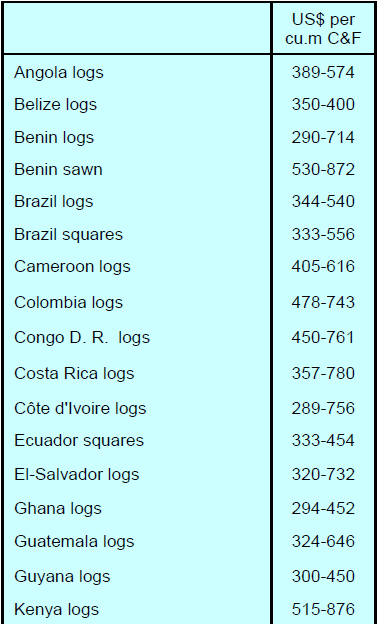

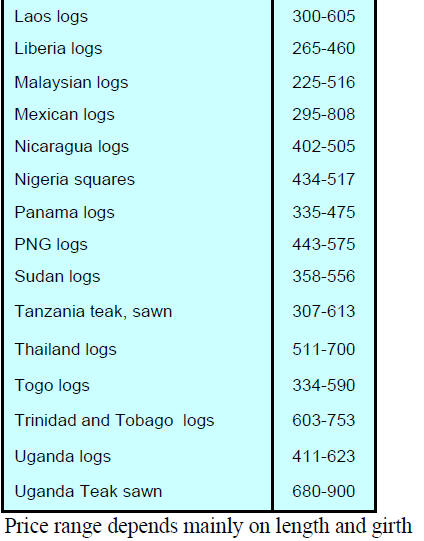

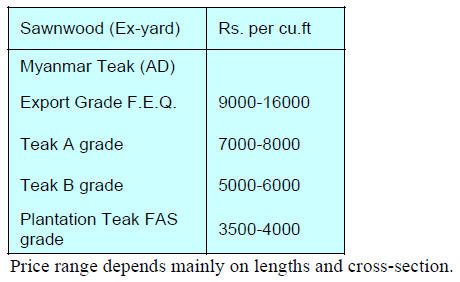

Imported plantation teak

Demand for imported plantation teak logs continues to be

satisfactory. Pressure for a revision of GST on wood and

wood products continues. In the absence of a decision on

the GST Indian importers are reluctant to commit too far

ahead and are only willing to maintain current price offers

to suppliers.

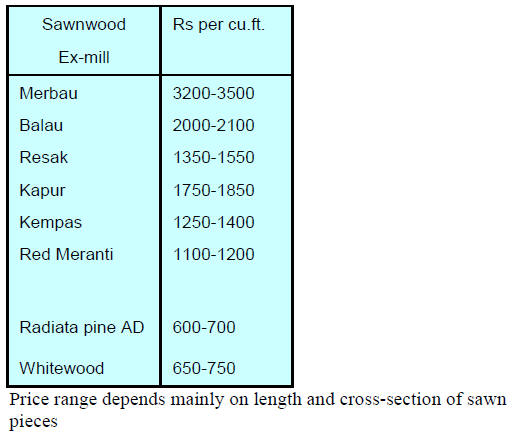

Locally sawn hardwood prices

Prices for imported hardwoods remain unchanged. Traders

report demand is firming as hardwoods begin to take

market share from imported teak where quality has been

declining in recent months.

Importers say the availability of sawn Myanmar teak is

satisfactory but that domestic sales are flat because the

price of Myanmar teak is high compared to alternative

hardwoods.

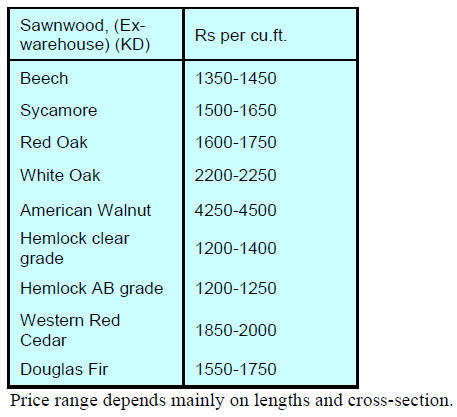

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

Prices for WBP marine grade manufactured by

domestic mills

At its 23rd meeting the GST Council almost 200 items

were shifted from the upper tax bracket of 28% to 18%.

Amongst the items which will enjoy a lower GST are

plywood and panel products.

This has been welcomed by manufacturers who have

lobbied strongly for a lower tax.

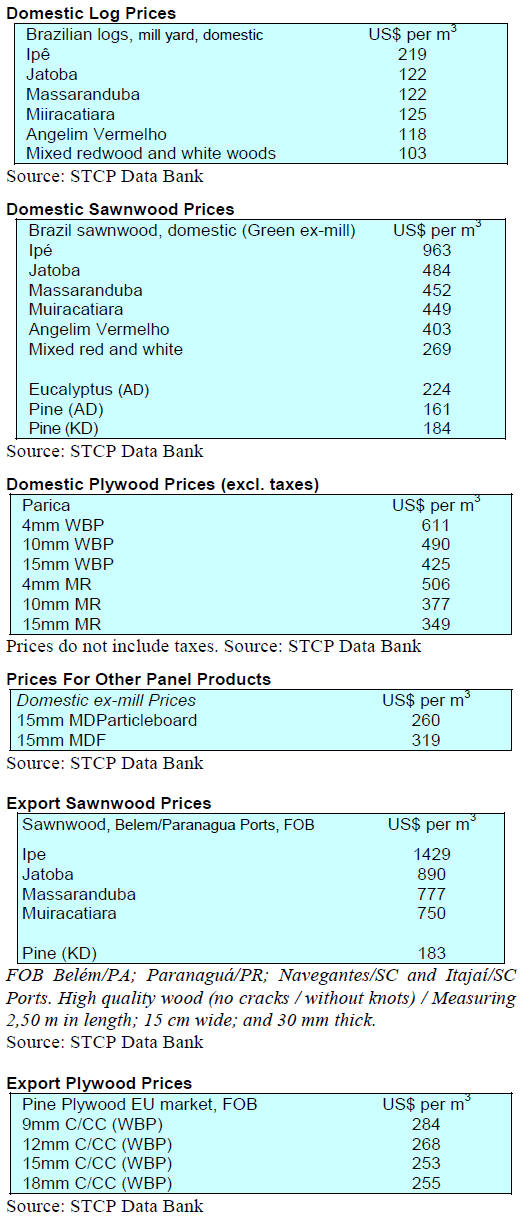

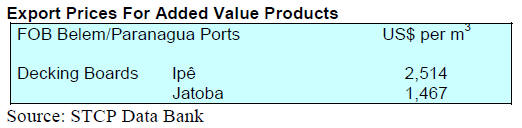

7. BRAZIL

Furniture production increases

in Southern Brazil

Rio Grande do Sul and Paraná states are two prominent

furniture centres in Brazil and according to IBGE

(Brazilian Institute of Geography and Statistics), furniture

production in Rio Grande do Sul state in August expanded

just over 10%. In the Paraná state the equivalent growth

was almost 5%. Year on year, production in Rio Grande

do Sul increased 2.2%, while that in Paraná rose 11.6%.

Wood-plastic panel production from wood residues

Early work on the production of a wood-plastic panel in

the state of Amazonas has been encouraging. Trial

production has utilised timber residues.

This value added product from residues of Amazonian

timber offers an opportunity to expand the range of wood

based panels available in the market.

Furniture exports increase

Data from the Ministry of Development, Industry and

Foreign Trade (MDIC) show the trend in furniture exports

in the first nine months of this year in comparison with the

same period of 2016.

From January to September 2017 furniture exports

amounted to US$456.9 million against US$ 432.1 million

in 2016. Looking ahead, the MDIC expects total exports

for 2017 to be around US$660 million. Brazilian

contribution to the global furniture trade of about US$270

billion is around 0.25%.

The trade balance in the furniture sector continues positive

as imports have been falling reflecting the state of the

economy.

Between January and September 2017 furniture imports

totalled US$398 million, down 14% year on year. Brazil

imported furniture from China worth US$124 million,

down 6% compared to the first nine months of 2016.

Huge reforestation initiative in ‘Arch of Destruction’

Conservation International (CI) along with the World

Bank, the Brazilian Ministry of Environment, the Brazilian

Biodiversity Fund, the Global Environment Fund and the

"Living Amazon" will begin a major planation effort in the

Amazon region known as the Arch of Destruction.

This area encompasses large parts of Rondônia, Pará,

Acre, Amazonas and the Xingu basin areas considered

most seriously affected by deforestation for cattle

ranching. It has been reported that around 70,000 hectares

will be planted.

8. PERU

Exploring new export

opportunities

Through a cooperative effort the Tambopata and

Tahuamanu Export Consortiums in the Madre de Dios

region and Tropical Forest Business EIRL, a consulting

firm, work has begun to seek international marketing

opportunities.

The aim is to improve the levels of competitiveness of

products manufactured in the Madre de Dios region and

identify potential markets.

In the first week of November the Tropical Forest team

completed an assessment of the Dominican market, an

important consumer of solid wood products, especially

precious wood of tropical origin such as that produced by

Peru.

Information on major Dominican timber importers and

their buying trends will be used to develop a marketing

plan. The initial survey suggests there is demand for

species such as cachimbo, ishpingo, congona, quillosisa

and interest in others such as sapotillo and misa. There is

also a growing demand for decking particularly in the

main tourist centres.

Strengthen skills of professionals in Iquitos

Around 30 forestry professionals will be selected to

participate in a second course "Supervision, Use and

Conservation of Forest Resources", organized by the

Forestry and Wildlife Resources Oversight Agency

(Osinfor), together with the National University of the

Amazon (UNAP).

The purpose is to strengthen the skills of professionals

through training and shared experience in the forestry

sector as well as to train professionals responsible for

monitoring forest resources and wildlife. Emphasis will be

placed on supervisory methodologies and the collection of

field information.

Plan for planting 10 million seedlings

Within the framework of the National Forestry Week, the

Ministry of Agriculture and Irrigation (Minagri) and

authorities in five regions (Apurímac, Ayacucho, Ica,

Huancavelica and Junín) launched their plan to plant 10

million seedlings from now until 2018.

Planting began the first half of November in the town of

José María Arguedas, Apurímac region where the

authorities and communities actively participated by

planting the first million seedlings in the five regions.

The species planted are mainly pine, teak and eucalyptus.