2. GHANA

Ghana joins satellite based forest monitoring project

The Forestry Commission will participate in a project to

monitor activities in the country’s forest so action can be

taken immediately to protect against illegal activities.

The project will develop new methods to detect changes in

the forest cover to provide for fast and accurate

identification of deforestation and degradation. This five

year project being funded by the UK Space Agency’s

(UKSA) International Partnership Programme and will be

conducted in Ghana as well as Brazil, Colombia,

Indonesia, Mexico and Kenya.

Trials will be undertaken in three forest types; forest

reserves, reforestation areas and coastal ecosystems.

Project Coordinator, Professor Ernest Foli, said the

system

can distinguish between tree crops and the natural forest

cover.

Business sentiment improving says industry

association

The Association of Ghana Industries (AGI) has released

its second quarter Business Barometer Index (BBI) report.

The BBI for the second quarter 2017 stood at 109.2, up

from the 103.8 in the first quarter. The BBI measures

business sentiment.

When meeting the press, the president of the AGI, James

Asare-Adjei, indicated that, at the beginning of the year

business confidence rose and had continued rising into the

second quarter with most businesses having high

expectations for the business environment this year.

However there are major challenges facing the private

sector such as the high cost of electricity, high interest

rates, access to credit, exchange rate movements as well as

tough competition from imports. Asare-Adjei urged the

government to address the cost of energy, the high interest

rates and the bureaucratic hurdles at the ports.

3.

SOUTH AFRICA

Rand forecast to weaken further

Analysts report little movement in demand for wood

products as confidence has slipped due to the political

turmoil. To the surprise of analyst, President Zuma

survived another vote of no confidence, his 8th, but this

time over 30 of his own party voted against him.

The South African rand weakened prior to the noconfidence

motion and continued to fall even though the

motion form the opposition was voted down. Analysts

warn that further falls in the rand are likely in the coming

months.

All eyes have now turned to the expected clash at the ANC

convention in November so prospects for a quick recovery

in the rand exchange rate look slim.

Sentiment in construction industry at 2008/9 crisis

level

There is still no sign of funds flowing into the government

infrastructure programme so millers and traders have to try

and survive while waiting. A report from Stellenbosch

University’s Bureau for Economic Research (BER) says

optimism in the construction sector has fallen to levels last

seen during the 2008/9 economic downturn.

Construction prices have risen this year which is good

news for companies but the BER says demand in the

second half of the year is expected to weaken. There are

already sign that this is likely as applications for building

plan approvals have started to fall.

The political and economic turmoil in the country has had

a profound impact on non-residential construction with

building plans falling over 60%.

For more see:

https://www.ber.ac.za/home/

The residential housing market is very quiet with little or

no activity in detached units. There are some apartment

blocks and town houses being built but the timber input

per square metre is lower in apartment blocks than in

detached units.

Market round-up

Demand for American hardwoods has seen some growth

but this is mainly due to the exchange rate with ash,

walnut, white oak and red oak being the main movers.

The panel market has been stable with some expansion in

demand for MDF. Plywood producers say stocks are

moving well enough. The decking market has been very

quiet this year as homeowners hold onto their savings.

Sales of meranti have improved slightly and the price

increases reflect the higher cost of import rather than

firmer demand.

The consumption of wood products from African shippers

is hampered by slow arrivals. There were some deliveries

of iroko recently and sales were brisk when they arrived.

Analysts report a shortage of kiaat in the domestic market

which has driven endusers to use alternatives.

4.

MALAYSIA

A focus on Africa to boost trade

Malaysia built up a RM9.88 billion trade surplus in June,

the 236th consecutive monthly surplus since November

1997 and the highest surplus since April 2016.

Bilateral trade between Malaysia and new markets in

Africa is expected to grow 3-4% this year as the

government is actively promoting Malaysian products in

the region. This comes after Malaysia-Africa bilateral

trade dropped 14% in 2016.

The main exports to Africa were of electrical products and

machinery, palm oil and refined petroleum products while

Africa’s top exports to Malaysia were agriculture

products, comprising cocoa bean, minerals, fruits and

natural rubber.

Export round-up – First 5 months

Malaysia’s wood product exports rose 6.8% to RM9.75

billion in the first five months of this year compared to the

same period a year ago.

The timber industry was one of the major contributors to

national export earnings recording between RM20 billion

and RM22 billion in revenue annually over the past 10

years. It is expected that growth in wood product exports

this year will be around 5%.

Furniture dominated export earnings in the first five

months of this year at RM3.28 billion followed by

plywood (RM1.96 billion) and sawnwood (RM1.6 billion).

In related news, the government intends to review the

National Timber Industry Policy (NATIP) to redirect the

course and strategic policies of the industry to fit into the

current situation. The review, to be conducted for the first

time since NATIP’s implementation in 2009, will involve

stakeholders, skilled manpower, innovation and

technology as well as sustainability.

Increase in protected forests in Sabah

The area of Class 1 Forest Reserves (i.e. Protection Forest)

in Sabah has been increased from 1,353,677 hectares to

1,386,614 hectares following amendment to the Forests

(Constitution of Forest Reserves and Amendment 2017)

by the State Legislative Assembly.

The total State Forest Reserves, after the reclassification,

is 3,540,748 hectares an increase of about 474 hectares

compared to 2016. Sabah is expanding a protected forest

near Mount Kinabalu to ensure the survival of a butterfly

species that can only be found in the area.

Following the re-classification and establishment of the

new forest reserves, the Totally Protected Area (TPA) in

Sabah increased 26% to 1,906,896 hectares compared to

only 1,874,061 hectares in 2016. There is confidence the

State government will be able to achieve its 30% TPAs

target by the year 2025 as planned.

As a result of the change, Class II Forest Reserves

(Commercial) have declined from 1,668,272.95 hectares to

1,659,899.95 hectares. Also reduced was Class III Forest

Reserves (Domestic) which went from 4,673 hectares to

4,656 hectares following the amendment.

The area of Class V Forest Reserves (Mangroves) went

from 256,0097 hectares to 232,039.29 hectares and the

Class VI Forest Reserves (Virgin Jungle Reserve or VJR)

declined from 107,013 hectares to 106,911 hectares.

Apply latest technologies for plantation development

A ‘Pest and Disease’ workshop was held in Kuching as the

State gears up to increase the rate of plantation

establishment. The main theme of the workshop was that

efforts need to be made to ensure pests and diseases,

which have caused many forest plantations to fail, are

avoided in Sarawak.

There were calls for greater investment in new

technologies, capacity-building and research and

development for early detection and control of threats.

This point was driven home by Professor Michael J.

Wingfield, a tree health expert and president of the

International Union of Forest Research Organisations

(IUFRO). He elaborated on the need to research tolerant

planting stock to ensure the success of investment in

plantations.

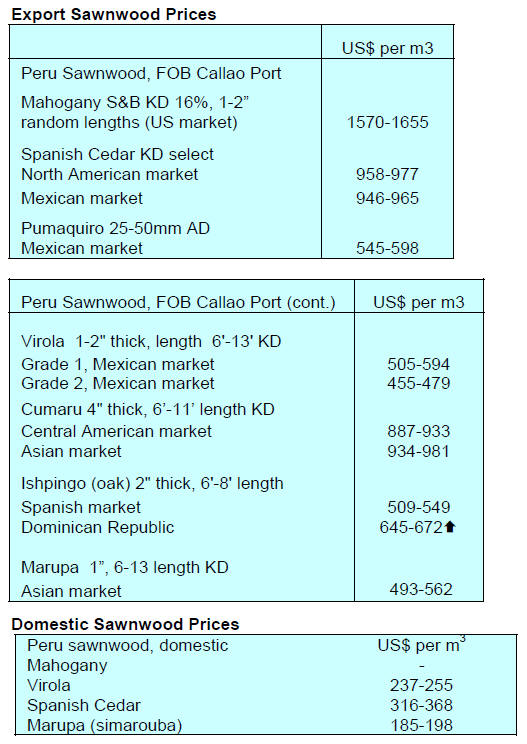

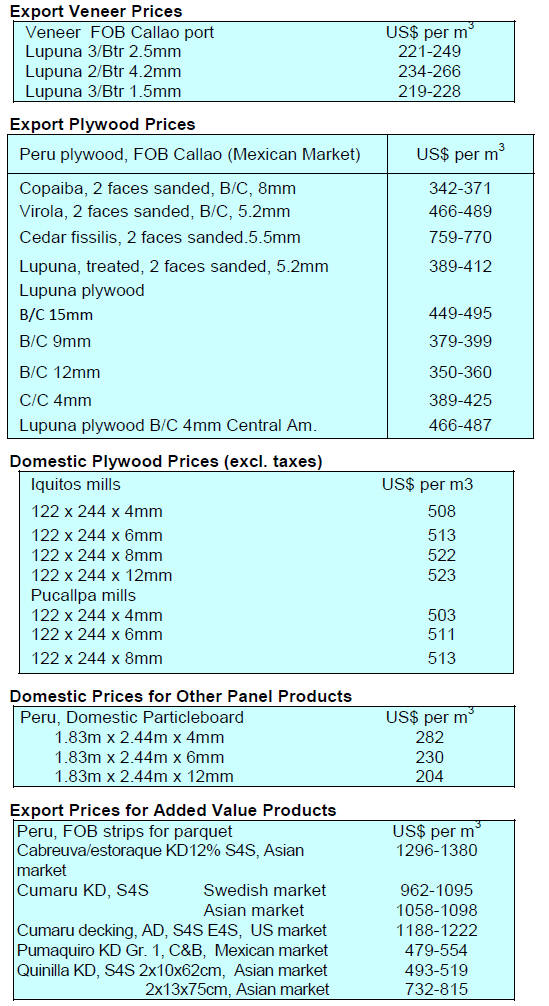

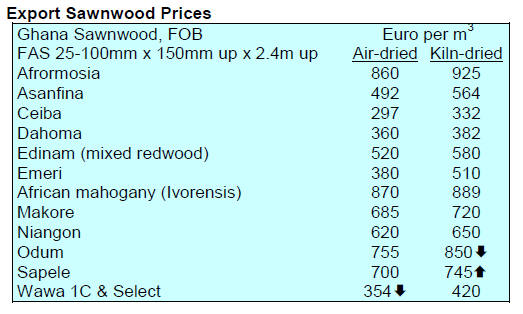

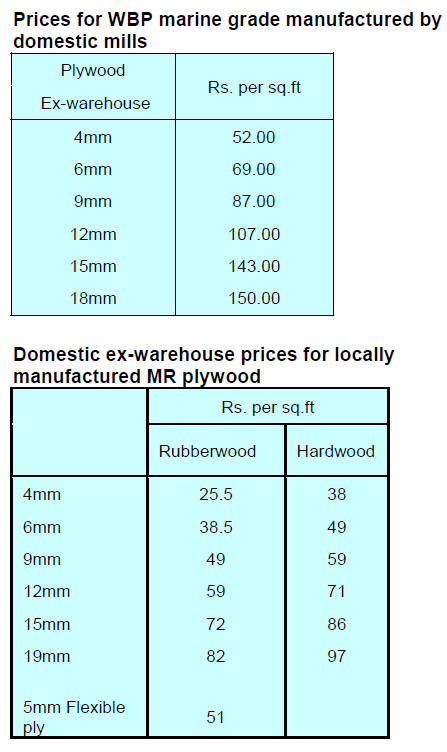

Plywood prices

Plywood traders based in Sarawak reported the following

export prices:

5. INDONESIA

Furniture makers moving out to Vietnam

From the beginning of this year several foreign owned

furniture companies have relocated from Indonesia to

Vietnam to take advantage of the more attractive business

environment.

Abdul Sobur, Deputy Chairman of the Indonesian

Furniture and Handicraft Industry Association said

Indonesia’s competitiveness is falling as production costs

rise and it is only natural that companies would seek the

most favourable locations. He estimated that around

20,000 jobs are at risk if all foreign furniture

manufacturers decide to leave Indonesia.

Vietnam's furniture exports were just over US$7 billion

last year, more than four times that of Indonesia's.

Developments in forest management should not put

jobs at risk

Calls have been made for the Ministry of Environment and

Forestry to be more creative in encouraging and fostering

businesses in the forestry sector that harvest timber

without harming the environmental integrity of the forest.

Viva Yoga Mauladi, Vice Chairman of Commission IV of

the Representative Council, House of Representatives

called for a balanced approach to conservation and

economic utilisation.

According to Viva, the Minister of Environment and

Forestry, Dr. Siti Nurbaya, should try to apply government

policies without undermining the business sector.

Issuance of permits for forest industry to be tightened

It is understood that the government plans to tighten

requirements for those applying for permits to establish

forest industries as a way to better protect natural

resources and preserve the environment.

The President has called on the Minister of Environment

and Forestry to follow procedures and carefully evaluate

the impact the proposed enterprise will have on the forest.

The President further pointed out that several protected

forests and national parks were facing the threat of

exploitation.

Developing environment-based economy, cooperation

with Finland

Dr. Siti Nurbaya, Minister of Environment and Forestry

recently met with the Ambassador of Finland, H.E. Paivi

Hiltunen-Toivio and Marjukka Mahonen, an adviser to the

Finnish Minister of Agriculture and Forestry of Finland.

The discussion focused on cooperation in the fields of bioeconomic

development at the forest management unit

level, efficiency and sustainability of utilisation,

bioenergy, sustainable forest management, sustainable

wood-based industries, ecotourism, pest and disease

control, forest fire protection and capacity building.

‘Light wood’ market developments

China has become the main market for Indonesia’s ‘light

wood’ products which include plywood, solid cores and

blockboard, taking around 3,500 containers per month.

Vice Chairman of the Indonesia Light Wood Association

(ILWA), Sumardji Sarsono, said the Chinese market is

currently absorbing about 95% of Indonesian exports of

these products with the balance going to mainly Japan and

South Korea.

Exports of ‘light wood’ products to the European and US

markets are small but could be increased if manufacturers

were more innovative in their production of light wood

products such as doors and furniture.

Re-denominate the Rupiah - dropping three zeros

The Indonesian media is reporting that Bank Indonesia has

been given the go-ahead to plan to redenominate the

rupiah which, says the Bank, will improve fiscal efficiency

and make commercial transactions simpler.

It has been reported that, while the value of the rupiah

would remain unchanged, the last three zeros on all rupiah

bills and coins would be eliminated. A draft Bill has to be

approved by the cabinet and then discussed in Indonesia's

House of Representatives. This may take place in late this

year.

6. MYANMAR

Correction

In our previous report we wrote: “Analysts report that the

Myanma Timber enterprise (MTE) may rent out its

workable heavy machinery and elephants to contractors.”

This was incorrect and we sincerely apologies to MTE.

The discussion on the arrangement between the private

sector and MTE continues below.

MTE clarifies private sector involvement in

logging

There has been heated debate on the news that the private

sector, through so-called service providers, may be

engaged where the capacity of the MTE is insufficient to

meet harvest targets.

The Myanmar Times newspaper has carried a reaction to

this from the Environmental Investigation Agency (EIA).

See:

http://www.mmtimes.com/index.php/business/27226-eiaaccuses-

mte-of-stepping-back-from-reform-commitments.html

In a Facebook response, MTE Deputy General

Manager, U Khin Maung Kyi, writes “MTE will use their

own facility, but in the event of the inadequate facility in

the five area of work; felling, skidding, (temporary) road

construction, truck logging and loading/unloading logs

MTE can use the services of regional people, who have the

related experiences, by paying for their service.

There will no involvement at all of the previous private

logging companies under the product-sharing sale system.

MTE is just capable to harvest 230,000 tons of logs mainly

because their heavy vehicles are about 30 years old and

(only) 1,300 of 3,000 elephants are fit enough for logging.

MTE is bearing the amount of 50 billion Kyats for the

current and retired 30,000 staffs. In order to keep the

operation ratio MTE is required to harvest 15,000 tons of

teak and 350,000 tons of hardwoods.”

According to a retired MTE General Manager, in the past

MTE used to hire elephants when the capacity the MTEowned

elephants was insufficient and the MTE would also

use local transport companies to save costs.

Tax on sawnwood clarified

The Ministry of Finance and Revenue has intervened in

the conflict between exporters and regional Internal

Taxation Departments over the tax on sawnwood. The

Yangon Division Internal Revenue Department previously

stated that a 10% Special Commodity Tax will be levied

on all wood products.

It now appears that the 10% tax will apply to sawnwood

with a cross sectional area of 12 square inches or more but

sawnwood of a smaller cross section and all other semifinished

products will be exempted.

Timber export values on the rise

According to statistics from the Ministry of Commerce,

wood product exports have started to rise after the decline

following the export ban introduced in 2014. Wood

product export values reached US$948 million in the 12

months to 31 March 2014 as producers cleared log stocks

in advance of the ban.

Exports of wood products were valued at US$212 million

in fiscal 2015-16 and US$247 million in fiscal 2016-17

and this was despite the tough trading environment in the

EU.

Last minute suggestions on Forest Law

Just prior to the government debate on the new forestry

law civil society groups proposed 4 amendments, 33

addenda and 21 suggestion to the Resources and the

Natural Conservation Committees of two houses of the

parliament.

The proposals from the civil society groups are related to

peoples’ rights, the role of communities, forest

governance, law enforcement and management, amongst

others.

7. INDIA

Strong rupee a boon for importers but all

struggle with

GST compliance

While importers cheer the stronger rupee other business

sectors are reeling from the effects of demonetisation and

from the introduction of the standardized Goods and

Services Tax (GST).

The rupee hit a two-year high in the first week of August

and it is expected to strengthen further as foreign financial

inflows accelerate in response to the weakening dollar. So

far this year, the Indian currency has gained almost 7%

against the dollar making it the best-performing currency

this year.

The stronger rupee is not yet a concern of the Reserve

Bank of India (RBI) which has said it does not expect to

intervene except to curb excessive volatility.

Interest rate cut in face of lower consumer prices

The Reserve Bank of India (RBI) lowered its benchmark

interest rate to a six-and-a-half-year low of 6% in early

August, down from 6.25% after consumer prices fell more

than expected and there was an overall slowdown in

economic growth. India’s gross domestic product grew

just 6.1 per cent in the January to March quarter, the

slowest since late 2014 and analysts blame the currency

swap issue and the GST which is proving tough for

companies to adapt to.

In its latest report on the economy the RBI said

“weakening industrial performance points to continuing

retrenchment of capital formation in the economy”.

Regulating the real estate sector

The reputation of India's real estate sector has been

undermined by frequent delays in projects and persistent

reports of poor quality.

Now a Real Estate (Regulation and Development) Act,

2016 (RERA) will provide the means to regulate India’s

real estate sector. The act was approved last year and the

Union Ministry of Housing and Urban Poverty Alleviation

had until May this year to formulate rules for the

functioning of the regulator. According to local analysts

RERA will greatly improve in transparency in the sector

and help protect the interest of the homebuyers.

Each State and Union territory will have its own regulator

whose means of operation has been defined by the central

government. Analysts report that while some states are

behind schedule many will soon have a functioning

regulatory system.

For more see: http://indianexpress.com/article/what-is/what-isrera-

and-how-will-it-help-homebuyers-4635705/

CREDAI invites investors

The Confederation of Real Estate Developers'

Associations of India (CREDAI) has appointed CBRE

South Asia Pvt. Ltd. its strategic partner for the 17th

annual international convention NATCON for 10th to 12th

August 2017 at the Park Plaza, Westminster Bridge,

London.

A press release from CREDAI says the convention is

expected to attract top developers and investors from

around the world. Key sessions of the three-day

convention include – “significance of private equity and

banks vis-à-vis the interest of projects”, “strategies to

garner institutional funding for real estate”, “emerging

trends in real estate”, “social media: a boon or a bane” and

“the best practices for navigating through the legal real

estate minefield.”

Additionally, there will be discussions on various other

issues such as the onslaught of digital media, business

success stories in customer services and the archetypal

model of technology as a disruptor in the industry.

See:

https://credai.org/press-releases/credai-appointscbreas-itsknowledge-

partner-for-the-prestigiousnatcon-2017

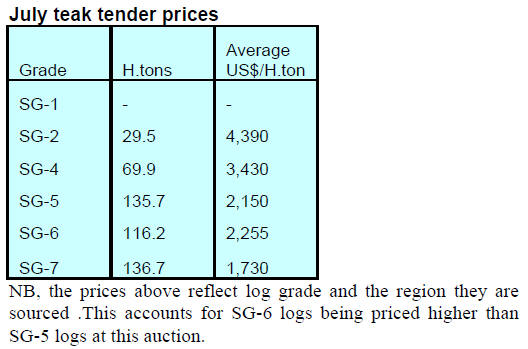

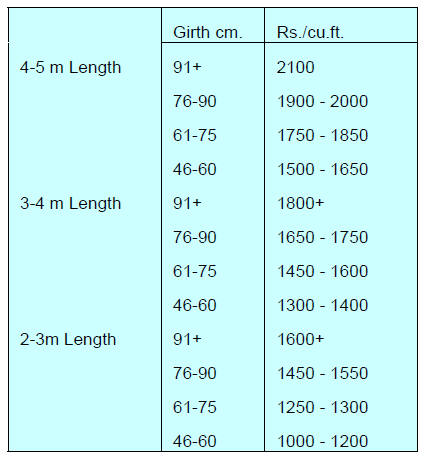

Central India teak auction results

In Madhya Pradesh teak logs are mainly 2 to 5 metre in

length and mostly in girth class 120 cms and below but

logs from this area are of good form being cylindrical and

the wood has a desirable golden colour with black stripes.

Buyers at the recent auctions were mainly from local mills

and merchants from Gujarat, Maharashtra, Rajasthan and

South India.

Auctions at almost all the forestry depots in Harda,

Jabalpur, Hoshangabad and Betul divisions are now over

and more than 8,000 cu.m of teak logs and around 5,000

cu.m of non-teak hardwoods were sold. Further auctions

will be held when the monsoon season is over.

Good quality non-teak hardwood logs attracted higher

prices than at the previous auction. Logs of 3 to 4 m. with

girths of 91 cms & up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora),

bhirra (Chloroxylon swietenia) and Pterocarpus

marsupium, were sold at between Rs.700 to 750 per. C.ft.

Second quality logs were sold at between Rs.350 to 500

per. c.ft and the lowest quality logs went for between

Rs.200 to 300 per c.ft.

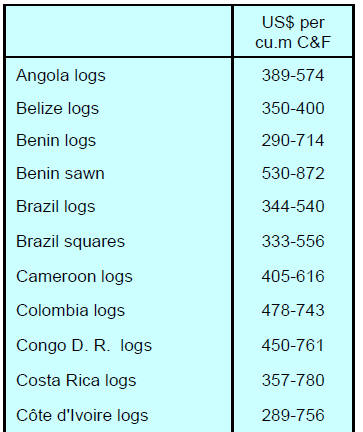

Plantation teak log prices C&F Indian ports

Traders report demand for imported plantation teak logs as

steady and prices remain unchanged for the moment.

Because of the introduction of the GST importers are

saddled with higher transaction costs.

Having to pay almost 24% by way of basic duty, plus GST

(18%) and surcharges and this is stretching the finances of

importers. As the rupee strengthens and because of high

transaction costs importers may open price negotiations

with shippers.

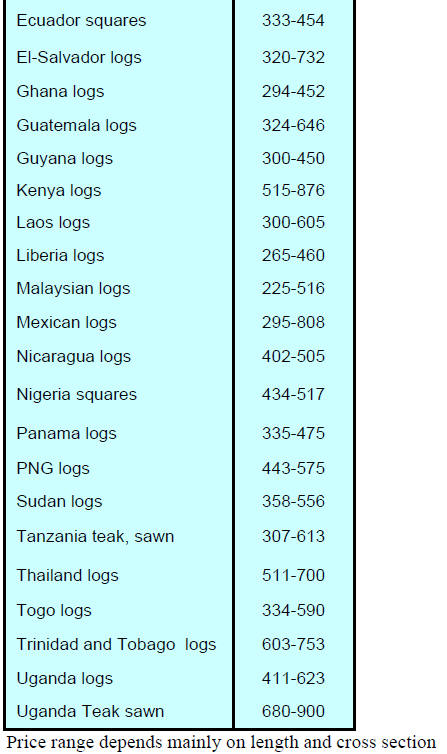

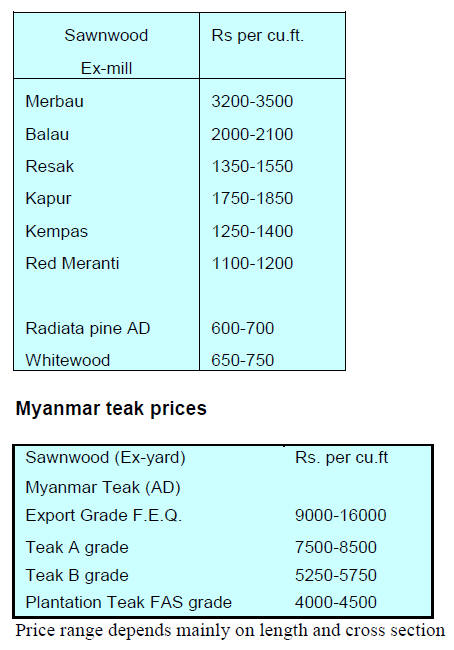

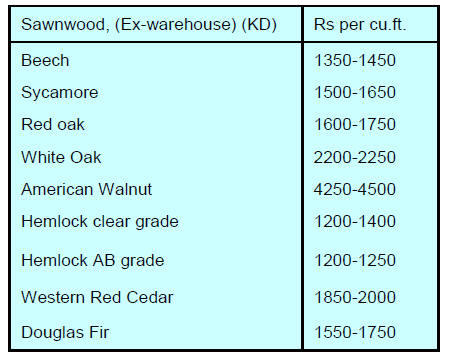

Locally sawn hardwood prices

Prices for hardwoods milled from imported logs are

unchanged.

There were no reports of price movements over the

past

two weeks. Availability of sawnwood in Myanmar is

reported as good but sales in the Indian market have

slowed as sellers are attempting to pass on to endusers the

full GST.

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

Plywood prices

After adjusting prices for the GST, excise duty etc. some

manufacturers have issued new price guides. The panel

sector continues with its strong representations to

government for a review of the 28% GST on panel

products. The aim is to have this lowered to at least 18%.

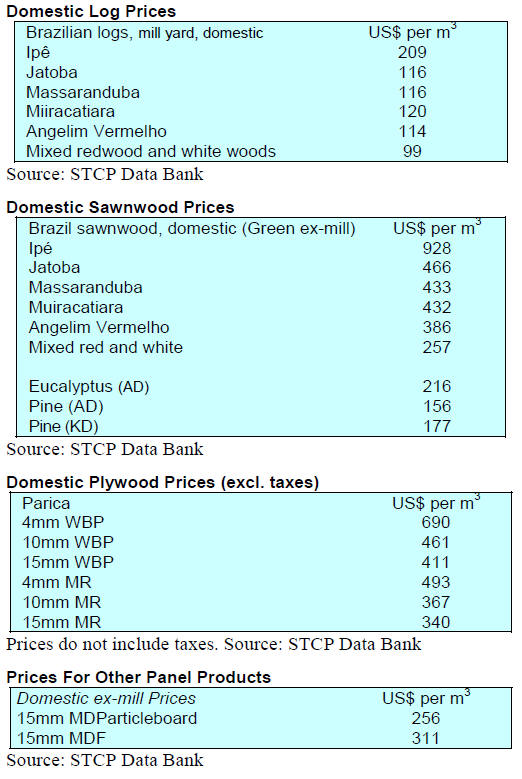

8. BRAZIL

Seeking improvements in tropical wood

processing

Utilising funds from the Amazon Fund a partnership

between the Federal University of Paraná (UFPR), the

Federal University of Amazonas (UFAM) and the

Brazilian Development Bank (BNDES) have mounted an

effort to raise efficiency in the tropical wood processing

sector.

This ‘Proindus Project’ aims to identify technological

solutions to lift efficiency in the production of high value

wood products. The project will establish a network for

rural communities in Manaus, Amazonas State.

The project will promote new technologies for added

value products and transfer these technologies to rural

communities in the Project area. The project will offer

training and capacity building from production to

marketing. The project aims to contribute to the economic

development and social inclusion of rural communities in

the region.

Productivity of sawnwood industry rises

The sawmilling industry in Brazil accounts for the highest

number of companies in the wood based industry sector

and production capacity per enterprise ranges from the

large sawmills with an installed capacity of around

250,000 cubic metres output per year to small mills which

produce less than 5,000 cu.m of sawnwood per year.

There was a sharp slowdown in national sawnwood

production in 2006, well-above the declines seen in other

sectors. Most of the decline in output was due to falls in

production from Amazon based mills.

In the period 2004-2005 there was a peak in sawnwood

exports due to firm demand in international markets and

the favourable exchange rate.

The latest data is indicating that productivity in the

sawmilling sector (as measured by production vs. worker

nubers) has increased gradually since 2015 which

indicates those companies still operating are more

competitive through optimising their production capacity.

It has been estimated that by the end of 2017 Brazil’s

production of sawnwood could be 3% higher than in 2015.

Although modest, this represents marked change for a

sector that has lagged behind in terms of raising

productivity and competitiveness.

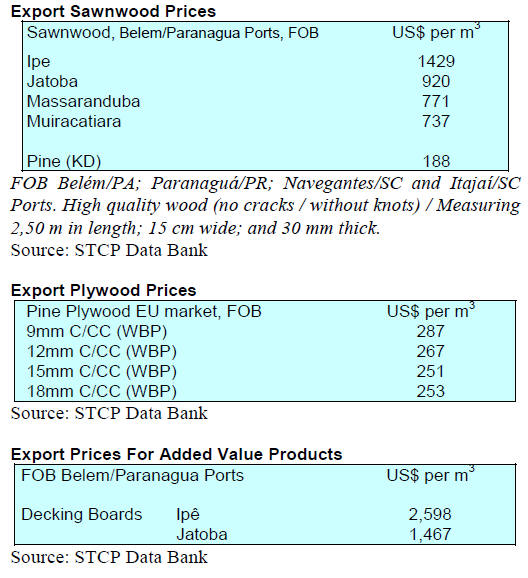

Logs and primary products top Brazilian timber

exports

In the first six months of 2017, logs and primary products

accounted for most of Brazil’s timber exports and the

tonnage exported was some 38% higher than in the same

period last year, according to the Ministry of

Development, Industry and Foreign Trade (MDIC).

The United States is the largest single buyer of pine

plywood produced in Brazil accounting for 34% of exports

of this product followed by Europe (30%).

The US is also the main market for wooden doors

manufactured in Brazil, accounting for over 70% of all

wooden door exports.

The largest buyer of tropical plywood produced in Brazil

is Argentina (45%) followed by the US (10%), Mexico

(8%) and France (7%). As for pine veneer, South Korea, at

42% of all veneer exports, is the major buyer followed by

Malaysia at 30%.

The Brazilian timber industry is benefitting from steady

growth in US economy. However, recent export data

published by the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI) shows that, while

export volumes are rising on the back of firmer demand,

prices are not.

Changes in export destinations appear to be having an

influence on the phenomenon of higher volumes but flat

prices.

Pine plywood exports totalled 934,682 cu.m in the first

half of this year against 835,841 cu.m in the same period

last year but companies have been unable to secure better

prices.

Last year pine sawnwood was exported mainly to the US,

China and Saudi Arabia but this year Mexico became the

second ranked market destination taking 22% of all

sawnwood exports.

9.

PERU

Campaign to register forest plantations

On 12 August a campaign for registration of national

forest plantations was launched by the National Forestry

and Wildlife Service (SERFOR) and the Regional

Government of San Martín.

The Executive Director of SERFOR, John Leigh, reported

that through the registration of forest and agroforestry

plantations, producers will be provided with a registration

certificate by the Regional Environmental Authority

(ARA) identifying the area established and the owner.

Across the country there are around 40,000 hectares of

registered plantations and in San Martín there are around

2,000 ha. of unregistered plantations. Five trained forest

officers will visit areas in Lamas, Mariscal Cáceres, El

Dorado, Moyobamba and Bellavista in order to register,

guide and provide information to owners.

According to official statistics, between 2000 and 2015,

1.8 million hectares of forest was deforested in the country

of which 382,000 ha. was in San Martin. To address this

SERFOR has developed a national forest recovery

programme and the promotion of plantations.

According to Law No. 29763 of the Forestry and Wildlife

Law any plantation, whether for production, protection or

recovery must be registered in the National Register of

Forest Plantations.

Exports fall in May

According to the Association of Exporters (ADEX), in

May 2017 Peruvian timber exports totalled US$47.8

million (FOB) an almost 8% drop compared to May 2016.

Of the total export value in May, China continued as the

main export destination with May 2017 exports climbing

almost 11% compared to May last year.

China accounts for around half of all Peru’s wood product

exports. Mexico ranks second at 11% participation but

May 2017 exports were down 13% month on month. The

US is the third largest market (10%) but here exports

dropped a massive 45%. Sawnwood exports during May

2017 were worth US$7.9 million down 23% compared to

May last year.

The main export market for Peru’s sawnwood in May was

the Dominican Republic, accounting for a 39% share of all

May sawnwood exports. Second is China with a 25%

share. In May there was a sharp decline in the value of

sawnwood exports to the US (-52%) and a similar pattern

was seen with exports to South Korea (-43%).

Serfor and Customs strengthen cooperation

To strengthen efforts to eliminate the illegal trade in forest

and wildlife species in the Piura region SERFOR will

assign specilaists to the Operational Control Division of

the Paita Customs Department.

Specialists from the Technical Forestry and Wildlife

Administration (ATFFS) Piura, a regional office of

SERFOR, explained that endangered species are protected

by Law No. 29762, the Forest Law and Wildlife and

efforts have been stepped up to stop the commercialization

of such species through fines and prison sentences as set

out in the forestry Law.