Japan

Wood Products Prices

Dollar Exchange Rates of 25th

July 2017

Japan Yen 111.9

Reports From Japan

Labour productivity lower than other major

developed

economies

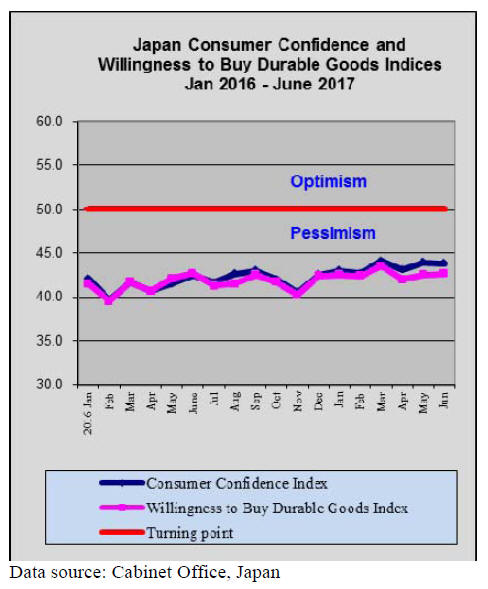

The Cabinet Office monthly economic report for July

states that the Japanese economy remains in a "moderate

recovery," mode with both consumption and capital

investment expanding.

However, last month the report said producer prices were

rising moderately but the July edition said this pace of

increase has eased.

Two issues are behind this change in language the slowing

in oil prices and suggestions that growth in global

consumption has weakened and that this will be

exacerbated by the impact in the EU of Brexit and the

knock on effect on imports.

According to a review by the government on the economy

and finances for fiscal 2017, to achieve sustained growth

Japan needs to address its severe labour shortage as well

as productivity which is lower than in other major

developed economies.

See:

https://japantoday.com/category/business/labor-shortage-poseschallenge-

to-japan%27s-economic-growth-report

and

http://www5.cao.go.jp/keizaishimon/

kaigi/cabinet/2017/2017_basicpolicies_en.pdf

Bank of Japan stands out alone

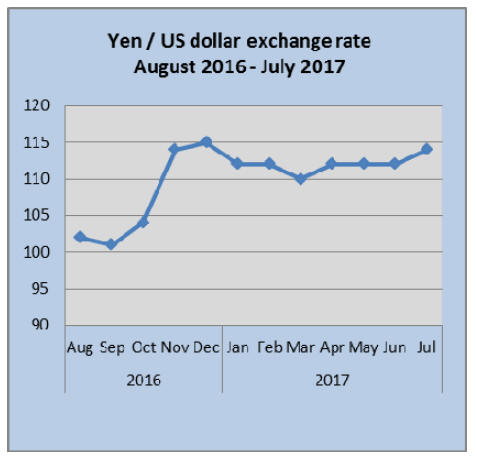

Despite moves by most other central banks to raise interest

rates, the Bank of Japan (BoJ) looks set to maintain its

zero interest rate for as long as possible.

At its latest meeting the BoJ reaffirmed commitment

to its

unconventional monetary policy pledging to continue its

monetary easing. In mid-July the yen was at its lowest

level against the US dollar in four months close to lows at

levels not seen since the end of last year.

Japan¡¯s wooden furniture imports

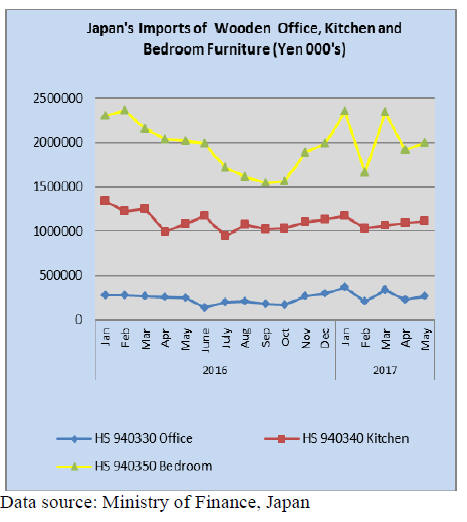

For the first time in several months the value of Japan¡¯s

furniture imports exhibit a level of consistency. Wooden

bedroom furniture imports in May expanded 17% and

imports of office and kitchen furniture rose slightly.

While kitchen furniture imports have been rising steadily,

imports of office and bedroom furniture have been more

erratic. Looking back several years the impact of the lunar

holiday period in both China and Vietnam, both major

furniture suppliers to Japan, is very apparent with

shipments around this period dropping significantly.

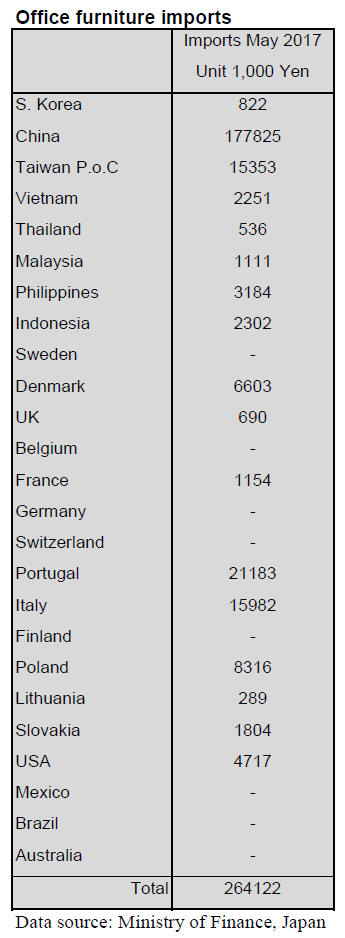

Office furniture imports (HS 940330)

Year on year May imports of wooden office furniture were

up 8% and month on month imports rose 17%. China,

Portugal and Italy dominate Japan¡¯s wooden office

furniture imports accounting for over 80% of May

imports.

In May this year imports from China fell slightly but still

accounted for 67% of all wooden office furniture imports.

Imports from Portugal and Italy are small compared to

those from China (around 8% each).

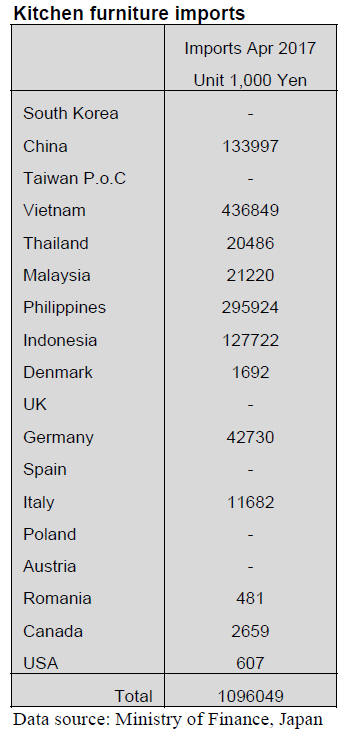

Kitchen furniture imports (HS 940340)

The top three shippers of kitchen furniture to Japan,

Vietnam, the Philippines and China accounted for 82% of

May imports of this category of furniture.

Manufactures in Vietnam, many of which are joint

ventures with Japanese companies have established itself

as the main suppliers of wooden kitchen furniture to the

Japanese market.

Year on year, imports of wooden kitchen furniture

rose

only marginally in May and a similar pattern was seen

with month on month imports. Shippers in Vietnam

accounted for just over 40% of Japan¡¯s May wooden

kitchen furniture imports followed by the Philippines

(29%) and China (11%).

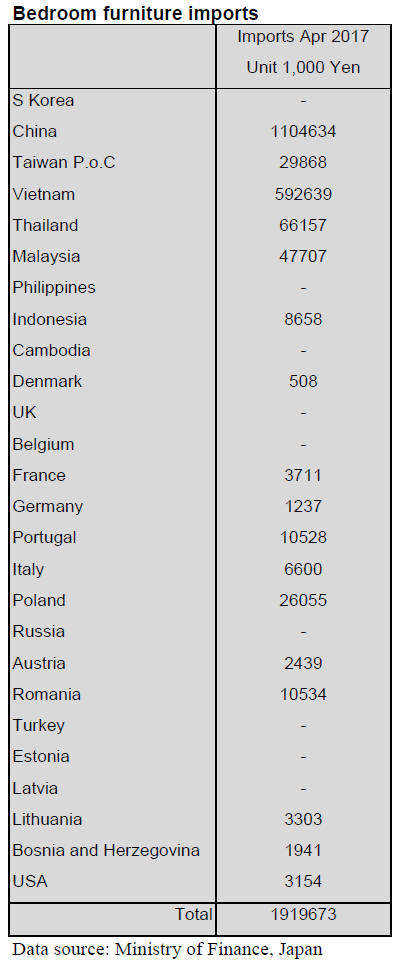

Bedroom furniture imports (HS 940350)

The volatility in the value of Japan¡¯s imports of wooden

bedroom furniture reflects to drop in trade from both

China and Vietnam in the early part of the year when the

Lunar holidays take place. If average imports for the first

five months of 2016 and 2017 are compared it can be seen

there was little change in the overall value. 2017 imports

just edged out those for 2016.

In May the three main shippers, China, Vietnam and

Thailand accounted for around 90% of Japan¡¯s imports of

wooden bedroom furniture. Imports from China were flat

compared to a month earlier but imports from Vietnam

and Thailand rose (8% and 11% respectively).

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Problem of South Sea log supply ¨C a look at the log

trade

Malaysia¡¯s Sarawak provincial government decided to

impose timber premium since July 1, which is one of log

harvest duties. Cost of logs of both hill logs and swamp

logs is up by about US$12 per cbm. Export log suppliers

and local plywood mills are proposing higher prices with

this new duty.

Looking at history of South Sea log trade, hardwood logs

were used for plywood manufacturing in Japan since

1960s and imported volume in 1973 reached 2,700,000

cbms. Japan used lauan logs from Philippines first then

after Philippine¡¯s resource dried up, Japan move to

Indonesia to import meranti then to Malaysia to use

serayah.

Japan had been looking for quality hardwood logs for all

these years but now the import volume dropped down to

200,000 cbms a year but plywood import has been

continuing at high level, which takes about 50% of

plywood demand in Japan. In 2016, total plywood import

was 2,77,000 cbms out of which Malaysian supply was

1,075,000 cbms and Indonesian was 90,000 cbms.

Mainly Malaysian plywood is used for concrete forming

and Indonesian plywood is used for floor base in Japan. So

for Japan, plywood supply from Malaysia is bigger issue

than log import.

In the past, when the new regulation such as timber

premium enters into force, normally there had been some

grace period of six months to one year but this time,

timber premium duty is imposed immediately since July1.

Log exporters and local plywood mills would buy logs

ahead of time before the new duty is imposed but there

have been various restrictions for log harvest such as

monthly harvest quota and diameter restriction, which

prohibits harvest of logs with less than 50 cm in diameter

at breast high so rush-in log purchase was impossible.

After all, decline of resources is the biggest problem

together with chronic labor shortage and harvest

restrictions by the government.

As to log import from Malaysia, India is now dominant

buyer so Japan has no control on export log prices. Then

looking at steady export price increase of Malaysian and

Indonesian plywood, Japanese industries have been

gradually shifting necessary materials from imports to

domestic supply.

Actually Japanese plywood mills have been manufacturing

concrete forming and floor base plywood with domestic

cedar.

Temperate hardwood demand rising

Orders on temperate hardwood products from North

America are increasing particularly for interior use like

flooring of large buildings. This is not seasonal demand

pickup but by construction of hotels for 2020 Tokyo

Olympic Games. Also public halls like music halls

traditionally refurbish during summer.

Ordered items are white ash, oak and walnut. Sawmills say

that there are more orders for flooring but they are not for

new building but refurbishing demand. Supply from North

America is scarce but there is more supply from Eastern

Europe, which is now source. Chinese demand for

furniture and interior materials continues steady. The

prices of hardwood products are unchanged. Red oak

lumber prices are about 129,000 yen.

Action plan to expand wood products exports

Wood products export strategy committee of the Ministry

of Agriculture, Forestry and Fisheries came up with the

action plan to expand wood products export.

In May 2016, by strategy to increase export of agricultural

products, the policy has changed from log export to value

added lumber export to China, Taiwan and Korea. This

time, Vietnam is newly added as new market. Then it sets

target volume to each country.

The Ministry¡¯s target is to expand total value of export of

agricultural and marine products from about 450 billion

yen in 2016 to 1,000 billion yen in 2020. In this, forest

products export value in 2012 was 12 billion yen then 25

billion yen in 2020 but it was 27 billion yen in 2015 so it

has exceeded the target already. To achieve target of 1,000

billion yen, further expansion of forest products export is

required.

Cedar export has been mainly low grade, low price logs

for China. To promote export of value added lumber, it is

necessary to improve degree of recognition of Japanese

cedar and find out needs of the markets.

It is necessary to develop new products to particular

markets of building and interior materials by using high

manufacturing technology of Japanese mills, which needs

to deal with the Chinese Building Standards then promote

propaganda with permanent exhibition halls.

In sales promotion, building of model house, finding local

partners, local builders and tie-up with local forest unions

to build up log distribution system in foreign markets.

Branding of Japanese cypress with characteristic of the

species and health effect is another campaign target. Korea

likes Japanese cypress with health effect by activating

physiological function of the species so it is mainly used

for interior materials and furniture .So far, log export is

main for cypress so cypress lumber export is the challenge

and finds a new market besides Korea.

New propaganda has started in other markets and China

seems to be promising market for cypress for interior and

furniture use.

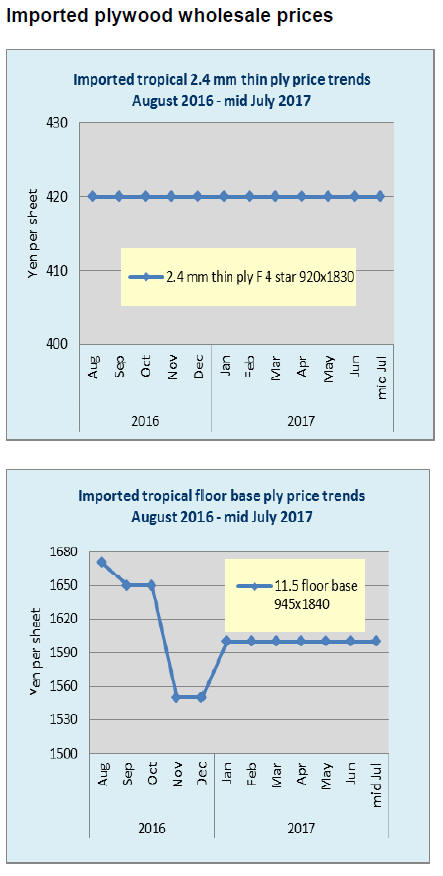

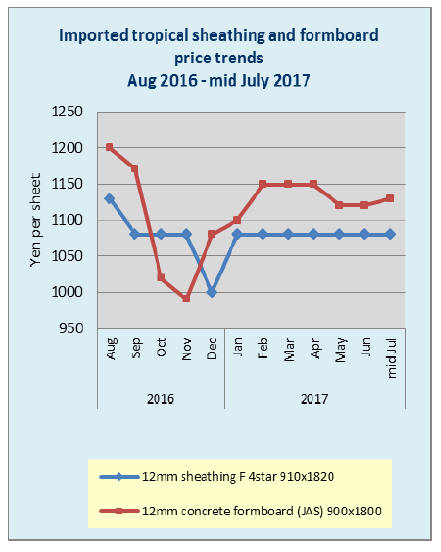

Plywood

Supply tightness of domestic softwood plywood has been

solved in majority of areas in Japan and there

were some low prices were offered in June but orders from

major precutting plants have started increasing in July so

the market prices are firm again.

May softwood plywood production was 242,800 cbms,

8.3% more than May last year and 3.7% less than April

with the shipment of 240,000 cbms, 3.0% more and 4.6%

less. The inventories were 91,300 cbms, 2,500 cbms

increase from April, only 38% of monthly shipment.

The market prices of imported plywood have been

gradually moving up by sharp increase of suppliers¡¯ export

prices despite dull movement.

Dealers and contractors started procuring with outlook of

price increase in future. May imported plywood volume

was 257,600 cbms, 11.0 % more and 10.0% more. The

importers try to buy futures with declining port inventories

but the market prices in Japan have always been behind

suppliers¡¯ proposed prices so they hesitate to commit.

The suppliers continue suffering log supply shortage so

the shipments are behind schedule of more than a month

so there is a chance that the inventories in Japan may drop

sharply.

|