2. GHANA

Expanding value added wood processing

The World Trade Organization recently organised a

workshop in Accra to discuss how best to add value to raw

materials before their export. This workshop attracted

participants for both the public and private sectors.

This WTO initiative forms part of its focus on "Challenges

in the multilateral trading system: perspective from West

Africa". The programme aims to help countries that seek

speedier industrialisation and need assistance on global

investments and trade.

The new government in Ghana is committed to greater

industrialisation and added value manufacturing to reduce

its reliance on commodity markets.

In Ghana, processed wood products accounts for a

major

share of all timber exports but sawnwood is classified as

‘processed’ but has little added value. The intention of the

government is to see companies invest in more

downstream processing.

A reduction in import duties debated

The Ghana government has hinted of plans to drastically

reduce import duties in an effort to minimise duty

avoidance which the authorities suspect is significant.

According to a government spokesperson, the reduction in

duties would also enable the ports to become more

efficient in clearing cargos.

Anthony Dzadzra, Director of Revenue, Policy Division at

the Ministry of Finance, mentioned this idea during an

informal meeting of the American Chamber of Commerce,

USAID and the Ministry of Trade which focused on a new

study of the impact of trade-related fees and charges on

trade and revenue growth.

U.S Ambassador Robert P. Jackson encouraged Ghana to

take advantage of the Trade Facilitation Agreement (TFA)

to simplify customs and other border control procedures at

the country’s ports. He added, this will reduce the cost and

time of doing business across borders, increase economic

growth and make Ghanaian goods more competitive in

global markets.

The WTO Trade Facilitation Agreement was conceived as

traders from both developing and developed countries

have long pointed to the vast amount of “red tape” that

still exists in moving goods across borders and which pose

a particular burden on small and medium-sized

enterprises. To address this, WTO Members concluded

negotiations on a landmark Trade Facilitation Agreement

(TFA) in 2013.

For more see: http://www.tfafacility.org/trade-facilitationagreement-

facility

The Organization for Economic Cooperation and

Development estimates that implementing the TFA could

reduce worldwide trade costs significantly with the

greatest benefits accruing to African and other developing

countries. Ghana has the potential to benefit significantly

from this new opportunity.

The reduction of import duty was part of the campaign

promises made by the new government during campaign

elections last year. Early this year Ghana sought the

approval of ECOWAS Regional Common External Tariffs

(CET) which came into effect on 1February 2016, to

review taxes downward to promote industrialization.

3.

SOUTH AFRICA

Efforts to coordinate recovery efforts in

Cape area

Forestry and sawmilling executives in the fire-ravaged

Southern and Eastern Cape areas, representatives of

Forestry South Africa (FSA) and Sawmilling South Africa

(SSA) have met to coordinate collaboration as efforts on

recovery begin. One of the first tasks is to assist affected

industries and develop plans to mitigate losses through

salvaging as much timber and wood products as possible.

The recent fires cause widespread devastation. There has

been extensive damage to plantations and one complete

sawmill was burnt to the ground. The scale of the disaster

is the one worst that the industry has experienced.

In terms of employment, there may be a short-term

increase in job opportunities during the salvage operations

and reforestation operations. However, in the medium to

longer term and until the plantation rotations get back to

normal some jobs may be lost.

The FSA, SSA as well as the South African Forestry

Contractors Association plan to ensure that the interests of

local businesses and jobs are protected. The South African

Wood Preservers Association (SAWPA) will carry out

research around the ‘treatability’ of burned poles.

http://saforestryonline.co.za/news/industry-rallies-recovercape-

fire-storm/

Outlook grim for consumers

Consumer confidence in South Africa slipped further

extending one of the longest periods of negative sentiment.

The Bureau for Economic Research at Stellenbosch

University conducts quarterly assessments on consumer

sentiment and has said the current run of negative

sentiment is the longest since the survey was launched in

1982.

In related news, the International Monetary Fund has

warned the South African economy will become

increasingly at risk to major shocks unless economic

growth is revived. The IMF says South Africa’s economic

growth is projected to increase to 1% this year and just

1.2% in 2018.

Jason Muscant, Senior Analyst at the First National Bank

Bureau for Economic Research, said the latest data show

that consumers continue to be under pressure especially as

food prices remain high which signals a drop in disposable

income.

4.

MALAYSIA

Ban on sawn rubberwood export

Malaysia has once again introduced a ban on the export of

sawn rubberwood. The current ban came into effect 1 July.

Over the past 20 years the government has periodically

imposed and lifted bans on sawn rubberwood exports. The

latest ban comes after Peninsular Malaysia furniture

makers found it increasingly difficult to secure sawnwood

for downstream processing. The ban comes as a relief to

the furniture makers as the cost of sawn rubberwood has

been rising steadily.

Last year, Malaysia’s furniture exports totalled to RM9.53

billion, 4.2 per cent more than 2015’s RM9.14 billion,

making the country, the world’s 9th largest furniture

exporter.

Rubberwood furniture makers had a strong case when

lobbying for the ban saying Malaysia had slpiped from 6th

to 9th in the global ranking of furniture exporters.

The argument used by exporters of sawn rubberwood

hinged on their success in attracting high prices from

buyers in Vietnam and China. In 2016 Malaysian

sawmillers exported sawn rubberwood valued at around

RM300 million.

Speaking recently Minister Dr Wee Ka Siong added

the

ban will provide relief for the industry as recently the cost

of the raw material had shot up to RM2,300 per tonne

compared with RM1,600 previously. With the ban on

export of local rubberwood put in place, furniture industry

players are now working hard to win back the confidence

of their overseas clients.

Drones rapid response to locate forest fires

Drones have been proven effective in trials in Miri and

Kuala Baram districts of Sarawak to quickly assess the

location and extent of forest fires. Rapid response arial

surveillance using drones will be effective in locating the

exact locations of any forest fires.

Last year, more than 1,700ha of land in the two districts

were ravaged by fires and there is a danger of more fires

this year. In past experience, all it takes is five days

without rain and a forest fire could be sparked easily.

Hidden wealth in Sarawak

The Sarawak State government will establish a research

council to coordinate efforts to explore the ‘hidden wealth

in the state’s natural resources’. According to Chief

Minister, Abang Johari Tun Openg, there is hidden wealth

in the Sarawak forest resources that can be exploited.

The research council would be empowered with regulatory

powers over research with the ultimate aim of benefitting

the state’s economy.

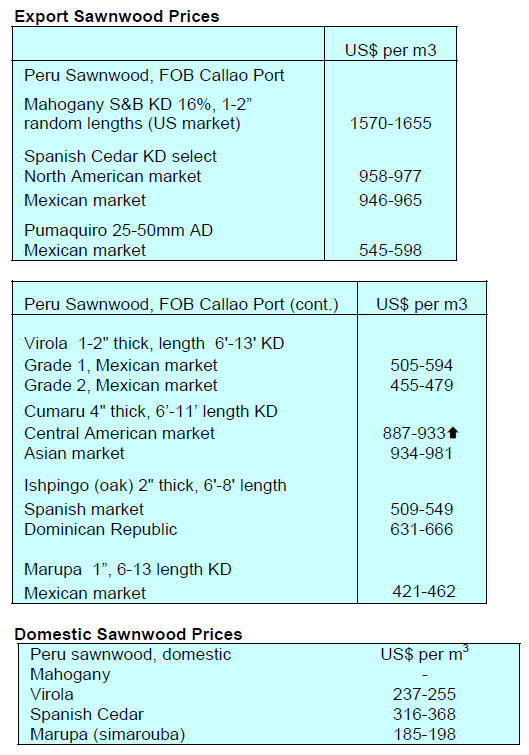

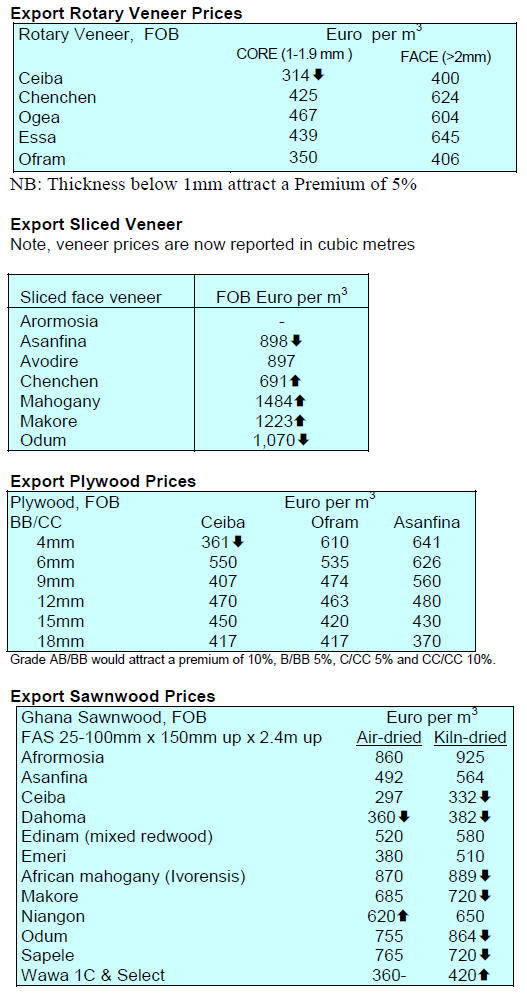

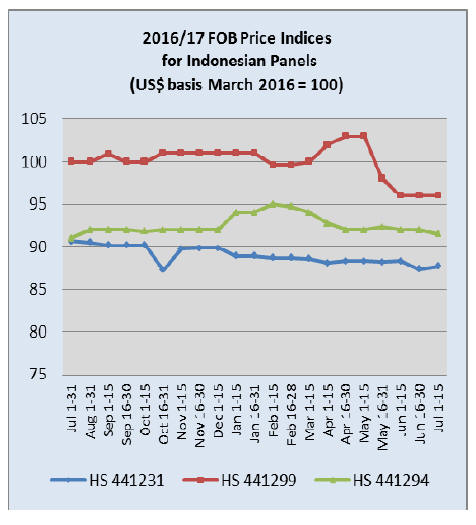

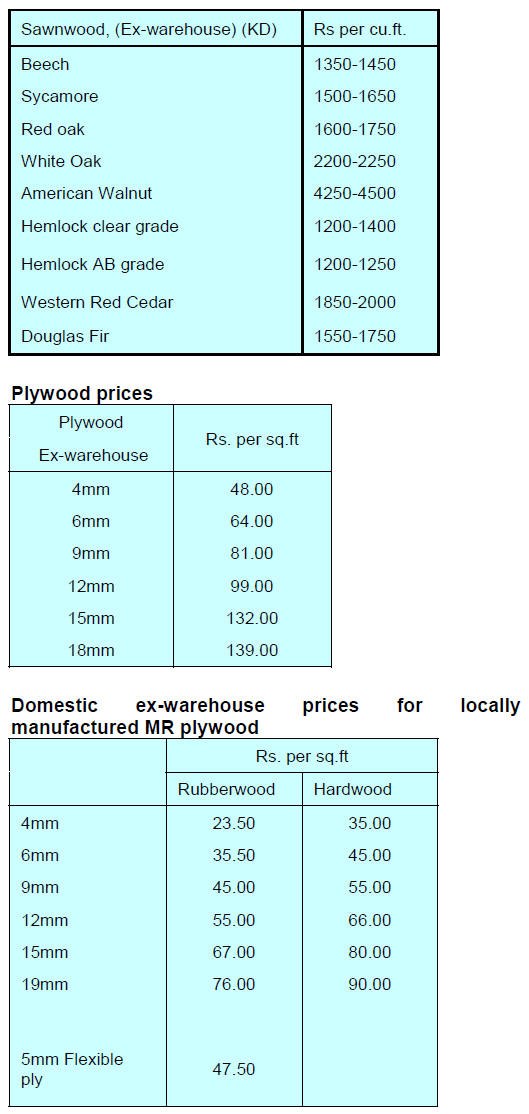

Plywood export prices

Plywood traders in Sarawak reported export prices:

5. INDONESIA

20,000 plus FLEGT licenses

Since the launch of the FLEGT Indonesia license scheme

on November 15, 2016 Indonesia has issued 20,778

licenses for the export of wood products to the EU. These

licenses were for products worth US$730 million and had

a shipping weight of 343,000 tonnes.

At a recent meeting, Michael Bucki of the European

Commission Delegation in Jakarta, reminded that the EU

timber regulation has three principles:

it prohibits placing in EU markets

timber

it prohibits placing in EU markets

timber

products which have not been verified legal

it requires EU merchants importing wood

it requires EU merchants importing wood

products for the EU market to conduct 'due

diligence' procedures;

it requires EU

operators to archive all data of

it requires EU

operators to archive all data of

their suppliers and buyers

Dr. Rufiie of the Ministry of Environment and Forestry

noted that FLEGT licensed wood products shipped to the

EU have a competitive advantage but that there are other

factors that contribute to determining the competitiveness

of a product, such as design, quality and price. This is why

Indonesian manufacturers must continue to assess

competitors in Vietnam and Malaysia for example as they

will be vying for a larger share of the EU market.

Challenge to dominance of China in the US market

The potential of Indonesian wood-based product exports to

the United States is huge and much more can be done to

increase exports to this market according to Arifin

Lambaga, President of PT Mutuagung Lestari.

According to Arifin, the US market for imported wood

products is around US$2 billion annually of which

shippers in China account for about half with Indonesia

only capturing around 10% of this huge market.

With the introduction of tighter formaldehyde emission

regulations, Arifin said Indonesian exporters have an

opportunity to increase exports to the US and take market

share from China.

The US government, through the Environmental

Protection Agency (US-EPA), has issued updated

regulations on the emission of formaldehyde from

composite wood products which include hardwood

plywood veneer core, hardwood plywood composite core,

particleboard and MDF.

Craftsmen to get help meeting cost of SVLK

certification

Sudarto, the Director of the Food, Wooden Goods and

Furniture Directorate in the Ministry of Industry has said

government policies on the SVLK need to be simplified so

as not to be a burden for manufacturers, especially the

SMEs. It is understood that the Ministry of Industry,

Ministry of Environment and Forestry, Ministry of Trade

and the Ministry of Finance plan to review this issue.

Sudarto said a contribution to cover the cost of SVLK

certification will be provided directly to SMEs which have

export potential but are unable, in the short-term, to meet

the cost of certification.

It has been estimated that a furniture maker needs find

around Rp 40 million to cover the cost of certification but

this is a very heavy burden for small companies and is out

of proportion to the value of exports they could hope to

achieve.

Austrian private sector keen to support Indonesia

KADIN Austria, the Austrian Chamber of Commerce and

Industry, supports timber Industry and Infrastructure

development. A spokesperson from KADIN Austria has

said the Chamber was ready to support Indonesia's

development process especially in infrastructure

development, power plants, the timber industry and

vocational training.

In addition, KADIN Austria will promote Indonesia’s

FLEGT licensed wood products. The Permanent

Representative of Indonesia in Austria, Darmansjah

Djumala, has reported that Austrian consumers appreciate

the wide range of wood products from Indonesia,

especially outdoor furniture.

6. MYANMAR

Private sector SMEs to get help from new

DFID

programme

A UK-funded programme called the ‘DaNa Facility’ has

just been launched. DaNa is Burmese for “prosperity”.

The aim of this programme is to reduce poverty and

increase incomes by fostering a strong business

environment conducive to the creation of jobs and

economic opportunities especially for SMEs.

At a press briefing arranged by the British Chamber of

Commerce Myanmar, Peter Brimble, the DaNa team

leader, said grant window is to be launched in August to

attract companies with projects to strengthen value chains

and promote inclusive economic growth with an emphasis

on businesses in agribusiness, community forestry,

garments and textiles.

The DFID website says this initiative was first launched in

May 2016 as one of three components of DFID’s

“Business for Shared Prosperity” (BSP) programme. DFID

is supporting activities of the Myanmar government’s

objectives and policies on economic development, which

includes the Livelihoods and Food Security Trust Fund

and trade and investment activities through the World

Bank Group.

Brimble said the main issues for Myanmar’s include

inadequate infrastructure and energy, limited financial

services (especially for SMEs). He also mentioned that

Myanmar government’s approach at present is mainly

regulatory with few programmes for new entrepreneurs

which DaNa hopes to address.

For more see: https://www.dai.com/our-work/projects/burmadana-

facility

Trade deficit balloons

Myanmar’s trade deficit in the first three months of this

fiscal year totaled just over US$1 billion as imports

exceeded exports

Data from the Ministry of Commerce shows that the trade

value was over US$7.128 billion compared to the

US$1.262 billion for the same period last year. For the

first three months of this fiscal year Myanmar ‘s exports

totaled US$2.855 billion while imports were US$4.273

billion. The impact of the log export ban on export

earnings is significant.

Priority areas for investment announced

The Myanmar Investment Commission (MIC) has

announced priority areas for investment by both domestic

and foreign entrepreneurs. These include: agriculture,

livestock and fishery, export promotion, import

substitution, power, logistics, education, health care,

affordable housing construction and establishment of

industrial estates.

Analysts write that the timber industry trade and industry

is not included although it contributed significantly to job

creation and export earnings in the past.

Despite not being included in the investment promotion

campaign the timber sector (through the Myanmar Timber

enterprise) is expected to contribute 37 billion Kyat to the

2017-18 budget revenues. MTE is one of the five

commercial state institutions that are set to contribute to

state income:

Minister - illegal felling and smuggling continues

Corruption in the forestry sector and the extent of illegal

trade in timber has captured the attention of the Parliament

with the submission of a proposal by a member of

parliament to strengthen the action to combat the illegal

logging. Analysts write that this is aimed at corrupt

authorities and weak law enforcement.

The parliament is also debating the new Forest Law to

replace the old law of 1992. Some civil groups are

requesting greater consultation before the law is submitted

to the parliament but this has drawn comments from

parliamentarians that they represent all constituents in

Myanmar.

U Ohn Win, Minister of Natural Resources and

Environmental Conservation has reported that K53.10

billion was earned from auctions of 50,245 tonnes of

seized illegal teak and hardwood during fiscal 2016-17.

However, the Minister has said illegal felling and

smuggling across the border continues and suggested that

local officials must be involved.

A system has been introduced to reward those reporting

illegal logging with reports saying informants will get

20% of the auction price of the seized timber and if the

information leads to the arrest of illegal loggers then a

30% payout will be made.

But informing on criminals is very dangerous. Between

2002 and 2003 eight people in Myanmar have died,

including a Forestry Department Deputy Director, 42

others have been injured confronting illegal loggers and

smugglers.

7. INDIA

Business leaders ask for more time to

implement GST

On 1 July India replaced its numerous federal and state

taxes with a single Goods and Services Tax (GST). This

replaces more than a dozen central and state levies

including factory-gate, excise duty, service tax and local

sales tax and is India’s most daring tax reform in 70 years.

Analysts say the single GST will cut red tape and increase

tax revenues. The Finance Minister said the change will

stimulate growth but business leaders have asked for more

time to implement changes. Many SMEs do not have

access to the internet to register on the GST network.

Under the GST goods and services will be taxed under

four basic rates - 5%, 12% 18% and 28%. Some food

items are exempted from GST but will still be subject to

existing taxes.

The GST rates for timber and plywood have been set at

18% and 28% respectively. The private sector feels both

rates are too high and have appealed for their review.

If a review is undertaken the private sector says it should

reflect a reduction over the old VAT. The rate of VAT

was not uniform throughout India varying from State to

State.

The change to GST could impact prices for imported

timber and logs. Analysts write that it appears Customs

Officers will assess import duty on the basis of baseline

prices provided by their head office.

The changes in tax rates and duties will eventually

filter

down to changes in C&F and wholesale prices.

Auctions in Western Indian

Auctions have been concluded at various Forest

Department Depots in the North and South Dangs and

Valsad Divisions. Approximately 8,000 cubic metres

mostly teak logs were put up for sale the balance were

hardwoods such as Adina cordifolia, Gmelina arborea,

Pterocarpus marsupium, Acacia catechu and Mitragyna

parviflora.

Since imported plantation teak logs are mostly of small

girth buyers of domestically sourced logs are keen to

secure larger girth as recovery rates are higher and the

wood quality is superior.

The flow of freshly felled teak logs has been good and this

will prompt the authorities to mount another auction in the

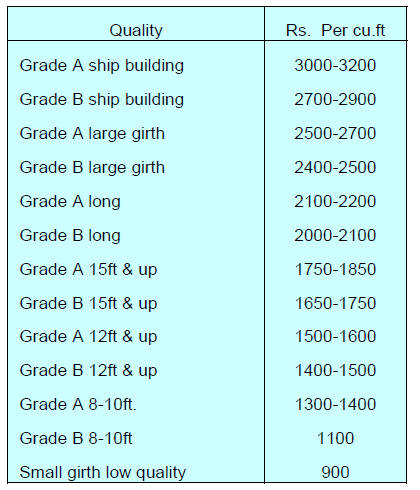

near future. Prices secured at the latest auction are shown

below:

Good quality non-teak hardwood logs also attracted

firmer

prices than at the previous sale.

Top quality non-teak hardwood logs 3-4m long having

girths 91cms & up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora) and

Pterocarpus marsupium attracted prices in the range of

Rs.800-1000per cu.ft. Medium quality hardwood logs

were sold at between Rs500-700 and low grade logs sold

for Rs.300-400 per cu.ft.

Marayur sandalwood - Rs11 million per tonne

The mood amongst buyers was very upbeat for the recent

sandalwood auction say analysts. This was the first auction

after the GST came into effect and was held 12 and 13

July. Some 70 tonnes of sandalwood in more than 200 lots

was offered.

With the introduction of the standard GST the tax rate rose

to 18% from 14.5% (previously the value added tax).

Analysts write that buyers response at the past auction was

very subdued as a result of uncertainty surrounding the socalled

‘demonetisation’ of high value currency notes last

year.

Over the past weeks representatives of major buyers and

temples visited the sandalwood sales divisions to register

their participation in the auction. At the latest auction there

was greater interest on the part of buyers representing

temples. While not major buyers, analysts interpret the

increased presence of religious organisation buyers as

indicative of the falling availability of sandalwood from

other, sometimes illegal, sources.

At this auction 33.5 kg of first quality sandalwood

(Vilayat Buddha) was offered, the first time in five years.

In addition, 69 kg of sandalwood root, 11.7 tonnes of Jai

Pokal (10th class) and 14.8 tonnes of mixed chips (13th

class) were included in the auction.

Though sandalwood auctions are also being conducted at

Shimoga and Mysuru in the state of Karnataka, Marayur

sandalwood is considered top in quality for high oil

content thus prices are high.

It has been reported that the average price of Marayur

sandalwood is Rs.11 million per tonne whereas it is

around Rs.57 million in Shimoga and Mysuru.

Sandalwood from Mysuru is considered second quality

compared to sandalwood from Marayur.

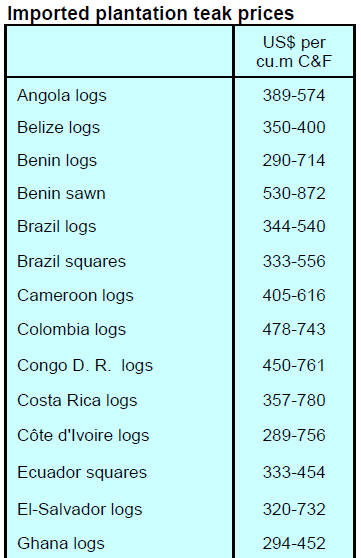

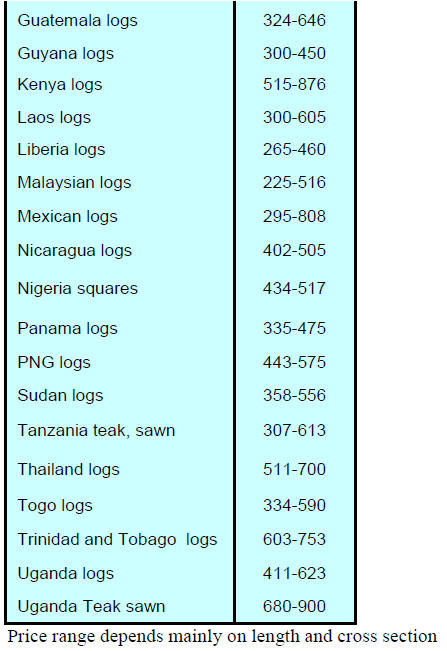

Imported plantation teak

Demand for imported plantation teak logs remains stable

and Indian buyers are benefitting from a stronger rupee.

Prices have not changed over the past two weeks but could

be affected by the 18% GST. As price changes evolve

these will be reported. Prices prior to the introduction of

GST are shown below.

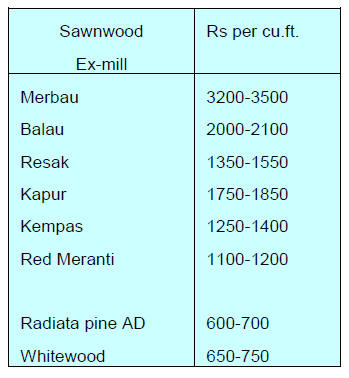

Locally sawn hardwood prices

Prices for hardwoods milled from imported logs are

unchanged but sales are subject to a GST of 18%. This

will inevitably lead to new price structures in the coming

months.

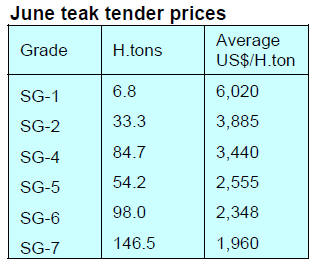

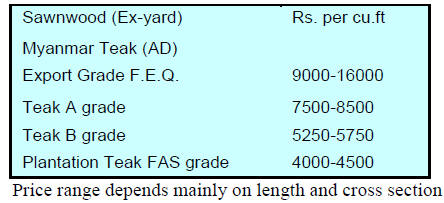

Myanmar teak prices

There were no reports of price movements over the past

two weeks.

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

40 million saplings planted – target exceeded

The Forest Department in Maharashtra State has said it

exceeded its target of planting 40 million saplings across

the state. As of 11 July 45.4 million saplings – 32.3

million in forest areas and 13.1 million in non-forest areas

– had been planted by 13,14,554 participants. Most

saplings were planted at Chandrapur, Ahmednagar,

Nashik, Palghar, Pune and Yavatmal.

This effort was part of the Van Mahotsav (Tree Planting

Festival), an annual tree plantation festival held from 1-7

July across India.

This festival takes place in all the States of Union

of India

and the present government policy is pressing for

increasing the present forest cover of 21% to 33%.

For more see: http://www.festivalsofindia.in/Van-

Mahotsav/Index.aspx

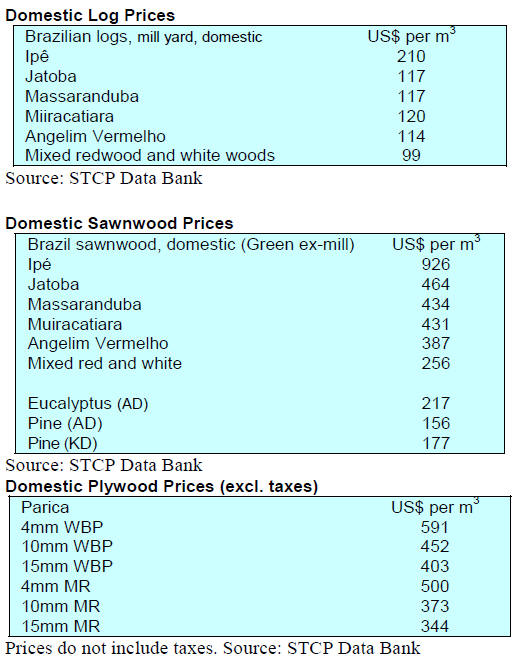

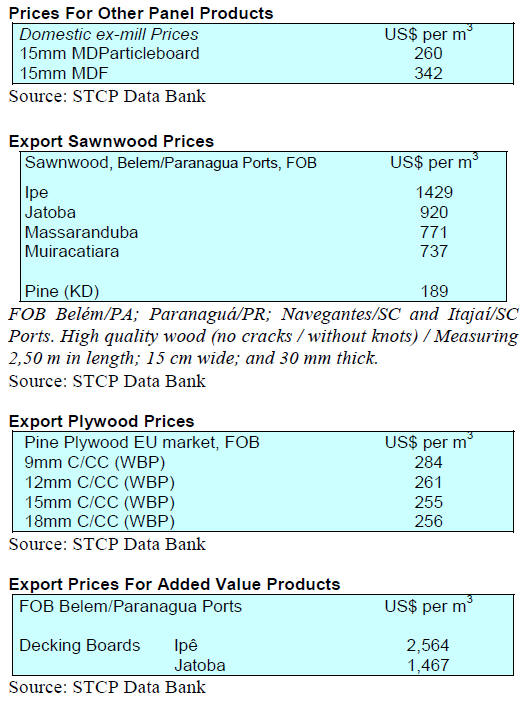

8. BRAZIL

Reducing illegal deforestation

The Mato Grosso State Government has established a

committee to monitor compliance with the goals set forth

at UNFCCC COP21 in Paris. Mato Grosso has committed

to reduce illegal deforestation to zero by 2020 and also to

take action to contribute to efforts to address global

warming.

A project submitted by the Center for Timber Producers

and Exporters of Mato Grosso (CIPEM) was selected for

support. The CIPEM initiative aims to adapt wood frame

technology to native timber species for civil construction.

The aim is to strengthen the industry, generate economic

and social development and contribute directly to the goal

of expanding the area under sustainable forest

management in Mato Grosso state from 2.8 to 6 million

hectares by 2030.

Building systems designed around wood have numerous

environmental benefits because wood is a fully renewable

material that captures and traps greenhouse gases.

Systemised building systems of the type being proposed

reduce building costs and minimise the amount of residues

during the construction.

This CIPEM project will attempt to utilise species that

currently have little or no commercial value and will also

see more forests protected and greater efforts made on

combating illegal deforestation.

No duty on imports of sawnwood

On 30 June the United States government announced

details of its annual review of the General System of

Preferences which included the renewal of duty free

imports of HTS 4409.10.05 (Coniferous wood

continuously shaped along any of its ends, whether or not

also continuously shape along any of its edges or faces).

This was seen as a victory by the Brazilian Association of

Mechanically-Processed Timber Industry (ABIMCI)

which had been lobbying hard for the renewal.

This means Brazilian exports of this product to the US

market will continue without import tax which could have

become 3.2% if the renewal was not approved.

This decision guarantees the continuity of the duty-free

treatment for the product for 5 years. If, after 5 years, US

imports from Brazil exceed 150% of the competitiveness

limit in US dollar or 75% of the total volume imported by

the US, this benefit will be automatically revoked.

ABIMCI had considerable support in its efforts to secure

this decision by the US. The Ministry of Foreign

Relations, the Ministry of Development, Industry and

Foreign Trade, the Presidency of the Republic and Apex-

Brazil, the Federation of Industries of the State of Paraná

(FIEP), the Brazil and the United States Business Council

(CEBEU) and National Confederation of Industry (CNI)

all contributed to this success.

Investment opportunities in the US timber sector

ABIMCI, in collaboration with the Federation of

Industries of Paraná (FIEP), participated in the Select USA

Summit sponsored by the US government in June.

The event, led by the US Department of Commerce,

focused on promoting business development with US

companies. The meeting addressed trade opportunities and

market potential and highlighting issues such as the

favorable environment for conducting business, legal

security and investments practiced in the country.

Parallel to the federal government's participation, various

U.S. states promoted their inward investment programmes

and representatives of several American companies

explained how the current US administration approaches

inward investment.

Representatives of ABIMCI participated in specific

meetings with US trade representatives and with the

Director General of the ‘Select USA programme’ which

aims to encourage business opportunities in the timber

industry.

9.

PERU

Strengthening inter-institutional

cooperation

The National Forest Conservation Programme for the

Mitigation of Climate Change in the Ministry of

Environment and the Forest and Wildlife Resources

Monitoring Agency (Osinfor) have signed an addendum to

strengthen Inter-institutional cooperation. The objective is

to promote good practices in the management and legal

and sustainable use of forests to contribute to their

conservation. The programme covers native and forest

communities as well as forest concessionaires.

Potential and opportunities in forest plantations

Where does Peru want to be in the next 25 years in terms

of forest plantations? This question served as the guide to

a discussion at a workshop that resulted in the publication

"Forest plantations in Peru: reflections, current status and

future perspectives".

The workshop was organised by the Peruvian office of the

Center for International Forestry Research (CIFOR), the

German GIZ (through its ProAmbiente II programme) and

the Peruvian Society of Environmental Law (SPDA).

The publication provides an overview of the current state

of the forest plantation sector in Peru and offers a common

vision for the medium and long term.

Manuel Guariguata, CIFOR Regional Coordinator for

Latin America, said “It is the synthesis of the visions and

opinions of many specialists, present ideas, options and

reflections on what has worked and what has not.

It aims to revitalise the issue of forest plantations as a

potentially important alternative for the economic and

forestry development of the country, in an

environmentally and socially sustainable way”.

The publication touches on technical, institutional,

capacity building, financing and incentive aspects related

to the forest plantations sector.

Workshops begin to elaborate National Forestry and

Wildlife Plan

The Ministry of Agriculture and Irrigation (Minagri),

through the National Forest and Wildlife Service (Serfor),

has initiated the first round of departmental workshops

involving stakeholders in the management of forest and

non-timber resources, wildlife, ecosystem services as well

as research and technology in the process of building the

National Forestry and Wildlife Plan.

These workshops will allow Serfor to define the strategic

themes of the forestry and wildlife sector as well as locate

and contact stakeholders related to the sector to compile

their contribution and ensure their participation in the

process. The second round of nine macroregional

workshops will be held in August.

Serfor wishes to incorporate three key elements: fostering

and ensuring wide participation; demonstration of

institutional commitment and the vision for modern and

productive growth of the sector.