US Dollar Exchange Rates of

26th June 2017

China Yuan 6.8411

Report from China

Chinese overseas investment in the timber sector

According to a report on China¡¯s Wood Products Trade

and Investment (2016) there were 167 Chinese enterprises

with overseas operations at the end of 2014. Of the total,

over 90% were private enterprises.

Private enterprises have become the main players in

overseas forestry investment and have taken a long-term

view to these investment and have the advantage of being

able to adopt quickly to changing production and trade

conditions.

The origin of the 167 enterprises identified in 2016 was in

17 provinces, autonomous regions and municipalities.

Enterprises in 5 provinces; Heilongjiang, Inner Mongolia,

Jilin, Shandong and Jiangsu p dominated the overseas

investors namely;.

Enterprises investing in overseas forestry and timber

operations are mainly from three areas, Heilongjiang

province, Jilin province and Inner Mongolia Autonomous

Region which is adjacent to Russia.

Enterprises from the Inner Mongolia Autonomous Region

invest mainly in forestry operations in Russia. The others,

mainly from the regions in China that account for much of

the country¡¯s wood product manufacturing such as Jiangsu

and Shandong provinces, invest in developing countries

mainly in raw material sourcing.

There are two main patterns of Chinese overseas

investment, one is direct purchase or lease of forest land

the other is joint venture cooperative arrangements.

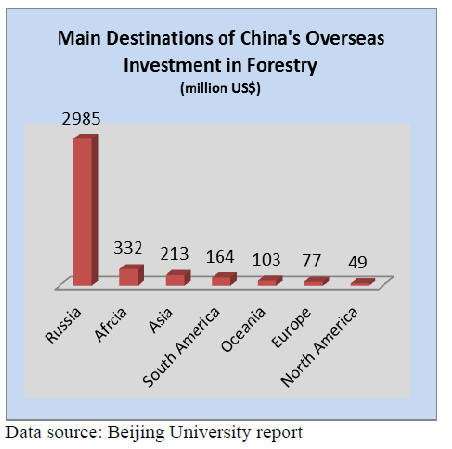

Chinese enterprises invest mainly in Russia, with smaller

investments in Gabon, Brazil, Papua New Guinea,

Australia and New Zealand and operations include

logging, primary processing and downstream

manufacturing. The distribution of investment in 2014 is

illustrated below.

Chinese enterprises say while trading is relatively low risk

the risks increase significantly with overseas investment

largely due to long term pay-back period, the complexity

of the international business environment, financial risks,

host government regulations and supervision and

environment risks.

Overseas investment by Chinese enterprises has been

increasing in recent years and the value of foreign direct

investment for Chinese forestry products industry is

expected to rise given the Chinese government¡¯s ¡°Go Out¡±

policy.

For more on this see:

https://www.cigionline.org/publications/deeper-lookchinas-

going-out-policy

As the go-out policy takes affect it is expected that

China¡¯s investment in forestry and wood processing will

become more diversified. It is anticipated that

multinational companies will emerge in the future.

It is further anticipated that the patterns of investment and

cooperation will become more diversified from traditional

direct purchasing or renting to mergers and acquisitions,

joint ventures, capital operation, strategic alliances, stock

exchange and this will lead to greater integration of

logging, intensive processing, logistics and trade.

Enterprises urged to strengthen capacity to comply

with US regulations

It has been reported that the USA Act of Formaldehyde

Standard for Wood Composite Products had been

introduced so that all composite wood products sold,

supplied and manufactured in the USA must meet the new

regulation.

Wood products are an important export product for China

and the value of wood products exports exceeded US$30

billion in 2016. Of this total, the export value of composite

wood products was US$7 billion.

The Chinese government¡¯s Inspection and Quarantine

Service has urged domestic wood products enterprises to

pay more attention to satisfying the regulations in

importing countries.

They have advised enterprises to utilise raw materials

whose formaldehyde emission comply with the standard of

wood composite products in the USA regulation.

Enterprises have been advised to establish a sound system

to control the export of toxic and harmful substances in

wood products to ensure that composite wood products

enter the US without difficulty.

The government is working to transform and upgrade

China's wood products industry to enhance added value

production. The focus is on technical training,

formaldehyde detection, improved self-inspection and

control, strengthen product innovation and design as well

as the creation of brands and image.

|