|

Report from

North America

A look back at 2016 ¨C where to now?

The US Federal Reserve increased interest rates in

December 2016, just the second time it has done so in a

decade. The impact of this on sentiment in the US far

outweighed the tiny adjustment made: it was read as good

news, the impact on the economy was immediate, and the

already buoyant housing sector got a further boost.

With the US economy much closer to full employment,

and given the ¡°live now, pay later¡± policies of the new

administration, consumer sentiment, business growth and

investment in housing should all expand, driving up timber

consumption and (because the dollar will strengthen)

imports.

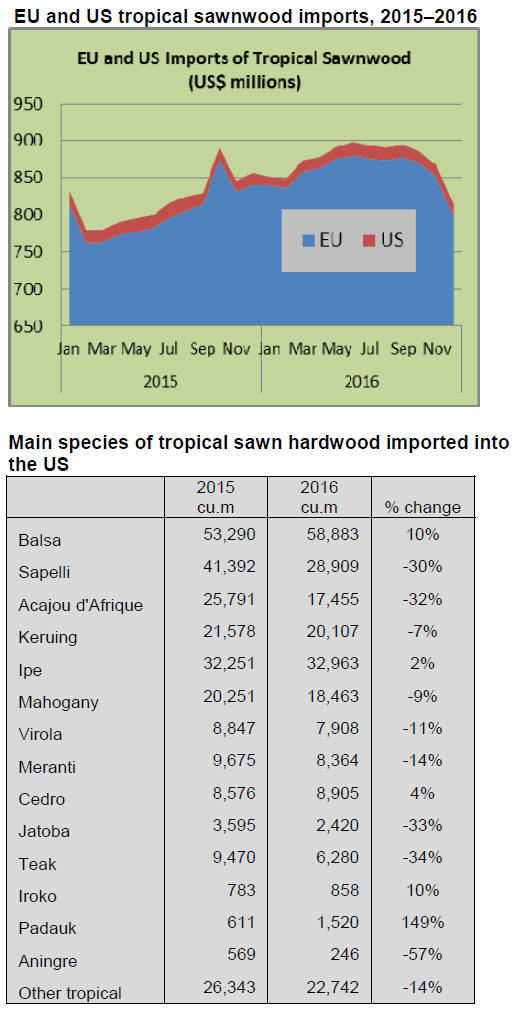

Consumption of tropical sawnwood down

Despite stronger housing starts and home sales in 2016,

tropical sawnwood imports fell by 13% in the US in 2016.

The fastest decline was in sapelli, with imports down by

about 30% compared with 2015.

The US has never been a big market for tropical

sawnwood, but with a population of 320 million

(compared with the EU¡¯s 508 million), and per capita

incomes 50% higher than in the EU, the value of tropical

sawnwood imports is miniscule and could be expanded.

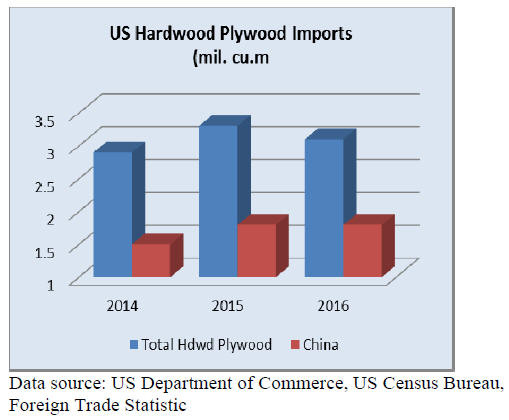

Tropical hardwood plywood imports decline¡

US imports of hardwood plywood declined by 4% in

2016, to 3.14 million m3 (valued at US$1.82 billion) after

a 12% increase in 2015. The decline was mainly in

imports from tropical producers: imports from Canada,

China and the Russian Federation all increased.

but tropical veneer imports rise

Tropical hardwood veneer imports were worth US$233.7

million in 2016, up 14% from the previous year. Imports

from many leading suppliers¡ªincluding Cameroon,

Ghana, India and Italy¡ªdoubled compared with 2015.

Italy was the largest supplier of tropical veneer in 2016, at

US$15.9 million, followed by China (US$9.6 million).

Côte d¡¯Ivoire, Ghana and India each shipped tropical

veneer worth more than US$6 million to the US in 2016.

Veneer imports from Cameroon doubled compared with

2015, to US$2.6 million.

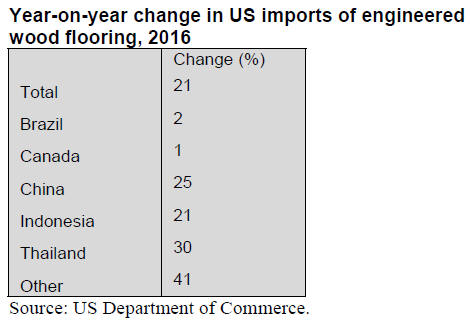

Strong growth in engineered wood flooring imports

US imports of hardwood flooring fell by 15% in 2016, to

US$40.5 million, although imports of this product from

China grew rapidly.

The main exporters of hardwood flooring to the US in

2016 were China (US$9.7 million), Indonesia (US$9.1

million) and Malaysia (US$6.3 million). US imports of

engineered flooring were worth US$164.6 million in 2016,

up by 21% from 2015, with all major exporters recording

increases.

¡¡

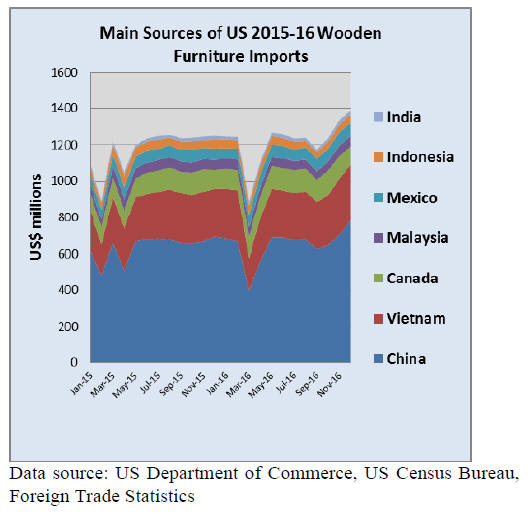

Record high in wood furniture imports

US wood furniture imports reached a record high in 2016,

at US$16.7 billion, up by 3% from 2015. The value of

imports increased from all major suppliers except

Indonesia (down by 9%) and Malaysia (down by 5%).

China¡¯s share of total imports decreased again in 2016

(although overall it was up by 2%, to US$7.82 billion), to

46.8%, but Viet Nam¡¯s share grew to 19.1% (at US$3.19

billion, up by 6%). Malaysia¡¯s share of total imports was

the same as in 2014, at 3.8%. Canada, Mexico and India

recorded the strongest year-on-year growth in wood

furniture exports to the US in 2016.

¡¡

Consumers confident in economy

A consumer survey by the University of Michigan found

that US consumers are positive about economic prospects

and reported higher household incomes.

The National Association of Home Builders is also

positive on prospects for the new build, single-family

home market which is good news for the flooring,

mouldings and plywood sectors. The Association

continues to be concerned, however, about the high cost of

labour in the building sector and rising land costs.

The greatest unknown in the US market is where US trade

policy will eventually settle. Will there be tariff increases?

The idea of a 20% tax on imports from Mexico has been

raised, which could have major implications for Mexican

wood exporters, US importers¡ªand US retailers and

consumers.

In an article titled ¡°Border tax proposal riles retailers¡± in

the 7 February issue of Furniture Today, Clint Engel wrote

that, ¡°A tax on imports from Mexico may help pay for the

Trump administration¡¯s proposed border wall, but it¡¯s the

consumer who will end up paying for more expensive

goods if the U.S. government adopts a broader tax on all

imports¡±.

Engel also noted that the National Retail Federation was

against the idea and that a new group, Americans for

Affordable Products, which includes home-furnishings

retailers, opposes the idea.

|