Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May 2017

Japan Yen 111.87

Reports From Japan

War on deflation gradually being won

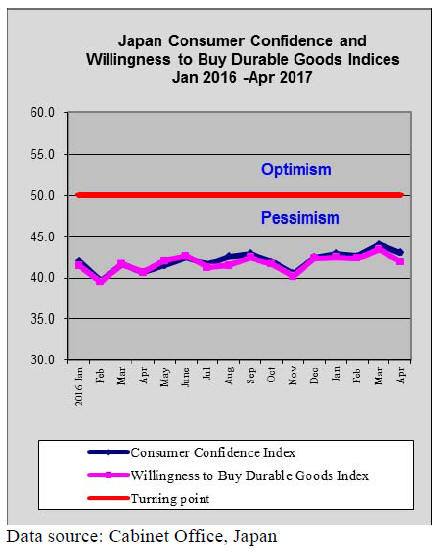

According to the latest release from the Japanese

Economic and Social Research Institute in the Cabinet

Office, consumer confidence in Japan fell slightly in April

from a month earlier.

The survey revealed that the index reflecting consumer¡¯s

perception on prospects for improvement in overall

livelihood fell month on month as did the index for

prospects for income growth. However, consumers

considered that employment prospects were improving

but, in line with sentiment in the retail sector, the index for

willingness to buy durable goods fell almost 2% from

March.

Expectations that deflation can be beaten are at the core of

consumer sentiment on employment. Japan has struggled

with deflation for nearly 25 years, but may now be

reversing the downward spiral.

March employment data showed that unemployment stood

at 2.8%, a 22-year low. This, along with positive GDP

growth, is likely to give employers the confidence to raise

wages further. According to Morgan Stanley report

average hourly earnings could rise by over 3% in 2018.

Post French election - yen weakens to delight of

exporters

The result of the French presidential election boosted the

euro, had a roll-on effect on the dollar and sank the yen

slightly. Both the euro and dollar advanced against the yen

by around 2% after the result of the poll in France. This

was welcome news in Japan as the yen had been

strengthening against the dollar, putting export growth at

risk.

Analysts are forecasting further dollar strength

anticipating interest rates in the US will be lifted higher,

possibly as soon as June.

A use for abandoned homes

The Japanese government has added clauses to exiting

legislation creating a system whereby regional

governments will register vacant properties with a view to

renovated those of suitable condition for letting to lowincome

families who cannot secure other public housing.

The current Safety Net Law is there to protect seniors

living alone, low-income families, disabled persons and, in

the event of disasters, displaced households. Such people

are eligible for public housing but not enough is available.

The revised law should result in an expansion in the stock

of homes and at the same time begin to address the

problem of abandoned houses.

See: http://www.japantimes.co.jp/community/2017/04/30/howtos/

safety-net-law-offer-new-lease-life-abandonedbuildings/#.

WRUGOV-GPIU

Import round up

Doors

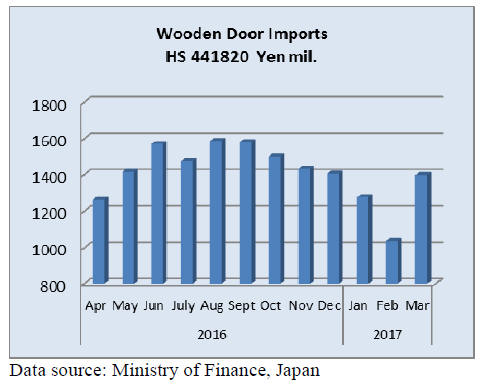

Japan¡¯s March 2017 wooden door imports returned back

to levels seen in December 2016, snapping the downward

trend that began in January this year. March imports were

up 35% month on month but were down 2% compared

levels seen in March 2016.

On a quarterly basis, 2017 wooden door imports were

down 19.5% from a year earlier.

The top suppliers in March, in order of rank, were China

(49%), Indonesia (9%) and Vietnam (9%) accounting for

81% of Japan¡¯s wooden door imports for the month.

Windows

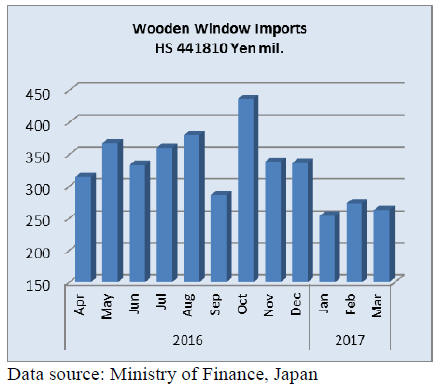

Year on year, the value of Japan¡¯s March wooden window

(HS441810) imports were up 10% but compared to

February import values fell slightly. First quarter 2017

wooden window import values were down 13% from the

same period in 2016.

In March this year three shippers accounted for over 85%

of the value of wooden window imports, China (49%),

USA (30%) and Sweden (8%).

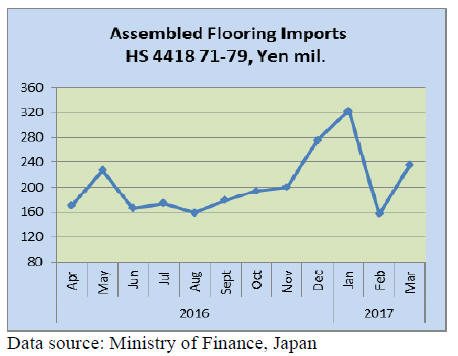

Assembled flooring

Following the massive correction in the value of Japan¡¯s

imports of assembled flooring in February this year there

was a rebound in March. March 2017 imports of

assembled flooring (HS441871-79) rose around 50% from

a month earlier.

Since September 2016 the value of assembled flooring

imports ha drisen every month until the correction in

February. The March 2017 import values are just below

levels reported in December 2016.

Year on year, March 2017 assembled flooring imports are

up 41% and first quarter 2017 assembled flooring imports

are up 22% compared to the first quarter in 2016.

One category of assembled flooring, HS441879, accounts

for most imports to Japan and within this category three

shippers, China, Thailand and Indonesia, accounted for

over 90% of Japan¡¯s imports in March 2017.

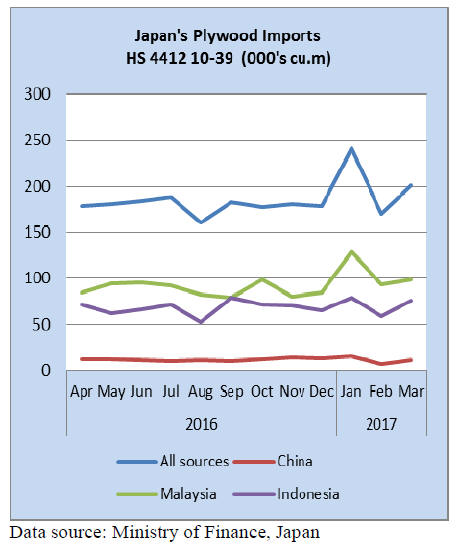

Plywood

The figure below shows the trend in imports of plywood (

HS 441210/31/32 and 39). Throughout 2016, as was the

case in 2015, almost 90% of Japan¡¯s plywood imports are

from Malaysia, Indonesia and China. This trend continued

into March this year. Most of Japan¡¯s plywood imports are

within HS 441231 (87%).

Year on year March shipments of plywood from the top

supplier, Malaysia, rose 18% with Indonesia seeing a

19.5% increase while imports from China, the third ranked

supplier, recorded a 44% year on year rise.

First quarter 2017 plywood import volumes were up 12%

compared to the first quarter in 2016. Imports from

Malaysia were up 20%, imports from Indonesia rose a

modest 2% while imports from Chian were flat.

¡¡

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood statistics for 2016

The Ministry of Agriculture, Forestry and Fisheries

announced wood statistics of 2016. According to that,

demand for logs was 26,029,000 cbms, 3.7% more than

2015. In log supply, domestic logs were 20,660,000 cbms,

3.0% more than 2015 and imported logs were 5,370,000

cbms, 6.4% more. Share of domestic logs was 79.4%, 0.5

points less.

By use, log supply for lumber was 16,590,000 cbms, 2.5%

more, for plywood was 4,638,000 cbms, 10.0% more and

for wood chip was 4,801,000cbms, 2.3% more. This tells

active demand for plywood, which was the highest

production since 2007. Wood chip was also the moist in

last ten years.

In supply of domestic softwood logs by use, lumber use

was 12,088,000 cbms, 1.6% more and plywood use

increased to 3,667,000 cbms, 9.8% more. Wood chip use

was also high at 2,715,000 cbms, 5.4% more. Both

plywood and wood chip pushed up domestic log supply.

By species of domestic softwood logs, cedar was 57.3%,

5.5% more, cypress increased by 4.1% and fir increased

by 4.5% but larch increased only by 0.6%. Pine decreased

by 13.0%.

For plywood manufacturing, cypress increased by 27.7%

more, larch did by 16.2% more and fir did by 24.6% more.

North American logs, which took 76.5% in imported logs,

were 4,106,000 cbms, 8.0% more than 2015 out of which

lumber use increased by 7.8% and plywood use did by

8.1%. Russian logs were 381,000 cbms, 11.1% more in

which plywood use increased by 51.0% while lumber use

dropped by 5.3%.

New Zealand logs decreased by 3.2% in which plywood

use increased by 40.0% while lumber use decreased by

4.4%. South Sea logs continues to decline for both

plywood and lumber.

Shipment of lumber increased to reflect higher housing

starts. That of squares like post and beam were 2.4% more

than 2015 and common lumber and lamina were 5.6%

more. Board like floor and sideboard was 5.9% less.

Shipment of materials for engineering works dropped by

8.3%, that for boxing and crating dropped by 2.8% and

that for furniture decreased by 19.0%.

Symposium on Clean Wood law

The symposium to discuss how the Clean Wood law

should be managed in actual businesses was held at the

Waseda University in Tokyo and 117 attended the

symposium from wood business and environmental

protection groups.

Four groups, Research project ¡®W-BRIDGE¡¯ team by

Waseda University to tackle practical attitude to

environmental issues, Kyushu University¡¯s tropical

agricultural science center, FoE of Japan of international

environmental NGO and Earth and human environmental

forum, held this symposium.

Content of the law, comparison to overseas illegal harvest

laws and how related domestic companies are dealing with

this law were explained.

As primary dealers of wood products, three trading

companies, Itochu Kenzai, Sojitz and Sumitomo Forestry

attended and explained that they have been tackling use of

certified wood products and firm traceability. Information

has been collected through their overseas offices and

environmental NGO.

As secondary dealers of wood products, Kashima, Japan

Paper Manufacturing Union and Sekisui House attended

and they reported that they make risk assessment by

cooperating with environmental NGO.

Plywood

Domestic softwood plywood supply situation varies by the

region. Tight supply in Eastern Japan has been solved but

in Western Japan, the supply still continues tight. March

end inventories increased by about 10,000 cbms but total

inventories are still about 100,000 cbms, which are low for

the demand.

March production was 264,500 cbms, 4.3% more than

March last year. The shipment was 254,900 cbms, 7.1%

more. Usually the demand weakens in March so this is

abnormally high. The inventories were 88,600 cbms.

Compared to March last year, this is about 30% lower.

May has many holidays and plants do maintenance works

so operating days are less than normal months but

precutting plants expect to have much busier days so the

supply may get tight again.

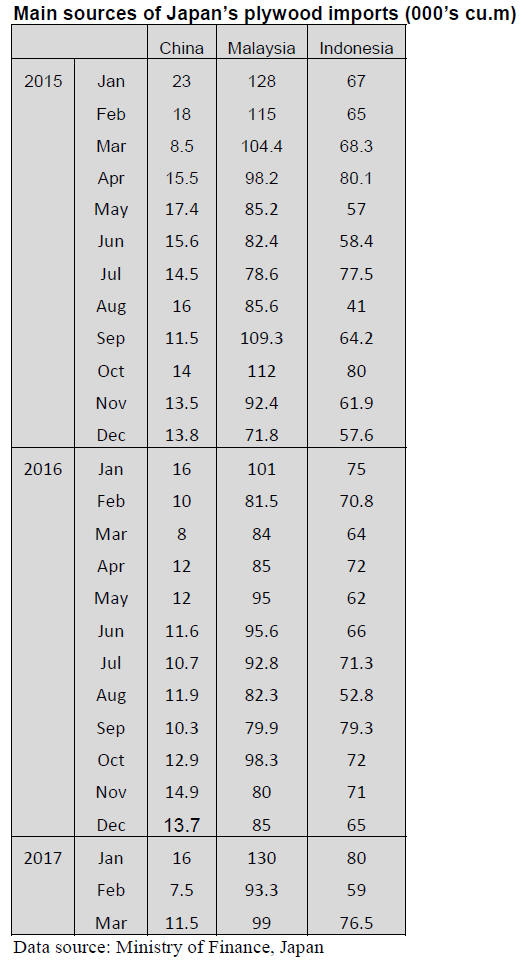

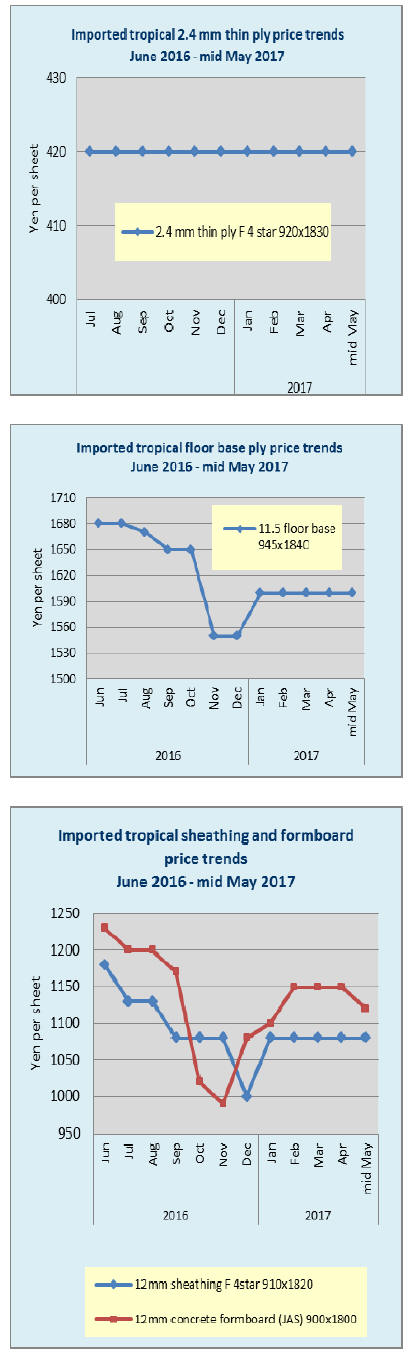

Imported plywood market continues weak by stagnant

demand. The market prices have been inching down on all

the items after low prices were going around in late March

to dispose of inventory for book closing.

The importers and wholesalers cannot afford to reduce the

prices as the cost is high so they desperately try to hold the

prices but as the yen gets stronger, the users hesitate to

buy now.

The arrivals in March were 261,500 cbms. Average

monthly arrivals for the first quarter were 258,800 cbms,

which were 27,900 cbms more.

|