|

Report from

Europe

EU timber imports rise to highest level since financial

crises

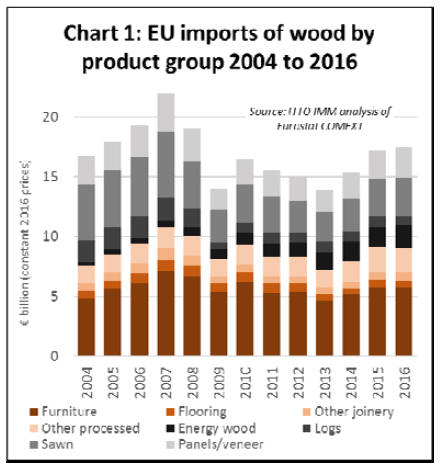

The total value of EU imports of wood products was Euro

17.48 billion in 2016, 1.3% more than in 2015. This

followed an increase of 12% to Euro 17.25 billion in

2015. In 2016 EU import value was at the highest level

since 2008 just before the global financial crises (Chart 1).

The value of the euro plunged 20% against the U.S. dollar

between 2014 and 2015, resulting in a sharp increase in

euro import prices at that time, particularly for goods from

North America and Asia. This was a major factor boosting

the value of EU imports in 2015.

However, the value of the euro remained relatively stable

against the U.S. dollar between 2015 and 2016 and had

much less impact on the import value trend last year.

2016 wooden furniture imports par gains of last year

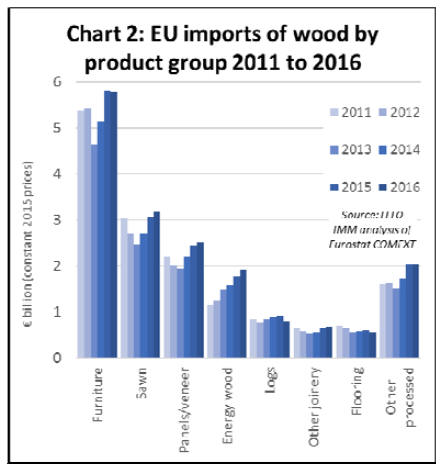

Considering individual products (Chart 2), the value of EU

imports of wood furniture fell by 0.3% to Euro 5.78 billion

in 2016 after a sharp increase in 2015.

This was mainly due to a decline in EU imports from

China. EU imports of wood furniture from non-EU

countries in Europe were rising last year. This forms part

of general trend of increasing EU dependence on wood

furniture manufactured in central and Eastern Europe.

¡¡

Rising trend in sawnwood and plywood imports

The value of EU imports of sawnwood increased 4.3% to

Euro 3.2 billion last year, continuing the rising trend

which began in 2013. There was a particularly significant

increase in the value of EU sawnwood imports from

Africa in 2016 which offset a sharp decline in imports

from South East Asia.

EU imports of sawn wood from Russia and other CIS

countries also continued to rise last year, helped along by

the relative weakness of currencies in the region.

EU imports of panels (mainly plywood) increased 3.1% to

Euro 2.52 billion in 2016 following an 11% in 2015. A

significant increase in plywood imports from Russia offset

declining imports from China and Latin America. There

were also gains in EU plywood imports from Africa in

2016.

The long-term rise in EU imports of energy wood

continued in 2016 to reach an all-time high of Euro 1.93

billion, up 9% compared to the previous year and nearly

four times the value of a decade ago. EU imports of

energy wood (now dominated by pellets) increased sharply

from the U.S. and CIS region last year.

Malaysia and Indonesia score with joinery exports

Following a 22% increase in 2015, EU imports of other

joinery products (mainly doors and LVL for window

frames) increased a further 4% to Euro 690 million in

2016.

Significant gains were made by Indonesia, Malaysia,

Russia and Ukraine in supply of joinery products to the

EU last year, while imports from China lost ground

(although China is still the single largest external

supplier).

EU imports of wood flooring fell back 9% to Euro 540

million in 2016, mainly due to a 11% decline in imports

from China to Euro 341 million. EU imports of ¡°other

processed products¡± (mainly classified under HS 442190

and not separately identified) remained stable at Euro 2.02

billion after a 17% gain in 2015. 56% of EU imports of

¡°other processed products¡± derive from China.

Tropical timber supplier¡¯s share of EU market

maintained in 2016

The value of EU imports of wood products from tropical

countries declined 0.8% to Euro 3.79 billion in 2016,

reversing the rising trend of 2014 (+6.1%) and 2015

(+15.3%).

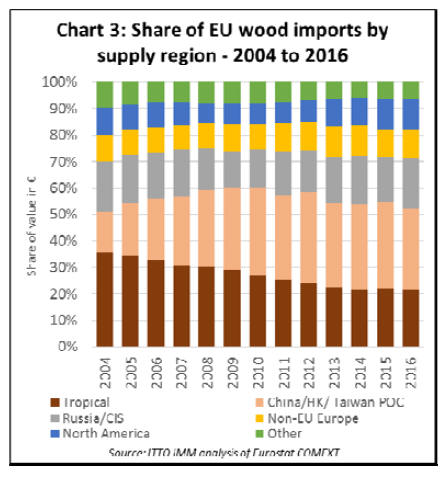

The share of tropical countries in the total value of EU

wood product imports has remained stable at around 22%

in the last 3 years.

The declining share of tropical countries in total EU

imports experienced in the decade prior to 2014 has halted

for now (Chart 3).

China¡¯s share in total EU imports of wood products fell

from 32.4% in 2015 to 30.5% last year, while the share of

Russia and other CIS countries increased from 17.2% to

19.3%. In 2016, there was a slight increase in share of EU

imports from non-EU European countries (from 10.5% to

10.8%) and North America (from 11.4% to 11.5%).

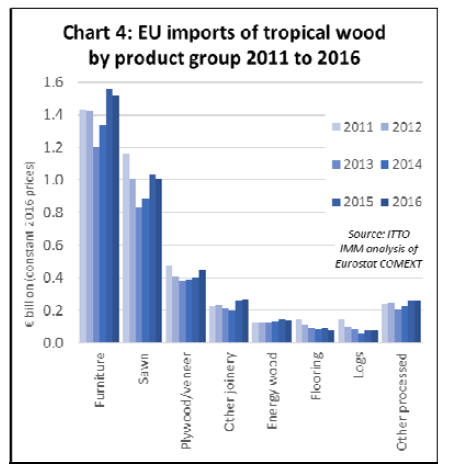

The slight decline in the total value of EU wood product

imports from the tropics in 2016 hides variations between

products groups (Chart 4).

Last year, there was a decline in EU imports from tropical

countries of wood furniture (-2.2% to Euro 1.52 billion),

sawn wood and decking (-1.9% to Euro 1.01 billion),

energy wood (-2.9% to Euro 138.9 million), flooring (-

20.3% to Euro 76.4 million), and logs (-4.2% to Euro 73.8

million).

However, these declines were partly offset by rising EU

imports from tropical countries of plywood and veneer

(+9.5% to Euro 44.4 million) and other joinery (+3.2% to

Euro 263 million - mainly LVL and doors).

EU wood products exports just short of record level

last year

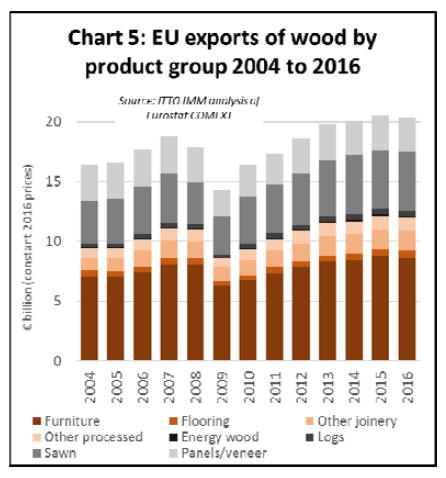

In 2016, the EU exported wood products with a total value

of Euro 20.40 billion, just short of the previous year¡¯s

record level of Euro 20.51 billion (Chart 5). The EU¡¯s

wood product trade surplus with the rest of the world fell

from Euro 3.26 billion in 2015 to Euro 2.92 billion in

2016.

This was mainly due to a 1.7% decline in EU exports of

wood furniture to Euro 8.60 billion in 2016, and an 8.6%

decline in exports of energy wood, to Euro 176 million.

Italian wood machinery sales give cause for optimism

The wood market in Italy has been depressed now for

several years. However newly released data on wood

machinery sales suggests there was a significant upturn in

capital investment in the industry last year.

Data from Acimall, the Italian association of

woodworking machinery manufacturers, show that total

sales by members to domestic industry were Euro 592

million in 2016, 31.6% more than the previous year.

Export sales of woodworking machinery also increased in

2016, but at a slower rate of 5.1% to Euro 1486 million.

Much of the recent growth in export sales has been

concentrated in North America.

Acimall suggest that increase in sales last year was driven

both by public incentives and measures to support

industrial activity and by rising wood product

consumption.

Taken together, the data shows that Italian machinery

manufacturers¡¯ total sales increased by 11.5% to Euro

2078 million in 2016. This is close to the industry¡¯s record

production level of Euro 2159 million in 2007.

New EU ecolabel criteria for wood flooring

On 25 January 2017, the EU published Decision (EU)

2017/176 in the official EU Journal establishing EU

Ecolabel criteria for wood, cork and bamboo based floor

coverings. The new criteria require that any virgin wood,

cork, bamboo and rattan in the finished products originate

from certified sustainably managed forests.

In addition, the Ecolabel criteria include a set of measures

to ensure low energy consumption for manufacturing,

drastically limit the VOC (Volatile Organic Compound)

content, and ban use of harmful chemicals for flame

retardant, binding and finishing applications.

The EU Ecolabel is a voluntary scheme, which means that

producers, importers and retailers can choose to apply for

the label for their products.

While not mandatory for the specified product, the green

procurement policies of many EU authorities now

recognize and may give preference to products bearing the

EU Ecolabel.

See:: http://eur-lex.europa.eu/legalcontent/

EN/TXT/?qid=1486024464540&uri=CELEX:32017D01

76

ATIBT publish new guide to using African timbers in

Europe

The Association Technique Internationale des Bois

Tropicaux (ATIBT - International Tropical Timber

Technical Association) has just released Volume 1 of their

"User Guide for Eco-certified African Timber in Europe".

The aim is to help transform attitudes to tropical timber in

Europe, enhancing awareness that it offers an efficient,

technically superior and responsible material for use in a

wide range of applications.

The ATIBT Guide shows how certified African species

can supplement and complement temperate timber species,

thereby helping to expand the total market for wood

products in Europe.

To achieve these goals the guide promotes both the natural

properties of tropical timber and the major effort to

independently certify and verify the legality of forests and

wood products in tropical Africa.

The ATIBT Guide was prepared by Patrick Martin and

Michel Vernay, both qualified timber engineers and

recognised experts in the use of tropical timber in

construction. Financial support was provided by PPECF

(Programme de Promotion de l'Exploitation Certifi¨¦e des

For¨ºts - Programme for the Promotion of Certified Forest

Operations) and the AFD (Agence Française de

D¨¦veloppement - French Development Agency).

Volume 1 of the Guide is intended for European users of

African timber, as well as all suppliers, distributors,

designers, public buyers and instructors whose activities

are linked to the timber sector. Volume 2, yet to be

published, will target African consumers.

The Guide is divided into two sections. The first section

provides technical information on the various aspects of

tropical timber. It explains in layman's terms the principles

of sustainable tropical forestry and its implications for

land-use change, carbon sequestration and other

environmental impacts, and describes the African

production region, progress to achieve certification and its

implications and benefits.

The first section also explains the various technical

properties of tropical timbers (mechanical resistance,

hardness, resilience, aesthetics, durability), provides

information on drying and other treatments and

appropriate applications, and thereby highlights the

benefits of using tropical timber in construction.

The second section of the Guide describes the wide range

of applications for which tropical timber offers clear

technical, aesthetic and environmental advantages,

including exterior and interior joinery applications, waterprotection

and other heavy duty structural and industrial

applications, boat building, and high value items like

musical instruments and turnery products.

For each application, the guide provides information on

the required properties of timbers, relevant standards, and

a list of appropriate tropical timber species.

For details see: https://www.atibt.org/en/eco-certified-africantimber-

user-guide-has-been-released/

|