|

Report from

North America

Ipe tops sawnwood imports by value but balsa top by

volume

Annual imports of temperate and tropical sawn hardwood

decreased 15% in 2016 from the previous year. However,

despite economic growth and a stronger housing market

hardwood imports were 961,733 cu.m. in 2016, down

from over 1.1 million cu.m. in 2015. The value of imports

declined 8% in 2016 to US$481.9 million.

Imports of most hardwood species decreased in 2016, with

the exception of temperate species white oak and western

red alder, which grew by over 50% from 2015.

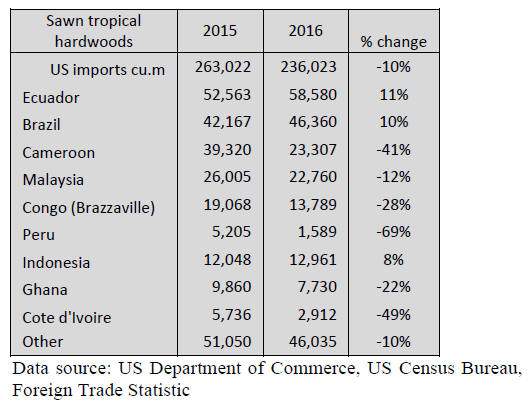

At 236,023 cu.m. tropical sawnwood imports declined

10% in 2016. The value of tropical imports decreased 13%

from 2015 to US$251.3 million. The share of tropical

sawnwood in the total value of US hardwood imports was

52% in 2016, down from 55% in 2015.

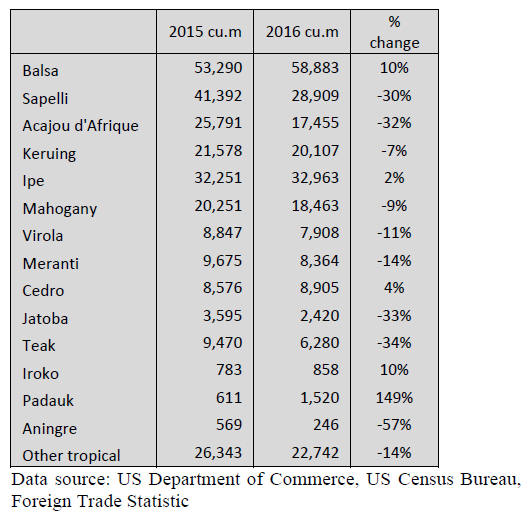

Imports of balsa, ipe, cedro, iroko and padauk sawnwood

grew in 2016, while most other species declined. Balsa

was the most significant imported species by volume

(58,883 cu.m.), up 10% from 2015.

Ipe was the most valuable import in 2016 at US$64.9

million, followed by balsa, sapelli and teak.

Sapelli sawnwood imports fell 30% in 2016 to 28,909

cu.m. Imports of acajou d¡¯Afrique, teak and jatoba were

also down by about one third from 2015. Keruing and

mahogany imports declined by 7% and 9%, respectively,

from the previous year.

Tropical sawnwood imports from Brazil and Ecuador grew

in 2016, due to higher ipe and balsa shipments. Imports

from most other countries declined compared to 2015,

with the exception of Indonesia. Indonesia increased

exports to the US by 8% in 2016, mainly in ¡®other¡¯

tropical species that are not specified in the trade

classification system.

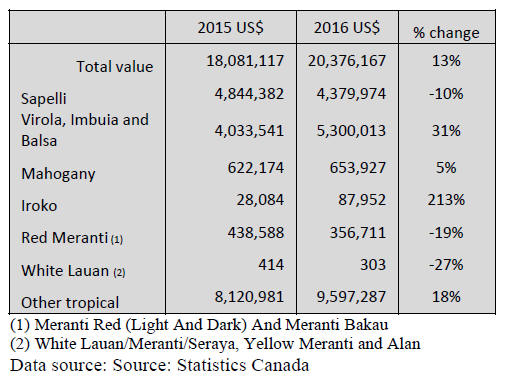

Canadian tropical sawnwood imports firmed in 2016

Canadian imports of tropical sawnwood increased in 2016

despite a drop in imports at the end of the year. 2016

imports were worth US$20.4 million (US dollars), up 13%

from 2015.

Imports of virola, imbuia and balsa (combined) grew 31%

in 2016 to US$5.3 million. The majority of this growth

was in higher balsa sawnwood imports.

Sapelli sawnwood imports declined 10% in 2016 but at

US$4.3 million sapelli still represented a significant

portion of tropical imports. Imports of mahogany

sawnwood grew 5% to just under US$0.7 million.

Most exporters of tropical sawnwood to Canada increased

shipments in 2016 with the exception of Congo (former

Brazzaville), Ghana and Bolivia. Lower sapelli imports in

particular affected imports from Africa.

The strongest growth from 2015 was in imports via the

US, which increased 73% to US$1.7 million in 2016.

¡¡

Suspension of published Federal Regulations

The Trump administration issued an order on January 20

directing all Federal agencies to suspend for 60 days the

effective dates of rules that have been published in the

Federal Register but have not yet taken effect.

This order opens the door to blocking rules that the

Environmental Protection Agency issued in the final

weeks of the previous Obama administration, including

the formaldehyde emission rule. Potentially rules could be

withdrawn entirely, withdrawn for further review, or they

will be allowed to take effect without changes.

Growth in furniture orders, shipments and retail sales

New furniture orders increased 8% in November 2016

from the same time last year, according to the Smith

Leonhard industry survey of residential furniture

manufacturers and distributors. This followed a 1%

increase reported in October. Over 60% of survey

participants reported order gains in November.

Year-to-date new orders were up 3% compared to the

same period in 2015. Year-to-date furniture shipments

increased 6% from November 2015. Inventory levels at

distributors and manufacturers were unchanged from

October and slightly down from November 2015.

Strong consumer confidence provided a boost to retail

sales. Annual retail sales at furniture and home furnishings

stores increased 3.8% in 2016 from the previous year,

according to the US Department of Commerce.

Cabinet sales increased in 2016

Cabinet sales increased 4.3% in 2016, according to the

Kitchen Cabinet Manufacturers Association (KCMA)¡¯s

latest Trend of Business Survey. Participating cabinet

manufacturers reported sales totaling US$6.8 billion for

2016, up 4.3% compared to 2015.

Survey participants include stock, semi-custom, and

custom companies whose combined sales represent

approximately 70% of the US kitchen cabinet and bath

vanity market. Stock cabinet sales increased +4% in 2016,

semi-custom sales increased +5.9%, and custom sales

increased +1.3% compared to 2015.

Furniture and cabinet makers expanding production

capacity

La-Z-Boy announced an investment of approximately

US$26 million over three years in its largest upholstered

furniture manufacturing plant in the US. The investment

includes a new innovation centre, various renovations and

technology upgrades, and a new transportation terminal.

Other US furniture and cabinet manufacturers have

announced expansion or investment plans, including

cabinet hardware supplier Blum who will invest US$16

million in upgrades at its headquarters in North Carolina.

MasterBrand Cabinets has announced it will grow its

workforce at its plants in Indiana.

Strong opposition to suggestion of border tax

Many US companies oppose introducing border taxes as

suggested by the Trump administration, and specifically a

20% tax on imports from Mexico.

A new coalition of companies and trade associations,

Americans for Affordable Products (AAP), has formed in

response to the proposed border adjustment tax. The group

argues that the tax will significantly hurt American

consumers.

Home furnishing retailers and associations that have

signed on to the AAP include the Home Furnishings

Association, IKEA North America, International Wood

Products Association, Raymour & Flanigan Furniture, and

Walmart.

|