Japan

Wood Products Prices

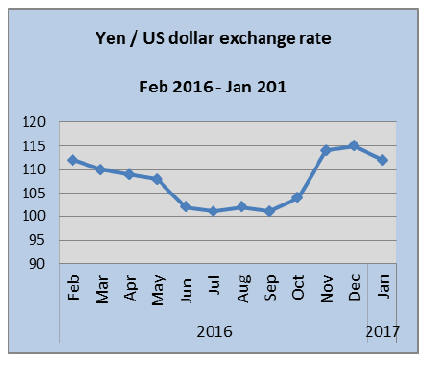

Dollar Exchange Rates of 25th

January 2017

Japan Yen 113.80

Reports From Japan

Exports at 15 month high

Data from the Ministry of Finance shows Japan's exports

rose in December marking the first increase in 15 months.

The export performance was boosted by strong sales of

electrical components and car parts, a positive sign for the

export-dependent economy but protectionism in the US

could undermine further growth in exports.

Exports to China, Japan's top trading partner, expanded

12.5% year-on-year and exports to the US, the second

largest trading partner, rose 1.3 per cent year-on-year, the

first increase in 10 months. On the other hand exports to

the EU fell in December.

For more see: http://www.customs.go.jp/toukei/shinbun/tradest_

e/2016/2016124e.pdf

Talking down the dollar

After a good start to the year when the yen/dollar

exchange rate was around 116 yen to the dollar, towards

month-end the dollar weakened pushing the yen to 112 on

25 January, disappointing news for exporters and the Bank

of Japan.

The dollar fell mainly in response to warnings from the

US President that the dollar was too strong and that this

hurt the competitiveness of American companies.

During the World Economic Forum in Switzerland an

adviser to the US President also warned of the risk of a

strong dollar to the U.S. economy.

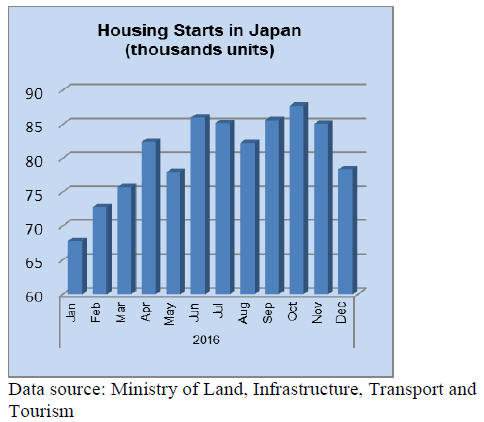

Bank of Japan concerned on housing oversupply

With home rents falling in Japan on a surge in

construction of apartments, the Bank of Japan now faces

yet another obstacle as it seeks to lift inflation.

In its regional economic report for January, the Bank of

Japan (BoJ) reported on the impact of investment in

housing and knock-on on demand for durable goods and

the conclusions were very sobering. In many cities and

even in Tokyo demand for rental properties was seen as

weakening due to an oversupply of properties.

The BoJ has expressed concern on the current

direction of

the housing market however, US interest rates are set to

rise further and this may give the BoJ an opportunity to

move away from its negative interest rate policy.

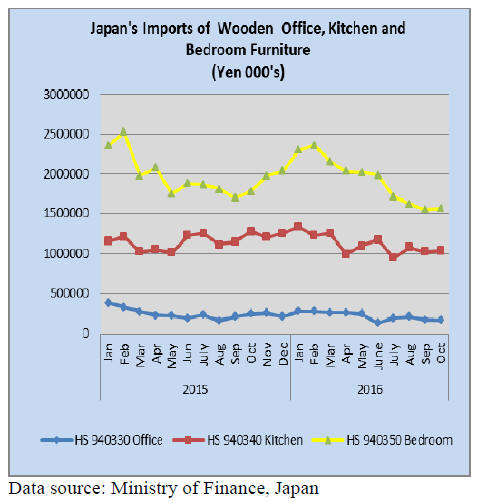

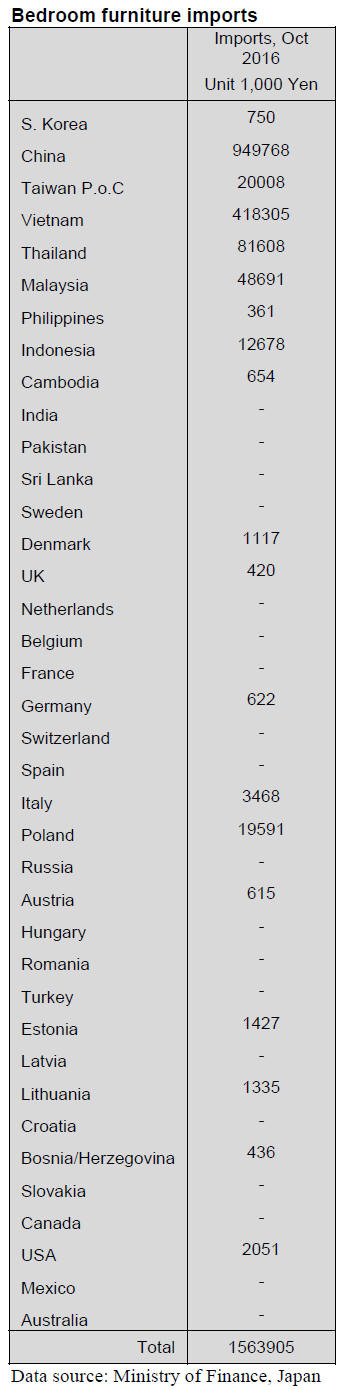

Japan¡¯s wooden furniture imports

In October 2016, for the first time since February of the

same year, Japan¡¯s bedroom furniture imports reversed the

8 month downward spiral. October 2016 bedroom

furniture imports rose around 1% from September levels

but were still some 34% down from the peak in February.

In contrast, kitchen furniture imports, while much smaller

than bedroom furniture imports continued at around the

same level as seen four months ago. Given that both

bedroom and kitchen furniture imports are influenced by

the housing market the difference in import trend is hard

to explain.

One possible explanation could be that imports of kitchen

furniture reflect the growth in renovations rather than new

home building and in the new housing market home

buyers are putting off non-essential purchases of moveable

furniture.

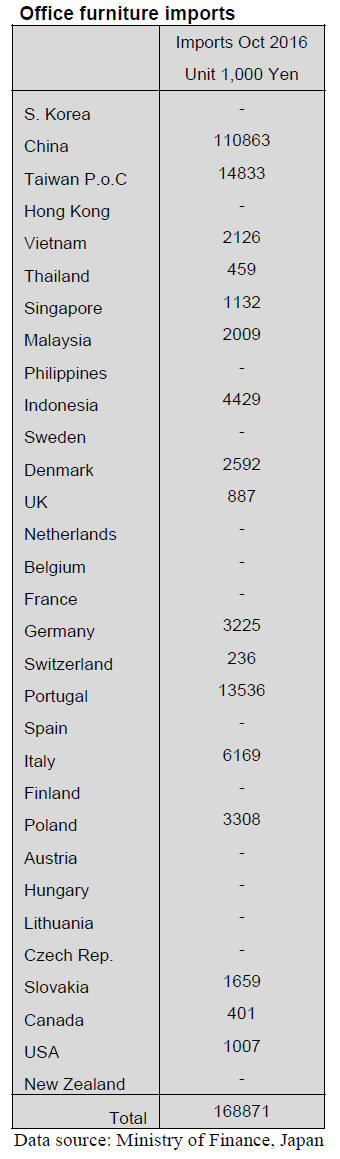

Office furniture imports (HS 940330)

Year-on-year, October imports of wooden office furniture

were down 31.5% and down 2.5% from levels in

September.

In October the top three suppliers accounted for over 83%

of all Japan¡¯s wooden office furniture imports and all

achieved increases in sales. China, the top supplier, saw its

share of all wooden office furniture imports rise to 66%.

The second and third ranked suppliers were Taiwan P.o.C

and Portugal which accounted for 9% and 8% respectively

of Japan¡¯s wooden office furniture imports.

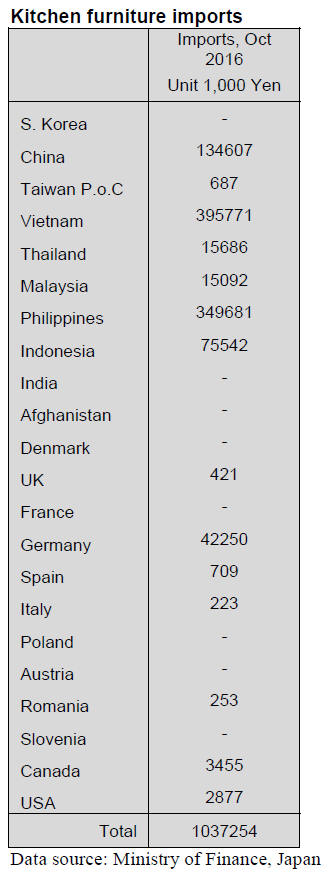

Kitchen furniture imports (HS 940340)

Japan¡¯s October wooden kitchen furniture imports

declined 18.5% year on year but were slightly higher than

in the previous month.

The top suppliers in October remain Vietnam, the

Philippines and China in order of the value of imports by

Japan. Between them, Vietnam (38%) and the Philippines

(33%) account for the bulk of Japan¡¯s wooden kitchen

furniture imports with China contributing a further 13%.

In October both Vietnam and China saw sales to Japan rise

while exports from the Philippines slipped slightly

compared to a month earlier. If imports of wooden kitchen

furniture from Indonesia, Thailand and Malaysia are added

to the total from the top three suppliers then around 90%

of all Japan¡¯s impprts of wooden kitchen furniture is

accounted for.

Bedroom furniture imports (HS 940350)

Suppliers in China lead the pack when it comes to Japan¡¯s

imports of wooden bedroom furniture, accounting for over

60% of all Japan¡¯s October 2016 imports of this category

of furniture. Vietnam is the second largest supplier

providing a further 27% of October imports of wooden

bedroom furniture.

The other main suppliers are Thailand and Malaysia

which

provide a combined 8% of imports to Japan. Year on year,

Japan¡¯s October 2016 wooden bedroom furniture fell 12%

with shippers in China bearing most of the decline.

Vietnam saw its share of imports rise in October.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Demand and supply projection

The Timber Supply and Demand Conference of Japan,

which is formed by five groups of imported wood

products, came up with the projection of demand for 2017.

Import of logs and lumber from major sources in 2016

increased but they are projected to decrease in 2017.

Housing starts in 2017 are forecasted to drop down to

940,000 units as compared to 970,000 units in 2016.

Therefore the demand for wood would decline in 2017.

Also recent sudden depreciation of the yen would

discourage imports.

In log import, North American would increase but others

like New Zealand, South Sea and Russia continue to

decline. North American log sawmills like Chugoku

Lumber continue stable operations.

Russian log import decrease due to fewer Russian log

cutting sawmills and logs for plywood are replaced by

North American logs and veneer from various sources.

South Sea log import in 2017 is estimated about 100 M

cbms by limited demand for plywood of South Sea logs.

Radiata pine lumber demand for crating would decrease as

the demand is replaced by domestic species.

In lumber, European lumber and North American lumber

would have stable demand. European lumber demand

would increase by about 18%.European lumber business

has been firm because of tight supply. Lumber from North

America has general purpose use so it increased in 2016

with increased housing starts. It will stay almost the same

as 2016.

South Sea (tropical) logs

Log production is down in supplying regions of Sarawak

and Sabah, Malaysia in the middle of rainy season so that

log prices stay up high and local plywood mills struggle to

secure material logs. Sarawak is having heavy rain

particularly and water level of rivers is higher, which

makes towing logs down rivers difficult.

Sarawak meranti log export prices are US$275-278 per

cbm CIF on regular, US$260 on small and US$245 on

super small. Since there are limited number of plywood

mills in Japan using tropical hardwood logs and the

necessary volume is not so much but India needs larger

volume so India is becoming price leader now.

Log production in PNG and Solomon Islands is also

dropping in rainy season but demand is getting low after

China slowed down purchase and India is also taking a

break now so the supply volume seems ample.

Market of keruing and kapur is getting smaller so the

arrival volume is small and the buyers are afraid of losing

money by strong offers so they take wait-and-see attitude.

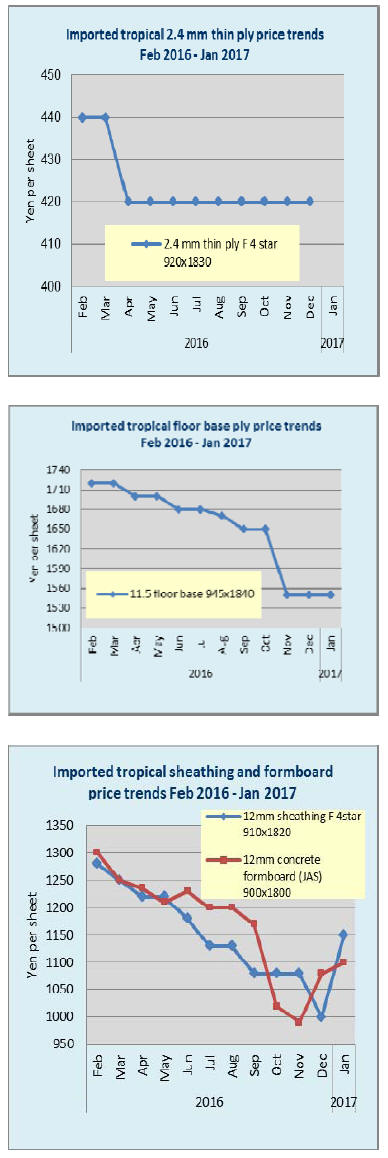

Plywood

Supply tightness continues on both domestic and imported

plywood. Domestic plywood supply is much tighter in

December than November particularly on thick panels.

Trading companies are trying to jack up the sales prices of

imported plywood, which prices dropped much last year

and future cost would be higher due to weak yen.

November plywood supply was 497,100 cbms, 3.3% more

than November 2015. In this, domestic softwood

production was 250,900 cbms, 8.0% more. High

production of more than 250 M cbms has continued for

three straight months.

The shipment was 252,100 cbms, 3.6% more, which is

higher than the production so the inventory dropped down

to 83,100 cbms.

Large precutting plants placed more orders in December

so supply tightness continues in January but precutting

plants forecast that the orders would slow down in

February so the peak of supply shortage seems to be over

soon.

The market of imported plywood is changing. The prices

are firming on 12 mm panel from Malaysia. The importers

need to increase the sales prices by higher FOB prices by

the suppliers and by sudden weakening of the yen.

Knowing that futures prices would be higher, some try to

secure in the market but nobody has anyinventory.

Supply side is bullish with tight supply of logs in rainy

season. The market prices on concrete forming panel and

structural panel are moving up and further increase may

come if the yen stays weak. Offer prices by Malaysian

suppliers in December of 12 mm concrete forming panel

are US$450 per cbm C&F, US$10 higher than November

and US$510-520 on 3x6 JAS coated concrete forming

panel, US$10 up.

Indonesian suppliers also suffer tight log supply so they

propose higher prices. Present offer prices are US$590-

610 per cbm C&F on floor base overlay better, about

US$750 on 2.4 mm (second class/F4star), about US$610

on 3.7 mm (first class/F4star).

Forestry Agency¡¯s demand projections

The Forest Agency held the wood demand and supply

conference to make forecast of major wood products for

the first half of 2017.

Generally the demand would decline compared to the

same quarter last year but supply of structural laminated

lumber and plywood would increase.

Forecast of housing starts by eleven investigating

organizations indicates 935,000 units in 2017 as compared

to 971,000 units in 2016.

Supply of domestic laminated lumber in the first quarter

would increase by 12.3% by remaining order balance

despite peak of the demand is over. Imported laminated

lumber for the first quarter would increase by 3.4% as

volume of contract in the fourth quarter was high then the

second quarter shows 2.4% less.

European lumber supply would be the same as 2016 with

steady production of lamina and genban in Europe.

Supply of imported plywood for the first quarter would be

5.1% more because the volume contracted in the fourth

quarter would come in from Malaysia and Indonesia then

volume from China and Vietnam would arrive before the

Chinese New Year. The second quarter would be 2%

more.

Demand of domestic softwood plywood has been tight

then demand for non- housing is becoming busy so the

first quarter forecast is 1.4% more than 3.2% more for the

second quarter but supply of domestic logs for plywood

shows 2.4% less for the first quarter and 7.3% less in the

second quarter so raw material supply would become

bottleneck for higher production.

Supply of North American lumber for the first quarter

would increase. Supply of North American logs should be

steady.

Russian lumber supply for the first quarter would be down

by 11.1%.

Radiata pine demand would be down as the demand is

rapidly shifting to domestic species despite promising

forecast of recovery of crating lumber demand by weak

yen, which should encourage export business.

South Sea log import for the first quarter would be down

by temporary reason of closure of lock gate of Niigata

port.

For more see Japan Lumber Reports Jan. 20, 2017 No. 690

|