|

Report from

North America

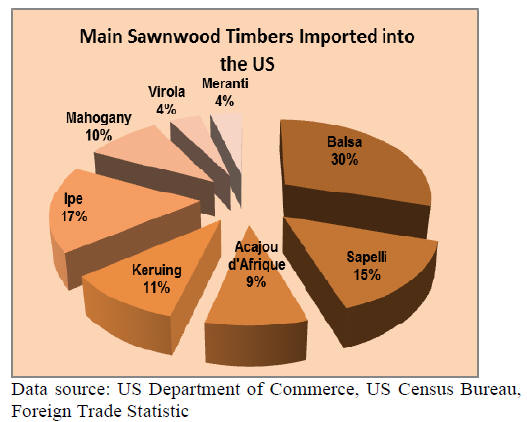

Ipe leading growth in tropical sawnwood imports

US imports of temperate and tropical sawn hardwood

grew 11% in November to 70,376 cu.m. The value of

sawn hardwood imports increased 4% from the previous

month to US$39 million.

Imports of tropical species were up 9% in November in

both volume and value following a brief one-month

decline in October.

Tropical sawnwood imports were 20,702 cu.m. in

November, worth US$21.5 million. Compared to the same

time in 2015, year-to-date imports of tropical sawnwood

were down 11%.

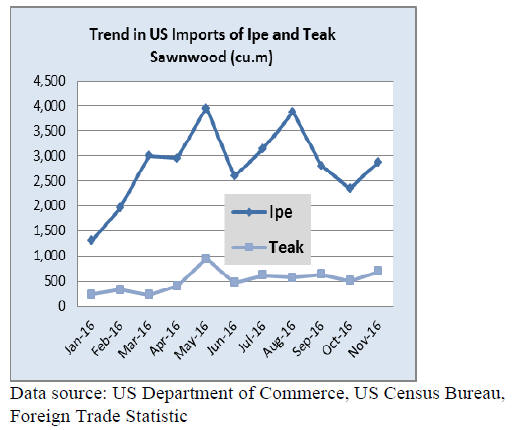

Much of the growth in tropical imports (and the October

decline) was in imports of ipe sawnwood. Ipe imports

grew 23% in November to 2,882 cu.m. Year-to-date

imports of ipe were up 3% from November 2015. 2,554

cu.m. of ipe sawnwood were imported from Brazil in

November.

Imports of jatoba, meranti, cedro, teak, keruing and

padauk also recorded month-on-month growth in

November. However, Sapelli sawnwood imports

continued to decline. Imports were down 8% month-onmonth

in November.

Imports of acajou also fell by almost one third in

November. Year-to-date imports of acajou were

significantly lower than at the same time in 2015.

By country, Brazil, Malaysia and Indonesia gained in

November due to higher exports of ipe, keruing and

meranti to the US. Imports from the major producers in

Africa were down in November.

Canadian sapelli imports down in November

Canadian imports of tropical sawnwood were worth

US$1.40 million (US dollars) in November, down 4%

from the previous month. Year-to-date Canadian imports

were up 16% from November 2016.

Sapelli sawnwood imports fell by one third in November

to US$258,168. Imports of virola, imbuia and balsa

(combined) grew from October with balsa imports from

Ecuador accounting for approximately half of the growth.

Year-to-date most major exporters of tropical sawnwood

to Canada gained over the same time last year, except

several African suppliers. Canadian imports from Congo

(formerly Brazzaville), Ghana and Congo (formerly Zaire)

declined compared to January to November 2015.

US importers prepare to meet CITES rosewood

regulations

The parties to the Convention on International Trade in

Endangered Species (CITES) have added the entire genus

of Dalbergia spp. in Appendix II to prevent unstainable

use of all rosewood species.

Beginning January companies that import rosewood

products must comply with the new CITES regulations.

Companies that utilise rosewood should make sure their

suppliers are in compliance with the new regulation.

The only exception is Brazilian rosewood (Dalbergia

nigra), which is listed in Appendix I as a species

threatened with extinction. Also added to Appendix II

were the three bubinga species of Guibourtia demeusei,

Guibourtia pellegriniana and Guibourtia tessmannii, and

kosso (African rosewood, Pterocarpus erinaceus).

From January 2, 2017, rosewood imports into the US must

be accompanied by CITES permits or certificates issued

by the country of export or re-export. This date applies

even if the shipment was exported before January 2, but

will arrive in the US on or after January 2.

Rosewood is used in musical instruments and high-end

furniture. According to the Woodworking Network, China

and Vietnam are the main trade and processing hubs for

rosewood.

The detailed explanation of the changes and other

resources are available from the US Department of the

Interior's Fish and Wildlife Service:

https://www.fws.gov/international/pdf/questions-andanswers-

appendix-II-timber-listings-December-2016.pdf

Anti-dumping investigation continues for plywood

from China

The US Department of Commerce will continue to

conduct its antidumping and countervailing duty

investigations on imports of hardwood plywood from

China. A judgment on countervailing duties is due

February 13, 2017, and its preliminary antidumping duty

determination is expected around April 27, 2017.

All six commissioners on the US International Trade

Commission (USITC) voted in the affirmative that “there

is a reasonable indication that a United States industry is

materially injured by reason of imports of hardwood

plywood from China that are allegedly subsidized and sold

in the United States at less than fair value”, according to a

USITC press release.

Included in the investigation are non-structural hardwood

plywood products used in the manufacturing of furniture,

cabinetry, wall paneling and similar products.

Not included are structural plywood, products which have

a face and back veneer of cork, multilayered wood

flooring, plywood which has a shape or design other than a

flat panel, and products made entirely from bamboo and

adhesives.

Apparent consumption of hardwood plywood in the US in

2015 was US$2 billion with almost 60% imported,

according to the USITC. The largest sources of hardwood

plywood imports were China, Indonesia, Russia, Canada

and Malaysia.

Six US plywood producers, comprising the Hardwood

Plywood Coalition, asked for this third investigation into

hardwood plywood products from China. The American

Alliance for Hardwood Plywood and the US kitchen

cabinet manufacturers oppose the investigation as

members are importers, distributors and retailers of

hardwood plywood.

The previous Department of Commerce investigation

ended with the removal of all anti-dumping and

countervailing duties on hardwood plywood from China.

China announced last December that it had launched a

complaint at the World Trade Organization over the

approach used by the US and the EU to calculate antidumping

measures against Chinese exports. The complaint

includes the use of third country prices when assessing

whether Chinese products are sold below market value.

Anti-dumping duty on wooden bedroom furniture from

China remains

In a required five-year review process the US International

Trade Commission (USITC) decided that revoking the

existing anti-dumping duty order on wooden bedroom

furniture from China would be likely to lead to

continuation or recurrence of material injury of the US

industry.

As a result the existing antidumping duty order on imports

from China will remain in place. The commission’s public

report Wooden Bedroom Furniture from China will be

available by February 15, 2017.

|